At the instigation of reader Doug, I’m shedding light on a remarkably flattering assessment of the Department of Justice, as revealed by a clearly planted story at the Law.com blog. It’s not so much that this article (as offensive as it is) important in and of itself, but it serves to illustrate the phenomenon that folks at te M&A boutique Lazard (when it was the top expert in CEO psychopathy) called “believing your own PR”. This sort of thinking bears examining because it is widespread in both Corporate America and within the Beltway.

The DoJ, which has been notably missing in action during the Obama Administration, has staunch allies in the big corporate law game that aver that the public is simply unaware of all the good work that the DoJ has been quietly doing on their behalf. It is important to remember that big corporations have every interest in promoting the notion that weak overseers are effective, so the interests of major law firms and the DoJ are aligned in presenting the DoJ as a tough cop when it is anything but that. From the Law.com puff piece (emphasis original):

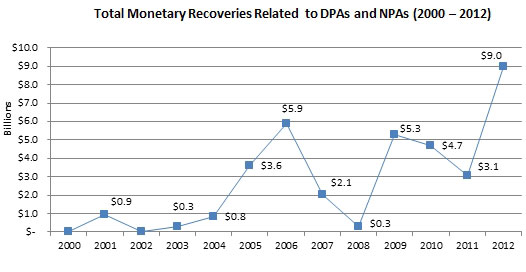

With Congress so worried about the national budget these days, maybe it should take fiscal tips from the U.S. Department of Justice. Federal enforcers obtained a whopping $9 billion in corporate settlements in 2012—a record amount that surpassed the previous high set in 2006 by nearly $3 billion….

Among those companies contributing the most to the federal treasury were GlaxoSmithKline, which paid a $3 billion penalty for drug misbranding; HSBC Bank USA, N.A. and HSBC Holdings, with $1.9 billion for money laundering compliance failures and trade sanctions; and UBS AG, with a $1.5 billion fine for fraud.

The numbers were compiled as part of Gibson, Dunn & Crutcher’s annual look at corporate settlements, called deferred and non-deferred prosecution agreements.

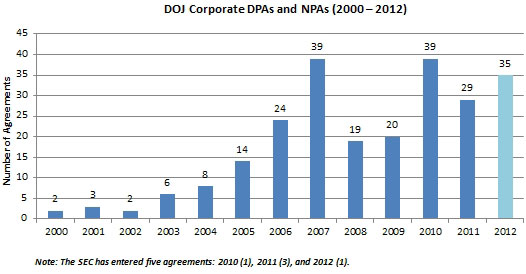

The use of the agreements, as opposed to corporate indictments, continues at a near-record pace. There were 35 deals last year; the previous high of 39 was reached in both 2007 and 2010.

….[One time prosecutor F. Joseph Warin] noted that the financial industry took the biggest hit in 2012. Besides HSBC and UBS, the government settled with Barclays Bank for $360 million; BDO USA for $50 million; Diamondback Capital Management for $9 million; Imperial Holdings Inc. for $8 million; ING Bank, N.V. for $619 million; MoneyGram International Inc. for $100 million; and Standard Chartered Bank for $327 million.

I’m sure readers can debunk this without my help, but as a matter of good practice, let’s parse this. First, the Bush administration was big corporate friendly; before the takeover by Rubinites, you’d expect a Democratic Administration to be tougher on corporations than Republicans. Second looking at outcomes without looking at context is highly misleading. It’s like looking at medical test results without knowing whether the patient is a 20 year woman with no history of major ailments versus a 65 year old smoker who has diabetes and has already had a heart attack. In 2006, the scope of financial fraud was recognized in only a few circles, and even when frauds have come to light, it typically takes prosecutors two years on average to perfect cases.

Note that none of these settlements relate to the financial crisis, but rather to money laundering, insider trading, Libor rigging (which was symptomatic of lack of oversight rather than a driver of the meltdown) and Glaxo.

Thus the results reflect how pervasive fraud is rather than how good a job the DoJ has done. As one lawyer put it:

It would be like Mayor Dinkins touting how effective he was at stopping crime because he had arrested so many crack dealers and users than he had in the past. In fact, crime was everywhere, that’s why he had so many arrests.

Since the DoJ has done so little enforcement on financial crisis matters, it seems probable that fraud will continue to be pervasive and so settlements will continue to be large.

