By Philip Pilkington, a writer and journalist based in Dublin, Ireland. You can follow him on Twitter at @pilkingtonphil

Perhaps the most obvious indicator that the US has become a society of debtors is the ever-expanding market for student loans. Recently clocked at $870 billion and rising quickly, this market has been a focal point for the recent Occupy movements. The White House knows that this is a key issue among potential voters and recently tried to provide some relief to debtors by placing a cap of 10% of discretionary income on the repayment of such loans – down from a previous cap of 15%. But of course placing a cap on how much needs to be repaid is hardly a solution to what appears to be a much larger problem.

Student loans are growing at a remarkable rate. Between the second and third quarter of 2011 they grew from an estimated $852m to an estimated $870 billion – that’s an increase of 2.1% in only one quarter; and this while other types of consumer debt either declined or remained flat. And even these estimates are pretty fuzzy because, as the New York Fed highlights, the market is highly complex and difficult to gauge:

Student loans support the education of millions of students nationwide, yet much is unknown about the student loan market. Relevant data are limited and, for the most part, anecdotal. Also, sources tend to focus on recent college graduates and do not reveal much information about the indebtedness of parents, graduate students, and those who drop out of school.

The rapid expansion of student debt appears to be due in large part to the increasing numbers of Americans enrolling in third-level (what Americans call “advanced”) education. This is not surprising given the slack and therefore highly competitive jobs market that doesn’t appear to be going away any time soon.

The market for student debt has also become remarkably complex. Again, the New York Fed gives us the details:

Unlike other types of household debt such as credit cards and auto loans, the student loan market is incredibly complex. Numerous players and institutions hold stakes at each level of the market, including federal and state governments, colleges and universities, financial institutions, students and their families, and numerous servicers and guarantee facilitators.

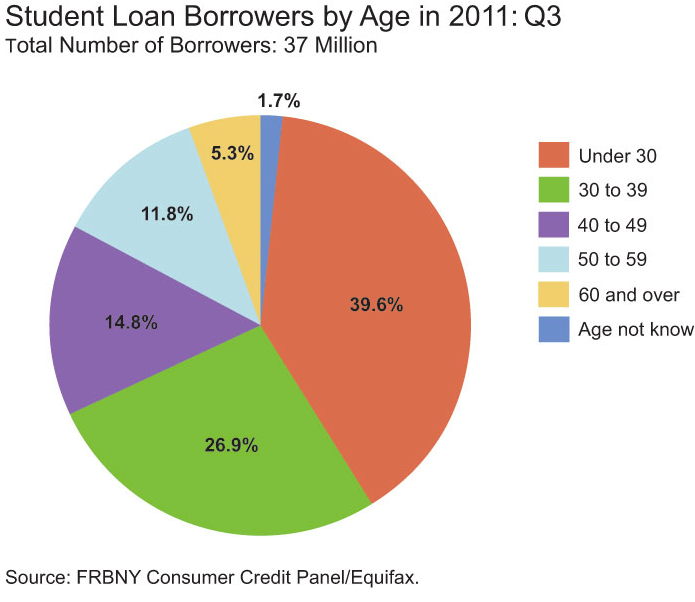

Unsurprisingly, the burden of this debt – at least, that which is counted – is falling on the shoulders of the young, as the chart below indicates.

Delinquency rates are already high and appear to be rising. Previous calculations indicated that some 10% of those with student loans should be considered delinquent. But due to the complexity of the market this is probably far too conservative an estimate and recent calculations by the New York Fed indicate that the actual figure is probably closer to 21%. That’s pretty whopping by any standard.

So, what does this all mean? At first glance the market appears to be enormous and the default rate high – surely this can only mean trouble for the financial sector. Recall that the subprime mortgage market was estimated at being about $1.3trn in 2007 and when that blew up it took the financial system down with it. The student loan market, clocking in at around $870m and rising, is certainly somewhere in that ballpark.

Nevertheless the student loans market seems to be slightly different. The subprime market was built on debts that were structured in such a way that they excluded only a so-called ‘black swan’ event – that is, the occurrence of a series of defaults that those constructing the debts deemed basically impossible. What they didn’t factor in, of course, was an asset price bubble in the housing market that, when it inevitably blew up, would raise the default rate significantly almost overnight.

It is not clear that there is such a potential for a black swan event in the student loan market. This market is not in a bubble per se. It is similar to the mortgage market in that it is an enormous amount of long-term debt placed on the backs of people who are going to have a very difficult time paying it off. But it is still not predicated on ever rising asset prices that could collapse at any moment, as the housing market was prior to 2008.

The only massive shock that could bring down this market all at once would be a sharp rise in the unemployment rate among college graduates. That could lead the payments system to break down and might constitute a so-called black swan event. This is unlikely, however, unless there is another massive financial or economic shock. And in such a case, the student loan market might be more of an aftershock than an earthquake. Although in saying that the possibility is not to be sneered at.

More important, perhaps, is the fact that many students in the US are burdening themselves with enormous amounts of debt in an era when opportunities are drying up and the future looks bleak. This seems to be an awful and retrograde economic strategy by the US government. And yet, although the administration recognises the problem, they continue to think that private sector debt is the way to fund the education system. This even though a federally funded education system would be much cheaper given that borrowing by the federal government is far less costly than by a student with an uncertain future.

But it is only the Occupy movement that has even raised these issues and they look likely to penetrate the mainstream in the near future, so concerned are the US about their budget deficit. More likely that the student loan market will continue its expansion and increasing numbers of students will be subject to what can only be described as a sort of debt peonage. Meanwhile the government will attempt to avoid bankruptcies through restructuring arrangement that, while preventing many from going fully underwater, hardly save them from the nasty prospects of persistent partial drowning in what can only be described as the financial equivalent of water-boarding.

Your source says that outstanding student loans amount to $870 BILLION, not million, as you write in the first two paragraphs.

Cheers. Typo. Not mistake. I knew it was billion. The rest follows as if it were.

student loan debt is higher today than credit card debt…incredible. Yet only 20% of americans graduate from 4 year university or vocational equivalent..as opposed to over 70% in other western democracy..having taught in both environs, my conclusion is, U.S. pursues cheap labor force, rather than fully educated…winner take all system..

Meanwhile the men that know how to run lathes and make things with their hands are all retiring. Vocational education is so important and yet this country pretends like it’s not. My advice to young guys, get a liberal arts education on your own time to make you an educated guy without borrowing money and if you do borrow, use it to

learn real skills like wood or metalworking, agriculture

masonry and electricity. Good plumbers are making good money in most urban areas. College graduates in useless fields like gender studies and low level information

technology are making pretty shapes on top of lattes and are deep in debt for nothing.

Good plumbers are making good money in urban areas? I guess my sister just married (and divorced) two un-good deadbeat plumbers? She never was a good judge of character…

Useless liberal arts degree and still employed.

Electricians I know are stripping bales of wire to get the copper out to buy groceries waiting for housing or CRE to come back, or home improvement loans even.

Cal, is talking TV talkie, not articulating in independent-minded English, or any other language but TV talkie (hearing something on the TV or radio or cable, etc., then repeating back without any cognition, reflection, etc.

The point and trend, for many, many, many years has been debt peonage and neoserfdom.

The get-over mentality is for those only capable of speaking TV talkie language.

Otherwise known as “the clueless”…..

Attacking any of those thousand points of confusion they aim at you won’t accomplish anything other than wasting time, and wasting money. Try thinking for yourself. Try thinking independently.

There are two electricians in my circle of acquaintances. One was laid off. The other was forced to move to North Dakota to find work. He and his wife now live in a trailer.

Perhaps student loan debtors that still have decent credit would be better off paying off as much as possible with credit card loans, then defaulting if necessary on those loans. This in consideration of the inability to get rid of student loans through bankruptcy, unlike credit czard loans.

