There appears to be no intellectually honest defense of austerity left standing.

The IMF has already ‘fessed up that it does not work in practice, that cutting government spending when growth is weak simply leads the economy to contract further, making debt to GDP levels even worse than before. That admission was based on the miserable results it has produced when implemented.

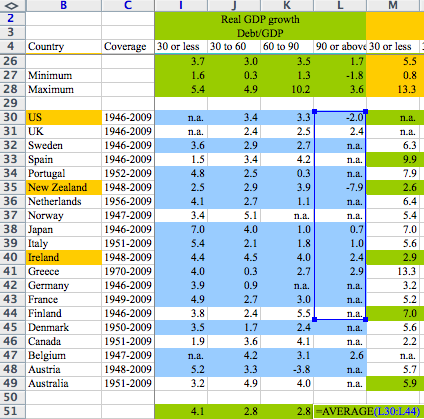

But now, a new paper by Thomas Herndon, Michael Ash and Robert Pollin of PERI, “Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogoff,” is a devastating takedown of the factoid commonly bandied about by austerians, that if government debt rises above 90% of GDP, growth suffers. That belief in turn was based on a paper “Growth in the Time of Debt” by Carmen Reinhardt and Kenneth Rogoff, which did a 20 country comparison from 1946 to 2009. This paper claimed that when debt rose over the scary 90% to GDP level, growth fell to -0.1%.

Turns out that is not true. A number of economists had challenged the findings for asserting causality when all it showed was a correlation. In addition, a number of economists tried replicating the Reinhart-Rogoff results for years, with no success. Reinhardt and Rogoff refused to share their underlying computations. Five years later, now that the Reinhart/Rogoff work is widely accepted as true, they finally sent their “working spreadsheet” to the PERI team. As Herndon, Ash, and Pollin report:

Our finding is that when properly calculated, the average real GDP growth rate for coun- tries carrying a public-debt-to-GDP ratio of over 90 percent is actually 2.2 percent, not −0.1 percent as published in Reinhart and Rogoff. That is, contrary to RR, average GDP growth at public debt/GDP ratios over 90 percent is not dramatically different than when debt/GDP ratios are lower.

So the widely touted finding is wrong on its face. The paper goes through a litany of what is wrong with their analysis. The biggest gaffe is a spreadsheet error which rather conveniently omitted five countries, Australia, Austria, Belgium, Canada, and Denmark, entirely. The paper stresses that this omission was necessary to achieve the negative-growth finding. The paper describes what it calls a “coding error”:

The omitted countries are selected alphabetically and, hence, likely randomly with respect to economic relationships. This spreadsheet error, compounded with other errors, is responsible for a −0.3 percentage- point error in RR’s published average real GDP growth in the highest public debt/GDP category. It also overstates growth in the lowest public debt/GDP category (0 to 30 percent) by +0.1 percentage point and understates growth in the second public debt/GDP category (30 to 60 percent) by −0.2 percentage point.

Mike Konczal obtained a copy of the spreadsheet. As he explained:

Being a bit of a doubting Thomas on this coding error, I wouldn’t believe unless I touched the digital Excel wound myself. One of the authors was able to show me that, and here it is. You can see the Excel blue-box for formulas missing some data:

And although the most glaring problem, it’s far from the only one. The authors found other, um, irregularities.

Reinhardt and Rogoff omitted data. The PERI authors note the cases when data was not in the spreadsheet because it was not available. But there were important cases when the information was simply not included. To wit:

More significant are RR’s data exclusions with three other countries: Australia (1946– 1950), New Zealand (1946–1949),and Canada (1946–1950).4 The exclusions for New Zealand are of particular significance. This is because all four of the excluded years were in the highest, 90 percent and above, public debt/GDP category. Real GDP growth rates in those years were 7.7, 11.9, −9.9, and 10.8 percent. After the exclusion of these years, New Zealand contributes only one year to the highest public debt/GDP category, 1951, with a real GDP growth rate of −7.6 percent. The exclusion of the missing years is alone responsible for a reduction of −0.3 percentage points of estimated real GDP growth in the highest public debt/GDP category.

On top of that, all data was not treated equally. Reinhardt and Rogoff weighted the sample in a way that gave the negative growth findings more significance than appears warranted.

As the PERI team explained, the paper did a simple comparison, lumping experience into four buckets: when government debt to GDP was 0-30%, 30%-60%, 60% to 90%, and over 90%. But within each bucket, they bizarrely weighted each sample by country rather than by the number of data points. The authors explain the consequences:

After assigning each country-year to one of four public debt/GDP groups, RR calculates the average real GDP growth for each country within the group, that is, a single average value for the country for all the years it appeared in the category….

RR does not indicate or discuss the decision to weight equally by country rather than by country-year. In fact, possible within-country serially correlated relationships could support an argument that not every additional country-year contributes proportionally additional information. Yet equal weighting of country averages entirely ignores the number of years that a country experienced a high level of public debt relative to GDP. Thus, the existence of serial correlation could mean that, with Greece and the UK, 19 years carrying a public debt/GDP load over 90 percent and averaging 2.9 percent and 2.4 percent GDP growth respectively do not each warrant 19 times the weight as New Zealand’s single year at −7.6 percent GDP growth or five times the weight as the US’s four years with an average of −2.0 percent GDP growth. But equal weighting by country gives a one-year episode as much weight as nearly two decades in the above 90 percent public debt/GDP range. RR needs to justify this methodology in detail. It otherwise appears arbitrary and unsupportable.

And you get a double-whammy: remember that New Zealand had three years of good growth with high debt to GDP levels that were omitted, so the -7.6% is an even greater overstatement. And the PERI authors stress, while the interaction of the mistakes does not affect the below 90% categories much (you get 4% growth in the lowest category and more or less 3% in the next two), it changes the outcome completely in the top category.

Dean Baker, who has long been a skeptic of the Reinhardt/Rogoff work, reminds readers of other reasons the work was sus, that of the causation we mentioned at the outset. Low growth is often the result of factors having nothing to do with government debt levels. Just look around you. We are in a balance sheet crisis of low growth as a result of a global financial crisis that was the result of too much private debt, most importantly at undercapitalized financial institutions. The rise in debt level was not the result of “profligacy” but of tax revenues collapsing as a result of the crisis, and spending under various programs increasing (notably unemployment-related programs). And the overwhelming consensus is outcomes would have been worse absent the automatic increase in government spending. Yet the Reinhardt-Rogoff prescription would have you believing the reverse.

Baker points out some of the earlier data points that similarly support the “high debt is bad” thesis don’t stand up to scrutiny:

There are all sorts of good reasons for questioning this logic. First, there is good reason for believing causation goes the other way. Countries are likely to have high debt-to-GDP ratios because they are having serious economic problems.

Second, as Josh Bivens and John Irons have pointed out, the story of the bad growth in high debt years in the United States is driven by the demobilization after World War II. In other words, these were not bad economic times, the years of high debt in the United States had slow growth because millions of women opted to leave the paid labor force.

And you have another apples and oranges problem, of mixing sovereign currency issues with countries that don’t control their currencies. De facto gold standard countries do have a hard time managing high debt levels, since they can only borrow to fund government debt, and as the periphery European countries show, will be subject to higher interest rates, which then makes financing costly throughout the entire nation.

