By Satyajit Das, derivatives expert and the author of Extreme Money: The Masters of the Universe and the Cult of Risk Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives – Revised Edition (2006 and 2010)

This four part paper deals with a key element of derivative market reform – the CCP (Central Counter Party). The first part looks at the idea behind central clearing of OTC Derivatives.

The key element of derivative market reform is a central clearinghouse, the central counter party (“CCP”). Under the proposal, standardised derivative transactions must be cleared through the CCP that will guarantee performance.

The CCP is designed to reduce and help manage credit risk in derivative transactions – the risk that each participant takes on the other side to perform their obligations (known as “counterparty risk”). The CCP also simplifies and reduces the complex chains of risk that link market participants in derivative markets.

Popular Mechanics…

The concept of clearing is not new or novel. It has been an integral part of futures and exchange traded derivative markets. Clearing for over-the-counter (“OTC”) derivatives has been discussed at various times since the mid-1980s.

In traditional exchange traded derivative markets, the contract is standardised, listed and only tradeable on the exchange through member firms. Trading is subject to the rules of the exchange as well as general law. The framework facilitates trading, provides liquidity and transparent price information. Security of contractual performance is ensured by interposing the Clearing House (the equivalent of the CCP) between traders.

Under the current proposal, traders enter into OTC derivative transactions, then novate or assign the contract to the CCP, which assumes the performance risk.

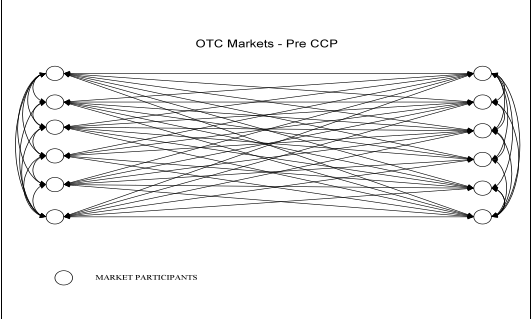

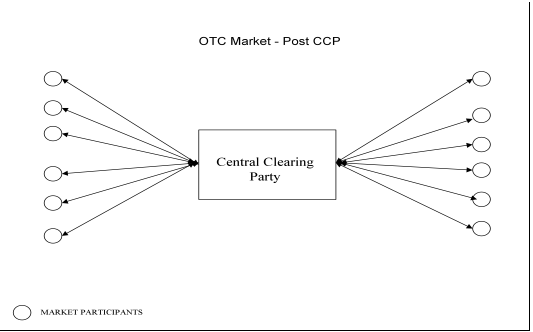

The effect of the CCP is set out in the Diagram 1 below. The credit risk of the CCP is substituted for the risk of individual derivative counterparties. It simplifies the chains of risk in derivative transactions. For example, if there are 100 counterparties, then there are potentially 4,950 bilateral contracts. The CCP reduces this to only 100 bilateral contracts. The impact on the quantum of credit risk is set out in Diagram 2 below. The interposition of the CCP reduces the counterparty risk significantly.

Diagram 1

Diagram 2 – Impact of CCP Credit Exposures

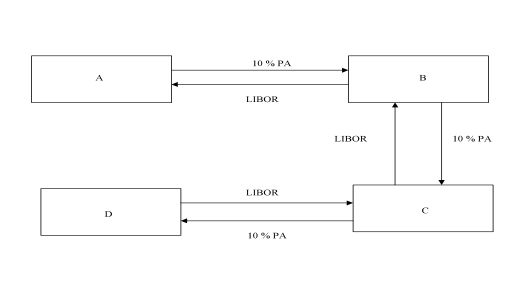

Assume the following 5 year US$ interest rate swap where A pays fixed rates of 10% pa against receipt of floating rate US$ LIBOR and D undertakes the exact reverse transaction. In this case, A enters into the swap with B while D enters into a swap with C. Banks C and D then move to square their respective positions with each other. On the basis that each swap was for a notional principal of US$100 million, the total market position is as follows:

There is now a total of US$600 million of swaps outstanding. A and D have open positions while B and C have matched swaps on their books.

If the swap fixed rate rises by 1% pa to 11% pa, then the gross risk on the US$100 million swap is US$3.7 million (equivalent to 1.00% pa present valued over 5 years). The risk in the market is as follows:

A has risk of US$3.7 million on B.

B has risk of US$3.7 million on C.

C has risk of US$3.7 million on D.

Market aggregate risk totals US$11.1 million.

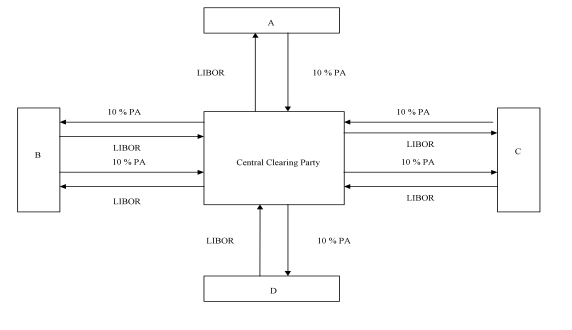

Assume that instead of transacting directly with each other, the parties all enter into their respective transactions with the CCP. The position then is as follows:

The market risk position is as follows:

D has no risk to the clearing house.

B and C have no risks as their payment streams cancel.

A has risk of US$3.7 million to the clearing house.

