The lawyers and writers that have gotten into the weeds of bad practices in mortgage servicing land (the folks at Foreclosure Fraud, Lynn Syzmoniak, Dave Dayen, and Abigail Field, to name a few) all deplored the mortgage settlement. One of the many complaints about it was that it gave a broad release on chain of title issues, in return for supposedly improved mortgage servicing. That was to be achieved through new servicing standards required of the big servicers (the five involved in the settlement of this year, and the 14 national banks who were party to bank friendly consent orders by the OCC in April of last year).

It seems now that the officialdom in DC has taken the position that foreclosure fraud is a thing of the past. By contrast, a number of states, most notably California, have made it clear they aren’t going to rely on these new servicing standards (which as we and other have discussed at length, actually serve to institutionalize foreclosure fraud by, for instance, making remarkably high error rates perfectly OK). These states are implementing various forms of “homeowners bills of rights” which among other things, typically create tougher punishments for foreclosure abuses. Various members of the mortgage industrial complex are up in arms, since tougher borrower protections, or more accurately, making servicers respect well settled dirt law that they’ve tried hard to bulldoze in the name of efficiency would hurt their profits.

In case you had any doubts about the wisdom of state-level actions, the discovery of a new type of abuse, computerized robosigning, should put them to rest. One of the servicers that was not party to either settlement is apparently so confident that no one will go after them that it is engaging in what looks to be a new level of systematized foreclosure fraud. From Deadly Clear (hat tip Lambert):

It appears Green Tree Servicing has been flying under the radar and was hardly noticed until a recordation research team began uncovering similarly signed documents – yup, the old robo-signed Assignment of Mortgage trickery again… but this time new and improved via computer, maybe for speed and precision, ya think?

It appears the signatures are in the computer – no dummies needed to sign – just fill in the blanks and push the buttons (as if that wasn’t committing an unlawful act)… “Who, me? I just filled in the information and pressed print…” Why bother to use humans when computers will do just the same… and what are they going to do – arrest or sue the computer?” How about the programmer or the button pusher or the boss?!

