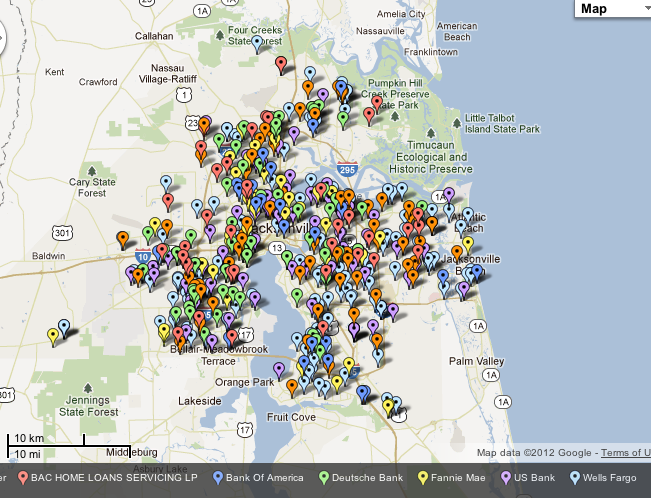

Ben Geddes of the Florida Coastal School of Law, working with April Charney, has been putting together Google Maps of vacant properties in Jacksonville, with the aim of cataloging all of Jacksonville and northeastern Florida.

These images help give a sense of the scale of the problem in high distress areas.

Here is the overview map of all vacant real estate owned (REO) as far as they had gotten on March 28. You can visit that map here to zoom in.

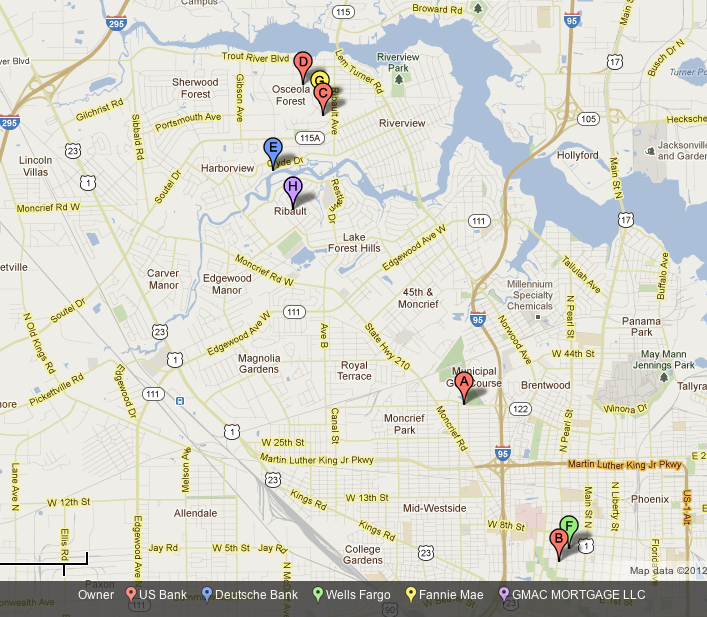

The maps as of today break out properties over $100,000 for those that were bought in at auction for less. Here is the +$100,000 view:

