In a new report, the Bank for International Settlements (BIS) – often called the “central banks’ central bank” – points out that bond investors are not as smart as they think, that Western debt is much higher than officially reported (since contingent liabilities and pension debts are excluded from official numbers), and that the recovery of the world economy may be crushed by fiscal problems.

The report states:

According to the OECD, total industrialised country public sector debt is now expected to exceed 100% of GDP in 2011 – something that has never happened before in peacetime. As bad as these fiscal problems may appear, relying solely on these official figures is almost certainly very misleading. Rapidly ageing populations present a number of countries with the prospect of enormous future costs that are not wholly recognised in current budget projections. The size of these future obligations is anybody’s guess. As far as we know, there is no definite and comprehensive account of the unfunded, contingent liabilities that governments currently have accumulated.

For background on the effect of aging populations on the economy, see this.

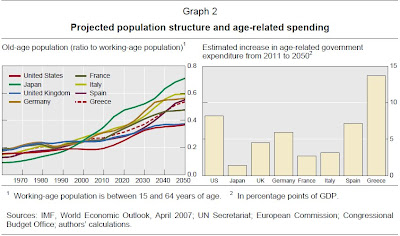

The report includes the following chart on age-related expenditures by country (click for clearer image):

Ambrose Evans-Pritchard succinctly summarizes BIS’ findings:

Official debt figures in the West are “very misleading” since they fail to take in account the contingent liabilities and pension debts that have mushroomed over recent years.

BIS writes:

More worryingly, the current expansionary fiscal policy has coincided with rising, and largely unfunded, age-related spending (pension and health care costs). Driven by the countries’ demographic profiles, the ratio of old-age population to working-age population is projected to rise sharply. Interestingly, this rise is concentrated in countries such as Japan, Spain, Italy and Greece, which are already laden with relatively high debts (Graph 2, left-hand panel). Added to the effects of population ageing is the problem posed by rising per capita health care costs.

In other words, BIS is slamming the Western nations for failing to budget for their rapidly aging populations and to set aside adequate funds during the boom. As Evans-Pritchard puts it:

BIS lamented the lack of any systematic data on the scale of unfunded IOUs that care-free politicians have handed out like confetti.

(And, of course, America has been spending money on both guns and butter).

Indeed, here are some recent stories about America’s pension crisis:

- Barron’s ran a story on March 15th called “The $2 Trillion Hole: Promised pensions benefits for public-sector employees represent a massive overhang that threatens the financial future of many cities and states.”

- Huffington Post ran a story April 5th entitled “‘Something’s Got To Give’: Massive Pension Fund Shortfalls Threaten To Bankrupt States”

- World Net Daily ran a story the same day called “America’s future? U.S. cities going bust: Public employee pensions burdening states, localities “

- The Los Angeles Times ran an op-ed on April 6th – written by the special advisor to Califonria Governor Arnold Schwarzenegger for jobs and economic growth – entitled “California’s $500-billion pension time bomb: The staggering amount of unfunded debt stands to crowd out funding for many popular programs. Reform will take something sadly lacking in the Legislature: political courage.”

The BIS report further points out that bond traders overestimate their timing and forecasting skills:

So far, at least, investors have continued to view government bonds as relatively safe. But bond traders are notoriously short-sighted, assuming they can get out before the storm hits: their time horizons are days or weeks, not years or decades. We take a longer and less benign view of current developments, arguing that the aftermath of the financial crisis is poised to bring a simmering fiscal problem in industrial economies to boiling point. In the face of rapidly ageing populations, for many countries the path of pre-crisis future revenues was insufficient to finance promised expenditure.

Further, BIS notes:

The risk that persistently high levels of public debt will drive down capital accumulation, productivity growth and long-term potential growth. Although we do not provide direct evidence of this, a recent study suggests that there may be non-linear effects of public debt on growth, with adverse output effects tending to rise as the debt/GDP ratio approaches the 100% limit (Reinhart and Rogoff (2009b)).

Actually, as Reinhart and Rogoff showed last December, 90 percent is the threshold:

The relationship between government debt and real GDP growth is weak for debt/GDP ratios below a threshold of 90 percent of GDP. Above 90 percent, median growth rates fall by one percent, and average growth falls considerably more. We find that the threshold for public debt is similar in advanced and emerging economies…

And, as Forbes noted about America:

Add the unfunded portion of entitlement programs and we’re at 840% of GDP.

BIS concludes with this bearish scenario:

If countries do not retrench quickly, they will create a market fear of “monetization” that becomes self-fulfilling. “Monetary policy may ultimately become impotent to control inflation, regardless of the fighting credentials of the central bank” it said.

