By Michael Hudson, a research professor of Economics at University of Missouri, Kansas City and a research associate at the Levy Economics Institute of Bard College

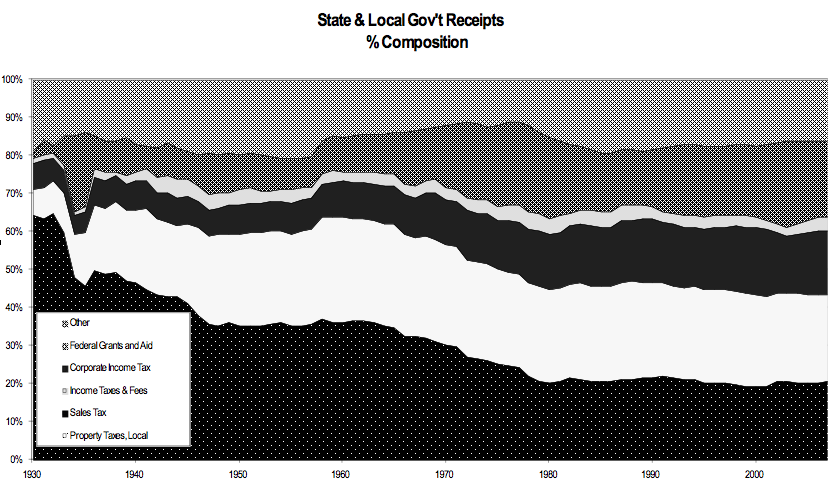

The cost of the 2011 cutbacks in federal spending will fall most directly on consumers and retirees by scaling back Social Security, Medicare, Medicaid and social spending programs. The population also will suffer indirectly, by lower federal revenue sharing with U.S. states and cities. The following chart from the National Income and Product Accounts (NIPA, Table 3.3) shows how federal financial aid has helped cities shift the tax burden off real estate, although the main shift has been off property taxes onto income – and onto consumption (sales) taxes.

State and local revenue, 1930-2007

Untaxing real estate has served mortgage bankers by freeing more rental income (the land’s site value) to be paid as interest. Property taxes have not absorbed anywhere near the rise in debt-leveraged housing and commercial prices. However, this has not lowered the cost of housing for most people. New buyers must pay a price that capitalizes the property’s rental value. Less and less of this payment has taken the form of local property taxes. More and more has been paid to mortgage lenders as interest. So cutting property taxes has simply left more revenue to be capitalized into higher debt-financed prices.

While homeowners saw their carrying charges rise, they nonetheless felt more affluent as real estate prices rose – inflated on easier and easier credit terms. Prices rose faster than mortgage debt as long as (1) interest rates were declining; (2) loan maturities were stretched out (ultimately reaching the point of zero amortization rather than the old-fashioned 30-year self-amortizing mortgages); (3) down payments were shrinking toward zero (rather than requiring 20 percent equity as used to be the case) and indeed as “liars’ loans” led prices to be bid up recklessly; and finally (4) cities refrained from raising property taxes as fast as market prices were rising. This left more revenue to be capitalized into higher prices, providing capital gains that home owners were encouraged to treat like “money in the bank” – by taking out home equity loans. This rising mortgage debt was increasingly important in enabling people to maintain their living standards, especially as they had to pay more for housing. So what appeared to be affluence and rising net worth from the value of one’s home on the asset side of the balance sheet found its counterpart in debt on the liabilities side.

From the local fiscal vantage point, these debt-leveraged price gains represented uncollected user fees for the site value provided by public infrastructure and rising prosperity. The bankers ended up with the rising flow of rental value, not the cities. This obliged tax collectors to look to other sources of revenue. So homeowners paid out what they seemed to be saving in modest property taxes in the form of rising sales taxes and income taxes.

By 2008 these financial system’s easing of credit terms had reached its limit. No more room for credit inflation remained, so speculators began to withdraw from the market. (They accounted for about one-sixth of demand for housing.) When the credit spigot was turned off, prices plunged – leaving the debts in place. (So taking out a home-equity mortgage was not really like drawing down money from a piggy bank after all. Years of future income had to be diverted to spend for past shortfalls.)