Haha! Yeah. Maybe. Talk about financial subterfuge!

a.k.a. – executing a proven financial strategy; debt rollover and restructuring to advance the borrower position into strategic default… kinda what Wall St does and is currently occurring in the sovereign debt market.

When getting ready to sign loans back in the 90’s one of my fellow students asked the representative from the financial aid office why we shouldn’t just put it on our credit card instead after she made it quite clear that student loans cannot be defaulted on. She really did not like that question!

It’s all about the securitizations: credit card receivables are securitized, so the actual amount of loans is almost besides the point when comparing securitized student loans to securitized credit card receivables — one has to track those credit derivatives leveraged against such loans — it’s all about the structured financial angles.

At one time I think you could have done that. Nowadays I suspect that the minute you tried it you would find all your credit yanked. You might get away with a few thousand.

“Perhaps student loan debtors that still have decent credit would be better off paying off as much as possible with credit card loans, then defaulting if necessary on those loans. This in consideration of the inability to get rid of student loans through bankruptcy, unlike credit czard loans.”

This is absolutely true of every last student loan debtor. Because of the obscene bankruptcy rules on student loans, if you have any chance to do so, it makes sense to borrow by other means and declare bankruptcy. You’ll save millions of dollars.

By the way, the strategy still works, but only if you’ve somehow managed to get a very large line of credit. You basically have to charge off the entire student loan very quickly and get the discharge from it before the credit card company realizes that you’re going to declare bankruptcy.

I’d say that’s more a function of how college has become yet another business. The proliferation of debt-farming private universities(and where exactly is that debt going I wonder; is it being securitized, too?) is obvious to anyone with a television. What is less obvious is the change in how ever respectable universities behave. To make it blunt, it is damn difficult to get expelled from a university today. Academic failure won’t cost you a spot in prestigious State or Ivy League schools. Behavioral issues can lead to expulsion if criminal or persistent, but even that isn’t the case for student athletes and certain legacy students. Instead, schools will allow failing students to retain enrollment while continuing to pay fees and rack up debt.

As far as how much a bubble we’re dealing with, I think it’s helpful to consider the education industry as a whole, and not focus on just the debts.

I believe a very high proportion of education today is vocational, and not undertaken out of a love for learning. An investment requires an expected payoff, one that is becoming more and more difficult to realize in our new economy.

This is an alarming trend. Education can benefit a person in many ways, not just financial, but that’s what seems to matter now. I don’t know what the effect will be of millions of young people losing faith in education once the financial benefits are reduced, but they could be great and long-lasting.

Which would harm your life more, not getting to own a home or not getting exposed to ideas, learning, literature and critical thinking?

One problem with student debt is persistently usurious interest rates. Many students who refinanced up to ten years ago are now locked in at 9%, while savers now receive zero thanks to the Fed.

Too much higher education is of dubious economic value. Choose your own examples. My own favorite example is law school. How many shysters can America really afford? You need a small cadre to push business transaction paper, but the rest simply prey on the medical establishment, foozle over home mortgages and compete for the attention of those with a plausable claim against somebody worth suing. There was a time when accounting offered opportunity to those who could read and count and write legibly, but computers have eliminated most of the grunt work. Computer science looks promising, but only to Indian and Chinese nationals who still work for comparitive peanuts. Even nursing offers shrinking opportunity, work speed ups, competition from minimally paid “technicians”. About the only fields which appear to be growing are catering to the super rich (personal trainer, personal chef, etc.) and talking nonsense about business, sports and weather on television.

High school students with an eye on the future should forget SAT preparation and develop talent at golf, football, basketball or baseball. Even if they fail at playing they can still catch on in broadcasting the games, second guessing the coaches or as sports agents.

We should sue you for slander for this one.

Seriously, though, if it’s going to be a nation of laws you need lawyers.

The rest of the condescending blather just demonstrates a basic ignorance of what most of America is actually doing day to day. Nice to be in the elite and all, but everyone thinks they are in the elite, and everyone thinks what you do is probably crooked, not real work, easy and overpaid. Same with me.

Excuse me, but you’re missing the point, and the bigger picture.

From the FCIC Report, little publicized, by the diligent work and effort of Phil Angelides and Brooksley Born, we find a telling passage explaining how the credit derivatives boys were given first dibs on the soon-to-come bankruptcies (both mortgage and student loans):

http://www.gpoaccess.gov/fcic/fcic.pdf

FCIC Report, p. 48 (go to p. 76 in pdf file)

The CFMA effectively shielded OTC derivatives from virtually all regulation or oversight. Subsequently, other laws enabled the expansion of the market. For example,

under a 2005 amendment to the bankruptcy laws, derivatives counterparties were given the advantage over other creditors of being able to immediately terminate

their contracts and seize collateral at the time of bankruptcy. (Emphasis added by me.)

(You might also check out p. 166 – p. 194 on a go to in PDF file: mentions Clayton Holdings, and Vicki Beal, which points to legal culpability of ratings agencies — most interesting when reviewing financial journalist Nomi Prins’ meltdown timeline from a Mother Jones article in August of 2008 – link below.)

http://motherjones.com/politics/2008/07/where-credit-due-timeline-mortgage-crisis

>>Education can benefit a person in many ways, not just financial, but that’s what seems to matter now. I don’t know what the effect will be of millions of young people losing faith in education once the financial benefits are reduced, but they could be great and long-lasting.<<

If a college education were reasonably cheap, the wider benefits would matter more to the prospective student, most likely. As it is, the financial-investment aspect is forced to be dominant. Also, if K-12 education were better, and gave students better tools for learning, i.e. HOW to digest complex material, folks with only high school educations could do a lot more learning on their own, through reading. I've learned a lot on this and other blogs, for example, and following links, reading material that others I know find impossibly "boring".

Another problem the student loan topic points to is an idea put forth when the Clinton Administration was "freeing" trade. The adherents of the new regime, when confronted with the question, "What are our about-to-become-unemployed factory workers supposed to do with themselves now?", replied, "Oh, let them get college degrees! Then they can become software administrators, accountants and animal therapists."

So now, as someone upthread pointed out, more young people than ever are trying to go to college. Coming out, many are finding an environment of too few jobs that demand their skills, but now they're starting life burdened down with debt.

Great!

“how much needs to be repaid” or how much of discretionary income can be attached in installment repayment plans?

The GSE BUSINESS MODEL,fatally flawed, being perpetuated by nursing students attempting to pump air ino it.

The elephant in the room is transfer of personal net income from other [future growth] areas of the economy to student loan debt. Not if the system will blow up or not, it will. The rate of increase is not sustainable, period.

SLABS the new wealth transfer machine.

Interesting data below

http://www.wisconsin.edu/budplan/tuition/Working-Old%20Files/TuitionHistory.pdf

UW Madison is one of the better bargains as far as Universities go. That said, look at the last decade – that is a double folks. Tell me that is sustainable. Moreover, this particular data I have linked does not include segregated fees or $200+ text books… which are all piled on outside the quoted tuition rates.

I really have to raise issue with the notion of examining a HEAVILY subsidized resource (like state school tuition) and complaining bitterly that it is now somewhat less heavily subsidized. Either way, it is still a gift!

Receiving back a portion of the taxes we pay the government in the form of a social benefit which most reasonably self-interested governments on the planet recognize to be in their own best interest is a “gift”? Replete with all the connotations of that loaded word such as unearned, unnecessary, owing in return, demanding reciprocity, frivolous, and expendable?

Surely you jest. Or did you just miss out on the fact that the talk-radio pundits who feed you these ideas are themselves jesting and are fully aware of the intellectual dishonesty and bias they are peddling? The majority of the readers of this blog prefer the intellectually rigorous humor Yves offers over your hackneyed tropes.

