Yves here. Some readers still equate quantitative easing with “printing money”, and Keen’s post explains what (little) QE actually does and does not accomplish.

By Steve Keen, author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program. Cross posted from Business Spectator

America is a land of contention, and one of the most contentious topics here (I’m in Seattle as I write) is the impact of the Federal Reserve’s policy of “Quantitative Easing” – otherwise known as ‘QE’. The Federal Reserve has committed to spending $85 billion every month buying a wide range of bonds from banks, until such time as the US unemployment rate falls below 6.5 per cent.

The Fed has implemented this policy because it believes it is the best way to stimulate demand in a depressed economy. Its critics oppose it because they believe this massive amount of ‘money printing’ must inevitably lead to ruinous inflation.

I reckon they’re both wrong, and in a seriously wonky post I’ll try to explain why, using my modelling program Minsky.

Minsky develops a model of monetary flows using double-entry bookkeeping – which is the same way that banks run their businesses – so it’s a powerful way to cut through the confusion over what actually happens in QE. But double-entry bookkeeping can make your head spin because it involves lots of ALE – and unfortunately not the fun intoxicating kind, but the boring accounting trio of Assets, Liabilities and Equity.

The heart of accounting is the principle that the difference between the debts other people owe to you (your Assets) and the debts you owe to them (your Liabilities) is your net worth (your Equity). This is drummed into accounting students as the “Fundamental Equation of Accounting”: “Assets equal Liabilities plus Equity”.

Double-entry bookkeeping (DEB for short) enforces this equation in two ways. Firstly, it records any Asset as a positive amount, and Liabilities and Equity as negative amounts. Secondly, it ensures that any transaction between accounts sums to zero. So, for example, if a rich aunt died and left you $1 million in her will, your accountant would show that as your Assets changing by plus $1 million and your Equity changing by minus $1 million. It sounds counter-intuitive when you first learn it, but it works to make sure you don’t make mistakes when tracking financial transactions.

Minsky uses a similar approach: Assets are shown as positive sums, so assets are increased by adding to them – no big deal there. But Liabilities (and Equity) are shown as negative sums, so increasing a Liability involves subtracting from it (is your head spinning yet?). So a loan of $1,000 from a bank is recorded as plus $1,000 in its loan account – an increase in its Assets – and as minus $1,000 in your deposit account – an increase in its Liabilities to you. The sum across the row that records the transaction is zero.

Then Minsky assembles a model of financial flows from the economy’s point of view, in which everything is shown as a positive – just as the Federal Reserve does when it compiles its Flow of Funds record of the entire economy.

Boy, I’ve probably lost half my normal audience already – and probably to Ales of a different kind. But if the rest of you have survived that intro, let’s plug on and build a model of QE.

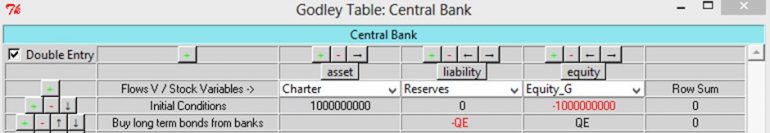

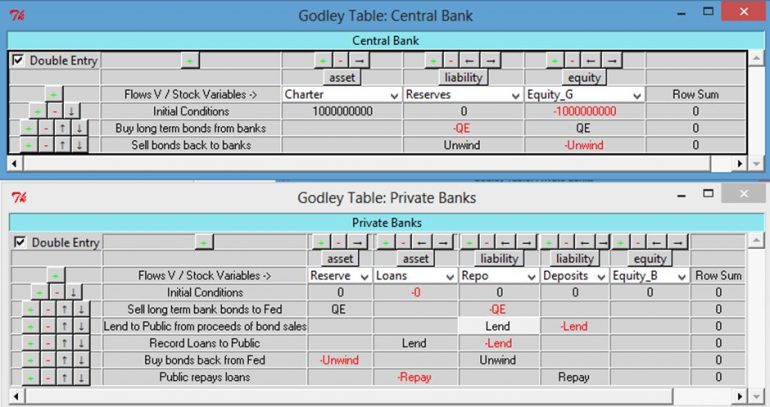

A model necessarily involves simplifications – otherwise you’d have a replica, not a model – and I’m using an extremely simple vision of a Central Bank. Firstly to acknowledge that it has an unlimited capacity to create money if it wants to, I’ve said that it has an Asset called a ‘Charter’ that lets it create as much money as it wants to. Then to balance its books following DEB, I’ve given it an Equity account that I label “Equity_FED” (for “Equity of the Federal Reserve”), and I’ve endowed this with an initial value that is the negative of the value of its Charter.

That leaves its liabilities to model, and as ‘the banker’s bank’ the Fed’s key liabilities are the deposits accounts of private banks – which economists call Reserves. Just to simplify the model, I set these as zero to begin with. So my model of the Fed in Minsky starts off looks like this:

Figure 1: The Fed’s balance sheet before QE

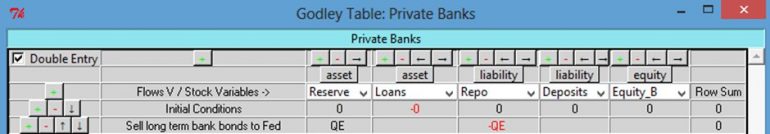

Next we have to model the private banks. I’m lumping them all together here (Minsky can handle modelling multiple private banks, but that’s not needed for this simple model), and giving them five accounts: two Assets, two Liabilities, and their Equity (Equity_B).

Their Assets are the Reserves they hold at the Fed, and the Loans they make to the public. Their Liabilities are the Deposits the public has with them, and another account I’m calling “Repo”.

Why Repo? Because when the Fed buys bonds off the banks, it normally does so in what is known as a “Repurchase Agreement” (or “Repo” for short): it buys a bond at one price and agrees to sell it back at another price at a future date. QE works the same way, but without a fixed date for selling the bond back. Figure 2 shows the private banks’ collective balance sheet before QE.

Figure 2: Private banks’ balance sheet before QE

Now enter QE. The Fed buys bonds off the private banks by transferring money from its essentially limitless Equity account. Following the rules of DEB, this is shown as a plus QE on its Equity and a minus QE on the Reserves of private banks: the liability the Fed owes to them has risen.

That’s seeing it from the Fed’s point of view. For the private banks, their Assets have risen by the amount QE. But they also have a liability: they have to buy the bonds back off the Fed whenever the Fed wants them to do so. For this reason, and to obey DEB, exactly the same amount has to turn up on Liabilities (and Equity – since the banks will make a profit out of this transaction by buying the bonds back for less than they sold them for – but for simplicity I’m ignoring this aspect for now). Figure 3 shows QE from the banks’ perspective: their assets have risen by QE (the Reserves liability of the Fed is an asset for the private banks), and they have a liability to the Fed of QE.