The good news is the paper has gone viral. Even non-economic sites have picked up on it and are flagging that the “error” has been hugely destructive, to wit, ars technica: Microsoft Excel: The ruiner of global economies? And Reinhardt and Rogoff seem to be engaging in desperate defenses. They contend in their initial response that the recomputation by Herndon, Ash, and Pollitt still supports their thesis that high debt levels are negative for growth. But this is disingenuous. There is a HUGE difference between showing a negative finding, of recessionary outcomes, versus an average of 2.2% growth for an advanced economy, which is considered to be an entirely respectable, if not exciting, growth rate. This is typical of the sort of thing Reinhardt and Rogoff said about their findings. From a Financial Times comment in 2010 titled No need for a panicked fiscal surge:

Indeed, it is folly to ignore the long-term risks of already record peace-time debt accumulation. Even where Greek-style debt crises are unlikely, the burden of debt will ultimately weigh on growth due to inevitable fiscal adjustment. The fact that the markets seem nowhere near forcing adjustment on most advanced economies can hardly be construed as proof that rising debts are riskless. Indeed, the evidence generally suggests that the response of interest rates to debt is highly non-linear. Thus, an apparently benign market environment can darken quite suddenly as a country approaches its debt ceiling. Even the US is likely to face a relatively sudden fiscal adjustment at some point if it does not put its fiscal house in order.

The “debt ceiling” is a coded reference to the 90% threshold in their paper, which they reference in the preceding paragraph. But as we indicated, those “ceilings” and “non-linear” outcomes have been observed in de facto gold standard countries.

Similarly, Reinhardt and Rogoff deny that they ever asserted causality in their paper. And in fact, they appear to have trod that line carefully. But they have certainly insinuated that debt in and of itself is a problem as opposed to a symptom. For instance, from a Bloomberg op ed in 2011 (hat tip Lambert, emphasis ours):

Our empirical research on the history of financial crises and the relationship between growth and public liabilities supports the view that current debt trajectories are a risk to long-term growth and stability, with many advanced economies already reaching or exceeding the important marker of 90 percent of GDP.

Readers are welcome to correct me, but I also do not recall a single time seeing either Reinhardt or Rogoff clearing their throats in public and saying their paper only showed a correlation. Both have written regularly and spoken out in favor of cutting debt levels as desirable and necessary. For them to claim they didn’t mean to claim causality is astonishing.

Now in fact there is a reason to be concerned about the artificially low interest rates the Fed has and is certain to continue to engineer. They are a massive transfer from savers to the financial system and to speculators on asset prices. But the solution is more demand and more investment, and if the private sector won’t provide it, government needs to step in. The evidence, as even the IMF has been forced to acknowledge, is that government spending is stimulative, and with a fiscal multiplier over 1 (which is also what the IMF found is operative in low growth economies), spending makes the denominator of the debt/GDP grow faster than the numerator, reducing rather than increasing debt ratios.

But the damage is already done. The establishment is too deeply invested in austerian thinking to change courses. How many times have we heard Obama make remarks along the lines of these from his 2011 Facebook town hall meeting:

So now what we’ve got is a situation not only do we have this accumulated debt, but the baby boomers are just now starting to retire. And what’s scary is not only that the baby boomers are retiring at a greater rate, which means they’re making greater demands on Social Security, but primarily Medicare and Medicaid, but health care costs go up a lot faster than inflation and older populations use more health care costs. You put that all together, and we have an unsustainable situation.

So right now we face a critical time where we’re going to have to make some decisions how do we bring down the debt in the short term, and how do we bring down the debt over the long term.

Reinhardt and Rogoff legitimated the backwards idea that debt is the problem. No, growth is the problem (now we can debate how to achieve growth in the face of current and prospective resource constraints, but that is a different conversation. A space race level push for a combination of energy conservation, which BP found increased its profits dramatically, and accelerating the use of less damaging energy sources alone would provide some economic impetus). The level of real (as opposed to official) unemployment shows how bad things are and how more needs to be done. Dean Baker describes the high human cost of the Reinhardt and Rogoff snake oil:

This is a big deal because politicians around the world have used this finding from R&R to justify austerity measures that have slowed growth and raised unemployment. In the United States many politicians have pointed to R&R’s work as justification for deficit reduction even though the economy is far below full employment by any reasonable measure. In Europe, R&R’s work and its derivatives have been used to justify austerity policies that have pushed the unemployment rate over 10 percent for the euro zone as a whole and above 20 percent in Greece and Spain. In other words, this is a mistake that has had enormous consequences.

But as Max Planck said, “Science advances one funeral at a time.” The same is certain to be true of economics and policy orthodoxies. Despite the IMF having said austerity is a crock, the Troika continues to tighten the noose around the necks of periphery countries, even as economic indicators in Germany continue to weaken. Obama is too deeply invested in making deficit cutting and putting Social Security and Medicare on a path to destruction to reverse course. The one benefit of this decisive debunking of the Reinhardt and Rogoff paper is it will be impossible for him to defend his actions as merely following the advice of experts. The experts have been shown to be wildly wrong, and any decision to follow their faulty analysis now rests squarely on Obama and his fellow travelers.

Reinhardt and Rogoff told our elites what they wanted to hear, and so the paper was accepted as gospel, despite the lack of peer-review or release of data and methodology.

I fully expect that abomination of a “study” to continue being used as justification for destroying the little peoples’ lives, while its flaws will simply be ignored.

Even fraud and professional malpractice will generate no response from these people.

There will be a brief embarrassed silence, then: “look over here folks, IRAN!!”

Then, gosh, look over there, NORTH KOREA !

Reversing the polarity, this means stimulus does not necessarily produce growth.

Spending is necessary but not sufficient.

As always, what matters is investment vs malinvestment.

May I add, Duh?

Where is my honorary PhD in Economics,

and ridiculous fee schedule for being

a member of the spin patrol?

Oh, that’s right…being accurate is worth approximately $0.

The big money comes from lying with numbers for fraudulent

profit.

Agreed. And it would seem obvious, but in this era of total irresponsibility and lack of consequence for being wrong, these two “economists” who cannot defend their pathetically simple errors SHOULD be completely disgraced, and nobody should listen to anything they have to say ever again. Their pathetic excuses are pathetic.

If I understand their errors you know they were just massaging data to fit their agenda. Nobody is that stupid. What are they, U. of Chicago-based?

until ordinary people understand how deflation/no inflation benefits the owners of capital, nothing much is going to change.

so who’s going to give the new “Cross of Gold” speech today? and with better success than in 1896.

better be a great speech….cuz you gotta compete against the Duggars, Bieber and youtube videos of dancing cats.

[U]ntil ordinary people understand how deflation/no inflation benefits the owners of capital, nothing much is going to change.

And that’s the frustrating part: it’s not like we’ve been here before. We already solved all these problems two or three generations ago, yet here we are, diddling over the same “fiscal responsibility” and “sound money” and “setting our fiscal house in order” nonsense. Can’t we euthanize these rentiers already, and get on with dealing with real problems?

Euthanizing them WOULD be dealing with real problems!

Changing the rules of ongoing inheritance would be REALLY dealing with the problem rather than the current silver spooned devil incarnate.

‘Austerity’ is not now, nor has it ever been, an economic program: It is a political program. The evidence for it’s effect historically has always been contraction, but the key is contraction of what for whom?

The ‘hard money’ credit rationing financiers of the 1800s preached austerity for the poor as a way to keep them under the boot and to keep national governments wedded at the waist to those same finaciers. Those same financiers were seldom shy about speculating greatly with the gains on their own account: no austerity for _them_. Meanwhile, real economies always hit hard times for the populace, but that was a feature not a bug for the speculative class, making assets cheap, and maximizing the weight of hoarded capital.

What we see now is more complex, but largely a variation on that theme. Germany in Europe in particular has been unhappy for 60 years with the loose bonding southern fiscs, and the putative ambitions of governments elsewhere in the EU to turn a Eurobond option into a money tree. So ‘the crisis’ is being used to club into submission every small indebted government to stamp out such practices by enforced debt service rather than new debt issuance. The idea that this is an economic stimulus mechanism isn’t taken seriously anywhere in the EU, it’s political vigilantism as a way of winning a long-running political economical argument within Europe. —And the Germans will pay dearly down the road and don’t doubt it if they are so foolish as to continue the present policy. In the US, ‘austerity’ is simply a political con game to force open the payment streams of Social Security and Medicare to the money center speculative class who have already looted, damaged, or attached everything else of worth in the country.