Attempt an original thought next time, for all our sakes.

90% of those students probably have paid little or no taxes in their lives. Surely they will pay taxes, but that is not really the point. What I am calling to issue is the ingratitude and the faulty math. The true cost of the education surely did not double over a few years, just the student’s share of it.

Society surely does benefit from a more educated workforce. However, the greatest direct benefit accrues to the student himself with 70% greater earnings per annum. By rights he should pick up a large share of the cost. To the extent that he does not, it remains a gift. I can understand when a student from a full-fare university (e.g. most ivy league) complains about a tuition increase. Many are pushing $50k/year. A state school that charges $0.25 on the dollar? No.

I dont listen to talk radio.

“I really have to raise issue with the notion of examining a HEAVILY subsidized resource (like state school tuition)”

Re-read what I wrote… Did I not say: “better bargains as far as Universities”?

However, the thrust of my post was tuition increases that are 3X, 4X, 5X multiples, or more, of inflation are unsustainable. Whether it is a state or private school, they are all enduring the same, an unsustainable “rate of increase” in tuition and aggregate educational costs.

Long term student debt being acquired by students will “steal” from another areas of the economy in the future …i.e. homes, autos etc. This was my [elephant in the room] to Phillip P, because I thought he missed this larger point in his post.

—-

Furthermore, Phillip points out, “The rapid expansion of student debt appears to be due in large part to the increasing numbers of Americans enrolling in third-level (what Americans call “advanced”) education.”

That is only part of the issue. College campuses turning into luxury vacation spots and faculty-to- administrative staff ratios are also drivers of costs on college campuses. *The fact it is estimated by 2014 there will be more administrative staff on campus than faculty raises another big red flag on where the costs are borne.

* http://nplusonemag.com/bad-education

gs_

Negative, young fellow, it’s an investment in civilization — which unfortunately we don’t exist in, but a kleptocratic plutocracy based upon nepotism and anti-merit.

Empires are not based upon the efficient use of resources and spread of happiness. — Iain Banks

Thanks for the link to the University of Wisconsin tuition chart. The way I remember it, I paid just over $300 for my first year of full-time tuition in the UW system in 1966. To put it in perspective, when I returned from the war in 1970 I paid $1200 cash for my first car, a 1967 Beetle. When that 3-year old car was new, it sold for $1800 (that’s eighteen hundred). In 1973 I supported myself working full-time in a bookstore in a mall in South Portland, Maine, starting at $2.10 per hour, IIRC. A five cent raise was a big deal.

I’m not quibbling — two members of my family have heavy school loan debt. As others have pointed out, it’s maddening that they are paying 8.5% on big numbers, when my retirement fund is earning zilch.

I use a VOIP service to filter the calls from the debt collectors. My current favorite tactic is to redirect the call to — hangup. My phone doesn’t ring — I check the log periodically. They use an army of people all over the country, many with cell phones, but I don’t mind playing whack-a-mole. I added a new filter to the list just this morning. In the past I enjoyed bantering with them, especially the really stern, mean ones. I was always polite, but it’s well they could not hear what I was thinking. Now I just filter.

I should add that neither my wife nor I are being hounded by debt collectors. They are looking for a member of the family, calling us in the hope that we will cooperate. I am extremely disinclined to cooperate.

Cdave,

The situation you describe is illegal. They can only contact you once in search of friends or family. Further, once they are told not to contact you again and you dispute the debt, no further contact should be received.

I suggest you Google “Fair Debt Collection Practices Act” in .ppt or .pdf form. Read it, then, follow the procedures when you receive phone contact from a debt collector. If that does not resolve the issue, then, file a complaint with the Federal Trade commission:

https://www.ftccomplaintassistant.gov/

[apologies to readers for clogging the thread]

Thanks, gs. I apologize for going OT. Most of what I have to say has been said by others, so I tried to add color. More real life stories. Our first grandchild celebrated his third birthday yesterday. (We can always find his birthday by looking at a graph of the DJIA, which began its ascent the next day, 3 years ago today.) His little brother was born two weeks ago. His mom is not going back to her job because she can’t afford day care for the two kids. Daddy is working, and paying child support to his first wife. The average student loan debt is $25k — but it turns out it’s possible to run up almost twice that in pursuit of an Associate Degree at a for-profit school in a big city. While her debt is technically not my debt, I feel her pain.

Getting an expensive degree that doesn’t help much with employ-ability seems like an underwater mortgage, from which it is impossible to walk away. We’re seeing 15-year fixed rate mortgage rates between 3 and 4% — wouldn’t it be nice if we could figure out a way to renegotiate these 8 and 9% loans down into the 2-3% range? Wouldn’t that avoided interest payment flow into the economy instead of into the coffers of the usurers? And large cloven-hoofed animals will fly overhead. Again, I apologize if I seem morose. It’s 5 PM CT on Friday, time for happy hour.

The black swan event is simple – suddenly people realise that the return on education is nowhere near what was expected and it is in their interests to default.

Exactly.

And this is incorrect:

> But it is still not predicated on ever rising asset prices

> that could collapse at any moment, as the housing market

> was prior to 2008.

As with all bubbles, the problem is MISPRICING.

If the investment COST does not justify the eventual RETURN (and it’s not going to, at current prices), it’s a bubble (and yet another easy-money financed one at that).

Pretty much everything else has already begun the repricing necessary to match a declining income lifestyle in the US, except for higher education.

This bubble, too, will eventually pop (in terms of the return value of a degree) and the price of attending college will adjust downward, but the debt will remain

and crush those who overpaid for their degree. That’s

a bubble, and it’s still blowing. Who could’ve known?

“Pretty much everything else has already begun the repricing necessary to match a declining income lifestyle in the US, except for higher education.”

Really? Not so far as I can detect. Take my trips to the grocery store as an example. Packaging is getting smaller and/or contains less food, but the prices keep rising. I expected to see these prices looking better as the economy tanked after the crash, but I think the trend accelerated.

I’d say it keeps getting worse for most people. The only businesses looking good are extraction based.

Maybe all the students can get jobs in collections and spend their workdays calling each other deadbeats on the phone.

Americans have drunk the kool-aid: vast numbers believe that education is a personal choice. Shockingly the college bound appear to be especially poisoned, so much so that many think nothing of taking on mountains of debt to get their degree. Clearly they believe the fairy tale that burying themselves in educational debt is a wise “investment” that will help them in the long run by returning generous future earnings. I also have a bridge to sell you.

The data that Philip helpfully discusses shows that as many as 3.7 million Americans currently are more than $50k in debt for higher education, totally $186 billion. The state of Oregon has 3.8 million residents, including 2 of 50 US Senators.

In addition to PHilip’s points I wonder about 1) the interest rates that public and private lenders are charging and 2) what percentage of the total debt is in the hands of private lenders. This figure, which is likely higher, may double faster than the figure for public lenders, as the exponentiality of interest is a factor in the rapidly expanding totals.

At the heart of the issue is the role of education in the US. The current model – effectively an elite system dominated by very wealthy private institutions that devote substantial resources to serving the effectively stateless 1% while placating a politically-sensitive domestic audience by underpricing ($55k is half of what they could be getting) – is producing a vast population of talented and energetic youth who instead of contributing immediately to the economy with their own consumption, innovation, and freedom, will struggle for years to satisfy the predatory appetites of non-producers in global finance.

An argument in favor of the American system of higher education was that it moved graduates into the workforce faster than its European competitors. European higher ed has been appallingly slow to move this important group into the workforce. The Bologna reforms explicitly address this deficit by mandating the Bachelors/Masters track at the expense of the Diplom/Magister track. Should this reform succeed then European graduates will have obtained a decisive advantage over their American counterparts: a European graduate expects to have manageable debt levels as a result of obtaining a degree while the average American graduate fist needs to repay about $25k and rising.