Figure 3: QE from the private banks’ point of view

QE is colloquially called ‘printing money’, and the fear that critics have about QE is that it’s going to dramatically increase the money supply and cause runaway inflation. But up to this stage in the model, QE has done nothing at all to the money supply.

That’s because, in a nutshell, the money supply that ticks over on Main Street and Wall Street is the sum of the liabilities of the banking sector to the rest of the economy, plus the money the banks have earned from their activities. In this simple model, this is the sum of Deposits plus Equity_B. So far, QE has done nothing at all to either. (In fact the banks could book the gain they expect to make from QE as part of their equity, but as noted I’m initially ignoring this detail in this simple model.) If QE is going to affect the money supply, then the banks have to lend from it to the public.

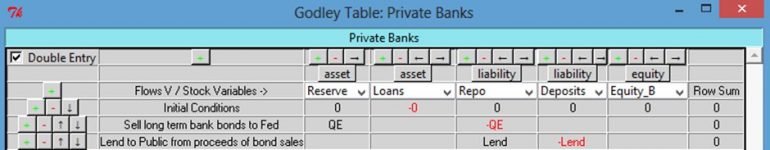

They can do so from the Repo account – so the next stage of the model shows them doing just that, with the flow Lend (see Figure 4). The banks have an incentive to do this, since the return they get on their Reserves from the Fed is a lot lower than they could get from the public (of course there are also good reasons not to lend, which I’ll get on to later).

Figure 4: The banks use QE to lend to the public

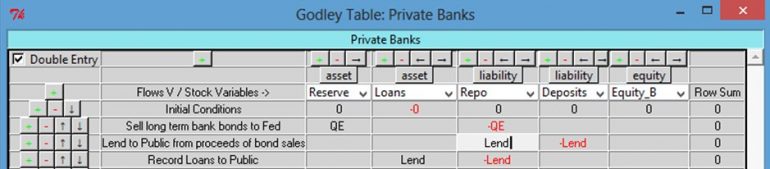

But this can’t be the end of it, because thus far the banks have lent money without recording the loan. So how do they do that? The loan to the public creates an asset for the banks (which must be shown as a positive), and this has to be matched by an increase in their liabilities as well (which must be shown as a negative). The next row shows this operation (see Figure 5).

Figure 5: Banks record the loans to the public

Notice what this does to the Repo account: the original lending from Repo is cancelled out by recording the loan! The net effect is just the same as if the banks had ignored QE and just lent to the public directly – creating assets on one side of their ledger (Loans) and liabilities on the other (Deposits). QE is actually quantitatively irrelevant to this operation.

Figure 6 completes the model by including repayment of loans by the public, and the (eventual) unwinding of QE by the Fed. It lets us work out the quantitative impact of QE on the money supply and the answer is – absolutely nothing. Nada. Zip. They money supply will expand if lending by private banks exceeds repayment of debt by the public, but quantitatively, QE is nowhere to be seen.

Figure 6: The full model including loan repayment and unwinding QE

QE could influence the money supply if it drove up lending by banks by increasing the margin between lending and deposit rates (which would make lending more attractive to banks), or by lower lending rates encouraging more borrowing by the public – and that in fact is what the Fed is hoping that QE will achieve (forlornly, in my opinion – which I’ll get to in a minute). But though it dramatically increases the Reserves of the private banks, it does nothing to directly increase the money supply.

So the ‘printing money’ moniker that critics give to QE is misguided: it actually creates no additional money at all (outside of the gain banks will make on the repo deal). For money to really be created, QE would have to go directly to the Deposits of the public in the private banks, and that’s not what QE does. ‘Printing Money’ is therefore a false model: it implies that Ben Bernanke is printing greenbacks and mailing them in little brown envelopes to everyone on Main Street, and that’s not even close to how QE operates.

But the critics of QE aren’t the only ones operating with a false model: so is the Fed. I’m sure that Bernanke knows that QE isn’t creating additional money, but he believes that it will reduce interest rates and thus encourage more lending by the private banks, which would stimulate demand. He sees no problem with more debt being taken on by the public, since he thinks that the level of private debt has no impact – good or bad – on the economy. From his “New Keynesian” point of view, a loan is simply a transfer from a saver to a borrower, and, as he put it in 2000: “Absent implausibly large differences in marginal spending propensities among the groups … pure redistributions should have no significant macro-economic effects…”

That’s where the neoclassical blindspot about banks gets in the way (‘New Keynesians’ like Bernanke and Paul Krugman are in fact a subset of the dominant sect in economics known as ‘neoclassical economics’). They imagine that lending by banks is just like lending between private individuals: if I borrow money from, say, John Carlson, then John’s spending power goes down and mine goes up – one largely cancels the other, and the net effect on macroeconomics will be just the difference between my propensity to spend and John’s, which will be a minor factor. They therefore argue that aggregate demand equals income alone, and the change in private debt can be ignored.

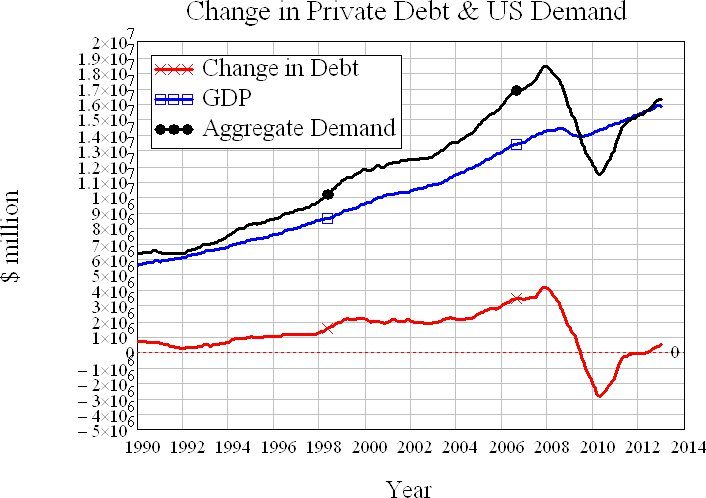

But lending from a bank isn’t like that: if a bank lends me money, then my spending power goes up without reducing anybody else’s. So bank lending is not simply a “pure redistribution”: it instead creates new money, and adds to demand when it is spent. From this perspective, aggregate demand is income plus the change in debt. (I get accused of double-counting here – I’ll explain why that’s not the case in another post.)

As I’ve explained at length before, this is why ‘the Great Moderation’ occurred – because Americans borrowed up big from 1993 till 2008, increasing private debt from $10 trillion to $40 trillion when GDP rose from $6 trillion to $14 trillion. It’s also why ‘the Great Recession’ occurred – because when Americans stopped borrowing and instead started to reduce their debt, demand (for both goods and services and assets like houses and shares) collapsed.

