Yves here. We’ve pointed out extremely cheery economic messaging on the front page of the Wall Street Journal over the past week, based heavily on stock market performance plus anecdata. This was the lead story a day ago:

The set of turbulent recent events, which also has included the administration’s aggressive deportation program and the U.S. bombing of Iran’s nuclear sites, has failed either to dent or improve the public’s overall view of the president. Some 46% approve of his job performance—unchanged from April—with 52% disapproving.

The poll shows why the near-unshakeable backing of Trump’s Republican base is so valuable to him. With 88% of GOP voters approving of his job performance—and 66% strongly approving—he has been able to retain political potency in Congress and among much of the electorate when voters overall are dissatisfied with the country’s direction and disapprove of the president’s handling of the economy, inflation, tariffs and other aspects of his agenda.

Contrast this cheery take with a story a day ago in The Hill, Polls turn sour on Trump as he hits new lows with independents:

Trump saw some of his lowest approval ratings of his second term over the past week, with his net approval in the Decision Desk HQ (DDHQ) average falling to more than 9 points underwater. He’s seen declines, in particular, among independents and on his handling of certain key issues like immigration.

At the same time, he’s trying to tame an ongoing headache stemming from the controversial case of the financier and convicted sex offender.

While his numbers certainly haven’t bottomed out, they indicate to a tough moment for Trump after a series of major victories in recent months.

Lee Miringoff, the director of the Marist University Institute for Public Opinion, said Trump’s quickly shifting political fortunes are part of his skill at “keeping the focus moving all the time,” which requires redirecting people’s attention to his benefit.

“But you do take a cost that your victories are short-lived, and the net effect is there’s still an awful lot that people feel has not been accomplished and that he hasn’t fulfilled a lot of campaign promises, even though some of it clearly was written and spoken of during the campaign,” he added…

Some polls have been better for Trump, with an Emerson College Polling survey only showing him 1 point underwater, but multiple major pollsters have found him trending in the wrong direction recently, including Morning Consult, YouGov/The Economist and Gallup.

The Gallup poll could particularly be a warning sign for Trump and the GOP, with 37 percent of respondents saying they approve of his job performance, down from 40 percent last month and 43 percent in May…

Democratic strategist Joe Caiazzo said the numbers are evidence that any grace period Trump enjoyed has ended…

He pointed to continued inflation amid Trump’s tariff policy, along with the public witnessing major raids from Immigration and Customs Enforcement (ICE) agents detaining people at places like schools, hospitals and churches.

And from a post last week on the declining caliber of US economic statistics, more on the heavy economic hopium messaging from the Journal:

In a bit of serendipity, the Wall Street Journal is giving a big dose of what supposed economic stories based on feelings look like. Two days ago, its lead item was The U.S. Economy Is Regaining Its Swagger. The argument at the top of the piece:

Consumer sentiment collapsed. The S&P 500 stock index fell by 19% between February and April. The world held its breath and waited for the bottom to drop out.

But that didn’t happen. Now businesses and consumers are regaining their swagger, and evidence is mounting that those who held back are starting to splurge again.

The stock market is reaching record highs. The University of Michigan’s consumer sentiment index, which tumbled in April to its lowest reading in almost three years, has begun climbing again. Retail sales are up more than economists had forecast, and sky-high inflation hasn’t materialized—at least not yet.

First, given that Trump was elected to a significant degree on a tide of voter upset about high inflation versus lackluster growth does not even remotely amount to “swagger” that can is allegedly being regained.

Second, placing a lot of stock in this stock market is also misguided. Admittedly, as Keynes warned, it can and will stay irrational longer than shorts might remain solvent….

The very next day, the lead Journal story was more flagrant boosterism. From The Global Economy Is Powering Through a Historic Increase in Tariffs:

The global economy is sailing through this year’s historic increase in tariffs, displaying an unexpected trait: resilience.

Faced with extreme uncertainty, businesses and households have surprised economists with their ability to hedge, finding a short-term path through as they await clarity on where tariffs will end up.

Global producers brought forward purchases and rerouted goods destined for the U.S. through third-party countries that are subject to lower tariffs. For the most part, households and businesses have continued to spend and invest despite the uncertainty, analysts say.

The world economy grew at a 2.4% annual rate in the first half of this year, around its longer-term trend, according to JPMorgan.

Trade volumes are buoyant, stock markets on both sides of the Atlantic have rebounded to record highs and growth forecasts from Europe to Asia are being raised.

Lordie. In January, the IMF predicted global growth for 2025 and 2026 to come in at 3.3%. A mere 2.4% is a big miss, not something to brag about unless you are a market tout serving easily manipulated clients (as in most equity investors).

And the IMF revised its forecasts in April based on Trump’s tariff announcements….and had its new 2025 global forecast at 2.8%! In other words, the world economy is doing worse in the face of the Trump tariff shock, with his high and arbitrary Liberation Day levels, than experts expected. And let us further consider that the IMF had deemed its initial global growth estimate of 3.3% to be lackluster.

Now to the main event.

By Stephen Praeger. Originally published at Common Dreams

The White House says the U.S. is in the midst of an “economic boom” under President Donald Trump. But voters aren’t feeling it in their wallets.

