Andrew Dittmer, who was an important collaborator on ECONNED, sent me pdfs of the notorious Citigroup Plutonomy reports for leisure reading. Michael Moore highlighted these two research reports (2005 and 2006) in Capitalism: A Love Story .

On the one hand, the authors, Ajay Kapur, Niall Macleod, and Narendra Singh get some credit for addressing a topic surprisingly ignored by mainstream economists. There have been some noteworthy efforts to measure the increase in concentration of income and wealth in the US< most notably by Thomas Piketty and Edmund Saez. But while there have been some efforts to dispute their findings (that the rich, particularly the top 1%, have gotten relatively MUCH richer in the last 20 years), for the most part discussions of what to make of it (as least in the US) have rapidly descended into theological debates. One camp laments the fall in economic mobility (a predictable side effect), the corrosive impact of perceived unfairness, and the public health costs (even the richest in high income disparity countries suffer from shortened life spans). The other camp tends to focus on the Darwinian aspects, that rising income disparity is the result of a vibrant, open economy, and the higher growth rates that allegedly result will lift help all workers. Yet as far as I can tell, there has been virtually no discussion of the macroeconomy effects of rising income and wealth disparities, or to look into what the implications for investment strategies might be. Now the fact that the Citi team asked a worthwhile question does not mean they came up with a sound answer. In fact, he reports are almost ludicrously funny in the way they attempt to depict what they call plutonomy as not merely a tradeable trend (as in leading to some useful investment ideas), but as a Brave New Economy development. I haven't recalled such Panglossian prose since the most delirious days of the dot-com bubble:

We will posit that: 1) the world is dividing into two blocs – the plutonomies, where economic growth is powered by and largely consumed by the wealthy few, and the rest. Plutonomies have occurred before in sixteenth century Spain, in seventeenth century Holland, the Gilded Age and the Roaring Twenties in the U.S.What are the common drivers of Plutonomy? Disruptive technology-driven productivity gains, creative financial innovation, capitalist-friendly cooperative governments, an international dimension of immigrants and overseas conquests invigorating wealth creation, the rule of law, and patenting inventions. Often these wealth waves involve great complexity, exploited best by the rich and educated of the time…..Most “Global Imbalances” (high current account deficits and low savings rates, high consumer debt levels in the Anglo-Saxon world, etc) that continue to (unprofitably) preoccupy the world’s intelligentsia look a lot less threatening when examined through the prism of plutonomy. The risk premium on equities that might derive from the dyspeptic “global imbalance” school is unwarranted – the earth is not going to be shaken off its axis, and sucked into the cosmos by these “imbalances”. The earth is being held up by the muscular arms of its entrepreneur-plutocrats, like it, or not..

Yves here. Translation: plutonomy is such a great thing that the entire stock market would be valued higher if everyone understood it. And the hoops the reports go through to defend it are impressive. The plutomony countries (the notorious Anglo-Saxon model, the US, UK, Canada and Australia) even have unusually risk-seeking populations (and that is a Good Thing):

…a new, rather out-of-the box hypothesis suggests that dopamine differentials can explain differences in risk-taking between societies. John Mauldin, the author of “Bulls-Eye Investing” in an email last month cited this work. The thesis: Dopamine, a pleasure-inducing brain chemical, is linked with curiosity, adventure, entrepreneurship, and helps drive results in uncertain environments. Populations generally have about 2% of their members with high enough dopamine levels with the curiosity to emigrate. Ergo, immigrant nations like the U.S. and Canada, and increasingly the UK, have high dopamine-intensity populations.

Yves here. What happened to “Give me your tired, your poor/Your huddled masses yearning to breathe free/The wretched refuse of your teeming shore”? Were the Puritans a high dopamine population? Doubtful. How about the Irish emigration to the US, which peaked during its great famine?

Despite a good deal of romanticization standing in for analysis, the report does have one intriguing, and well documented finding: that the plutonomies have low savings rates. Consider an fictional pep rally chant:

We’re from Greenwich

We’re invincible

Living off our income

Never touch the principal

Think about that. If you are rich, you can afford to spend all your income. You don’t need to save, because your existing wealth provides you with a more than sufficient cushion.

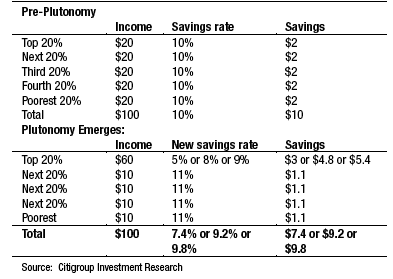

The ramifications when you have a high wealth concentration are profound. From the October 2005 report:

In a plutonomy, the rich drop their savings rate, consume a larger fraction of their bloated, very large share of the economy. This behavior overshadows the decisions of everybody else. The behavior of the exceptionally rich drives the national numbers – the “appallingly low” overall savings rates, the “over-extended consumer”, and the “unsustainable” current accounts that

accompany this phenomenon….Feeling wealthier, the rich decide to consume a part of their capital gains right away. In other words, they save less from their income, the wellknown

wealth effect. The key point though is that this new lower savings rate is applied

to their newer massive income. Remember they got a much bigger chunk of the

economy, that’s how it became a plutonomy. The consequent decline in absolute savings for them (and the country) is huge when this happens. They just account for too large a part of the national economy; even a small fall in their savings rate overwhelms the decisions of all the rest.

Yves here. This account rather cheerily dismisses the notion that there might be overextended consumers on the other end of the food chain. Unprecedented credit card delinquencies and mortgage defaults suggest otherwise. But behaviors on both ends of the income spectrum no doubt played into the low-savings dynamic: wealthy who spend heavily, and struggling average consumers who increasingly came to rely on borrowings to improve or merely maintain their lifestyle. And let us not forget: were encouraged to monetize their home equity, so they actually aped the behavior of their betters, treating appreciated assets as savings. Before you chide people who did that as profligate (naive might be a better characterization), recall that no one less than Ben Bernanke was untroubled by rising consumer debt levels because they also showed rising asset levels. Bernanke ignored the fact that debt needs to be serviced out of incomes, and households for the most part were not borrowing to acquire income-producing assets. So unless the rising tide of consumer debt was matched by rising incomes, this process was bound to come to an ugly end.