Austerity has nothing to do with economics, so it should not surprise that justifications for it have little to do with evidence.

Excellent point! Most decisions are made with primal emotions, then “rationalized” with “logic”. If logic fails, then use deception. If deception doesn’t work, then use coercion. Austerity is about power. The real debate is about what side of the stick you happen to be on.

ALL economic policy is POLITICAL.

If the implication is that MMT is somehow more sound economic policy and less political – bullshit!

Ultimately, the distinction between economics and politics is artificial and intended to obfuscate who wins and who loses when a particular set of policy precriptions is adopted. To pretend otherwise is to sever the inextricable nexus between PRODUCTION and POLITICS.

I have to disagree with you a bit. Austerity is the neoliberal solution to economic collapse. To put it another way, neoliberalism means getting money to businessmen so they will invest it. If businessmen are not investing, then, obviously, the supply of money is not big enough, so every drain on the money supply must be stopped up to make more available for businessmen. By drain on the money supply, neoliberals mean any money not in pockets of businessmen or lenders. To the extent there is any non-privatized government service, it must be undone so that the freed money can fly to businessmen and their lenders, setting the economy off once again in a joyful growth spurt. The sole thing neoliberal austerity has going for it is internal consistency.

So what we have seen is the collapse of the economy caused by neoliberalism and our leaders using neoliberalism to try to fix the economy. That they are doing this is indeed political, but they are using the neoliberal toolbox.

Lying and perpetuating the lie is where the money is. Enough politicians, financial houses, professional “economists”, etc. have too much invested in the system to let the system fail. Even when confronted by reality.

Those who promote austerity have a lot of loot to gain from austerity. And they will kill you to maintain their wealth and status.

As with many political issues, this debate has forgone the facts in favor of propaganda.

The correction in the spreadsheet error changes the growth in high GDP countries from -0.1% to +0.2%. This hardly changes the conclusions originally drawn by Reinhart/Rogoff nor is exactly an “In your face! moment for the anti-austerity crowd.

Reinhart/Rogoff offered their reasoning for excluding certain countries/years in their study: “To focus on the association between high debt and long-term growth, we only cursorily treat shorter episodes lasting under five years, of which there turn out to be only a few. The long length of typical public debt overhang episodes suggests that even if such episodes are originally caused by a traumatic event such as a war or financial crisis, they can take on a self-propelling character…”

In other words, Reinhart/Rogoff excluded high debt episodes in Belgium, Finland, and Australia simply because they did not meet the criteria of lasting at least five years. This methodology can be debated, but it is what Reinhart/Rogoff use.

At the end of the day, there are numerous studies that indicate high debt/GDP countries have subpar growth. The key question has always been which aspect is the cause and which is the effect? (The proverbial chicken and egg question for economics). Reinhart/Rogoff never really answered that question nor does the mentioned Amherst study.

At the heart of this debate are the assumptions and methodology used in these two different studies. Obviously if economists alter the original study’s assumptions and methodology, the result will be a different conclusion. While these points can be argued, empirically stating that these new discoveries refute austerity is just wrong–just like the Reinhart/Rogoff study never actually proved austerity is right. In other words, (to the disappointment of many) this controversy is much ado about nothing and we are no closer to the “truth” than before.

As long as a government can borrow money without consequences then times will be probably be good. Otherwise a government will be required to be austere or they will find a way to default on their debt in some fashion.

Never lend to any government unless you like giving up some or all of your money.

“Never lend to any government unless you like giving up some or all of your money.” [GetReal1]

I’m fully invested in U.S. Treasury bonds, and they’ve been doing very well thank you. It’s a time deposit, as opposed to the demand deposit of holding cash. Value of the bonds keeps going up because they are as good as gold. Ha ha ha — much better than gold in reality. U.S. bonds are guaranteed by the full faith and credit of the U.S. government, and the powers that be will never let the U.S. government mess with their money…

Well, you’re right on the short-term and a bit Pollyannaish on the longer term. Good luck.

I’d suggest you do a little more historical research. Pretty much every government and fiat currency has eventually crashed.

You’re biased because you view recent history (ie the past 4-5 decades) as indicative of longer term history.

When has that happened since 1792 in the US? (The US was on the gold standard and running a govt surplus in 1929 when that crash happened. We’ve been on fiat domestically since 1934.)

“Pretty much every government and fiat currency has eventually crashed.”

As has pretty much every government and on-fiat currency. What’s your point?

Detroit Dan:

Are you invested in 30-year Treasuries? I understand they are paying around 3% interest. Having never bought Treasuries, I asume that a $10,000 Treasury would pay $300 of interest after 30 years.

Assuming the investment is rock-solid safe, what is the big deal about $300 of interest over 30 years, which is $10 of interest a year?

Maybe provide a short lesson on how bigger profits can be made in the interim, by selling the bond at an opportune time. Thanks for any help you can provide.

Don Levit

I own some 30 yr. Treasuries. They pay interest bi-anually. A $10,000 30 yr. bond at 3% interest would pay 300 dollars per year. At the end of 30 years you get your original amount back. If you sell before 30 yrs. you could get either more or less back depending on interest rates at that time.

THanks, Patricia.

That sounds a lot better and a lot more realistic than what I thought.

Don Levit

there were actually fewer calculation errors when people used green accounting paper and pencils. That forced a discipline upon you and made you think.

Excel makes it so easy that you just type away with the TV on, and tell yourself you’ll proof it at some later point in time. Then you get lazy and say, “Well, it’s probably accurate, I was pretty careful.” And you just let it go.

A fiasco like this also raises questions about the underlying growth rate data itself. Was it calculated using Excel spreadsheet formulas in the home countries? Probably from about 1985 on.

Either all the errors cancel each other out or they compound themselves into unrelenting nonsense. I have a feeling which one of those it is, but I can’t prove it.

What percentage of GDP sez poofh, yeah but[!!!]… P is Real… Mannnn…

While the egregious coding error may be random, the broader methodology is not—and the methodology is TERRIBLE.

The categorization of countries, and the bizarre weighting scheme seem designed for the sole purpose of walling off a portion of the countries with certain debt ratios from those with growth _and_ debt, and them allowing a few bad years disproportionate weight in the jiggered sample. The number of countries used is to begin with ridiculously small. The time period is suspect also, as post-war, Western economies are a _highly skewed_ set, nothing like ‘all countries with high debt,’ or ‘debt vs. growth in economies of different maturity,’ or so one. The sample is extremely suspicious in its narrowness, othing like R & R’s landmark paper on sovereign defaults.

It is hard to be agnostic regarding the implications of a putative ‘coding’ error in this paper. The kindest thing one could say is that the author’s just didn’t care _what_ the actual numbers were, they already had their conclusions, so they didn’t even bother to look at the output. Given that all the excluded data points lean the other way from the author’s conclusions, I’m inclined toward the darkest suspicions. Buth then, a refusal to publish ones data or compurations is a screaming huge red flag for any study. Never trust secret ‘data,’ as we see again here.

Trade secrets (Independence)… pink slime… or is it grey goo…

Wow, thanks for highlighting this.

This kind of piece makes me want to scream. This is not an economic problem!! It is a political one. This means that what is true is a lot less important than what perceptions are. You can come up with all the economic studies you want, tarted up with lots of charts, and math and unless the guy in the street (read:voter) understands it and buys into it, you’re still at square one. People have deeply ingrained values about thrift, not spending beyond ones means, etc that are great for an individual but not for a government – this is what you have to overcome.

I think there are several basic questions that need to be addressed:

How will you know that it is time to withdraw supports and how will you do it? (making the argument that it can go on forever will be very tough sell).

What is the plan, other than spending money? I think people have a perception that this is a palliative measure that buys time, but to do – what?

What about the big banks, that seem to be getting all the benefits of super-cheap money, while comparatively little gets to main street? In other words, if it isn’t helping _me_ why should we just keep doing what we’re doing?