Higher education is seen in much of western Europe as a public good, a necessity for both individuals and for society as a whole, As a result many European democracies make higher education ridiculously cheap from the American perspective.

“Higher education is seen in much of western Europe as a public good, a necessity for both individuals and for society as a whole, As a result many European democracies make higher education ridiculously cheap from the American perspective.”

Ireland had free higher education for passport holders up until the economic crisis. It was the best investment the country has ever made.

Why shouldn’t most university education be pretty cheap? Until a student gets to the final year of the more technical majors, it’s not clear to me that the true cost of supply is particularly high.

The increase is attributable to a few factors, some of which are covered online. A bunch of it is the rise of for profit colleges (e.g U. Phoenix) which target weak students, sometimes even the mentally ill, load them up on government debt for an expensive, often 2nd rate education. The better schools have undergone a decade or two of services expansion. More counselors per student, park like grounds, fancier living accommodations, better food. When I was a student the big theme was endowment building, which I’m sure continues. That effort has probably stalled along with the SP500 over the last decade+. Finally, the best paid professors are not there to teach. They are there to run research groups and pull in grants. The university gets to keep the overhead, often as high as 65%. The problem is that these guys can have swelled heads and may start demanding more money from the department than they pull in. They could just have a dry spot in grant funding. (Grants are harder to get now.) Funding gets diverted to fund chairs for these guys. And of course, you still need to pay for instructors to cover the teaching load.

Expectations and enrollments are up. Endowments aren’t pulling in what they used to. Government grants are down.

Oh, it gets worse. Many college administrators decided that they should pay themselves the way CEOs do, i.e. obscene amounts for wrecking their institutions, and they’ve been working hard to do so. The Boards at colleges are of course the same chumps who are on the Boards at corporations, and are often happy to play this game….

‘Higher education is seen in much of western Europe as a public good, a necessity for both individuals and for society as a whole, As a result many European democracies make higher education ridiculously cheap from the American perspective’

A pair of fascinating and rather frightening articles by Stefan Collini in the LRB makes clear that this is increasingly untrue of Britain at least:

http://www.lrb.co.uk/v32/n21/stefan-collini/brownes-gamble

‘But the report proposes a far, far more fundamental change to the way universities are financed than is suggested by this concentration on income thresholds and repayment rates. Essentially, Browne is contending that we should no longer think of higher education as the provision of a public good, articulated through educational judgment and largely financed by public funds (in recent years supplemented by a relatively small fee element). Instead, we should think of it as a lightly regulated market in which consumer demand, in the form of student choice, is sovereign in determining what is offered by service providers (i.e. universities). The single most radical recommendation in the report, by quite a long way, is the almost complete withdrawal of the present annual block grant that government makes to universities to underwrite their teaching, currently around £3.9 billion. This is more than simply a ‘cut’, even a draconian one: it signals a redefinition of higher education and the retreat of the state from financial responsibility for it… what is of greatest significance here is not the detail of the financial arrangements but the character of the reasoning by which they are justified. Britain’s universities, it is proposed, should henceforth operate in accordance with the tenets of perfect competition theory.’

Browne is the ex-CEO of BP who golden-parachuted out just before the Gulf spill. As an LRB letter writer put it: ‘It was an out-of-fashion courtesy on the part of Stefan Collini in his magisterial dissection of the Browne Report not to draw attention to the author’s dismal record as chief executive of BP – culminating in the recent oil spill, for which the blame has fallen on his unfortunate successor. Why a failed businessman in his retirement should be asked to advise a failed government on how to make our universities cost-effective is a mystery.’

It’s not really a mystery though, is it? The reason governments have to, or appear to have to resort to fees and a market model, is because the money for ‘block grants’ for public goods such as education has been tricking upward into the financial sector for years, largely as a result of that sector’s successful installation of toll booths in all public cash cows. Hence foxes like Browne on the ramparts of every public hen-house that can turn a profit.

Thanks! Simply a fantastic link, and commentary. As I noted below, perceiving higher ed as a market seems common sensical as the notion of “investing” in your future has the naturalness of a burp. But individuals who employ it while trying to be reasonable about their career paths appear to frequently drop the analogy pre-maturely.

If you’re going to see the project as a personal choice about how to invest money then see it properly as a derivative, a bet on the contributions of your education to your future earnings. See debt not as a loan but as a bond sale, and for heavens sake calculate accurately, using real data and quantitative inputs and recognized equations. If fact why don’t we just set up an OTC for university students to trade their paper! If financial industry talent could get insanely rich on the stuff, screw up and get bailed out by taxpayers than so can undergrads!

“Britain”, as you call it, has not been European since 1450.

UK can only be understood accurately as as an “Anglo” state : UK, US, AU, NZ, Canada (shrug). The “Square Mile” should probably be considered a separate state.

also a dinger:

http://www.lrb.co.uk/v33/n16/stefan-collini/from-robbins-to-mckinsey

If the EU is smart, they will continue this policy.

Twenty years ago Americans were told it was OK to offshore manufacturing because “we’re going to be nothing but the high value brains”. That was a lie then, and the student debt bubble is part of the end game in destroying American higher education, high tech R&D, and what remains of our “technology advantage”.

All part of being a third world country.

check my math; i get a 43% increase in January consumer debt owed to the federal government over 2010’s first quarter

http://www.federalreserve.gov/Releases/g19/current/default.htm (under major types of non-revolving credit)

The above was referring to the third to the fourth Q in 2011. Student debt rose 2.1%. Others declined or remained flat (according to NY Fed).

january is more recent; the category i cited is student loans

Student ‘debt’ has little to do with students, nothing to do with education whether liberal or practical, and everything about shifting public money into private pockets. And THAT equation is why the student debt conundrum appears so nonsensical and balloons before our eyes seemingly unstoppably. Pilkington: “This [vexatious situation persists] even though a federally funded education system would be much cheaper given that borrowing by the federal government is far less costly than by a student with an uncertain future.” Yes, public _scholarships_ would be far more cost effective for the students and the public. The middlemen making a guaranteed profit for doing nothing but intermediating themselves in the process are the army of ants under the living room carpet none will discuss but whose interests decide absolutely everything in the process.

There was a time when ‘loans’ for students were not the primary way of financing education. A cobbled mass of relatives savings/income, scholarships, student labor, and very limited personal borrowing put individuals through university. Less than half the public by far went to university, and if you didn’t have the money you didn’t go or withdrew. That was that. A large expansion of public grants allowed many to go to university who couldn’t afford to before. The first major expansion was for military veterans, which established the principal of univeral qualification rather than narrowly targeted ‘scholarships.’ Loans were not a great option for students because, rather obviously, recently graduated students often started with low paying jobs or an intermittant transition to the work force and had few if any assets, so they were poor candidates to maintaina steady loan payment schedule and an asset backstop against default even if they could ultimately repay some level of debt linked to their earning potential. It wasn’t uncome for loans to be made only when guaranteed by a third party, typically the student’s parents who had real assets.

How then did loans enter the picture at all, let alone become the MRSA of financial instruments now eating the face off a generation of Americans? Politicos decided to steer profits to small-timers in the banking industry, often Savings and Loans. Since students looked to be an iffy profit source unless repayment was guaranteed by some third party, the government offered to guarantee the same levels of debt then on offer for students’ parents. Not sky high, but some. That meant that grants needn’t be appropriated, a political chore, while third parties were _GUARANTEED_ a profit, regardless of default, for simply fronting the dough. Issuers quickly moved to shed these loans however, with student debt amongst the first to be securitized routinely, something which the government guarantees greatly facilitated, natch. In fact student loans became valuable parts of speculative financial instruments (this is more Yves’ beat than mine btw), because the sovereign guarantees attached made then useful offsets for greater risk elsewhere in a security or the like.

