The notion underlying the Volcker rule is that too big to fail institutions have a government backstop and therefore their activities should be restricted to the types of intermediation that support the real economy. The taxpayer has no reason to fund “heads I win, tails you lose” wagers. Various firms, most notably “doing God’s work” Goldman, has tried to play up the social value of its role, whenever possible wrapping its conflict-of-interest ridden trading activities in the mantle of “market making”.

A big problem in taking about market making versus position trading is that, Goldman piety to the contrary, the two are closely linked. Even though all the major dealer banks created proprietary trading operations to allow top traders to speculate with the house’s capital, plenty of positioning also takes place on dealing desks. While dealers are obligated to make a price to customer (well, in theory, it’s amazing how many quit taking calls in turbulent markets), they are shading their prices in light of how they feel about holding more or less exposure at that time. And the dealing desks, just like the prop traders, are seeking to maximize the value of their inventories over time.

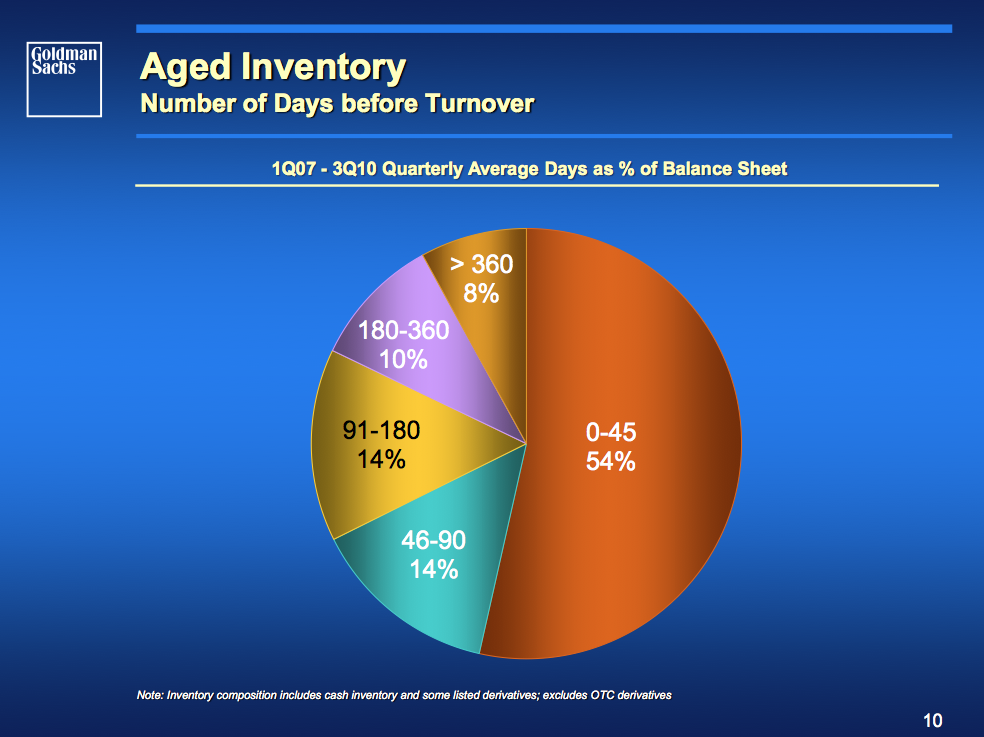

A Goldman discussion of risk management presented yesterday (hat tip reader Michael T) gives reason to question that much has changed on Wall Street regarding the role of position taking, now taxpayer supported, in firm profits. One slide shows that nearly half their positions are held more than 45 days.

However, before making further comment, we must note that both the rather long time frame (why show an average from the crisis to now? the environments were wildly different) and the exclusion of OTC derivatives makes this slide useless in terms of understanding the length of Goldman exposures, which therefore suggests it was crafted to obfuscate. But even taking it at face value, Ace Greenberg of Bear Stearns, who was considered a hands-on and effective risk manager (he was not in that role when the firm imploded) had a much simpler management rule: any position over three weeks old was to be sold.

Note that the presentation weighs heavy on the use of Value at Risk, and shows Goldman to be running lower VAR relative to market volatility. There are widely-discussed problems with VAR which lead it to understate risk, for instance, that it by design chops off tail risk, which is the risk that will kill a levered firm, and that the correlations used to measure the risk reduction of exposures in different instruments and markets, behave very differently in stressed markets. But reader Michael C pointed out that VAR can be useful as a proxy for position risk assumption, so running ANY VAR means a firm may be taking position risk and thus running afoul of Volcker Rule precepts:

What is Prop Trading?

That’s an easy question to answer.

Any position that ends up in the Var exposure is prop trading.

Var measures exposure to market risk. Var is the measure of market risk used to determine the amount of capital required to support the trading activities at banks under the BIS capital framework. There is no uncertainty about what constitutes trading risk (prop trading) . Indeed, the market risk capital requirements were designed to enable the prop desks at banks the flexibility to manage the market risks of their prop activities free of regulatory interference regarding the component pieces, provided they held capital against the books.