The total market risk falls dramatically with the interposition of the CCP.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Earlier versions of this piece have been published as “Tranquillizer Solutions Part I: A CCP Idea” and “Tranquilizer Solutions: Part 2 – CCP Risk Taming” in Wilmott Magazine (May and July 2100)

TTMLIS, because this scheme appears to set the derivatives market up for transparency and centralization. I thought the allure of these products was the privacy and inability to price them openly, leaving the possibility that one of the parties is getting a killer deal. If these specific derivatives are run through a clearinghouse, we create another market, and the demand for otc, opaque paper just saunters off to the next dark corner.

I agree that it will do what it says it will do, but will it solve the underlying problem?

Solve perfectly? No. But the risks will go down – mostly from the fact that more collateral will have to be posted and you’ll have inital margin and daily mark-to-market margin. From what I can tell, a lot more skin will have to be put into the game, which is never a bad thing.

If if did work as advertised, do you think Das would be writing a four part series? Stay tuned.

Can’t wait for the rest. Satyajit has a remarkable ability to take the extremely complex and explain it in terms anyone can understand.

Shouldn’t voiding the opaque (unreported to shareholders) derivatives during bankruptcy force the market to be open? Let’s say a company files for bankruptcy. How its funds are disbursed to counter-parties is a function of existing legal system. When a bank goes through all claims, CEOs oral promise to pay a cab drive $1 billion comes much later than other legal claims.

Why not push unreported derivatives even later in the chain? Who makes derivatives sacrosanct?

This is all nonsense. Interest rate swaps are not the problem. The problem is credit default swaps for the benefit of gamblers who do not own the bonds. Why not talk about the real problem instead of putting out all this mind bending gibberish?

LTCM blew up on simple interest rate swaps. They got to be over 10% of the market. This was a basic risk management fail. You can’t exit a position like that quickly without taking massive losses and they were so highly geared as to be loss intolerant.

If they had been dealing with an exchange, it would have been obvious how big there position was and the exchange either would have refused it or required extra margin, which would have stopped LTCM.

IIRC, LTCM was executing defacto credit spreads — spreads between bonds of different sovereign governments and also between on-the-run and off-the-run Treasury securities.

The latter, while not a credit spread, looks low risk but is deadly.

This is fighting the last war mentality of generals, ruminating on how they would do things differently, in the past, if they could only relive their youth. The people who come up with financial innovations, aren’t really trying to make the world a better place in which to trade for their children and their children’s children. They are creating virtual spaces for surplus capital, because the real economy is too small to contain all of the notational trillions.

So creating transparency for bullshit, will just show how clearly we are truly being bullshitted. And of course, the mere act of perception, will change the phenomena altogether in a financialized Heisenberg Uncertainty Event. And then, the bullshit will move onto another arena, newly innovated, for the process to go on unobserved, until we catch up with it after some other disaster occurs.

How about this, a central party should be a clearing house to obtain a license to carry on a legally defined trade. If a new type of trade is developed, it can not be used in any capital market until it gets licensed as a useful and non systemically risk causing or other wise bullshitting piece of Wall St hoakum designed to fleece clients. A sort of FDA testing for new financial products. That’s what we need. I am sure we will not starve or freeze in the cold while future Nobel Prize winning genius develop these terrific new innovations, which will usher in a risk free world of wonder and contentment for all.

Dumb question: why can’t risk be handled better in other ways besides playing the odds. Yes it is a quantum economy and this is how we have currently chosen to live in it, but does that mean we can’t deal with risk on a shit happens basis. (Right now we are trying to pretend shit doesn’t happen.) Deal with it in real time with real products not in financial time with financial products… or something like that. If stg is worth betting on economically, it should be worth following through on.

Possible example: Solyndra. Why did we give taxpayer money to Solyndra in a venture-capital kinda deal, hoping they would be a breakthrough company? It doesn’t make much sense since a the same time we bent over backwards to do free trade with China, who then (and already by the time we financed Solyndra) came in like a harvesting machine and undercut all our solar energy companies. It was slaughter. Competition at its finest. Another dumb question: Did the seemingly irrational derivatives market take off like scalded dogs (thank you Jim) after we embraced all this free trade insanity?

Is part of the idea here to limit trading activities so that they are more likely to remain in the sphere of utility (legitimate hedging say) as opposed to speculation and regulatory arbitrage? If not, is it inherently desirable to decrease the riskiness of speculative activities, especially by establishing a central facility that acts to gaurantee performance? It seems implicit that a central clearinghouse facility would be backed by the taxing power of the government(s) that imposed it. Can a measure that allows speculators to transfer risk to a third party truly reduce systemic risk?

No offense, but this is nuts. How do you margin a single name CDS that is essentially a barrier option? The delta can go from zero to 1.0 for a small change in price. The CDS can have the same price at 15% vol that it does at 75% vol and then triple in price at 80% vol.

How do you hedge a single name CDS anyway?

Please, don’t get fooled again. All central counterparty clearing does is add more smoke and mirrors to what is essentially socializing losses.

BTW,the the major equity options clearing houses would have been insolvent on October 1987. Only a freak coincidence that a clearing firm was owned by the U. S. government saved the word.

You want a real solution, make banks hold their credit derivatives in a non-bank subsidiary and they agree never to ask the government for a bailout.

Clearing Houses or…..Laundry Machines? IDK…snicker.

Skippy…I like mine with extra fabric softener and no starch please.

The answer is no.