Polling released by Gallup Thursday found the president’s approval rating at just 37%, the lowest point of his second term so far, with an all-time low approval rating of 29% among independents.

This precipitous decline has been helped along by sagging approval on the economy, which has historically been the issue where he gets the most support. After a high of 42% in February, approval for his handling of the economy is likewise down to just 37%.

An uptick in inflation seen over the past month has exacerbated the cost of living crisis Trump promised to abate on the campaign trail.

A poll released Friday by Data for Progress found that, “Only 30% of likely voters report having enough income to be able to comfortably provide for their household’s needs, while a plurality of voters (43%) say they have enough income but money is tight, and 20% say they do not make enough to provide for all household members’ needs.”

(Graphic: Data for Progress)

“As his approval tanks, President Trump has finally lost voters on the one issue where they’ve historically trusted him: the economy,” said Lindsay Owens, the executive director of the Groundwork Collaborative. “Not only has Trump shirked his promise to lower prices, he’s made the situation substantially worse as his tax and tariff policies have landed a double blow to household budgets.”

According to data from Indeed, cited by Forbes, 43% of Americans have seen their wages lagging behind the cost of living over the past year. The jobs feeling the worst crunch are those “at the low-to-middle end of the pay spectrum.”

Trump has imposed the highest tariffs on imported goods since the Great Depression. After months of relative quiet, they began to make their impact felt this past month, with consumer prices up 2.7% from the previous year, compared with just 2.4% in May.

While rising rent costs were the top driver of inflation in June, prices for clothing, toys, and consumer appliances all rose, as did food and energy.

The president was elected on promises to tackle the cost of living. But now 70% say that he is not focused enough on lowering prices, according to polling released Sunday by CBS News. Meanwhile, 61% say Trump is focusing too much on his tariff policy, which remains broadly unpopular.

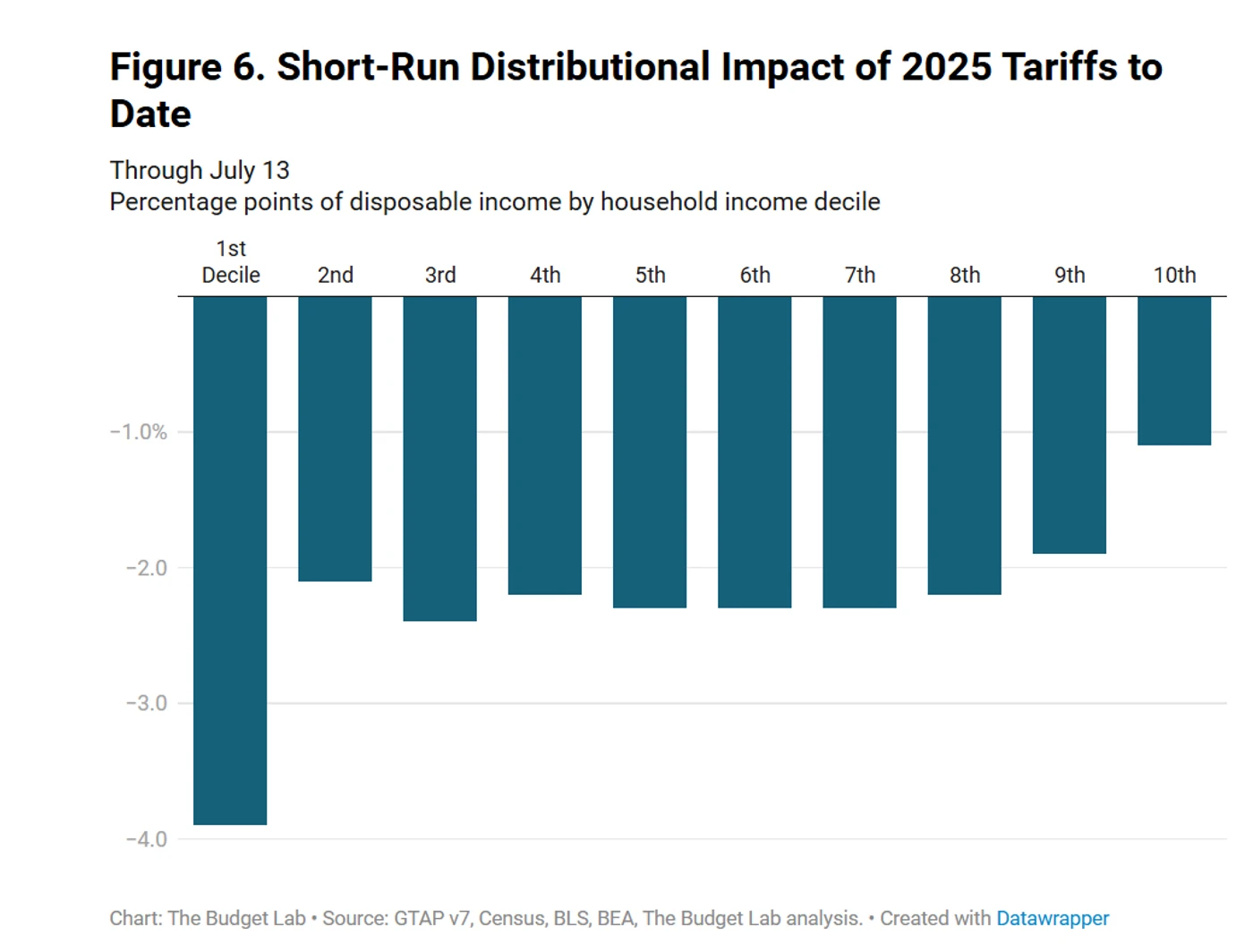

Yale’s Budget Lab estimates that it would cost the average household $2,770 worth of disposable income per year if tariffs stayed at their current rate indefinitely, with the worst impact—especially in the short term—on the poorest Americans.

