On the one hand, debating the merits of the Volcker Rule may seem a tad academic, given the rousing opposition it is encountering from Congress (and you have to love the world of politics: the biggest obstacle is, basically, “We sorta have a deal, you can’t retrade it!” Funny how banks and AIG get to redo their deals on quick notice, but the poor chump public? Not a chance). But it is worth pursuing nevertheless for two reasons. First, reform talk is not going to go away because the phony reforms are insufficient to prevent future train wrecks. So this line of thinking may well be revisited. Second, and more important, this discussion will hopefully help clarify the objections I raised recently, and probably did not articulate clearly enough for all readers.

My major focus of concern was Volcker’s pronouncement that he saw public funds backstopping commercial banks, but not investment banks. He therefore recommended that commercial banks be prohibited from engaging in proprietary trading (which he chose to define more broadly than private equity fund and prop desks, and to include speculation on customer dealing desks, which he was confident could be defined, although he offered no specific metrics). The problem is that he depicted this sort of trading as “part of the natural realm of investment banks”. He does not want investment banks to be backstopped, and thinks that (and restricting commercial banks’ trading activities) will solve the problem. He does admit that there is a wee bit of a problem with “systemically significant non-banks” but he seems not to grasp the essence of the problem: that the reason these firms are “systemically significant” is that they both crucial to the operation of the global debt markets (making them essential to commerce worldwide) and enmeshed via financial mechanisms (repos) and risk transfer devices (particularly credit default swaps) which means if any one of these key players goes down, it risks bringing the entire system down.

i on the ball patriot used an electrical metaphor:

Picture this – a smooth running parallel circuit of vanilla greed banks …

Imagine it is as if the preexisting structure was set up as a nice little circuit of vanilla greed banks, all happily wired in parallel, with wire mains of sufficient capacity to supply funds from the big battery of the taxpayer to the individual banks. To keep the circuit running smoothly, the treasury, the fed, and the congress, acted in concert as a regulator, and controlled the flow of funds from the taxpayer battery to the individual banks in this parallel circuit of banks. It was a relatively efficient circuit.

Now picture this – a not so smooth rewired combination series parallel circuit …

The wealthy ruling elite (fill in your own villain here), through an array of various deceptive means, hijacked the government and took control of the fed, the treasury, and the congress, and had the existing simple fairly well regulated parallel circuit described above drastically rewired.

Through their machinations they created a new combination series parallel circuit with twenty or so much bigger banks wired in series, with high capacity wires, right off the tax payer charged battery. This series string of big banks now fed the simple smoothly running parallel circuit of smaller banks. They also increased the wire size of the mains of that parallel section of the circuit, but not the feeder wires to the individual smaller banks in that parallel circuit, to insure that the big banks would always have maximum flow of funds.

The effect of this new circuit was twofold;

1. If any of the big banks failed the whole circuit went dead (too big to fail), but smaller banks could fail and the funds from the tax payer battery would keep flowing to the big guys and the other smaller banks.

2. The big banks, by acting in concert, could now, in the aggregate, control the entire circuit to;

a. Allow a free flow pass through of funds to create cheap credit and a huge global bubble — which they certainly did.

b. Pop the bubble by creating grossly over leveraged counterfeit derivative products that would effectively rattle, shake, and instill trillions of dollars of mistrust in the new system circuit, and at the same time have the effect of; frightening consumers into a savings mode and further depressing the popped bubble economy, and, also make the smaller banks unwilling to lend for lack of good investments in the now fully depressed environment (green shoot bullshit aside).

c. Allow them, the big banks, to further drain the taxpayer charged battery by engaging in greater unregulated speculative schemes so as to create a rinse and repeat condition until the tax payer battery goes completely dead.

Yves here. I differ with him that popping the bubble was part of a plan; I see it as simply an inevitable outcome of too many people making short term decisions and not caring that the long term was unlikely to work out well. But you get result (c) independent of how (b) came about.

But a clearer explanation of why Volcker’s proposal comes short via a very clear and clever presentation by Raj Date of the Cambridge Winter Center for Financial Institutions Policy, via Mike Konczai at New Deal 2.0 (hat tip Ed Harrison).

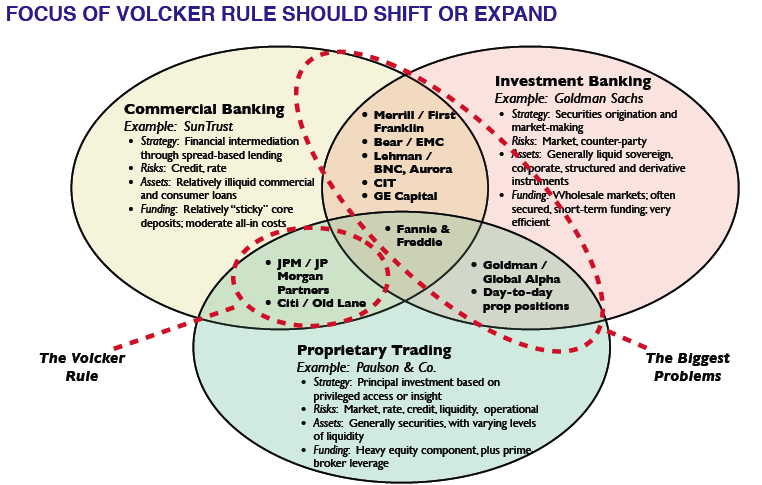

The key bit is that the Volcker Rule omits the very activities at the heart of the crisis (a complaint yours truly and others have made) and the paper shows through some very clear visuals where those gaps are. Date’s overview:

On January 21, the Obama Administration proposed two sets of new measures to contain systemic risk: limits on financial firmsʼ size (as a fraction of market liabilities); and the so-called “Volcker Rule”, which would bar bank and financial holding companies from putatively high-risk activities like private equity investing, managing hedge funds, and proprietary trading.

• A real solution to a non-problem. Firms that combine elements of the commercial banking, broker-dealer, and proprietary trading business models can pose systemic hazards. But the Volcker Rule focuses on the least problematic of those hybridized activities. For sound market-based reasons, commercial banks are simply not involved in significant levels of private equity or hedge fund-like investing.