Market Risk exposure (which includes credit risk translated into market risk through capital market and derivative activities (i.e CDO and CDS)) arises through the trading activities of the institution.

The “who can tell what’s customer driven and what’s prop trading “ argument is completely bogus. If the activity leaves the institution with net market risk exposure, that activity is prop trading. I believe this is Volcker’s view.

To determine what is appropriate prop trading for an institution, review the Var exposure by trading desk at each institution, then determine which prop trading desk rightfully belongs in a federally backstopped institution. To be precise, review the positions feeding the Var. The risk calculation methodology issues are irrelevant for this argument.

For example, if the structured products desk at GS generates market risk and thus Var, and if it’s a major profit center, GS needs to convince us that this is an activity that should be supported by any type of govt support…

GS’s defense that the prop trading represents a sizeable but small % of their revenues is nonsense. They may make the lions share of their trading profits on transaction spreads, but the additional % they designate as prop trading on the residual exposure is a piece of the whole trading activity that is considered as “prop’ trading under the global banking standards.

Reader comments on the disingenuous or merely sanctimonious elements of the Goldman presentation are encouraged.

It’s interesting you mention Ace Greenberg here. I’m making my way through his book in my usual lazy way. Got it for like 4 dollars and 90 cents. I normally would never purchase a bank CEO’s (or former bank CEO’s) book, but of all the group (which I mostly despise and detest) I always found Ace the most likable. First because he was Hebrew, and I respect all Hebrews’ intelligence (I don’t know if the J word is censored here, so that’s why I use the word Hebrew). BUt he wasn’t New York Hebrew, so we get more honest talk, and less snobbery from him than we often get from the New York version. And yet he beat a lot of the New Yorkers (Hebrew and at Gentile firms) at their own game. And although I don’t want to paint Ace Greenberg as some kind of “Saint” (I’m sure he had his moments of ruthless intra-company office cloak and dagger) I don’t think he would have ever allowed the derivatives games and credit exposures to occur that happened under James Cayne, and at their rival Lehman, under DICK fuld. Certainly not to the DEGREE that they did.

Actually Cayne did a power play move with the board of directors and got Greenberg shunted off to the side so Bear could take more risk which Cayne sold to the board as “make more money”.

I beg your pardon….calling Alan Greenberg better than the other NY Hebrews??? Excuse me, but AMBAC doesn’t think so. Read the entirety of the AMBAC complaint and perhaps you will change your mind. I called all of these assholes when I read the complaint and told them what I think of their ilk. Garbage.

“The likes of Tom Marano, Mike Nierenberg, and Jeff Verschleiser ran the scam mortgage operation at Bear Stearns EMC. As we are finding out through the Ambac law suit aimed at Bears Stearns assets, their emails discuss overt, ongoing criminal operations. As David Dayen noted here at Firedoglake last Tuesday:

They falsified that data for the rating agencies to get AAA ratings, never told the investors about the bad loans in the pools, and sold the shit as gold. …

…the Bear traders would sell toxic mortgage securities to investors and then sell back the bad loans with early payment defaults to the banks that originated them at a discount. The traders would pocket the refund, and would not pass it on to the mortgage trust, which was where it should have gone to be distributed to the investors who owned the bonds….”

And THAT all happened under GREENBERG, not CAYNE. Get your head out. Greenberg is just as culpable. I would never read the garbage that spews from his mouth…even for $4. Never.

First, managing compliance type risks is completely different than managing trading risks. Bankers Trust is the walking example of that. Great at the latter and completely indifferent to the former.

Second, Greenberg’s influence at the firm had been waning, and he was gradually being eased out. You’d need to check the more detailed accounts to see how great his influence was in 2005. Not saying he wasn’t ultimately responsible, but you need to dig to be sure.

Saying “any VaR implies position” is a bit strong. If you do a vanilla IR swap and take the money by charging spread (be it on fixed or LIBOR), and off-load it via a par swap, you still will have IR VaR – your margin carries discounting risk.

You can get rid of that too to some extent, but it requires dynamic rehedging, so you’ll always carry some residual risk unless you get your fee up-front.

What can be said pretty strongly though, is when a desk has any VaR limit, it’s impossible to tell whether it’s really just market making or taking private positions, or what is the mix.

To an extent you could say it would be almost silly of the trader (from his perspective) not to use the VaR limit if it’s there and he’s not getting any flow, but has a view.

I always found Volcker Rule as nice in theory, unenforceable in practice. I can imagine that someone would creatively structure a fee for a client transaction so that the fee would be in effect a private bet on the market direction (and it wouldn’t even have to be a complicated structure, it could be as simple as different timing of fixed cashflows).

Fair point, I will tone down that statement.

The statement is correct, Any var implies risk. That’s the point, risk exposure can be measured. A tolerable level of market risk resulting from market making activity is ok. Exposure beyond that limit would be prohibited.