Figure 7: Aggregate demand collapsed when the growt of private debt stalled and turned negative

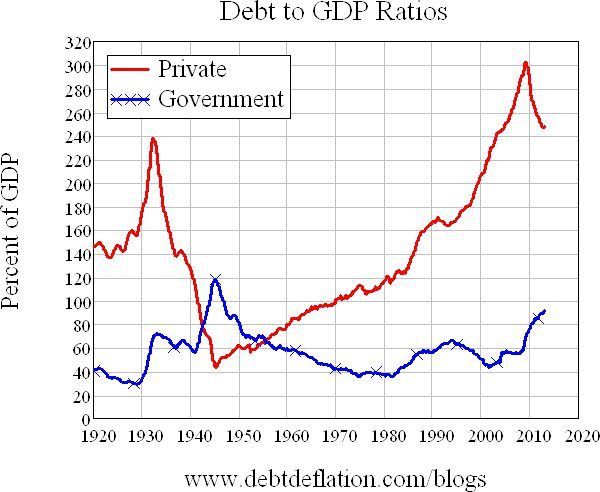

So contra Bernanke’s belief that the aggregate level of private debt doesn’t matter, it matters a great deal. That in turn means that Americans are very unlikely to spend more because of QE, because they’re already straining under a level of private debt that is unprecedented – even after several years of deleveraging, the level of private debt compared to GDP is higher than it ever was during the Great Depression.

Figure 8: America’s debt to GDP ratios since 1920

Lower interest rates therefore aren’t going to be a great enticement to Americans to borrow money from banks (or each other). They may do a bit more borrowing—especially if the Fed’s actions have spurred rallies in asset markets, which I consider below—but this is likely to run out of steam pretty quickly.

So QE isn’t going to cause The Great Inflation as some of its critics fear, but nor is it going to restore normal economic activity, as Bernanke appears to hope it will. However it’s not “mostly harmless” either: it could well be guilty of another charge critics throw at it, of artificially inflating asset markets in a way that could lead to market crashes when it is unwound. Considering this issue involves making my Minsky model of QE a bit more complicated—so if you’ve had enough of accounting ALEs for one day, skip the rest and go drink a real one. If you’ve got this far, you deserve one.

Complexities

I ignored some extra issues in the above analysis that could enable some of QE to enter the money supply. These include other uses that banks might make of the excess reserves (such as buying shares from the public), and the Repo margin that banks will ultimately make when they buy the bonds back from the Fed when QE is unwound. There’s also a factor in QE that could reduce the money supply too – payment of interest on bonds in QE. This is because QE is not like standard Repos which last as little as a day or week, so presumably the banks have to pay interest to the Fed since the Fed owns the bonds for an indefinite period.

I’m tentative about these additions – I’m open to correction that I’ve wrongly characterised what banks do or how QE works here. That said, this final model shows two ways that QE could actually increase the money supply: by banks being net buyers of shares (and other assets) from the public before QE is unwound, and by the net margin that banks will make once the Repo side of QE comes to fruition (and which they have probably anticipated to some degree and booked as profits already). So QE could increase the money supply, if (a) the banks are net buyers of shares while QE lasts and (b) they make a margin on the repo trade within QE.

Figure 9: QE with share trading and Repo margin

Putting this all together, the net quantitative effect of QE on the money supply comes down to net buying by banks of shares (and other assets) from the public, and the difference between the Repo margin the banks make on QE and the interest they (presumably) have to pay to the Fed while QE lasts. There can also be a price effect – which is all that Bernanke really appears to be targeting – of lower interest rate costs spurring more borrowing by the public, so that net borrowing (the difference between ‘Lend’ and ‘Repay’ in my model) is larger than it would have been without QE.

All that results in this equation (generated by Minsky) for change in the money supply:

Of those factors, the largest is likely to be net buying of shares by banks while QE lasts. If this logic is in the ballpark of what banks are actually doing, then this puts flesh on economist Michael Hudson’s remark that “Bernanke’s helicopter is dropping money on Wall Street, not Main Street”, and on fears that QE is helping drive a stock market bubble. The reaction of the stock market to fears that Bernanke might start to unwind QE this year could therefore be well founded.

Confession

Here I have a confession to make: I am not, and never have been, an Accountant. I didn’t even study it at University: though obviously I studied Economics, I did so as part of an Arts/Law degree, and thus avoided the dry and dusty topic of DEB (double-entry bookkeeping). I’ve only belatedly come to appreciate its importance in understanding our monetary economy too – my earliest academic work on money ignored DEB – but I hope now I’ve atoned for my sins of omission.

NO THEY DO NOT. Honestly, how do you get away with making such easily falsifiable statements, and why do so many people like Yves apparently go along with you?

You may not like the “money multiplier” model of bank money creation, but you cannot deny that it’s in every introductory macroeconomics text book, and that the money multiplier model only makes sense because bank intermediated lending differs from lending between individuals.

Wow, is your ire misplaced.

Banks have no role in neoclassical economics. Microeconomics is based on an assumption of a barter economy. Keen has discussed this ad nauseum in his book and other economists have pointed it out independently. In macroeconomics, banks sit outside the neoclassical paradigm and are nowhere to be found in DSGE models. Interest rates are an input that somehow materialize. Financial economists study how markets and investments operate, but their work does not connect to macro, or even to the banking system (see Larry Summers on “ketchup economics”).

Fascinating. So the level of indebtedness of the average punter is irrelevant to economic activity in Bernanke’s worldview. Amazing. Stupendous. Ludicrous. A five year old could do better understanding demand and debt.

I recall that Paul Krugman said something to the effect that questioning the money system was off-limits for economists.

But the banks keep screwing up the economy and one of these days, if not now, it’ll be one time too many.

He did say that, you are correct. Just pointing that out.

I have plenty of faults with Krugman, damn plenty, but you know, many mainstream economics priests- Er, I mean Economists, dont even bother to point something so obvious like that out (probably because they are paid/incentivized to not do so…)

Economics is a self-selective field. One group was out for profit, and the other group studied economics because they wanted to understand the world* without being exposed to anything too ugly or complicated**. Yves Smith writes about economics because its an area of concern to her old career which if she is like most people was somewhat determined by the first person to hire her and the first thing she did well that people will pay.

*I might be giving them too much credit. My guess is they just wanted to sound important.

**Look at that great economic data from 1941-1945, or what labor saving devices did the American South produce in the early 19th century which required white people to not do any labor? If we cut defense spending, people will lose jobs!

Yves writes:

This incorrect. It wasn’t even correct 10 years ago, maybe 20 years ago it was.