Sorry for the rant, but these learned pieces where ‘economist A debunks theory by economist B’ just aren’t very helpful. The anti-austerity crowd is going to have to do a much better job explaining things to the general public.

What? A pack of politicians, alternatively sleazy and looney, are going to reduce grandma to spending her golden years eating out of trashcans and rotting away in unheated rooms. All this over what turns out to be a monstrous lie, or an idiotic error. You think your Joe Sixpack everyman won’t be interested by that?

The reality is that opinion polls consistently show that the public wants hands off Social Security at all costs. And, despite the incessent coaching from our betters, we continue to find the economy and employment to be a more pressing concern than debts and deficits. The reality is that our problem is not one of conveying our message to the average Joe and Jill, like we were canvassing for Save the Children or something. The problem is that the state has been seized by a rentier oligarchy, and its past time to react vigorously.

Just because there are errors in R+Rs study does not prove that our debt path is sustainable.

The constant use of the cat food hyperbole is a tip off that you really don’t have any plans next to ever increasing spending. Which, incidentally, is exactly what has been happening anyway.

Yes, but the question is, Spending for the benefit of whom?

Exactly. I see commentors on here whining about how corrupt government is with austerity. Do they honestly think that giving politicians more money to spend will mean it is spent efficiently and honestly?

What RG says. If my choice is austerity, or continuing to feed bon-bons to McDonnell Douglas, Raytheon, United Healthcare and Merck … maybe I prefer austerity.

A good point about, “….spending for whom?”

It’s not the taxes collected (albeit our Fed tax system is also corrupt) but the allocation of those monies.

(And, the “black budgets” not accounted for that cost this country untold billions by our conduct with those un-supervised budgets)

As an aside to other good commenters:

Nothing is going to change until the basics of our safety net(s) are thoroughly shredded…such as SS, unemployment insurance (both state and Fed), continuing crushing of organized labor etc)

Then all bets will be off….and you may (I say “may”) see the ordinary rabble take to the streets with “pitchforks”.

@ian — you know a lot, but apparently you don’t know that voters don’t count.

I don’t mean voters can’t count, I mean voters don’t matter.

Ian:

You raise some very important questions.

While Wall Street has profited immensely from our financial environment, the typical family is treading water, if not virtually drowning.

Less and less of the corporate dollars are going to employees, and more to owners and investors.

In regards to austerity versus debt, it seems to me that debt has received way too much importance in helping to solve our economic doldrums. Whatever happened to American ingenuity and hard work? Whatever happened to excess capital being put to innovative and productive use?

What is it about debt and deficits that seem to have such a powerful hold in attracting our hopes and dreams for a more prosperous future?

Don Levit

Well there ya have it…I guess this cements their position in a Hillary White House. NEC here we come!!!

President Smash’n’Grab just wants those wrong experts to be right long enough for him to get done with his Smashing and Grabbing. Then his family (he expects) will be permanently moved into the World Aristocracy. He has his eyes on the end game, permanent financial wealth, security and privilege for himself and his next ten generations of descendants.

Frankly the fact that this immiserates the Working Class is a feature, not a bug.

After all, what’s the point of being an aristocrat if their are no peasants to oppress?

Leisure, wine, good books…beats working.

You have to admit there were easier, less competitive ways to become rich. Being a banker, for instance. The Presidency offers the ability to do the greatest of favours for your friends; it would seem that Mr. Obama finds that irresistible.

The denials have already begun. From the New York Times Economix blog:

“There’s nothing about this that will change my view of the universe,” said Douglas Holtz-Eakin, a former director of the Congressional Budget Office and prominent Republican economist. “The sun still rises in the east. It sets in the west. And a lot of debt is still bad.”

Debt is bad because debt is bad. He’s literally arguing that he knows because he knows. Can someone please explain to me how we get these low- IQ morons running everything?

I guess he thinks the sun moves around the earth.

Heliocentrism: it’s only a theory!

He could have easily said,

“The sun still rises in the east. And sets in the west. THE WORLD IS STILL FLAT!”

I mean, hes arguing pretty much the same thing, and with just as much evidence.

I hate to give the NYTimes the slightest credit, but whether by accident or design Holtz-Eakin’s quoted remark sums up the entire philosophy of which he is an exponent. Too wonderful that he uses a flat earth metaphor justify his position.

Stupidity pays.

Your comment is dubious…

The man is making a general statement, probably clarified if you read the article. A mice would see that debt will reach a point in which it becomes unpayable and collapses on itself. I suggest checking how much actual money is outstanding vs debt. When you factor in that saving and checking accounts are swept daily, the money is simply not there.

#flash: “The man is making a general statement, probably clarified if you read the article.”

Obviously you didn’t read it, it is not clarified one bit. In fact it is a one-off statement from Mr. Holtz-Eakin in the middle of the blog post with absolutely no follow-up whatsoever.

On the other hand, your statemet concerning actual money outstanding vs. debt is a very good point. I don’t recall the exact numbers from a very recent article I read, but total Money Supply is somewhere between $2T and $3T whereas total debt is in the neighborhood of $50T (I’ll be honest, I don’t remember the exact numbers, but the ratio was ridiculous).

Obviously the total debt cannot ever be repaid… so it seems to me that no one should care if we give up on this austerity meme since even the present debt level will never be anywhere close to being “repaid”.

There isn’t enough money in the world that can pay off the debt, that’s how high it is. We should declare a debt forgiveness jubilee.

You clearly don’t know how the monetary and banking system works.

The problem in my mind is that many of the indebted countries in the study spent their borrowings on productive investments in the early years…ports, highways, bridges, factories…but nowadays the borrowing goes to fuel consumption & useless wars & social welfare. Which skews the whole thing. Of course if you borrow for productive investments AND the productivity gains can outstrip the debt service, you should borrow. If it doesn’t then you shouldn’t. I don’t think R&Rs conclusion has changed much.

Debt is baaad, mmmkay?

http://www.youtube.com/watch?v=5G4HxrVx20A

if I made an error this big and consequential on my job, my career would be over.

Good point. The question occurs: how many secretaries/accountants/paralegals/etc. lost their jobs this week because of such error (real or imagined)? And what was the average loss sustained – $5k, $10k?

The small time dealer-junkie gets 3 to 5, 1 to serve, while HSBC is TBTP.

And to think, NPR wants us to think that it is Venezuela that is corrupt.

Ever seen a RISOP? Everybody should get the chance to curl up with a good RISOP. Ever seen what 50 megatons can do? You can’t really see the point of a RISOP until you consider that a hundred thousand Greeks have to eat out of garbage cans because a tenured Princeton professor can’t do arithmetic.

Ah, Princeton, Harvard, UMd, Peterson Institute what’s the difference nuke em all

If econ were the hard science it poses as, the consequences of these revelations about the data set would be predictable for RR.

Wow.

So you think R&R’s work is the intellectual “linchpin” behind “the austerity movement”?

Yes. See this list of RR

dupesciters. Yglesias: “This is literally the most influential article cited.” Thoma: “a major reason for the push for austerity at a time when expansionary policy was called.” Baker: “politicians around the world have used this finding.” The Hill: “The study has been widely cited in the media and on Capitol Hill during the push to rein in the deficit.So, yes. Do you have an alternative

source of propaganda“intellectual linchpin” to propose?Yes, it’s been cited everywhere and Reinhardt and Rogoff have spoken at all sorts of venues and media outlets.

The Wall Street Journal article on this contretemps is “Seminal Paper Draws Fire” and it is the second-most e-mailed article, trailing reporting on the Boston Marathon bombing.

http://online.wsj.com/article/SB10001424127887324485004578427112435204642.html

Hey TBv,

Wow! I’m surprised you are surprised.

I know they aren’t fucking little boys but they are being caught with their pants down helping the elite fuck the rest of us.