• A non-solution to a real problem. By contrast, broker-dealers (or investment banks) are quite frequently engaged in trading and investing for their own account — both as a necessary consequence of their market-making function, but also as a means to capture incremental value. Because investment banks (appropriately) fund themselves substantially in short-term and overnight markets, allowing them to take on volatile and illiquid assets is systemically dangerous. Indeed, it was the proliferation of such “shadow banking” that was perhaps the single biggest driver of the credit bubble and ensuing crisis and government response. But the Volcker Rule, as currently defined, does not apply to most investment banks. Indeed, if the largest investment banks (Goldman Sachs and Morgan Stanley) were to give up their bank holding company status, the Volcker Rule would leave even them untouched.

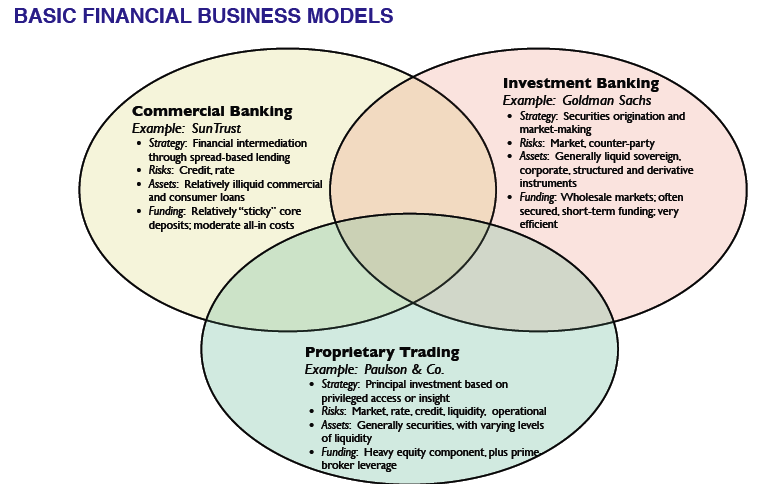

He illustrates the problem first by showing how various types of players operate:

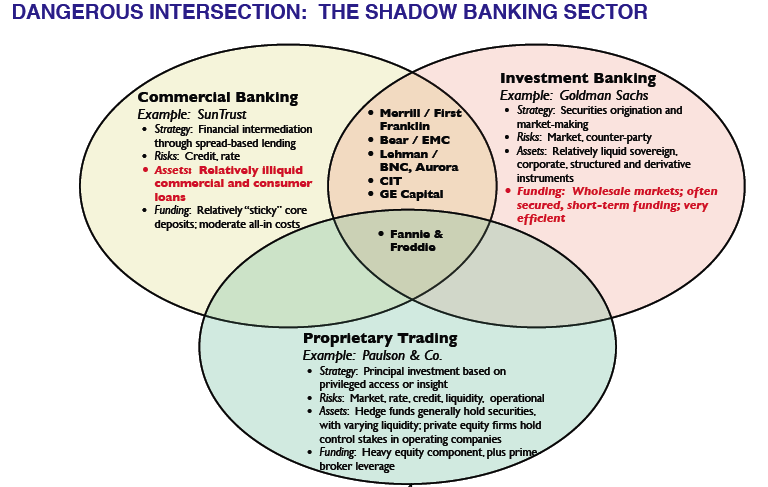

He then shows why this is not such a hot idea:

Many of the credit bubbleʼs excesses can be traced to the “shadow banking” sector, which is essentially the intersection between commercial banking and investment banking business models: shadow banks take illiquid credit and interest rate risk (like commercial banks), but fund themselves principally through the wholesale markets (like investment banks). Because of long-recognized regulatory loopholes, shadow banks were also frequently able to operate with significantly lower capital requirements than commercial bank competitors. With both capital and funding advantages in hand, shadow banks grew to some 60% of the U.S. credit system.

Now that might not be so bad…except per the red sections below, there were mismatches between the liquidity of the funding (which could disappear quickly) versus the assets, which were not terribly liquid. But it was those very same illiquid assets that were moved into bank like structures (conduits and SIVs in particular, but you also have the same problem with any securitized assets sitting on the balance sheets of trading operations):

And the Volcker Rule is not attacking the real problems:

The presentation also has a nice discussion of how to define and measure proprietary trading on page 7.

The Cambridge Winter site seems to have fallen over; or perhaps it is just short of bandwidth.

Presumably it will be back up gain in due course.

Very good point and explanation.

The shadow banking system provided a route of intermediation that the formal banking system could not provide. The primary vehicle of intermediation being the securitization of mortgage loans and other collateralized debt. The incentive to chase yield creates a very curious dynamic. The shadow banking system is not a fixed set of entities. In fact, I believe that it can be fairly demonstrated that traditional banks move in an out of the set of shadow banks at a fairly regular rate.

Much of the dialogue has been at the periphery of the problem while the core problems are ignored. It is my view that the core issues are: the fiat currency that was a failure the day it was instituted, and, the fractional reserve deposit taking system that is inherently vulnerable to illiquidity, if not insolvency.

Greed, hubris and fraud operate as accelerants and find their individual expression in such canards as the efficient market hypothesis and the presumtion that the efficiency of the market is of such force as to eliminate the need for the prosecution of financial fraud.

Couple the foregoing with the inability to recognize that the concept of too big to fail is more than the acceptance of moral hazard. It is the vehicle of missguided borrowing in the hope that prosperity can be restored by incurring additional debt.

Clearly the “Volker Rule” falls far short of what is required for the development of reforms that will put the economy on the path to a better allocation of resources and the reestablishment of the improvement in living standards.

On the other hand, if the “Volker Rule” is accepted for what it is, then we can open a dialogue that will be productive. At this point we have obstructionism and short sighted political goals that are misdirecting the effort.

This piece, by focusing on what the “Volker Rule” does not address contributes to the development of what could be a productive dialogue. The problem that is highlighted is the fact that while it would be helpful to reconstitute a contemporary ‘Glass-Steagell’ act, it is equally important to recognize that the shadow banking network needs to be subjected to comparable regulation.

Super catch & post, Mistress Yves!

Re: “..securitization of mortgage loans and other collateralized debt..”

True, but the most important point which should be hammered over and over again is: The securitization of EVERYTHING — therein lies the rub!