Now that federal aid is falling – along with revenue from sales and income taxes – local budgets are falling into deficit. But for many cities and states, their constitutions and regulations prevent them from running deficits. So they face a number of hard choices.

It is hard to raise property taxes back toward earlier rates, because the rental income already has been pledged to the mortgage bankers. To tax heavily indebted property would lead to more foreclosures and abandonment. And the Obama Administration’s hope that banks somehow will use the Federal Reserve’s tsunami of cheap (0.25%) reserves and credit to re-inflate a new real estate bubble is in vain, because bankers have little interest in lending to property that is still sinking in market price. It is easier to speculate on interest-rate arbitrage with the BRICS and get a foreign-exchange premium as well, or simply to play the market. Banks report winnings in the derivatives trade day after day, with nary a loss – an indication of how poorly their hapless customers and other outsiders must be doing! So the path of least resistance for most cities and states is to cut back spending on public services, and above all on pension plan contributions.

The ultimate sacrifice (and the aim of financial predators) is to sell off public land and buildings, roads and other transportation services, sewer systems and other basic infrastructure. In this aim, the investment bankers are being aided and abetted by the credit ratings industry, threatening to downgrade cities that do not sell off their public domain. In this respect the financial end-game of privatization is similar in the United States to pressures by the European Central Bank to force the indebted PIIGS economies to engage in privatization sell-offs, Third World and post-Soviet style.

Just as in Europe, when revenues are squeezed and something must give – either debt service, payment to pensioners or current payments to labor – the financial sector is seeking to take all the available surplus for itself. This puts creditors in the forefront of today’s class war against labor.

On the eve of the September 2008 financial crash, cities such as Birmingham, Alabama and Chicago already were looking for ways to cope with the fiscal squeeze imposed by political pressures from the major local campaign contributors – the real estate and banking sectors – to cut property taxes. One seeming path of little resistance was to gamble in the Wall Street financial casino, hoping to make easy gains rather than making landlords, wage earners or consumers pay higher taxes.

Landlords and bankers encouraged this speculation as an alternative to taxing property. Landlords wanted to pay less in property taxes, and banks knew that whatever rental value buyers could save in the form of lower taxes would end up being used to bid up prices to capitalize into debt service for mortgages to buy properties up for sale.

Here is the dilemma that states and cities now face: So much urban property is sinking into negative equity territory that a rise in property taxes will lead to even more foreclosures and abandonments, and hence even lower fiscal returns. To avoid this, cities are seeing Chapter 9 bankruptcy as the main route to free themselves, especially from problems that stem from an unwarranted trust in bankers to help them out of the earlier fiscal squeeze by putting them into losing financial gambles. Orange County in California successfully sued Merrill Lynch to recover damages, and Birmingham also was awarded recovery payments from JP Morgan Chase.

Birmingham and Chicago as microcosms of the national debt squeeze

Now that financial fraud has been decriminalized for all practical purposes, most financial victims are obliged to sue for reimbursement in civil court without much help from prosecutors. Alabama’s state capital Birmingham is a case in point. After a predatory financing arrangement to upgrade its sewers in 2008 forced its Jefferson County into bankruptcy, the Securities and Exchange Commission (S.E.C.) negotiated $75 million in fines and reimbursement of fees to be paid by JP Morgan Chase as lead lender and negotiator for the complex interest-rate swaps they had advised the country to take, ostensibly to protect its economic interest. The banks also forfeited nearly ten times this sum ($647 million) in termination fees. But the court-appointed receiver grabbed the $75 million settlement for payment on the debts the country still owed.

As usual, the banks had paid the fine and made reimbursement without admitting any wrongdoing. To the financial sector, deception and fraud is part of the game, after all, not a tactic that can be prosecuted as criminal. They paid their fines without admitting any wrongdoing, and without even admitting the S.E.C. charges. They merely paid up and kept silent – while the Justice Department and Internal Revenue Service were still in the time-taking process of ruling on legal claims brought by Jefferson County. The case prompted bankers and bondholders to bring pressure on the state of Alabama to take responsibility (that is, take on the debt liability) all on behalf of statewide taxpayers, and to demand that all lawsuits brought for financial fraud to be dropped.