Some states may be tempted to carry out a creeping default by stoking inflation. “The payoff to do this rises the bigger the debt, the longer its average maturity, the bigger the fraction held by foreigners.” The BIS said the danger that any government would consciously take this path is “not insignificant” in the longer run.

Of course, a brutal fiscal purge in every major country at once itself poses a danger. The result would be to crush recovery and tip the world economy back into crisis, making deficits worse again.

Ultimately, though, the primary cause of this acute stage of the global debt crisis is very simple.

As BIS warned in 2008, nations worldwide were bailing out their private banks by transferring toxic risk from the banks onto the sovereigns’ own books. The giant banks are, of course, still drowning in debt and – using real world accounting – insolvent, due to all of their gambling schemes gone wrong and toxic assets. The “too big to fails” all over the world have acted like a drowning man who grabs onto someone else and – thrashing around wildly – ends up drowning both.

I don’t yet have an opinion on whether it’s a good idea or not, but debt repudiation appears to be a growing response to the debt crisis.

So George:

Let me paraphrase this.

Because the Bond market, TBTF, and Wall Street got into trouble and also because of over optimistic forecasting on returns for pension funds by companies which allowed companies and states to take down funding and spend it on other things, the solution as I understand it is to trash people? And this comes after TARP and other associated programs and the Fed plunging $trillions into Wall street.

More the issue in the US is reversing the decline of Participation Rate or that percentage of the Civilian Non Institutional Population as a part of the Civilian Labor Force. With an end of rececession 2001 Participation Rate of 66.7% would put ~ 3 million people back into the Civilian Labor Force generating tax revenues for SS and Federal Income.

Peter Peterson sponsors both Concord and AEI and consistently has advocated solutions that ride on the back of the Middle Income brackets with the demise of SS and Medicare without touching private enterprise. Quoting either group certainly would not be a feather in your hat George and certainly there are better solution abounding such as closing the gap between revenue and payouts for the next 75 years for SS . . . 2.02% right now which converts it back to a paygo for Congress to loot again and not pay back.

Give this man a cigar!

Remember when those pensions were set up BECAUSE those jobs were so low paid and crummy it was the only way to get workers?

These jobs and pensions have now become “over paid and too expensive”.

Well, not really, these jobs and pensions actually sorta kept up with inflation. It’s everybody else that got forced to eat a shit sandwich for the last thirty years.

But now it’s the people’s fault? All they were ever guilty of doing was taking a job and working and expecting their employer to honor their contracts just like those billionaire bankers that wrecked the world’s economy and got million dollar bonuses because we had to honor their contracts (except these people never wrecked the world’s economy).

Just more pillaging of the middle class.

The pensions were given to automotive workers in lieu of higher wages.

I don’t understand what you are asking, or what you think I am advocating.

I am always on the side of the common person, and not the TBTFs.

If we had broken up the TBTFs years ago, and put government resources into rebuilding the real economy and employing real people – as many of us advocated – instead of throwing money at the megabanks and sponging up their toxic debts on our nations’ balance sheets, we wouldn’t be in this acute crisis today.

George:

Where was I asking sh*t, I am telling you. Save Labor at the expense of Wall Street, TBTF, and the Bond Market. Citing Peterson, Concord and AEI is acquiesing to them. Where has productivity gone since the eighties? Certainly not to Labor and to Capital. http://2.bp.blogspot.com/_Zh1bveXc8rA/SuddUhLWUaI/AAAAAAAAA7M/iU2gefk317M/s1600-h/Clipboard01.jpg Labor’s Share, http://www.angrybearblog.com/2009/10/labors-share.html

What I read in your post is that someone must pay for the excesses and to date it is SS, Medicare, Healthcare, and the Middle Income Brackets. Perhaps you are to subtle; but, I perceive it for what it is George. Perhaps, Bruce Webb and Coberly will see a different perspective than I do. I don’t. Tax capital gains and non payroll wages and the problem will be solved.

Then too, I may be misinterpretting your stance.

You are totally misinterpreting my stance.

My goal at all times is to promote what is the best for the most people. I’m not suggesting trashing pensions or benefits.

I am – instead – trashing corruption and oligarchy.

http://www.google.com/search?hl=en&client=firefox-a&hs=c4m&rls=org.mozilla%3Aen-US%3Aofficial&q=site%3Ageorgewashington2.blogspot.com+oligarchy&aq=f&aqi=&aql=f&oq=&gs_rfai=

This is total crap.

Governments dont need to save money. Thats a ridiculous concept, unless you are a government that doesnt issue its own currency like a state govt. In the case of the US its completely ridiculous to talk about “saving” money for a rainy day or anything else.

