Last month, I criticized the well meaning but naive strategy of the Occupy Wall Street group Strike Debt for dealing with consumer debt, which is to buy severely discounted debt from debt collectors and forgive it. My main complaint was that there were more productive approaches, such as wider publicity and distribution of the Debt Resistors’ Operations Manual, providing more counseling and legal support to borrowers, and using debt purchases to develop cases against the debt sellers. By contrast, the Rolling Jubilee increases the profitability of bad system by providing more revenues to the incumbents, while the debt purchases are unlikely to do more than help a few random people. It might make for feel-good PR, but it won’t make a dent in the problem.

Perversely the post got pushback on the last (and by implication, the least important) issue raised, namely, that of possible tax problems with the scheme. I wanted to revisit this issue and demonstrate why the responses of allies and members of Strike Debt have failed to put the issue to rest, and more important, why this matters.

The short version is that Strike Debt maintains that there is no risk here, when as we will demonstrate, the outcome is not knowable at this juncture (yes, that is unsatisfying, but welcome to the world of tax). It’s possible that things will work out just fine for the Rolling Jubilee. But if not, the ramifications to Strike Debt and the borrowers whose debt was cancelled would be significant. Thus, to dismiss this very real possibility is irresponsible.

Tax issues are nerdy. You need to be prepared to read this entire post, carefully. Go get some coffee or a cola. I’m planning to box readers about the ears if they raise issues that were addressed in the post.

To review: normally, the cancellation of indebtedness is treated as income unless the party is in bankruptcy or can establish that they are insolvent. Strike Debt claims they do not need to issue 1099-Cs, the usually-required notification to the IRS that debt has been forgiven. They further claim that they have “double checked” with the IRS on this matter. In addition, Strike Debt is conducting its activities through a 501 (c)(4), which is a form of tax exempt organization (a “Civic League and Social Welfare Organization”). As we will also discuss, its debt forgiveness plan also appears to run afoul of the IRS’s published requirements for a 501 (c)(4).

Why the Tax Risk is Real, and Strike Debt’s Due Diligence is Inadequate

While the Rolling Jubilee site currently does not discuss the tax implications for borrowers whose debt has been forgiven, the Strike Debt scheme rests fundamentally on the idea that their cancellation of debt can be construed as a gift. (note that the site previously stated, “a project like this …will almost certainly have no effect on anyone’s taxes.”). Otherwise, borrowers will have to report the cancelled debt as income, which in many cases would require them to pay more in taxes. And this issue is binary: a transfer is either a gift or it is income.

It is important to understand that issue separate from whether Rolling Jubilee has an obligation to report to the IRS on debt cancellations (as in the borrower liability for taxes is independent of whether the income is reported).

It is also important to understand that this is a novel tax argument. Allies of Strike Debt claim the movement has “double checked” with IRS on the impact of their plan on debtors, but this statement is a sign of inadequate tax knowledge. The only type of reading from the IRS that can be relied upon is a written opinion, known as a ruling.

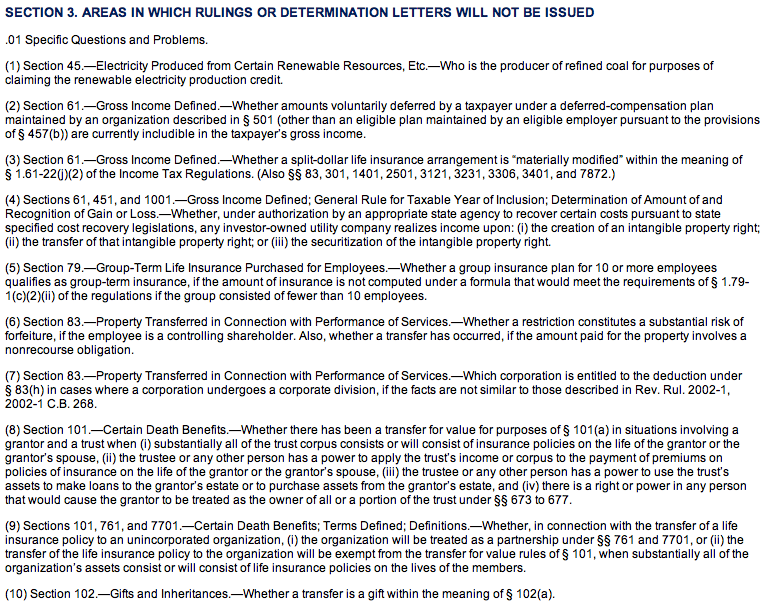

Yet the IRS has always included the question of whether a transfer is a gift (and a cancellation of debt is a transfer) on their annual published list of questions on which it will not issue a ruling. Moreover, even if Rolling Jubilee had been able to get a ruling, a ruling is valid ONLY for the party requesting it. Thus Rolling Jubilee could not obtain a ruling as to the tax implications for borrowers; it can get rulings only regarding its own tax matters.

Thus whatever view Strike Debt got from the IRS on the gift question (I’d hazard from a phone rep) is irrelevant. The agents that answer the call center lines are not lawyers, have only 20 hours of training, and their job is to answer routine questions, like whether points on your mortgage are tax deductible, not novel and complex tax issues. Even so, they have been found to give incorrect answers 20% to 30% of the time on everyday tax matters (see here, here and here). Relying on bad tax advice from IRS does not relieve the taxpayer of the consequences, such as filing late, owing penalties or more tax.

Below is the 2012 IRS “no ruling” list, see item 10:

We need to underscore the basic problem: Strike Debt issue is an extraordinary question involving a rare intersection of incompatible rules. No one gives phone answers to complex questions like that, not just in the IRS but in general.

Sophisticated taxpayers get tax opinions from law firms with recognized expertise in tax matters, or ask for rulings from IRS (a non-starter here), or document their positions with heavily researched memos. Rolling Jubilee should get one of its sympathetic celebrites to write a check to a serious tax lawyer to take a proper look.

Now it may be that Strike Debt has confused the issue of whether it needs to file 1099-Cs with the question of borrower tax liability. Rolling Jubilee has this cheery language in its FAQ:

Will the Rolling Jubilee have to file a 1099-C Cancellation of Debt form with the IRS?

No. The Rolling Jubilee will earn no income from the lending of money and is therefore exempt from filing a Form 1099-C under the Internal Revenue Code Section 6050P.

As one tax attorney wrote:

Now, this isn’t the end of the story in my mind–the form is just a form, and the IRS is very clear on that same page that COD [cancellation of debt] income is owed even if no form is required, just like you still have to pay tax on income even if you (for various reasons) never got a 1099-DIV/INT/etc. In fact, if there is COD income but no form, I’d actually be *more* pissed at Strike Debt, because they imply (but do not legally state) that there is no COD income, thus leaving the COD cancellation recipients hanging in the wind when the IRS comes tapping on audit (the argument “I saw it on an Occupy website and that’s why I didn’t pay taxes” has exactly zero legal bearing on audit).

And the IRS does audit about 1% of the people making under $200,000 a year. (Their position on not being required to issue 1099-Cs is also debatable*, but that’s not germane to the thrust of this post).

There are at least two reasons why the transfer might be deemed to be income rather than a gift. The first is that Rolling Jubilee, by buying debt, is participating in a commercial activity. The second is that the IRS has very stringent notions of who proper recipients of gifts are. Middle class individuals are not seen by the IRS as proper recipients of charity.

We discussed the “commercial activity” issue in our earlier post:

…it’s problematic when the giver of the gift is the holder of the debt, standing in the shoes of the lender. That makes it look a lot like straight-up debt forgiveness. And the “abolish” language that Strike Debt has used in its literature is consistent with that characterization.

There was a temporary mortgage relief provision enacted in 2007 that expires in 2013. The existence of that exception reinforces the view that debt cancellation = income unless a specific exception applies (section 108(a)(1)(E)). Especially since many mortgages are held by investors who are not the original lender.