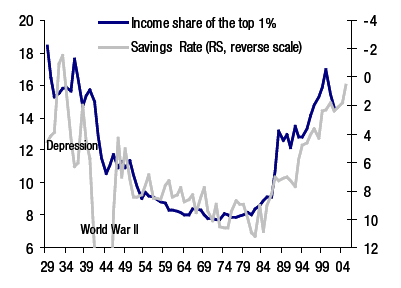

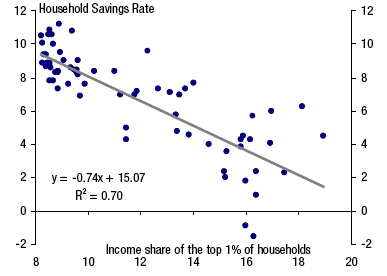

The US shows a negative relationship between income concentration and savings (data points 1929-2002, with 1940-1944 excluded, which is defensible, given widespread wartime rationing):

Canada shows the same downward sloping relationship, as does the UK (although the authors have to massage the data a bit more, with one downward sloping line for the period before 1990, with a shift for the 1990s period).

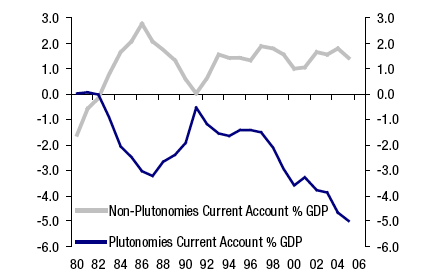

And not surprisingly, plutonomies, with their low saving rates, run current account deficits:

Note this chart excludes the newly industrialized nations of Asia, particularly China, which would presumably make the surplus line in the chart above even more dramatic.

Now correlation is not necessarily causation. However, for those of you who are keen to lower level of borrowing in the US and other debtor countries, it would appear that reducing income inequality needs to be part of the program.

It would be interesting, in the interests of full disclosure, if the authors of such self-serving propaganda were required to list their income and assets along with their credentials—not only in fiscal/economic papers, but in editorials on health care reform and entitlements shredding as well. It’s not just history that’s written by the winners.

And as you suggested, it’s more usually despair, not adventurism, that motivates the great human migrations. In 1994 my family and I uprooted ourselves from the land of our childhoods, left our house to strangers, and moved across the state to a place where we knew no one, because the unemployment and lack of opportunity at home had sentenced us to a life of poverty. That’s desperation, not dopamine.

”

Living off our income

Never touch the principal

Think about

”

U bet, Saint Yves! For the 99% percentTylers, money is worthless for the moment. Those Tylers simply save every penny of it plus its interest and dividends for some time in the future when it can be converted conveniently into what the 99% percentTylers truly need==POWER. TopTylers have a 0.09% MPC, Marginal Propensity to Consume, but middleTylers have 50% MPC. Sadly, bottom Tylers have 110% MPC until credit card maxes out. MPC for bottomScrapers then drops to 100% minus debt service garnished. Did your illusory charts fail to illustrate all 3 Tylers? Did you neglect someone important?

Is the heresyParty the middleScrapers? Are members of the hypocrisyParty a combination of bottomScrapers plus topTylers? Do donkeys==hypocrisy? Do elephants==heresy?

U B Judge

U B Subset definer

Immigration policy in the US has changed. The poor from the favelas of Brazil or the shanty towns of Manila can’t get in here. Check out the waiting lists and see who gets to the front. Our immigration policy is based upon skills and the need for certain skills. Hence the phrase brain drain.

Only in immigration from Mexico and Central America do you see the Irish model, or the open-immigration model from the 19th century, and that is because of an open border and proximity.

Imagine how American views of the Chinese would change if China was on our border, and it was Chinese peasants who could come here en masse- rather than the so-called ‘cream of the crop’ that we see now. And if Mexico was 2,000 miles away and we only saw the Mexican elite.

Changes in US immigration patterns and policies is a relatively unexplored aspect of American history, and is also behind the shallow stereotypes we have of different immigrant cultures.

To be more accurate, I should say, if Mexico was across the ocean…as it is 2,000 miles away from some parts of the US. Anyhow.

“as you suggested, it’s more usually despair, not adventurism, that motivates the great human migrations”

Very true as the last big wave of emigration (from the former Soviet Block) came when economies of post Soviet States were complete mess and poverty was rampant.

A related question is “How stable are plutonomy-based societies, especially in crisis?”. It looks like in many cases the crush took away the empires that were the base of the plutonomy. At the same time the USA managed to restructure itself in 30th-40th (not without help of WWII).

Related question is how quickly elite degenerates in plutonomy ? Bush II among other things was a clear sign of degeneration of the elite.

Great topic and post but I just have a few points to add.

I usually like Michael Moore but I was appalled that he attacked the authors of this Plutonomy report like he did. Those guys are absolute heroes and should be given medals for writing that report. They dared tell the unvarnished truth about the economic model of the United States. And yes, given their intended bankster audience, they go on to cover up their unabashed use of the truth with some easily refutable nonsense about how Plutonomy could be a good idea. The best thing that could happen is have this report distributed to ever literate American citizen.

The other way they covered their tracks was to confuse Plutonomy with the Anglo-Saxon economic model in order to avoid being called anti-American lefties. The fact is that while Canada, Australia, and Britain (CAB) do share a similar (and unfortunate) macro-economic outlook, our three English-speaking cousin countries are nowhere near entering Plutonomy in terms of income disparities. If we look at the Gini index numbers, with the CAB countries around 32, they are just a little above the EU average of 31. The EU range is from Sweden at 23 to Portugal at 38. So while the CAB number are not great, neither are they exactly Plutonomic either. One word of caution is that I am not sure of the trend lines for our CAB friends.

