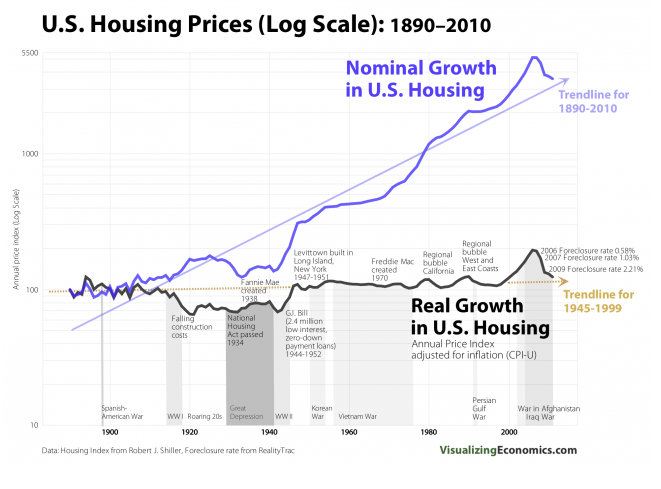

I try to avoid republishing other people’s very cool charts, but this is on a pet blog topic. So you readers please be very nice and go look at the accompanying text at Visualizing Economics and better yet, subscribe too (hat tip Richard Smith, click to enlarge):

This serves to confirm the idea that from a policy standpoint, housing is best regarded as a forced savings vehicle or a store of value rather than an investment.

the only reason houses seemed to increase in value was because of the bubble and because the dollars they were “valued” in became worth less at a faster rate than the houses did, & because low interest rates kept payments monthly payments relatively low, encouraging more low down-payment buyers…absent dollar inflation, houses are a depreciating asset, albeit with a longer time span, just like cars are…and im speaking as someone who has watched his own home deteriorate in “real” value over almost 40 years…

”

dollars they were “valued” in became worth less at a faster rate than the houses did, & because low interest rates kept payments monthly payments relatively low, encouraging more low down-payment buyers…absent dollar inflation,

”

~~rjs~

Do home prices suddenly rise when long interest rates unexpectedly drop? Did Bill Gross recently hint that long rates would inevitably rise big-time? Indicate that he was deep into the process of dumping long treasuries? Since his suggestion have long rates actually fallen? An unexpected drop in rates for people who have faith in Pimco? But why home price rises as long rates and mortgage rates drop? Less money spent for loan interest means more money for bidding up the price of homes? Sounds logical to me.

If, then teaser rate mortgages that automatically adjust upward are a built in bait-then-switch deflationary pressure on homes. When you move into home, rates determined by actual mortgage payments are low thus equity in home is high. As your actual payments rise your equity automatically drops. Of course this may not follow for an individual home combination mortgage holder. It definitely influences the aggregate of homes and the aggregate of mortgage-springers. Do you see how it works, this insidious built-in Ponzi?

Everything you see or seem

is merely a dream

within a scheme

within a

Ponzi

!

Bubble yes – Depreciating asset only partly so – and why is that important?

Houses (improvements) do in fact depreciate and designs become obsolete. i don’t see this as any different than the depreciation that takes place in factories, technologies, office buildings, most drugs, patents, business systems; essentially just about everything that is owned in the stock market – except commoditities and land.

That land that is owned (in desirable places) and is connected to utilites and includes vested rights for use is a scarce commodity – The improvements (a house) also represent a basket of commodities as lumber, copper, steel, concrete, gypsum, energy, along with accumulated labor. A fact is that many of the oldest homes were built in the most desirable places. I’m not talking about Cape Coral, Modesto, Bakersfield, or Las Vegas.

On the positive (macro) side of the bubble, most of the houses built are still standing and available to serve people as housing. However, somewhat like the Chinese “ghost” cities, a lot of homes were built in areas where land was cheap, isolated and not very desirable – so the worst problem is the misallocation of economic energy that occured.

We are now seeing a re-shuffling of who “owns” the houses. For most folks who end up renting, they will be renting at far less cost than the price of ownership in 2006.

Jim Elliott wrote “That land that is owned (in desirable places) and is connected to utilites and includes vested rights for use is a scarce commodity”

Absolutely! If the selling price of land had been controlled, “house” prices could not have bubbled as they did, and the crash would have been much less than we experienced. A land value tax would have accomplished this. Maybe one could be in place for the next bubble.

Admittedly, houses also contain raw materials such as copper which can be recovered and has value, but the salvage value of such material is a tiny fraction of the value of the land.