Here is what the IRS says about debt cancellation by gift (1995 Market Segment Specialization paper for grain farmers):

Cancellation by Gift (IRC section 102)

Gifts or bequests are excluded from gross income. Congress recognized that the presence of donative intent on the part of the creditor is difficult (if not impossible) to establish in a business setting. The committee reports accompanying the Bankruptcy Tax Act of 1980 state: “*** it is intended that there will not be any gift exception in a commercial context (such as, a shareholder-corporation relationship) to the general rule that income is realized on discharge of indebtedness.” Thus, the gift exception generally applies only in noncommercial contexts.

OWS is relying on the notion that they are organized as a not for profit and is not making money as a lender, hence this make their activity noncommericial. The sale of debt is a commercial activity. When OWS purchases debt, it enters into a commercial relationship with the debtor. OWS would have to overcome the IRS interpetation of legislative intent that there can be no gift in a commercial context. Case law requires detached and disinterested generosity on the part of the donor for a gift.

Moreover, middle class borrowers are not considered a proper charitable class under the tax law. For instance, see this language from a summary of a 2011 IRS private letter ruling. Notice the use of the word “exclusively”:

The IRS observed that it has previously held that helping low income persons obtain adequate and affordable housing can constitute a charitable purpose, but that similar activities to assist moderate income home buyers and owners may not serve a charitable class. The Service further noted that if a purportedly charitable organization operates in an essentially commercial manner, it may be determined to be operated for a non-exempt commercial purpose, rather than for a tax-exempt purpose….

In the current case, the Service determined that the organization did not operate exclusively for an exempt purpose as described in IRC § 501(c)(3). The reasons for this conclusion included the following:

The organization was not operated primarily for the benefit of a charitable class. It did not screen applicants for participation in the DPA program on the basis of income, and did not target the program to areas that were needy of such assistance, such as residential areas experiencing deterioration of living conditions, or suffering from discrimination and prejudice or neighborhood tensions.

Readers may contend that the people being pursued by debt collectors are ones that were unable to pay off their creditors, ergo they must be poor or under financial stress. That isn’t necessarily so. Chase employee Linda Almonte was fired for objecting to the sale of 23,000 loans in which there was a major error in 60%, either in the amount owed or whether a judge had ruled in favor of the bank. Banks are known to sell disputed debt, debt discharged in bankruptcy, debt close to or past the statute of limitations, or where they can’t successfully find borrower wages or bank accounts to garnish. Given that the debt in many cases is old (it has often been traded several times), a borrower could have gone through a rough patch, stared a creditor down, and now is in better financial shape. (Update/clarification: the governing idea is that the test here is income, whether or not the borrower is under financial stress. In other words, if you have moderate income, even if you are up to your eyeballs in debt through no fault of your own, it appears the IRS will not regard your financial duress as making you a suitable case for charity. Note that this is a different notion than under cancellation of debt, where being in bankruptcy or fitting the IRS definition of insolvency IS an out from having the cancelled debt included as income).

The real issue here is that Strike Debt will be buying the debt blind. It would be an operational nightmare to try to track down borrowers to ascertain their current financial status, and even if Strike Debt found them, there’s no assurance they’d cooperate in answering intrusive questions about their financial condition. And Rolling Jubilee has never conceptualized this program as being about helping poor people but helping the indebted. Its site proclaims: “Think of it as a bailout of the 99% by the 99%.” This may be admirable, but the 99% is a much bigger cohort than low income individuals.

“Oh, the IRS Won’t Go After This”

Some supporters of Rolling Jubilee have argued that either the IRS won’t find out about the debt forgiveness or won’t intervene because it would look silly and OWS would ridicule them in public. I have to tell you, these are remarkably naive viewpoints.

The IRS reads the newspapers. The Treasury Department separately maintains a news clipping service. The IRS also pays whistleblower bounties and performs audits. Rolling Jubilee has hardly been secretive about its plans. The IRS could ask Rolling Jubilee whose debt was forgiven.

And even if the IRS does not act immediately, that is no assurance that Strike Debt is in the clear. Gretchen Morgenson’s column two weeks ago dealt with a case where the IRS weighed in on an issue years after it was raised in the media. The statute of limitations on individual Federal income tax returns is three year after the filing date, so any debts forgiven in 2013 are exposed to the IRS questioning treatment of the cancellation of debt through 2017.

As for the “oh, they wouldn’t dare,” are you kidding? Being in the tax collection business means doing things that are not popular every day of the week. The IRS routinely goes after people who win cars on game shows, with the typical result that the taxpayer has to sell the car to pay the taxes owed. Similarly, the IRS recently denied tax exempt status to an organization formed to give debt counseling to troubled homeowners. Being involved in a worthy cause does not mean you can flout the rules.

The Use of a 501 (c)(4) is Also Problematic

Rolling Jubilee is using a 501 (c)(4), which is a form of tax exempt organization used for “social welfare” purposes, which can include lobbying and political activities as long as they are primarily for the promotion of social welfare. However, the debt buying scheme appears to run afoul of the “private benefit” rule. From the IRS discussion of 501 (c)(4)s:

To qualify for exemption under section 501(c)(4), the organization’s net earnings must be devoted only to charitable, educational, or recreational purposes. In addition, no part of the organization’s net earnings can inure to the benefit of any private shareholder or individual.

Forgiving someone’s debt could be a violation of the private benefit rule. Middle class debtors are not a charitable class. Generally, individuals must be poor or distressed to constitute a charitable class. This discussion underscores the idea that only minor exceptions are permitted:

Although charitable and certain other types of tax-exempt organizations may provide benefits to private individuals, benefits of this nature must — to avoid jeopardizing tax-exempt status — be incidental both quantitatively and qualitatively in relation to the furthering of tax-exempt purposes. To be quantitatively incidental, the private benefit must be insubstantial when measured in the context of the overall tax-exempt benefit conferred by the activity. To be qualitatively incidental, private benefit must be a necessary concomitant of the exempt activity, in that the exempt objectives cannot be achieved without necessarily benefiting certain private individuals.

Nor would winning on the gift question save it from running afoul of the private benefit question. A transfer without consideration to a private individual who is not poor or distressed is a private benefit. The IRS recently revoked the exemption of an organization that provided down payment assistance because it did not restrict those gifts to lower-income buyers. If it were to lose its 501 (c)(4) status, Rolling Jubilee would owe additional taxes and penalties.

What Would the Consequences Be if Rolling Jubilee Loses Its Tax Argument?

If Rolling Jubilee’s tax position is incorrect, the consequences would be ugly. In many cases, the people it claimed it was helping would be worse off than if it had done nothing.

The forgiven debt would be treated as taxable income. If the individual is a non-taxpayer (as in has too little income) the debt forgiveness could push them into owning taxes, and for anyone who was a taxpayer in the year the debt was forgiven, would result in additional taxes owed.

The worst of this is that in many cases, the debt forgiven by OWS would be invalid debt: past the statute of limitations, discharged in bankruptcy, disputed, paid off but for some reason not removed from a bank’s systems. In these cases, if Rolling Jubilee’s tax view turns out to be incorrect, the borrower will be considerably worse off, since he could have disputed the invalid debt (and debt collectors tend to roll easily) but will now have to disprove the validity of the debt to the IRS. The result is that this shifts the burden of proof: in debt collection matters, the burden of proof is on the plaintiff, the debt collector, to demonstrate the validity of the debt and the amount owed. In disputes with the IRS, the burden of proof is with the taxpayer.

In addition, even if Strike Debt is correct in its gift argument, it would in some cases owe gift taxes. It does not appear prepared for this eventuality. Nor would winning on the gift question save it from running afoul of the private benefit question. Even a gift to an individual is a private benefit. If it were to lose its 501 (c)(4) status, Rolling Jubilee would owe additional taxes and penalties.