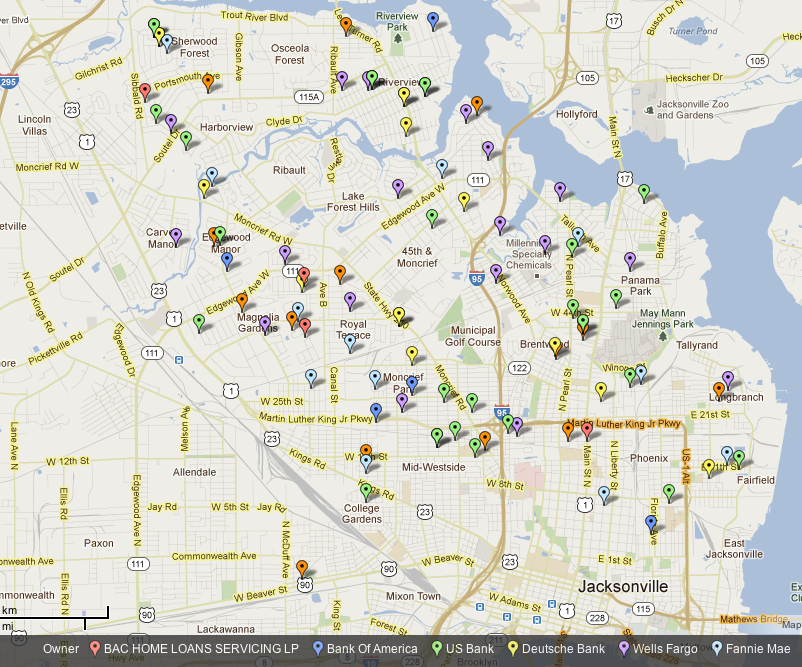

Contrast that with the REO under $100,000:

And yes, the two latest maps show the same zip codes: 32206, 32208, 32209.

Lynn Szymoniak has sent lists of recent foreclosure sales by Bank of America in West Palm Beach. Of 32 sales in March, only 6 were for more than $100,000. 7 were for $100 and and an additional 6 were for less than $10,000. She said in most cases these prices would considerably exceed the final sales price.

More analysis of this type would shed more light on the prospects for housing in various markets. Of course, that is probably the last thing brokers and banks want.

So what will happen to the FED balance sheet, if say house price to fall further 10-15% ? Will they keep expanding it and buy the next debts that turn bad until the TBTF banks are clean from those toxic assets ? If so, could you calculate how long the idle reserve generated and the “earning” on it will cure the TBTF banks balance sheets ?

Nah, I foresee another 15% rise in gold. And buy gold now to buy a house later :-)

The FED is about ready to start taking the ‘toxic assets’ and putting them back on the banks balance sheets to be written off. Which is the point. This will speed up deleveraging and credit issues as banks are able to refiance to something reasonable.

Another 10-15% in nominal reductions simply isn’t happening. Foreclosures going up is a good thing. It is a sign the “cylical” phase of this bust is over.

Counterpoint: foreclosure map for San Francisco, CA:

http://www.trulia.com/for_sale/San_Francisco,CA/x_map/foreclosure_lt#for_sale/San_Francisco,CA/x_map/foreclosure_lt/37.727581,37.775952,-122.502635,-122.386454_xy/13_zm

Almost all over $500k. Some, $7-800k. How does one have hundreds of $800k foreclosures in one city?

1,400+ foreclosures in SF.

I think your map is not comparable to the Charney maps. The Jacksonville maps are of vacant REO and the researcher found the price at which it was bought by the bank from court filings. You map looks to be realtor asking prices. And the houses may not be vacant yet. I’ve seen brokers in Mountain Brook, AL (one of the 10 wealthiest communities in the US), put listings on houses in advanced stages of foreclosure, which is hugely embarrassing to the owners who are already going through a lot of personal stress.

Remember what Szymoniak said: in most cases these prices would considerably exceed the final sales price. If these were indeed foreclosure auction prices, you need to see how those prices compare to eventual sales prices. I’m sure it varies by community and area of the country.

“listings on houses in advanced stages of foreclosure, which is hugely embarrassing to the owners who are already going through a lot of personal stress.” –

That’s happening here in MA. Owners, or someone, is adding notes stating “bank approved of “X” amount for sale”. Basically broadcasting to everyone that the homeowners are in trouble in already in the process of foreclosure.

MoM from January, foreclosures went from 202 in my city to 217 in March, I haven’t tallied the short sales, as some may not be listed. Anyone stating all is well is delusional, as the price index is a 45 degree spike down, 5%+ YoY year decline in pricing for my area.

“which is hugely embarrassing to the owners who are already going through a lot of personal stress.”

Embarrassing to whom? It’s a source of pride, defaulters are heros, Banks and their attorney’s are crooked, the Treasury Department is selling out families to anyone with mo’ money.

‘When Rome fell I refused to refused to render unto Ceaser’

Steve, you should see the stronger zip codes in Silicon Valley! The prices for very average 1500 sf homes are holding up above 700-900k!