Aren’t property taxes based on full value the equivalent of a land value tax?

Property taxes grew at the same rates as the nominal growth rates during the boom. The subsequent plunge in real and nominal values hasn’t resulted in a corresponding plunge in real estate taxes.

The current inflated tax bill/(declining)market value ratio may continue to temper property values going forward as you suggest. We’re testing your theory in real time.

Yes, a new tax is the solution to all our economic problems. Duh, WINNING!

The phrase “depreciating asset” when applied to housing is not only meaningless but totally wrong. A car is a depreciating asset because it goes to zero over time. It’s a mechanical device. It will fail and rust away with only scrap value. I grew up in a 250 year old house. Please explain to me how this asset “depreciated” over time? Explain that to my parents who still live there and bought it for 25k in 1970? Do you think this asset “depreciated” for them? You can argue about its “investment value” and if the money they spent over the years was worth the return, but that’s a different story.

As I’ve said from the beginning (only to be drown out by the crazies who scream “depreciating asset” on one side and the marketing realators on the other) a house is a place to live. It is truly either “forced savings” or a value store and that’s it. When I was buying my first house, my wise father told me that the purpose was to have no housing expense when one grew older and retired. And if you were sufficiently hard up some time in the future, you could sell it to supplement your retirement. It should NEVER be thought of as an “investment” a “starter home” or anything else. It’s a place to live. That made me buy my house but what also did is that I’m not at the mercy of a landlord’s whim, I don’t have to move whenever I don’t want to, I can do what I want to it, and I have my own space. It’s not a business decision. When you start thinking of it as one, you’ve already lost.

And over 250 years, considerable money has been put into remodeling and addind ammeneties undreamed of when it was originaly constructed. Without electric light and running water, or at least the capacity to add them, the house would be worth very little today. Even regular maintenance like a new roof can be considered a counter to the natural depreciation. The higher the maintenance costs of an item are, the shorter it’s “economic life” is. If it keeps a fixed price with no maintenence it doesn’t depreciate. If it takes 50% of the initial cost to keep it’s “value” the same, it is depreciating very quickly.

While I certainly DO consider housing an “investment,” I don’t think that it is wise to use it as a “speculative investment.” Rather it is an investment that returns its dividends “in kind,” which is to say as housing. Since the transaction costs are high, and the anticipated economic life of the house is greater than the mortgage term, living in one place for as long as you can will maximize return in the absence of speculative gains.

I think there is a basic misunderstanding of what depreciation actually is, where the idea came from, and where the true value actually lies.

Depreciation is not the maintenance costs; it is the drop in value of X due to time, wear, tear, etc…; Marx came up with the idea of depreciation to account for the natural degradation of machinery or technological obselescence of equipment. The purpose being to help maintain the production of products when entry costs are high and new technology makes other technology obselete.

Some con-artists convinced politicians to allow depreciation for buildings (to include homes) even though they do not become obsolete and the price for building and maintaining them hasn’t changed much over the last three or four hundred years.

The true value lies not in the building, but in the land. A house isn’t ‘worth’ much more than the value of the materials; don’t confuse the price some fool or lemming will pay with the value. The land is the key and that value is based on location or what may be under it or run through it (and that you can’t make more of it, unless you’re Holland, but that is rare).

If housing is an investment, then it is speculative only. You’d need to have a pretty lax definition of ‘investment’ if you consider a roof over your head an investment; rather it is a human right. Certainly there is money to be made in speculation, but most lose in the long run and the big winners win not because they are good investors, but because they have connections to insiders (for example, they can get agricultural land changed to residential when others cannot or they can buy prime land for cheap right before the government invests in the area (check out Lyndon Johnson and Al Gore) and the access to other people’s money.

though that house may still be livable now, i’ll bet 250 years hence it’s value will depreciate to zero, just like a car…

Hilarious. My father lives in a house part of which was built in 1700. The family acquired it in the mid-fifties for 25K. It’s now worth well over a million. And, quite frankly, it’s very poorly built by today’s standards. However the original part of the house, about 1/4, survived since 1700 with whatever maintenance was required through about 275 years during which housing was housing and not a speculative investment.

The housing bubble coincides with bank deregulation and interest rate reduction and the acute decline in middle class earning power.