(Graphic: Yale Budget Lab)

But they are set to grow more intense beginning on August 1, when Trump has said he’ll roll out new levies on imports from some of America’s top trading partners, including Canada, the European Union, Mexico, Brazil, and South Korea.

According to economists who spoke with Vox, the worst effects are likely yet to come. Preston Caldwell, chief U.S. economist for Morningstar, said inflation would likely peak in 2026 rather than 2025.

“Companies have started paying tariffs on their imported goods, but as far as the goods that are being sold in stores right now, those are primarily being drawn from the inventory of goods that were brought in before the tariffs,” Caldwell said. “So most companies are still not really having to recognize the loss of tariffs yet to a great degree.”

“The more that it becomes clear that tariffs are here for at least the foreseeable future,” he continued, “the more that they are going to have to eventually adjust to this new reality, which will entail increasing their prices.”

Owens said that will likely translate to even fiercer backlash against Trump.

“Working families,” she said, “know exactly who to blame as they pay higher prices on everything from groceries and electricity bills to school supplies and appliances.”

Which brand of Kool Aid is actually worse for an individual’s or a family’s economic health and well beng, overall and broadly ask rhetorically? I’ll concur that they can pull the other leg. Anecdotally things seem presently, kinda balanced but the tariff policies continue to loom out in future months like a proverbial Michael Myers. My snarky input aside is that cheerleaders in the media are like the choir members. “Hallelujah hallelujah.”

Brand 1, In office and positions of power since January 2025. The economy is roaring back and strong, you just don’t recognize that or appreciate it all we’ve done. Chair Powell will cut interest rates to 0.0% and we will all dance a happy dance.

Brand 2, in office from January 2021 until January 2025. The inflation you’ve experienced, all in that head of yours. You don’t acknowledge the administration of Biden as the redux of FDR ? Eat your stock market gains and enjoy that rich increase in insurance premiums.

On record just to add….six months in is not a sufficient measuring stick. I always retain the ability to be proved wrong by future outcomes.

YouTube videos I’ve found funny recently are Canadian ones showing the US business owners catering to tourists who are suffering catastrophic reductions in revenue yet are full of hopium, saying things like “The Canadians haven’t come because of bad weather”.

The Canadian channel owner found that hotelier particularly funny, as you can imagine. The thing that (if true, I can’t find official statistics to corroborate) should worry the US industries relying on tourists is that whilst, indeed, the reduction in numbers of people might not look too bad, these are foreign tourists who spend a LOT more per capita than a typical US domestic vacationer.

Unless AI is even more ubiquitous than we thought, those videos of the Vegas strip at 1am looking dead should be really worrying to USians.

I don’t know if i agree with the part about Canadian tourist spending more. I grew up in a tourist town with a large Canadian draw (maybe 1/3 from Canada) and from my and my friends’ experience, Canadian’s are notoriously cheap. Tourists from other countries, probably true.

“Canadian’s are notoriously cheap.”

Speaking personally as a Canadian, I am not cheap. I am also forgiving, in that I forgive you your slight against Canadians. For my part, I would happily buy you, Duke of Prunes (and/or the Duchess), a drink or a dinner.

I am, however, proudly frugal or thrifty or however you’d like to say it—besides cheap. For instance, I will not give a dollar to Rogers Communications or any other corporate thief. I vote with my dollars.

“Companies have started paying tariffs on their imported goods, but as far as the goods that are being sold in stores right now, those are primarily being drawn from the inventory of goods that were brought in before the tariffs,” Caldwell said. “So most companies are still not really having to recognize the loss of tariffs yet to a great degree.”

So the Trump VAT hasn’t really kicked in yet. And unlike the one in Europe it will be used to cut taxes on useless fat cats like him rather than pay for health care etc.

Undoubtedly the Trump cult among the Repubs–and the Dems have their own plaster saints–will be hard to forego. A friend visiting a Christmas store in Nashville reports Trump Christmas ornaments for sale. Having Epstein’s best buddy hanging from your tree seems a dubious celebration of the birth of Jesus. Meanwhile increasing cost for the stuff under the tree may not matter so much to the party of wannabe oligarchs. But MAGA is in many ways a religious thing. Their fondness for the libertine NY playboy was always a bit desperate. Still what else do they have? Our political landscape is very decadent.

Anyway thanks for the above.

I’m hopeless addicted to the sparkliest of all sparkling waters-Topo Chico, and the idea of paying for Mexican water makes it even more delicious when I go for a 12 step program, er that would be 12×12 oz bottles.

The retail price has gone up 15% since we hit Mexico with the tariff stick.

Its the only noticeable change i’ve seen since the tariffist attacks began.