* * *

What has been most disturbing about bring up these issues is the defensive, even angry, reactions to raising legitimate questions about the tax issues. What Strike Debt is doing is analogous to someone who has found a chemical that kills cancer cells in a petri dish. Rather than do animal studies, or even do a lit search on whether this compound is toxic, they’ve proposed to go directly to putting it in the water of individuals who have neither been informed of nor given their consent to this procedure.

The previous post was analogous to saying there don’t seem to be any human studies on this particular compound, but similar compounds have caused adverse reactions. Rather than do further research or get patient/borrower consent, or hold a reserve for tax litigation and paying the taxes of adversely affected borrowers, Strike Debt’s allies instead are shooting the messengers.

This attitude is shocking. This OWS scheme has the potential to make the people it says it wants to help worse off than if it had done nothing. As discussed longer form in the earlier post, it has other courses of action open to it that would help them combat predatory debt collectors with no downside risk. Nor does it appear to be doing any contingency planning for possible adverse outcomes. But rather than do the responsible thing, undertake a proper investigation, and make course corrections if needed, Strike Debt appears more concerned about preserving its image with its celebrity backers than the welfare of debtors it says it wants to help.

––––

* The language in the FAQ suggests that Strike Debt is taking the position it will earn no income from its debt purchases. As remarkable as it may sound, the question of whether uncollectible interest is income is not a settled tax question.

The IRS does provide for a safe harbor from providing 1099-Cs:

(b) Safe harbors—(1) Organizations not subject to section 6050P in the previous calendar year. For an organization that was not required to report under section 6050P in the previous calendar year, the lending of money is not treated as a significant trade or business for the calendar year in which the lending occurs if gross income from lending money (as described in paragraph (d) of this section) in the organization’s most recent test year (as defined in paragraph (f) of this section) is both less than $5 million and less than 15 percent of the organization’s gross income for that test year.

But “Gross income from lending of money” in (d) includes:

(1) Income from interest, including qualified stated interest, original issue discount, and market discount;

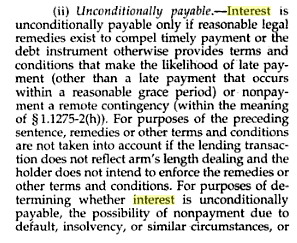

And the latest definition of “qualified stated interest” I could unearth quickly (2007 regs), this section emphasizes that it hinges on the contractual right to receive interest, and to ignore the possibility of non-payment:

While this discussion of case law does indicate this issue is not straightforward, the part that raises a hurdle Strike Debt is that mere non payment of interest or distressed market value is not proof of noncollectibility. And remember, if the debt in question does not meet the IRS standard of noncollectibility, interest accrues, which means Strike Debt may have interest income:

In Jones Lumber Co., 404 F.2d 764 (6th Cir. 1968), the court required an accrual-method taxpayer to recognize interest income because the taxpayer failed to provide evidence demonstrating “reasonable doubt as to the collectibility of the notes” due to the financial condition or insolvency of the debtor (doubtful collectibility). Even though the loans had no ascertainable fair market value, the taxpayer was required to accrue interest because there must be “a definite showing that the insolvency of the debtor makes receipt improbable.” (See also Georgia School-Book Depository Inc., 1 T.C. 463 (1943)).

Such a “definite showing” must provide that doubt relates to a permanent uncollectibility, according to the U.S. Court of Claims in Koehring Co., 421 F.2d 715 (Ct. Cl. 1970). The court held that a taxpayer must accrue income despite the payor’s financial problems that resulted in nonpayment when payments were due. The taxpayer regarded the obligor’s financial problems as temporary, and such financial problems did not affect the taxpayer’s expectation that it would eventually receive payment. (See also European Amer. Bank and Trust Co., 20 Cl. Ct. 594 (1990), aff’d per curiam, 940 F.2d 677 (Fed. Cir. 1991): “For accrual of income to be prevented, uncertainty as to collection must be substantial, and not simply technical in nature.”)

Establishing its position on the subject, the IRS issued Rev. Rul. 80-361, confirming that a taxpayer need not recognize interest in circumstances for which there is doubtful collectibility of such interest (the doubtful collectibility exception). In the ruling, a taxpayer may stop recognizing interest as it accrues when a borrower becomes insolvent. Most notable in the ruling, the Service differentiated between interest related to the period before the borrower became insolvent and interest related to the period after the borrower became insolvent. The IRS ruled that the lender must recognize interest prior to the borrower’s insolvency as it accrues, and such interest could be subject to section 166 as a bad debt deduction in the event of uncollectibility.

Let’s do a little math. The Rolling Jubilee site shows that they assume they will be buying debt at 5 cents on the dollar (see their front page, the ratio of the debt forgiven to the amount they have raised so far). And let’s assume that the average interest rate on the debt is 15%. That’s conservative: it will probably be higher. You can hardly get a rate below 12% even if you are current and have decent on unsecured consumer borrowing, ex a short term teaser offer.

At $500,000 of donations (I’m assuming that counts as income) they can buy $10 million of debt. That $500,000 has to be at least 85% of total income per the test of this section. So the most they can have in qualified stated interest is $88,235. That’s 5.88% of the assumed level of qualified interest $88,235/1,500,000). They have to extinguish the debt in 21 days or they might have a problem.

And this, sport fans, is why they should have a heavyweight tax professional look at these issues. Even if there is a problem here, it appears it could be addressed simply by making sure that when Strike Debt acquires debt, they go through whatever steps they need to take to forgive the debt promptly. As a volunteer organization, they might not take simple steps to eliminate possible risk, which in this case might be to process debt cancellations expeditiously, if they don’t realize there is reason to.

Question: If I buy a debt of 10,000 from the creditor for 10.00, the actual value of that debt is now $10.00. Would it be considered “forgiveness” if I simply collect what I paid for it?

Yes – that’s still debt forgiveness

And if the debtor bought their own debt and never collected it?

Yeah, yeah — I know, just don’t feed the debt trolls. But still, for argument’s sake, would it be tax-kosher to buy your own debt and not collect it?

Every debt is someone else’s asset keep that in mind. However here’s a new SCAM this would once again bail out the banks at Taxpayers expense!

$1 Trillion Bailout: Student Loans

snip

There is now a proposal before Congress for the government to pay off all the banks that have lent money to students.

The government has already changed the bankruptcy law to make it almost impossible for students to escape this debt. But the banks still cannot collect the money.

So, it’s Congress to the rescue! Bail out the banks! But do it in the name of helping the poor students, who were so stupid as to take on these debts.

more

http://teapartyeconomist.com/2012/12/03/1-trillion-bailout-student-loans/

WASHINGTON PROPOSES $1 TRILLION BAILOUT FOR DELINQUENT STUDENT LOANS

snip

Adding another $1 trillion dollars to the national debt isn’t exactly “forgiveness” for young people—it’s prolonging the payoff. In fact, student loan bailouts are a catch-22 for young people because they’re going to be held accountable for paying off the national debt and interest payments.

http://www.breitbart.com/Big-Government/2012/11/29/1-Trillion-Dollar-Bailout-The-Student-Loan-Catch-22

The question isn’t clear. If you only collect $10 and you forgive the rest, you have cancelled it. If you collect $10 and you resell it, someone else can still collect and it has not been cancelled. If you haven’t cancelled or forgiven it, you still have the option later of cancelling it or reselling it or trying to collect more than the $10 you got so far.

just pay them back in full, what they paid for the debt !

What if StrikeDebt changes their approach slightly, and files suit to collect the debt, then dismisses the suit with prejudice (or allows the debtor to win a summary juudgement motion by failing to answer, etc.). They’re not forgiving the debt – just making it uncollectible.

As the debtor has won a lawsuit, would this not solve the gift/forgiveness issue?

This would be a perfect project for legal services offices to coordinate with OWS Debt.