Calling out propaganda is what Yves excels at. We respect her for that. Please take your lack of respect for the truth elsewhere.

It’s George Osbournes’ favourite economics paper. I’ve seen it described as “Canonical” in the British media. It’s the best thing the austerians had.

There’s no mention of this refutation on the BBC website.

Please don’t mention George Osborne. It’s bad for my blood pressure.

http://www.mirror.co.uk/news/uk-news/george-osborne-ex-prostitute-issues-sue-153565

undeniably.

There’s a reason why the economics/financial community has collectively shit a brick at this news.

There was another, less significant paper by Alberto Alesina, but in general R-R has been easily the most cited paper for the austerity advocates. This isn’t a controversial claim.

Why those austerians are such a bad bunch…

How on earth can you starve the poor citizens of paper, digits, devaluation of their currency, theft of their purchasing power. Can’t they see that we, the small group of government beaurocratic thugs (including unions, federal employees, banksters, companies with gov subsidies), will be unable to continue to extort the livelihood of the rest of you suckers. We are doing it for your own good. When you hear someone asking for budget cuts, remember that it simply means we cant extort more money on top of the obsene amounts we are already extorting.

Now, go back to your job, remember to work as hard as you can, produce as many goods as you can, that way we can use the un-backed non-austere currency our government printed and handed to us to buy your stupid wothless products. You stupid idiotic slave you, you better be happy you are getting our dollars with pretty pictures on them.

Oh yes…the wonderful world of government theft, i mean, government spending. Sure, they are the good guys.

Best – government – the – private sector – ever bought… infected as it were… eh.

If they just hadn’t taken the money for that school, I coulda bought another sixpack…

This is on point why?

L. Randall Wray of UMKC has a tough post on this one today, here.

After expressing outrage, highlighting the new criticism, and also recalling a previous paper by Yeva Nersisyan and himself, Randy says:

This answers the question of “How will you know that it is time to withdraw supports . . . ” The answer is you’ll do that when there’s full employment, not before.

As for how you’ll do it, that’s a question MMT economists answer easily. The answer is that full employment will be created by a job guarantee program and that deficit spending on the program will be withdrawn when the private sector has hired everyone away from the program. The MMT JG program is a new “automatic stabilizer.” Spending on it swells when the private sector no longer wants to employ everyone. It comes near to disappearing when the private sector hires everyone back.

The question was also raised about how deficit spending can go on forever? That’s answered by MMT as well here and here.

You consider these easy answers? Where is the evidence that this will work? And has anyone recreated the evidence using the same data?

RG, think about it. If everyone what wanted to work was able to get work through government spending, then there would be lots of money available to the workers to buy the things that they needed. There would thus be demand for goods and services so that full employment would bring growth with it.

Except those workers have to be creating real value, instead of make work, otherwise, we’re just creating a new unsustainable consumption cycle.

Well, RG there’s lots of literature out there about how the JG would work. How about reading some of it. I can tell you that it won’t involve “make work” if it’s an MMT proposal but will produce real value for the communities in which the work is done. This will happen because the work will be designed by those communities and assigned in them according to their needs. There will will be a big bottom up component to the process.

Of course it’s true that a JG has never been tried before. But New Deal efforts in the 1930s which produced an enormous amount of value that we still get benefits from today and the Argentine Jefes program are both cases that suggest that a real JG would be very successful and more successful than either. There’s plenty of literature on both of course. There’s also a good series on the JG that’s part of Randy Wray’s MMT primer here.

And yes, the answers are easy; but you do have to read the literature I cited to get them. Now, I know you’ll now claim that you have read it and will tell me there’s no empirical data there. But you’ll need to get a bit more specific than that. Specifically, you’ll have to say which specific MMT-based claim that needs empirical testing hasn’t been tested.

I tend to agree with you about deficit spending until the private sector is “fully employed.”

And, at that point, it seems that balanced budgets or even surpluses would be necessary. It reminds me of the Bible story in Egypt, when they had 7 years of feasts, to prepare for the seven years of famine.

In the last 45 years, we have had, what, 3 tiny surpluses, and 42 huge deficits.

So, it seems your theory of deficit spending to raise us up to our full potential has been overused and under performed.

And, even if we can never default on our debts, what does that privilege do for the average guy like you and I and Ian?

Don Levit

Well, you know Don, you need to be more specific than that about the connection between deficit spending and full employment. Specifically, MMT works with the Sector Financial Balances Model. You should know a bit about that because, as I recall you commented on some of Randy Wray’s work on the subject a few years back. Anyway, you should know that a full employment budget when a nation’s running a trade deficit has to have Government deficits large enough to compensate for demand leakages due to private sector savings and the deficit. So, it’s not just running deficits that will produce full employment. The deficits have to be large enough to do that or you still get stagnation, like the US and Japan have now. For example, if the private sector saves 6% of GDP and the Foreign Sector balance is 6% of GDP then the Government needs a deficit of 12% of GDP or full employment won’t be produced. What you deficit spend on also counts. If you deficit spend on low multiplier tax cuts for the wealthy that will drive up the % of GDP that goes to savings, luxury imports, and foreign travel, so then it will require still higher deficits to get to full employment. Our government may have run deficits all of the years since 1971 but 4, but it has never run deficits that were high enough to produce full employment since we became a sovereign fiat currency system in 1971.

To run such a deficit this year, assuming 6% savings and 4% foreign balance, indications are that the Government would have to aim for and get a $1.6 Trillion deficit. Instead, it’s trying for $960 Billion which will guarantee less than full employment unless the private sector blos a very, very big credit bubble.

So we have to make up for the private sector savings and foreign trade balance.

Is that to be made up, dollar for dollar?

It seems to me that private sector savings is what we need, excess capital put to innovative and productive use.

As far as the foreign trade balance, certainly there are some benefits to Americans , at least some Americans, for incurring such a balance.

People a lot smarter than I could attest to that.

The point here, Joe, is that you place so much emphasis on deficits, and part of that dependence is the use of formulas you cite that supposedly HAVE to balance.

And, the ONLY way to balance the different entities is to… keep increasing the debt.

Isn’t ther more ingenuity, faith, and plain hard work that could replace a good portion of these powerful deficits?

Don Levit

I think you’re missing the point. If you think savings are important then you need to provide space for the private sector to save. Assuming the private sector also wants to run a trade deficit, then depending on how much it wants to import more than it exports you have to provide the space for that by running government deficits large enough to accommodate both savgins and import desires. The household portion of the privates sector as well as many businesses not in the financial sector took a huge bath in the crash of 2008 and its aftermath. So, savings desires increased. The foreign balance decreased because we’re exporting more oil. But the two together are not summing to about 10% of GDP. If we run deficits lower than that then people must import less, save less, or both.

But right now people don’t want to import less and they need to save more to recover from the debacle; so it’s terrible policy to force a government deficit on them that is too small or to run a surplus. It just makes people poorer both in real terms and in financial terms. Why do it, when it’s unnecessary.

But you think it’s necessary because unless we do it the debt subject to the limit must always go up and we will have no way to pay it off. That is simply false, Don! There is a way to pay it off, and the solution is given here. Please read it!

And, btw, the biblical analogy is totally inappropriate in this situation since it was referring to food supply, real wealth, which is always limited in supply. Of course, it made sense to put aside enough grain during 7 years of feasting to prepare for 7 years of famine. But it makes no sense for a government with virtually unlimited ability to create fiat money to put aside some for “lean years.” That’s because for such a government there are never any lean years when it comes to its ability to supply fiat money, since at can always do so at will.

There is an exception to this however. The Government’s ability to produce fiat money could be restricteded at any time through the stupidity of Congress repealing the Executive’s platinum coin seigniorage authority, or people passing a balanced budget or a gold standard amendment. Since this is true it would be prudent for the Government to produce a huge amount of electronic credits in its Treasury General Account (TGA) against the day when that kind of mistake might be made. The volume of electronic credits that ought to be created is open for debate, but, in the past I’ve advocated for a $60 T coin, and others have suggested a $100 T coin or even a $ 1 Quadrillion coin.