I stopped drinking my favorite bubbly water, topo chico, after coca-cola bought them and jacked up the price 3x.

Hetch Hetchy water is tasty enough for me.

Exactly. Brand 1 and Brand 2 both have me rolling my eyes at narratives around economic stats. And the polling is just as suspect.

And this:

“In January, the IMF predicted global growth for 2025 and 2026 to come in at 3.3%. A mere 2.4% is a big miss, not something to brag about unless you are a market tout serving easily manipulated clients (as in most equity investors).”

Most likely whoever is raving about 2.4% isn’t writing in response to the IMF, but they are responding to doomers (real amd imagined) that were probably predicting something close to the end of the world because people were saying “tariff” out loud.

Sometimes it’s just hysteria mongering responding to hysteria mongering.

But, hey he is gonna get us drugs at 1500% discount! These people are idiots. I got out of the stock market after the 2008 debacle. Never went back, I’m not making money but no one is stealing it from me either. These tariffs haven’t really kicked in yet, wait for that one! People will realize this idiot has not a clue, and ther will be huge shortages and very high cost. We will never be able to manufactor things. That would mean investing in factory buildings and assembly plants instead of stock buy backs. So NOT going to happen. Trump will deport the work force and then what?

“investing in factory buildings”? Seems like it’s all going into so-called AI infrastructure:

https://www.reuters.com/markets/us/ai-gravity-defying-us-gdp-2025-07-23/

“the AI-related capex boom – in data centers, graphics processing units, server infrastructure, power and related hardware and applications – already accounts for more than one-third of this year’s second-quarter U.S. GDP growth”.

If/when this bubble bursts, duck and cover!

A capex boom in vast energy and water consuming money making complexes largely devoid of ongoing human employment.

Hopefully it is a bubble.

Even worse. The initiatives that do try to build production in the US tend to run into a problem.

Not enough people in construction to build that factory right now, come back in X years.

And if a factory can be build right now? You might not find enough qualified personnel for it. As this article from Jan 2025 points out 1/5 plants in the US are underutilized due to shortages of workers (also note the spike during the initial outbreak of COVID-19).

It seems that I’ve read this story somewhere before…Maybe last year…Oh, yeah…”Nobel laureate Paul Krugman says this isn’t a ‘Goldilocks’ economy – it’s even better, thanks to strong growth and cooling inflation” https://www.businessinsider.com/paul-krugman-nobel-laureate-economy-gdp-growth-inflation-goldilocks-scenario-2024-1?op=1

Funny how perceptions of the economy have a partisan bias!

Precisely. The Uniparty invariably trumpets its economic “success” despite structural realities which continue to exclude broad swathes of the citizenry from sharing the benefits — mostly by design.

It’s a con.

Well these reports can’t be right. Trump asked all his golfing buddies how they were going financially and they said things are going great, especially with all the tips that he sends them of what he is about to do. And when Trump sits in at a Cabinet meeting, he takes great satisfaction on seeing that half of them are wearing gold Rolexes. And all his neighbours look like they are wealthy too. In fact, everybody that he knows is going great financially and that must mean that the economy is going great, right?

This is not to be confused with the drunk man looking for his keys under a streetlight because the light was better there than where he lost his keys.

Trump is a maroon (ht Looney Tunes) and he’s getting worse. The real tick tock is how long before he falls apart completely.

That said, he is capable of pulling back and going all TACO which is different from the set in concrete mindlessness of Biden and his ice cream.

The real victims here are in Gaza and other places that most Americans prefer to ignore. We the USian frogs have been boiled–or at least many us.

His core constituency is more than happy with his economic policies.

“More Than a Dozen U.S. Officials Sold Stocks Before Trump’s Tariffs Sent the Market Plunging

Records show well-timed trades by executive branch employees and congressional aides.”

https://www.propublica.org/article/us-officials-stock-sales-trump-tariffs

The timing is almost impossible to attribute to coincidence. Large purchases of short-dated call options (bets that the stock market will rise within days) on the S&P 500 ETF occurred within 15 to 20 minutes before Trump’s announcement on April 9. These trades yielded profits exceeding $30 million overnight. Sources close to the investigation have identified at least three hedge fund managers who attended a private dinner at Mar-a-Lago on March 30, just three days before Trump’s initial tariff announcement. All three funds dramatically increased their short positions in the 48 hours following that dinner.

https://upriseri.com/insider-trading-trump-tariff-announcements/

Wholly agree. His heavy-handed approach is clearly being used to jumpstart his agenda(s) while distracting from underlying buffoonery. Who benefits is always hidden by this master showman while we speculate who those are pulling strings.

>>>The global economy is sailing through this year’s historic increase in tariffs, displaying an unexpected trait: resilience.

I am just piling on here, but really, I want whatever the writer is ingesting, imbibing, injecting, or snorting. It must be some good sh!&.

I’ll pile on some more. The writer clearly does not live in the real world. Hence the need for “ingesting, imbibing, injecting, snorting”, or, as you say, some good sh!&.

The writer probably has a good income and lives in a safe suburb or a gated community. The writer almost certainly does not walk the streets of his urban area in the small hours of the morning, does not frequent “disreputable” bars or diners or coffee-shops, does not stay in cheap hotels or motels when travelling. Because (s)he’s on an expense account.

