In the final hours of the 2012 Presidential campaign, Obama backers have been trumpeting the case for their candidate, and like most electioneering, some of the claims don’t stand up well to scrutiny, particularly regarding the impact of regulations on big financial firm profits.

The normally astute Gillian Tett leads the way by looking at the dramatic headcount cuts and restructuring at UBS, which is largely exiting fixed income, a core business for global banks (note she is not doing this out of fealty to Obama, but some Democratic party stalwarts, such as Paul Krugman and Mike Konczal, have made strong claims regarding the impact of Dodd Frank. So we’ll deal with Tett’s argument first). She sees it as a harbinger for the City, and by extension, Wall Street, and bizarrely blames UBS’s action on “those half-formed Basel, Dodd-Frank and Volcker rules.”

The fact is UBS has been in the crosshairs of its primary regulator, the Swiss National Bank, for some time. Its actions indeed appear to have been major contributors to UBS’s downsizing, but were separate and apart from, and more important for this discussion, more draconian, than any of the other pending rules she cites. Separately, investment banking businesses (securities trading and businesses that have long been aligned, such as mergers & acquisition) are very cyclical. Past downturns that were less severe than the global financial crisis have bitten major Wall Street firms badly. Now that these former stand-alone businesses are mingled in with the broader “banking” industry, which includes the more stable retail banking and asset management businesses, the extreme cyclicality of the trading engine has been missed in the analysis of industry dynamics by casual observers. That’s particularly unfortunate, since it allows banking industry incumbents to peddle their self-serving narrative, that the fall in their profits is due to nasty government interference, as opposed to blowing up their customers en masse and having fewer parties left to fleece.

Back to UBS. The Swiss have good reason to be deadly serious about getting their too big to fail banks under control. The banking sector in Switzerland is so outsized relative to the real economy that the failure of one of its two big banks (Credit Suisse is the other) would send a huge economic shock. When UBS needed to be rescued, the Swiss government set up a vehicle which bought bad UBS assets and funded the vehicle with $25.8 billion of loans. Even though the rescue resulted in billions of dollars of losses, it is widely regarded as a success. The SNB was also alone of all bank regulators in requiring its bailout recipient to hire an outside firm to probe how it had gotten in this fix and publish the results in a report to shareholders.

As a result of this wake-up call, the Swiss decided to impose capital requirements on their biggest banks well above the to-be-implemented (and still being thrashed out) Basel III standards. From a 2011 summary (emphasis ours):

Large Swiss banks are currently required to provide for a capital adequacy target in a range between 50% and 100% above the international minimum requirement (pillar 1) of Basel II. In good times, these banks must increase their capital up to a target level of 200% (100% pillar 1 and 100% pillar 2). These buffers will then be available to the banks during crises up to an intervention level of 150%.

To reduce the likelihood of a systemically important bank becoming insolvent, the TBTF Banking Act Reform Bill proposes that capital adequacy requirements become more stringent. Systemically important banks will need to hold equity of at least 19% of the risk-weighted assets. This equity capital must be divided into three different components (see box, TBTF capital adequacy requirements):Basic requirement. This consists of an equity ratio of 4.5% of the risk-weighted assets (Common Equity).

Capital buffer. This consists of a minimum of another 5.5% of Common Equity and a maximum of 3% contingent convertible bonds (CoCo Bonds). These CoCo Bonds will be converted into equity if the Common Equity falls below 7% of the bank’s risk-weighted assets (debt equity swap).

Progressive component. This consists of a minimum of 6% of the risk-weighted assets. It is made up entirely of CoCo Bonds, which will be converted into equity if the Common Equity falls below 5% of the bank’s risk-weighted assets.

This means that 10% of the risk-weighted assets must be issued by Common Equity and the remaining 9% may consist of CoCo Bonds. These proposals are considerably more stringent than the international standard provided under Basel III. Basel III will implement a capital requirement of 10.5% only, with an additional requirement for systemically important banks of about 1% to 3% of the risk-weighted assets (the latter figures have not yet been agreed).