Of course, producing such a coin won’t cause inflation because the money wouldn’t be spent in the economy to cover deficits until Congress appropriated the deficit spending.

Joe:

When you make statements like the government will never have lean years, and fiat money can be created out of thin air, I simply have no response.

Even if that were true, I could not even begin to explain why it is true.

I cannot reaonably comment on ideas which, to me, seem to have no reason.

The only long-term effect I can see of this type of thinking, is that the arrogance and hubris will lead to our downfall.

To put it in your lingo, compare the arrogance of your statements to those of Pharoah and Haman.

Shalom,

Don Levit

Don, I don’t know what to do with this reply. My statement about the Government having no lean years is clearly relative to its unlimited ability to generate currency, coins, and reserves in whatever value it wants to. Responses to that statement talking about arrogance, Pharoah, Haman, etc. are nonsense. What I’ve said is either true or untrue. As of now, with respect to the Government of the US it is true. The ability is authorized by the Constitution and the 1996 platinum coin legislation. If you disagree with the idea this authority is there, we can argue about that. But drawing moral lessons from to bible seems neither here nor there.

On the Excel bug: It’s not a bug. It’s a feature.

Somebody’s gotta say it!

Not unlike being able to post some comments, but not others… It’s a riddle, wrapped in a mystery, inside WordPress..

You use zillions of e-mail addresses, all fake. That is getting you caught in the spam filter.

Stick to one.

Single email address. Done.

Well, this clears everything up. Apparently it is not what I say but who I am.

Gosh, I thought we were pals.

It’s not a circular reference issue, it’s something else…circular…circle…

hmmm

As far as I’m concerned, the absurdity of the R-R paper would remain all the same even without those horrible “errors,” since implying causality (though in the response they denied suggesting causality ever… oh really?) when you argument is basically “a high ratio causes a slump in the denominator” is rather unscientific rhetorical acrobatics, but I’m glad that that silly paper got some comeuppance at last.

I was rather annoyed by all those people who seemed to think that saying the magical word “Rogoff/Reinhardt!” would settle everything.

But actually, it always clarified things for me when someone trotted out R&R (Regurgitated Refuse)– at least, after I checked the book out from the local library. I knew nothing about this book beforehand, but was completely unable to finish reading it, because it set off too many red flags for me. It read like a propaganda piece and I returned it within the week as a very disingenuous and not at all clever example of flim-flam. Thank goodness I did not spend $ on that drivel!

‘Is High Public Debt Always Harmful to Economic Growth? Reinhart and Rogoff and some complex nonlinearities’, the 2012 CERDI paperAlexandru Minea and Antoine Parent were among the first to question Reinhart and Rogoff (RR).

Though, initially, they deferred towards agreement (using RR data sets) by stating: “…similarly to RR, average economic growth is lower for countries with debt levels between 90 and 115%, compared to countries with debt levels between 60 and 90%.”

But lacked the courage of their conviction to call it outright fraud when they discovered from the same data that: “average economic growth is higher for countries with public debt above 115%, compared to countries with debt levels between 90 and 115%” , and more importantly…. “that average economic growth is not statistically different for the former group compared to countries with debt levelsbetween 60 and 90%.”

Effectively a debt to GDP doughnut – and an, almost certain, impossibility. As such, these brilliant young economists, provide a perfect example of how, in order not to appear ‘RR’ heterodoxic (a death knell for their career no doubt) they lean, fawningly, towards couching their findings in such terms as: “Although one should reasonably refrain from concluding that governments should adopt loose fiscal policies, leading to high public debt levels, to foster economic growth, this latter result provides a new perspective on the “debt intoleranceratio” emphasized by RR.”

Emphasizing that: “additional evidence is needed before suggesting policy recommendations regarding growth effects of fiscal policy in such high debt regimes, which may be subject to complex nonlinearities. Similar to RR, we find that a debt-to-GDP ratio over 90% is reducing average economic growth. However, contrary to RR, the contraction ineconomic growth is much less obvious”.

Being unable to close the hole in the econometric doughnut (‘ shortcomings, including (i) the specification of exogenous thresholds in the public debt-to-GDP ratio, (ii) the absence of econometric tests for the relevance of the regimes,and (iii) the presence of brutal transitions in the debt-growth relation around the debt thresholds’), Alexandru Minea and Antoine Parent attempted to apply a technique called the ‘Panel Smooth Threshold Regression (PSTR) method’ (a fudge factor).

But, despite this statistical deference to orthodoxy (as they call it, “In the spirit of RR”) they still find that: “… compared to countries with a debt ratio between 60 and 90%, countries with a debt ratio between 90 and 115% experience a decline in their average economic growth rates. Although this decline is statistically significant, notice that the economic growth contraction is much less pronounced than acknowledged by RR. In addition, contrary to RR, we find that countries with a public debt ratio above 115% present an average growth rate which is higher compared to the average growth rate of countries with a public debt ratio between 90 and 115%”.

And, More importantly: “….the growth rate of countries with a debt ratio above 115% is not found to significantly decline compared to the growth rate of countries with a debt ratio between 60 and 90%”, and “In addition, we even show that raising public debt can even increase economic growth, in a context of high debt levels, namely when the public debt-to-GDP ratio is above a threshold level estimated at around 115%.”

Two young economists might now be holding laurels and not bupkis, if only they had been less concerned about upsetting the ‘establishment’ (Reinhart and Rogoff in particular).

Even SPSS and MPLUS can handle analytics with missing data without throwing the results off like here.

Does economics still have an effective peer-review system, or has it simply become unsustainably corrupted?

The “work,” that formed the basis of the book was not demonstably peer-reviewed at all, most likely because it would have been rejected from any reputable journal. The weighting of data alone would have appeared odd to the reviewers, who would have requested supporting data…

Yves,

Thanks for writing this up. I had seen the general headline elsewhere. But – as is your m.o. – you have written this up in a very clear and persuasive manner which drives home the importance of the story.

Somewhat but not entirely off topic as it relates to the Austerity conversation, I wish to thank you, GW, for your own April 11 piece that called attention to a study by wind energy expert Paul Gipe, who reported that – for the amount spent on the Iraq war (based on a lowball estimate of the cost of that war and subsequent occupation) – the U.S. could be generating 40%-60% of its electricity with renewable energy, and further showing the cost of the Iraq War could prospectively have paid for the entire cost of a Renewable Power Grid for our country: http://www.washingtonsblog.com/2013/04/for-the-price-of-the-iraq-war-the-u-s-could-have-a-100-renewable-power-system.html

Thank you.

Part of the problem is that scientists do not accept an obligation to share their data with other scientists and many refuse to do so. They accept the need to describe how they use data, but not the need to supply the data itself, along with any adjustments they may have made to it.

The single most outrageous part of this whole story is that these Harvard economists got away with not sharing all their data for replication for OVER TWO YEARS.

All my friends in the “hard sciences” are up in arms at this kind of secretive research, wondering if this is the norm for the field of economics.

And rightfully so, this will be a major PR hit for economists and we need to set some serious journal standards and overhaul the peer-review process to ensure this kind of absurd event doesn’t happen again.

Most are stopping short of accusing R-R of outright corruption and dishonesty — at the very least, what Reinhart and Rogoff have done is extremely unethical — but I’d take it one step further. There are direct connections between R-R and right-wing think tanks and corporate interests (Reinhart’s hubby is an AEI fellow, Rogoff is a known Republican who is cited heavily in Heritage.) It’s no secret that AEI is a major corporatist think tank.

Hopefully we’ll get some more information in the coming weeks. The initial response from R&R was a complete joke — denial and insistence that their conclusions are still right.