In other words, the writer is not OF the real world.

Let’s count the enormous economic and mistakes of the Trump administration — 1) tariffs; 2) immigration and deportation; 3) the BBB’s tax cuts for corporations and the wealthy combined with benefit cuts for everyone else, and increases to the military budget, resulting in further bloating of the federal deficit and putting the dollar’s reserve currency status at great risk; 4) defunding scientific research and development; 5) attacks against and defunding of education, including introducing policies of mandatory indoctrination; 6) federal legislation to legitimize crypto currency; 7) Ukraine/Russia, Israel/Palestine, Israel/Iran; 8) backwards energy policy, i.e. fossil fuels over renewable energy; 9) side lining and defunding of scientific knowledge with respect to climate change, weather forecasting, and disease prevention in exchange for political power; 10) unilateral breaking of trade agreements and climate accords with our allies and trade partners; 11) imperialistic threats against Canada, Greenland and Panama; and 12) rampant corruption at the highest levels, and the elimination of the laws and governmental agencies that protect us against this corruption.

I can’t think of any Trump policies trending in the right direction. The damage being done is enormous. This is the reality that is not yet reflected in polls or the stock market. It’s only a matter of time.

I agree with you completely,

Another thing that really needs a number of its own, is the normalization of the american gestappo agents on the streets of the US. Now we have ICE, agents, breaking laws every day, yet the police won’t do anything about it. We have the cancerous tumor of a homeland defense agency recreation of the old border patrol agency; part of the post 9/11 war on freedom, running around, kidnapping people. Threatening any americans who happen to be anywhere near their crime scenes, which are happening all over , not near a border. They are running around going after people who are in violation of immigration rules. Someone in this country illegally is guilty of a civil infraction. Basic violation of immigration rules isn’t even a criminal violation. The abuse americans are exposed to by a rogue agency, who don’t show their faces, don’t bother with actual warrants signed by a judge. they often just have “administrative” warrants….. which means they really just made it up themselves,,,

Couple this with the expansion of holding facilities… for those the gestappo catch… now maybe illegal immigrants… tomorrow maybe for those who are guilty of wrong think… or some such thing.

Where are the courts? where are the legal scholars? the bar associations? the courts? the police?

They are obviously in on this scam. the drug war… the copaganda… the post 9/11 war on freedom… the brown shirts are really where the rubber hits the road to oppression.

It should be included in your list. IMO

Was there a baby in that bath water?

I am not an American but beside #2, I agree completely. However, the immigration and deportation is likely not seen as a problem anywhere in the world, except the way it is maybe carried out.

Canadians have cheered up when the federal government has stopped its massive immigration programs runing at over 450000 per year. Insane.

The biggest contribution to government coffers have been for some time taxes from housing sales. crazy! This is not a sustainable economy.

Well, I cannot say I was cheering. Our immigration rate probably was a bit too high but our fertility rate is well below replacement levels so if we wish to even maintain our population levels we need immigrants.

And while the reductions substantial I am not sure they were earth-shattering.

From 500,000 permanent residents to 395,000 in 2025

From 500,000 permanent residents to 380,000 in 2026

Int many ways the reduction in student visas was more starting A number of colleges, and to a lesser extent, some universities, business plans relied on foreign students to keep them solvent. This seems very true in my province of Ontario where chronic under-funding by the provincial government made foreign students’ fees a necessity.

With Pandemic denialism we’re gonna need as many people as possible still healthy enough to work. It’s gonna be lit.

If the Trump administration wanted to curb illegal immigration, it would go after (large) employers illegally employing immigrants and throw the responsible CEOs profiting from it in prison.

Indeed. Like Maxwell has a client list in her head, those employers have the illegal immigration lists.

First the territory preceeded the map, then the map preceeded the territory. Now it seems as if the map and the territory are unrelated entities.

Spreadsheet land/world is not real resource land/molecule world.

It’s become increasingly obvious the official numbers have been useless for years. GDP, unemployment, even “consumer confidence” surveys don’t seem to reflect the economic conditions around us.

About two years ago I indulged a decades long desire to open an entertainment business. It’s about as non-essential as they come. The monthly income has declined every year, despite glowing online reviews and local enthusiasm for the effort. In evaluating our prospects going forward I’ve started paying more attention to “indicators of disposable/discretionary income” which can be tricky to come by.

Movie theaters have continued to struggle post pandemic, as have casual dining and even snack foods. Alcohol sales dropped in 2024, the first decline in 3 years. Travel and tourism are down everywhere, but especially here in the US where Canadians and Europeans have gotten the message to stay home.

Yes there are potential non economic reasons why fast food and snack sales are off. Some consumers are likely getting the message and making healthier choices. Some are letting the Ozempic ™ choose for them. But it’s not hard to find evidence that consumers are limiting their “mad money”.

Maybe some genius can come up with a “discretionary spending” index that captures spending and pricing trends on a basket of non-essentials. Movie ticket sales, Fast/snack/impulse foods, video gaming, leisure travel and alcohol/weed sales could be tracked in a consistent and methodical way that captures not just the immediate economic conditions but perhaps more importantly people’s forward expectations of prosperity.

“It’s tough making predictions, especially about the future” Economic uncertainty abounds and this may be the ultimate price for MAGA chaos. The possibility that wage and expense conditions will get worse can amount to a “quiet deflation” that suppresses a lot of economic activity.