And predictably, Warin as mouthpiece for the corporations who prefer settling their dirty laundry, defends the practice:

And what of critics who say the deals don’t really deter bad corporate behavior because big companies just consider the fines a necessary cost of doing business?

“That’s nonsense,” retorts Warin. “I am in boardrooms and senior management meetings frequently, and no one perceives these matters as a cost of doing business.”

Besides being costly and damaging to a company’s reputation, a serious investigation is a huge distraction from the mission of the corporation, Warin said.

A former Federal prosecutor disagreed. Via e-mail:

The “losses” for the fines need to be put into perspective of the profits that are being earned off of the criminal behavior. If they are significantly less than the profits, than no matter what anecdotal advice given by the source quoted, the incentive is to commit more crime and make more money. Also, it is of course individuals who profit off of the crimes, and if you do not punish/deter them (and why would a billion dollar fine deter a single executive if he/she got to keep theirs), then what meaning will it have from a deterrence perspective.

So while it is better to have some fines than no fines, the fact that the numbers are at record highs might just mean that there is record fraud and record willingness on behalf of DoJ to allow those responsible (and who profited) for the fraud to buy their way out with other people’s money (that is, shareholders).

Why bother shredding such a lightweight, laughable article? There’s been a vogue for metrics in performance management, and as this example illustrates, they are often garbage in, garbage out exercises.

Readers may recall how we highlighted how SEC enforcement chief Robert Khuzami got so riled up by very mild criticism by Simon Johnson in a New York Times blog post that he felt compelled to weigh in. Khuzami couldn’t possibly get so exercised if he were able to make an honest self-appraisal. But if you look at presentations he has made to Congress, like Warin on behalf of the DoJ, he defined his accomplishments in terms of how many cases his department has filed. In this environment, that’s like defining success in terms of how many parking tickets you have written. The most meaningful result for a regulator or prosecutor is one that is not readily quantified: have you made potential criminals afraid of you? Notice that the DoJ and SEC metrics don’t even consider what should be their fundamental concern, which is deterrence and meting out meaningful punishment to violators.

Pathetic propaganda indeed. This stuff, and the responses like Khuzami’s, really give us insight into the minds and characters of the people who “make it” to the top in such corrupt environments: weak-minded, lacking in integrity or depth of character, their chief talents clearly lie outside what most would likely see as necessary for a key enforcement/regulatory official. Since strength, independence and character are lacking, what traits do people like Khuzami and Geithner actually manifest?

the key qualifications are – go along to get along and cover my back

Khuzami’s former position before head of enforcement at SEC was General Counsel at Deutche Bank – he replaced Richard H. Walker….. who then became GC at Deutche Bank- his old position – trading places – so that what one did do is covered as well as what one doesnt do

and by the way both were previously former partners at Cadwalader Wikersham – major Wall Street law firm for the banks

Who in their right – neoliberal economic rational mind – want to – RISK – tainting the name of a potential future employer.

Skippy… is this a trick question thingy… seriously… personal character is a death sentence to moving up the food chain… eh.

anyhow it is so nice to see that the major funding from all this funny money is coming back home from overseas – terms of trade and all that i suppose, or maybe just honest to goodness US big biz i’m sure….

I somewhat disagree about corporations, CEOs and board members “ok” with paying a fine for the “cost of doing business”. First off, these guys are sociopaths, they don’t like their hands slapped or told they did wrong, period. Its not about money anymore, its about power, and that makes them feel like some power slipped. And yes, it does require dedicated resources from the company to address the criminal accusations. And these guys do believe they are above the law, they spent loads of time and money to make sure of that. And, in the back of their minds, they never know when something bad turns and the possibility of jail scares them to no end.

So don’t dismiss the DoJ is doing nothing and this is just a cost of doing business. I’m not defending the DoJ, they are as corrupt as any other gov organization. But they are doing something very unpleasant to these criminal outfits. Yes, they should do jail time. But at least its something.

A month, or so, worth of profit. No addmission of wrongdoing. Go and sin some more.

Yes. Custer was operating in a target-rich environment at the Little Bighorn. He and his boys could hardly miss. But that doesn’t mean the 7th Cavalry had a good day.

“But at least its something.”? That something is merely the theater of the absurd that allows the DOJ to do nothing effective.

Another way to say it is that you are looking at the wrong hand of the magician. The DOJ’s actions are merely the necessary distractions that keeps the crooks in business.