“Responsibility” is supposed to be only for debtors, not for the financial sector itself. This is how the banks have managed to rewrite the laws, after all.

Jefferson County is now debating whether to declare Chapter 9 bankruptcy to free itself from debts that can be paid only at the cost of disrupting economic continuity and living standards. The city’s debt quandary is a microcosm for the U.S. economy as a whole. Its lowest-income residents are burdened with financialized charges for sewer-system debt payments so far beyond their ability to pay that they face the same fate as Latvians, Irish and Greeks: As the local economy shrinks, they must move in order to find jobs – in places less debt-burdened and hence lower-cost. The “free market” choice is to emigrate to flee the debts imposed on their economies and on themselves personally.

Well-to-do Birmingham families have yards large enough to have their own septic tanks as an alternative to paying for access to sewers, but lower-income families living in small houses or apartment buildings lack this option. One county commissioner asked: “Why should the poor have to pay for the ill-gotten gain of some of these banks who poisoned the well in the very first place?” Other commissioners demanded that bondholders “bear the entire cost of a $20 million fund that is being created to help low-income residents pay their sewer bills.”

But the government usually provides relief only for creditors – above all, relief from criminal prosecution for their business plan that involved making loans beyond the debtors’ ability to pay. Some states have fraudulent conveyance laws to prevent this, as well as to prevent banks from misrepresenting the quality of their loans to outside investors. There are laws to punish appraisers who give false appraisals, and mortgage brokers who fill in false income reports to qualify for loans. But the S.E.C. has seen its staff and budget slashed and deregulators appointed to oversee its affairs. It has no authority to prosecute, only to make recommendations to the Justice Department, where Attorney General Eric Holder has followed the Obama Administration’s support of Wall Street, feeling no obligation to live up to the promises to make that a change from the Bush Administration’s similar lax behavior.

The financial sector recognizes a dimension of economic behavior that textbooks politely refrain from citing: the ability to capture regulatory agencies, gain control of the courts and buy control of politics. The Supreme Court has ruled that corporations have the same rights as individuals to contribute to campaigns, a euphemism for buying the loyalty of politicians and judges, and obtaining veto power over regulatory appointees. Corporations pay lower income-tax rates and are free of value-added and excise or other sales taxes paid by consumers.

Unlike real people, corporations cannot be sent to jail. Corporate shells shield owners and managers from criminal prosecution for the wholesale frauds that have left Countrywide Financial, Bank of America, Citibank, JP Morgan Chase and other pillars of the banking community free to make civil settlements for deceptive policies without admitting wrongdoing. And whereas individual crooks need to pay their own lawyers, corporations pick up the tab for their managers, while contributing generously to politicians who rewrite the laws to decriminalize fraud and deceptive business dealing. The corporate-backed media applaud politicians who insist that families “take responsibility” for their unemployment risk, debts and health care – while bailouts free the wealthy from having to suffer losses on bad loans.

Rhode Island recently rewrote its laws to place bondholders ahead of other creditors, including pension recipients. Under the new law, “city officials who intentionally fail to pay bondholders can be removed from office or held personally liable for the payments.” In contrast to the pro-debtor trend of legislation since the 13th century, wealth at the top of the pyramid takes precedence over retired schoolteachers and other public employees. The effect has been for the city of Central Falls, Rhode Island, to seek Chapter 9 bankruptcy protection to avert a 34 percent cut in pensions to its retirees in order to pay bondholders.

Rhode Island is not alone in giving legal priority to bondholders. “Illinois has some of the strongest bondholder protections anywhere, which explains how a state that began its fiscal year with $3.8 billion in unpaid bills from last year – and whose pension system has less than half of the money it needs – is able to keeping selling bonds. State law requires Illinois to make ‘an irrevocable and continuing appropriation’ of tax revenues into a special fund every month that can be used only to pay bondholders.”

Chicago has balanced its budget not by taxing finance and real estate gains, but by selling off its roads and other basic infrastructure. Much as in feudal Europe, the leverage is financial. Privatizers are charging tolls and even installing parking meters on the city’s sidewalks to charge cars for parking by the minute. New York City has slashed is public subway and bus service, extending commuting times and making life harder. It has privatized its television and radio, replacing public airtime with commercial advertising.