DSGE models can incorporate banking and the good ones do! (the really good ones stipulate a system with endogenous money as well — i.e., loans not deposit-constrained).

Veblen’s Theory of Business Enterprise (1904) correctly explained the pivotal role of banks well before we even had a central bank. He distinguished what he called ‘the business system’ from the industrial system, which operates the real economy, in which material and human resources are combined to satisfy human needs (real and imagined).

The business system essentially involves sabotage of the industrial system for the purpose of accumulating private profits. Its techniques are monopolization, combination, equity plays, and, particularly during the past 30 years, executive looting. Although banks have a theoretical role in the industrial system insofar as they merely disburse community savings for productive purposes, their more important function is to supply the speculative fuel energizing the business system, which demands an incessant recapitalization of real assets, producing booms and busts, and wealth accumulations, resulting in windfalls for the few and a treadmill for the many.

Banks supported by a central bank now have an unlimited power to create loan credit and steroidal operation of the business system, regardless of any consequences to the industrial system and those dependent upon it. Bank executives keep the profits of these speculations, and the public absorbs any losses. Unsurprisingly, the banks maximize speculative lending and derivative bets. While the real economy contracts, speculative bubbles become bigger and more pervasive.

Ultimately, there must be a crash, but it may be a long time before ultimately arrives.

Nothing has really changed in 100 years except for technological advance, supporting propaganda and blanket insurance for banks and bankers.

Chris,

Provide me with some examples not assertions. It was most certainly correct in 2009, numerous articles then pointing to the failure of DSGE models to incorporate the banking system.

And they don’t incorporate it now in any meaningful manner either.

DSGE models treat economies as having a propensity to equilibrium. As discussed widely, banking and financial assets do not have a propensity to equilibrium (see a good layperson recap via George Cooper’s The Origin of Financial Crises). Any system of collateralized lending has an INHERENT propensity to boom-bust cycles. So properly modeled, it CAN’T fit in DSGE framework.

Here’s an example from a few years ago that quite explicitly models banking (but not endogenous loan/deposit creation):

http://www.federalreserve.gov/events/conferences/fmmp2009/papers/Gerali-Neri-Sessa-Signoretti.pdf

But the whole topic of incorporating credit intermediation/banking sectors into DSGE goes way back to Bernanke modeling credit intermediation in the 80’s with Mike Gertler (less than 20 years ago — 1989).

He wrote another great paper also with Gertler in the 1999 (with Gilchrist) that successfully modeled the banking sector in a DSGE model (the aspect of downturns being aggravated by banking panics).

But if you’re going to alter your statement from “banks are nowhere to be found in DSGE models” to “they don’t incorporate it now in any meaningful manner either” then I’m not sure how to interpret the incorrectness of your statement. There are people out there who don’t think DSGE models meaningfully incorporate anything and are inefficient at modeling any macro phenomena.

The most explicit has been work AFTER Bernanke Gertler and Gilchrist’s model where people have included perfectly competitive banking sector, monopolistically competitive, loans funding deposits, loans creating deposits.

I can’t imagine that anybody would think that Christiano, Eichenbaum, and Evans in 2005 did not “incorporate it” in a meaningful manner. Bernanke would probably disagree, so would the hundreds of other economists who have been incorporating credit and banking and developing the frictions and interactions with the macroeconomy….

@Chris Engel…. sorry can’t help myself defective marsupial thingy… but how did they model epidemic fraud wrt loan – credit creation and ensuing high-jinks.

Skippy… its like modeling the solar system with out Jupiter… eh.

Just because neoclassicts are wrong doen’t necessarily mean that Keynesians or Keen are right. In the UK, QE has done nothing apart from hike up shares, commodities and, now, even property. These don’t count in the consumer price index so it follows that QE can possibly be causing inflation. Static wages next to rising prices don’t count in conventional economists measures of inflation either.

It seems an article of religious faith that QE is good for the economy. At a guess I’d the dogma in reinforced because QE followers worship at same temple as the magic money tree devotees.

Straw man. Saying that the conventional criticisms of QE are wrong is not tantamount to saying QE is good.

Keen clearly stated that QE is not tantamount to money printing and did say later that it might indeed goose asset prices.

So what exactly is your beef?

The goosing of asset prices is intriguing and helpful for me in Steve’s land down-under. It may make life difficult for normal workers but what it has done is provide the illusion of ‘wealth’ increasing especially via superannuation notional valuation which is where the savings of more ordinary people reside. As a result the crash of 2008 which caused much rumblings is being forgotten temporarily and the financial planners are sprooking one again, though for how long is hard to say.

Yes, and the multiplier is demonstrably false. Banks do not need reserves to make loans, they do not wait to receive a deposit to make loans, and the money supply does not expand with the quantity of reserves.

The money multiplier is based on a 19th Century conception of banking.

Even if you debate the order of execution it does not take away the fact that our system is still based on checks and balances.

One of the reasons why we are in this dire situation is because we are increasingly bypassing the checks and balances that were put in place to protect it.

This is the type of discussion that turns people off to economics in general, which is a shame. You have people like Keen who are concerned with theory but primarily with reality. What ACTUALLY causes financial crisis? How do you actually explain economic depressions and the pickle we are in now? What role does private debt have to play? What relationship does finance have to production? As usual, the neoclassical crowd resorts to theory and theory alone (since the real economy, economic history and the like have no place in their theories to begin with).

“The money multiplier in textbooks is a rudimentary tool used to try and quickly explain how money gets created. It was very clear to me how individual banks created money, no hidden agenda from my teachers.”

Your teachers didn’t write the books or create the theories. It is up to your teachers to decide whether or not the theories they teach you will help you understand the actual real economy and how it operates in reality. It is up to you then as a student and a person with your own mind to determine if your teachers are right and if the theories do help you to understand the way the economy actually works. They key is the assumptions. If your teachers teach you theories on perfect competition and perfect competition doesn’t exist, what do you do? If they teach you that people have perfect information, or they teach you neoclassical capital theory (which was completly destroyed by Sraffa decades ago, the neoclassical economists of the time like Samuelson admitted as much) and if we know that has nothing to do with the way firms and actually operate, what do you do? Or how about free trade? You can be taught comparative advantage but what did Ricardo say, what were his assumptions (like capital and production staying put and not going moving to other countries) and what has been the record of free trade in practice? Or how about externalities? How do neoclassical economsits deal with externalities and environmetnal/ecological issues? Do their pet ideas have a snowball’s chance in hell of working and, again, what assumptions are needed for their ideas to actually work?