I know I could be accused of doing here what Leo Strauss does to Plato but what is so obvious is that the authors coined the word Plutonomy because they knew they could never get away with calling it what it really was, the Latin American Model. The US Gini is 45 whereas the Latin American range is from 43 in Nicaragua to 60 in Bolivia. But given the direction things are moving, with wealth in the US getting more concentrated by the minute, while in contrast a plethora of socialist governments have taken power over the last decade in Latin America, by 2020 the US will be near the top end of the Latin American Gini range.

In any case the more Plutonomy gets the discussed the better.

As for John Mauldin’s little theory, what he is really trying to propose is that immigration tends to filter for alpha males. Of course (as velobabe now knows ) nothing could be more false. Immigrants tend to come from countries with huge income disparities. In these countries the alpha males will tend to stay at home since by definition they have near monopoly access to all best women. Why in the hell would they want to take a chance on a new country when they are doing just fine in the old one? It’s the loser beta men, who have no chance to reproduce in a society dominated by a few big men, who take the desperate chance to emigrate in search of a society where they have a chance to reproduce.

Besides, in a middle class society the state must crush the violent and risk-taking impulses of the alpha male through a system of punishments and disincentives anyway. They do this by means of police forces, property rights, justice systems, and monogamy laws; the state claims its monopoly on violence and assumes the role of proxy-alpha. This way lesser beta man have a better chance at finding mates, since the pre-feminist women, knowing they are protected by the proxy-alpha of the state, value more highly the breadwinning abilities of the beta man over the protective violence of the alpha male. In America the only alpha males who can exist are at the extreme ends of society. In other words, you have dirt poor violent gangstas who reject the authority of the state; as well as super rich economically violent bankstas who by means of controlling and manipulating the state have enough power to protect themselves from the usual state sanctions against male alpha behaviour.

But it is true as the US moves towards Plutonomy and the middle class break down, combined with female economic options, there will be more and more scope for male alpha behaviour and less room for beta male success.

I know Ajay Kapur, one of the authors of the Citigroup report on Plutonomy. The man is both fearless and brilliant. All you need to know is that he listens to Britney Spears and Pink Floyd during his morning workout.

Kevin, you definitely get it. Michael Moore, despite his best intentions, did not. Ajay was just telling it like it is. Sometimes what shows up in the mirror is not always pretty, but hey, there it is, so we have to deal with it instead of looking away.

On the dopamine thing, I agree there is the other d, desperation. Pretty sure that is what drove the French branch of my family from France to Canada three centuries ago, and from Canada to the US one century ago.

But there are plenty of desperate people (and families) who don’t have the daring it takes to leap into the totally unfamilar. So maybe it is not an either/or thing. Maybe it is both desperation and dopamine at work. Look into it and I suspect you will find both are present.

you had me at, alpha male†

I never fail to enjoy your analysis (and the businessman in me instinctively wants to see you monetize your talents). I’d like to see you incorporate a little more of the work on relative consumption to enrich the alpha male angle (while we still live in a mostly patriarchal, male-dominated society, husband-seeking is not quite as important as it once was and mate-seeking in general is only relevant to a portion (albeit high) of the population) and then start publishing.

Thanks AJ, you may have planted a little seed….

I am in absolute agreement with Elwood. It is a simple case of accumulative causation, specific groups have not only the advantage of capital accumulation, but also social networks and concurrent government capture, this leads to an increasingly larger accumulation for a smaller section of the population. They export work overseas and keep consumptive goods at an artificially high price to get better margins on the sale of consumer goods. But the lack of capital accumulation for the larger section of the population will lead to stagnating demand and lower returns on capital invested in industry. The only thing you have left is to speculate on assets and equities, or squeeze higher margins out of the workers in developing countries or the middle class in your own. Asset bubbles big surprise. The system is basically cannibalizing itself.

You have external forces in this equation but with savings rates as high as they are in the exporting countries and influx of petrodollars to dictators and oligarchies in petro states the situation is reinforced further. So what do you do, you float consumer debt, which passes the problem on to the next guy. Until you get a more equitable system it will just repeat the same trends, what we see is symptomatic.

This whole alpha and beta male dichotomy is quite nonsense. There is no objective proxy for this alpha or beta distinction. Most everyone has the ability to breed with a suitable partner, where are your means of selective pressure? Potential accumulation of resources, which potential to accumulate is predicated upon parental wealth and connections? If you want to characterize someone that has the fortune of birth as an alpha male go ahead but there are just as many wastes inhabiting the upper echelon as other categories. You may be able to look at our current economic circumstances as a failure of that particular elite to manage the economic-political system.

Stelios,

Mo further down the thread pointed out the same problem with the alpha / beta dichotomy. I’ve been reading about this all weekend and when I read the comments on dopamine the first thing I thought of was of a Foundation Myth that needed to be debunked. But I overshot a bit by not taking into account genetic merit vs. hereditary privilege. In other words the alphas (either for hereditary or genetic reasons) who had access to wealth and women stayed while some betas emigrated and other betas stayed and as a result their genetic lines probably met a brutal death. In Mo’s example a man needed to own a farm to have a reasonable chance of having a wife but even that was no guarantee. So Maudlin’s explanation as to why some betas left while others stayed may (or may not) be linked to higher dopamine levels.

But if what I read about only 40% of men historically who pass on their genes is true (compared to 80% of women) then there really is some sort of division between men who have access to mates and those who don’t, whether it is genetic or hereditary. Since we live in middle class societies we rarely think of these things as they are usually the result of intention choices, but in poorer societies there is intense competition for mates among males. In these societies polygamy often makes more sense for women since one tenth of a Big Man is worth more than all of a Nothing Man. But if the Big Men are monopolizing the women that makes life very tough for the other men. Our society does not allow this sort of thing (even Tiger got shot down) so instead the Big Men monopolize resources instead.

In pacific Island culture pre-modern times, when economic, population vs resources barriers, tribal leadership granting of marriage, excluded some from breeding, a canoe was the only hope.

What a drive, to set forth with out knowledge, with out guaranty…

Island hoping is now futile and only population control or resource import at above cost enables life to go on.

Skippy…I would postulate that we have replaced nature’s fury with our own…the money cycle.

