Yves here. Take note in particular the discussion of the state of play in Italy. Even though other countries under the German yoke are complaining, Italy is the one that can credibly defy Germany, and the Germans know it.

I welcome comments from people who are following European media. I’m not sure that Latta’s failure to round up supporters matters much. I’d imagine he wants to position himself as Berlusconi’s messenger rather than a staunch ally.

By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

As I mentioned earlier in the week Italy may have a new parliament but there is very familiar person who appears to be pulling the strings, and how long such an arrangement can last is questionable. Over the last couple of days Silvio Berlusconi has placed several demands on the new PM including a re-negotiation of Italy’s deficit commitments and abolition of some taxes. So far the taxes have stayed, but Berlusconi has already made rumblings about withdrawing support while the new PM heads to Berlin attempting to run with Berlusconi’s anti-austerity agenda:

Italy’s prime minister has urged the European Union to drop its insistence on austerity policies and promote initiatives fostering growth instead.

Prime Minister Enrico Letta said on Tuesday in Germany that “it is absolutely necessary” to foster growth and job creation to help the 27-nation bloc’s stalling economies “so that our citizens see Europe not as something negative but as something positive”.

Letta’s visit to Berlin for talks with Chancellor Angela Merkel marked his first official trip abroad and came only hours after his winning approval by the Senate in Rome.

Merkel said she saw no contradiction between budgetary discipline and the goal of economic growth.

“For us in Germany, budgetary consolidation and growth are not at cross-purposes but have to go hand in hand to lead to greater competitiveness and therefore more jobs,” conservative Merkel told a joint news conference ahead of private talks with centre-left Letta.

As I’ve spoken about previously, this is going to go nowhere in a German election year. We may see some concessions in Q4 but until then Mr Letta isn’t likely to see much in the way of help. In my opinion he would have been far better of taking a trip to Paris and/or Amsterdam to muster some support before heading directly for Merkel’s door.

In the meantime, while the Italians attempt to re-negoitate their contract with the EU, the bad news just keeps coming out from the rest of the periphery:

Spain is heading for another year of recession after figures showed GDP contracted in the first three months of 2013 amid a widespread slowdown in consumer spending, rising unemployment and predictions of further declines in house prices.

The economy shrank by 0.5% in the first quarter, according to Spain’s national statistics office, in line with government predictions that a recovery will be delayed until the end of the year.

One analyst said the economy, which started to decline in the summer of 2011, was on course to repeat last year’s 1.9% contraction before stabilising in 2014.

The gloomy outlook followed a raft of weak figures showing that Spain remains in the grip of a deep recession. A report by the credit ratings agency Standard & Poor’s showed that the housing market continued to be a drag on growth. House prices have already fallen by more than 40% in some areas, sparking a wave of repossessions. Tens of thousands of families are unable to sell their homes while they remain in negative equity.

You can head over to Tinsa to check out the house price movements. The Mediterranean coast has seen falls of over 40% from peak while the average of the other areas is close to 30%. Either way these are punishing numbers and the loss of private sector wealth attributed to them is a massive drain on the national economy. The troubling thing is that house prices aren’t just still falling, but appear to be accelerating downwards in the latest figures. I’ve discussed previously what I see as balance-sheet recession dynamics in Spain and it is little wonder that the Spanish government continues to revise down revenues and economic estimates. Not so long ago Q3 2013 was the period where everything would bottom and begin to get better in the EuroZone, but it appears that we’ve finally seen the end to that delusion with the Spanish government now predicting this years deficit to be 6.3% of GDP and nothing that comes close to meeting the existing treaties until at least 2016.