The 19% figure is simply (wonderfully) breathtaking by international standards. UBS threatened to restructure the bank from a capital/regulatory standpoint and domicile its investment banking operations outside Switzerland, only to find that no sensible central bank would take on such a problem child. This is Richard Smith’s helpful tracking down of how this all played out in timeline form (after reminding him of the importance of the SNB action):

I now read it as a combo of the Swiss not folding on the capital regs, plus the Adebolu thing, plus the crap FI markets.

http://www.distressedvolatility.com/2010/10/swiss-finish-sets-new-standard-for.html Swiss cap reg proposed Oct 2010 but not much talk about it for months.

http://www.reuters.com/article/2011/05/01/swiss-regulation-idUSLDE74007M20110501 Empty threats from UBS about looking for a new domicile, minister has called their bluff.

http://www.reuters.com/article/2011/04/28/ubs-idUSLDE73R0K020110428 Snark from Swiss shareholders about the relocation but in fact by April 2011 (see previous link) Gruebel has already given up on that idea. Oddly the stories about UBS moving (mostly May 2011 onwards) only get started properly after it’s given up on the idea. That will be echoes from other lobbyists elsewhere with their own axes to grind (UK US).http://www.guardian.co.uk/business/2011/sep/18/ubs-shakes-city-again Rogue trader Adebolu blows up

http://www.bloomberg.com/news/2011-09-24/gruebel-quits-as-ubs-chief-ermotti-interim-successor-bank-to-reduce-risk.html Out goes Gruebel. It looks as if he had started to notice that his IB buildup wasn’t going to work but Adebolu nailed him completely.

http://www.ft.com/cms/s/0/5aa094e4-1142-11e1-9d04-00144feabdc0.html#ixzz1e2KcngL4 In comes new bloke with axe to sharpen.Takes a year to sharpen the axe and here we are.

Now let’s go the other part of the Tett narrative, which as someone who has been in and around the industry since 1980 I find truly peculiar. While the aggregate figures from her article, cited below, are accurate (and Simon Johnson has invoked similar statistics regarding the financialization of the economy), it leaves the reader with the misleading picture that the financial services industry, particularly the highly paid end that has been a magnet to the “best and brightest,” has had a linear march upwards from the the late 1970s-early 1980s to now:

Take a look, for example, at some research conducted by a New York based economist, Thomas Philippon, partly in association with Ariell Reshef of the University of Virginia. They chart the fluctuations of American finance since 1880 and show, firstly, how dramatically finance swelled from the late 1970s to today. Jobs in banking multiplied and the financial sector, adjusted for defence spending, rose from 4 per cent of gross domestic product to just under 9 per cent at the peak. Banker pay swelled too: although average banking salaries relative to non-banking professional salaries were almost at parity in the 1950s, by 2007 they were 1.7 times higher.

This masks serious, wrenching downturns in investment banking businesses, meaning the highly paid debt and equity origination/distribution/trading businesses, which traditional commercial banks, by dint of well over a decade of effort, finally colonized. When I joined Goldman in 1981, the firm was not enjoying great earnings and was still shell-shocked from the one-two punch of the major equity bear market of 1973-1974 and the deregulation of commissions. Wall Street was similarly hard-hit by the combo of the end of the stock bull market and takeover boom of the 1980s. First Boston effectively failed in 1988 and was merged into Credit Suisse, which was a not recognized de facto end of Glass Steagall, since this was the merger of a bulge bracket investment bank with a full fledged commercial bank. Employment in M&A, which had been one of the major profit drivers of the previous decade, fell by 75% in 1990-1991. This was also the time when the S&L crisis was ravaging major banks (Citi received its equity infusion from Prince Al Waleed in 1991). In 1994, an unexpected increase in interest rates sent shock waves across Wall Street (necessitating among other things a back door bailout of firms unduly exposed to Mexico, courtesy Robert Rubin raiding the Treasury’s Exchange Stabilization Fund). The resulting derivative losses destroyed more value than the 1987 crash. One of the casualties was Goldman:

But in 1994, substantial investment and trading losses, along with Friedman’s departure (Rubin had left in 1992),precipitated the loss of about 45 partners and their capital. Jon Corzine was elevated from head of fixed income to senior partner and named the head of investment banking, Henry M. (Hank) Paulson, as president. Corzine and Paulson immediately reduced employee headcount and costs by slashing pay and bonuses, stabilizing the firm by the end of 1995. They also put restrictions on the withdrawal of partners’ capital, and replaced Goldman’s traditional partnership structure of unlimited liability with one that named the firm as general partner and named individual partners and equity holders as limited partners.

There is also a key difference between that past, smaller S&L bubble unwind and aftermath: Alan Greenspan engineered a very steep yield curve, which allowed both commercial and investments to earn easy and comparatively low risk “borrow short-lend long” profits. By contrast, the severity of this financial crisis has led the Fed not only to drop short term rates to unheard of low levels, but to flatten the yield curve (via Operation Twist and the purchase of mortgage bonds). While that flattered financial firm balance short term by supporting asset values, it also undermined a lot of low risk traditional income sources (for commercial banks, also simply using customer “float” or money in transit, which can be deployed profitably on a short term basis when interest rates are not in ZIRP land).

Look at what has happened in areas that have not felt the hand of Basel III or Dodd Frank. M&A again is the poster child. Consider this gallows humor from the FT’s Lex column in late September:

Hooray! So far 2012 has been dismal for mergers and acquisitions. According to Mergermarket, activity in the first nine months is 20 per cent below the same period in 2011.

And 2011 was not at all a good year either.

How about private label mortgage backed securitizations? That was a huge profit engine in the bubble just passed, and it is making zip in the way of profit contribution now. There was all of one deal in 2011. The reason, sports fans, is not reregulation, but the lack thereof. As we’ve recounted at some length in this blog, investors were badly burned by the pre-crisis abuses, and they aren’t getting back into the pool ex serious protections, which simply have not been implemented (or enough newbies finally taking the helm at investment firms that memories will have faded, but that will take at least a few years).

Isn’t the Volcker Rule making a difference? It’s hard to say, since rules are still being duked out, and we are strongly of the suspicion that, as before prop desks were spun out as separate activities, that banks will still be able to do a lot of positioning on customer desks. But the opportunities for prop trading profits parallel those for hedge funds, and hedgies have had a lousy last two years, again strongly indicating that it is hard to blame Wall Street’s fading fortunes largely or even meaningfully on new regulations.

Look, for instance, at this earnings recap from October last year (post Dodd Frank) as an illustration:

Goldman Sachs, weighed down by problems in its private equity portfolio and the broader global economic woes, reported a loss of $428 million, compared with a $1.7 billion profit a year ago.

It’s only the second quarterly loss for Goldman since the investment bank went public in 1999.

The company reported a loss of 84 cents a share, worse than analysts’ predictions of a loss of 16 cents, according to Thomson Reuters.

The troubles, which follow similar weakness in the second quarter, underscore the difficult environment for investment banks. Goldman, widely considered the savviest trading firm on Wall Street, had a significant revenue drop in crucial divisions like fixed income and investment banking amid the market turmoil.

The firm got whacked by negative net revenue of $2.48 billion in the investing and lending group. The results included a $1.05 billion hit on its private equity investment in the Industrial and Commercial Bank of China, a strategic investment made in 2006; I.C.B.C. stock fell roughly 35 percent in the quarter. The firm also booked net losses of roughly $1 billion related to equities, on top of net losses $907 million in debt positions.

“Our results were significantly impacted by the environment, and we were disappointed to record a loss in the quarter,” Lloyd C. Blankfein, Goldman’s chief executive, said in a statement.

None of the causes cited has squat to do with regulations. And we have not even gotten to other factors, such as how the rise of HFT has led retail investors, a good source of bread and butter profits, to withdraw from trading.