Don’t discount the Facebook going public – all cash buyer effect. They have to live somewhere.

What would be interesting is some data on the dollar value of the mortgages on these properties.

I also lived in Jax for a few years, and I can tell you your notion that “locals” would never go to these areas is utter nonesense. First of all, who do you think live in those areas? Yes, Jake, that is the low-income portion of town, north of downtown so i guess when you mean locals, you mean the white upper-class or the yokels on the westside.

I can say of the time I lived there, its the only area I actually liked because the people there werent a bunch of over-privledged business geeks. Spring Street area is a place of history and unfortunate realities. Take a look at the Jacksonville Ash Site Superfund site which has affected a number of those areas. It turns out that a waste incinerator in town sold contaminated ash to use as fill in many of those neighborhoods and they have spend the last five years excavating the neighborhood to correct the problem. I am certain that had an effect on home prices as well as desire to live in the neighborhood.

Sorry, Jake, that is supposed to be a response to Fuzzy Insecticide or whatever his name below this post is.

Jacksonville RE is a mess. I grew up there. Those sub $100k REOs are all located in areas most locals would NEVER go under any circumstances. They are not pretty ares of town.

I sold a home there a year ago at a 45% loss. Yeah, i wrote the check to the bank. It sucked. However, it is probably worth 10% less than that now. It’s awful down there, but finally seems to be stabilizing at least a little.

I would be very leery about buying a foreclosure anywhere due to the chain of title problems brought into the open by the SF audit done by Aequitas. I am one of a number of brokers urging my local assessor/recorder to do a similar audit here in Sonoma County so we can find out how bad the problem is here. Due to the very thin reserves held by title companies I am of the opinion that even buying insurance that covers you from chain of title problems may not be enough and I won’t show REO to my buyers unless and until there is some way to ensure they can get title. When 46% of “Foreclosures” are so flawed that they are void on their face it is too risky.

My perception is that the property market has been severely damaged.

It’s not just foreclosures and REO’s. I suspect the problem exists with any property that was securitized where the chain of title is unclear, or if not securitized but reliant upon MERS rather than properly recorded. Additionally, there may be risk to a properly recorded property when adjacent properties have not been properly recorded.

I also believe you are correct in pointing out the weakness of the title insurance companies. Their ability to sustain business when a flood of claims are made is questionable. Even they believe that as shown by their need to obtain assurance from the bank that the title is clear. I can just imagine a multiple of claims being made and the title insurance company attempts to put it back on the assuring bank but the bank is unable to pay the claim as well. You’ll have paid a premium on insurance to get screwed.

I would recommend avoiding the property market until this is all sorted out.

No. I think this article is missing something. I live and work in WPB in a real estate firm. The banks always buy back their assets at way less than note value or future sales value. I think the ones that are bought back at higher values are because court-steps bidders have done their due diligence and looking to make a steal on a vacant home that still a good buy. The bank, therefore, has to pony up in order to make sure they are the ones recapturing the asset. The rest that sell for far less are usually encumbered with HOA liens, city code violations and/or vandalized and ravaged. (missing appliances, actual vandalism, mold intrusion, etc)

$100 is a typo right?

No, it isn’t.

But it does open a potential area for investors to profit. I know so little about bankruptcy law that I should probably stay mum, but I would offer this little tidbit. I once knew some shrewd bucks in Denver who played banks during foreclosures. The gist of the approach was to identify homes with existing mechanics liens. They would then find the party who filed the lien and purchase it from them. This gave them the ability to bid on the property during the foreclosure proceeding. Banks routinely low-balled these auctions, assuming they alone had standing, although my friends in the know said the banks could offer up to the remaining principal on the mortgage without losing a dime. In one instance, these bucks picked up a house valued at $1.2 million for $40,000. These two guys worked for a title company and spent free time looking for such opportunities. Needless to say, the banks were not appreciative. A bank offering just $100 for title would be easy pickings.

Being one of the few people with the real facts its pretty annoying when all you find is dishonest attys, judges and press. If you want to get to the heart of it all do your civil war research. Do ancestry research you to may find your from one of the 1st National Banking Families, and they’ve lied to you your whole life about who you really are!