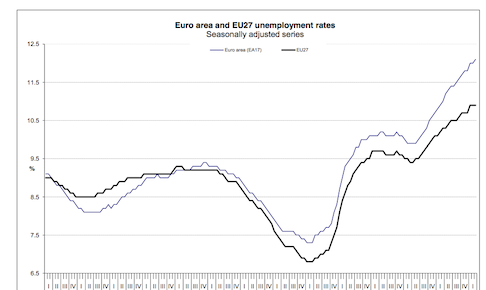

Of course you only have to look at the latest employment figures from EuroStat to understand that nothing is getting any better for the south Europeans:

The euro area1 (EA17) seasonally-adjusted unemployment rate3 was 12.1% in March 2013, up from 12.0% in February4. The EU271 unemployment rate was 10.9%, stable compared with February. In both zones, rates have risen markedly compared with March 2012, when they were 11.0% and 10.3% respectively. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 26.521 million men and women in the EU27, of whom 19.211 million were in the euro area, were unemployed in March 2013. Compared with February 2013, the number of persons unemployed increased by 69 000 in the EU27 and by 62 000 in the euro area. Compared with March 2012, unemployment rose by 1.814 million in the EU27 and by 1.723 million in the euro area.

Among the Member States, the lowest unemployment rates were recorded in Austria (4.7%), Germany (5.4%) and Luxembourg (5.7%), and the highest in Greece (27.2% in January), Spain (26.7%) and Portugal (17.5%).

Compared with a year ago, the unemployment rate increased in nineteen Member States and fell in eight. The highest increases were registered in Greece (21.5% to 27.2% between January 2012 and January 2013), Cyprus (10.7% to 14.2%), Spain (24.1% to 26.7%) and Portugal (15.1% to 17.5%). The largest decreases were observed in Latvia (15.6% to 14.3% between the fourth quarters of 2011 and 2012), Estonia (10.6% to 9.4% between February 2012 and February 2013) and Ireland (15.0% to 14.1%).

That blue line just keeps heading for the moon.

I see the official Irish leprechaun making noises about “reform”

These are the worst kind of liberal.

They seek to put a intellectual & moral cover over deep systems of control.

http://www.rte.ie/news/2013/0502/389927-michael-d-higgins-european-union/

More weekends of quiet vomit to come I fear.

Wilson wannabes.

“Over the last couple of days Silvio Berlusconi has placed several demands on the new PM including a re-negotiation of Italy’s deficit commitments and abolition of some taxes. So far the taxes have stayed, but Berlusconi has already made rumblings about withdrawing support …”

Not correct.

On Monday Letta has promised to cancel the real estate tax and freeze VAT, just what Berlusconi wanted. Berlusconi’s first officer, the new vicepresident of the Republic, Angelino Alfano, told after listening to Letta’s speech on Monday: “it is music to our ears”.

Letta’s speech has been described in the European press as quite smart, pleasing both its center-left constituency and Berlusconi’s voters.

Um, a “promise to cancel” isn’t a done deal.

I’m sure the Germans will object. I’d assume this was part of the message Letta was carrying to them.

Now he may indeed not blink, but we need to see what sort of threats the Germans make. The OMT is subject to legislative approval in Germany. That’s a pretty big hostage.

I’m pretty sure the abolition of the real estate tax and freeze of VAT is part of the done deal with Berlusconi, in order to have a gov’t in Italy.

Germans may not like it but although their coercive power is substantial, it has some limits, particularly now that France is not on their side. See:

http://www.spiegel.de/international/germany/tensions-grow-between-germany-and-france-over-austerity-a-897318.html

On the other hand the Bundesbank deposition against the OMT really is a very big thing. I’m surprised by the lack of coverage of that deposition in the Spanish press.

We hear so much talk about more austerity or less austerity. But why does not anyone see that most of the problem countries of the Eurozone have one and only common characteristic: the EMU.

Without the Euro, Spain would never had been able to build this huge housing bubble. Without the Euro, Germany would not have been able to sell so much arms to Greece, etc.

Without the Euro, countries with temporary problems would devalue, but one at a time.

IMHO, intelligent and coordinated breakup of the Euro is the only sensible course of action. But when have you heard politicians say “We screwed up” and the honest thing to do is undo our huge blunder?

I fear they will rather have millions of people out of their homes and on the dole rather than admitting error.

I’m not sure there’s a chance of Italians getting any significant concessions from Merkel, election year or no. She gives the impression of being incapable of admitting error.

A George W Bush in drag?