A purely market making firm will have a low risk profile, since the market making position would be hedged.It follows that the profit wouldn’t be outsized since its a spread business. They would dump the position (and unwind the hedge) once a buyer was found.

Oversimpifying a bit, a firm that has oustsized blended market making/prop revenue is trading and the var would indicate that, since ‘market making’ exposure would be expected to be low and steady,Material variations in var would indicate prop trading is driving revenue.

If any of you so-called Judeo-Christians out there had bothered to read the Old Testament, you would understand that Blankfein was being honest for the first time in his life. After all, didn’t God smite every single frickin’ man, woman, child, and beast on the planet with the exception of his chosen friends and animals?

And that shit is not even the end of the story! Just wait until Blankfein gets to the Apocalypse! Personally, I think he is currently in the part with all the begatting, since it certainly feels like he is screwing all of us, all the time.

Reads like an Enron presentation circa 2000, impressive theory, intimidating message & uninterpretable numbers

except for slide 18 of course: Enron never showed a chart with less than non-stop exponential growth

i think the author is missing some very fundamental understanding about how dealers work. sorry to be rude, but that’s sincerely how i feel about it.

dealers are taking second order market risks all the time, and that’s what VaR is trying to capture. By 2nd order market risks, i mean, e.g. when a dealer sells a treasury note to a client, he will immediately buy a treasury futures back so that, at least on the first order market risk perspective, he is immune. what he is risking on, though, is that treasury note can keep going higher but his futures price can go down. but this is a basis risk he has to take, because, otherwise, he will just reduce to a broker.

if we strictly follow the spirit in your article, all dealer desks need to be wound down to be brokers. but that’s almost equivalent to say let’s kill the derivative business altogether.

You are making a straw man argument. The first contention is that VAR is a good measure of risk assumption (how much is debatable, but VAR does reveal position risk). The second issue is how much of that really should be tolerated given that all major dealers are on the taxpayer dime and positioning profits are to the benefit of the house, not the customer or broader society. But some positioning is necessary, ergo a modest level of positioning profits related to that necessary position taking should be tolerated.

Basically this is tantamount to the idea that positions should be flattened over a pretty short time horizon. The fact that Greenberg regarded three weeks as intolerably long is big tipoff.

I respect both replies from Yves and MichaelC.

As to whether I was making a straw man argument, I was aiming for the below statement when I was writing my comment:

“Any position that ends up in the Var exposure is prop trading.”

I don’t agree that derivative market making is in the end of the day a broker business. If you purely rely on client flows to match trades, I do not think any OTC derivative business will survive. You may argue that, fine, let’s move all to the exchange. The trouble is many corporate clients do need tailored term sheet otherwise the hedge is just near useless.

Above aside, I do not have any problem with your reply to my comment.

I was fairly new to this blog (or any financial blog sites) even though I have heard of your site before. Apology if I made any mistakes here.

Not sure who your referring to as the author but I’ll weigh in on my bit.

Your example describes what I would expect a market makers position to be, a residual basis risk arising from the customer trade vs the hedge. Therefore a modest level of residual risk is acceptable, which I thought was clearly stated.

Re your conclusion, isn’t the market making function a broker business, at the end of the day?

As to killing the derivatives business, the point is to contain the derivatives business within the banks so that the banks don’t conduct prop trading via their derivatives book. There’s nothing to prevent them from accomodating their customers. They just can’t build up positions that would represent a view (prop trading). This is relatively easy to monitor, and it should be the responsibility of the banks under Dodd Frank to defend if challenged by the regulators.

The easiest way to monitor that and keep them honest is to keep an eye (and a lid) on their permissable market risk exposures.

As the rules and definitions are being written the regulators can use this simple principle to drive the definitions of prop/non prop so that the spirit of the Volcker rule survives. If a banks risk position expands beyond a threshold necessary to support the market making function, then they violate the rule.

Forget about what the banks say for the moment. Look what they’ve done. Traders have fled the banks. Maybe that’s temporary and they’ll return if they think the banks will persevere and figure a way to game the rules.

But the flight signals to me that some of the smart money is betting that prop trading at the banks will be contained and easily monitored if the regulators decide to grow a spine.

And to sddress the inevitable argument that it’s just too much work to track all this stuff, refer to Goldman’s restatement of their FICC results provided to the FCIC. The initial tantrum when the FCIC asked for the derivatives breakout was forgotten when they finally provided it. And don’t you know GS revealed they lost a lot more money in that business than they had previosly disclosed. Oddly this was presented as a PR positive by GS when it was released at the end of the year. But more importantly it gave lie to the line that it is impossible to break out positions/pl at a sufficient level of detail to distinguish prop/customer pl attribution.

Had a really bad night, and dreamed that Goldman-Sachs had become the new Nazis, launching a Blitzkrieg against the American middle class with Lloyd Blankfein as Gruppenführer in an SS-Uniform.