The stuff about dopamine is gibberish. The levels aren’t measurable in people without invasive procedures, and the levels don’t matter. It’s the effective concentration in synapses that matters, again impossible to measure in practice. They’re inferring it from low risk aversion or high tolerance of novelty. But it would be more honest to just reference risk aversion or novelty-seeking.

Moreover, this is based on the old “hardwired” brain-as-computer nonsense, not to mention 19t century notions of heritable traits. The brain is plastic, with neurotransmitter levels changing in dynamic relation to embodied experiences, which are respondent to environmental conditions. Yves point about hard times leading to increased migrations are evidence of this. People find risk of leaving home more palatable when things at home are going poorly. Those same people are likely to stay when things at home are going well.

Oh yummy, new ways to intervene in the marketplace. Long live the all knowing apparatchiks. They have done so well these last couple of years!

The US shows a negative relationship between income concentration and savings (data points 1929-2002, with 1940-1944 excluded, which is defensible, given widespread wartime rationing):

The period 1940-1944 included a huge amount of genuine capital investment in plant and equipment. This was the flip side of “wartime rationing”. Ford Motor Company had to build Willow Run and train the workers before it could start kicking out B-24s.

I see no reason why this period should be excluded. If anything the period from 1939 to 1945 should be studied intensively for lessons in emergency capital mobilization and skilled worker training and retraining.

Economics taught as late as the early 1970s often presented “consumption” and “investment” as mutually exclusive choices. At the microeconomic level the individual can choose to spend $1 on a coke (“consume”) or save $1 (“invest”). At the macroeconomic level the economy either operates a coke plant or can do something else with the labor and energy, such as “invest” in foundries, aluminum smelters, build servo motor plants, etc.

Plutonomy, my – my – my, what an ingenious application. Couple that with a lot of crap think pop science and you get a delusional excuse to be used to mollify the guilt associated with unconscionable theft.

For the material reported, plutocracy would be the accurate word. But then, that word is generally applied as a perjorative and would not assuage the guilt of the new robber barons.

The data does raise several interesting considerations. Is it wise for the rich to spend all their income? Is it wise for the wealthy to spend all their income? And perhaps more important, how shall the poor save for future consumption when their current income is zero?

Another area of consideration would be the problem of erroding purchasing power. As savings are a form of investment, what is the appropriate rate of income to be compounded to a future sum for use as necessary? Is the rate to a Treasury Note or Bond acceptable; or do you need something more to account for the expected loss in purchasing power? Will there be a loss in purchasing power? In 75 years of experience the loss in purchasing power has been at a compound rate of 3.25%. So, if Treasuries are paying 4.5%, in order to hold purchasing power I will need to obtain a rate of 7.75%.

Now that last item pushes me down the safety scale to junk bonds. Is there another way to resolve this dilemma? Well, I could buy now, make payments over time and enjoy consumption now. Now there are Mortgage Equity Withdrawal, Credit Cards and vender time payment plans. I’ll use those little beauties and beat the bastards at their own game.

Not only is that a rational choice, it is the American Way.

If the rich are wise, they will convert their riches into the ownership of the means of production. For the wealthy, especially those actually operate the means of production they will be wise to escalate prices at every opportunity so as to hold constant the purchasing power of revenues. Now that is also the American Way, beat inflation by raising prices and save nothing.

Alpha Males, Dopamine Rush, BULLSHIT!!!! It’s all about the purchasing power of that which we call money.

Plutonomists would be wise to understand the implications of rapidly expanding ICT (Information & Communication Technology) , a highly inter-dependent and fragile technological infra-structure (see John Robb’s GlobalGuerillas for more on this) and the concept in behavioral economics called the “Ultimatum Game.”

Imbalances that could be enforced via ignorance, isolation and fear aren’t going to be sustainable for long… not that they ever were…

On the Birth of the Global Social Organism

http://culturalengineer.blogspot.com/2009/05/on-birth-of-global-social-organism.html

You should add China and Russia to your list of countries with high income disparity, although that doesn’t exactly help your hypothesis.

I would note that specifically in China, the savings rate is between 30 and 40%, but the Gini index of China is now the same as that of the US, and of course China has the world’s largest current account surplus.

Don’t believe me? Then visit Shanghai (as I often do). Or read here:

http://en.wikipedia.org/wiki/Gini_coefficient

As for Russia, read here:

https://www.cia.gov/library/publications/the-world-factbook/fields/2172.html

Note also that the Gini indices of China and Russia are rising rapidly, while that of the US has risen at a much lower rate.

It is typical of leftist governments to have a very high concentration of wealth in the hands of a very few. Maybe we overlook this fact because leftist governments have so little wealth to distribute inequitably (think Venezuela and Cuba, Vietnam, etc).

Note also that the Gini indices of China and Russia are rising rapidly, while that of the US has risen at a much lower rate.

That’s not what the link you gave says:

According your CIA link:

China’s Gini is rising 0.25 per year between 2001 and 2007.

Russia’s Gini is rising 0.34 per year between 2001 and 2008.

USA’s Gini is rising 0.42 per year between 1997-2007.

So the US rate is rising much more rapidly than either China and Russia.

By the way, Australia, Canada, and Britian’s Gini rates have all been falling during a similar time period.

By “are rising” I didn’t mean to go back to 1997. Here is some current data.

In 2009, the China Gini index rose by .47. See:

http://news.xinhuanet.com/english2010/indepth/2010-03/13/c_13209601.htm

In 2009, the overall Gini index of China was 47.0, HIGHER than the US at 45.0. See

http://www.photius.com/rankings/economy/distribution_of_family_income_gini_index_2009_0.html

Between 2007 and 2009, the US Gini index WAS UNCHANGED. See:

http://www.photius.com/rankings/economy/distribution_of_family_income_gini_index_2009_0.html

versus

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2172rank.html

But all this misses the point. The author says that high income disparity results in a low savings rate. No matter what the TREND, the absolute value of the Chines Gini index of disparity of income is HIGHER than that of the US, while the Chinese savings rate is also enormously HIGHER than that of the US. So the author is demonstrably utterly wrong.