Europe is steered into the abyss by stubborn sociopaths who don’t know any humanity. Rephrasing Oscar Wilde: “Sociopaths know the price of everything and the value of nothing”.

“Italy is the one that can credibly defy Germany, and the Germans know it.”

Maybe. But that sentence would be utterly wrong if translated into “Italian politicians can credibly defy German politicians”. Brouhahaha. I have not seen any credibility at all among european politicians, neither north and south of the alpes nor east and west of the Rhine, for a looooong time. Credibility? There is no such thing in European politics.

Think about it this way: There was a glimpse of hope when the French elected Hollande. Now look how that turned out and go read Beppo Grillo’s take on Italy’s new government.

The economic monster of total inhumane madness a.k.a. austerity which they unleashed in the south-east of Europe is unstoppably crawling its way to the center, as Varoufakis and others predicted long time ago. It’s just like Dead Man Walking on his slow but steady path towards Berlin. Yes, this man-made crisis will be coming home to roost. But the sociopaths will never admit that reality and will rather continue to whistle in the dark. So, all what’s left is to wait for the next (incredible) historical catchphrase like “let them eat cake if they don’t have bread“. Heading for the worst moon. Ugly.

We should criminalize political policies that exceed a damage threshold. I’m not kidding. With all the legal language that manages to wrap itself around other human agreements, I believe it is possible.

That is a great idea.

“House prices have already fallen by more than 40% in some areas, sparking a wave of repossessions. Tens of thousands of families are unable to sell their homes while they remain in negative equity.” –

The best way to get the economy back up and healthy is in the quote above.

The equity that is negative – jubalee/forgive it – take the loss and do not pay.

Why on earth would selling assets (homes) at inflated prices be healthy for the economy. The only time a house is wealth producing is when it is built or upgraded (employing labor on property – no other way – and with property produces wealth). Re-selling assets that already exist, be it at a loss or gain – is wealth creation neutral – neutral = 0. It is the lag of constant or increasing debt in the private sector at odds with falling house prices (actually its the land value in flux)- That is what is killing the economy – compound interest payments on inflated (boomed) land prices (yes land – weather it have improvements or not) – Another words – debt overhang.

How skewed is it? take a look EU!

Simple example – I am Joe Farmer. I can produce 3 tons of wheat an acre and get $140 per ton = 140×3=$420.

So what do I do:

Pay all operating, overhead and labor costs to produce the wheat.

Upon examination, fully 60% of the cost to produce wheat has nothing to do with actually producing wheat. It is paid out as economic rent – it is the cost of land…to lease, rent or buy. It should be apparent that land price is driving the cost of production – the biggest single expense – production cost is NOT market cost. When land price drives production cost beyond market cost… you get a loss.

Now why would the farmer or the consumer be happy if property prices move up in the economy – it drives costs of living up when rising and, leaves less left over for other consumption. –

Who benefits from rising land prices? it’s not the farmer or the laborer or the consumer or the combine manufacturer…. it is the speculator in the land, the rentier class, the lender against the inflated asset price – It is those, who without employing labor, extract economic rent.

A ‘free market’ used to defined as ‘free from economic rent’

Given how great the economy is – where human capital and investment in industrial capital is valued far less than Financial Capital and, since Financial capital gets all the tax breaks and global shelter….wouldn’t it be wise to tilt the table back the other way? Using such mechanisms as taxation designed to limit or reverse financial capital’s advantage over human beings

Total = $270

Yes, Henry George was right. Speculation is the tail wagging the economic dog. Central banks exist to bail out the well connected speculators. Everything else is opera. The people are just casualties. The game could continue forever, but climate change will end it. Sauve qui peut.

How is it that Italy can credibly leave the Euro and Spain cannot? What economic strength does Italy still retain that has not been globalized? Both Spain and Italy would be vulnerable to a major decline of oil imports and pharmaceuticals.

Thank you for any comments?

Italy still has a decent industrial sector which exports quality goods that the world wants to buy, and low household debt. It didn’t have a house price or house building boom.

OTOH, it has a cripplingly high govt debt to GDP, Euro denominated.

Yeah, their debt to gdp ratio is half that of japan’s but over the 90% red line of economic death. Oh, wait….