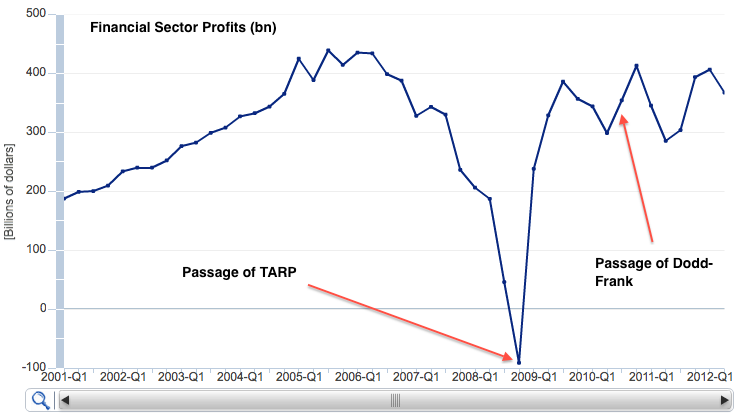

The broader picture of the financial services industry similarly does not paint the picture that the Democrats would like you to believe, that the passage of Dodd Frank has been the driver of Wall Street’s fallen fortunes. Via e-mail from Matt Stoller:

His comment:

TARP (which is really shorthand for the bailouts, it means TARP and HERA, which is the bill that bailed out Fannie and Freddie, which was passed at roughly the same time) is correlated with a spike in financial profits. Dodd-Frank is correlated with… nothing.