No matter how much they spend today they can ALWAYS buy whatever is available on any day in ten, fifteen or fifty years. What will be available and how much it will cost will have something to do with what they do today but it is only related to scarcity and the unwillingness to plan for proper resource allocation in the future, NOT how much money they do or dont have to spend. These kinds of articles show that most people confuse finance with economics and they are NOT the same. It is this confusion that lead too many people to believe that a rising stock market or rising home values was an indicator of economic strength.

This financilaization of our economy has placed a money veil over the eyes of too many Americans and has rendered us unable and unwilling to detach the two systems from each other. It keeps us from looking under the hood and seeing how the monetary system operates and for whom.

When is somebody going to counter the tiresome claims thrown out by numerous debt “errorists” that our ” unfunded portion of entitlement programs are at 840% of GDP” ??!!. This analysis and conclusion is no different than one would come to if you took ALL of Aetnas life insurance policies, totalled up what they will eventually have to pay out on them and while looking at what they currently hold to pay those off (a sum significantly less than that total) said “How are they ever going to pay that liability off ?

We need a radical restructuring of our life insurance companies, their credit rating needs to be lowered substantially, they are at risk of default” Its almost criminal that they are allowed to make these types of claims unchallenged by anyone with a knowledge of how insurance liabilities are funded (which is what SS, Medicare and Medicaid are)

Deficits don’t matter until they matter.. and then they *really do matter* !! Will we ever get to that point? Expect spending to continue with abandon until the printing press is taken away, but that will not happen until the Federal Reserve is brought to heel (or crushed under foot/boot). But who does that?

Isaiah comes to mind …

The Lord looked and was displeased

that there was no justice.

He saw that there was no one,

he was appalled that there was no one to intervene.

That pretty sums things up.

As far as social security is concerned, most honest discussion that I have heard has indicated that a modest increase in the tax or an increase in the wage level cap would manage these issues without further concern.

GAO found in 2005 that 2/3 of US corporations weren’t paying taxes and 68% of foreign companies weren’t either through expatriating their profits or other loopholes. Similarly, it is quite obvious that the decrease in capital gains has only fostered asset speculation in the finance industry.

Effective taxation on the top .1% is lower than for a significant portion of the population. We could make up the tax shortfall through carbon taxes, higher taxes on luxury goods, legalizing marijauna. Cuts on our massive prison, defense, healthcare, and security industrial complex would also improve our situation greatly.

It amazes me how people are suddenly patriotic when they benefit from it, like in the case of not paying their taxes. If we want the USA to turn into Latin America, with massive levels of kidnapping, low level urban warfare, and political oligarchies we can continue on this pathway.

These IOUs are the politicians’ faults, not the recipients who have been unwillingly wrapped up into a massive ponzi scheme. They have been doling out tax breaks to the upper class, under some false pretense of trickle down economics, and there has been nothing but asset speculation as a result of the increasing inequality in this country. The notion of passing the burden onto the middle class due to corruption at the level of politicians, their lobbyists handlers, and their corporate managers is absurd.

Fools think that there is no reason to support the poor, not only are investments in the citizens of this country investments in our future productivity and competitiveness, but social programs were set up to prevent the instability that massive inequality creates. You say let them eat cake then be willing to deal with the consequences.

“Every gun that is made, every warship launched, every rocket fired, signifies in the final sense a theft from those who hunger and are not fed, those who are cold and are not clothed.”

President Eisenhower

I personally am tired of hearing about our BIG problems of unfunded liabilities in 2040-2060. That problem isn’t going to amount to a hill of beans if we’re spending one to two trillion over budget on our HERE AND NOW spending.

“Every gun that is made, every warship launched, every rocket fired, signifies in the final sense a theft from those who hunger and are not fed, those who are cold and are not clothed.”

That is an ignorant statement,Guns can be used to hunt food,and without the warships to protect them,all those poor and hungry will soon be dead.

Put your “Peace” shirt back on and go back to your bong.

If you want to call Eisenhower a hippy, that is up to you, he said it not me. He also said beware of the military industrial complex, which is presently at issue in relation to our National budgetary problems. If you don’t think all of those interest groups were pulling for us to waste American lives and money in that quagmire that is Iraq than you are kidding yourself. According to Stiglitz our intervention in Iraq could potentially cost upwards of 5 trillion.

Maybe you should lay off the crack pipe because there is little other reason for such grossly flawed argumentation. He was talking about military expenditure not hunting. You can’t hunt food with a bomb, a rocket, a nuclear weapon, or a aircraft carrier for that matter. That is what the majority of military expenditure is spent on. Even following your ignorant line of reasoning, I don’t know if you would want to eat any animal after it had been pummeled by an automatic assault rifle.

