By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

So it’s yet another two days where the leaders of the EU get together for a dinner (this time it’s tarte, fine eggs/mushrooms, braised veal on bed of fresh spinach followed by a chocolate trio) and attempt to thrash out greater economic integration. Up for discussion is Greece and Spain, what to do with the funds from the financial transaction tax and most importantly the plan for a banking union.

Given previous results the expectations are running fairly low and Reuters reported that Hollande and Merkel are already at odds over some key points:

Germany and France, Europe’s two central powers, clashed over greater European Union control of national budgets and moves towards a single banking supervisor before a summit of the bloc’s leaders began on Thursday.

German Chancellor Angela Merkel demanded stronger authority for the executive European Commission to veto national budgets that breach EU rules, but French President Francois Hollande said the issue was not on the summit agenda and the priority was to get moving on a European banking union.

The two leaders met privately for 30 minutes just before the start of the 22nd EU summit since the euro zone’s debt crisis erupted nearly three years ago. Afterwards, a French source said they had agreed on the need for a tight timetable for introducing banking union.

In the lead up to the summit Angela Merkel had stated that Germany wouldn’t be rushed on the banking union and reports in the last hour look as if she has got her way:

German diplomats say leaders meeting in Brussels have reached agreement on creating a powerful single supervisor for eurozone banks and the plan will be implemented at some point next year.

France and Germany have been tussling over how to best shore up Europe’s struggling banks. France wanted a single supervisor in place by the end of this year — because that would allow Europe’s bailout fund to directly loan money to banks, a key tool in fighting the crisis.

But Germany has been dragging its heels because it’s nervous about such loans.

The diplomats said leaders reached agreement Thursday night to draw up the legal basis for the supervisor by the end of this year. They will then put it into place sometime in 2013.

It is yet to be seen what the UK, Finland and Sweden have to say about this given they have been opposed to a banking union for their own reasons, and let’s not forget the risk of post-summit backflips.

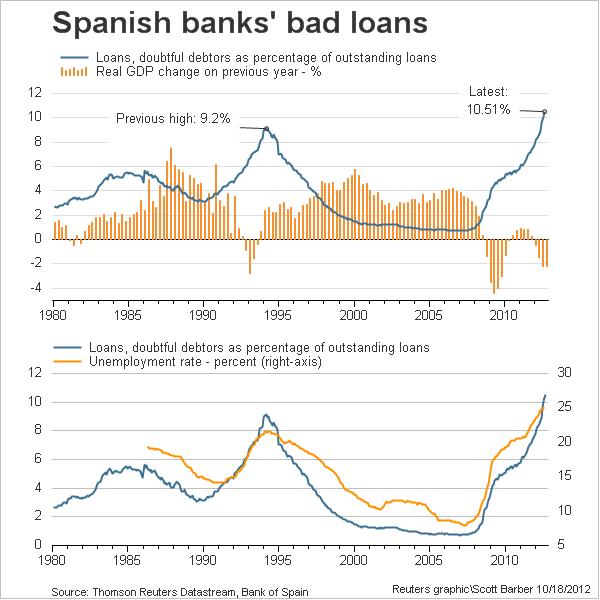

The single supervisor makes way for direct banking re-capitlaisation and a further move towards a banking union. As I’ve talked about previously, without the banking union there is no supra-European deposit insurance which means that deposit outflows from the periphery are likely to continue and this will add to the pressure on the weaker sovereigns. In regards to that we saw Spanish bad loans reach a new record overnight:

Spanish households and companies defaulted on their debts in record numbers in August, hurting the country’s lenders and highlighting the need for an aid package and bad bank to help the economy out of recession. A property crash left banks with billions of euros in bad debt from real estate developers on their balance sheets but the problems have spread to small businesses and other sectors. Loans that fell into arrears in August increased by 5.3 billion euros ($7 billion) from July, reaching 178 billion euros, Bank of Spain data showed on Thursday.

Spain is setting up a bad bank to siphon property assets off lenders’ balance sheets and banks are preparing to receive the first funds from a 100-billion-euro credit line agreed with the European Union. But the record loan data raises the question of whether consumer loans should also be transferred to the bad bank and if Spain will take too little of the European cash. The government estimates it only needs 40 billion euros.