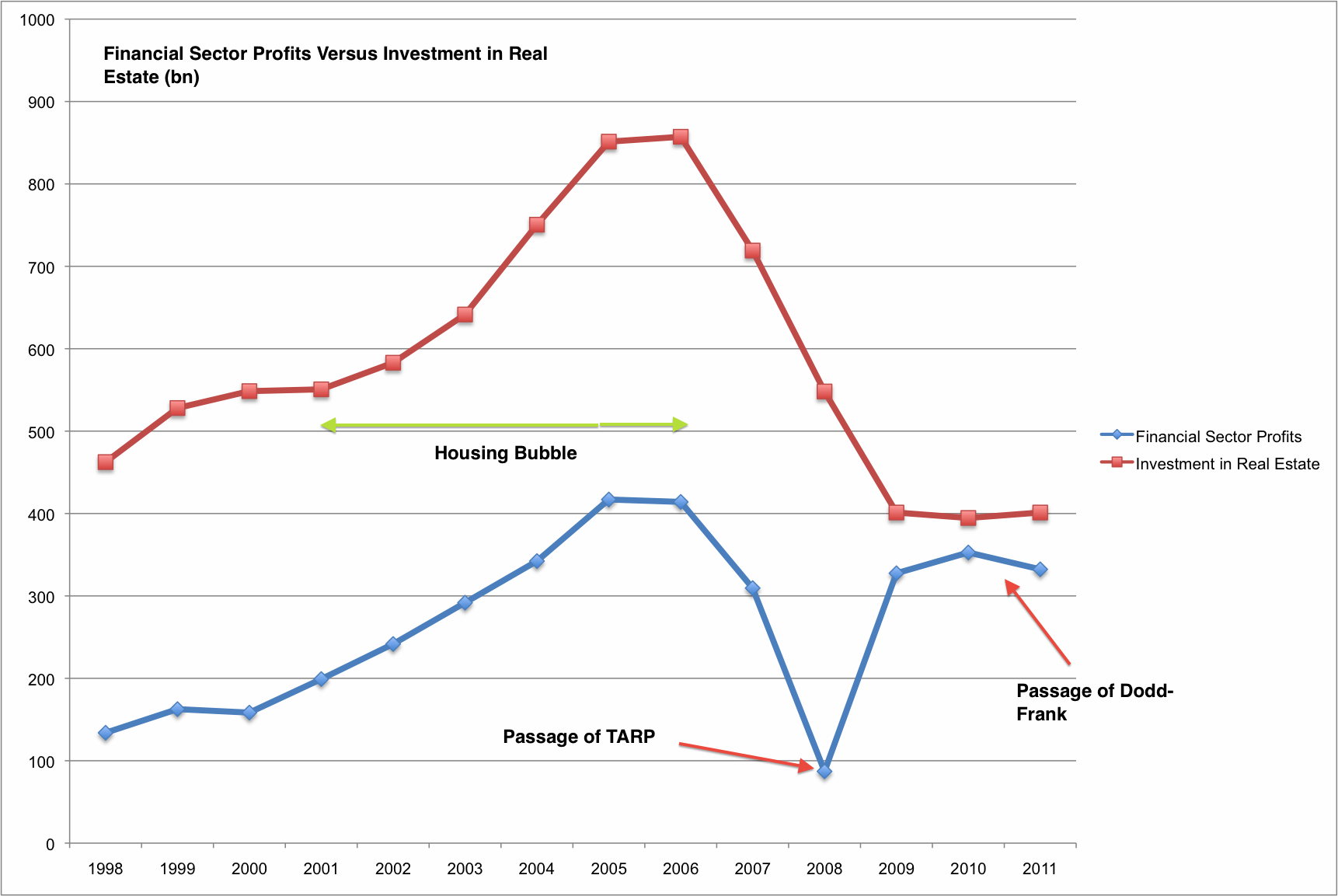

Stoller’s second analysis shows the strong correlation of financial services earnings with the housing bubble (click to enlarge):

This chart reveals that financial sector profits are actually still at 2004 bubble levels, and that the profit increases and declines are correlated with the bubble and TARP, not Dodd-Frank.

This is a major topic, and we’ll be returning to it, but there is one big takeaway: in trying to bolster the case for Obama, Democrats are unwittingly carrying the financial services industry’s water in blaming new regulations for their crappy profits, when the direct consequences of the crisis they created is far and away the biggest culprit.

My banker friend never stops whining about Dodd Frank. She claims it destroys her mega bank’s return on equity. I remind her that her bank has no equity, that its balance sheet is simply fiction enabled by the Fed. Oh, no, she says, that’s just Citi and JP Morgan. Yeah, sure.

What’s her phone number? hahah.

Heads of the Fed & Treasury like few big banks. First it’s easier to get things done, you get a few guys together and deals are made so monetary policy and such is easier to get done, second they can’t see the small and medium banks, all they see is the competition with German Deutche Bank or British Barclays etc. That a concentrated banking sector means inefficient markets and reduce competition doesn’t even register.

The heads of the Fed and Treasury are captured regulators, doing the banks’ bidding instead of their jobs. We can see their actions as the policies and preferences of the moneyed class.

The good of the public would be served by small retail entities doing banking as a utility. It’s likely the private financial firms are shooting for monopoly position. JP Morgan, at the beginning of the century, found his profits grew the more of the finance industry he controlled.

And, financial firm CEOs running the world would appeal to their egos. To quote the American sage B. Springsteen, “Poor man wants to be rich, Rich man wants to be king.”

Laborers knowing that science and invention have increased enormously the power of labor, cannot understand why they do not receive more of the increased product, and accuse capital of withholding it. The employer, finding it increasingly difficult to make both ends meet, accuses labor of shirking. Thus suspicion is aroused, distrust follows, and soon both are angry and struggling for mastery.

It is not the man who gives employment to labor that does harm. The mischief comes from the man who does not give employment. Every factory, every store, every building, every bit of wealth in any shape requires labor in its creation. The more wealth created the more labor employed, the higher wages and lower prices.

But while some men employ labor and produce wealth, others speculate in lands and resources required for production, and without employing labor or producing wealth they secure a large part of the wealth others produce. What they get without producing, labor and capital produce without getting. That is why labor and capital quarrel. But the quarrel should not be between labor and capital, but between the non-producing speculator on the one hand and labor and capital on the other.