The history of economics is filled with theories that eventually get replaced. Classical economists used the labor theory of value and analyzed the economy in terms of class. That is no longer the case in most economic programs and with most any neoclassical economist. It seems that reality doesn’t seem to matter to neoclassical economists. Neither does the fact that their ideas have been taken apart piece by piece, neither does the failure of their ideas in practice. Neoclassical economics is much closer to religion than anything else. It isn’t to say there aren’t some useful ideas here and there but on the whole, it is less than worthless. It has persisted because it benefits powerful people, economists have spent their entire lives studying the nonsense and there is money behind the facade.

..count me not at all “turned off” by this exchange…it is totally stimulating, to those of us not (non)classically economically educated…(though that is not to what “nonclassical” refers)…

..inherent exchanges afford learning opportunities, of a variety of discipline..

In 2003, when the real estate bubble was starting to show the hockey stick effect, I had to make a convincing presentation to a committee. So I asked my spouse how I should present my facts. The answer was KISS, 3 points maximum.

How on earth could one explain the situation and convince the audience by keeping the explanation to a 3 point slide… in 2003?

That’s when I realized that we were doomed; that I could control my own debt level and help people pick themselves up when they would crash but that was it.

Some people revel in complex matters but most avoid them like the plague.

I think this article and this site is great and I enjoy the conversation. I was talking about the responses that the defenders of the neoclassical faith always articulate. It turns the conversation away from reality and back to their crappy, reality less, failed theories.

So Me, agreed with all. Neoclassical economics is a theology. I only differ with you in the respect that Neoclassical economics was deliberately and explicitly invented _as a theology_, it’s inventors knew it was a con. I’m serious. NeoEcon was about spewing enough excelsior and blue ribbons around that popular interest in materialest economics, the place of labor in production, and the politics of socialism could be drowned out and driven out of the class room. NeoEcon is propaganda, in other words. That anyone has been fool enough to apply it’s nostrums in practice is a testament to the power of lazy belief, since any serious study of political economy showed neoclassical economists as right down there with carny barkers and thimblerig prestidigitators selling ‘self improvement tracts’ on the side.

Could you please tell us where you got that idea?

Research Endogenous Money Theory or Circuit Theory.

The money multiplier found in every Principles of Macro textbook (D=1/R) simply expresses a relationship between the MAXIMUM quantity of deposits and the required reserve ratio. It’s a static boundary condition, nothing more. While every textbook also includes a highly stylized example of how it works using a given reserve ratio and quantity of new reserves, this is just using a geometric series to solve and explain a simple algebra problem.

There’s nothing in the money multiplier that explains what actually drives the process (e.g., the supply and demand for loans). There’s nothing that shows how the process actually evolves over time – the geometric series exposition is instantaneous, there’s no dD/dT dynamic. There’s nothing that links the creation of deposits to real economic activity.

No one is ignoring the fact that introductory texts contain a money multiplier. They’re simply pointing out that 1) it’s just a simple boundary condition, not an actual model of how a banking system creates money and 2) it’s completely disconnected from the rest of the economic model, similar in many ways to the quantity theory of money.

That’s because there is still no model that can tell us if the new money will go into housing or a new craze such as tulip bulbs or cabbage patch kids.

And when we figure it out, life might not be worth living because that means we’ll have the crystal ball.

The textbook ‘money multiplier’ model is a lie invented by bank shills to conceal the fact that banks individually create money.

The money multiplier in textbooks is a rudimentary tool used to try and quickly explain how money gets created.

It was very clear to me how individual banks created money, no hidden agenda from my teachers.

no, the textbook ‘money multiplier’ model claims that the banking system *as a whole* creates money by lending out deposits and keeping a fraction in reserve. This is a lie.

Banks do not individually create money in the textbook ‘money multiplier’ model. The model is con.

In reality banks individually create money with keystrokes. They do not ‘lend out’ deposits or reserves.

What banks actually do in reality would be considered to be fraud or counterfeiting by many people. Hence bank shills invented a lie to cover it up.

*The model is a con.

It will do both (never mind that housing turned into a “craze” thanks to banks and speculators).

You get a craze any time some random asset grows faster in market “value” than the average interest on a loan.

Take any asset that someone want to use for something, be it shelter, transportation, production or anything similar. Likely the person can’t afford the full asking price up front, so they take up a loan.

Now if the interest on the loan is low enough, and the demand for that kind of asset is high enough, the person may well be able to sell the asset again down the road, pay off the loan and pocket a profit.

Once enough people catch on that this is possible, the speculators move in and the craze starts rolling.

the one “stopgap” on all this is the banks willingness to lend. Sadly they get blinded by the glare of the craze in motion. This because until the craze collapses, all the banks see are dropping default ratios.

Meaning that less and less people are defaulting on their loans while the craze is ongoing. And so the banks could have made even more money had they been willing to loan out more, and to projects previously deemed too risky.

What is happening in the background is that the banks are indirectly playing hot potato with a potato that is growing hotter on every pass.

This because as the craze is building, the total debt is ratcheting up as the asset is being passed between speculators.

And i think Keen’s work with Minsky has already modeled this, and demonstrating a death spiral once the “potato” goes boom and people start defaulting en mass.

“The money multiplier found in every Principles of Macro textbook (D=1/R) simply expresses a relationship between the MAXIMUM quantity of deposits and the required reserve ratio. It’s a static boundary condition, nothing more.”

This is the problem! It is NOT static!!! It is NOT a boundary!!! It does NOT even rudimentarily explain money creation. Virtually every central bank on the planet works via automatic overdraft. As the demand for reserves increases the system automatically adds them. As banks lend they create deposits and those deposits (as well as the increase in interbank clearing to support the lending transactions) causes and increase in demand for reserves. The central bank automatically responds via open market operations or discount window lending to meet those demands. If it does not it will lose control of its target interest rate and I’ve yet to ever see that happen to a central bank which issues a freely floating non-convertible fiat currency.

The money multiplier was a good explanation of how bank creation of money worked under the gold standard, with no reserve bank, during the Free Banking Era.

That makes it something of historical interest.

(For clarity, it also applied under bimetallic and silver standards.)

Meaning it “works” when Mr. Central Banker can’t just walk into a vault, wave his magic printing press and present a new pile of bills. Or in other words, it “works” when there is a finite supply involved somewhere.

But such finite supplies fuels hoarding and deflationary spirals. One can see historical examples of this when the access to British coinage was limited to the American colonies. Local trade in the colonies often devolved to straight up barter because of this.

The money multiplier never envisioned a Federal Reserve $16 trillion bailout of the banks, in which zero interest loans with no maturity are made against fictional assets like mbs, cdo, etc.

Today’s money multiplier is essentially infinite.

PS, most of the lending is going into speculation.

Is that paragraph (starting: That’s where the neoclassicl blindspot …”) claiming that economists like Bernanke and Krugman think bank lending is just like lending between private individuals, or not?