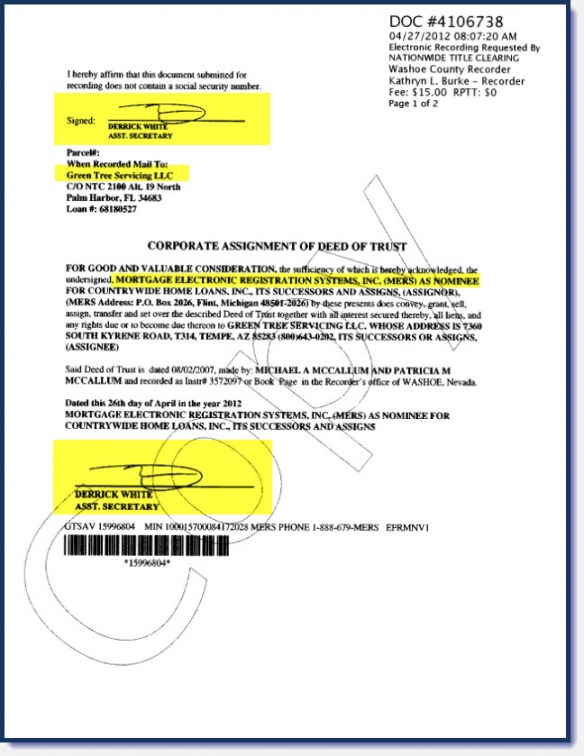

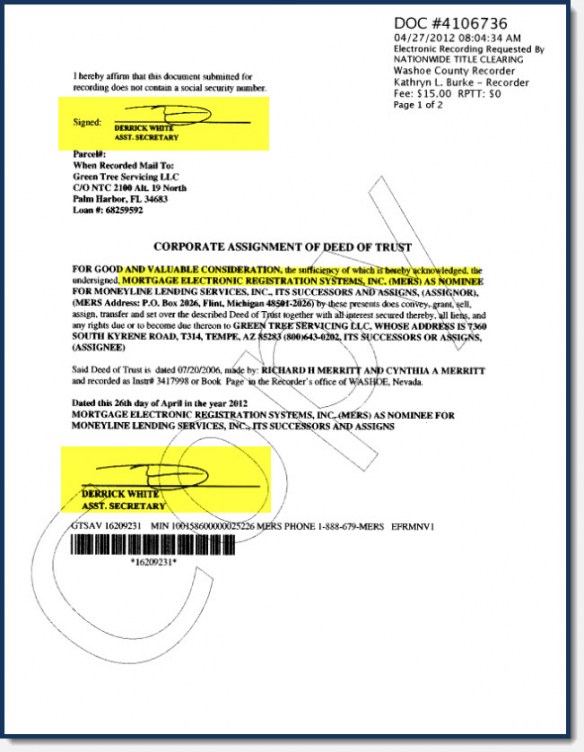

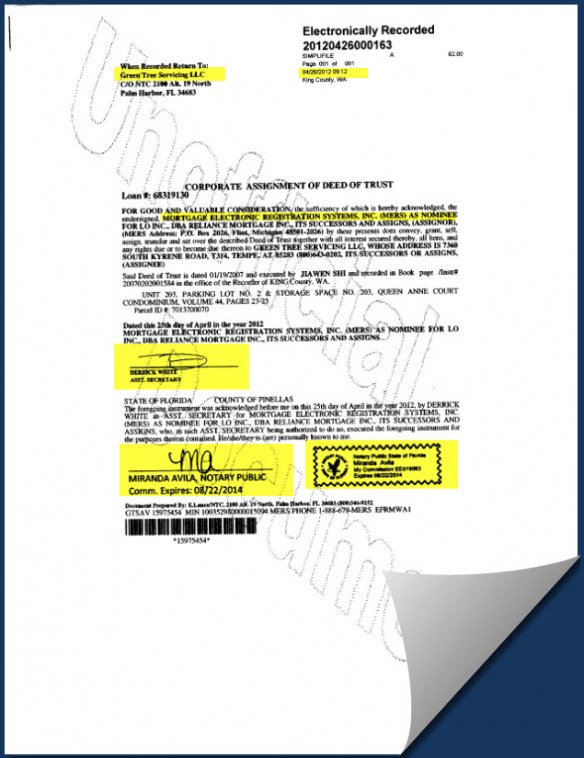

These are some examples of documents. Look at the similarity of the signature of Lisa Derrick in the first two, made three minutes apart (already way too similar) with a third made on an entirely different set of documents:

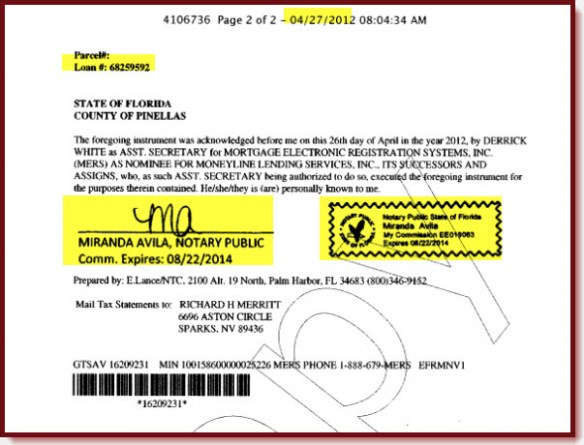

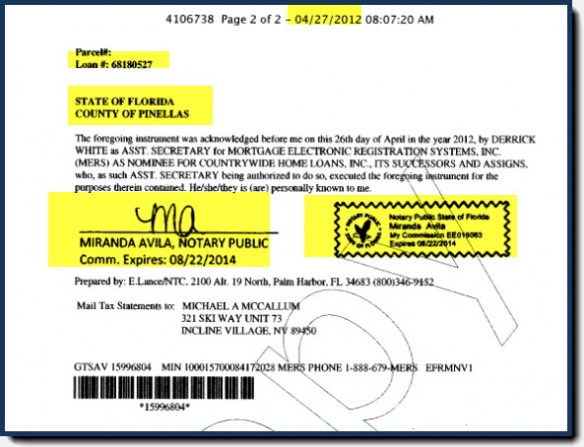

And while we are at it, look at the notary’s signature on the document above, that of Miranda Avila, and now look at the following documents:

Now cynics will correctly point out that Green Tree is a small operator. But that misses the point. Real estate was once a slow, deliberate business precisely because the integrity of property records is an important bulwark of capitalism (cue Hernando De Soto) and housing is most families’ most important asset. As Barry Ritholtz pointed out early in the robosigning scandal, this should be a zero fault business. It used to be that way (ex well constructed, typically local frauds) and the fact that, again and again, the banks have been both given a free pass and not required to clean up their bad practices, is the worst of all possible outcomes.

It’s also worth noting that Green Tree is the sort of small potatoes operator that Schneiderman’s Potemkin mortgage task force could pursue with impunity, since it won’t rattle any of the powers that be. But he’s guaranteed not to take even this teeny a step. First, one of the major purposes of the mortgage settlement was to pretend that chain of title abuses were a thing of the past, so showing that to be a sham would be more than a tad embarrassing. Second, going after a Green Tree, even though it might actually help some real people, won’t generate the sort of headlines that Schneiderman & Co. need to legitimate their their empty effort.

Yes.

This appears to be the further erosion and vaporization of capitalism.