Maybe it’s time to abandon the stock indexes and pay attention to roller rinks, amusement parks, and bowling alleys.

Congrats and best of wishes on your business venture. It can definitely be a difficult road to hoe, I lack both guts and any vision to do that*. Earlier in the week I read and watched a few snippets on the US consumer and trends in fast food or quick service restaurant chains. Chipotle and Subway were highlighted in my comments, someone chimed up that paying $15 to $20 for a burrito and a soft drink / tea is getting a bit high priced.

I once had a random idea for a small location to serve breakfast or lunch items, and it would close daily by 3pm. When prices surged back in 2021 to 2022 I quickly accepted that would be a losing idea, especially since I lack restaurant experience.

I think a good many eateries are accidental non-profits now with the cost of food and employees skyrocketing, particularly in Cali where wages are pretty high.

Don’t see many new restaurants opening around these parts~

I work in a cafe in a tourist town where most are escaping the heat from the Central Valley. Anyway this summer compared to last summer is noticeable slower for business. Even the locals are not showing up as much as they use to. It’s not looking good and people are pretty stressed on a lot of fronts.

The $25 breakfast is alive and well, not affordable.

@griffen at 10:50 am

I just had that experience last week. I bought a McDonald’s quarter pounder with cheese and a chicken burger, no drink no fries, in a small town in Ontario:$17.50 (with tax in CAD). About double what I expected. I hadn’t eaten in a MacDo in 10 years. Big surprise for me. Guess I’m out of touch with fast food reality.

Long COVID can cause alcohol intolerance.

I never understood why Trump and others, including the mainstream cable news who despise him, equate the stock market with the real economy.

Corporate ownership of both himself and the media, perhaps?

Here in my little corner of the Upper Mid-West, I am seeing some dramatic increases in imports, things like a can of coffee, bananas, spices, foods that don’t grown here in the USA. But gasoline at the pump is down.

From what I see online, some foreign countries are upset about the Trump Tariffs. Probably because they will be producing and selling less in the future. No wonder they are rushing to find other buyers for their products.

Who will be paying the tariffs ? It will be the USA consumers who are importing the products. One site I follow claims the importers will eat the tax increase (because corporations jacked up their profit margins during covid). Supposedly they will want to keep their market share regardless of the Tariff, and take the cost out of their bulging profit margins.

I expect the lower 80% or so of USA residents are going to see a drop in their standard of living. But at least the Billionaires will be happy with tax decrease.

Rant over.

(because corporations jacked up their profit margins during covid).

My guess is they will jack up the prices again and blame it on tariffs.

The boss class looks at 6 in 10 americans scraping by and afraid and is certain that number should be 9 in 10.

The beatings will continue

The point Wolf Richter is making over and over is that corporations have already jacked prices as high as they can go without hurting sales. Many manufacturers have reported reduced income due to the tariffs, especially GM as he points out. I’ll include the disclaimer that I’m not a trump fan.

https://wolfstreet.com/2025/07/22/gm-ate-1-1-billion-in-tariffs-in-q2-will-likely-eat-more-in-q3-shifts-production-to-the-us-to-cut-costs-and-has-cash-left-over-to-waste-on-share-buybacks/

Considering Trumps long storied history with the Fight Business, I can imagine an AI Trump as the ringmaster at the “10% versus the 90% Smack Down.”

“Hello fight fans! Are you ready to crumble??!!”

The crowd goes crazy. The “contest” turns into a cage match. Cage courtesy of ICE, Homeland Security, and FEMA.

Don’t even bother staying safe anymore. It’s too late now.

As the Lady on the Stair says to the Party crowd in “All About Eve-l,”: ” Fasten your seatbelts, it’s going to be a bumpy fight.”

“Ultimate Fighting Championship (UFC) CEO Dana White said over the weekend that multiple fighters are in line to be on the list for a faceoff expected next year on the White House South Lawn.”

https://thehill.com/homenews/administration/5403496-dana-white-donald-trump-ufc-fight-south-lawn/

Maybe they can pit these UFC fighters against teachers, cancer researchers, and meteorologists with the winner receiving funding for their programs?

https://www.nbcnews.com/news/us-news/sd-teachers-scramble-dollar-bills-dash-cash-rcna8704

I would get behind this becoming an International Fight Club affair. Get luchadores, pub brawlers, honky tonk battlers, babushka belters, etc. to fight it out for preferential tariffs for their respective countries. Make it an annual affair with tariffs reset according to the results yearly.

The world of Joe Mauser lives! (No, not the baseball player.)

You are in the business. Any idea why Mack Reynolds novel “Mercenary from Tomorrow” hasn’t been made into a film or show?

Tariffs will function as a very regressive tax and we are probably seeing only the beginning of it. This also explains the obsession with Trump to keep gasoline prices low and why he is unhappy with the “bone-crushing sanctions” that neocons are so interested in.

Canadian here… I’m not following the data closely, but anecdotally, at least, we’re basically in a recession. People say jobs have become really hard to find, prices and rents still feel unaffordable, and they feel a high level of uncertainty. And from what I know of the historical US-Canada economic relationship, things can only be just slightly better in the US.