Student loans are a source of guaranteed profit for financial speculators; these loans have zero to do with educating anybody. This is one part of the reason loan issuance has ballooned, largely at the expense of grants. Just as Philip says, it would be far more cost effective for the US government simply to issue grants. The same money and more is now being used to pay financial speculators for losses on excessively issued loans. But what’s missed in that is the profit that speculators take on these loans _regardless of the loss to the government or to the students_. That profit is guaranteed, and those who get it have gamed the political system to elimate grants, you see. More loans = more profits for speculators securitizing, so the natural incentive is, well, ISSUE MORE LOANS. Grants issued are loans not issued; ergo, eliminate grants. Loans not issued are profits not made; ergo, loan more. If loans are available, institutions can charge more—somebody else is paying—so the price goes up; ergo, loan volume rises. The incentives in this game of the system are manifestly to raise costs which can only be met by loans which, however, are universally available regardless of the borrowers nominal creditworthiness, i.e. a students income prospects once into repayment. Because the real income source is the Federal guarantee; the student-citizens are merely the debt-serf fodder for everyone else, the ‘legal entity’ needed to pull off the shift of public money formerly going into grants now propping up the profit on securitization to financial speculators.

Discussions of, say, what education is really for, or what it really is worth, of how much might if fairly cost, or of how best to raise the money to pay for that and from whom are all excellent questions. We or anyone interested might have illuminating discussions regarding these. But none of these questions have anything to do with ‘student’ debt. Because student debt as it is no being perpetrated is a kind of legal fraud, shifting money from the sovereign government into the hands of private speculators in _very large volume_. Yes, somebody may get a university education in the process. Or not. Or get one at ridiculously escalated cost because of perverse incentives in the funding. But student LOANS are about guaranteed private profit and a golden crutch to the securitization industry. And because of this, our sick government and broken society will continue the present predatory issuance of these loans absolutely unchecked by any sense of risk or decenty because, y’know, the government is going to pay no matter what. Unlike the subprime mortgage scam with all of the same incentives (and most of the same players), which subprime loans only became de facto guaranteed after they became worth little or worthless, student loans are guaranteed from issuance by the sovereign. If a generation of students have their lives ruined by these toxic instruments, so much more risky than any dope or ecstasy that might be ingested during a higher education, nobody in on the scam, certainly including the government gives a damn.

Like taking pennycandy from a baby . . . . Remember, ‘student’ loans aren’t about students, their about profits.

“‘student’ loans aren’t about students, their about profits.” –

QFT

they’re about profits.

Very interesting. You should write something on this.

Regarding the guarantee on debts by government. My understanding is that not all debts are guaranteed. Only those issued in a certain way.

Sans massive simultaneous default, I agree, the loans are a definite source of profit (a perfectly liquid financial asset, even) in that they are always going to be paid back. But as you point out, the subprimes were all guaranteed, if only after the fact of a massive default event. I think many in the industry acted as if they knew this. They must have known at some level that someone was going to pick up the tab.

If we saw a ‘black swan’ event in US student loans (say, due to a huge hike in the unemployment rate among grads) I think it would look like a financial bailout to the American public. Even though some — not all — of these loans are underwritten by the US government, if they all blew up at the same time I think you’d see a financial crisis of sorts because the US government would find it difficult politically to step in and perform the bailout function regardless if this was written into the contracts. It would all become too obvious.

So Philip, I’m afraid I’ve written about as much on it as I’m liable to. I’d toss this one to Yves if she wants to take it up, because the issue of ‘debt-for-profit’ in securitization here, and the politically induced supression of grants in favor of wealth-transfer loan guarantees are ripe for expose.

I don’t think subprime securitizers knew anybody would pick up the tab, btw; they believed they were immortal and that the money train would never stop. That’s my view: they were that stupid.

Well, the subprimers thought that the ‘wall of liquidity’ would never go away. And it never truly did because the Fed stepped in. They may have made the right bet for the wrong reasons, but it was the right bet all the same.

. . . “But since this wouldn’t be America if you couldn’t monetize your children’s futures, the education sector still has its equivalent: the Student Loan Asset-Backed Security (or, as they’re known in the industry, SLABS).

SLABS were invented by then-semi-public Sallie Mae in the early ’90s, and their trading grew as part of the larger asset-backed security wave that peaked in 2007. In 1990, there were $75.6 million of these securities in circulation; at their apex, the total stood at $2.67 trillion. The number of SLABS traded on the market grew from $200,000 in 1991 to near $250 billion by the fourth quarter of 2010. But while trading in securities backed by credit cards, auto loans, and home equity is down 50 percent or more across the board, SLABS have not suffered the same sort of drop. SLABS are still considered safe investments—the kind financial advisors market to pension funds and the elderly. . .

More here: http://nplusonemag.com/bad-education

I have read many articles recently on Student debt, this one still seems to get to the heart of the issue. However, a fact check on some of the stats may be in order.

gs_

Exactly right, Richard. If anything about this corrupt and perverse system will change, it will have to be making these “student loans” dischargeable in bankruptcy. Then, like mortgages, the only students paying them will be those determined to become perpetual slaves and distinguish themselves from slackers who walk away.

Among the disastrous effects of the system is the dumbing down of higher education. College graduates of today know less on average than Long Island high school graduates in 1960. Of course, a high school education in 1930 was also superior to a college education in 1964. Ultimately, everyone will be a college graduate, and nobody will know anything, making the task of bending their minds to propaganda either easier or more difficult, depending on how hard it is to get the attention of the totally ignorant, as opposed to fooling those who listen carefully to every word and take notes.

Thank you RK for this powerful comment and thanks Philip for starting the thread.

Didn’t Obama take the middle man out of student loans?

Republicans had a fit but lost the vote.

Only one of two things Obama did for the people.

> a source of guaranteed profit

A government gauranteed profit should be very low.

Certainly somewhere around the return of a 10 Year Treasury.

Of course, the inexplicable profit is the visible

tell that mispricing is going on, and the current “CountryWides” of student debt are actively and

knowingly constructing the next socialized

tax payer loss while they harvest the privatized

gain today.

Thank you! I’ve been trying to say this…but not so well for some time now. What happened to scholarships? The student loan debt problem began somewhere in the 90’s. Those who excelled in school and would normally be qualified for scholarships and grants were instead steered towards loans. So the reward for excelling in school? Decades in debt. Nice.

Perfectly articulated, sir!

Seen these articles yet?

http://econintersect.com/wordpress/?p=19634

‘Student ‘debt’ has little to do with students, nothing to do with education whether liberal or practical, and everything about shifting public money into private pockets.’

Just like everything else of any importance in life. Education joins housing and health as opportunities for the predators-in-charge to suck wealth from a citizenry which has devolved into a collection of ‘marks’, a resource pool to be exploited, rather than a resource to be nurtured and developed.

‘The middlemen making a guaranteed profit for doing nothing but intermediating themselves in the process’

Capital has now colonised virtually everything, hasn’t it? It’s almost seems as if we are approaching some sort of vampiric singularity, beyond which the thieving has sucked so much life out of the body politic that there’s nothing left, eventually leaving even the 1% and their enablers with hunger pangs.

‘How then did loans enter the picture at all’… ‘Student loans are a source of guaranteed profit for financial speculators’

Later in the thread there are candidates for direct blame, bankruptcy acts, this change in practice or that – but the overarching cause is the same as it is for housing or health; it’s the growth of banking from 5% of the economy in the 60s to 45% today. The causes for this include the decay of government (of the idea that government exists for the majority, not special interests), itself largely brought about by cause#2, the relentless efforts of capital to insinuate itself into the ‘toll booths’ of public cash cows, and of course the equally relentless pro-market, anti-collective acculturation which has accompanied both, allowing every invasion of profit-driven market ideology into our lives to seem like the natural order of things.

