A correspondent e-mailed me about his belief that credit market valuations are more than a big dubious. For instance, subordinated tranches of commercial real estate bonds, which at the lows of last year were trading at 30 cents on the dollar are now at 90 cents. He thinks (and this is a space he knows) that a lot of it will go to 5 cents on the dollar.

This is an extreme example of liquidity-charged valuations versus projected future fundamentals, aka the greater fool school of investing. But at a price of 90, how much upside is there, even on a greater fool thesis?

Jeremy Grantham, in his April newsletter (hat tip reader Richard A) also sees evidence of frothiness:

So now, Bernanke begs us to speculate, and we are obedient. Despite being hammered down twice in 10 years and getting punished for speculating, we again pick ourselves up off of the canvas and get back into the good fi ght. Such persistence is unprecedented – 20 years for each really painful experience has been the normal recovery time – but Uncles Ben and Alan have treated us so well in these two disasters that, with hindsight, they don’t feel so bad after all. Yes, the market is still down a lot in over 10 years and on our data is likely to have a second consecutive very poor decade, but we have had two wonderful recoveries in which the more speculative you were, the more money you made. So why not break the historical rules and try a third time? Perhaps this time it will be lucky.

Still, it does seem inefficient for the Fed to help us up and then lead us off the cliff again. And to do it twice seems like sadism. And for us to play the game once more seems like lining up behind hot stoves and begging, “Please, can I burn my hand a third time?” Investors used to be more pain averse. It used to be “once bitten, twice shy.” This time, surely it should be “twice bitten, once bloody shy!” The key shift seems to be the confi dence we now have in Bernanke’s soldiering on with low rates and moral hazard to the bitter end, if necessary, cliff or no cliff. The concept of moral hazard has changed. It

used to be a vague expression of intent: “If anything goes wrong, I will help you if I can.” It seems to have been transmuted into a cast-iron commitment. The Fed seems to be pledging that it will bail us out after every flood. All that is lacking is a rainbow!Speculators are not stupid. They see that after each crash, a long, artifi cial period of low rates and easy financial borrowing has been delivered. They see that Bernanke is an unreconstructed Greenspanite in that he refuses to address bubbles, but will leap to help ease the pain should a bubble break. With asymmetry like that, why not speculate? And so another bubble appears and then another. This time, the

recovery for the total market was 80% in one year, second only to 1932, and the really speculative stocks are almost double the market, as they also were in 1932. But frankly 1932 was far worse than our crisis where, according to our research, only 7% of the market value of speculative stocks remained, compared with 35% this time. Back then, they deserved that kind of rally. And even though I guessed last

April that we would have a quick rally to 1100, this looks quite likely to be far more.

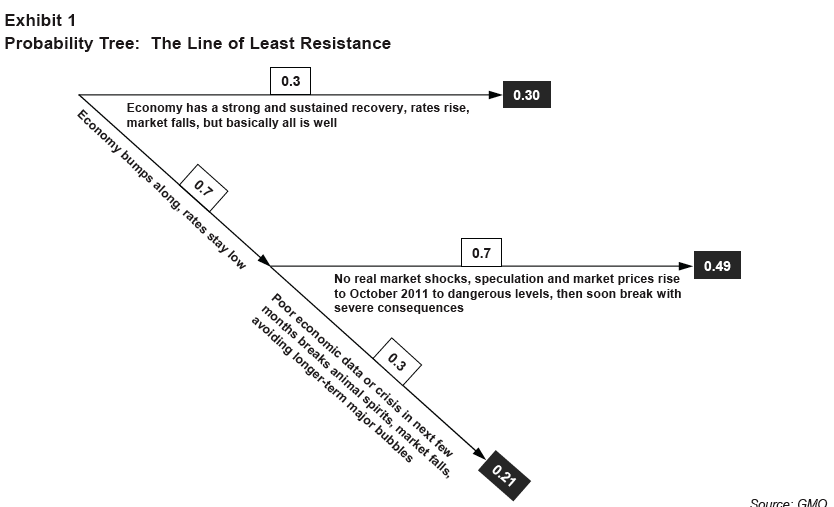

Despite his reservations, Grantham sees the odds favoring stocks moving higher both near and intermediate term:

Do readers see other examples of similar (arguable) valuation disparities?

I have been pointing out the bubbles in stocks and commodities for an age. Neither reflects what is going on in the real economy. The stock bubble has been fully mature and ready to go splat for the last 6 months. It could blow up Monday or last to the end of the year. It is just a question of which event will set it off, an exogenous event, a sovereign default, someone getting a little too cute in some market play. It could be anything or nothing.

my thoughts exactly !

I bought a new tyre for my bike on Friday. The shopkeeper told me how much prices had leapt in his trade just recently. Inflation ahoy, at least in the UK.

There was a gorilla at the Bronx Zoo that just got hired away as a CDO trader. This could be a sign. His name is Ralph. In a suit he could pass for a Neandrathal and he eats bananas at his desk all day. At least he won’t lose the firm’s money.

So the problem is FORWARD, isn’t it? That means a nearly 50% jump of earnings is projected, which should heavily rely on financials. Who knows what will happen in the rest of year? But of course a bubble can last some time.

The market is not overvalued. Foward PE ratio is at 15 based on earnings estimates. Not only that we are about where we were in 2006 so we have 4 years worth of collecting assets which means comapnies current book value should be higher than it was in 2006 despite the value destruction that occured over the last 2 years providing for a higher base from which to add discounted cash flows.

The more interesting question is has raising debt levels, aging populations and slower technological innovation across the globe created a new paradign where the old methods of valuation are invalide or fail to take into account new, have yet to be seen black swans.