We are also expected to hear from the Greek PM on the progress, or lack there of , on Greece’s progress to meet its emergency program obligations. I don’t expect the speech to lead to anything as everyone is well aware that Greece already needs a further debt write-off , although the EU does appear to be pushing for a debt buy-back in order to hold off the inevitable. In the meantime back in Athens anti-austerity rallies have turned violent once again.

There is another full day of the summit to come , so we will get further announcements over the next 24 hours.

This article from The Economist sounds substantially more positive than yours.

http://www.economist.com/blogs/charlemagne/2012/10/eu-summit-1

“TONIGHT I have confirmation that the worst is over.” President François Hollande’s bullish assessment came at the end of yet another long night of debate at a European summit. His lectern was marked “Jeudi 18 Octobre”, though it was well into vendredi 19.

The main reason for his optimism was the pre-dawn compromise on banking union: the euro zone’s new banking supervisor was on course to be legally established by the end of the year, and would become operational “in the course of 2013”. So some time next year the euro-zone’s rescue fund, the European Stability Mechanism (ESM) could be used directly to recapitalise troubled banks.

As the French tell the story, European leaders were able to drag Germany back to last June’s promise to create a banking union in order to “break the vicious circle” between weak banks and weak sovereigns, after it had tried to backpedal from several aspects of the deal.

Indeed, the agreed timetable was faster than promised in June, noted Mr Hollande, and the ECB will have the power to supervise all 6,000-odd euro-zone banks.[…]

So? EU officials and elected representatives have never exactly lacked confidence. So why is this noteworthy?

That is laughable.

The countries are still broke.

If they agree on anything that will make internal politics of each country more unstable.

Who can not say the EU experiment was planning this from the very start. ?

Looking back at it now – their machiavellian efforts to crush the nation state concept from all angles and all spheres of Irish life from the 60s & 70s onwards is truely awe-inspiring.

From the destruction of the men in peek caps in the 70s (Irish small farmers and fishermen to the advantage of the ranchers) and thus a cohesive political base.

To the change in the political geography courses to promote Regionalism.

To the Londons big bang of 86 and the uncontested rise of Monetarism.

To the almost toal export of European capital towards the Brics so that the elite could earn a income from this global wage arbitrage.

The EU council is a expression of pure evil.

People ask why there has been no Resistance in Ireland to this Demonic market state………..simply because Irish society now no longer exists.

It has been a pure capital conduit since 1987~

We are their best pupil – the stupid stupid Irish slaves.

A bunch of fucking muppets.

http://www.youtube.com/watch?v=VnT7pT6zCcA

The video clip is inspired.

The technocrats fiddle while Rome/Athens/Barecelona/Dublin burns. The people…? Let them eat braised veal.

The gap between the european public and its putative leaders has never been wider. Europe’s credibility is dissolving, and only the carefully constructed and long detested ‘democratic deficit’ is preserving the dysfunctional union from ignominous collapse.

Will the Greek people deliver the Coup de grace…?

Make no mistake, there will be a banking union. Clumsy plodding, almost in self-parody, is the European way.

Literally nauseating.

Greece borrowing money to buy back its own bonds which are now discounted 50%. That will achieve the right loan to GDP ratio for more bailout money from the ECB. The ECB doesn’t have the money to loan Greece the money to buy back its bonds. So that will have to be the “international” creditors. And the EU summiteers are still awaiting the credit report on Greece by its international creditors. (We are led to believe the only international creditors are the IMF and Europeans of various nationalities but who else could they be?)

And Spain is doing a bad bank for all its real estate and small business defaults. Private debt. Is it possible this bad bank is going to be the National Bank of Spain? Kinda like the Fed buying up MBS? But the National Bank of Spain is destined to have no sovereignty whatsoever. Can’t print. So these purchases will have to be at a super deep discount. And technically then, how can any of this be called sovereign debt?

At what point do all these discounts trigger CDS payouts? Or has that already been resolved?

Oh right. These are all assets whether Greek bonds or Spanish mortgages. And after this discount cycle the assets can be offered up again to the CDS holders at killer prices, discounted even more. Those sales will turn into a debt collection festival. And everybody will call it good. Except for Burning Man.

Just curious. Will the ESM oversee 6000 banks in a private banking EU-wide network which will also have 15 or 20 “systemically important” banks? Or maybe 27. I think I can see fiscal politics sneaking into the design.