Credit bureaus will pick up the lawsuit. It will damage the borrower’s credit record, particularly if the debt is old. Commentors on the original post were concerned that telling the credit bureaus that the debt was cancelled would hurt borrowers, see:

http://www.nakedcapitalism.com/2012/11/occupy-wall-streets-debt-jubilee-a-gimmick-with-tax-risk.html#comment-919400

And this would clearly be worse, litigation stays on your credit record for 7 years or longer. And since each new entry has its own timeline, this keeps that loan being a bad loan on someone’s credit report longer:

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or an unpaid judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.

http://www.consumerfinance.gov/askcfpb/323/how-long-does-negative-information-remain-on-my-credit-report.html

Credit agencies pick up legal filings: this would almost certainly be picked up even if OWS did not report it.

What, if someone files a lawsuit against a debtor, and the debtor wins – the debtor’s credit is still hurt? I’d hope this was not the case, or that the debtor could get it removed by showing proof that they won.

Yes. It is remarkably difficult to get credit bureaus to correct records. So you suffer the damage until they get around to fixing it, assuming they ever do.

I have had 4 tangles with a credit bureau:

1. One where a landlord who was getting foreclosed on (!) sued me for non payment of rent (last month, I felt pressured to leave pronto). I had indeed not paid based on the advice of my attorney. Bad advice. Even though we settled, so the suit did not proceed, it took at least 18 months to get rid of the entry in my credit history.

2. NYC mistakenly filed a tax suit. I had paid the friggin taxes, I had a the cancelled check, and they never sent a single notice that they thought the money was due. They vacated the suit (vacated means it never should have been filed). Again, took well over a year, including serious nastygrams to the credit bureaus, to get it fixed.

3. Credit bureaus merged me with another person who had a shitty credit record! She had a different name (different middle initial) lived in a different (but nearby) zip code, and had a different Social Security number. But even with 2 SSNs, credit bureaus remarkably unwilling to fix problem. In fact, because (in those days) the credit reports showed the account #s, I called her creditors (like Macy) and told them to get after the credit bureaus, with all the info, I could go and charge in her name at their stores and she’d be stuck with the bill. Every one was horrified and issued letters pronto. Even so, again over a year to get it fixed.

4. Citibank mistakenly issued a delinquency notice on an account. I had closed it, they didn’t close it properly, they kept charging monthly minimum fees, which went into a credit line, which meant per them I was not paying on a credit line. Citibank super duper apologetic, man in customer service sent credit bureaus letter after letter telling them to fix it. He sent letters, no joke, 6 to 8 times to all 3 bureaus, again it took well over a year to get it fixed.

I’ve had good luck with filing complaints with the CFPB. I was skeptical about the recent campaign by CFPB to “rein in the CRAs” and thought it just lip service. However, my complaints were resolved in a timely manner to my satisfaction. One was a complaint about soft inquiries being on my report for much longer than 2 years and the CRA refused to remove. When I complained to CFPB the inquiries were removed. Another was a complaint against Cap 1 and the CRA allegedly “verifying” erroneous derogatory information. A third was Fannie Mae and Bank of America running inquries with no permissible purpose as they were no longer creditors – the debt was discharged in BK 2 years prior and they were barred from attempting to collect a debt. That too got removed. It’s worth a complaint (even to just vent!) if you are still having trouble.

The credit bureaus should be outlawed. It’s obvious that there’s some sort of collusion involved in the system which uses them, because *they are no damn good* — it’s not worth running a credit check and no competently operating business would ever use the credit bureaus at all.

(Incidentally, this is how to run a successful small bank: ignore the credit bureaus and lend to creditworthy people who they’ve blacklisted.)

So credit will be hurt, but tax liability will be taken care of? That’s certainly better – still problematic, but better. I also wonder if Rolling Jubilee could not forgive, but not collect and just let the statute of limitations run out?

Reread the post. In many cases, and probably a significant majority, the debt is invalid or disputed. Suing as a way to clear up those cases makes the borrower worse off, since there is no cancellation of debt income issue. The better way to deal with those situations is to help borrower fight debt collectors. If the debt is invalid, they should be able to prevail. And there are VASTLY more people in that situation than the small number that Rolling Jubilee could ever help via debt purchases.

When the Red Cross buys cots and blankets on the private market, does that result in a tax liability to RC or the recipients of the gifted blankets and cots?

Why is this OWS Debt Jubilee any different?

Purely guessing, but I would say that to the IRS a disaster victim is a proper recipient of charity, where a debt slave is not (at least with regard to their debt).

That would be an interesting question to explore, wouldn’t it?

Another question. Government (HUD, FHA, State and Local Housing Agencies) have a dizzying array of programs to subsidize mortgages (downpayments, points and percent of interest) to help people who can’t otherwise afford to buy a home. So I wonder — consider a Mrs. Jane Doe who gets a government-subsidized 3.5% interest mortgage where on the private market Mrs. Jane Doe would not be able to get a mortgage for less than 9%. She has been given a gift by the state (with tax payer dollars) of 5.5% interest over the term (let’s say 30 years) of that mortgage. That is a lot of cash. Does she then owe tax on all that cash that she “saves” by having the subsidized mortgage rate? I doubt the IRS thinks so.

The activities of non-profits are, in certain contexts, justified legally precisely because they “further the policy and mission of [some government program.]”

So too here, government subsidizes (artificially low) mortgage rates of persons who can’t pay for a fully-loaded mortgage, and a nonprofit proposes to liquidate the debts of a person who doesn’t have the means to pay the debt. Both actors (gov and nonprofit) are providing financial assistance to financially stressed Americans.

And nobody can complain that the bottom feeding owners of crap debt (most of which, if audited properly, would probably turn out to be unenforceable/expired/illegal) are being “gypped” of their greasy cut — OWS is paying them what they are charging. (Which is the greater concern I had, because if OWS is not careful with due diligence it may be artificially creating a crap-debt “market” that would not otherwise exist, or may be artificially inflating prices charged by bottom feeders for crap-debt.

ADDING Another Question: When Federally-owned student loans are forgiven (this does happen, and I recently read about this happening though I do not have the link handy), does the Federal loan forgiveness trigger a huge tax bill for the student borrowed based on the amount “forgiven”? That sounds absurd, no? (Not that absurdity isn’t baked into to all aspects of our economy, but still.)

“borrowed” should be “borrower”

1. Those programs have historically been targeted at low income borrowers. And they still owe the principal amount (the loan balance).

2. People who get cheapie credit card offers or 0% financing on cars aren’t taxed as if the rate was too cheap. in 2002-2004, credit card companies actually offered cheap offers, not for 6-18 months, but FOR THE LIFE OF THE BALANCE. They were hoping enough people would miss a payment and incur a penalty rate for them to make enough money across the program.

Re. your point (1) — I don’t know what you mean, here, by “low income people” or why it should make a difference — it is a subsidy/gift either way. Moreover, a lot of FHA, HUD, state and municipal programs in fact provide mortgage assistance to people who are not relying on some sort of government assistance to live. As an example, take the raising of the cap on FHA insured mortgages since 2008, which was a device to create another “bubble” in real estate — the FHA insurance and favorable rates allowed purchases in areas like San Francisco and NY via mortgages worth a hair under $700K.

Another example might be Section 8 — The government kicks in for anything that is (I think) 30% of the resident’s income. There are many Section 8 voucher users who are in the workforce — I don’t think they are issued a tax bill for the difference between what they pay in rent and what the government kicks in (which again, in an area like NYC) might mean anywhere from a few hundred bucks to more than a thousand (!)

Also the fact that government subsidized mortgagors “still pay the principal” is irrelevant. Presumably debtors who took on consumer debt (car, credit card, etc.) have paid something of their debt before defaulting. And as little as it has been advertized, it would be intereting to know whether FNMAE et al or private servicers servicing FHA insured mortgages who have excused/forgiven mortgage debt then contacted the IRS to let them know of the “gift”/”benefit” given to the debtor and then whether IRS held these debtors liable for taxes on the forgiven debt.