We know a lot of knowledgeable people expect geopolitical trends to exact a price on economies world wide. Being just a layman, I defer to those opinions.

I cross the British ColumbiaWashington State border frequently. As much as things are bad in Canada (at least in BC), it seems much worse in the US

People on the US side look much more tired and worn out. Precarity seems greater. Anyway, just my observations.

Interestingly, here in the SF Bay Area, the city of Berkeley is saying that they lack staffing. 30% lack of staffing in most departments, except the Police dept that is getting an additional surveillance system. The council really believes that the private co. provider when they say no ICE can possibly use the info.

And now Trump wants to clear those unsightly useless eaters from the camps that have to be regularly “cleaned”. With his new game for the homeless, families who have loved ones with SMI and Grave Disability are the new targets for Alligator Asylum/Hospitals.

Jails and Police are fully funded. Grrr.

Focusing on immediate indicators and public sentiment relating to the economy, I submit, is a distraction.

The single most salient fact is that a typical 30-year-old cannot come close to affording a starter home. The yawning affordability gap in this enormously important sector has grown so wide over many years that, at this very late stage, bridging it in anything like a timely fashion may be impossible. And a remedy may be forever out of reach.

If that’s the case, if basic family housing (or car) affordability is forever barred — with no possible remedy within the bounds of, say, an acceptable inflation rate — where are we as a nation?

argentina in the 70’s comes to mind…just before the dropping people out of plane part comes along.

as ive said for decades: everything “we” have done to the third and second world(and much of the first, for that matter), will eventually come home to us.

that’s where we’re at as a nation.

So, they can. Here is one easy example.

Now, is that starter home in great condition? No. Is winter fun in Cleveland? Also, no. Is that house in a fun metropolis with booming job opportunities for young people so that they want to start a family there? Very much no. But can your typical employed 30 year old afford a house for 80k$? Yes. And can you make a good life in Cleveland? Sure. Probably not ‘Gram worthy though.

That’s the problem. Where we have opportunities for young people to grow their income and start their families in places people think are cool and exciting, you need lot of money to afford the cost of living. In other places, you don’t have the same pressures. If more businesses embraced the digital nomad remote work thing, then more young people could live in places like that and move into property ownership much more easily. But we’ve decided that can’t happen I guess. So we have people gate keeping home ownership and giving young people either extreme FOMO or despair.

But does the “typical 30-year-old” want to move anywhere far from family and friends just to buy a starter house? Meaning having to find a new job and losing all of your social support system. It’s not just Cleveland or Detroit or St. Louis having a bad rap, it’s that you’re really tempting fate to uproot yourself (and spouse and children, if you have them) to be in any distant location where yet another serious economic downturn may leave you unemployed and friendless. All the talk about people looking down on the affordable parts of the US neglects the total upheaval of moving far away when there is every indication the future is going to keep getting worse, maybe much worse. I’m sure there are hyper-mobile web platform engineers or AI researchers, but that’s a tiny percentage of the working people looking for a first or second home.

I would suggest that the description of a typical 30 year old in Pelham’s original comment excludes a spouse and children. If it doesn’t, the cost of childcare and a good many other things are cheaper in Cleveland too. People used to move to opportunity all the time. That was what built up California. I agree that moving far away from a support network can be daunting.

But, following your line of thinking, there’s never a good time to take a chance on a move to new area when you do have a family. The best time to make that move is when you are unencumbered by obligations. Which given all the data and hand wringing over our younger generations not getting married and not having children, you’d think would mean if anyone should be open to moving to place for a low cost of living, it’s the currently rent impoverished crowd.

Well said. Please see my comment below. Barring extensive (and expensive) government intervention in the housing market, which will of course only open the field to more private sector predators, millennials and Gen Zers are screwed. Sorry. I really, truly feel for them. I do.

Fifteen years of zero interest policy (ZIRP) by central banks has got us where we (they) are today. Bankers saved their banks while destroying two generations plus anyone of any age who might have had some savings and was counting on the interest. They saved New York while destroying the country. It has been the greatest transference of wealth, from people to banks and other corporations, in history. No exaggeration. Trillions upon trillions of dollars.

There was a time when governments were a countervailing force against the greed of corporations, in these times, banks and real estate corporations. There was a time when governments would have imposed an excess profits tax on those who benefitted from lax central bank policies. No longer. Such taxes are on the books, but legislators are reluctant to use them because their re-election depends on the donations they get by not doing so.

And so, here we are in 2025, two generations living month-to-month in Mom’s basement or four in a one-bedroom apartment or ten in a three-bedroom house—if they’re lucky. If they’re not, they’re sleeping in doorways or living in drug-rehab centers.

I know of which I speak. I do not live in a gated community or stay in a four-star politician’s hotel. I’ve seen it, I’ve seen it in my urban downtown area on my early morning walks, I’ve seen the homelessness, the drunkenness, the drug use, the smashed windows, the plywood over them, the closed shops, the hopelessness, the despair. I see it every morning. And this in Canada of all places! Until now, unthinkable.

I’ll close on this somber note: You cannot impoverish two generations and not expect blowback. It’s coming, mark my words. When I do not know. What form it takes I do not know.