I am one who does not understand much at all of the INS and OUTS of the topics discussed. Not that I would not be willing to be taught to understand but I see no real purpose of trying to understand how thieves talk about the whys, hows and whens they do their business. ]

I do understand when the curtain closed for us in 1913. The Federal Reserve and the Income Tax both of which has led us to the abyss that we are encountering today.

That was good ball, I missed that one!

To the extent that all form follows function, it seems to me that one of the unstated social challenges that shadow banks arose to fill — and maybe this is what motivated Mr. Blankfein’s believe that his firm does “God’s Work”, although perhaps I give too much credit there, no pun intended — is the notion of unequal distribution of wealth in society.

The US and Western society at large has grown up from slavery though indentured servitude through sweat shops and meat shops through suffrage fights, labor union fights, Jim Crow. A big march through death into life. And In the 1990s the “right to capital” was invoked as a driving metaphorical force that propagated the expansion of credit through Fannie, Freddie and increasingly the shadow banks. Yes, they took on “risk” but in more prosaic terms they extended capital (lent money) to many folks who would have been denied loans by traditional banks. Denied wrongfully! Denied capriciously! Denied the big Dream! Denied their God-Given pursuit of happiness. Denied a veritable and functional “human right”! If this this isn’t injustice, then what is!

I remember the commercial for a place called Champion Mortgage — “When your bank says no, Champion says YES!”

No, the credit bubble, like most financial bubbles, was at bottom an unconscious dionysian drive of the Spirit Demos, the Spirit Demon or Daimon, more appropriately. It was essentially a Democratic project, not in the political sense but in a rebellion against an aristocratic distribution of capital. It was a sun flare of the great American Dream, right out of the torch of the Statue of Liberty.

Of course, all things become their opposites. Like the Temple of Baal became the Vestal Virgins. And the Brotherhood of the Apostles became the Holy Roman Empire. And so the Body Demos became, in a few quick years, it’s opposite. A concentration, not an expansion of wealth.

And yet the underlying force was inherently egalitarian, and that seems to be the inevitable tension that any financial regime needs to better articulate and navigate. How do you get capital to those without it? There are three solutions. Taxation, credit or equity investment. And then how do you protect capital from the counterfeiters — of either coin or credit?

This is clearly a question of natural rights. Those without capital have a natural right to have it — just as any child born into a tribe has an inherent right to air, water, meat and grain and fire. And those with it, have a natural right to have a reasonable degree of it protected. Societal wealth grows best when those rights are balanced in a fruitful tension, and the mechaism of extending capital to those without it is a crucial aspect of that tension.

For all it’s faults, and all its labels of “elitism”, the shadow banking system was and is inherently, in spirit, an egalitarian, democratic and to some degree, revolutionary, proposition. Yes, it was commandeered and driven over a cliff by looters, but that should not obscure it’s essential theoretical nature.

If this is still a democracy, then I vote for Jim the Skeptic’s 10% annual savings rate on the other thread.

YS:

I doubt the Volker rule will help much. We should end bank holding companies. Limit bank size to 1% of total banking system assets, such limit established annually. Require all banks, being any institution holding federally insured deposits to have at least 10% equity capital. Have each bank designate “responsible officers”, (RO) one for evey $2 billion in assets. The ROs will be liable for three times each’s last three-years compensation if the bank goes bankrupt. If the RO can’t pay, he gets five years in federal prison. What, bring back debtors’ prisons? Yes. If you want to be a bank executive, those are your job conditions. Period. Then end all banking regulation.

Dead on, dood! Which is exactly why it will never happen without a very bloody revolution!

IF the Volcker Rule were posited as a panacea, much of the criticism that has been leveled by various sources including the bank lobbysists and congressmen would be correct. However, I do not think it was, but I could be wrong.

What the Volcker Rule would have accomplished is taking the gamblers away from the subsidized “discount window” of Fed and TReasury programs. It would have also put a serious dent in the ‘TBTF’ meme, although it alone was not enough.

There is a reason that the banks engaged in a decades long effort, costing hundreds of millions in lobbying payments of various sorts, to overturn Glass-Steagall.

Perhaps the new ‘reform legislation’ will be effective, but I doubt it quite a bit. And then we will see the return of the pundits, suggesting this tweak, and that tweak, this addition to close that loophole, and the zombie banks will continue to drain the life from the real economy, while paying enormous bonuses to their captains, with gains from gaming nearly every financial instrument and market in the western world.

Were that I am wrong, I doubt it very much.

My concern with your Volcker coverage on this stems from your assesment in the opening

Given the rousing opposition it is encountering from Congress (and you have to love the world of politics: the biggest obstacle is, basically, “We sorta have a deal, you can’t retrade it!”

From where I’m sitting jumping on the “Dead on Arrival” bus lands you on the right side of political concensus but doesn’t lead to a more meaningful dialogue on its shortcomings, which I think is your aim. Instead, it feeds right into the hands of ,’fuck off, we’re already done with this’ crowd and shuts the discussion down.

My view is also based on my read that Volcker was introducing ADDITIONAL issues not addressed in the rest of the package. And that the additional things were aimed at, among other things, introducing a 21st century version of Glass Steegal into the overall package.

So I think your ‘major focus of concern’ is just plain wrong and the arguments built on that view leave me unconvinced. (I’m not saying I can’t be, just that I’m not yet)

By focusing on commercial banks he was implicitly focusing on the shadow banks. I’m not convinced you’ve considered that in your analysis. You conclude he hasn’t but I believe he expected his proposal would lead to addressing the concerns in “the biggest problem” areas illustrated in the ‘shift and expand” slide. If that’s the case then my preference would be to see his idea treated with some consideration, rather than the with the derision it received from the get go. It was an opening move, not checkmate.

My criticisms are about (1) framing the issue, as in the DOA headlines, and including the headline in this post.

and (2)the flaw in your case re ‘major focus

Re(1) that’s your perogative, I’m just venting. Reasonable people can disagree, but I think the approach doesn’t serve your stated purpose.

But (2) is a difference in interpreting facts. Perhaps you’re right that a literal interpretation of his proposal supports your conclusions, but I think that interpretation ignores his past experiences, his understanding of the global markets,and his current involvement with the global regulatory regime.