The ending of federal revenue sharing will exacerbate local budget constraints. The fact that many cities and states have constitutional requirements of balanced budgets – just as Republicans advocated for the federal government in the 2011 debt-ceiling agreement – requires that taxes be raised, public services cut, or assets sold off. California’s Proposition 13 prevents the state from raising property taxes in keeping with market prices, tying its hands fiscally and obliging it to commercialize its once-great university system. Students must now take on enormous education debt for what formerly was free or subsidized. New York City’s real estate tax likewise favors large investors and wealthy homeowners, at the expense of co-ops and condominium owners in apartment buildings. The rising rental value that local tax collectors relinquish does not lower housing costs; it merely enables the land’s site value to be paid to bankers. Rising debt-inflated housing prices have priced the city out of the market as the manufacturing center it formerly was. Its textile buildings and other industrial properties have been gentrified, leaving it a one-industry (finance) town focused on Wall Street.

At the international level, Irish voters confirmed the policy of taking bad European Central Bank advice to put the interest of bondholders first by taking bad bank loans onto the government’s balance sheet and taxing the population to make up the losses, even at the cost of imposing a generation of debt-strapped depression on their economy. This is the self-destructive road to debt peonage that the IMF and World Bank forced Third World countries to follow for many decades. The fact that this ethic reverses centuries-long social values promises to make the great debate of the 21st century over the issue of which debts are paid and which will not be – and how much debts should be written down.

The fact that this ethic reverses centuries-long social values promises to make the great debate of the 21st century over the issue of which debts are paid and which will not be – and how much debts should be written down.

Write them down to zero, all of them. I’ve done so in my mind already, why not you?

And then if enough people self-jubilate, as a bottom-up movement, we’ll reach that tipping point where the whole kleptocracy comes down.

The only other option is a restored, far worse feudalism enforced by debt indenture.

For as long as you recognize the existence of system debts, they’re only going to compound. Soon you’ll be passing through figurative toll booths and be on a meter in order to move along the street or even to breathe.

Not only to breathe, but, prior to this, to drink clean water. Already futures on it, I’ve read. Privatize the Great Lakes. Just start calling the people Privateers again. The Electro Golden Hind.

The only other option is a restored, far worse feudalism enforced by debt indenture. attempter

A debt write-down only helps debtors but savers are also cheated by our banking system (of honest interest rates). So a better solution is a universal bailout of the population. It could be accomplished without increasing the money supply by:

1) Forbidding the banks from creating any more credit pending fundamental reform. This would be massively deflationary by itself as existing credit was paid off so balance that deflation by:

2) Sending monthly and equal bailout checks to the entire adult population equal in total to the amount of credit paid off the previous month.

The above would fix everyone including the banks and state and local tax revenues without a serious risk of price inflation.

One very minor quibble about an otherwise excellent piece: Montgomery, not Birmingham, is Alabama’s capital.

Last winter, Gingrich suggested that someone introduce a bill to allow states to declare bankruptcy, go into Ch.11, and seize entire state pension plans. This is the next step, and I think someone like Walker will do as told, despite the required “shame” of his “budget repair” thus having failed. I am sure this is one of ALEC’s ace cards. Who will introduce this model legislation ? A Disaster Capitalism epitome.

Kudos to my former professor at the New School who over 40 years ago taught me to view the world and it economic systems differently. Never did I realize then that economics of backwardness of nations like those in Latin America in the 60’s would apply to the USA today. We have indeed become a part of the “world-wide ghetto function” but in ways and to a degree that I am not sure even Dr. Hudson could have imagined in 1971.

The anti-debtor trend is not just a symptom but a true core of the sickness: society is now just a machine designed to pay the banks and other financial speculators leading to debt slavery and the end of classical bourgeois society.

“Unlike real people, corporations cannot be sent to jail”.

Their CEOS and stockholders can. Naturally it’d require some reform in legislation because corporations are designed to avoid responsibility in business, unlike old good true private business, but it’s all a matter of political will, just like solar energy and all that is good for us.

But there seems to be not a single Bourgeois politician or political party with the guts to rein on banks and corporations.