Had there been a public banking option (and a public health option and genuinely public housing option) and no money in politics since the 60s the massive theft that growth in finance represents could have paid for first class education for all Americans who wanted it. They could have owned their own houses and been looked after when they were ill. It is a measure of how successfully capital has colonised even our minds that the above statements seem so childishly naive, even to me. But they’re not really, and weren’t, not so very long ago.

Another credit ‘event’, not necessarily of the worst-case scenario variety, might end up creating a new paradigm for education. Large institutions with depreciating plant and voracious managerial overheads will not be able to pitch fees low enough, and even governments bending over backwards will not be able to entice student ‘marks’ into eternal debt peonage when alternatives exist.

Providing we are vouchsafed a relatively free internet, laid-off academics and smart start-up entrepreneurs will offer virtual educations to beat the pants off the dinosaurs, and smart employers will have assessment/examination recruiting staff who know how to test them for the skills they need. With cash-strapped institutions forced in the future to water down the rigor of award assessment, that piece of paper may look more and more like a certification of mediocrity. The educative info on the net is already legion and employers may find it financially expedient and more productive work-wise to do their own certifying, not caring over-much where their employees got their expertise, so long as they can demonstrate it exists.

No more golden eggs, and no more geese.

So Glenn, I hope to be around and kicking when that ‘plucked goose event’ comes down—but not before my wine library is stocked! If it’s five minutes to the endtime, I’m pouring a glass and whistling ‘Nintey-six Tears’ wearing something like a smile.

I’ve got some nice 90’s Henschke… cue the band…

http://www.youtube.com/watch?v=VojhqH_zFC0&feature=fvwrel

Skippy… punch the sky!

PS. we still have the spring… eh.

Addition to the play list…

http://www.youtube.com/watch?v=d7R7q1lSZfs&ob=av2n

Skippy… substitute what ever you like for golden brown.

PS… Damn you now you got me started… The Stranglers – No More Heroes

What happened too?

http://www.youtube.com/watch?v=2B4bsqYxwo0&feature=relmfu

aaaarrgh,

Nice ‘N’ Sleazy

http://www.youtube.com/watch?v=OYqllpnyWrY&feature=autoplay&list=AVGxdCwVVULXdYiZFhSJ4uG-ANQgkb94rr&lf=list_related&playnext=4

The nacked cap cruse…

http://www.youtube.com/watch?v=OYqllpnyWrY&feature=autoplay&list=AVGxdCwVVULXdYiZFhSJ4uG-ANQgkb94rr&lf=list_related&playnext=4

Skippy… damn you sir!

I don’t want to use the comment portion to make a long post on college loan debt, but let me make a few observations from someone who has been — and still is — in “the belly of the beast.”

I have a lllooonnggg history with student loans. First, when I entered college in 1965, I was in the vanguard of students who borrowed under the then-named Guaranteed Student Loan Program; second, I wrote education law — including higher education law — for former Vermont U.S. Senator Robert Stafford; third, I worked in the student loan business for Vermont’s state-based, “non-profit” student loan agency; and fourth, now retired, I am still paying on federal parent loans I took out for our children.

When the media discuss the student loan problem, they almost exclusively focus on students and ignore that there is also a not insignificant slice of parents who have taken out PLUS loans (Parent Loans for Undergraduate Students). Those loans are the liability of the parent, not the student. The loans I took out through the former Federal Family Education Loan program carry a fixed 8.5 percent interest rate, and there are very few options for parents encountering difficulty in paying back their loans. Students, by contrast, have many more options in repayment and enjoy lower interest rates.

At a recent “town meeting” held up here in Vermont by Bernie Sanders, who sits on the Senate committee with jurisdiction over higher education loans, I raised this issue. Right afterward, two other fathers came up to me thanking me for bringing it up; they, too, are in the same boat. Bernie noted the issues I raised, but so far, I have no indication that he plans to do anything.

Am I right that at 8.5% your debt doubles every 6 or 7 years?

only if you are not paying anything on the loan — but the point is 8.5% is certainly usurious given the FED driven ZIRP environment. I guess you could refi your house to pay off the student loan — oops that asset has already been beaten into the ground …

“It is not clear that there is such a potential for a black swan event in the student loan market. This market is not in a bubble per se. It is similar to the mortgage market in that it is an enormous amount of long-term debt placed on the backs of people who are going to have a very difficult time paying it off. But it is still not predicated on ever rising asset prices that could collapse at any moment, as the housing market was prior to 2008.”

Others have made this point but it needs emphasising. The value of student debt IS predicated on a rising asset price. The foundation is the capitalised value of education. There are good reasons for thinking that students have miscalculated their likely lifetime wages. Annecdotally, I see it in the army of well educated waiters in Manhattan, and also in the wave of firings in finance.

Im not worried about the engineers and doctors. Im worried about those with non-vocational educations, and lawyers. I would short their lifetime earnings if I could.

I did make that point. But it’s still not an asset bubble per se because it cannot ‘crash’ overnight like a housing bubble. Even if you have overeducated waiters this would be a gradual squeezing, the ‘financial equivalent of water-boarding’ as I said. Not a crash with a wave of defaults.

Re capitalizing the value of education:

Are you suggesting that students are estimating their future earnings and effectively issueing a bond in the amount of a certain percentage of those earnings plus a coupon? If so couldn’t students get together and issue CDOs? Some of the students would be AAA, i.e. the men going to Harvard, and some would be CCC, i.e. the women going to some state u. creative writing program.

Your article misleadingly discusses a market, when in fact no secondary market has existed since 2008 and the primary market disappeared a year later when the Feds began directly originating all student loans (shift might have been 2009 and 2010, but you get the idea).

Just to play devils advocate, student loan programs are essentially university subsidies, rather than educational subsidies. Perhaps it is not the worst thing, given that the university is still one of the US few globally competative institutions.

First off, its not a subsidy program by the government. Government subsidies come out of government spending and are, to put it in simplistic terms, paid for out of tax revenue. Student loans, even those subsidised by the government, are paid back by the student. So, its not the same thing.

Not all loans are subsidised by the government either. There are plenty of unsubsidised, but guaranteed loans. And then there is a private market too. Although this may well have shrank since 2008 or whatever.

I respectfully disagree. RE: Subsidy program – if default rates are indeed as reported and you factor in the number of students that will never repay loans based on public interest forgiveness and income based repayment loan terms, then you can forget whatever Washington says, these loans are not budget neutral (but I suspect you already knew that).

RE: Private markets – You are correct that there is still some private issuance student loans. Certainly, a great number of the loans in the $870 billion headline are private issuance, w/gov’t guarantee. But aside some an insignificant portion of loans, since 2009 all loans have been originated out of the Fed. Direct Lending program from the Dept. of Ed.

Finally, if you can show ANY PRIVATE secondary market activity in years 2009, 2010, 2011 I would be very interested. I tried to find it for a research project, and failed. But I don’t doubt some (OK, most if not all) NC readers are much more adept at this type of research than I

Its a bit of a stretch to equate a loan guarantee with a subsidy. That would imply that those that put together the legislation were secretly banking on default. Also, if the students have difficulty in paying back the loans this will be reflected in their future credit ratings. A direct subsidy would have no such effects.

Again, in Ireland prior to the financial crash we had a direct subsidy program and it was one of the best pieces of legislation that the government ever undertook. Giving much of the population higher education degrees was VERY attractive to foreign investors. It paid for itself and then some. But then the Eurocrats told us to scrap it…

Don’t know the details of the markets. I’m pretty new to this. My main point was to establish that this is not — as The Economist — have stated, a bubble per se.