Ms. G.

You are mixing apples and oranges in multiple categories when the IRS is quite precise about specific categories.

1. Moderate and upper income people are not suitable candidates for charity per the IRS (the language is “not a charitable class”). I’m not sure exactly what the income tests are. It may be context-specific

2. Per Tiercelet’s comment below, which is actually more germane than my remark, the government gives all sorts of subsidies to individuals and corporations. Some are taxable, others aren’t, and others effectively aren’t (tax credits and exemptions). I don’t see you complaining, for instance, that interest on corporate bonds is taxable while interest on muni bonds isn’t.

3. Interest is not principal. People dealing on arm’s length basis in commercial setting often arrive at low/below market rates. Usually that is meant as a buyer subsidy or inducement. So is buying someone dinner or taking them to a sports event (in our super-low interest environment, you don’t see many loans with what is called an original issue discount structure, where you pay no interest and have it all effectively bundled into the principal, as in borrow $80,000 and pay $100,000 back in 5 years. There are rules for how the lender has to recognize interest each year even though he gets no cash).

4. The example you cited (Section 8 housing) is for low income people but it falls under 2 anyhow.

Yves,

Thanks for the info on the IRS category of legitimate “charitable donees.” I’ll look that up to see what the parameters are. It is an interesting area indeed — IRS definitions of who/what qualifies for tax exempt charitable giving. It sounds, from your example re. the debt-counseling ogranization, that there is a built in bias within the IRS charitable org. regs that mirrors the Neo-Liberal regime’s blessing of indebtedness at all costs, and making impossible (by all means necessary) the freedom from indebtedness.

You wrote: “I don’t see you complaining, for instance, that interest on corporate bonds is taxable while interest on muni bonds isn’t.” The issue is tax liability on forgiven agreed-upon payments. Thus the issue using the bonds hypothetical would be: if the bond issuer defaults on payments to the bond holder, and the bond holder forgives the balance of the payments under the bond structure, would the bond issuer be liable to IRS for the forgiven bond payments if the bonds in question are (1) munis or (2) corp bonds.

As for mixing apples and oranges in multiple categories …. it seems that there are a lot of items within this area of what constitutes a debt forgiveness that does not trigger a tax liability for the debtor that should be treated as apples-to-apples but are apples-oranges only because of the Klepto Neo-Lib framework in which they are currently defined.

The state gives gifts all the time, this is different from a gift from a private party subject to tax.

On the question of student loan debt forgiveness, I’m pretty sure that it would actually be taxable if it’s private student loans. Programs like IBR (Interest-Based Repayment) for government-held student loans, which write off the balance of the debt after 25 years of minimal payments, *do* result in a tax liability for the student on the forgiven debt balance.

Yes, it is massively unfair. That’s because the tax code is written to the benefit of people in power. Fancy double talk won’t get around it; the courts and the legislature know who their masters are, and it’s the 0.1%.

Blankets and cots do not generally have an interest payment attached to them, but a mortgage does. Read the quote at the end of the article that starts, “In Jones Lumber Company…”

The interest is (or should be) an irrelevant factor and a red herring.

The paragraph discussing the Jones case (and others) speaks — it seems to me– to the liability of the person/entity *forgiving* debt by taking a deduction for lost income/uncollectible receivables (basically). All the cases seem to say is that for the taxpayer not to accrue interest after demonstrated insolvency of the debtor it has to make a showing that the debtor was (basically) a deadbeat and that trying to collect from said debtor would be like trying to get blood out of a stone.

have to think like big business and FIND THE LEGAL LOOPHOLES !

Thanks for the kind shot across the bow of these folks. It is the best and cheapest education they will ever get.

An ounce of prevention is worth a pound of cure.

Having no expertise in law or accounting, in either of which taxes are a recognized specialty, I think I shall quietly tiptoe away and leave this to a legally definitive settlement. At some point in the future–and hopefully not devastating to people who thought they walked away clean.

As suggested, filing suit to collect, and then ignoring further legal process, is certainly a good method. Then too, the interest rate could be adjusted to 0.00000001% per annum, which can be satisfied by collecting (or trying to collect) a few pennies every few years.

No, it isn’t “a good method.” It’s “a method that somebody in a blog comment thread thought was a good idea.” Which I’m sure will go over big in an audit.

Also, openly collusive litigation is generally frowned upon.

Tax-exempt organizations certainly have a role to play. I know many people involved with tax-exempt charities who do impressive direct social services work, for example. They are doing the work that used to be done by government agencies, such as school counseling, etc.

That said, the complexities that come with 501 non-profit status are one of the reasons that I think that they are often unsuitable for politically sensitive projects. Whenever you add complexity, you increase risk. Political activity that challenges the fundamental underpinnings of the system is difficult enough already. Fighting to keep tax-exempt status is just one more point of failure.

It is very difficult, however, to get this idea across to some people. This is because the idea that political activity absolutely _must_ be conducted within the auspices of a non-profit is very prevalent among large sections of the professional college-educated class. They simply can’t see any other options.

The downpayment assistance program that is mentioned in the article is notable as an example. The system allows for charity, i.e. the wealthy and/or powerful donating to the poor. However, using the tax-exempt form for collective action among middle class small holders is forbidden. A cynical person would say that is because charity doesn’t challenge the system, it simply ameliorates problems, while leaving those on the receiving end dependent. Collective action among the middle class can threaten entrenched interests. Let’s examine the organization [org] mentioned in the IRS private letter ruling.

Essentially the org received its funding from home sellers, in the form of a donation. Buyers receive a grant from the org as downpayment assistance, perhaps 3% of the purchase price, according to the IRS ruling letter. According to the IRS “defines the term “charitable” for section 501 (c)(3) purposes as including the relief of the poor and distressed or of the underprivileged, and the promotion of social welfare by organizations designed to lessen neighborhood tensions, to eliminate prejudice and discrimination, or to combat community deterioration.” Notice that this is all ameliorative. It also means that an organization has to serve “the poor or distressed or underprivileged.” But what happens when they aren’t poor or distressed or underprivileged, but are instead middle class/working class people who want to aggregate their financial resources to shift the political system? Well then, they would not be covered under 501c(3) tax exempt status.

—->”distressed”

Anyone whose debt is already in collections is very, very likely to be distressed.

FYI, if you really want to do “absolutely anything” without paying federal income taxes, organize as a church.

Sometime in the 1990s, the IRS stopped enforcing *any* of the rules on churches, and they are running amok doing whatever they like; the Church of Scientology is essentially a for-profit operation, and it gets away with it. So this is clearly the way to go if you don’t want any questions.

There is an important aspect to this post that is not narrowly technical, which is:

Rolling Jubilee is not making it clear to participants what the risks are, among which are running afoul of grey areas in tax law.

The Occupy I know, or thought I knew, wasn’t into getting people involved without their informed consent. If I wanted to set desperate people up to be used for the “higher purpose” of making some sort of political point, then I could just join the Democratic Party.

Spend some of that celebrity money on a good, clear statement of the risks involved, from an actual and authoritative lawyer, and post it. “Checked with the IRS” just pins my bogometer.

As a simple small business bookkeeper, I’m wondering why OWS instead of forgiving the debt, doesn’t just recognize it as uncollectable accounts receivable.

I’ve always thought as bad debt as a casualty: like a house that burns down. Its essential value is zero, whatever turnup blood someone squeezes out.

Recognizing bad debt may look like a gift to the IRS, but in the cash world, it’s just worthless paper.

I’m sure the IRS will get around to this only after they’re done dinging MBS pass-thru vehicles for REMIC violations, right?