It is not only bad from an ethical viewpoint or from the viewpoint of the economy of people’s joy and pain, what really matters after all. It is horrible from the viewpoint of demand: there is no demand anymore, what destroys the economy as a whole.

If the banksters get away with their apparent plan, in the end there will be billions of slaves, producing almost nothing for almost zero demand. I imagine that then unemployment will be like 90% and Malthusian eugenics (i.e. Nazi-style death camps against the poor) will be pushed ahead by the stablishment’s propaganda machinery, while all the advances in genetics and such will be put to the service of a genetically modified new pseudo-human species, like in “Brave New World”.

If they get away with it… up to us to stop them and make them pay for their crimes against humanity.

I expect social media to redirect inner city violence toward the real culprits. when local shops are burned – I suspect a false flag operation.

Angry mobs should be targeting BofA and Wells Fargo, and Goldman Sachs.

It would make great reality TV….

I don’t trust the direction of the anger at this point.

Remember, the militias were all infiltrated by the Clinton Administration. Individual groups didn’t know they were being manipulated into lawlessness by government agents until it was too late. Modern media makes that harder.

To briefly elaborate on Professor Hudson’s portrait of the Jefferson County Alabama sewer system controversy:

1) Jefferson County went into debt to comply with an EPA-mandated upgrading of its sewer system.

2) In 2003 a local financial agent and a county commissioner were instrumental in successfully engineering a refinancing deal in which JP Morgan was the major agent and involved interest-rate swaps, bond insurance, issuance of auction rate securities and costly fees for this service. The trail of money transfers would also involve Goldman Sachs.

3) In five years the county debt ballooned.

4) Several county commissioners involved in the refinancing decision and the local representative of the refinancing scheme were convicted of bribery.

5) During this period of identified financial wrong doing, bribery convictions were also rendered on commissioners and contractors relating to the original contracts issued for sewer improvement.

Why can’t EPA mandated anything, also, ADA mandated comp

compliance, be financed by low interest bonds put out by the feds?

Yes, the article fails to mention the almost certain reason for the refusal of the sewer commissioners to BK the sewer authority: that countersuits by the bondholders would expose the corruption of the commissioners and their cronies. A former mayor is already in jail, and I bet most if not all of the commissioners deserve to be.

Both paying a bribe and taking one are supposed to be illegal, seems like the ones who took them got in trouble (rightly so) but not those that paid them

Revenue graph is hard to read, due to unclear labeling of revenue sources.

Which source was around 65% in 1930 and around 205 now? Any reason for that large change in tax burdens?

Original

Uploaded with ImageShack.us

Ugh. here

Thanks so much. That chart in black and white is worse than useless.

Sorry: 205 should read 20%

People in Birmingham and other places affected by the financial parasites should just refuse to pay anything into their corrupt game. Assume sewer privatization somewhere , the property tax payers are liable for the skyrocketing charges to a private owner. What if people pay their property taxes and refuse to pay the sewer charge above and beyond the rate they used to pay when it was publicly owned?

What are the private owners going to do? Put a lien

on the entire town? MCFD, Mass civil financial disobedience is required. Do you think the sheriff

is going to evict many people if say one out of threee

property owners is owing the Sewer Corporation of America?

Sewer system and water system are generally the same and billed together. They will just shut off your water. Here in Dayton I see the water revenue people out just about every week cutting off people’s water. It is still owned by the city, but very aggressive in cutting off service, but more so than the electric company (DP&L) or the Gas Company (Vectren)

In the “negotiations” between Jefferson County officials and the banks one proposal was to charge county septic tank owners a sewer tax to pay for the renegotiated debt.

While no doubt there are poor people with septic tanks, this past week the Birmingham News reported that many large suburban properties in affluent communities also have septic tanks. Given the overturning of Birmingham’s occupational tax, it is conjectured that some of the same affluent opponents oppose a tax on septic tanks.

When it comes to Chicago’s bankruptcy, the people don’t have far to throw stone, or hopefully something more serious? The Mayor’s Office, where

corporate lawyer and ex spokeblab for Obama, Rahm Emanuel is busy helping to parasitze the last equity out of homeowners and pensioners.

“State law requires Illinois to make ‘an irrevocable and continuing appropriation’ of tax revenues into a special fund every month that can be used only to pay bondholders.”