No integrity in the records?

No wonder ‘the markets’ appear to be racing about in a desperate search for value these days. Surprise, surprise.

Yves,

Nationwide Title employees have stated in their depostions that they use scanned signatures in there documents.

———–

15 Q Okay. So Mr. Bly didn’t actually sign the Corey

16 Assignment; is that correct?

17 A Well, he didn’t physically sign it, but he –

18 that meets with the standards for electronic document

19 recording.

20 Q Okay. Are you referring to a specific state or

21 federal law?

22 A This — no. Specific counties across the nation

23 have started setting it up, so part of like going more green

24 and not having as much paperwork that you can electronically

25 record documents. They have different settings anywhere

1 from just feeding them information to feeding them like a

2 PDF or TIF version of the document that gets recorded, that

3 they record in their imaging bank, stamped electronically,

4 and then send back to us as having been recorded once it’s

5 verified on their side. That document was one of those.

6 Q Yes, ma’am. I understand how it was recorded

7 electronically. I’m just trying to — to determine whether

8 or not Mr. Bly actually signed a physical document or if

9 a — his signature was created by Planat Press.

.

http://stopforeclosurefraud.com/2010/11/01/full-deposition-transcript-of-nationwide-title-clearing-erica-lance-bryan-bly/

———

Here are other auto scanned signatures Releasing Mortgages, Satisfaction of Mortgages etc…:

.

http://stopforeclosurefraud.com/2010/10/10/are-mers-signatures-on-documents-real-or-scanned-duplicates/

If I could respectfully add a 3rd reason for the mortgage settlement ballet: 1) “thing of the past” — bury it. 2) a ‘small potato’ (Green Tree) won’t “generate…headlines” to legitimate the scam.

But 3rd, aren’t THEY really worried about Robo-Signing?

“Can you believe the signature” (Deadly Clear)

Excuse my naivety. Isn’t there such a thing as criminal forgery?

In the US, District Attorneys have been given the power to let criminals go free by “declining to prosecute”.

This power is illegal. In fact, if a judge decided to enforce the law as written, he could put DAs in prison for corrupting the justice system. But the judges don’t do that.

So DAs give favored criminals free passes to commit crimes.

We have no justice system in the US any more.

Au contraire — we have justice vs drugs, terrorists, and the rest of the unexceptional world.

With fannie, freddie, FHA, and HUD deeply involved with RE transactions, I can’t help thinking the federal government has a vested interest in whitewashing chain of title problems.

I’m wondering if there is any discussion of home BUYERS rights? I’m still not clear what this all means to a buyer of foreclosed properties, or even normal sales where mortgages or notes went thru the MERS weedwacker?

What this means to a buyer of “foreclosed properties” is very simple: all you’re buying is a claim in a quiet-title lawsuit. You are not in any sense buying property. You are merely buying the right to file a quiet-title lawsuit to try to get property.

If the true property owner decides to fight you, you probably won’t get the property.

I reserve the right to still be confused. I hear in my state that “foreclosure sales are final” or something like that.

The other thing I worry about, not being a RE lawyer or having a seat on the Supreme Court, is that the destitute foreclosee is not the “true property owner”. I wouldn’t worry so much over possibly being sued by him/her and their yellow pages attorney. But it seems to me somewhere in the pre-break chain of title is some bank with a huge high powered legal staff. Yikkes. But that is why I buy title insurance….I think.

To be fair, it’s not ‘property rights’ as such that forms the bulwark, but faith in the myth of the unassailability of property rights. Now certainly property registration was done properly for a large part of the past century, but I imagine that the system was just as rife with fraud during the interbellum, and it recovered from that as well.

And exactly how much fraud would you consider ‘acceptable’ before the recovery is complete? Jeez………!

“To be fair, it’s not ‘property rights’ as such that forms the bulwark, but faith in the myth of the unassailability of property rights.”

And to be fair back, despite Marx making a strong argument to the contrary, we’ve decided over the years to codify those beliefs into these things called “laws” which are meant to prevent the rule of might, and the breaking of which, called a “crime,” is supposed to–in a perfect world I guess–lead to consequences like fines and/or imprisonment.

Read up on the rule of law, it’s a fascinating thing.

“but I imagine that the system was just as rife with fraud during the interbellum, and it recovered from that as well.”

YYes, why not just keeping repeating the grotesque mistakes of the Great Depression over and over (as long as someone’s making bank, eh)? Especially since our “leaders” are trying to out-do it this time around in length if not depth.

Marx, eh? Am i witnessing some kind of fishing expedition?

Why do you imagine the system was rife with fraud during the interbellum? Do you have any basis for that imagination?