Checking into several securitized trusts involving student loans, and see monies diverted to senior management’s SERPs and QSERPs.

The universities won’t be globally competive any more when the world figures out that behind the branding, all the teaching is handled by adjuncts making wages worse than a fry cooks, and that the administrators are skimming off all the cream (and ladling it out to their cronies while they’re at it). The university as a teaching and scholarly institution has managed to survive for a thousand years, but thirty years of domination by kleptocratic neo-liberals (sorry for the redundancy) has put it on its death bed.

I think the perspective I have was not communicated effectively to either you or Phillip. Universities are failed as educational institutions, for sure. But they continue as powerhouses generating high quality, cutting edge research and vast amounts of information. What other industry has its workers pay the management to generate the product? In that regard, I do not see US univesities loosing their competitiveness anytime soon, for I do not see the success of the 99% in the near or mid-term future.

‘The universities won’t be globally competive any more when the world figures out that behind the branding, all the teaching is handled by adjuncts making wages worse than a fry cooks,’

and also that people can so become brilliant auto-didacts almost for free online. So long as employers can test them adequately, why is there a need for a testamur from institutions increasingly seen as profit-driven sausage-factories?

The University where I work has just begun to implement a 7.5% staff costs reduction and 164 permanent academics have so far been offered voluntary redundancy or given notice that they soon will be. These are largely those academics who specialise in teaching, because the metric used by management is the number of research articles published in academic publications over the last few years. They have actually used the phrase ‘not pulling their weight’ to describe people who may have opted, or been better suited to teaching than research, as if teaching/learning was a secondary function of universities.

From the Stefan Collini article I mentioned upthread (re the UK):

‘expansion of numbers on the cheap has dramatically diluted the level of attention to individual students that most universities can provide: nearly all parents with children at university hear disturbing reports of overcrowded ‘seminars’ and minimal contact hours or attention to written work. In addition, there can be no doubt that the Research Assessment Exercises have, on top of their other obvious failings, fostered a culture within universities that rewards research disproportionately more than it does teaching. The devoted university teachers of a generation or more ago who were widely read and kept up with recent scholarship, but who were not themselves prolific publishers, have in many cases been hounded into early retirement, to be replaced (if replaced at all) by younger colleagues who see research publications as the route to promotion and esteem, and who try to limit their commitment to undergraduate teaching as far as they can.’

‘and that the administrators are skimming off all the cream (and ladling it out to their cronies while they’re at it).’

The facilities services section of our place (property and buildings mainly) has just been privatised. Successful bidder? Brookfield Multiplex.

Enjoyed this satire of our Vice-Chancellor:

http://video.theaustralian.com.au/2169688753/University-staff-face-the-axe

The basic problem is that the financial services sector has too many of us convinced that credit makes things more affordable. By this simple deception, they manage to suck untold wealth out of the world economy.

Excellent piece and some very good comments.

If anyone’s interested, I have a 2-part interview on student debt servitude, “Learning Through Debt” that just appeared on the Diet Soap podcast (also available via itunes):

http://dietsoap.podomatic.com/

I make the argument that student debt has especially pernicious features as what I call an “existential” debt, where the person him or herself is collateralized.

The problem is not student debt per say. As a 30yo who’s social circle consists mostly of people with high student debt, I can tell you it is a burden but it is not the most important concern for us.

High unemployment, low pay, high housing costs and high retirement savings costs are much more worrisome.

If we can have good job opportunities, more reasonable house prices and access to investment returns that allow us to save for retirement without having to allocate 50% of our income to it, we will gladly pay the student debts.

My friends are scientists, engineers, doctors, lawyers and programmers in the 25yo to 35yo range. With their junior salary, none are able to afford a house in an urban center and most are able to save very little for retirement. The few who bought houses are in outer suburbs 15 miles away from their work.

Yes it would be nice to have lower student debt, but it doesn’t compare to how nice it would be to have a good job, a house at a reasonable price and a credible path for retirement savings.

BenE: Then you need to join your local Occupy. The current political economy will deliver none of those things.

I’m still thinking you can thank NAFTA and its equivalent policies as being longer scale responsible for this state of affairs. There just aren’t enough jobs. We let them go overseas.

Equating NAFTA and loss of US jobs as the locus of your problems is the free trade issue whereby American corporate

conglomerates are able to profit from a global market by creating off-shore jobs at cheaper wages and little overheads in the pay packet. Are you not American believing in the free enterprise/capitalist system as practised? Do you not believe that Canada is losing manufacturing jobs to US and winning several WTO decisions in several natural resource sectors that US does not comply with? Do you not believe that a quid pro quo was made for US jobs on the military F-135 fighter ordered by Canada?

I hope you’re not a native English speaker as your remarks weren’t particularly cogent.

Labor arbitrage and the resultant labor deflation and poverty with offshoring of jobs and a chunk of the GDP along with said jobs, is certainly involved in the entire equation.

Principally, NAFTA was firstly about the privatization of the Mexican banking system for the recapture of the lucrative drug money laundering business (see Ravi Batra’s excellent Greenspan’s Fraud for a review of which banks heavily lobbied for and financed the passage of NAFTA) and secondarily the offshoring of jobs to a cheaper labor market, eventually benefitting no one except the transnational capitalist class.

No thinking person believes in the predatory capitalist system as practised today. And the WTO, and the WTO Financial Services Agreement are simply shams to enrich the multinationals and those who own them.

I’m American, but not believing whole heartedly in the “free-enterprise” system. It has its places and its moments, surely. I’d like it if my government would negotiate for ME as yours should for you.

On the topic of the post, I’m wondering if sensing that there aren’t jobs to go around isn’t making us all behave a little desperately.

Part of the problem is the boomer demographic bubble, IMO. As a Gen Xer, I’ve spend most of my life in delayed adulthood waiting for various boomer-spawned bubbles to collapse before I can move forward to the next stage in my life. No investments or real job until the .com lunacy worked itself out. My wife didnt start having children until 37 and we finally bought a house almost two years ago at 41. I have no doubt that as that generation morphs into a bunch of crabby seniors, I’m going to have to pay quite a lot to the local public school just to educate my children. They already ask for a $800/student/yr donation. The money goes to provide basic P.E. education and an extra kindergarten teacher. Music, art and bus service already got canned. I don’t remember this when I was a kid.

I fully expect the stock market to underperform for the next 15 years as that generation drains what little there is in their 401ks, and for returns on capital to be minimal. Finally, when it is time for me to retire, social security / Medicare will be shattered.

The only savings grace in all this is that the value of labor should be correspondingly higher. So much for early retirements though. Have more kids next time.

A question that no one seems to ask is how many of these students pursuing degrees are actually up to the task of becoming doctors, lawyers, engineers etc. (and the related question of how much actual demand exists for these professions)?

Seems to me a significant percentage of students are being herded in this direction (to the benefit of lenders and private colleges) when they’d be better off pursuing vocational skills at lower cost and with apprenticeship options to help pay the freight. Or don’t we need welders, plumbers, electricians, and carpenters anymore?

My own experience may be instructive. At 19, straight out of high school, I went to sea as an apprentice marine engineer. By year 2 I had enough money saved to take an electronics program at a community college, and opted for that instead. I also took a course on driving heavy trucks because having a plan B seemed like a good idea. As a result I had two solid skills, neither of which required any financing.

Sure, I could have gone for an engineering degree but neither I nor my family could afford it, so I took the best path available and I don’t regret it. I’ll just add that this was in the 70’s when the economy was as big a mess as today, and jobs were just as scarce.