Co-operation between employer and employee will lead to more friendly relations and a better understanding, and will hasten the day when they will see that their interests are mutual. As long as they stand apart and permit the non-producing, non-employing exploiter to make each think the other is his enemy, the speculator will prey upon both.

Co-operating friends, when they fully realize the source of their troubles will find at hand a simple and effective cure: The removal of taxes from industry, and the taxing of privilege and monopoly. Remove the heavy burdens of government from those who employ labor and produce wealth, and lay them upon those who enrich themselves without employing labor or producing wealth.

Legal Gambling

The gloom is fading from the real estate situation. More nibbles during the last few weeks than the last three years. If January brings us good rains, this next year will open the door to the sunshine – a case of rain bringing the sun.

It is to be hoped, however, that there will never be another boom. The crash of the boom of 1923 was due to the same causes that wrecked the wall street stock market. People sold what they did not own. They made a payment down in the hope of getting the property off their hands before it began to burn. Real estate fell into the hands of sharp-shooting gamblers who had no interest in land. To them it was just a pile of blue chips on a roulette wheel.

Oh, dear. Where to start…

Management exploitation of labor has a long and honored history in American business. Southern apologists for human slavery pointed to starvation wages and unfair employment practices in the Northern factories. Unions were born not from academic discussion or Sunday sermons, but at the end of gunfights, riots, and legal oppression that backed and extended management private army rule.

To get a management job in an American corporation, one of the base requirements is called a “view qualification.” Simply put, does the applicants have the correct view of the importance of management and the dismissal of labor. Any graduate of a business school has been thoroughly vetted for pro-capital, anti-labor bias. It’s Darwinian: any who don’t obey capital don’t get degrees, don’t get jobs, don’t join the servants of capital.

And, of course, management is the main loser in automation. Most of their functions can be replaced by software and networks. Yet, most of the current efforts become an attack on labor, not usually automation, but immigration, foreign workers, offshoring, contract temps, legal union busting, differential labor agreements, piling on the work, etc.

Management-labor relationships are low-trust, and will continue to be so. For many good reasons.

The idea of excusing corporations from taxes is underhanded. Corporations get social benefits of defense, educated workers, a legal system, etc. Not paying taxes makes those benefits a public subsidy for private gain.

And I’m not sure the distinction between capital and non-productive capital. The theory of the current structure has management the servants of capital, while in reality ownership is diluted into non-issue servants of professional management. Unless Bain or someone like them gains legal control and then the place is looted for all value. The difference is between slow bleeding and a quick slash.

Putting labor and management on the same side, say, in an ESOP, sounds good on paper. But it takes a culture change that nobody’s trying to call forth. Look what happened to the ESOPs in the 1980’s.

Three or four years ago I ran across a blog page about a quotation from Adam Smith. Can’t remember if it was from “Wealth Of Nations” or “Theory Of Moral Sentiments”, but it was the observation that employers typically felt mortally offended if workers spoke to them as equals. They felt so much better dealing with slaves. Sorry for not tracking this down, the blog author (and I) felt this obsrvation of human nature was more important than the spurious references to “the invisible hand” that we usually get.

One of the sadder things about this Ongoing Transfer of the Middle Incomed Wealth to the coffers of the One Percent: in my neighborhood many people hold mrgages that are underwater. And what is especially sad is that in all cases, where people have actually lost their home, they had found buyers for the home, which would have given the bankers 2/3 of the original 2005 price of the home. Now the banks own the home, as they weren’t willing to take the loss. (Even though these losses have been insured against.)

Are these homes going onthe rental market? Of course not. The bankers are holding them until they all decide that rental prices have gone through the roof. Then and only then will these homes be rented out. However right now, there are three houses for every person now living in their van, or their parents’ basement.

The only thing keeping me sane is that there have been third party candidates, whose debates can be heard and who have decent ideas. But the two Major PArty Candidates, both of whom are indeed planning on genocidal “tweaks” regarding Social Security, are both fascists, and it is the willingnes of most Americans to accept Fascism Lite over Total Fascism.