If it is making that claim, then it is false. If you think Bernanke doesn’t understand these ideas, you are a fool.

If that paragraph is not making that claim, then my ire is misplaced but I think Keen needs to write more carefully because that para sure comes close to making that claim.

Yes, mainstream pre-2007 DSGE models did not include banks, because model makers mistakenly thought banks were amongst the large number of things the model excludes on the basis that they are thought not to matter. That does not mean DSGE modellers thought bank lending was the same thing as private sector lending, they’ve taken intro macro, the know about bank money creation (even if you all think the money multiplier model gets it wrong, it’s still a model in which bank lending is very different from private sector lending, which is the point under discussion here).

You can now find DSGE models with banks in, so statements like “banks … are nowhere to be found in DSGE models” need updating.

The problem with your interpretation is that Krugman has stated, “for every borrower there is a saver” repeatedly on his blog. He and most mainstream economists believe reserves literally become the deposit rather than being an entry on a balance sheet.

Teaching anything about DSGE models is insane. I mentioned above how divorced from reality neoclassical economics is. I can’t think of a better example than DSGE models. I don’t even know if I can draw a parallel in another field. It like an astronomer who studies astrology because he wants to know how the universe works. Ugh.

“You can now find DSGE models with banks in, so statements like “banks … are nowhere to be found in DSGE models” need updating.”

What the banks in DSGE models do doesn’t even remotely resemble what banks in the real world do. The DSGE banks basically just collect deposits and then loan the deposits straight out, pure intermediation. The only reason they were added was to be able to introduce a friction (interest rate setting on deposits and loans via monopoly power) and then create a “shock” and see how the model responds in the face of the friction. This is pretty much the standard way that everything in NK DSGE models is modeled – a friction that slows down the price adjustment mechanism followed by some sort of “shock” (demand, technology, financial in this case, etc.) and then seeing what happens to key variables in successive time periods. It’s abject nonsense, that like most economic models developed over the past 130 years, starts by making dubious assumptions (typically involving equilibrium and market clearing) that are not only empirically false but also completely unnecessary and uncalled for (unless you’re setting out to prove your premise from the start). They should be tossed in favor of real simulation models.

Yes, they’ve basically added a doofus version of banking that allows them to do what they did before (shock the model for interest rate increases).

As I wrote earlier:

“DSGE models treat economies as having a propensity to equilibrium. As discussed widely, banking and financial assets do not have a propensity to equilibrium (see a good layperson recap via George Cooper’s The Origin of Financial Crises). Any system of collateralized lending has an INHERENT propensity to boom-bust cycles. So properly modeled, it CAN’T fit in DSGE framework.”

Debating the DSGE model, is like debating whether the Tooth Fairy’s coin which you found under your pillow is real, or not….of course the coin is real….but that doesn’t mean

the Tooth Fairy ain’t a work of fiction.

Michael Hudson’s remark that “Bernanke’s helicopter is dropping money on Wall Street, not Main Street” is apt but neglects the “feel good” factor as the 401K statements start to go radioactive. Of course, such false allures help one to forget one’s “balance sheet fundamentals” that your wage income has barely moved and neither has your debt repayment drain. Still dreaming is what it’s all about that you can one day turn asset bubbles to your advantage and maybe you can when you inherit your parent’s estate but what a way to run an economy! As the article below makes clear “bubble economies” always involve the game of “Musical Chairs” when you’ve stopped dancing around the chairs and the music stops there’s always someone left without a chair!

http://neweconomicperspectives.org/2013/02/the-spinning-top-economy.html

Money WAS dropped onto main street, the problem is that it is hard to measure what-ifs.

With no bailouts or QE, real estate might be even lower. I read that in many crisis, housing can go from 50% if income to less than 10%. Unemployment could be over 30% and GDP might have dropped like a rock and stayed there.

With no bailouts or QE, the banking system and economy would very likely have collapsed à la 1929-1932. The minimal TARP and the massive QE saved the status quo ante 2007. The implied promise was reform of the banks and an end to the shenanigans that led to the collapse. But we now see those were lies to keep the public from demanding real action or a true restructuring of the banks. So, QE has been nothing but life(style) support for the rich and pain for everyone else as we work to pay-off the debts.

Of course, the hole is so big, and the austerity push (to avoid admitting the need for bailing our Main Street with real dollars) so suffocating of real economic activity, that we’ll not see the day when the crisis is over for everyone.

As Warren Buffet predicted, we now have a sharecropper society.

QE had squat to do with the rescue of the financial system. Jim Hamilton found it lowered bond yields by a grand 17 bps. That is tantamount to nada.

And it bought only GSE debt, so (contrary to some commentary of people who didn’t look at the how it works) it didn’t help toxic assets, which are credit sensitive, not interest rate sensitive.

The only impact it might have had on the banking system was signaling that Fed was willing to throw anything and everything at the problem.

Can you clarify this sometime, perhaps as a separate post? I’m not seeing how this fits together. Where do the dollars come from, if not being created by the government?

“QE had squat to do with the rescue of the financial system. Jim Hamilton found it lowered bond yields by a grand 17 bps. That is tantamount to nada.”

So why is it being done? If private savers are interested in these financial assets at prices reasonably close to what the Fed has been paying, why is the government backstopping all of this to accomplish nada?

“And it bought only GSE debt, so (contrary to some commentary of people who didn’t look at the how it works) it didn’t help toxic assets, which are credit sensitive, not interest rate sensitive.”

Isn’t part of the bailout that the GSE’s got bailed out? Their debt was sold explicitly under the pretext that it was not backed by USFG.

“Freddie Mac securities are not

guaranteed by and are not obligations of the United States

or any federal agency or instrumentality other than Freddie

Mac.” — Freddie Mac, January 2008.

[warning, opens PDF]

http://www.freddiemac.com/mbs/docs/mbs-product_brochure.pdf

I’m not quite getting this. Aside from which round of QE, wasn’t the point to flood the system with “liquidity”, so as to prop up financial “asset” prices, rather than letting them be written down? (If T-bonds and GSE bonds were targeted, it’s not just the direct effect on their rates that’s at issue, but the transfer of funds to “riskier” assets). That, plus the increase in wealth-effect consumption demand, seem to me to be the main points.

The finding that ‘QE had nothing to do with bailout out the banking system’ seems too convenient a finding. Like “TARP made money”. The first QE provided liquidity while the Fed jawboned Accountants to suspend Mark-to-Market.

They STILL don’t MtM. And they probably WON’T until the Fed sparks a ‘housing recovery’ (thanks to…the latest QE).