Joe,

Not to obscure your larger point, which I think still holds, but there is something seriously funny with the CIA’s numbers for China. From 2001-2007 China’s Gini goes up from 40 to 41.5. In 2008-9 we know it goes up 0.47 and that it ends up at a total of 47. That means it jumped an incredible 5.03 in one year from 2007-8. That is just not credible.

In any case it’s not your fault it’s the damn CIA screwing things up!

Change “leftist” to authoritarian and you are on to something. The left right divide is not nearly as informative in this instance as the libertarian authoritarian divide.

I don’t know about libertarian / authoritarian scale either. Where would Sweden or the other northern European social democracies fit in on this scale? They have the best Gini scores but I would never call Sweden libertarian, and it’s not exactly authoritarian either (but some Swede’s may differ on that!). To me, with one huge exception, the Gini tables generally correlate with total wealth. That is the richer the country the better the Gini score (the more even the distribution of wealth). Amd inversely the poorer the country to worse the distribution is.

The huge exception to this rule is the US.

The other correlation is between democracy – oligarchy – true monarchy (not the UK type, the real kind found in poor African countries) with democracies having the best Gini scores, the oligarchies the middle scores, and the poor monarchies the worst scores. This makes sense of course as you would expect a democracy to spread the wealth around. Here the US fits in where it belongs in the middle of the table among the other oligarchies.

The policies adopted by the Republican Party and the neo-lberal Rubin Democrats, have, whether intentioinal or not, seem intended to make the entire United States into something like the State of Mississippi, with a tiny super-ealthy ruling elite, a small, insecure middle classe, and the remaining mass of people uneducated, drugged and boozed out, comforted by religion, divided along racial lines, and available for cheap labor when needed. And Mississippi and Louisiana have always been the states that most closely resemble Central American republics (with the exception of Costa Rica, which is relatively egalitarian, and now Nicraugra, which of course the American right hates).

Maybe we should try Islamic banking — it appears to be far more moral in structure, and, could the destruction of Islamic banking be one of the reasons why we are dropping pedators (child killing missiles) on Pakistan? …

Excerpt;

“What Is Islamic Finance?

In order for one to understand how Islamic banks have virtually escaped unscathed from this financial crisis, it is essential to have a grasp of the basic fundamentals of Islamic finance. Islamic finance is based on shariah, or Islamic law, which in essence requires that gains be derived from ethical and socially responsible investments and discourages interest-based banking and investments. Islamic finance is fundamentally different from the conventional banking models as it is based on a profit and loss structure (PLS) and the prohibition of riba’ (interest). This structure requires that the financial institution invest with the client in order to finance the client’s transaction rather than lend money to the client. Due to the inherent risk involved in any investment, the financial institution is entitled to profit from the financial transaction. This is a stark contrast to modern finance in which interest is one of the key methods by which banks make money through their products, such as mortgages and personal loans.

Another fundamental distinction of an Islamic bank is the absence of insurance protecting client deposits found in conventional banks. While the PLS structure permits receipt of money by depositors when deposits invested have earned a profit, they must incur losses when deposit investments incur losses to comply with shariah mandates. Deposit insurance, such as the protection provided by the Federal Deposit Insurance Corporation, defeats the very purpose of the PLS model, as the depositor does not incur any risk. The deposit insurance is an integral part of the western banking regulations but is in direct conflict to the basic concepts of Islamic banking. The issue of deposit insurance has proven to be a major hurdle for western, primarily European, banks that wanted and have chosen to provide shariah-compliant products. European banks overcame this hurdle of deposit insurance by informing clients that the insurance was not shariah-compliant.[1]

Islamic banks have been marketing their services aggressively in the West. The conventional commercial banks have in direct competition with the purely Islamic banks begun offering Islamically structured products to their clients through “Islamic banking windows’. However, confusion exists about Islamic banking. In many minds, the prohibition of interest is the defining characteristic of Islamic banking, but it can be distinguished from conventional banking by its concern with spiritual values and social justice.

The fact that interest is prohibited does not mean capital is costless. Islam is not opposed to a return on capital. What it prohibits is the predetermined pricing of capital. The owners of capital have no right to ask for additional payment without sharing risk. Thus in lieu of fixed interest which is prohibited, the lender will be a participant in the enterprise. [2] “

More here …

http://paknet.net/islamic-banking-and-global-financial-market-signs-of-sustainable-growth/

Why even that nazi pope and france support Islamic finance …

http://www.brusselsjournal.com/node/3819

Deception is the strongest political force on the planet.

Maybe we should try Islamic banking

We are. Our Shariah style “banks” are called “private equity” firms here.

No thanks.

Here are cultures where majorities are easily led by clerics into regarding scheduled maintenance of equipment as blasphemy. The rationale here is simple. If it’s the will of God for a piece of equipment to break down, then it will break down. Trying to prevent this event is therefore trying to prevent the will of God from being realized. This is clearly blasphemous for “one who submits to the will of God”, which is the definition of a Muslim.

There is not and there will never be leading edge Islamic military aircraft, naval ships or land combat vehicles. Or anything else. Although I oppose most of the current tactics of the “war on terror”, I do so in the certain knowledge these aboriginies cannot reach us. Unless we’re sufficiently afflicted by amnesia, apathy and abulia to bring them here ourselves.

Charcad, wake up and smell the coffee. “These aboriginies”, as you so naively characterize them, are here and doing quite well …

Excerpt;

“The recession gripping the nation has taken less of a toll on American Muslims who follow age-old Islamic laws against paying – or charging – interest.

They’ve also been shielded by socially responsible retirement plans because Shariah– Islamic law – forbids investments in banks and mortgages as well as tobacco, alcohol, gambling, pornography or weapons.

“If everybody was Shariah-compliant, there would be no recession,” said Farouk Fakira, a Yemeni immigrant who moderated a discussion on Islamic finance at Sacramento’s Masjid Annur last week.”

More here …

http://islamicfinancenews.wordpress.com/2009/03/30/if-everybody-was-shariah-compliant-there-would-be-no-recession/

Deception is the strongest political force on the planet.

I’m wondering how much of this stuff might be reflections of the demographics of the baby boom generation.