R&R says their doooooomed……..

fair enough, but it’s the highest in europe I think.

Anyway, they could just de-fault frankly. I hope they do something along those lines.

default means recapitalizing the Italian banking system and they don’t have the authority to do that as long as they’re in the Euro.

RICH AND REST

What Happened to America 1980-2009???

Labor took it on the chin Financials took it to the bank

Here are awful numbers of our Plutocracy.

NET WEALTH OWNERSHIP

1%=35%–5%=63%–10%=77%–20%=89%–(80%=11%)

FINANCIAL WEALTH OWNERSHIP

1%=42%-5%=72%-10%=85%-20%=95%—(80%=5%)

If those numbers do not disgust you are a Republican.

ESTATE OWNERSHIP

One family owns more wealth than 90% of families.

It began in 1981 when Reagan started cutting top rate from 70% to 28%,

a 60% tax cut for the rich. He increased spending by 80% and Debt 189%

GW Bush tax cuts with 60% getting 16% and 5% got 48%.

We borrowed 6100B in 8 years so the rich could get richer.

Republicans fought to keep 2% tax cut. That 2% own 50% of financial wealth

and take 30% of all individual income. It includes these incomes in millions-

4000-3000-2000-1000-500-100-50-10. They need a tax break more than we need jobs and investment in infrastructure.

Boehner is saying he got a mandate not to raise taxes. Crazy Republican.

In 2013 budget it projects we borrow 900 Billion. That revenue can be gained via removing Bush tax cuts and cutting tax exemptions for the top 10%.

We MUST begin to cut the horrid debt that enriches the rich and burdens 80%.

Get $$$ out of control of government. It can be done.

In 2009, top 10% paid an 18% tax rate on individual income. Many paid 1% or less of income in Payroll taxes. 70,000,000 workers paid full rate. Top 50% paid a 12.5% Tax rate. 15% more would have balanced our budget.

Put bottom tax rate at 28% on ALL income.

And thats the latest Democratic Party News Report.

The people in charge of Europe have no idea what they are doing. I am being deadly serious.

Oh yes they do. They’re doing exactly what we’re doing. They are keeping their big German and international banks afloat. The Germans can only afford to supply the interest on periphery debt. So Germany is floating its own banks. Italy and Spain have to figure out what do do with their own economies. It is all very strange. Beppe G. said it flat out – Italy would have its heart sucked out by the internationalists. Molto strano.

They know what theyre doing, which is why theyre doing it. HOWEVER…

They dont know the kind of danger they are messing with. This whole mess, while it may gain them something short or even mid term, chances are high this whole experiment will blow back right in their faces at some point.

And the elites will have noone else to blame but themselves.

All parties in europe belong to the “one big party of the elites”.Even the leftist parties only care for their seats in the parliaments.All of them corrupt to the bone in one way or another.

But let me do a remark as a european.

Here in europe we have almost daily large protests,not only in southern europe but more and more also in france and soon surely also even in germany.Millions of people are out in the streets.

And I wonder so I ask the americans:You guys over there have 50 million people on food stamps?15% of all US-citizins?

We europeans have 2-3% of our population in the soup kitchens.For us this is like war,like a natural disaster,the end of the world.So my question is not for stiiring shit but honest:When will the americans start some kind of “mass-protests against poverty”?What happened to all the occupy-movements?

We did have a lot of demonstrations on May Day. The one in Seattle broke into violence at the end of the march.

Thank you.We here in europe dont hear anything about this.No reports about protests in the US.Please keep us informed.

I live in a big city and there were no noticeable protests. I think the situation in America is not as dire as in, say, Spain which is suffering from Great Depression like levels. There’s still lots of suffering here, but most people I know go about their lives like nothing has changed.

Here is the main story about “[w]hat happened to all the occupy-movements.”