Suggestion for your next links listing:

Simon Johnson did a thorough job of critiquing the Volcker plans in his testimony the other day (read it on Baseline).

MichaelC,

In this post and others, you maintain that Volcker’s proposals get at the problem, when a look at how the financial system works now says they don’t. We keep talking past each other here.

As I have said again and again, the critical part is the debt markets, which are at least as important to credit intermediation, if not more important, that credit extension. Volcker keeps acting as if you can backstop banks and leave speculative traders (and he SPECIFICALLY MENTIONS investment banks) on their own. This is just nuts.

I have read Johnson’s testimony. I differ with his rhetorical approach. He says Obama and the Volcker Rule have the right objectives, of limiting the risk-taking of backstopped firms. But the debate does not surround the aims here, the debate surrounds the particular suggestions in the Volcker Rule. By putting forth a program that creates an illusion of solving a fundamental problem, I see the Volcker Rule as presented by Volcker himself as woefully incomplete. It is being touted as a solution when it fails that standard.

For instance, Chris Whalen has described JP Morgan as a $1.3 trillion bank attached to a $76 trillion derivatives clearing operation. Will ANYTHING in the Volcker rule limit JPM’s derivatives clearing exposures? No. And one can argue that JPM was the proximate cause of Lehman’s failure (JPM decided to withhold $14 billion of cash and collateral it held on behalf of Lehman, which was the final blow).

Reading Volcker’s testimony again, he maintains a distinction between commercial banking and investment banking that is irrelevant, perhaps even counterproductive in understanding what happened in the crisis and what needs to be done.

Repo serves a function very much like deposits. There is nothing in the Volcker rule to limit institutions funded by repo. And repo is even MORE subject to runs than deposits, as we found during the crisis (increases in haircuts can be as destructive as refusals to roll repos).

That’s why these firms were backstopped. They are dependent on a unreliable short term deposits, and they carry longer term positions. Even though the Date paper focused on the conduits, which was the most acute problem, dealer firms are structurally long the bond market. If one has a run via the repo market, it can’t liquidate inventory at anything other than distressed prices (and I don’t mean super distressed, I simply mean the order sizes will be out of whack relative to market conditions, since the conditions that led to difficult conditions in the repo market are certain to adversely affect liquidity all across the credit market).

So the risks inherent to repo, which was exacerbated by the credit default swaps market (dealers had supposedly hedged positions with other dealers; if one side of the trade fails because the firm providing it goes belly up, the dealer on the other side is suddenly exposed) meant the entire credit infrasture could go under due to cascading failures.

This is why the firms were backstopped. Volcker abjectly fails to deal with this issue, this is THE reason the big banks and former investment banks were backstopped. I don’t know why you continue to defend the Volcker rule and ignore what I have written over and over.

As for Johnson, yes I have read his post. I raised the same issues he raises in previous posts (and you seem to have ignored them there, which leads me to wonder whether if something is written by a Recognized Authority, like Johnson or Volcker, you pay attention, but when it comes from a mere commentator like me, you don’t pay heed).

I have said that Volcker relies unduly on the resolution authority, and like Johnson, contend that it won’t work, both due to the fact that banks operate in foreign jurisdictions and due to the fact that the Rule (and the other elements of proposed reforms) do little to solve the connectedness issue. You cannot put one of these firms down neatly and easily with them when they have counterparty exposures in actively traded markets. I quoted Harvey Miller, who pointed that even bankruptcies of medium side broker dealers were disruptive to markets. And by medium sized, he clearly meant domestic US, way way smaller than Lehman.

One area where I differ with Johnson is his pessimism re regulation. We have had effective regulation. The FDIC just issued a bloody-minded proposal on securitization, which is bizarrely getting no press (the media has consigned it to the deep freeze and is instead talking up the much weaker OCC version). The problem is the Fed, which even before Greenspan took it out of the regulation business, was never much of a regulator. But we will probably need another crisis for the officialdom to develop the will to charter a sufficiently tough-minded body (which I suspect will have to lie outside the Fed).

So I don’t know how to talk to you on this issue when you ignore much of what I have written and then criticize your mischaracterization of my views.

My point is simply that the Volcker plan wasn’t meant to address all the issues. It was meant to supplement the others.

The components should be judged on that basis. That’s all I’m saying.

I added the referral to Johnsons piece because I thought it was useful to anyone interested in the topic. It wasn’t meant it as a rebuke.

I tend to agree with MichaelC, and think you are talking past it.

The Volcker Rule take the non-banks off the cheap money feedbag from the Fed and Treasury. he does not wish to subsidize what is essentially speculation.

That is the key point, and I see Nothing in what anyone else is proposing that will do this.

Jesse,

1. With all due respect, you are missing my point, which is that the global debt markets WILL be backstopped. They are a bigger source, in aggregate, of credit than traditional banking. They will notT be allowed to fail. So pretending we are not backstopping them is a misleading idea that plays right into the hands of the banksters. The Vocker rules dangerously maintain that illusion. Legislators and the chump public will believe “Mission Accomplished” when the banks themselves know the problem has not been fixed, ergo, they will be rescued, ergo they will abuse their “let’s all pretend we don’t have it” guarantee.

2. I have proposed remedies. The biggest are defining those core debt market activities and subjecting any firm that engages in them to aggressive regulation, in particular, much bigger capital requirements. The other is aggressively regulating the CDS market, with an explicit policy goal of limiting it as much as possible, with an eye to shutting it down once it has been shrunken further. There are reason, sadly, you just can’t ban the product right now. A lot of dislocations will result. An exchange isn’t workable, since adequate initial margins make the product uneconomic (a point no one is willing to discuss, that a properly margined exchange or clearinghouse kills CDS immediately). I have more detail along these lines in my book.

You miss that the Goldmans, Bears, and Lehmans got debt “product” from their own, internal pipelines, as well as banks and non-banks. There is nothing here to prevent a bank from securitizing product.

Oh, and those SIVs? The heart of that business was London. The biggest firm, Gordian, was not a bank. So how does the Volcker Rule prevent banks from selling loans to CP and MTN funded SIVs, and investment banks or even banks placing the liability side of their capital structure? Answer: not.

Now SIVs are temporarily out of fashion, but so were CDOs for a while after that market blew up in 1999. The new version supposedly fixed the problems with the first gen version.