I’m one of them who got lucky and is hoarding my acorns to last me the rest of my life. That seems like a normal instinct that may be multiplied by the large population looking at the same goals.

A few big players may be tipping the tipping the scales to extremes. A huge number of grasshoppers are going into autumn with no reserves, but wanting them, which makes the situation more bipolar.

Being a leading-edge baby boomer, I’ve seen all kinds of agencies take credit for our transition through life phases. For example, MADD deciding that we needed to be reined in when we were youg and dumb and then taking credit for fixing things as we got older and wiser. The same with police and crime.

I’m not saying that there isn’t a lot of greed-based accumulation by a privileged few that needs to be legislated to balance the common good. The system is very broken right now. But there is going to be a big and natural trend to stuff money away and try to live off the interest, because lots of us are getting old and that’s the obvious goal. Maybe it is unsustainable and the machine will break.

I was led to believe that putting money into the stock market was feeding business and growth. That is what was happening but the crash chased lots of money to safer investments. I’m not so sure my simplistic model of the stock market was right anyway.

Whatever the problem that we are looking at, let us not forget that on the social scale us aging baby boomers are going to continue to twist things away from previous trends.

Yves, I also saw the 2006 plutonomy report linked in a comment over at zerohedge.

The nice little ditty I noted on page 10, Gotta give ’em some credit for calling it exactly right:

Our whole plutonomy thesis is based on the idea that the rich will keep getting richer. This thesis is not without its risks. For example, a policy error leading to asset deflation, would likely damage plutonomy. Furthermore, the rising wealth gap between the rich and poor will probably at some point lead to a political backlash.Whilst the rich are getting a greater share of the wealth, and the poor a lesser share, political enfrachisement remains as was – one person, one vote (in the plutonomies). At some point it is likely that labor will fight back against the rising profit share of the rich and there will be a political backlash against the rising wealth of the rich. This could be felt through higher taxation (on the rich or indirectly though higher corporate taxes/regulation) or through trying to protect indigenous laborers, in a push-back on globalization – either anti-immigration, or protectionism.We don’t see this

happening yet, though there are signs of rising political tensions. However we are keeping a close eye on developments.

Kevin de Bruxelles – It’s the loser beta men, who have no chance to reproduce in a society dominated by a few big men, who take the desperate chance to emigrate in search of a society where they have a chance to reproduce.

WTF?

My Dad emigrated from Ireland in the late 50’s. Here’s how it happened – oldest brother gets the farm, younger 3 brothers are on their own. Their options? Marry a female (an alpha female?) with a farm and no brothers, or emigrate. (One of the brothers tried this, but the woman’s father seemed to think my uncle didn’t have sufficient financial alpha and the relationship ended.) All 3 went to England and became nurses. Dad really didn’t care for the condescension of the Brits so when presented with the opportunity to come to America, he took it and loved it.

The 3 “beta” brothers married and had children. “Alpha” brother back at home may have had access to the most desirable females, but he didn’t marry until much later in life so no little “alpha” males were produced to inherit the farm. His wife wasn’t much to look at, but she was strong and could cook a mean goose. (She offered one to my mother for us to take home in our suitcases.)

Anecdotal evidence – sure – but I think it shows that economic circumstances (with a dash of ambition or desperation) are the primary motivating factors determining who stays or goes.

Mo,

To be honest the whole alpha-beta frame does start to break down from the lack of a clear definition of what an alpha / beta really is. People tend to twist the definitions of each to meet the goals they are trying to reach. In your father’s case (and many other Irish immigrants from the 50’s-60’s, I have family in Belfast and so I have heard many similar stories) he was a sort of hereditary economic alpha and his brothers hereditary economic betas but it is true this says nothing about their genetic disposition to be alphas or betas.

But your point is well taken and I’ll have to rework that whole alpha / beta immigrant thing to more clearly take economic considerations into account!

oops, that should have been,

his older brother was a sort of hereditary economic alpha while he and his brothers were hereditary economic betas

hum, mo, i think you just described my bf (boyfriend) who is irish and oldest of three sons and father came to america in late 40’s. i was asking him about mother, bride and wife power and i thought he was an alpha male. he struggles mind you, like all the irish. but he is my PM (precious metal). i am for sure an alpha female, no doubt and very spoiled. but he works real hard (cooks)(caddies), and is 12 years younger than i am. so we figure it is about perfect. i die at 90 and him at 80. audios†

This means we need lower taxes for the rich to help them save more. Because that means more investment capital and more jobs for everybody.

– Gerry “Bingo” Buckman, author

page 789

“Prosperity to Paradise: A New Model for Social Utopia”

MegaDynamics Books

Op Cit

There you go again, another mistake.

It should be page 791, unless you’re quoting from the fiftheen edition, in which case, it should be page 2548, with the quote revised to say, ‘This means the squirrel king, in his tiny, quaint forest kingdom consisiting of only one squirrel subject, should run a bigger deficit by borrowing more from his only squirrel subject so the solitary squirrel subject (i.e. the priveate sector) can save more.’

Everyone appears to ignore a new wealthy class. This is the government employee who has a geneerous defined benefit retirement at an early age. This employee also has medical insurance that most non-government workers can only dream of. They are truly the new elite. Apparently, they now outnumber the productive in that there are more of them than folks who actually make things.

Income and wealth inequality is the root cause of financial instability. Capital, and the need for capital must be balanced for an economy to function stably.

If the accumulation of capital exceeds the need for capital to fund growth, the taxes on wealth and capital gains must be increased, and that on consumption and consumer income decreased .

If consumer demand, and the attendant capital needs, outpace capital accumulation, the reverse is required. Taxes then should be shifted from capital gains to consumption and consumer income.

Over the past several decades capital accumulation has outpaced the demand for capital, largely due to reductions in top bracket tax rates and stagnation of middle class incomes. The discussion that follows shows what happens when this occurs.

Enterprises need capital to expand and take advantage of new opportunities. This allows economies to grow to accommodate increases in population and the attendant need for new jobs.

If too little capital is accumulated, growth will be curtailed. If the effect is severe enough, sufficient growth will not be achieved to accommodate population increases and the need for additional jobs, and the standard of living will fall.