IN the 275 years a bunch of new roofs were put on. Of course as noted earlier HVAC, plumbing and electrical were added. It probably is not known if any wood replacement was needed. If you watch life without people or life after people you see what happens to houses if just left along. Depending on the location and roof type in might be 30-80 years or less until the roof fails, once that happens the house is toast. Let alone how short a time till windows break, etc. Mother nature wants to knock a house down and give her enough time and she will do so. (If in the SW desert the time may extend, but if you look at Chaco Canyon, you see that even those buildings fell into ruin.

…except in New Orleans’ Veuix carre’ where dereliction increases the value…

Seriously, the house now has an historic marker on it and it’s worth over a million also. Think that 25k in 1970 (which, btw, was not cheap in my area then) as worth it on both investment terms and in human ones? It was built by people that didn’t know what building codes were, but I can tell you that the main beam is a sight to behold, as is the original brickwork in all the fireplaces. It will be here 500 years from now unless it gets hit by lightening and burns to the ground, which is always possible. Btw the land itself is now worth over 200k, so no matter how you slice it, it works out in time.

Time, you know, it’s what people don’t think about when they are told by real estate agents that it’s a “starter home” or “you can trade up”. I was told that if I didn’t plan on being somewhere for 5 to 10 years, it was not worth it to buy, just rent. Good old fashioned advice to be sure. Even after the bubble is over I’m fine in my house. And, frankly, they’ll carry me out feet first if I have anything to say about it. And that’s worth more money than you can calculate.

mbh,

You sound a bit defensive. By your description, the house was probably undervalued in the 70s, and is certainly overvalued now. Either you don’t understand inflation and depreciation, or you are just ignoring them. Houses cost the upfront fees plus all the fees to keep them standing (repairs) and in your possession (taxes). Add up those fees over 250 years, adjusted for inflation, and then you have the story. If you buy at a market downturn (like it seems you did), you may come out way ahead, but that doesn’t make housing not a depreciating asset, that means that whoever sold you the house took a big loss and to you it shows up as a big gain.

Many McMansions built 15 years ago already need a new roof and windows while houses built in the 1950s still have the same stain glass windows.

Materials used can make a huge difference in terms of depreciation/maintenance costs.

And then there is always location, location, location. But that’s mostly about the land.

I think you’re just talking different concepts of “value.” Both sides are right: No, your 250-year-old house isn’t worth “a million bucks” or something, based on opportunity cost, inflation, maintenance and other factors — and yes, your 250-year-old house is priceless. Of course it has value, depending on its location, architecture, and the shape it’s in. But not all value is measured in dollars and cents.

This points to the very heart of where we went wrong in this country. We knew “the cost of everything but the value of nothing.” Everything was an “investment” and not “a place to live” that might actually cost us something — but hey, places to live cost something. Even a log cabin in the woods isn’t free, if you have to build it yourself.

You don’t build graphs measuring the appreciation of something like that. And by the way, I don’t even understand the units and scale of this graph anyway. Basically, if your point is that housing isn’t a hot investment because it’s never been, I already knew that.

Most of us in the U.S. have warm, electrified roofs over our heads, and that in itself is beautiful and priceless without greed being involved. Maybe previous generations thought it was worth something to sacrifice and work and pay taxes to support the infrastructure that made that possible. What was the cost of that? It can’t be measured, either.

A striking chart! In the DC metro area there appears to be a two tier market. One with mortgages and very few sales published in the WaPo which is like my appraisal, houses worth around $175,000. I lost $100,000 in the bubble. But, the second tier is the cash sales around $60,000 from the banks; near my purchase price in the 70’s.

I assume the difference is due to all the efforts to keep the current too big to fail banks alive. Once the banks are nationalized and Freddie Mac dismembered, housing prices would fall to what workers can afford to rent.

Are stocks that pay out all their earning as dividends forced saving vehicles? The investment return of a house is NOT the appreciation. It is the imputed rent savings less costs–what you save by buying instead of renting, in other words–divided by price. Saving as the investment return on a car is how much you save by buying instead of leasing/renting, divided by the price of a car. One of the costs of both housing and cars is depreciation. The above chart shows that houses have not depreciated much, which means the investment return on houses is better than you might expect otherwise.

The SPECULATIVE return on both houses and stocks is the change in P/E ratios. If the return on houses (cap rate) was, for example, 6% back in 1995 and then dropped to 2% in 2005 and then rose back to 6% by 2011, there were speculative gains and losses layered on top of the 6%/2% investment return. If the house was bought with leverage, then those speculative gains/losses could easily dwarf the investment return.

I definitely agree with your main point, and it has long seemed incontrovertible to me that most should not view housing as an investment.