“Highly-militarized, federally-coordinated police used such brutal violence to break up the Occupy protests…that the Egyptian military used the crack down on Occupy as justification for the murder of protesters in Tahir Square, Egypt… Speak with most Americans today and you will be amazed that they don’t realize (1) how much police violence was inflicted or (2) that the protesters – like the original Tea Party protesters – were standing up for the American people against the incest between big banks in New York and politicos in Washington. The bottom line is that the powers-that-be used a combination of brutal violence and disinformation to take the wind out of the protests.”

http://www.washingtonsblog.com/2012/09/the-real-meaning-of-the-1-year-anniversary-of-occupy-wall-street.html

“Without [the] repression, most of the encampments would still exist (though they were beginning to face other problematic issues).”

http://www.dailycensored.com/looking-back-on-occupy-by-ken-knabb-the-situationists/

This is quite shocking.But it also shows what the elites every where in the US and europ have on the planning for the next years.In the EU we have now he “eurogendfor”,a private pan-european army of the elites to fight “social unrests”.

We europeans need the US-citizins on the streets.we all have to fight against the madness of these mad banksters and their paid politicians.Dont let them intimidate you.And also dont let them make you “anarchists” by using private arms against police and security forces.If the time will come they will try this every where to make most of thesociety cry out dor “law & order”.But in reality this will become a junta of the banksters.

Link on eurogendfor?

One word: Race

Jim

Yves,

Unless the German Government itself breaks with the Euro, to be honest there is not much more it can do to try and scare Italy, and by so doing increase further anti-European and anti-German sentiment across most of Europe.

Whilst the ECB may be under the thumb of of the Bundesbank, and by dint, Frau Merkel, this is not true in the European Council, particularly if you take France, Italy and Spain as a Bloc, not to mention the UK – remember decisions on the Euro have a huge impact on the UK economy presently and anti-European sentiment is not only growing, but will be available for all to see come Friday morning following the results from local elections in which the UKIP, led by one Nigel ‘the mad hatter’ Farage is expected to do quite well.

Given the Troika of the IMF, ECB and Commission is pretty well detested in about half of the EZ member states, the very question of the EU’s survival, and not only that of the Euro is at stake.

Its fair to say, that Merkel and her SDP opponents in Germany are presently playing politics with the future of Europe, and this may come back to bite Frau Merkel on the arse in the next 5 months if she is not careful.

Suffice to say, when even pro-European forces are questioning the Troika and European Union itself, sooner or later, something has to give.

In my own humble opinion, either the ECB comes under some European political accountability, with a duel mandate to focus on both inflation and employment, or, the future of Europe is in doubt.

Indeed, as a professed European social democrat and supporter of a pro-indepence Wales, one certainly would not wish to drop the neoliberal yoke of Westminster and the City of London, to have it replaced by a European yoke – an issue the Scots Nationalists need to focus on.

In a nutshell, unless the EU can deliver on its twin premise of peace and prosperity, it is doomed and all talk of Federalism can be abandoned – indeed, why join a Federal structure if it mirrors that of the USA, that is, its dysfunctional and represents oligarchic forces opposed to the general will of the population.

Mmmm. I’m pretty sure we’re cousins. My great great grandmother was Anne Rogers from Pembrokeshire, Wales. And it’s not because I feel a kinship that I agree with you. I’d like to see local currencies flourish. Is that against the law of the laws of the EU Magnificence?

Susan,

My father’s side of the family were originally from Merthyr Tydfil – coal and iron – so guess they moved there in the 1840’s or thereabouts, mums side of the family were colliers and my grandmother from farming stock in Hereford – not really done any family history research, even though I read History at Uni – not too many Rogers about though when compared to Jones, Davies and Williams – so, definitely working class stock and proud of it.

As for Welsh independence, was an ardent Labour Unionist, however, 34 years of neoliberal crud and witnessing its effects firsthand have taught me only a divorce from Westminster offers any real hope for my country – we’re still quite commentarial, although that’s changing as well I’m afraid, hence a desire for a left-of-centre homeland – despite some goodness out of the EU, on its presently trajectory, I’m inclined not to look to Brussels for answers to our present predicament – still, we have lots of water, still some coal and large open spaces, so hope exists – although not under the Conservative Party or Labour I’m afraid.

Hi colleagues, nice article and good arguments commented

here, I am in fact enjoying by these.