If too much capital is accumulated, rates of return on capital drop. As rates of return drop, capitalists seek ways to improve them through the use of leverage or through the use of techniques to increase the demand for credit.

If leverage is used , risk increases, necessitating even larger rates of return. This leads to a potentially unstable situation. So there is a limit to the amount of leverage that can be used.

As the limits of leverage are reached, investment banks and hedge funds will look for ways to stimulate demand for credit. This can be done by relaxing the standards for issuing credit, and compensating by using techniques to hide risk.

By collateralizing debt and issuing insurance on debt capitalists can be made to feel more comfortable with less secure investments. Debt issued with relaxed credit standards can be mixed with more secure debt making it harder for rating agencies to correctly assess risks. If regulation does not keep up with these measures, or decreases, the value of the collateralized assets and insurance instruments will be jeopardized.

Excess capital can also result in additional risky speculation. When returns on productive investments are low and approaching inflation levels, capitalists will be willing to take larger risks in short term speculation on valuable assets and commodities, caused prices to rise. In turn, the rise in prices creates an upward momentum in asset prices that attracts even more speculation. Such price bubbles tend to be self sustaining as more and more capitalists are willing to take advantage of the upward momentum in prices, until eventually that trend cannot be sustained and the bubbles burst.

All of these measures are driven by the need to increase returns on capital, when there is just too much capital for the real investment needs of the country. This is the situation that has developed over the last few decades largely because returns have been going more and more to capitalists while workers wages have stagnated. With stagnating wages, the demand for goods and services has not kept up with the accumulation of capital.

The stagnation of wages has been caused largely by shrinkage in the manufacturing sector, causing consumers to seek returns in the financial sector and to tap available credit to sustain consumption. This is evidenced by the excessive growth of the financial sector. At the same time, high income and capital gains tax rates have been reduced, accelerating the income and wealth gap between capitalists and middle class consumers.

Unless taxes are shifted to wealth and capital gains from consumption and consumer incomes, this increasing spread in income and wealth will continue to cause instability and the kind of financial crises we are now experiencing.

The latest round of economic stratification is driven by the global competition for profits. America was a great place for just about anybody after WWII, and the Cold War made everyone important, even African Americans, whose bodies were needed for cannon fodder as much as for propaganda value with the civil rights movement countering Soviet criticism of American hypocrisy with domestic apartheid society in the South and calls for political rights and freedoms internationally against Communist Economies, military dictatorships and strong man regimes. Of course, all of that fell by the way and the average American is redundant, a 1000 times over, with cheap labor around the world, little social restraint on rapidly industrializing developing countries and massive confusion domestically, with gay marriage, and baby killing taking prominence over losing your house and job during this economic catastrophe. Little money is left to save, after wages are depressed, annual raises typically in the 1-2% range and all other cost go up. The credit card became the food stamps of the middle class and the home equity line of credit, Heloc, the capital or mad money pool depending on your state of mind. Of course, all gone. So, what have serious social scientist been doing while Wall Street was stuffing its pockets and everyone tuned into James Cramer?

The New Class Society, by Perrucci and Wysong, 3rd Edition, 2007.

This book explores how class-based resources and interests embedded in large organizations are linked to powerful structures and processes which in turn are rapidly polarizing the U.S. into a highly unequal, _double diamond_ class structure. The authors show how and why American class membership in the 21st century is based on an organizationally-based distribution of critical resources including income, investment capital, credentialed skills verified by elite schools, and social connections to organizational leaders.

Booknews

Sociologists Perrucci (Purdue U.) and Wysong (Indiana U.-Kokomo) describe the transformation of the mid-century, middle-class American society into a bifurcated and polarized two-class society: 20% privileged, and 80% new working class. The first edition appeared about five years ago. Annotation c. Book News, Inc., Portland, OR (booknews.com)

This whole topic is BS and as usual will keep the conversation around the edges so that focus will be dispersed and we will continue to miss the salient point of our dismay.

I highly recommend a read of Ellen Hodgson Brown’s ‘Web of Debt’ and the blog http://www.webofdebt.com/.

We will continue to have the Rich/Poor disparity until we abolish the FED.

Well, that was all cringe-inducing. Our kleptocrats think their depredations can all be rationalized away if they are called plutonomy? And it wasn’t the devil that made them do it. It was dopamine. I wonder if the intrepid authors bothered to mention that dopamine levels are often elevated in schizophrenics.

A hefty chunk of this seems like psychobabble. I always thought the savings rate was terrible because most people had no money left after blowing it on things like food and heat. Now you say the rich don’t save much either, because they’re spending it. On what? How many yachts do you need? I can see them collecting antique cars a la Jay Leno, but that has no affect on the sales of new cars. Or what about millions on a Picasso? Again, how does that drive standard consumerism? And of course the real unanswered question still is: how the hell is this supposed to be good for the country as a whole?

Picasso’s art sells millions of framed fine art prints for office walls, which makes jobs for frameshops and printers. Jay Leno’s cars need waxing, a yacht needs a dock and an anchor, which costs money. Somebody has to make this in a business environment. You need to read my book “Prosperity to Paradise: A New Model for Social Utopia” where I explain it all and how everybody can be rich at the same time. You just need to cut my taxes while I cut yours. Don’t be a pessimist about this. You’re only hurting yourself.

-“Bingo” Buckman, Certified Profit Master (CPM)

You can take my course in Financial Miracles for 5 easy payments of $99.99. Guaranteed to open your eyes to a new world of wealth and profit laying at your doorstep.

Is that a companion to your book “Easy Riches in Real Estate: It Only Goes Up”? :-)

Rich people are kind,

Delicate,

Noble,

And,

Discerning shoppers,

That buy,

Voting machines,

Beauty queens,

Erections,

Elections,

Cops,

And judges,

Poor people,

Toll roads,

Politicians,

Pedator missiles,

And,

No penny candy,

Penny candy is for the poor people that wash and wax the rich people’s balls, clean their wombs, and epoxy weld their souls and spirits together …

Deception is the strongest political force on the planet.