Many reasons to go after Green Tree:

http://www.sfreporter.com/santafe/article-4849-this-is-still-going-on_.html

When lenders break the chain of title, they lose all claim on the property in question. Moreover, they should be forced to refund all mortgage payments made after the chain was broken.

Now if they’ve truly stopped breaking the chain of title today, that’s fine. But the fact they’ve broken the law in the past makes them unfit to do business and their corporate charters must be yanked — right after they’ve paid back those mortgage payments.

They should also be frog-marched directly to prison.

I certainly agree with that sentiment. Frog march them away right after they sign over any interest they may have once hoped to claim and force them to give the house, free and clear, to the homeowner and to then take all responsibility for any and all problems in future having to do with a trashed chain of title. Weaselman will never do it though.

Or better yet, directly to the town square to have their heads chopped off!

Speaking of chain of title, these comments I received from a prominent attorney who represents a large title company. He prefers to remain anonymous, thus far:

“Chase, B of A, and presumably others, are now sending out letters of forgiveness of debts on selected seconds (generally involved in short sales as far as I can tell), that absolve the debtor of any further responsibility for their loan balance. The lenders get to credit these amounts against the “settlement” arrived at among the banks and various attorneys general. As junior liens, these would be subject to being foreclosed out if the borrower defaults on the senior encumbrances.

The lenders are required to notify the IRS of this with whatever tax effect there maybe the problem of the borrower, and the credit rating agencies. The lenders are not causing reconveyances of the deeds of trust, nor are they paying recon fees or recording fees. The liens, although unenforceable, will remain as clouds on the title.”

They will remain as clouds on the title because no “mortgagee” can forgive their second loan properly by clearing it off the title without looking at the entire chain. To quiet a title is a long and expensive process. It used to average 6 years and $30,000 in legal fees. I’m sure it is much more difficult now with the MERS fiasco and all the rest of the securitization fraud. This problem is a Gordian Knot.

Nationwide Title Clearing is MERS’ silent partner in all this. NTC needs to be audited too.

We’re going to see a lot of these quiet-title lawsuits in the near future. Anyone buying a house without an absolutely pristine record (no resold mortgages, no post-1990 mortgages) should simply budget $60,000 to quiet the title.

That will keep property prices down, once people notice. :-P

A Gordian knot – where every tangle and snag has been placed there by someone who collects a fee on its existence.

I got a forgiveness letter for my second mortgage from BOA in July. As of the end of Sept the account was reported to the credit bureaus as paid and closed with a zero balance but still no satisfaction has been recorded with the local deed’s office. They were prompt in recording an assignment of mortgage that was filed two days after the date of the forgiveness letter, so I am assuming they would file a satisfaction on record. Then they issued a press release on their website regarding these letters and that does mention a release of the lien (though no mention of it in the actual letter I received). I am giving them till mid-November to file a satisfaction of the mortgage and if it is not done by then, I will follow the laws of my state and demand they do it or be subject to a fine up to the loan amount. I expect to receive a nice e-recorded satisfaction with e-signatures to complement the questionable assignment they already filed.

Green Tree documents are Exhibit A for Lambert’s theory of computer code becoming law.

Easy solution. Make a program that signs with inconsistencies comparable to a human.

The “signatures” appear to be those of one Derrick White. Who is “Lisa Derrick”?

Susan , I think everyone knows the investigations have been a whitewash. Fed and DOJ actions have been to funnel profits to banks while limiting their legal liablilities. This is not capitalism and we’re messing with the secret sauce “property rights” that made the United States a success.

Used to be that signatures on any kind of land document had to be signed in Blue for precisely the reason that a photocopy could be easily made. Looks like that tradition went out the window…

So little time and still so little real understanding between the difference of eNotary and eRecording Vs the inefficiencies of wet signing paper documents. In both cases electronic execution of electronic documents provides significantly more document integrity and security Vs. wet paper signatures. In eNotary, a digitial certificate authenticates who they are, if they are current and authorized to notarize that specific transaction In a paper world you have non of that. Also keeping the transaction electronic provides a complete electronic, (data & time stamp) of who did what through-out the transaction, (chain of tile) again in a paper world you really don’t have any of that. You guys really need to get educated on how the “new” secure eSigning & eNotary technolgies really enforces and solves these issues that in a paper world you cannot

Mr. Beale, improvements in print technology, and its availability to virtually all, has rendered that practice meaningless.

I viewed a number of recently filed satisfaction of mortgage docs in my local records and Bank of America is doing this same practice…both the VP or assistant and the notary are all e-signed. As for digital certificates, who is to say that the person doing the button pushing really is the person whose signature is being affixed? Is it too much work to just sign on a line? I know when I have to have something notarized, I must show my ID and sign in the notary’s presence. Why can’t these banks and title companies be held to the same standard?