Ah, but did the firm handling the loan make a profit by evicting the former owner rather than do a deal? Did insurance cover foreclosure, but not a re-negotiation of the original loan, or forgiving part of the principal?

is Phil Graham still around serving on the UBS Board maybe he can help

Sweden wants to do similar things like the Swiss have done. However, as Sweden is part of the EU there is a complication. According to the stenographic notes from the responsible committee in Sweden the EU says that Sweden can NOT use legal means to force banks to have larger buffers. The reason: EU competition laws.

So, even though the Swedish people, the Swedish parliament and the Swedish government want to enact legislation to reduce the risk and possible harm of a banking crisis it is not yet possible to do so. Negotiations are ongoing, it will be informative to see whose interests are deemed to be most important: The possibility of high short term return on equity for banks or financial stability.

But … but … it’s all Bush’s fault. I mean … gee whiz … Obama is for the little guy isn’t he?

A vote for Obama … or Romnay … is a vote for the status quo. You know … helping the rich get richer by transferring (our) wealth via bailouts and the Bernanke Federal Reserve.

Vote for Gary Johnson and at least demonstrate that not everybody believes their horse manure.

Financial regulation? Enforce the laws already on the books and these yahoos will have a real personal understanding of moral hazard.

Vote for someone who doesn’t believe he can start a war whenever he wants, spy on whomever he wants, and imprison or kill anyone he wants? Crazy suggestion!

The bigger issue is Western economies, including the United States, playing to lose by allowing predatory private bank debt lending to undermine their real economies whilst state capitalist banks in China issue debt at close to zero or at zero interest rates whilst also regularly rolling-over or cancelling that debt which has allowed much higher growth rates over the last thirty odd years and will continue to do so. See NotProgressive’s comment on ParaPundit article:-

http://www.parapundit.com/archives/007840.html

In the third decade of this century Communist China will take over from the United States as the world’s superpower and if you think that’s a good idea you don’t know much about human nature!

I was going to ask about Krugman’s assertion that Dodd-Frank sent a shockwave across the financial industry. That certainly doesn’t mesh with everything else I’ve read about it.

So many good liberals have decided to carry water for the right-wing Obama administration. They must be terrified at the thought of a Mormon president or something. It’s a shame, to say the least.

OFF TOPIC …. BUT TIMELY

If you haven’t figured it out by now …. your corporate candidates are geoengineering another storm for New York….. Bains Weather Channel and corporate/gov agencies are puttin the hurt on about 1/3 of the countries population in a fight over votes? Really?

After spending a summer suffering under a geoengineered induced drought, we are greeted with deliberate FU storms before the election and knowledge that our TBTF banks have failed. Don’t worry … Geoengineering has cost what 30 billion in crop loss and another 30 billion in hurricane damage? That’s a 60 billion dollar bailout for the banksters…and they are not done with the Geoengineered Holocaust.

Is NY going to fight back or keep taking it?

Or do you see and agree to the benefit of getting wiped off the face of the earth so the bernake and wallstreet mouseoles can move the market along?

Hopefully this will help…..

Hurricane Sandy Under Aerosol Geoengineering by DHS to Modify Intensity and Land-fall?

The confirmed aerosol geoengineering, deliberate manipulation

and potential intensification of Hurricane Sandy under the DHS H.A.M.P.

operation, could be prosecuted as criminal act when the consequence

cannot be distinguished from a Weapon of Mass Destruction to be

inflicted on the lives and property of citizens of the United Sates by

DHS’s deliberate and covert experimental modification.

see here: http://theintelhub.com/2012/10…

************

Meteorologist around the country are gathering and presenting evidence

that hurricane Sandy was an orchestrated event by the US government. In

the first video meteorologist show and explain how hurricane Sandy is

manipulated from its conception.

see here: http://www.realistnews.net/Thr…

You actually don’t say anything in the post about Krugman or Konczal. Was the post truncated for some reason?