Yves, I get what you are saying loud and clear and agree with you.

We need to backstop the entire system as long as it takes to wind down the big players that have wired themselves in that series portion of the circuit and that could still collapse the system. Prioritize the threat level of each and apply regulation proportionately. As each is wound down and regulated properly put them back in the old Vanilla Greed parallel circuit.

I’m confused about your posts because it seems to me you and volcker don’t disagree about regulateing the non comm bank financial institutions

From:Volckers testimony concerning regulated non-comm bank activities:

What we plainly need are authority and methods to minimize the occurrance of those failures that threaten the very fabric of financial markets.

The first line of defense, along the lines of Administration proposals and the provision of the House Bill passed last year must be authority to regulate certain characteristics of systemically important non bank finacial instituions. The essential need is to guard against excessive leverage and to insist upon adequate capital and liquidity.

If this bit fails, then resoltion authority takes over.

Yves remedies

I have proposed remedies. The biggest are defining those core debt market activities and subjecting any firm that engages in them to aggressive regulation, in particular, much bigger capital requirements.The other is aggressively regulating the CDS market, with an explicit policy goal of limiting it as much as possible, with an eye to shutting it down once it has been shrunken further

My conclusion: Volckers plan addresses Yves proposed remedies.

I understand that it is assumed the capital markets firms won’t be adequately regulated and will remain TBTF, and that Resolution Authority is a poor solution. but the plan does adrress regulation of the non-comm banks

If I still don’t get your point lets stop here.

Interesting post … some thoughts …

• Yes … Simple stories are needed …

This post dovetails with the post below (“Is the Need for Simple Stories Getting in the Way of Banking Reform?”), as the drawings discussed are graphic attempts to de-complexify and simplify what is going on. Mike Konczai at New Deal 2.0 expresses a need for them when he applauds the Raj Date diagrams, and, in the same post says, ”a coherent explanation for journalists and lay-people of shadow banks and overlapping business models is something I’ve been trying to do for a while.”

It is my belief that just as intentionally created complexity is a deception used to extract wealth, the simple narrative, or illustration, that demystifies that complexity, is needed to increase the perception of those who have been deceived so as to allow them to regain that wealth.

• I don’t think the Raj Date Venn diagrams offer a clearer explanation than the described and proposed electrical circuit illustrations (not getting defensive here, really) …

1. The Venn diagrams are more a presentation for an academic journal audience as opposed to a Popular Mechanics ‘lay person’ audience. Graphic content and style should match the audience. Venn diagrams are more abstract and less concrete than simple battery circuit illustrations that symbolically depict real objects that relate more closely to reality and are more readily understood by the general public. As Ross Perot used to say, “We need to take a look under the hood!”

2. The Raj Date Venn diagrams depict only the types of banking/trading and therefore highlight and focus on just them. In so doing they downplay the taxpayer, and the; FED, Treasury and Congress, as regulator, which must then be explained peripherally in text. Why is that downplayed?

3. The real problem here is the gross deception and corruption and how do we best eliminate it. The better that you can graphically portray that process the better you will be able to unwind it. I would even include on my proposed graphic circuit diagram simple depiction for the ratings agencies, quants, and sell out corporate media (FT,WSJ,Times, etc.) used to validate this whole deceptive crisis. This whole debacle could be shown and explained to the lay public in two simple, juxtaposed, before and after illustrations. If I can find the time I will draw them up.

• The players — Vanilla Greed, Pernicious Greed and the lay public …

The question then arises why inform the lay public at all and who will do it? Who benefits?

That depends on one’s perception of the present overall dynamic and power distribution in the established order. I see this clearly as a split at the top in the world of finance into two factions: The good old fashioned Vanilla Greed, and the newer more elite Pernicious Greed which has now more strongly captured the government and is in the process of implementing its global ‘full spectrum dominance’ strategy. In the process they have cleaned good Old Fashioned Vanilla Greed’s clock! Without getting into the particulars of that elite Pernicious Greedy strategy — and I differ strongly here with Yves — its driving force is one of control as opposed to one of profit, and, that driving policy includes eliminating much of its customer base, including the Vanilla Greed Banks!

So … who will arouse the lay public?

1. The uninformed lay public does not have the information nor the resources to make the change.

2. The elite Pernicious Greed banking faction wants the change.

3. So … that leaves the job up to the Old Fashioned Vanilla Greed banking faction which at this point in time still has sufficient resources to effect change. Those who are bright enough to recognize that if you intentionally lay to heavy a debt burden on your customer base to purposefully kill them off, you will destroy all future profits. Along with arousing the public to assist them effect change they need to bone up on their politics. They have really been snookered!

Deception is the strongest political force on the planet.

Could have said this in the close more clearly;

1. The uninformed lay public does not have the information nor the resources to make any remedial change.

2. The elite Pernicious Greed banking faction that created the new order does not want remedial change.

3. So … that leaves the job up to the Old Fashioned Vanilla Greed banking faction which at this point in time still has sufficient resources to effect remedial change back to the old parallel smooth running circuit. Those who are bright enough to recognize that if you intentionally lay to heavy a debt burden on your customer base to purposefully kill them off, you will destroy all future profits. Along with arousing the public to assist them effect change they need to bone up on their politics. They have really been snookered!

Deception is the strongest political force on the planet.

If a level 2 electrical engineer can not diagnose the fault with a DC motor, after a day at it, good luck to the general public.

Used to do a bit of work with 480V 3 phase 100AMP service gear (prep blasting equip) have seen licensed electrician enter buss room and witnessed the brightness of the sun from out side the door LOL (he lived, sans eyebrows and frontal hair), fork lifts running over Appleton connectors with said feed running live through them, building engineer blown across alleyway to the SAG building trying to prime 600V main with cowboy boots on lol, SAG building 60ft conduit with wire colour codes changing half way through due to lack of materials which caused a few small fires (not to worry fire detection was in place except no one wired them in lol, asked sparky wiring up live boxes at plastic molding/extrusion Mfg plant if he had too much grog last night (shaky hands) and when he said no ask how many hits hes taken down the road, too which the reply was a few lol.

So great analogy to those that comprehend, but even some in the game might find it hard.