Foreclsoures are just a symptom of FRAUD, COLLUSION AND MURDER! They just try very hard to contain it all! Regardless, I will continue to speak for the people no one will speak about! Humanity, fairness, and honesty have no price!

Do you know who you really are? mortgagefraudclosure.blogspot.com

Interesting the topic of embarrassment would come up. I have long thought the whole foreclosure process was designed to demean, embarrass and shame the homeowner. It starts with the folks who show up each month to take photos, check your utilities and maybe even ring your doorbell to verify occupancy. This is followed by the legal notices in your local newspaper. And if it requires having to send the sheriff out to personally deliver your eviction notice, it provides great fodder for the neighbors who will help spread the word. And when victory is in hand, notices are plastered on your former home to ensure there is no doubt what happened. All of this is a warning to your neighbors: be a good debt slave or this will happen to you.

My TBTF bank/servicer started foreclosure proceedings while my loan was current. A simple inquiry about the possibility of a loan modification set off a chain of events that could not be stopped. Continuing to send my monthly payment (sans their BS attorney fees) could not stop a servicer-driven foreclosure. Complaints filed with my AG, the OCC, BBB and anyone else I could think of could not stop it. Two attorneys could not stop it. Once they have designs on your house, it is almost impossible to save it.

My complaints only made the pressure/embarrassment attempts worse. Instead of once a month, the “property preservation” folks started showing up every other week. On two occassions I returned home to find half of my lawn mowed (I had continued to maintain my property as usual). Even though I was in constant contact with my servicer (often several times a week) and they verified occupancy on numerous occassions twice my utilities were shut off.

After the sale date, the realtor hired by Fannie Mae turned up the pressure on me to sign a “Cash for Keys” agreement. Of course, I declined. Forfeit six figures plus in equity for $3500? Sure, right. I had to call Fannie Mae several times to complain about the realtor. After vacating the property he got his revenge. Instead of the standard one or two notices posted on the property, my former home had a notice displayed in EVERY window.

For almost two decades, I did the “right thing” and paid my mortgage on time – each and every month. When the recession impacted my business, I made many personal sacrifices in order to do so. Still, I felt embarrassed and shamed by my situation. I am way past these feelings but still suffer from the effects. The former neighbor who can’t look me in the eye at the grocery store. The invitations that stop coming. The friends and even family members who silently seethe because they have to pay their mortgage and I don’t.

Anyone who suggests the stigma attached to a foreclosure no longer exists has not been through a foreclosure.

This isn’t shame, this is called predation. Think of all the other foot soldiers who presume “they are doing the right thing” on behalf of Fannie Mae. (The press, the courts, the AGs, the good Germans)

Pardon my ignorance on the subject, but how did a bank start foreclosure proceedings on you when you were current on your loan, making payments and had over $100,000 in equity on the property?

It’s shockingly easy for them to do a nonjudicial foreclosure. They just do it. Nobody checks up on them. They could foreclose on a house that doesn’t even have a mortgage, or for that matter, a house that doesn’t even exist.

All you can do is:

(1) if you have real title insurance (e.g. an ALTA “Homeowner’s” policy) you can notify the title company and hope they will defend you in court. This is more likely to work if you have an obvious fact set such as owning your house free and clear (there IS no mortgage so how the bleep can you be in arrears?).

(2) After they foreclose on you, sue them.

You should definitely pursue option (2) if you can show the facts. To that end, track down when your bank (your checking-account bank) says your mortgage payments were cashed/claimed. At the first hint of trouble, you should have used a payment method that gave them no room to claim any of your payments were late. Old-fashioned way is by registered mail with return receipt requested. New-fangled way is using a good electronic bill-pay system that records when the payment was made.

If you can prove you did not default in any way, you should be able to win a good judgment in court, including attorney fees. Not sure if you can get the house back, but definitely all your damages.