But seriously, why does Strike Debt need non-profit status at all? They could set up LLCs with non-pass-through treatment (i.e., make “corporate” not “partnership” election) and file 1040s showing no income–i.e., this would be akin to a hobby, such as owning thoroughbreds. As long as Strike Debt didn’t try to deduct “losses” (from cancelling assets) against other real income, they shouldn’t get into trouble there.

There are two other possibilities–they could purchase the debt and (a) quietly not enforce it but technically leave it outstanding, or (b) they could recast it as a 50-year bullet (for example) with interest capitalizing. In either case it seems likely Strike Debt could provide the needed credit relief by reporting the debt as “current” to the credit bureaus (but query whether, in the case of (a), the IRS would have access to that ostensibly private credit records and be able to use them against Strike Debt to show that Strike Debt is taking inconsistent positions with the IRS vs the credit bureaus).

Also in the case of (b) (recasting), Strike Debt would then be on the other side of the argument, having to show that the reamortized debt is still “collectible” so as not to create forgiveness income.

The first seems worth looking into – don’t forgive, but don’t collect. Eventually, the statute of limitations runs and it’s not collectible.

This is a hairbrained scheme and typical of the Occupy Movement’s impotent tactics of operating strictly within the rules of the existing (criminally rigged) system.

I am tired of this Movement and its unwillingness to seriously challenge the system. They should be bringing class action suits against unjust laws and debts, not playing by the rules of the sewer markets.

If a man is cutting people up in back alleys, do you challenge him to a knife fight?

If the intended recipient is not insolvent, they could refuse the gift (in writing).

The tax implications, as Yves said, are the least interesting negative aspect of the Occupy Debt. Most of this debt that is being purchased is probably uncollectable for various reasons.

I tend to agree. I think that a far more interesting exercise for this OWS Jubilee group would be to purchase the debts and then set up an audit operation that would culminate in a report demonstrating what percentage of the debts are invalid, unenforceable, illegal, etc.

One of the whistleblowers that we read about here at NC in the past year was, if memory serves, reporting precisely on the corruption at the Creditor Company bundling of debts to sell to bottom feeders for pennies on the dollar.

Imagine what great raw data for a database and analysis OWS Jubilee could collect through its purchasing program. The findings from the analysis may (if as I suspect the vast majority of the debts sold in bulk to bottom feeders are illegal ab initio) prove a very strong support to people who might benefit going the route of the Debt Strike Manual.

Most of the debt might be uncollectable, but consumers don’t know that, and neither do judges. Getting rid of an uncollectable debt at least means less harassing phone calls, less payments under duress, less anxiety for the harassed debtor. A debt that is invalid is still a threat if you can’t afford the time, effort and expense of challenging it.

Filing lawsuits is a really bad idea and would make the whole project much more costly as each suit would require a filing fee. Why not just sit on the debt, do nothing and let the statute of limitations lapse? Maybe IRS would still come up with a way to consider that as taxable income.

If OWS buys the debt and then channels it into an audit research group (without filing lawsuits or seeking to collect, etc) then there are no lawsuits against the debtors.

One thing that’s not clear, though. Aren’t the debts already on the debtor’s credit report *before* the creditor sells off the debt to a bottom feeder, i.e., a lawsuit to collect the debt would granted not be a good think for the debtor, but how much worse is that than a notation on the credit report that the debtor has defaulted on his/her debt?

Unpaid bills can show up on your credit report as soon as 90 days in some cases, though it usually takes longer. By the time your debt has been sold at 5% to some bottom-feeding third-party collections outfit, it has long since become a fixture on your credit report.

Nonetheless, the collections creeps who call and write will warn you that this could go on your credit report.

The vast majority of debtors can be depended on to wilt like pansies in a forest fire at the mere threat of a bad credit report or a lawsuit when their first thought should be, “Might this total stranger be lying to me?”

This post seems to miss the point. Debtjubilee is political theater and the specific granular issues of tax liability are irrelevant. They can never buy back enough debt to have any significant effect on the debt system except to win a PR victory. I guess in that sense the fact that this post takes them premise so seriously is a victory itself.

That is not how they are approaching it. Look at their site. They proclaim this as a bailout by the 99% for the 99%. They have a meter showing how much they intend to retire, implying more is better. And they says that they are doing medical debt now, and they intend to move on to other kinds of debt. If their intent was to make this theater, they’d only buy a little, spend time researching the backgrounds, and develop PR and maybe litigation strategies. Instead, the transparency section of their site says all the money (and they have raised a half a million so far) is to go to retiring debt or related expenses. This is not the profile you’d see if the objective was political theater.

In fairness, judging OWS by what their print copy “should” look like seems a bit off the mark … after all, this is the movement that deliberately eschews Power-Point-style lists of demands (to the great consternation of main stream media and politicians who are incapable of engaging debate with anything except a list of bullet points) …

::) :)

No, this is people who pride themselves on their web-savvieness and put time into what their message should be. The people behind this include quite a few writers and journalists, so the communication if anything is more carefully crafted than you see from most business people. Comments on the first post noted with some suspicion how slick their website was, the tech savvy had to tell them it wasn’t that costly to develop something like that.

And Power Point is the antithesis of slick, it is kludgey and lame.

I concede the point. I was one of those who was skeptical of this enterprise because of the high quality of the website (and the celeb-roster device, among other things). Still, and despite the indignant commenter who posted about high level professionals being involved with OWS and being capable of “doing good for free” (it was a very sanctimonious post, if memory serves), I’m not prepared to bet my penny jar that there aren’t other agendas underlying the official mission.

@Ms G “I concede the argument” is a very important and praiseworthy thing to have done (and as a former policy debater, I simply hate to do it, and do it badly).

Arriving at some approximation of the truth is important, and who will help us do that but we ourselves? The press? The political class?

And if you believe (as I do) that the clash of ideas and the testing of facts is important as a way of moving toward the truth, then there’s really no way to move the discourse forward as a community unless participants in the debate are willing to admit that sometimes their points are…. wrong!

So, kudos

Now we are about to see again what the longshoremen learned about Occupy last year. That is, Occupy doesn’t respond to criticism well, they don’t change their tack when their actions are hurting the people they are purporting to help, and they tend not to listen to anything that is rooted outside of their rhetorical framework.

Let them buy up more debt. The forebearance program which does not cancel debt, but leaves people alone with no action to collect, is nobody’s business but the noteholder. I propose a 99 year hardship forebearance program, payable in current dollars, 99 years from now. It is still a perfoming asset, held in abeyance for 99 years. How’s that for informed consent. Courtesy of the Free Law School Class of ’78.

@PT — I hope they read your post — this is a simple and elegant and entirely legal solution. And good value as far as Free Legal Advice from Class of 78 goes … :) :)

99 years forbearance, for the 99%

And a bargain compared to $16 Trillion to the .01%. Everyone should be happy.

Winning slogan.

Just curious to know if you’ve offered to work with SD on the campaign. If I was working with them I would jump up and down to get you involved!

All of the open questions would also do well to take into account the lesson I learned when I was doing legal research for Congress:

At a certain point, the law is whatever the courts and the lawyers say it is. Even getting a good tax lawyer’s opinion wouldn’t matter. What matters is how the judges on the various cases — not exactly a revolutionary cadre — decide to rule. You would have to be phenomenally naive to think they’re going to sit idly by and let the nobility of Occupy’s position tie their hands if it meant a serious political inconvenience.

The only sure way to make change within the system is to go into it knowing you have a friend on the inside. If you don’t, you’d better hope you find one, because impassioned argument is not going to persuade the guardians of the rentier class’ entrenched interest.

I don’t disagree, but understanding the statutes and case law would give Strike Debt a much better sense of the mines (the issues that could foul them up) and what current thinking is (as in how radical or conventional their positions are relative to precedent).

Impassioned argument, however, is what wins in the only court which matters in the long run: the court of public opinion.