Its a necessary cost of doing business in their eyes. Its not as pleasant to them though as you would paint it. It is painful to the elite. They hate it. And yes, it is a distraction to make the sheeple think something is happening. But make no mistake, it is a very unpleasant experience for the CEOs and board members. And their will be heads to roll in the DOJ for it.

‘That’s nonsense,” retorts Warin. “I am in boardrooms and senior management meetings frequently, and no one perceives these matters as a cost of doing business.’

In 2011, Goldman Sachs set aside $3.4 billion for future litigation requirements. That was the year after it paid $550 million for Abacus! Then when things looked better, Goldman only had to set aside $2.7 billion.

Of course, the fines are “the cost of doing business” and Goldman is still being sued regularly and still paying small “parking” fines.

Only loss of job and jail time will change the dynamics of fraud and corruption at Goldman Sachs.

http://online.wsj.com/article/SB10001424052748704506004576174140177421436.html

I commented on another blog here about the DOJ’s long-running “self promotion” through public service ads, which tout their Efforts Against Big Crime.

The ads urge listeners not to buy “illegal downloads” or “fake knock-offs,” because the $$$$ from such purchases goes straight to “gangs” and organized crime.

I guess DOJ regards itself as doing SUCH a good crime-fighting job in this area that it needn’t turn its attention to financial fraud, particularly the banks that launder those gang and organized crime dollars.

Yves says — “Why bother shredding such a lightweight, laughable article?”

Yes, indeed. It’s a matter of judgment and conscience. When we see good people struggle with such questions, it’s an encouragement to us all.

Regrettably, the problem is even worse. Eric Holder is a lapdog of the Obama administration; we can no longer pretend that there is ANY independence in the Justice Department. Decisions on who to prosecute or not prosecute are made politically through the White House. Whether it be Wall Street, BP, Bradley Manning, Tim DeChristopher, OWS, or killing American citizens abroad, the White House, not the DoJ, is calling the shots.

All you need to do is a little thought experiment as economists are fond of. At what salary is it personally profitable for a CEO or other high ranking official to skirt the laws to increase their wealth through the company. By this I mean that the chance of incarceration is very low and the cost of any fines and legal fees are affordable (assuming they have to be borne personally and not by the company). I would wager that at the current high salaries, even if they get caught it is still lucrative. I’m not implying that they all do it just that there appears to be very few disinsentives.

So it would appear that the DOJ / FBI / Stasi has lied to congress.

So will congress be hauling the director and or his minions up to testify ?

Perhaps Barry Bonds lawyer is available.

hey …. clicking around ESPN … just read that Oakland CA pays $4 million a year to Goldman Sachs

http://www.bloomberg.com/news/2012-12-20/oakland-pays-17-million-for-nfl-raiders-as-cops-get-cut.html?cmpid=otbrn.sustain.story

Aside from “deterrence and meting out meaningful punishment to violators,” there is another goal of criminal prosecution: obtaining restitution for losses on behalf of victims of crime. These U.S. Justice Department Get-Out-of-Jail-Free/No-Admission-of-Guilt “parking tickets” never include restoration of the assets and interest stolen from investors through fraudulent wrongdoing. After all, the defendants are former/potential employers waiting just outside the federal revolving door.

In California, our Constitution, Article 1 Section 28(b)(13), guarantees the right of the victims of wrongdoing to collect restitution via the criminal process:

“(b) In order to preserve and protect a victim’s rights to justice and due process, a victim shall be entitled to the following rights:

…”(13) To restitution.

“(A) It is the unequivocal intention of the People of the State of California that all persons who suffer losses as a result of criminal activity shall have the right to seek and secure restitution from the persons convicted of the crimes causing the losses they suffer.

“(B) Restitution shall be ordered from the convicted wrongdoer in every case, regardless of the sentence or disposition imposed, in which a crime victim suffers a loss.

“( C) All monetary payments, monies, and property collected from any person who has been ordered to make restitution shall be first applied to pay the amounts ordered as restitution to the victim.”

Read the whole “Victim’s Bill of Rights” — then write your Congress-critter.

California has some of the most aggressive and egregious foreclosure frauds, thanks to the unusual “deed of trust” system. And I don’t see any prosecutions in California.

Your Constitutional provisions seem to be dead letters, perhaps because DAs are allowed to issue “get out of jail free” cards even in California. Got private prosecutions?