Skippy…I found the fault in the control board to the DC motor, moisture had entered the control box after owner drilled some holes on the top too dissipate heat and a leaky roof took full advantage.

PS. said electrical engineer was top dog at an Ashland Chemical Plant whee!

Most people do not understand electrical circuitry, and visuals like the Date charts are becoming increasingly common in the news, so I think his charts are comprehensible, and likely more accessible to most people than discussions of circuitry.

In spite of Skippy’s bad experience, I disagree with you on the abilities of blue collar scamerica to understand simple basic wiring diagrams. Knowing basic electricity is now a mainstay in most all technical trades. The point is, diagram style fits market segment (audience), and the Venn diagrams displayed appear to me to lack some pertinent information.

That aside, I am with you on the importance of revealing the intentional complexity of the various scam products involved, and the chicanery that went into creating them, but in the end, not everyone has your knowledge and ability to do that, nor will they ever have it. What they will have though, is trust in your knowledge, and your abilities, and your integrity (put me high on the list), to make reasoned judgments about what is and what is not a scam. That information will then be used by those who trust and believe in you to downstream it, through simple narrative, and a variety of media and illustrative methods, to the general public.

As for simple narrative being a problem in the past, relative to describing the depression because it played into the hands of the banksters and masked the complexity of the machinations involved, consider; who paid for the creation of those simple narrative myths and the promotion of them. It was the same sell out journalistic hack propaganda machine, employed by the same wealthy ruling elite, that taught us all that, “Honest Abe Lincoln was a great President who freed the slaves.”, when in reality he was a political opportunist prick that mass murdered American Indians and presided over an insane and unnecessary civil war.

Which gets to the real problem with simple narratives. The real problem is the reach, or intensity of voice — the comparative loudness of the delivery of the narratives! The corporate business media incessantly pounds these simplistic narratives into our ears like thunder whereas any opposing media is like the sound of a small goose feather landing in a puddle of water. How many impressions per day does the aggregate corporate western media slap on the minds of its aggregate citizenry as opposed to how many NC impressions land on those same minds?

The challenge is to create those simple narratives, in many forms and styles, based on trust, in you and others like you, and, more importantly, use the internet to organize and broadcast those narratives in a louder common person voice. Simplify and link out!

Deception is the strongest political force on the planet.

Yves,

The case for a RICO indictment of Goldman Sachs gets stronger and stronger:

NYT

Goldman Helped Push A.I.G. to Precipice

http://www.nytimes.com/2010/02/07/business/07goldman.html?ref=business

By GRETCHEN MORGENSON and LOUISE STORY

Published: February 6, 2010

— See, also, the January WSJ interview w. Hank Greenberg

http://online.wsj.com/article/SB10001424052748704130904574644693895033518.htm

RICO: http://www.ricoact.com/ricoact/nutshell.asp#bank

Whoever knowingly executes, or attempts to execute, a scheme or artifice:

to defraud a financial institution, or

to obtain any of the moneys, funds, credits, assets, securities, or other property owned by, or under the custody or control of, a financial institution, by means of false or fraudulent pretenses, representations, or promises shall be fined not more than $1,000,000 or imprisoned for not more than 30 years, or both.

18 U.S.C., section 1344 (emphasis added). Bank fraud is probably not a common predicate act because people read the first subsection and believe the fraud must be against a financial institution and fail to read the second subsection’s language concerning funds “under the custody or control of” a bank. Under section 1344(2), bank fraud potentially arises even if the victim is not a bank and even if the bank did not lose any of its own property pursuant to a scheme to defraud. Bank fraud arguably occurs whenever a scheme to defraud enables the perpetrator to obtain any funds “under the custody or control of” a bank.

Good thought.

Now which scam ‘rule of law’ attorney is going to prosecute?

Deception is the strongest political force on the planet.

The main source of overnight funding for the market maker investment banks is obtained from OMO’s. IMO only commercial banks should be primary dealers with the new york fed.

Everyone on this planet that does not have a basic understanding of electronics is a prisoner to the devices surrounding them, their is no shortage of agents willing to hold the gun, and the next economy is going to be an order of magnitude more powerful.

It would be to everyone’s advantage to learn the basics, and go as far as possible up the ladder to physics, which is why the first pier after farming should be electicity, and why all subjects should be simplified into basic components.

At minimum, everyone should have an appreciation for those who must grab ahold of that primary circuit to install the initial inductor, and everyone in the semi-neutral, middle class capacitor needs to understand why joining capital discharges the economy.

Agency will stick a gun to your head every time.

When you switch out a small economic motor, with a much more powerful economic motor, you want the small motor to pull up the slack on the components, which is the reason for the Volcker rule.

It would be nice to upgrade all the devices first, but, as you are observing, the devices never want to be upgraded, and will not participate until they see the profit right in front of their face, when they see the new voltage. It’s a catch-22 situation.

Galileo’s monetary system turned a lot of lead into a small amount of gold, with the lubricant of blood. It’s time for an upgrade.

Knowledge is a complex heuristic, a coping mechanism, which should be simplified to resonate at the earliest possible moment, if you want democracy.

The entire legal system, the certification barrier membrane, the public “education” complex supporting it, and the replicative breeding controller, should be looked at through the lens of RICO.

Had the economy been working properly, without apoptosis jumped, smaller firms would have automatically backfilled the vacuum created when the working capital leverage of vertical organizations was exposed to disclosure. The dominoes have been falling ever since.

Finding the as-is abutment never ends; sunlight, the bloggers, is the best medicine for the shadow banking system. The roadway builders have to ensure independent system access so the bloggers cannot be shorted out.

The mafia simply migrated from industry, to marry finance. Having been a soldier with the operating engineers, I always find it amusing when the lackies threaten me. Capital is a gravitational body, it really doesn’t matter who controls it. What matters is the middle class keeping its distance.

Capital does not build economic motors.

The primary problem is not the finance mafia. The problem is those remnants in the upper middle class that think they are still a part of the mafia.

For example, most elevator mechanics have no idea how elevator electronics work, but they are holding a gun to your head, because you need that elevator, you cannot get certified, you have no access to the proprietary “education” materials required to access arbitrary circuits, you have to be a relative to keep a card, and you need proprietary parts from the vertical industry market-makers. And if you try to bypass the “system”, the entire host of government “servants” will attack you.