Not that I am suggesting we eliminate military spending, but maybe that we could tone it down a bit since we spend more on our military might than almost all the other countries combined. Really we could spend twice as much as the next guy or the next 3 countries and still manage to cut our annual expenditure by more than 66%. In 2008 we were at 600 billion and China was at 84 billion. All we are doing is projecting imperial hubris and leading ourselves in the trap that was set, this country is overextending itself into collapse. This was basically the plan all along and a bunch of fools have fallen into it.

And, just because I advocated legalizing marijauna, does not mean that I smoke it. The costs of arresting and imprisoning so many non-violent offenders outweight the benefits.

Tax the rich.

So funny that this theme of having to scrap all pensions and other retirement insurance programs because, they are just too darned expensive (sheesh!) — all of a sudden seems to be showing up just about everywhere. The libertarian blogs, the BIS reports, conservative think tanks (naturally). Not a single chance that this is a directed viral PR move….nope not a chance at all.

http://www.counterpunch.org/cooke02242010.html

“Some states [countries] may be tempted to carry out a creeping default by stoking inflation”

I read and then noted on Credit Writedowns a few days ago that:

“Morgan Stanley published a very interesting research report recently in which they made the observation that nearly half of all US budget outlays are now effectively indexed to inflation”

According to Edmund Conway

http://www.telegraph.co.uk/finance/comment/edmu…

a similar figure for the UK is 80% !!

If true, perhaps inflation could lead to a galloping default, not a creeping one!

It is always funny when people believe they, together with the majority, will be able to squeeze the money needed to pay all promised future pensions, out of somebody or something. Can you say entitlements?

Even if you effectively implement a tax of 99% on all rich people, it won’t suffice. You would need to expropriate the working people of about a quarter of their income *just for pensions* – but there you will have a majority against doing so!

So it’s not going to happen, pensions will never be paid in full purchasing power. Get over it.

You say a 99% tax on rich people would not pay pensions? Show the numbers on that.

Only the neocon thugs and teabaggers (the same group really) have brayed about 99% – or some other ridiculous figure – income tax on the rich. What people want is simply for the rich to pay their fair share (40% would do), specially since it is/was the masters of the universe who exported all of the well paid manufacturing jobs to Asian workers getting no benefits and $5/day wages; so they could first make workers pay all the taxes and then unemploy all the workers (unless of course they are willing to work for $5/day no benefits) which effectively puts governments under constant enormous financial strain; forcing the government to privatize everything at pennies on the dollar to corporate ownership and end social support programs – which is the main objective of the economic stagnation and unemployment purposely and knowledgeably brought on by the masters of the universe “off-shoring” as many middle class well paid manufacturing jobs. While the masters of the universe were purposely and completely destroying the middle class they were non-stop working with their paid off Republican flunkies to successfully eliminate every tax they or their corporations pay.

Dollars are amoral; wealthy elites and their corporate fronts are amoral; governments have the ability and job of representing and enforcing (unless permanently crippled by extreme Republican partisanship) human and social morality, the benefits of which can never be described in terms of dollars -while the costs are. There are many reasons why as conservative darling Grover Norquist has continuously pleaded for the end to government due to governments’ ability to impose morality on the amoral masters of the universe and limit their extraction of wealth from a severely threatened middle class translates into masters of the universe’s unconditional all out war against government and the middle class.

Two questions

How do we reconcile the existence of CDS premiums on the debt of sovereign currency-issuing nations with the notion that such nations can only default by choice? Does the premium only reflect the possibility of devaluation?

Another interesting question relates to Dean Baker’s pointing out that the 10y Treasury, yielding up to 4% in the current environment; whereas the 10yT was yielding 6% in 2000 at a time when the Federal Gov’t was running budget surpluses. What does this comparison tell us about U.S. deficit/debt fears?

i really feel like this is going to turn out to be a big non-issue when it comes to the crunch. people living longer is a GOOD THING provided that they are also living healthily for longer. the only reason commentators have this issue to hyperventilate over is that we are still some way (i.e. a lot more than one election cycle) from reaching the real crunch point, and therefore politicians can afford to kick it into the long grass.

the solution: raise the retirement age 5-7 years, then index it to life expectancy, legalise voluntary euthanasia for the extreme elderly (you’d be surprised at the number of takers), and aggressively enforce a ban on age-discrimination in the workplace (incl a right to work idefinitely beyond the retirement age provided competence can be demonstrated).

sorted.

legalise voluntary euthanasia for the extreme elderly

Let’s put a little pressure on gramps…gotta get our hands on the estate.

Gold is the only currency that is no ones liability. No debt is denominated in it and it is free of sovereign default.

Alan Greenspin said” Gold is the ultimate form of payment, in times of extremis, nothing else is accepted”

Welcome to times of extremis.