If reflating any asset back into bubble territory is

actually a cure for our economic woes, is it ok if

the few(er) of us who are still gainfully employed

also quit our jobs in favor of everybody relying on

the Fed to inflate us all to riches and financial independence? Surely, we can all just live on the

capital gains from (Fed induced) asset appreciation?

Or are you saying that only works if it’s restricted

to the beautiful people?

“Interest rates are an input that somehow materialize.”

Not only that Luis Enrique can’t be bothered to do a balance sheet analysis of the non-government sector including all global economies where he’d discover that accounting on aggregate the interest on private bank loans cannot come from this sector but must come from the government sector to drive economic growth. The same mechanism applies for reserves and savings.

Steve Keen wrote a terrific book, but this post makes one enormous mistake: assuming that QE is ever going to be unwound. It will not be unwound because it cannot be unwound without collapsing the financialized economy. What QE amounts to is a gift to the TBTF banks and their executives. The whole thing is papered over with newspeek abbreviations: TALP, TAF, TRAF, BARF, etc. According to the GAO, $16 trillion was dispensed between 2008 and 2010 against assets that weren’t worth the electrons they had been printed on.

I agree with Steve that he doesn’t really understand accounting. Believe me, if your aunt dies and leaves you $1 million, your equity goes up, not down, and you can take that million to the bank and earn $1.67 on it every month.

I didn’t follow that either. Is that a misstatement or do I really not get it? Why does an inheritance reduce your equity? OK, I see now, it’s a double negative, your equity is reduced by a negative amount, so in the final tally you still have your aunt’s million.

Think of the accounting equation this way: Assets – liabilities = equity (ie, what you own minus what you owe = what you are worth), that’s more intuitive. Basic math allows us to restate this as assets minus liabilities minus equity = 0, or A = L + E (ie, everything you have either belongs to somebody else or yourself, eg, your house = mortgage plus equity). If everything has been recorded correctly, your total A-L-E = 0, and bookkeepers regularly ‘balanced the books’, to check the accuracy. If it didn’t sum to zero, you had to hunt through to find out where you went wrong. For ease in summing accounts, assets are denominated ‘normal debits’ and liabilities are denominated ‘normal credits’ and denoted with red ink (olden days), a minus sign or in brackets in the accounting equation; equity may be a credit if you are ahead of the game, but can also be a debit if you are in the hole. Example: House $100,000 + mortgage ($150,000) + equity $50,000 = 0. This, BTW, shows ‘positive’ equity (no brackets)but this homeowner is clearly underwater.

Most of you won’t have seen this b/c financial statements are stated in ‘normal’ terms, ie, liabilities and positive equity shown without brackets, b/c of the confusion it causes. But it was a great hoot for me in accounting 101, Chapter 1, to find that ‘red ink’ was exactly what you wanted on your bottom line!

I have a long background in accounting and this must be the first time I have read NC and my head *didn’t* spin!

“Most of you won’t have seen this b/c financial statements are stated in ‘normal’ terms, ie, liabilities and positive equity shown without brackets, b/c of the confusion it causes. But it was a great hoot for me in accounting 101, Chapter 1, to find that ‘red ink’ was exactly what you wanted on your bottom line!”

OK, I’m beginning to see what’s going on, and a lot of it is conventions to account for the loss of color printing.

The 19th century account books I’ve seen (yes, I’m a bit of an antiquarian) have a very particular style. The asset books are written positive, in black ink, with any “subtrations from assets” being in red ink in parentheses.

The liability/equity books are written in positive form, in *red* ink, but NOT in parentheses, with any “subtractions from assets” being in black ink in parentheses.

This particularly complicated convention clearly got messed up at some time.

Please note that this convention meant that the parentheses were always the same for any given entry in both of its copies, while the ink color was always swapped for the two copies.

It’s quite a useful set of rules. If you need to check for entries which didn’t get matched up properly, you’re looking for exactly the same string of characters in both books. And by having the dominant ink color be different in the two books, you make it really easy to tell which book you picked up.

FYI, the reason for the confusion is the application of double entry bookkeeping where it is not used (in DEB, equity is a liability, thus a positive liability is not good – that’s just the complimentary statement to the observation that the person to whom you owe the money is happy that you owe them. For them, your liability is their asset. In general, this is why money is referred to as debt – it’s just a promise one person makes to pay someone else).

Personal finance is much simpler with single entry bookkeeping (like balancing your checkbook). If the equation is positive, that’s good.

Assets – Liabilities = Net Worth.

Just add $1 million to your cash (assets) and throw a party.

Steve’s not confused, you are just not following his logic. Since he is trying to make the columns add across to 0, an Increase in Equity is recorded as a negative number. Thus, the $1 million inheritance is recorded as a positive number under assets and a negative number under equity, increasing the balance of both.

Ah, so! Now it makes sense more to me.

But Equity = Assets – Liabilities requires that one sum Assets and sum Liabilities first. Equity then falls out as the difference.

Since he is trying to make the columns add across to 0, an Increase in Equity is recorded as a negative number. AJ

Ah, so! Now it makes sense to me.

But Equity = Assets – Liabilities requires that one sum Assets and sum Liabilities first. Equity then falls out as the difference.

Still, direct entries to Equity is possible too, something I haven’t considered that much.

‘If a rich aunt died and left you $1 million in her will, your accountant would show that as your Assets changing by plus $1 million and your Equity changing by minus $1 million.’ — Steve Keen

The appropriate application of double entry bookkeeping to this event is that your assets are credited with $1 million, while your aunt’s are debited by $1 million. This is the same bookkeeping that applies every time a check is deposited.

Your equity rises by $1 million; your aunt’s declines by $1 million; deposits in the banking system as a whole are unchanged.

Steve Keen probably is confusing his hypothetical with a loan. If you borrow $1 million from the bank, then your assets rise by $1 million with the loan proceeds, but so does your liability to repay it. In this case, your equity is unchanged, not negative as Keen states.

Frankly I didn’t work through Keen’s further examples since he is so obviously out to lunch on double entry bookkeeping. The classic application of double entry bookkeeping to banking is Murray Rothbard’s The Mystery of Banking, which is posted here:

http://mises.org/books/mysteryofbanking.pdf

Rothbard’s book is where I learned about double-entry bookkeeping too. Rothbard’s diagnosis is correct, but his “solution” isn’t, being a primitive gold-bug (there is no other kind).

Keen’s example is either a typo or he’s still learning. In either case, I would not count him out. Can YOU do differential equations? Or can many economists?

Um, no, Jim. Double entry means two entries *per accounting entity*. In this case, you would record a debit to Cash (or Bank) $1 million, credit Equity $1 million on your books. Your aunt’s trustee/executor would record it as debit Inheritances Payable $1 million and credit Cash (or Bank) $1 million on her books.