Sure, higher education has become a racket, but it is what it is. No one’s twisting your arm to take that on any more than than buying an overpriced home on zero down. My advice to young people: Don’t run with the sheep. Take some personal initiative and figure out an alternative. There are lots of successful people in this world who don’t have university degrees. Probably more than do, when you get right down to it. It’s all in how you measure success.

Any discussion of student loans (and parental education loans) MUST include the rather astonishing fact that this indebtedness is the ONLY consumer obligation that is NEVER dischargeable in bankruptcy. Repeat: NEVER!

In this context, what, exactly, does “default” mean other than the opportunity to increase the interest bearing total with fees and penalties which also can NEVER be discharged.

Add to this the pervasive sentiment that the only way to assure a financially secure future is to attend college regardless of the cost or course of study and the only conclusion is both ominous and inescapable–the next generation is being deliberately lured into lives of perpetual debt slavery that “no one could have seen coming.”

Get out while you can is one answer. A debt jubilee is another. Making the debt dischargeable through bankruptcy again is a third.

Massive inflationary spike is a fourth.

Aka send everyone a 20k platinum coin.

Massive inflationary spike is a fourth.

Aka send everyone a 20k platinum coin. Anon

A ban on further credit creation plus a metered universal bailout to prevent deflation is a fifth, non-inflationary solution.

Yes, this is an important point. The flip-side that much of this debt is underwritten by the government is that debt-holders cannot generally shrug it off in a bankruptcy court.

Another alternative is that you can leave the US forever. I’ve met people who have done this.

I paid off my loans but would welcome a debt jubilee that freed all students, underwater homeowners and those families who have been wiped out and are currently indebted due to medical expenses. I truly think that is what needs to happen…and renegotiating trade agreements to encourage local hiring.

Quite simply , the masses are bent over the barrel.

They perceive that they have little choice but to pay whatever the cost for a college degree.

There are professions you are simply locked out of without a degree regardless of what you actual know.

We do not have a merit based economic system.

Parallel structures are important. And if I had been smart, instead of book-smart, I would have learned a trade. That is, skills that can be traded and hence appropriate for the world’s fastest growing economy, System D.

Student loans are NOT dischargeable in bancruptcy. MAJOR disincentive to defaulting. I am not in favor of borrowing and not repaying… choices and consequences. HOWEVER, the insured parent of student loan interest rate is 8.99% (oh lets call it 9 %, shall we?) and the insured student loan rate is 6.99% – 7% ). How does one progress on that debt, right out of school? And, what signal does that send to students and our future workforce of how well we respect/ value them , or dirsepect and choose to ‘have our way’? The rates are galling: we give to ‘preferred’ too- big- to- fail entities at zero %. PHUC. My choice? Work my ass off, not let kids take loans, pay cash, and not play the game. I even liquidated my meagher 401K to pay a few semesters. Felt good in a small way to take back those few pennies I had let the gaping gluttonous maw of the vampire squid temporarily ingest into its Jabba-like slimy disgusting corpulent ‘being’.

From the Oil Patch.

Yeah yeah, an anotha thing…. I left out arrogant and smug in my description of the squid. Also, why can’t the rate be 2 to 3 percent, in a revolving loan fund? Maybe federally issued revolving loan fund backed by US education investment bonds?

Same here. I managed to get 3 kids through some good, expensive colleges without debt, also at the cost of retirement security. Student debt and the ridiculous cost of college education may be the most serious time bomb we face. Education is essential but increasingly out of reach. So we allow our children to become debt slaves. For what? It’s destroying their lives and the future success of our country.

Bankruptcy laws must be changed to permit discharge of student debt and modification of home mortgages.

Much of the loss from discharged student debt will be paid by taxpayers, but if we can survive trillions for the parasitic banks that gambled and lost depositors’ money, we can afford this far better use of money. It’s not clear that there would be a much greater loss. There is a limit on what overburdened students and parents can pay, and at some point many will give up.

There would be no appreciable loss from permitting mortgagors to modify home loans. Reducing the debt to the fair market value of the home would reduce further erosion of residential real estate. Those who are struggling to pay an underwater mortgage are not candidates for bankruptcy unless the struggle fails. In that case, the loan goes into default, and without the possibility of modification, the burden on the market is far greater — cost of repossession and corrupt servicing practices. REO remains a burden on the market bringing down the value of neighbors’ homes as well.

Lenders and their lackeys have persuaded many people that the failure or inability to pay debt is a moral issue. Breeding such nonsensical ideas strengthens the bonds of the debt slaves, but no one benefits but the slimeballs buying legislators and the bankers who caused the disaster that will turn the “golden years” of many to sorrow.

Greece and Argentina both provide free higher education. So did/does Libya, even after bombings and other recent bank sponsored terror and destruction. Cuba, Norway, Finland also – frequently superior. Sometimes free was even extended to “them freeloadin’ ‘immigrints'”.

Just as a lack of underwriting and faulty assumptions led to the housing bust, so too will a lack of underwriting and faulty assumptions lead to a bust in college enrollments, unless the government chooses to underwrite it all. All it takes now is a credit score and the continuing cultural assumption by the debt buyer that college leads to well paying jobs for all. Who wants to be the parent who is perceived to not have supported his child’s future by failing to sign on to the debt? With parent, child, education establishment, and government all having significant vested interests in perpetuating the easy money that feeds it, who’s to stop it?

People seem to forget that it was the Bankruptcy Reform Act of 2005 which wiped away the ability to discharge student loan debt.

This was just another law pushed through by the oligarchs to further fleece the serfs a la the rescinding of Glass-Stegall, the Commodities Futures Modernization Act of 2000, etc etc.

Although I agree with PP’s points, let’s not lose sight of the fact that many of the current problems really do have clearly demarcated events which have proved catalysts to our current woes.

I wonder if PP would consider the Federal Reserve Act of 1913 as one of those catalyzing moments? ;^)

Exactly, and to repeat:

http://www.gpoaccess.gov/fcic/fcic.pdf

FCIC Report, p. 48 (go to p. 76 in pdf file)

The CFMA effectively shielded OTC derivatives from virtually all regulation or oversight. Subsequently, other laws enabled the expansion of the market. For example,

under a 2005 amendment to the bankruptcy laws, derivatives counterparties were given the advantage over other creditors of being able to immediately terminate

their contracts and seize collateral at the time of bankruptcy.

Sorry, forgot to mention about that 1913 Federal Reserve Act, which granted private banks the right to lend money, at interest, to the federal government, also same year the federal income tax was established, which at that time was paid directly to the Federal Reserve, as interest on those loans to the government.

Also, around that legislative time in 1913, the Oil Depletion Allowance was also passed into existnece, as well as the financial restructuring, and tax exemption, for foundations, thus allowing the economic elites to hide their wealth and ownership of other companies and financial instruments.

People seem to forget that it was the Bankruptcy Reform Act of 2005 which wiped away the ability to discharge student loan debt.

No, student loans have had significant restrictions on discharge since 1978. Additional restrictions were added in 1984. Basically, as soon as the baby boomers were done with college. Details here.

We’re creating generations of debt peons for the 1% to feed on.

Law schools are being rocked by accusations that the cost of a JD has increased outrageously (in constant dollars) and that the schools have misled students about their prospects for employment in any law-related job that might service their debts (undergrad + law may equal $100K or more).

Isn’t it likely we will actually see the total price of education eventually rise to the expected value of said education over a person’s working life? I wouldn’t be surprised if this came to pass within the next few decades, without government intervention…

And of course, any “market” like this will not take into account any risks of not getting an average or better job.

Actually, we will see the price of education decrease to the expected value–which is currently low as we tend to do more certification than education. Go Phoenix! Go Kaplan! Go 3rd tier state school!