There is a web site that provides a very in-depth analysis of housing default – the name is http://www.foreclosureradar.com – It has a multiplicity of ways of segmenting out RE in varying stages of default: NOD, Notice of Sale, Auction, Postponements, how far underwater it is, equity held, etc etc. It shows analysis in what RE goes back to bank, purchased by 3rd party, and final sales price.etc. Unfortunately, it is not showing historical information going back beyond a certain point, which would give meaningful data over time. It also analyzes the loans and estimated value on the property, shows what banks hold the note, but it does not show if the “expected” value at auction price on court house steps suddenly started out lower (i.e. if the bank really wanted to get rid of the property). These are the properties deemed of such value, that they were or are not sold off in tranches to larger scale investors. You can see that the high value properties, such as those in Silicon Valley where I live, are held back by the bank and then put on the “retail” market, where they have completely skewed it, so the retail (non-all cash) buyer doesn’t have a chance to buy it. It has completed manipulated the market pricing. Yes, there has been deflating price, and it has been significant, but it’s taken a long time for the air to come out of the balloon. If they can rig the market, the bank takes the gain. The service does have the names of borrowers and addresses, history on the property over years obviously downloaded from the assessor’s office, so you can see the title trail, etc, so there is a privacy issue, but this can all be had for a low per month fee.

It also shows mapping, segmenting, etc. I have used it to analyze CA, but it does OR, WA and a varying amount of other metro areas and states. It goes far deeper than Trulia and other sites.

If a full history of what has transpired were opened up, it pretty much sews up the case on manipulation. It took awhile for the black hole of banks to get a system going, but they have dialed it in for the past year or more. I’m sure the accommodative easing combined with this inventory “management”, kept the world from blowing up and 50% of the country being homeless.

What originally brought this on in the lending side (banks again, thank you) cannot be understated. 50% of the homes owned in America have the hands of the banks wrapped around their owner’s balls, to put it plainly. You can see why there has not been large scale backlash societally and politically. The free-for-all was just stunning, and to some degree, it continues in the confines of the black hole of wealth. Americans are bewildered – and frankly, unaware and uneducated. It’s just too overwhelming – just the way the banks like it.

“An alternative to the commons need not be perfectly just to be preferable. With real estate and other material goods, the alternative we have chosen is the institution of private property coupled with legal inheritance. Is this system perfectly just? As a genetically trained biologist I deny that it is” – Garrett Hardin

While I appreciate the sentiment expressed, it seems somewhat illogical to me for a person to claim (implicitly) that their expertise in biology somehow conveys expertise in moral philosophy, ethics, and economics. Just sayin’…

Just think, another 5 million or so people who savor the thrill of embarassment, c’est magnifique.

While I don’t doubt Duval-Jacksonville is near the top, I believe Lee County, Florida (southwest Florida from a defacto perspective) is “ground zero” for foreclosures.

I think those maps are deceptive. Each little tear drop shaped icons is about a quarter of a mile across as per the legend on the map. If this map showed all residential units in this area as blue pin-points, and foreclosures as black pin-points, it would look very different, and not nearly as scary. I think this site is mildly biased against accepting the existence of a possible real estate recovery for emotional reasons (if real estate recovers, we don’t get to drag the bankers behind our pickup trucks). But I still think it’s the best site on the web. I’m going to make a prediction that as the market recovers in the coming months, we’ll see statements here that read something like this ‘Well yes, real estate is recovering in Atlanta, Sacramento, San Diego, Riverside, Boise, Duluth Las Vegas, Denver, Portland, Seattle, and Spokane. But it’s still going down in two neighborhoods in Orlando!!!’

I meant particularly the first map. The others are more sane. Although I’d like to see all of the little tear drop shaped icons changed to snarling dragons spitting fire as per maps from the ninth century AD.

This map isn’t nearly as severe as it could be; there are much scarier-looking maps on foreclosures from places like Cleveland. Or even the eastern suburbs of LA. Mark in the vacant areas too and then it looks relaly bad….

Those people who are a novice to the real estate marketplace really should take the time to understand what legal contracts should contain. A hire invest in arrangement should be truthful to the home owner as well as lessee. Nonetheless, naive lessees may well fall prey to inaccurate legal agreements.

homes for sale anaheim