The level of complaints about servicer screw ups in the HAMP program and more recent horror stories from borrowers not seeking loan modifications confirms something we’ve noted on this blog: that servicers fee structures aren’t set up for them to handle the workload associated with high volumes of foreclosures. Accordingly they devised processes like robosigning, which are legally impermissible, as a way to contain costs. Many of the abuses still have not gotten the attention they deserve. For instance, the most widely used foreclosure platform for the industry, that of Lender Processing Services, does not have a field in its software to allow a foreclosure of a person in a Chapter 13 bankruptcy to be processed differently. This results in impermissible charges. For instance, when a Chapter 13 debtor is in a bankruptcy plan and sending his payments to the Chapter 13 trustee, who in turn disburses them to various creditors, there is no such thing as a late payment. But if the old borrower due date was the 10th of the month and the trustee sends checks on the 15th, the bank will record a late fee. Then when the borrower emerges from Chapter 13 which means he is current on all the debt under the bankruptcy plans, the bank will send him a bill for what is typically several thousand dollars of fees. The borrower who is still under a lot of financial stress (Ch. 13 plans by design soak up all of a borrower’s income) then has to spend money he does not have to go to court to get the charges removed.

We also pointed in previous posts to signs that foreclosure filings had fallen markedly versus year prior levels. From Bloomberg:

U.S. foreclosure filings fell last month to the lowest level in three years as lenders under legal scrutiny struggled to process a backlog of defaults and put new systems in place for home seizures, RealtyTrac Inc. said.

A total of 225,101 U.S. properties received notices of default, auction or repossession, down 14 percent from January and 27 percent from February 2010, the Irvine, California-based data seller said today in a statement. The number was the lowest since February 2008, and the year-over-year decrease was the biggest since the company began keeping records in 2005…

“It’s clearly taking the lenders and servicers longer than anyone had anticipated,” Rick Sharga, RealtyTrac’s senior vice president, said in an e-mail. “Beyond that, the industry itself is in a state of dysfunction.”….A glut of resubmitted paperwork is “taxing the resources” of loan servicers, and judges are demanding greater scrutiny in states where courts oversee foreclosures, Sharga said….

In Florida, a judicial state that’s been among the hardest- hit by the crisis, total foreclosure filings plunged 65 percent from a year earlier. It still ranked second for total filings.

The Florida slowdown may also reflect the fact that the state attorney general is investigating the state’s major foreclosure mills. One of the very biggest, the Law Offices of David Stern, announced this week that it was closing at the end of March.

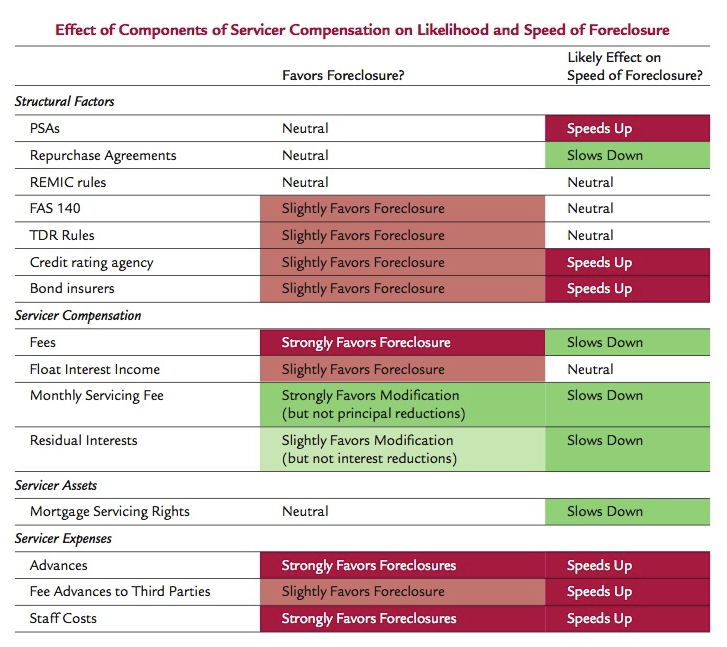

Mike Konczal also highlighted a very illuminating chart from a paper by Diane Thompson of the National Consumer Law Center, Why Servicers Foreclose When They Should Modify and Other Puzzles of Servicer Behavior, which shows how payments to servicers influence their behavior in foreclosures:

Wow, interesting chart. Slow-and-painful is the way forward, huh?

Then there’s this in today’s Baltimore Sun

Former law firm employee says over 1,000 deeds were recorded with false signatures

Sorry, yesterday’s Balto Sun – I stand corrected

Yves,

The larger factor that highlights the Servicer’s errors are the attorneys!!!

I am willing to bet that the main reasons Florida’s foreclosures are down are:

April Charney

Matt Weidner

Greg Clark

Tom Ice and many other Consumer Advocates and Defenders of the Constitution.

There are well over 2 dozen Great Lawyers that are relentlessly trying to make a difference in Florida.

In contrast, in Nevada there are only 4 Great Lawyers working against the tide.

Behind almost every one of the anti-bankster ruling, there is a Great Lawyer attempting to uphold a rule of law.

This is the MOST IMPORTANT untold story of this Crisis.

There are just a bit over a million lawyers in US. Where is the Million Lawyer March? There is probably less than 300(if that) lawyers working to uphold the law on behalf of our people. This is the true crisis in representation.

There was a great piece “Crisis in Representation” published by Brennan Center for Justice in October 2009 and this issue has been greatly amplified since, due to astronomical rise in defaults tied to negative equity.

On a personal level I am very fortunate as I have ALL 4 of the Nevada’s Great Lawyers working on my case in some capacity. A real Dream Team!

But… there are a millions of families in desperate need across our great country and unless more attorneys join our quest for resolution there will be many more darker years ahead.

I sincerely hope that you and any other person that truly cares will help me to publicize this issue.

History will judge every-one’s actions, it always does.

I welcome all comments at: providencegroup@ymail.com

Relentlessly battling Banksters in Nevada,

Bill Kay

I mediate several foreclosures cases every week in Florida. I know dozens of lawyers on both sides of these cases, some very good and some very bad. It’s difficult to say whether the drop in filing is due to the consumer lawyers in the trenches, the Florida AG, or the spotlight shined on the shady practices of many of the servicers and their lawyers. One thing is certain though, the drop in filings is temporary, and is only until those problems can be worked out. I know for a fact that there are tens of thousands of foreclosure cases at these plaintiff’s firms waiting to be filed. It’s far from over.

http://www.pinellasmediation.com

http://www.facebook.com\mediatorken