Chicago has balanced its budget not by taxing finance and real estate gains, but by selling off its roads and other basic infrastructure. Much as in feudal Europe, the leverage is financial. Privatizers are charging tolls and even installing parking meters on the city’s sidewalks to charge cars for parking by the minute…”

If meters are privately owned, can motorists contest their tickets in civil courts? How about suing the parking authority Inc. in the same?

“Jul 21, 2011 – Chicago Mayor Rahm Emanuel, who supports standardized test-based accountability, has decided to send his children to a private school…”

It’s not often that the bad guy is so close at hand and so easily impeached. Of course most people will be more

interested in “their” ball teams.

These transfers, often involving considerable fraud, from local and state coffers to private hands are looting and kleptocracy. From a macro point of view, they are a drag on the real economy and increase unemployment, thus contributing to deflation.

What is interesting in the Jefferson County sewer case is that while some of the commissioners went to jail no one from JPM, the crooks who set up this swindle, was ever charged.

Just out of curiosity I was wondering if anyone knew how corrupt these various districts and commissions tended to be. Anecdotally, I have seen a lot of local stories of cronyism in them and in other structures like school system bureaucracies. Are these the places where the small time klepts hang out?

Local government has always existed to line the pockets of the politically connected with tax-payer loot. Nothing new here, expect (maybe) that the local loot is now being redistributed directly to the global financial elite.

Until the peasants figure out who is screwing them nothing can possibly change. One would expect, however, that the clueless (less smart) will always be screwed by the sociopaths (more smart).

(Smart not-equal intelligent).

Dr. Hudson declares the states, and local governments therefrom, basically heading towards deflation (primarily from housing) driven insolvency.

While the history is rich here, due to the depth of Dr. Hudson’s understanding of these legal and financial relationships, the turning around of the trend appears rather hopeless.

Absent some new federal revenue sharing mechanisms it appears the states are headed straight for the poorhouse, and therefrom unmanageable social unrest.

The best hope for any transition to a new federalist posture comes from Congressman Dennis Kucinich’s NEED Act legislative proposal.

http://kucinich.house.gov/UploadedFiles/NEED_ACT.pdf

In his Bill, which modifies the money powers of the nation back to a public monetary authority for money creation, he includes the sharing of these money powers with the states to the tune of having 25 percent of all new monies created being paid directly to the states for state development purposes.

Given our $13 Trillion economy and 3 percent steady growth, that would amount to about $100 Billion annually to the states.

Whether this solves or merely softens the state’s budget woes will be determined by what else happens in the meantime.

Anybody out there have any better ideas?

For the Money System Common.

Anybody out there have any better ideas? joebhed

Yes, see my comment at August 22, 2011 at 10:13 am.

Alabama politics aside, when elected leaders make decisions contrary to ethics and the “good of the people” they should be prosecuted for malfeasance with potential fines and jail time. I’m not seeing that happen anywhere, but my gut tells me Americans have had just about enough.

I foresee a time when the attitudes will reverse, monopolies will be busted, and banksters will go back to being bankers.

It won’t happen without physical action from us common folks. Non-violent demonstrations of solidarity are the antidote to an administration that has proven time and again that “Wall St. is our Main St. What crap!

“[NYC] has privatized its television and radio, replacing public airtime with commercial advertising.”

This is simply incorrect. Please see

http://tinyurl.com/3smd3ae

And as someone who uses the subways 7 days a week, I believe the reference to “slashed” services is a gross exaggeration.

I am in general agreement with the thrust of the article, however.

Hello,

I am Kavin Matthews and I am a member of some financial communities. I just visited your site (nakedcapitalism[dot]com). The articles of your site is really worth reading. The quality of your content is excellent. After seeing this, I would like to request you something. I love to write financial articles and I would like to contribute something for your site if you’ll give me the permission. I can give you an original guest post and I assure you that it will be published only in your site. If you want, you can suggest me the topic also and I will write accordingly. Please let me know your thoughts. Waiting for your positive reply. Reach me at: kavin[dot]matthews25[at]gmail[dot]com

—

Thanks & Regards,

Kavin matthews

the crisis was killing. but i turned 62 and got a reverse mortgage now life is a breeze