I keep hearing the Boom word from US presidents, but it is rarely defined. I remember hearing Obama using it when the economy was growing at 2.4%, but how can that be a boom when the economy used to grow at over 4% in the 50s and 60s, or 3.2% from the start of the 70s to the end of the century? It wasn’t just Obama, the B world has been used by pretty much every president in since GWB, and the US economy has only averaged 2.2% growth since 2000. (All numbers from BEA.gov.) Is 2.4% a boom because it is 0.2% above average? I find it hard to use that term for 2.4% growth when remembering that the US economy used to average real growth of over 4%.

Just another note on the 2.2% real GDP growth. Since 2000, it has come at a time when the federal deficit has averaged 4.58% of GDP, as opposed to 2.88% for the 25 years before that. Remembering that federal deficit spending is included in the GDP calculation, how can we call anything a boom when the growth in federal liabilities are larger than the value of economic growth? (https://ycharts.com/indicators/federal_surplus_or_deficit_as_percent_of_gdp )

I wish there was an actual definition for the word economic boom.

“I wish there was an actual definition for the word economic boom.”

You are digging in the right place.

Much depends on if someone is focusing on post-2020 or zooming out on stats for decades upon decades.

And the elephant in the room is that so many economies are more and more dependent on the wealthier (and fewer in the grander scheme) inhabitants.

Neglecting to consider historical statistics is like having Alzheimer’s, everything seems new and fresh every day. During Trump 1.0 I heard the Donald say that the economy was in its best shape ever, I heard someone in Biden’s admin say the same thing when he was in power. I wonder how many Americans just accepted those statements as accurate?

“This is the way the world ends

Not with a BOOM but a whimper.”

Anybody remember the last true bear market? Well, let me tell you as a reader of books and an old-timer, it was from Sept. 1972 to Sept. 1974. Fifty years ago. It was a grinding relentless sickening decline on the Dow from 1020 to 607. Adam Smith (aka George Goodman and not the famous economist obviously) wrote about it in his 1981 book “Paper Money”. In those years, according to him, Wall Street was like a ghost town. No trading, no customers, no hefty bonuses for brokers and analysts.

But the Fed did not intervene. Not until the Greenspan years did Fed intervention vis-a-vis the stock market become common. Then, with only that one indicator in his mind, did “The Maestro” begin to orchestrate his “Great Moderation”. It worked for a few years. Unfortunately for him, the housing bubble of 2007-08 blew his unregulated free-market theories out of the water. He has since voiced a mea culpa of sorts.

I am no fan, unlike Greenspan, of the stock market as a synedoche for the economy at large. It wasn’t then, it’s even less so now. It’s only a measure of how well the comfortable are doing. Nothing more. And furthermore, it’s reliant on bogus statistics, like phony inflation and unemployment figures generated by government agencies, which are always understated because to tell the truth would be BAD.

One more thing regarding statistics: Homeless figures. Having seen figures for my mid-sized Canadian city, I am almost certain they are massively understated for US cities such as LA. Ten years ago here, homelessness was estimated at 2% of the adult population and from my on-the-street observations it has only grown worse. And this with good social supports and climate. I seriously doubt homelessness in LA is less than 1% (and declining so they say) given the passage of time and the much harsher social environment in the USA.

So much BS everywhere. Alas, they who control the statistics control the narrative.

I’ll admit up front I’m a chart guy. They show history. When you look at a long term chart, say back to circa 1994 and the S&P was under 500. Nothing after that looks good or normal.

These are good points you highlight, as well the comment by SB late on Sunday. The 70s were a real Clustermess, the oil embargo and waiting in long lines, the inflationary spiral culminating in that period into double digit levels in the Prime rate. There were seemingly few good alternatives to unscrew that situation. The level of interest rates began to decline from those lofty levels and in just economic terms that provided a good tailwind to the valuation of equities along with changes in administrations over the decades.

Things really got cooking once Bill Clinton was elected and he moved past that whole debacle to pass a healthcare agenda ( maybe my recall is bit wobbly ). Tax policies became more liberal, there were definite changes to incentives and executive compensation bogeys as well. The mid to late nineties were lit I want to say, that to me seemed to be the era where the stock market gains really began to escalate and gains compounded. Gonna stop here, yeah after circa 1998, those bubbles followed and the GFC in 2008, and to add in the repeal or removal of Glass-Steagall, all culminating to bubbles bursted.

As a 23 year old in the US, I was able to buy a small condo for $60k with several thousand down.

In 2001 (before 9/11) I was able to sell it for $120k. Something screwy happened between 1996 and 2001. I know the Internet really went mainstream in 1996…

I feel like I am living amongst Wolf Richter’s drunken sailors in DC/MD/NoVA. Every one is complaining about how much stuff costs but no one is really slowing down their purchases or stopping vacations early. Home upgrades are still happening. Home sales have slowed considerably though.

It’s back to that weird quantum reality scenario we had leading to the election last year. I feel like there are two realities people are experiencing and I don’t know what is real. I typically take Wolf’s analysis with a grain or two of strong salt around the rim of my margarita because he presents a skewed perspective IMO. But what he’s saying seems to really be what is happening around me. For once the data and my experience line up. I doubt the rest of the US can say the same though.

The Emperor’s New S*** Sandwich.

“Who are you going to believe, me or your lying eyes?”