The PE ratio for the S&P 500 Index is 23.9 and the forward PE ratio is 19.6 which historically are both very high. In addition, these PE ratios are based on cooked books; that is, FASB rule 157 has been modified so that banks no longer have to mark their toxic assets to market valuations, making reported bank earning numbers PURE FANTASY. If you truly believe that the insolvent Citigroup actually made $4.4 billion dollars in the first quarter of 2010, I have a bridge in Brooklyn that you will also buy.

The political and financial elite are using taxpayer money to save themselves, period, and lying to us about how well their looting is working for the country. Academe is lying to us also—i.e., academe knows that markets are not efficient and free market capitalism is a myth, but are either bought off by the banks or are too scarred to say anything—and the MSM trumpets all of this propaganda because that is what they do.

The elite think that lies will rekindle the “animal spirits” and restore the economy; but, because of the elite’s policy of increasing debt while GDP contracted, the US financial system is now more fragile and at greater risk of deflationary collapse then in December, 2007, when this recession began.

Your PE ratio numbers are wrong. If you want a somewhat good counter argument go to the the link below. Also has links to the raw data you can see it for yourself.

http://www.investorsfriend.com/S%20and%20P%20500%20index%20valuation.htm

I am bankruptcy lawyer for a long time in SoCal — kind of a canary in the coal mine.

Represent a lot of RE vulture funds.

There is very little DIP money for anything other than partially finished apartments. Some exit money for partially finished houses and lots. Everything, even apts, is at a discount to the senior piece. Threat of DIP priming loans very good to get senior to take a discount.

Commercial rents have seen some firming.

Money is still very cautious. But like the RTC days, this is probably the time to get in. But a new bubble — Treasuries and the equity sure — in RE, I dont see it for awhile but there will be one eventually there always is.

“The market is not overvalued. Foward PE ratio is at 15 based on earnings estimates.”

Well as long as we are looking forward, can I have a pony?

corporate profits for companies listed on exchanges has held up remarkably well in the downturn… until profits start falling or profit growth starts slowing dramatically, or we get an external shock, there really is no reason to sell stocks. Value gets harder to find but that does not imply a crash in itself.

I think a lot of ppl get sucked into this ‘speculative rally’ before it ends badly.

“The market is not overvalued. Foward PE ratio is at 15 based on earnings estimates.”

So I guess at the bottom it must have been around 4 or 5….. Gosh…. or 1 or 2.

“FANTASY” really is the word. “DELUSIONAL” is what bubble feeders are.

I think of it this way, in particular with the time just after the DJIA hit 14,000 (at which point I said it is time to bail out):

A bunch of guys are sitting in the club car smoking cigars and looking out the back door of the train. “Wow, what a great ride, look how far we’ve come,” they say to each other, reading the earnings reports.

Meanwhile, the front of the train just went off a cliff….

XRT consumer discretionary= 100% retracement.

AFTER the collapse of the System, if you mention the possibility of a crash to the average citizen, they can’t conceive it as even a remote possible outcome. Baffling.

After a lecture last week, a Citigroup investment banker last week told me that a colleague of his just closed a $3 billion dollar bond deal for California, and is set to do another $3B. When I asked him who’s buying, he said Europeans assume that the U.S. government is guaranteeing *everything.*

I have no clue how much, if any, was true. But if it is, it’s another example of the bubble. Isn’t “mark-to-fantasy” a wonderful accounting concept?

The market is not overvalued.

Insert foot and chew like a rabid weseal…ROFLMAO…thanks I needed that!

Skippy…Americas becomeing more and more like that which it via propaganda, used to decry. The motherland, Homeland Security, etc…should just join the central party now!

Sieg Heil the Corporatist!!! May they endure for a thousand years!!!

Putin raising 5,5 billion at 3.63%

To all who dont like my stats and want to create their own reality that justfieis their own emotions, I really hope you dont do something dumb like shorting the the S&P 500.

RHS,

If the market goes up or down is not the question, its a matter of_what its based on_ie fraud, accounting gimmicks, Fed window loop, etc.

Its a lie full stop, you can participate in this lie or not, that depends on your take of morality and ethics.

Skippy…lots of people said it could only get better just before the last time…eh. Hope you have a good day.

Skippy says:

“Its a lie full stop, you can participate in this lie or not, that depends on your take of morality and ethics.”

I guess you live on a commun which produces its own electrcity so you can blog.

HAHAHA,

ad hominem attack much? I though you were all about data, RHS?

M. Grantham talks about the Australian housing bubble. Sent a note a couple of days before the interview which might be of interest.

Can be accessed here:

http://www.zerohedge.com/article/guest-post-case-against-aud

Best,

Damien

just curious to know how many readers who are so bearish on the economy (including me)and therefore bearish on the stock market (I’m not sure) actually drill down to individual company reports and earnings statements. For all the negativity and cautiousness out there, things dont look too bad at most individual companies…

I never figured why people need “relatable” roles. In some circumstances, sure you desire your characters to be relatable. But it’s not incessantly a prerequisite. If all characters ever were people we could connect to (i.e. similar to people we’ve met), then why the hell would we ever watch TV in the 1st place? Why not merely go out and speak to live people?

Damn, very nice website. I actually came across this on Yahoo, and I am happy I did. I will definately be revisiting here more often. Wish I could add to the post and bring a bit more to the table, but am just taking in as much info as I can at the moment.

Thank You

Chinese Restaurant Dublin

Hey, cool website. I actually came across this on Yahoo, and I am stoked I did. I will definately be revisiting here more often. Wish I could add to the post and bring a bit more to the table, but am just absorbing as much info as I can at the moment.

Thank You

Italian Restaurant Dublin