At the same time, real estate is an asset that for thousands of years has been subject to a fair amount of volatility and thus makes for a good speculative buy-low/sell-high strategy, especially given the widespread availability of 80%+ nonrecourse asset-backed leverage.

I think the chart is fiction. Here’s why: Angelo Mozillo was the Henry Ford of home loans and he caught the eye of the MIC. In 2003 George Bush encouraged all Americans to own a home. Interest rates were good and terms were almost nonexistent. Why would a president do that? Big banks have always been tight with the MIC, as LBJ told us in his autobiography regarding his decision to go into Vietnam. When he got back from Dallas one of the first things he did was to “call a banker friend of mine…” Bla bla bla. So back to the present: the scheme was hatched in 2000 to pay for Iraq, Afganistan, Pakistan, Georgia, Northern Iran, Syria, Eqypt, and now Libia, Yemen, Bahrain, Somalia, etc. and it seemed like a no brainer. Win-win. If the investors had not found out it was bogus. But in 2006 (because money was being sucked out of the economy with a giant sucking sound that even Ross Perot could never have imagined) people started to default. Our allies in Europe, our Nato allies, noticed this immediately and they also noticed that the CDOs were totallly bogus – they were not securitized at all and Europe could read the writing on the wall. They called b.s. and demanded their money back. Funny. Hank Paulson tried to intervene with secret trips to Europe to no avail. And we had to eat all the bogus CDOs and CDSs. The money from the American investors, the pension funds, etc, had no doubt gone straight to the Pentagon, it had not gone to the banks, they were only the evil brokers of this deal. (Kruschev was so wrong. He actually said that the West could not muster the finances to go to war because democracy got in the way.) So no money was recycled into the economy to keep it strong and in balance. No money at all. Towns and states began to go bankrupt. Pensions failed. There were no jobs. The Europeans, and maybe the Asians, made the Big Banks buy back the CDOs as early as 2006, when cat was first out of the bag (litigation in Florida in 2006 proved this but it took the USA another 4 years to get outraged) – when the banks were caught in the bind they thought was win-win (the US economy was so strong that the MIC could suck money out of it by a scheme that took investments from the pensions, slipped it off to the MIC, gave the banks a commission, and hooked every homeowner to produce an income stream for retirees, and banks, etc.) but it was not win-win, the banks were on the hook themselves. And we see the outcome today. The graph of the value of real estate has very little to do with anything except the value of gold.

And what’s the objective of the Military Industrial Complex? The capitalist Industrial side needs to secure resources – oil and gas, mostly, and capture markets, the “developing” world. The military side is the enforcer in this economic adventure.

If you are paying interest on your mortgage, a house is not an investment. Sorry.

If you pay cash, you can call it an investment. Investments lose money sometimes, however. There’s no rational reason to expect a house to trend long-term above inflation, though. Only in a bubble will the value exceed inflation.

Thanks for this chart. Now I have a handy way to explain my rationale for renting to everyone who thinks I’m crazy.

If I invest the difference between rent and a mortgage, I can easily save up enough money to buy a house in cash where and when it makes sense. And I don’t have to pay twice the sale price over the 30 years of a mortgage.

house prices wont bottom until everyone on this thread throws in the “homes are an investment” towel…

House prices are holding up in London!

“This is typical of the type of Cannibal Capitalism going on in this country. What I am really afraid is that the collapse of the mortgage market, the attrition to the middle class will only accelerate¬. The loss of household wealth will have far reaching effects as families that would have been able to buy a house will be caught in an endless “rent trap” of perpetuall¬y rising costs, no equity, and no end. Goodbye suburbs, hello tenements. This fear was mention earlier this week in the New York times article “Without Loan Giants, 30-Year Mortgage May Fade Away ” by Binyamin Applelbaum¬. Then backed up by Michael C. Hill who has written “Cannibal Capitalism¬”.”

30 year mortages will not fade away. Think about it. 30 year fixed rate loans are the banks bread and butter. The rape people for years and have collected the lion share of the interest.

Do people actually think that there wasn’t some master play by the banks to amortize loans. Banks figured out people tend to refinance or move every 7 years. Look at your amortization schedule and see that the first seven years of payments are almost all interest.

This is the same reason they were willing to do option arm loans. As long as real estate stayed flat, appreciated with inflation or dropped a few percentage points in value the banks could put more poeple into homes and collected interest. They could line their pockets with billions more in interest received in the short term without regard for the long term.