Agree completely. The link elsewhere on here to Randy Wray’s response is useful and essential reading, IMHO.

This lack of sharing data among scientists is rife in the climate science world as well. It is intolerable that people have to resort to foia requests to get it.

Reuters reported yesterday “OSLO (Reuters) – Scientists are struggling to explain a slowdown in climate change that has exposed gaps in their understanding and defies a rise in global greenhouse gas emissions.”

It appears the catastrophe alarmists making the wild claims are going to have to cough up their data because the models are not matching observable data; ie, the real world.

http://www.reuters.com/article/2013/04/16/us-climate-slowdown-idUSBRE93F0AJ20130416

To a scholar, cherry-picked data and unchecked formulas are unethical in themselves, before we get to the not sharing them. See Hugh

http://www.correntewire.com/comment/218730#comment-218730

But then RR are not scholars, but propagandists

Yes, I agree it would be much better if scientists accepted an obligation to share their data with other scientists, and in most cases it would be easy to do so using the internet. Papers would be published as of now and the relevant data would be made freely available on request over the net.

But scientists are not only searchers after truth, they also have careers, and they may hope to mine their data for more publications in the future. In addition they may spend many man hours modifying data and may not wish to give away the benefit of this work to rival scientists.

The troubloe is we see scientific work through rose tinted glasses and miss the institutional framework in which it actually occurs.

Working backwards from conclusions to premises has some obvious benefits, corporate funding being just one of them.

Who needs rationality when we have the Higher Truths of Free Market capitalism?

Real scientists (in physics, biotechnology, immunology, etc.) have lost their funding, careers, reputation and all future citations for such selective manipulation of data.

Reinhardt and Rogoff have suffered only slight blemishes and in blogs such as this and probably minimal damages in the upper echelons of current governments.

Further proof that economics as a science is a bogus premise.

imho

“Readers are welcome to correct me, but I also do not recall a single time seeing either Reinhardt or Rogoff clearing their throats in public and saying their paper only showed a correlation. ”

Well, the certainly never caution all the pundits and politicians who claimed causation.

But it’s mission accomplished for R & R, who I’m sure will be well cared for by the elites. The task is completed–The paper quashed the stimulus debate and justififed QE. As you nted, the policy makers won’t change course and the public won’t likely understand the implications well enough to get organized.

As for quoting Planck, I wish I could be more philosophical. But funerals for scientific ideas like pre-quantum physics are not the same as the heinous intellectual corruption of our economics departments and business schools, which dishonestly enable economic policies that lead to real human suffering–and funerals.

As for quoting Planck: “Science advances one funeral at a time.”

That may be true for physics, but unfortunately it’s just the opposite for economics. It regresses one funeral at a time. Bad enough when the old guard has to die off in order for better theories to be accepted, but economics is largely a case of the old guard having to die off in order for worse (but more ideologically palatable to some) theories to be accepted. We have geniuses at esteemed universities making their careers on bizarre tautologies like Real Business Cycle theory. How could you get any worse? Keynes has gotten tired of spinning in his grave.

This must be Theoclassical Commandment two:

First: men shall fear inflation as the most terrible economic feature on earth.

Second; Public debt will always, and under any circumstance, maintained below 90% GDP to avoid the fury of bond vigilantes.

Third: Trade secrets shall always be above the rule of law. Any law that menaces trade secrets is, consequently, flawed.

…

As I always say, there is no such thing as economics as a separate field from politics. Economics as a field is used to confuse political issues. This is yet another example of that fact.

Wow, 2.2% growth! Not nearly nough to get to full employment nor to repay the debt.

2.2% is average over an economic cycle. That means you can’t attribute the situation we are in to gov’t debt, particularly since gov’t debt to GDP was tame before the crisis.

The point was that ever accumulating debt did not stop the downturn. Nor did ever increasing spending jolt the eocnomy enough to pay down the debt. When the business cycle turns, you’re going to end up with wide deficits that won’t be paid off.

First, they never have to be paid off. Second, the answer to the objection that we’ve been running deficits is that they weren’t large enough to compensate for demand leakages due to savings and trade. See above my reply to Don Levit on the SFB model.

If debt is never paid off, not even a portion of it, won’t reasonable people think that the government is either unwilling or unable to do so.

And, if they think that way, wouldn’t that effect people’s full faith and credit in our government?

Don Levit

Don, the national debt is constantly being paid off. That is what taxes and other purchases from the government are. The private sector redeems its government debt = money. The government pays off its debt by giving the private sector something non-monetary – oil leases, government surplus, or a statement that you have paid your taxes. (Paying off bond debt with currency is not really paying off a debt, but transforming it.)

The problem is that government debt is so secure, people are so sure of the ability of the government to pay its debts off this way, that they accumulate it. This causes the total debt outstanding to rise as the government tries to keep economic activity going.

As I think I wrote in an earlier response to you, it is perfectly possible and common for even private sector entities to behave this way. To keep paying off debts, but have the total indebtedness constantly rise. And the private sector – as a whole – generally does behave this way, outside of depressions, debt-deflations. If you keep on paying your credit card bill then the bank can raise your limit. Stable major corporations like utilities could often keep raising their total debt levels for decades – because they had a good record, based on their stable business, of paying their bills when they came due.

Since the government prints what we use as our basic money at will – currency & bonds – NFA, the only constraint on it is inflation. Governments worldwide for decades have been grossly underspending on the needs of the real economy, the gross underspending only partially alleviated by showering massive welfare on the wealthy, who then trickle down some of it. This gross underspending / welfare for the rich leads to growing deficits and debts, far larger than common sense New Deal/Social Security/Keynesian/MMT spending would lead to. MMT would lead to the soundest, hardest money of all time. Hey, I’ve even gotten Wray to endorse my hard currency plan. Let’s Leap the Fiscal Cliff: Who’s Afraid of Deficits, Anyhow?

Economics is not only not a science, but also not informed by science. Apologies to people like Steve Keen, Yves and others working in the field doing work that feels more scientific to me as a biologist. There is cheating in science – see http://en.wikipedia.org/wiki/Sch%C3%B6n_scandal

It’s ridiculous that R&R did not have to provide their spreadsheet on publication. What I find so hard in social science generally is getting relevant data. The costs of primary research are prohibitive and secondary sources unreliable. As mentioned above, one can design a healthy spreadsheet only to fill it with material that may be defective.

All developed countries ‘need’ project programmes in energy conservation and development. It’s reasonable to go for full employment and decent wages. Yet economics can’t make this viable and puts up ‘argument’ that doing what makes sense will make the sky fall. I’m loose with the term economics – its really politics (as above). We are “better off” with market forces, keeping people poor, out of work and so on. I can think of biological systems like austerity. A classic example comes in some social mice. King mouse forces austerity on others in scarcity and plenty to retain his own advantages. King mouse needs no economics to justify this.

I once thought economics was a way for us to get rational action not bound by biological forces. Having taught the subject I despair it reinforces the very base leadership systems of mice.

One can see that a drive to full employment in, say, the UK alone might well produce inflation and non-competitive wages. Its even possible to think decent wages and secure living might demotivate workers (research suggests not). We should be advancing the spreadsheet of full employment, decent wages, conditions and sensible projects across wide trading blocks. The block to this is not our intellect, its the human king mice.

“King mouse needs no economics to justify this.”

As with other types of vermin, we clearly we need some cats. I’ve got three.