The simple solution is to wire right around that computer controller, and accept responsibility for mission critical components. It’s much more costly to avoid responsibility, in every possible way. You can hide from it for a while, but it always catches up, with interest and penalties.

The middle class has no business trying to maximize revenue and minimize cost, as if the two were seperable. They resonate, toward and away, in both directions. Accounting gimmicks only make them appear seperable.

To avoid paying a good mechanic six figures, the duplicitous public is paying the nexus 7 figures, bad mechanics six figures, and bringing down the entire economy, due to opportunity costs, hidden externalities, approaching the vertical.

(pick any industry. it’s not an elevator problem. it’s a system problem. The elevator mechanics are “complying” like everyone else.)

Hay, I’m going to do a PLC course soon lol. Now I’ve got to contend with a guilt trip.

everyone should take a plc course. many efforts will crystalize, and you will always have a job.

you don’t have to work for the nexus, but even if you do, so what?

while taking the class, think about ways to fill the initialization registers electrically, instead of through the GUI.

I’m doing it as a result of an accident (CHI) with no patience for further calamity’s. There is a new breed of human working out there these days, I’ve watched a lot of hard earned talent punch out of the building game due to sales driven projects that make the financial mess look like a Lego’s dilemma.

This new breed of human scares the crap out of me and I lay it all at the feet of the nexus as you call it.

So after 2 degrees 7 trade licenses building everything from multi-million dollar homes in LA, retrofitting all lighting fixtures for the city of Burbank CA, Chemical factory’s, the clading on the AT&T building Colorado Springs, distribution centers across America, mining work for Bechtel, Brisbane Air Rail Link and a dog box or two I’m off to fix elevators lol!

Just me and my laptop ahhhh I can hear the serenity now.

Although I see a ray of light, I helped a young friend get a project asst mgr job with a new mob over here and they built the first 6 star green Mfg plant with folks from Sweden and Germany coming over to do the assembly line install, plus their all over their safety, quoting, job completion time lines and responsibility’s ie no short cuts.

The company’s name is paramount to its future.

Maybe some vanilla banks could do the same eh!

Skippy…I hear you on the GUI issue and high 5 to mid/high 6 figures.

I still don’t understand why securitization should be allowed to exist at all, period. It seems to create unbounded moral hazard. And it seems impossible to effectively monitor, either by regulators, credit agencies, or investors, or anyone else. And it offers a constant temptation to the unscrupulous. Why should it be allowed at all? What advantage does it give TO THE SYSTEM AS A WHOLE? I think it is A LIE to say that securitization lowers the cost of credit. It only SEEMS to lower the cost of credit, until the scams and frauds are exposed and the whole edifice tumbles down.

Similarly, I still don’t understand why credit default swaps should be allowed to exist, unless any company offering them is as strictly regulated by the state as any other insurance company, with, most especially, careful and intrusive monitoring of the ability of the cds issuer to pay out.

I’m no expert (obviously), but if you are looking for a simple narrative that the public can understand, my questions are these:

Why should securitization be allowed AT ALL? Under any conditions, at any time, at any place, ever, by anyone?

Why should any company that sells credit default swaps be allowed to engage in any other business whatsoever? It’s an INSURANCE company.

Why should public money (in the form of deposit insurance) ever be allowed to be placed at risk ‘making a market’ in foreign exchange!!? or in stocks? or high yield bonds? Why should public money be placed at risk in making risky margin loans to let people to gamble on the stock market? Let alone engaging in proprietary trading – why should any of these things be allowed to be done with public money, under the sleepy eyes of incompetent regulators?

In fact, why should public money be placed at risk in making commercial real estate loans? Every time I turn around there is another banking crisis because of a property bubble in commercial real estate. Bankers, even good honest bankers (let alone the crooks) are fooled over and over again.

If the US government has to step in and guarantee bank losses, why should banks be allowed to engage in ANY of these activities? Surely there is enough risk in just engaging in straight personal and commercial loans. For instance, interest rate risks, and the ‘borrow short-lend long’ risks, and the ‘recession’ risks, and the ‘individual credit’ risks. Isn’t that enough kinds of risk for any large group of fallible human beings to be expected to deal with successfully?

I don’t understand why any of these things are allowed. I think the general public doesn’t understand why any of these things should be allowed.

As I said, I am an amateur here, but the more I find out, the more shocked I am at what is going on. And the more convinced I am that the whole thing should be torn down and thrown away.

I don’t think we should regulate the ‘shadow banking system’. I think we should dismantle it.

I can see why corrupt politicians like it, and I can see why unscrupulous businessmen like it, but I do not see how the public gains by allowing any of this stuff to go on.

What am I missing here?

Random comments:

I am not an academic and I found the Venn diagrams quite useful for understanding the article. For goodness sake, you learn Venn diagrams starting in 3rd, 4th grade I believe. Or at least one used to. I did not attend high school and I sure understand Venn diagrams.

As a lay person with a “Popular Mechanics” level of understanding of the economic situation I am wondering why there is such widespread agreement of the concept of “Too big to fail” and “systemically significant”.

How can I as a lay person know that these concepts are not just another Y2K type of scare tactic? Aren’t we really talking about a gambling addiction to the global casino as Hazel Henderson refers to the global markets?

Who has methodically modeled what would happen if those systemically significant entities did fail? I mean a thorough analysis of what would happen acutely and over the long run?

What happened in Russia when the Soviet economy collapsed? And how about Cuba? You can say it is not analagous because those were not capitalist systems, but what if you look at it from the perspective of human behavior when a money system fails? My cursory knowledge is that after the initial crisis everyone who can starts growing food, people have more leisure time and life is less stressful as long as there is the ability to grow food in one’s backyard. People help one another much more. And it does not take that long to rebuid.

How many of you involved in this discussion have actually lived a subsistence lifestyle for a significant period of time? It does change your worldview.

Manusoba Fukuoka suggested that it is spritually necessary for people to be involved in growing at least a small per cent of their food. We lose some fundamental perspective when we are cut off from the source of our sustenance. And now economics has become sooooo abstract I think in part because of exactly this kind of disconnect. Do any of you know what I am talking about? Or do you just think I am a kook? I am curious.