The debt jubilee is an incredibly smart public relations stunt, if done properly. The courts may go along with the law as it is written, in which case this will just work and there will be no tax bill. This is probably the best move for the Forces of Power, because then they can say “see, there’s no need for government action, private charity will take care of the problem!”

Or the courts may decide to impose unjustifiable and illegal taxes. In which case the *courts* and the *government* look bad. This is a dangerous game: the courts and the government have discredited themselves through many, many other previous actions (copyright law, patent law, drug law, mortgage law, torture, etc etc etc), and we all know true authority comes form the consent of the governed.

In this case, the debt jubilee people say “See, it’s your oppressive government, they won’t even allow us to help you”, and in ten years the government has changed its position or been overthrown (I’d hate to guess which).

From a PR perspective there is no downside — assuming it’s done properly, which means having lawyers to fight the likely legal cases. Win or lose, they have to at least try to defend the correct position in court in order to retain public support and lay blame for any trouble at the hands of the court.

*sigh* so much effort spent on what really should be a side-issue.

If I understand what OWS is proposing right, it in effect wants to run a lottery where the first prize is a full debt forgivness, and a second prize (if you can call it that) is a debt forgivness with a tax bill attached.

Running a normal lottery would be cleaner and have a similar net results, but then it would not provide the feel good factor of helping people. Of course, it would also make it clear that all this is, is a transfer of money to the current debt-purchasing system, with no long-term benefits.

It’s like the policeman buying shoes video. It’s great and hearwarming (especially around Xmas), but makes little if no difference in larger scheme of things.

From that PoV the whole debate here is wasted time. Yves’s time spent on researching the above is not going to be wasted only if it helps to redirect the effort of OWS into something slightly more system-changing (and there have been suggestions as to what to do)…

Strike Debt wants to be tax exempt so their donors can get a tax deduction on their contribution. If they were for profit they would not get the same level of donations.

They should sell the debt for a penny to the person that supposedly owes the debt. Then the person can inform the credit bureaus that the debt has been satisfied, if they want to.

No, donations to a 501(c))(4) are not tax deductible. Rolling Jubilee’s promotional literature also warns that donations to Rolling Jubilee are not tax deductible. It is, however, tax exempt. The entity itself is not subject to income taxes.

501 (c)(4)s are the same type of entity that are used for lobbying and SuperPacs. it is 501 (c)(3)s that are tax deductible to the donor.

Thanks for the correction, Yves. What about selling the debt they buy to the alleged creditor for a penney?

True about the non-deductibility of donations to lobbies/PACs that are 501(c)(4). But get this — according to one website at least, those donations are deductible by the donor as “business expenses”! Another Apple/Orange situation that seems to stem more from politically motivated semantics/sophistry than common sense, logic or (!!) reality.

nterestingly, the IRS says that donations to 501(c)(4) groups can be deducted as business expenses.

Here’s the link: http://money.howstuffworks.com/philanthropy3.htm

Sorry about the stray sentence at the bottom of the post.

“Similarly, the IRS recently denied tax exempt status to an organization formed to give debt counseling to troubled homeowners. Being involved in a worthy cause does not mean you can flout the Elite (rules).”

Fixed that for you. OWS should consider that the authorities will bend the rules for this just as they have for beating unarmed people. The idea that debt should be forgiven is dangerous to them. The bad publicity of having the IRS go after whoever wins this debt lottery, won’t matter. It will be spun by the media as everything else has been.

“Hippies try to skip out on their taxes, IRS says NO WAY. News at 11”

You are missing the point. As indicated above, the mortgage counseling effort was denied tax exempt status because it was not helping poor people only.

This is not about the authorities changing the rules to go after OWS. This is OWS willy-nilly taking tax risk by not even bothering to do adequate homework.

The IRS’s position in the mortgage counselling case is suspicious on its face, and I wonder if it was properly contested.

But the Rolling Jubilee people have an even better case because *by definition* everyone they are helping has been unable to pay their debts (with the possible exception of people unwilling to pay their debts, which should be a really small number).

There is no rule that you have to be destitute to be the recipient of charity.

The key takeaway point here, however, is that the IRS may well create a hassle, even though Rolling Jubilee is on absolutely solid legal ground, and as a result — *Rolling Jubilee needs lawyers*. Refusing to take lawyers on and getting defensive to critics is a sign of bad management.

I’m sure the tens of thousands of people arrested and the thousands who were injured, brutalized, and/or had their stuff confiscated or destroyed during the Occupy suppression actions around the country and the world didn’t have full disclosure of what they might be in for either.

Even if they sat through one of the workshops Legal offered on “what could happen” many were surprised and even Legal was sometimes horrified at the tactics used to suppress civil disobedience by Occupy. Some of those who went to jail were so traumatized by the experience, they still can’t talk about what happened to them and what they witnessed. Some of those who went to jail or were otherwise brutalized were not even Occupy participants but were simply caught up in the massive official suppression actions.

Strike Debt is a civil disobedience action which may well encounter the same sort of suppressive overkill other Occupy actions have encountered and are still encountering.

It hasn’t happened yet, though. If there is an official intent to suppress Strike Debt, however, it won’t be particularly avoidable, either.

Bollocks. Multilevel, cynical, and manipulative bollocks.

1. Of course nobody can know everything that can happen in the future. But many Occupations did try to disclose — by committing to non-violence, for example. And most people participating in Occupations could do some form of risk assessment; after all the history of protest in the United States is not unknown.

2. Such is not the case with Rolling Jubilee. There is no disclosure of the risks; “we checked with the IRS” is so sloppy and lame you don’t even bother to defend it. Why not use some of the celebrity money to offer some real legal advice and post it for all to see? Afraid?

3. You make the situation even worse. We’re talking about a Rolling Jubilee effort. I checked the FAQ and I don’t see “civil disobedience” there. I check Strike Debt and I see this:

That sure doesn’t sound like civil disobedience to me. So you’re just redefining stuff on the fly. Worse and worse.

Sounds to me like you want to use debtors as cannon fodder for some “greater good.” Like I say, if I want to get involved with that kind of user, I can just join the Democrats or work for Obama. Hardly prefigurative!

NOTE Nice try on using the real sufferings of Occupiers who were assaulted by police for a project that’s looking more unethical by the day. Worse and worse.

Have a nice day Lambert.

A nice day for me is shredding a bad argument. Which, from your non-response, I just did. Thanks for your support.

—>”Why not use some of the celebrity money to offer some real legal advice and post it for all to see?”

Or simply to hire some lawyers!

Even though the ‘debt jubilee’ tax position seems pretty clearly valid to me — the tax rules are more straightforward than they look — it’s going to be contested.

Sounds like the preisthood of the cult of expert opinion feel affronted.Has this actually come up in the actual real world ?

Since OWS hasn’t bought any debt except one test case, how could it have?

And name calling does not alter the fact that Strike Debt is proposing to take action that could inflict costs on the people they say they are trying to help. And there is no indication they intend to do anything to remedy the damage they might cause.

Put it another way: if you regard the risk as so remote, why don’t you offer to pay the taxes of people who might up paying more and funding litigation to fight the IRS if it does make assess more taxes? Since you deem the risk to be nil, I’m sure you’ll happily volunteer to backstop the project financially.

Nobody in their right mind would volunteer to pay taxes which are not owed.

However, yeah, anyone with legal expertise might want to volunteer to assist with the inevitable court cases. Even though the claim that this would be taxable is plainly bogus, it’s not going to prevent it from being a long mess of court cases before that’s settled.

Your government will always prevent you from helping yourselves or others, this question of “tax implications” was innevitable once the owners realized this was a legitimate threat.

David Graeber discusses the Rolling Jubilee action and the general issue of debt with Sam Seder on the Majority Report, 11/14/2012.

A question raised: “What is Financial Disobedience?”

http://www.youtube.com/watch?v=m-EMlVfQtVI

So you’re saying that because some guy on a YouTube somewhere says something, that’s full disclosure?