PRAISE OBAMA

Shutting down two dumb wars

Proposed Universal Pre-Kindergarten

Proposed a jobs program to create/save 4 million jobs

Expanded SCHIP to cover 11 million children

Affordable Care Ace which makes every American who earns less 135% of

the Poverty level eligible for Medicaid

Nearly doubled funding for Pell Grants and increased the number receiving Pell grants by 67%

Overhauled the Food Safety Program

Advanced women’s rights in the work place

Ended Don’t Ask Don’t Tell in the military

Passed the Hate Crimes bill

Appointed two women to the Supreme Court

Fixed the Pre-Existing condition in health care

Invested in Clean Energy

Overhauled the credit card industry

Signed Dodd-Frank an effort to regulate the runaway financial Gambling Industry

Established the Consumer Protection Bureau

Proposed Tier 3 Vehicle emission standards

Just a few to remind the people “he is trying to do good”

Mr. Swinney:

-those countries invated by the US still have troops in them;

-proposals aren’t worth a pinch if not acted upon;

-many of your statements need an example to prove them;

He is also doing bad things:

Extending tax cuts to the rich;

Cutting programs like Social Security and Medicare which will increase poverty;

Getting rid of the Rule of Law in many areas, e.g., not going after fraud in the banks and foreclosure corruption;

Throwing out Single Payer healthcare;

Supporting a disfunctional Justice System under Holder;

Killing innocent people on a whim with drones;

Supporting and implementing austerity;

Creating the conditions for increasingly more wealth inequality;

Promoting the rise of oligarchy and kleptocracy in his choice of advisors;

Using the Revolving Door extensively;

Supporting torture by inaction;

Not closing Guantanamo; etc.

In other words, it’s a mixed bag.

I think we underestimate the damage that private credit creation has done relative to declining public (but still really private) credit.

The entire global trade structure is unsustainable.

The elite wish to preserve their gains even if for example it means the destruction of large countries such as Italy so as to provide another fleeting surplus for the speical few.

Why ?

Countries such as the UK have been destroyed more or less.

Its a country of hairdressers and wanabe showbiz singers / tv stars.

They simply no longer have the skill base to sustain themselves.

It was wiped out

This is a very, very serious matter. I am shocked at the evident lack of transparency of Reinhart-Rogoff even more than the results and analysis being wrong.

Shocked, shocked.

http://www.slate.com/blogs/moneybox/2013/04/16/reinhart_and_rogoff_respond_researchers_say_high_debt_is_associated_with.html

We literally just received this draft comment, and will review it in due course. On a cursory look, it seems that that Herndon Ash and Pollen also find lower growth when debt is over 90% (they find 0-30 debt/GDP, 4.2% growth; 30-60, 3.1 %; 60-90, 3.2%,; 90-120, 2.4% and over 120, 1.6%). These results are, in fact, of a similar order of magnitude to the detailed country by country results we present in table 1 of the AER paper, and to the median results in Figure 2. And they are similar to estimates in much of the large and growing literature, including our own attached August 2012 Journal of Economic Perspectives paper (joint with Vincent Reinhart) . However, these strong similarities are not what these authors choose to emphasize.

2012 JEP paper largely anticipates and addresses any concerns about aggregation (the main bone of conention here), The JEP paper not only provides individual country averages (as we already featured in Table 1 of the 2010 AER paper) but it goes further and provide episode by episode averages. Not surprisingly, the results are broadly similar to our original 2010 AER table 1 averages and to the median results that also figure prominently. It is hard to see how one can interpret these tables and individual country results as showing that public debt overhang over 90% is clearly benign.

The JEP paper with Vincent Reinhart looks at all public debt overhang episodes for advanced countries in our database, dating back to 1800. The overall average result shows that public debt overhang episodes (over 90% GDP for five years or more) are associated with 1.2% lower growth as compared to growth when debt is under 90%. (We also include in our tables the small number of shorter episodes.) Note that because the historical public debt overhang episodes last an average of over 20 years, the cumulative effects of small growth differences are potentially quite large. It is utterly misleading to speak of a 1% growth differential that lasts 10-25 years as small.

By the way, we are very careful in all our papers to speak of “association” and not “causality” since of course our 2009 book THIS TIME IS DIFFERENT showed that debt explodes in the immediate aftermath of financial crises. This is why we restrict attention to longer debt overhang periods in the JEP paper., though as noted there are only a very limited number of short ones. Moreover, we have generally emphasized the 1% differential median result in all our discussions and subsequent writing, precisely to be understated and cautious , and also in recognition of the results in our core Table 1 (AER paper).

Lastly, our 2012 JEP paper cites papers from the BIS, IMF and OECD (among others) which virtually all find very similar conclusions to original findings, albeit with slight differences in threshold, and many nuances of alternative interpretation.. These later papers, by they way, use a variety of methodologies for dealing with non-linearity and also for trying to determine causation. Of course much further research is needed as the data we developed and is being used in these studies is new. Nevertheless, the weight of the evidence to date -including this latest comment — seems entirely consistent with our original interpretation of the data in our 2010 AER paper.

Carmen Reinhart and Kenneth Rogoff

April 16, 2013

“A space race level push for a combination of energy conservation, which BP found increased its profits dramatically”

BP = British Petroleum?

????????????

Yes they spent $30 million and saw savings of $650 million.

Does anyone know whether the erratic GDP figures in New Zealand between 1948 and 1951 had anything to do with militant unions? This culminated in the Waterfront Dispute in 1951 that shut down the ports in Wellington and Auckland and had large swathes of the public service in the streets. The military was brought in to load and unload ships. The dispute resulted from inflationary pressures that had not been matched by pay raises. Only a brave analyst would naively (lets be generous) apply this data to a model implying some kind of causation.

I hope it’s an auspicious sign for rolling back the suicidal austerity in Europe that this defective paper is put to rest/shame the same day as Madam Thatcher.

as a liberal American, what has always bugged me about the UK/EU is that the “liberal” position in Europe is pro-EU, pro-Euro-federalization; hence pro-corporatist, pro-bank.

While liberal Europeans and Euro-sceptic conservatives (like UKIP or Mme. Le Pen) obviously are not naturally allies on many issues, they should be working together when it comes limiting the power of Brussels.

but then again, the American left and Rand Paulites should be working together on a lot of issues like 4th amendment, etc.

To put this thing into a little bit of context from a math expert’s (Mathbabe) perspective, here’s the last comment on the R-R “modeling” effort:

“5) And this is an easy model. Think about how many modeling decisions and errors are in more complicated models!”

http://mathbabe.org/2013/04/17/global-move-to-austerity-based-on-mistake-in-excel/

She is effin’ Awesome !!

I’ll bet aggregate consumption falls if private debt rises above 90% of GDP.

The ultimate real physical product of private debt creation – the car

Is in trouble in its homeland.

The German car market is now down and out with the rest of us (except the UK of course)

http://www.acea.be/images/uploads/files/20130417_PRPC-FINAL-1303.pdf

Of the large car markets in March its the worst hit at -17.1 % and -12.9 % January to March.

Already thats a decline of 100,000 vehicles from the same period last year.

Also of the medium to small markets the former strongmen of the North in Finland & Holland seem to be the worst hit.

March reg

Finland : – 58.6 %

Holland : – 31.4%

The sacrifice of Cyprus is not enough to bail these little monsters out with Cypriot car reg down – 58.9% in March with just 405 cars…………

More cars were sold in Iceland….

How long has the R&R paper been “out there”?

Hello there, I believe your website could be having internet browser compatibility problems.

Whenever I look at your blog in Safari, it looks fine

however when opening in IE, it’s got some overlapping issues. I simply wanted to provide you with a quick heads up! Other than that, great site!

Just a little results-oriented “methodology” serving the interests that further a good american economist’s career.

Z

The fact that the good economist folks that came up with the study … r&r … wouldn’t fully divulge how they got to their conclusions from the onset tells you all you need to know. It wasn’t no accident … it was a conscious cover-up from its very inception.

Z

Terrific post, Yves.

To Joe Firestone:

Does MMT make any data point choices in its framework— or put in a slightly different way—does MMT ever make any choices as to where to conceptually cut their focus?

For example, would you admit to a conceptual choice as to where to cut your historical focus in your understanding of the history of money or would you admit that a conceptual choice is at work in your emphasis on state fiat money creation rather than private bank-created money?

Are such choices in any sense political?