Obviously there are areas of urban concentration that will be painfully affected but why not plan for a collapse to avoid such suffering. We know that humans are at their best when there is a crisis. Not governments, but neighbors and strangers.

According to my cursory research, small business accounts for 60% of the GDP. WOW! I got the impression from the media that our economy is predominantly made up of the likes of AIG and Citibank and the auto industry etc etc. But is it really?

You may think I am a nut, but I am really very intelligent but am not invested in the current paradigms. There are so many mental models that are swallowed, hook, line and sinker by so many of our society’s members. Much of conventional economic wisdom is really insanity in my book.

Ever heard of the crisis before the cure concept? Ever experienced it? Conventional medicine prevents you from experiencing this so we are left in the dark about natural principles that govern so many aspects of human life including our societies.

kjcad,

I’m sympathetic with your line of thinking, but I don’t think those examples serve you well.

I can’t speak for what happened in Cuba, but the results in Russia were not pretty. GDP fell by 50%, male lifespans fell by 5 years, and you had a plutocratic seizure of assets by the politically connected. So the average person was MUCH poorer, with a few on the top becoming unbelievably rich.

“just curious”:

I am probably not the person you want an answer from, but the themes you present are consistent with those presented on this site for the last year.

Like physics, economics is really quite simple, until you get into the details of 7 billion humans interacting with planetary and universe evolution.

Sometimes, when individuals stray too far away from the core, they get lost, and, instead of stopping to get their bearings, they speed up, on the often mistaken theory that they will find a landmark sooner rather than later.

When such individuals gather into a replicative mass, entire economies are sucked into their gravity, which, I think, is a re-statement.

Internet travelers recognize inconsistencies quite quickly, and many have spent significant periods “on the streets” and “in the woods”. Increasing such democratic participation was the driving force behind developing the Internet. It is in the nature of finance to exploit such resources as they mature, to distribute the new and recycle the old.

You are not going to see the leading edge, unless you are working on it, because finance has a habit of pre-selling the future, but quantum development is another subject.

The judges would better serve their own purpose by focusing on reducing the length of patents toward zero, until they reach the equilibrium point, like adjusting a carburetor, to increase their efficiency.

Adding .05% to 99.95%, and putting a patent on it is absurd, but we can’t throw away all the mythology at once, can we?

It doesn’t hurt to clean the carburetor once in a while, and, every so often, to replace it all together, with a better model.

kjcad,

The source of an individual’s sustenance is dependent on the spiritual and physical health of the total organism planet earth. Living closer to the earth is futile when the skies rain down toxins from above and the water that flows through your little plot of land is despoiled by those who have deceptively availed themselves of a greater share of the total organism planet earth and used that share foolishly and destructively.

If you were “really very intelligent” as you claim, you would realize that you ARE living in ALL of the current paradigms which include the Fuckuoaka paradigm you have so deeply swallowed.

The current paradigms are all human deceptions, with the current theoretical bullshit surrounding the world of finance having the most impact due to the depth of the deceptions and the aggregate number of people it effects so negatively.

We live in a cannibalistic dog eat dog world. The spiritual necessity of life is to get one’s needs met through choice guided by perception. That includes maintaining equilibrium in one’s sphere of influence which includes the entire planet and the wage and asset spread of other humans that exist on it.

Deception is the strongest political force on the planet.

Replacing an economic motor is tricky business.

Once the job is done, everyone has to go back to thinking that capital does all the doing, so capital will feel secure, to securitize. War is the misdirection.

It’s the Lazarus trick.

after the war, the middle class was much better at playing along with the mythology. the last generation took it seriously.

Capital is under implosive pressure; it’s only out, temporarily, is to give up part of the empire.

Of course its helper priests are spinning it to get as much for themselves as they can, arbitrarily exposing cracks preemptively. Capital wants no part of seeing what evolution looks like up close.

I thought Volcker was proposing to separate all three categories from one another (or at least attempt to).

The nuts-and-bolts of actually accomplishing full separation of commercial banking, investment banking, and proprietary trading might be tricky, I suppose, but it seems eminently sensible to try to accomplish that goal.

And I think it is far from certain that allowing investment banks and/or trading firms to fail WOULD cause that much damage to the “real economy.”

Geithner keeps saying that, but why should we believe him? It is not believable to me that there are no better ways of protecting the economy than rescuing existing troubled financial firms.

Why wouldn’t strengthening existing SOUND banks, and/or creating new banks, and/or taking other measures to directly rescue the most innocent of the victims of this crisis, all be BETTER ways, needing less taxpayer funding, to deal with this mess or the next one like it?

What the Volcker plan needs is (1) an unequivocal law that says the government and Fed WILL NOT rescue investment banks or traders (and spelling out how such failed firms will be closed down) and (2) a fund, built from taxes on investment banking and trading, to use to mop up after failed investment banks and traders.

Sunshine laws for both types of firms should be considered as a way to make it safe for everyone else to have dealings with these firms. I see no public purpose in allowing ANY secret deals.

I know, politically, such ideas have no chance.

Karen, I agree with you entirely. Except the part about there not being any chance of this happening politically.

I have yet to hear anyone give any sort of credible explanation why society in general was better off by not allowing Citibank, and Bank of America, and Wells Fargo to fail. It is intuitively obvious why their CEOs, and their Boards of Directors, and their shareholders, and their bond holders were better off by being bailed out. Sheer selfish advantage. I can see how corrupt politicians benefited, from Bush to Obama, and from Paulson to Geithner. But how exactly would the failure of those firms brought down the American economy?

The assets of those companies wouldn’t have disappeared, they would have been sold to other banks, and begun to be managed by competent executives.

How would the American economy have been worse off if the assets of these banks had been sold off?

Just two points:

1) I would not write off Volcker immediately. I believe he knows he has to separate all three. You have been critical of him, based on a speech. Is it possible that he will fix it while in process?

2) Regulators often use a trick like this. They take a basic case and let the world debate, then they add inconsequential bits that usually weaken the regulation tilting it in favour of vested interests. With a man of Volcker’s integrity, I think he is using this trick to achieve the opposite. He loves ambiguity thats not good for long term but at the hands of Volcker I hope it turns into something better.

Possibly I am too awed by the fellow. But I hope!