Keep digging!

This is really interesting article.

I just donated to the People’s Bailout. I guess I think a lot of it is symbolic and worth “fighting the system”. However, I agree that if you’re swimming upstream, better to get your ducks in a row ahead of time.

That said, can’t feel too bad about donating. Sometimes when people do something “outside of the box” – they don’t always do it right but it still creates changes down the road – by raising the questions people never asked before.

thank you for writing this

Maybe OWS have adopted a consciously ‘provo’ strategy? Pay off peoples debt. Don’t keep records and let the IRS puruse key individuals in OWS who are happy to pick up some jail time as conscientous objectors against the machinations of the unjust system? It’s a good opportunity to highlight the double standard operated by the IRS: regulatory rigour for working people and a free pass for the corporate sector.

This could simply turn into a ritual ‘burning of the debt records’ via some virtual sleight of hand. Many people have served jail time after refusing to pay the the military component of their taxes, so there’s clearly a constituency out there.

This might be a good or a bad tactic, but that’a another argument.

No, they are not buying the debt of people in OWS. They are buying the debt of random people. That’s why this is objectionable, they may be creating a tax mess (and actual costs) for people who never agreed to this or were informed of the risks.

First, their site make that clear, that the debt buying is random (they use that word), and second, it’s actually remarkably difficult to find who owns your debt if your original lender has sold it. Even if they wanted to pursue the strategy you suggested, it would be well nigh impossible.

And they need to keep records for tax purposes, plus on their site, they promise “full transparency”

Question–

The debt-holder’s characterizes of a debt as forgiven, rather than non-collectible doesn’t really end the matter for the IRS, correct?

By this, I am looking at a situation where the debt has previously been in some sort of collection effort, with insufficient debt verification by the agency, rendering that debt uncollectable. If the debtor has kept the paper trail–demand letters/debt verification responses, etc., if audit time rolls around, the IRS could still rule the debt uncollectable despite Strike Debt’s characterization as forgiven.

I understand this is is more an academic question–in the real world no one wants to be put in the jeopardy of an audit, many of the debtors don’t have the paperwork, etc.

Just curious though.

^debt holder’s “characterization”

Dear Friends,

I just created the petition “Don’t Steal Our Home Freddie Mac” and wanted to ask if you could add your name too.

This campaign means a lot to me and the more support we can get behind it, the better chance we have of succeeding. You can read more and sign the petition here:

http://start2.occupyourhomes.org/petitions/don-t-steal-our-home-freddie-mac

Thank you!

Marcie

P.S. Can you also take a moment to share the petition with others? It’s really easy – all you need to do is forward this email or share this link on Facebook or Twitter:

http://start2.occupyourhomes.org/petitions/don-t-steal-our-home-freddie-mac

Looking through this, I agree with the final conclusion here:

“Even if there is a problem here, it appears it could be addressed simply by making sure that when Strike Debt acquires debt, they go through whatever steps they need to take to forgive the debt promptly. As a volunteer organization, they might not take simple steps to eliminate possible risk, which in this case might be to process debt cancellations expeditiously, if they don’t realize there is reason to.”

First, the Rolling Jubilee’s characterization of its debt-forgiveness activities as gifts is correct. The IRS might dispute it, but then the IRS holds all kinds of wrong legal positions; the courts will undoubtedly side with Strike Debt. But for that, Strike Debt needs a lawyer.

Second, an attempt by the IRS to force the beneficiaries of these gifts to pay taxes would not merely be legally unsound, it would be politically unsound, and would generate quite sufficient backlash to overthrow governments. The executive branch will probably not be stupid enough to make this mistake.

Rolling Jubilee is also correct in its 501(c)(4) position. It’s pretty obvious that people who can’t pay their debts are in a “distressed” position and therefore helping them out counts as charitable activity, regardless of the people’s income or other situation. The percentage of people who are simply choosing not to pay their debts is going to be small enough to be de minimus.

And again, an attempt by the IRS to treat this as anything other than charitable activity would be politicially unsound, of the “governments get overthrown for this” variety.

Rolling Jubilee is on safe legal ground, *but it does need lawyers*.

“In disputes with the IRS, the burden of proof is with the taxpayer.”

Not true. As in all civil cases, the burden of proof starts out neutral (“preponderance of the evidence”). If the IRS takes a position plainly contrary to law, the burden of proof is on the IRS and the courts will smack the IRS down in summary judgment (and have done so).

In this case, the burden of proof may be on the taxpayer, but this is not true as a *rule*.

it amazes me… rolling jubilee is a good idea but perhaps the wrong approach. First you want to buy up old debt and abolish it without really knowing the circumstances from which the debt was obtained or without being able to ascertain whose debt is being purchased. Let’s face it, there are many irresponsible people out there that just plain get themselves into debt stupidly… because there is no educational process to the debt trap that most people fall into.

Let’s say that you abolish someone’s debt who is foolish… the first thing they will probably do is go back into debt… almost guaranteed. Why do you think that banks target people who filed for bankruptcy… yes, they have the foresight of knowing that these people can’t file gain… but they know that these people are easy marks…why…because their profile says so… and they will fall again and again to the tricks and practices that ultimately end up on the profit side of the creditor. The banks never loose! They will get their money by either sticking it to people that are paying or write off the debt…including ridiculous bloated fees that were added on just because the laws allow them too. Get frickin real…they write the laws and will win either way!

Also the amount of debt that you will abolish with this program can be compared to swatting the fly off an elephant’s ass. In the long run it will fail just as the Occupy Wall Street movement ultimately failed.

Also, I find it ludicrous that you are taking donations using services like PayPal and WePay. Who do you think is making money on that. The banksters are getting theirs no matter what. Plus you are encouraging the use of credit cards… because many people donating don’t see themselves as being in a position of the people you’re trying to help. Ultimately you are taking money from the 99% (the rest of us) and adding it to the banksters bottom line… sure there will be a few people helped but in the long run it won’t matter… and the percentage of people being helped that truly got there for extenuating circumstances will more than likely be low… it’s sort of a reverse lottery effect.

I kind of see a self fulfilling nobility practice going on that will only suit to make the Rolling Jubilee group feel important and the banks a bit more money. Global cause that is too big of a problem to make a difference in this manner… again elephant’s ass and the fly. What you have to realize is that very little of the debt that is sold for pennies on the dollar gets collected… because it is generally unsecured debt. This kind of debt doesn’t have to be paid. Debt collectors can’t garnish wages, slap a lien on someone’s house, throw someone in jail or any of that crap… but guess what, they sure threaten to.

Education is the only thing that will let people know that all their unsecured debt can just be walked away from. They will get the collection notices and calls… but armed with the proper information, they can alleviate those calls and letters by simply ignoring them. They can take all that kind of debt and place it in the round file. The money that they are not shoveling out to those thieves can be used to pay off secured obligations.

I can’t tell you how many times I see people driving around in fancy cars and living in a shack. They have no real world training to help them realize that it’s all a sham. We are bombarded with advertisements geared at making us consume and spend money we don’t have. We are bombarded with movies and television shows depicting a lifestyle that is not sustainable for most people…especially with the way the system currently works. If I don’t drive a nice car, I must be a low life. If I don’t live in a nice big house I must be a low life If I buy this or buy that then I am NOT successful…bullshiznitz! We are loaded to the gills with a pile of dung and people just keep swallowing it. We have become junkies for consuming crap we don’t need and most of it we really don’rt even want it because of the price we ultimately pay.

Rolling Jubilee would be better off taking the collected funds and buy up a Rolling Jubilee congressman or senator or two and fight fire with fire! It’s time to get the laws changed so that people have better remedies and don’t get caught in the trap to begin with. Unless you can round up a million plus people ready to march on D.C. armed and willing to take a bullet… then this will accomplish nothing in the bigger picture.