I’m at a bit of a loss to understand your beef. The piece describes at considerable length how the fall in bank industry profits has nothing to do with Dodd Frank, which is contrary to the position of its backers, that the bill had significant effects on the economics of the TBTF banks (which were the focus of the legislation).

1. There is nothing to address with Krugman. If you look at the linked piece, it simply has an assertion re the impact of Dodd Frank, no backup. There is no argument to rebut. It’s hard to parse handwaving.

2. I may get to Konczal later, but the discussion of the cyclicality of trading/investment banking profits and the Stoller charts rebut Konczal’s position that Dodd Frank is significant.

And if you really want further discussion: First, Konczal talks about the impact of swap clearing. This is bullshit because that has NOT happened, and there is no assurance that it will happen. . One of the huge defects of Dodd Frank is that so much of it was kicked over to studies and detailed reg design. This gave the industry the opportunity to have a second go at it, which they are using to full advantage to weaken and limit the scope of any rule changes. Second, the $4 to $4.5 billion in swap revenues (which is across ALL banks, and European banks are big players in the dollar swaps market) simply isn’t all that big a deal even if it does happen. Swaps are a plain-vanilla, low margin product. And contrast that $4 to $4.5 billion (across the major dollar players, the 19 or so primary dealers) of a low profit, mature product v. Citi’s last QUARTER revenues fo $14 billion. This is not as big a deal as Konczal would have you believe. Third, Konczal discusses the impact of the Durbin amendment, as in the changes in interchange fees. As critics point out, this was not part of the intent of Dodd Frank, which was to address TBTF, and the Durbin amendment was slipped in at the 11th hour. The only reason it survived similarly has pretty much bupkis to do with Obama, it was a protracted Alien v. Predator fight between retailers and the banks and the retailers largely won.

I love that metaphor. Unfortunately, the Alien vs Predator movies ended with the whole place being blown up, killing all the innocent human bystanders.

Here’s Krugman making a doubtful claim that reforms by the Democrats “undermine” some parts of the finance business:

http://krugman.blogs.nytimes.com/2012/11/02/dewey-cheatham-and-howe-for-romney/

I don’t know. Like I said, I haven’t heard of anyone doing anything differently because of Dodd Frank. I’d love to hear what Prof. Krugman thinks he or we are going to get in return for his support of Obama.

adding: I guess that linked post is just handwaving, too. There’s no there there.

Upping capital requirements on the biggest does not in itself shrink the giants. Some lucky (read powerful) financial “utilities” even got access to the Fed’s discount window, even while eluding the Act’s wind-down provisions (see http://bit.ly/Vr3efE for analysis on Morgenson’s piece in the NYT). You would agree with her argument.

You are right. We are scared to admit the underlying truth – which I guess is that our banksters are as mad as Mao starving his people with dreams of turning their grain into a new Chinese Navy for a Chinese world empire. We don’t need this centralisation of finance – but what is the realistic alternative given 100 years of failure in establishing democratic foreign policy. Churchill was unseated in his own constituency in the 1920s by someone standing on this platform. Look at the opposition now.

Yves,

I assume you mean US RMBS issuance, as there was quite a few issues in UK/Europe/ROTW. And investors definitely want more – hey, they even started to ask for buy-to-let issuances as to get more yield (the hunt for yield is on again, who knows what consequences it will have this time…)

One of the impacts of Funding For Lending Scheme (FLS) is that there’s likely less RMBS issuance from UK, of which quite a bit was USD issuance, which already driven spreads on new RMBS issues to sub 100bp over LIBOR.

I have been exploring for a little for any high-quality articles or weblog posts on this sort of area . Exploring in Yahoo I ultimately stumbled upon this website. Studying this information So i’m satisfied to show that I have an incredibly excellent uncanny feeling I discovered just what I needed. I most indubitably will make certain to do not overlook this website and give it a look on a constant basis.