Banks have to have 30 year mortages or they will need to create a completely new business model. Even if they are just servicing the loans there will be no housing market if people can only get 15 year loans. There will be no housing market if people are required to pay 30% down on homes, especially if the market stagnates.

The middle class is getting squeezed and they are paying more for expenses and earning less and less. The cost of education, food, gasoline, energy are skyrocketing. Where are the middle class americans going to save the 30,000 before they are close to 40. If you make a large salary or have family to help out it might be easier but it will take away the ability for the middle class to buy homes and it wll stretch the Gap between wealthy and non wealty even more as those with money will be the only ones able to buy real estate. Sounds a lot like England way back when.

The main problem is that the “trusts” holding the various tranches of mortgage notes don’t exist. So the CDOs and CDSs were bogus as well. How else do you explain 24 trillion dollars worth of bailouts,advances at the discount window,loan backstops,TARP,TALF,Maiden Lane I II & III,and on and on ad nauseum. The notes never made it into the trusts,they were sold multiple times to multiple parties,unbeknownst to them,80/20 loans with 2x PMI,foreclosure proceeds not being advanced to the trustee by the servicer. All backed up by bogus appraisals,with the loan docs dummied up by the cut & paste department in each mortgage originator’s liar loan dept. If the appraisals didn’t “hit the number” the appraiser was threatened with no more work,or not being paid. Bubble? Hardly.

Yes, it’s really true that now a days many real state existing . Maybe a lot of people wanted to have a nice home. But the question is can we assure that the house we buy nowadays will have a high quality of materials?

Can real vs. nominal housing assure us to have a better home?

@vietnam vet: two tier market…

I think this is an important observation. If the distribution of prices is added to this chart – is the story different for some regions/classes of houses?

First, it’s pretty likely that land rents don’t go up much in semirural communities with little or no job or population growth. I live in a MD suburb of DC, and I can assure you land values are pretty high here, if not as high as they were at the bubble peak.

Second, one commenter on USENET pointed out a few years ago that home price histories might be deceptive. Why? If there’s a home which accelerates in value, it’s price might eventually get “reset” as follows: the house itself will eventually depreciate to zero and be condemned. If the records start anew with the new house, all the gain in land value is wiped out as far as the longitudinal analysis of the bookkeeping is concerned.

As many have pointed out above, _homes_ depreciate; land does not (except when land rents take a hit due to changes in the surrounding area).

The idea that _land_ value only keeps up with inflation is laughable. Land is a scarce asset. Furthermore, if it really only kept up with inflation, then real GDP growth would lead to real land values asympoting to zero. Not gonna happen.

One of the reasons the land bubble happened in the first place is that most economists don’t understand or pretend not to understand land economics. That’s why so few advocate higher land taxes, even though (a) land taxes are the most equitable form of taxation, (b) land taxes are the most efficient, since supply elasticity is zero, (c) greater taxes on land will inhibit bubbles.

Your argument neglects the critically important task of equitably collecting the tax. If your interest is egalitarian, your argument should include taxing land owned by government, schools, religious groups, and “charities.” Such entities should be compelled to abide by employee compensation limits roughly in line with national average household income. If these organizations cannot pay the taxes, the land should revent to “unclaimed” status. In places like New York City, our proposed new world would see a lot of “scarce” land open up for new use and tax generation.

My humble opinion is that the concept of housing needs to be dissected into two parts: land and improvements (buildings). The improvements aren’t worth more than their replacement value. The land is where almost all the price volatility and uncertainty happens. The value of the land is determined by its productive use value. In the rural area the productive value is from agriculture, mining, forestry or some other extractive industry. In an urban area the productive value is the residual of the population’s total income after subtracting for all other costs of living. All the other costs of living are more or less tradable items (there is price arbitrage across geography), and so any increase in income will be used to bid up the price of the non-tradable item (land). Debt financing only serves to capitalize expected future income into the present. So the availability of debt accelerates the price increases of land.

Here is the funny thing about all the recent increases in commodity prices, in the absence of increased debt availability or massive accelerating increasing government deficit spending, land prices (home prices) will decrease. If a worker has $1000 of income and commodity prices increase, then the residual left over from daily living will be less to contribute to land bidding (house buying, down payments, monthly payments, whatever).

Something popped into my head today: if you have a mortgage, especially a dual-income mortgage, you cannot consider going on strike. Without the power to strike, a union is impotent.

An “Ownership Nation” is a right-to-work nation.

Some houses, neighborhoods, and monuments have aesthetic value. Are works of art depreciating assets?