I am not sure why Canada is being dragged in this discussion as it has had considerable current account surpluses for years. I actually do know why Yves and Simon Johnson are on an anti Canadian bent, its because Canadian PM Stephen Harper is going to blow up any idea of a global bank tax this June at the G20. I actually have suspected that our esteemed Prime Minister was going to do this all along but Simon and Yves are only catching on to it in the last week or two. One of my greatest fantasies in life would be to see Stephen Harper and Jim Flaherty tag team Simon Johnson and Yves at WWF RAW. I’d pay big money to see that on PPV, Andrew Bell and Kim Parlee could act as guest commentators.

Tim,

With all due respect, your comment is delusional. On an anti-Canada bent? There is nothing in this blog to support your charge. The material you found objectionable is from the Citigroup report, and I included it, since there is no online version of the report, to show that the income disparity v. savings finding appears to be robust. And if I can’t get through the visa hurdles to move back to Sydney, I am moving to Vancouver down the road.

Sorry, I just get furious that Canada gets lumped in with the UK and the US even though Canada I think has made many of the hard decisions on things such as bank capital and government budgeting that much of the world has punting on for the last thirty years. Now that I have calmed down I think the methodology in the report was very much contrived to create some mythical idea of commonality among so-called Anglo Saxon economies. I would say Canada has many advantages citied of the UK and the US such as low unemployment without major downsides of high consumer debt and OUTRIGHT FRAUD of the US mortgage market. As much as some such as Simon Johnson have taken crictising the CMHC as a government subsidy to Canadian banks I am absolutely certain there has never been the outright corruption in the CMHC mortgage market as there has been in the private label US ABS/CDO market.

There’s more to the savings rate/income disparity regression than meets the eye. For want of a better term, let’s call one’s propensity to save, saver’s confidence. Let’s play a little hypothetical. What effect might financial system weakness have on saver’s confidence. That is, if one worries that the dollars he saves today would be worth less tomorrow due to inflation, one should seek a return on one’s savings near the anticipated inflation rate. But, if such investments appeared horrifically risky, one might choose to save less instead – and use the additional income to purchase inflation resistant assets, or even to improve one’s lifestyle. This may sound insane (it really is, but go along with me for a moment) but given the logic above, it may actually be good for consumption to create an environment where “savers are suckers.”

Also, the time-series of savings and income of the super-elite ends before this recent credit crunch. I have heard that people are saving more now than they did before the crash – a reason for low consumer confidence. Unless the income of the super-elite declined as well, this return to saving might run counter to the hypothesis. But here’s a real threat – people are saving in T-bills, gold, CDs and near-zero interest CDs, and cash – not stocks, bonds, and the like. They are not hedged against inflation and have focused on savings aimed at ensuring a return of capital, not return on capital. Why? Sufficient chicanery has taken place that many of us simply don’t trust the banksters and their minions and we lack the knowledge to hedge our bets skillfully. It would be interesting to compare the distribution of capital (savings) among shares, gold, bonds, etc. through time. My guess is that as markets decline in profitability (or increase in scandal), savings move into low-production, low-risk forms. This seems intuitively obvious. It is also obvious that such a trend would have huge implications for economic health.

Interesting post. On first blush one would think that the rich would be high savers, afterall they don’t “need” to spend it all. But the point about not having t worry if they d spend it all is a good one. Perhaps there is a difference between high income people and high wealth people in that regard, although the Venn Diagram of those two groups would tend o show a very larg overlap. Poor folk have very low savings rates simply because there is so little excess left over fo them to save. Thus the large inequality hits from both ends. It would be interesting to see an analysis of how a rising or high Gini index affects each side, and what the relative impact is.

“Yet as far as I can tell, there has been virtually no discussion of the macroeconomy effects of rising income and wealth disparities, or to look into what the implications for investment strategies might be.” YS

Or maybe also of the “microeconomy effects” of wealth disparities?

With some deference, I disagree with the notion that high income groups save less than low income groups — even though the tables definitely shows that high income disparity correlates historically with lower savings rates in the U.S.

The apparent paradox of high savings at the top income levels and low total social savings is resolved by distinguishing between “real” savings and “shadow” savings (essentially hoarding), — and between income and wealth.

The term savings is uninformative in regard to economic consequences. It ought to be called non-consumed wealth because savings includes assets that are neither invested nor consumed. A portion of income re-circulates as a source of productive investment; the varying portion that remains does not, and is put into financial instruments and added to the stock of wealth. At the highest levels of wealth, the outlets for productive investment may or may not be numerous, depending on historical circumstance. Absent productive outlets, the “savings” will be hoarded in financial instruments and not circulate to produce goods and wages. During a bubble, hoarded savings re-circulate as speculation (or inflation of financial assets). No new products have been created, employment may actually decrease (if the asset is a controlling interest in a takeover company’s stock), and the added value is solely an inflated price.

The stock of wealth may circulate very slowly, if at all. A high velocity of the circulation of money produces jobs, higher incomes, lower debt, and higher savings. A growing disproportion of wealth at higher levels produces lower social savings rates, though a higher rate of “savings” (productive investment plus hoarding) among high-income groups. These are “shadow” savings, assets of the shadow banking system.

Increasing disparity of wealth lowers savings mainly at the bottom. At the far more numerous lower end of wealth distribution, people borrow to maintain their consumption. This is negative saving. Hence, the total social “savings” rate is very low. But by lowering productive consumption of things (rather than purchase of financial assets or debt), income disparities also affect the balance between productive and unproductive savings, and lower the velocity of circulation of money. The terms “saving,” “investment,” and even “consumption” are outmoded as descriptions of what affects the real economy of jobs and incomes.

“We’re from Greenwich

We’re invincible

Living off our income

Never touch the principal”

“Living off income” can mean that we have more than enough income, and so we can add to our stock of wealth (principal).

We’re from Greenwich

Got good health

Too much income

Adding to our wealth

Okay. Not as good.

Does anyone know of any good studies on wealth and savings, or on wealth inequality and the circulation of money?

Love watching heroes, it started from boring to a fine tv series now. After watching first few eps, Was like, its just an xmen . But it turned out to be fun to watch, I hope new episoded will be out soon.