By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

European monetary aggregate data from the ECB came out this week and continues to follow the trends we have seen over the last year.

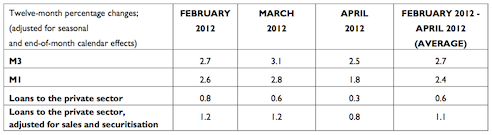

The annual growth rate of the broad monetary aggregate M3 decreased to 2.5% in April 2012, from 3.1% in March 2012.1 The three-month average of the annual growth rates of M3 in the period from February 2012 to April 2012 stood at 2.7%, unchanged from the previous period.

M3 Components

Regarding the main of M3, the annual growth rate of M1 decreased to 1.8% in April 2012, from 2.8% in March. The annual growth rate of short-term deposits other than overnight deposits (M2- M1) stood at 3.2% in April, unchanged from the previous month. The annual growth rate of marketable instruments (M3-M2) decreased to 2.9% in April, from 4.1% in March. Among the deposits included in M3, the annual growth rate of deposits placed by households increased to 2.5% in April, from 2.2% in the previous month, while the annual growth rate of deposits placed by non-financial corporations was more negative at -0.8% in April, from -0.2% in the previous month. Finally, the annual growth rate of deposits placed by non-monetary financial intermediaries (excluding insurance corporations and pension funds) decreased to -1.0% in April, from 4.4% in the previous month.

Counterparts to M3: credit and loans

Turning to the main counterparts of M3 on the asset side of the consolidated balance sheet of Monetary Financial Institutions (MFIs), the annual growth rate of total credit granted to euro area residents decreased to 1.4% in April 2012, from 1.8% in the previous month. The annual growth rate of credit extended to general government increased to 7.7% in April, from 7.5% in March, while the annual growth rate of credit extended to the private sector decreased to 0.0% in April, from 0.5% in the previous month. Among the components of credit to the private sector, the annual growth rate of loans decreased to 0.3% in April, from 0.6% in the previous month (adjusted for loan sales and securitisation2, the rate decreased to 0.8%, from 1.2% in the previous month). The annual growth rate of loans to households stood at 0.5% in April, compared with 0.6% in March (adjusted for loan sales and securitisation, the rate decreased to 1.5%, from 1.7% in the previous month). The annual growth rate of lending for house purchase, the most important component of household loans, stood at 1.0% in April, compared with 1.1% in the previous month. The annual growth rate of loans to non-financial corporations increased to 0.5% in April, from 0.3% in the previous month (adjusted for loan sales and securitisation, the rate increased to 0.7% in April, from 0.5% in the previous month). Finally, the annual growth rate of loans to non-monetary financial intermediaries (excluding insurance corporations and pension funds) decreased to -1.5% in April, from 2.3% in the previous month.

So its pretty much all down hill again. Credit to the government sector continues to be the major growth component for credit, but as you can see the private sector, even including the strong core, is slowly moving toward deleveraging.

And, as we continue to see with all European data, the worst of it is being reported in places that can least afford it.

Italian M3 growth, a broad measure of the money supply, rose only 0.28% on the year in April, suggesting the European Central Bank’s cheap loans are having little effect.

Italian M3 rose at an annual 1.09% in March, shortly after many of the country’s banks took advantage of the ECB’s three-year liquidity offers.

Italian M3 had been declining on an annual basis for the previous four months.

So…this means austerity is working extremely well, or just very well?

It is doing precisely what it’s supposed to do, making rentiers fabulously wealthy and stealing from everybody else. So I’d vote for “extremely well”.

Being a European and keeping money in Euros or worse in the bank is a very risky proposition right now. If you are in Greece, Spain, Porgual, etc you run the risk of capital controls being introduced without warning and worse yet your money converted to Drachma or Lira at a none-to-attractive rate if your goal is preserving purchasing parity. We’re probably seeing a huge flight to move money into German or Swiss banks, or even better the U.S. dollar. And the Greek, Spanish , and Irish government’s are in no position to make up the difference. These are not government’s with their own fiat currencies.

So, does the German citizen vote to assume the debt of the peripheral nations, or does the German voter opt to pull the plug on the ill-fated Eurozone experiment.

Conscience of a Conservative says:

“We’re probably seeing a huge flight to move money into German or Swiss banks, or even better the U.S. dollar.”

Is this some kind of beggar-thy-neighbour game we should all enjoy playing?

Thank you for an insightful piece.

Charts showing the decline in the Velocity of Money in both the EU (broken out by nation) and the U.S. would be interesting to see as well.