Note: There isn’t actually any equity involved on the aunt’s books. Trust accounting is different since the goal is not to see if you made or lost money (equity), but to ensure that funds have been disbursed as authorized. Govt accounting is like this too, which confuses people who are used to profit-oriented business accounting.

BTW, you should work through the article, Steve is fumbling but *totally* not ‘out to lunch’.

I hear you on the accounting fun of people applying accrual basis to government books, but I still agree with the conclusion that Keen is out to lunch on this particular post.

The only way to fund the bailouts without QE is to raise taxes on the wealthy. Those are the only two major sources of marginal dollars. So to say QE is irrelevant is to claim that the President and Congress are willing to meaningfully cut the bankster bailouts and national security state. I see no warrants for that claim in this post.

The only way to fund the bailouts without QE is to raise taxes on the wealthy. washunate

No. Keen also recommends a universal bailout, including non-debtors, with new fiat. THAT would fix everyone from the bottom up in nominal terms and in real terms too if (as Keen also recommends) leverage restrictions were slapped on the banks to prevent another bubble.

Um, F. Beard, how does that fund the financial fraudsters and war criminals and all the rest?

Plus, printing new fiat is exactly what QE is. The process of spending existing fiat is called taxation.

Washunate: Plus, printing new fiat is exactly what QE is. Printing new fiat, plus shredding (perhaps temporarily, more or less) what the Fed’s new fiat buys is what QE is. If QE is just buying Treasury bonds, it is just monkeying with interest rates. Unnecessary, not too meaningful prestidigitation with smoke and mirrors. Mainly just reverses the Treasury’s unnecessary magic show called a “bond auction.” The main, and very successful purpose of these shows is to confuse everyone, to make them disbelieve very simple, very obvious truths.

As Yves says: “QE had squat to do with the rescue of the financial system. Jim Hamilton found it lowered bond yields by a grand 17 bps. That is tantamount to nada.” And QE has much less than squat nada to do with allowing Uncle Sam to spend on the national security state or anything else. Uncle Sam and his national security state don’t need rescuing. The rest of us need rescuing from IT!

The process of spending existing fiat is called taxation. BZZZTTTT!! NO!!

The government really, really, really does not get or spend “existing fiat” when it taxes. When the government taxes, the “existing fiat” is GONE. When the US government spends, it spends new fiat money into existence. The US government does not need anybody’s money. If you want to make life hard on yourself and imagine that the Fed isn’t part of the government, then the thing to understand is that the US Treasury stands behind the Fed, gives value to the Fed’s otherwise worthless money, NOT vice versa.

A lot of people don’t grasp that the MMT thinkers, like all true philosophers, really mean what they say. Figures of speech are misunderstood as precise theoretical statements, and precise theoretical statements are misunderstood as figures of speech.

The Fed cannot stop QE until the President and Congress implement a budget that replaces QE with taxation. This is just basic math.

No, it is quite mistaken. QE (and bond auctions) are merely monetary operations. Taxing and spending are fiscal, and far more important and consequential. QE doesn’t and can’t “replace taxation”. Doesn’t mean much, and if it stopped tomorrow, wouldn’t mean much. Business as usual, government “borrowing”, printing bonds, Treasury auctions and no QE would have worked just fine. Especially fine in a depression, when the gubmint (hopefully) deficit spends like mad, because that is what a depression is. A bear party when everyone wants government debt = NFA = money.

I would just ask you to think through this logic to the end. You acknowledge that interest rates would go up if the Fed sold its existing $3 trillion worth of securities and stopped purchasing new ones.

So, what happens as interest rates go up because the government (the Fed) isn’t buying the Treasury and Mortgage-backed securities? Over time, interest payments overwhelm the budget (or taxes are raised to offset the spending).

This is why exponential growth simply doesn’t exist in sustainable systems – at some point, even 2% compounded growth becomes astronomical (or, as I prefer the joke, economical). This is why the government has to choose between ending QE and keeping corporate welfare. It can’t do both – the act of having a budget that provides massive corporate welfare necessitates printing the money to pay for it.

Maybe a quantitative approach would be more persuasive.

In the 12 year period from September 2000 to September 2012, public debt outstanding increased from about $5.7 trillion to $16.1 trillion. Now, over short periods of time, I’m not a deficit fetishist. We are a wealthy nation and have the means to invest in productive outlays in the public commons of infrastructure and social insurance.

http://www.treasurydirect.gov/govt/reports/pd/histdebt/histdebt_histo5.htm

But waste isn’t productive investment. We cannot continue on a path of 9% compound annual growth forever when that growth is being squandered rather than spent wisely. At some point, we either have to shift from wasteful corporate welfare to productive investment in the public commons, or, there will be some kind of reset of the system (external war, internal revolution, currency collapse, police state, whatever) as the basic mathematics of long-term compound interest overwhelm short-term accounting gimmicks and kick the can strategies.

If the government unwinds QE and instead funds corporate welfare by selling securities to private actors, then even 3% or 4% interest rates will start taking up huge portions of the budget if outstanding debt is growing anywhere near 9% annually. And of course, there is a nonzero risk that rates would rise much higher, because the whole point of markets is allowing markets to price things – you can’t decree what the interest rate is without buying the securities directly (which then lets the market set the price for dollars – you can’t guarantee purchasing power or wage increases when increasing the money supply, particularly when most of the benefit accrues to criminal enterprises closest to the money spigot).

If we had 9% compound growth and the average yield on outstanding debt reached 5%, by the end of the decade you’re talking about spending a trillion and a half dollars just on interest.

And all of that doesn’t take into account what will happen to the already insolvent TBTF firms when their existing holdings decline in value due to the increase in interest rates. The GSE backing alone carries a risk level on the order of trillions of dollars – if that risk wasn’t material, they wouldn’t need government backing!

The whole house of cards is premised upon funding corporate welfare through inflation – stagnating wages and rising prices. Mathematically speaking, the government simply cannot stop inflating the money supply unless it stops the corporate welfare necessitating it.

Very good comment. Double entry accounting has a reason, not just to be confusing. It gives you a quick and accurate and understandable answer to basic money questions, like did the company or I or the government earn/lose money or is what I gave the same as what s/one else got?

thanks for the posting

I also initially lost Steve at that point, but I think it’s just a matter of clarifying which convention is being used. There are two main conventions you can use for double-entry accounting, depending on which values are entered as positive numbers and which as positive.

If you record assets, liabilities and equity as positive numbers, then you want to express the fundamental equation as E = A – L, which is equivalent to both A – L – E = 0 and A = L + E.

If instead you record assets as positive numbers, and equity and liabilities as negative numbers, then you have the fundamental equation A + L + E = 0. And that is equivalent to A = -(L + E).

Suppose we use the first convention, and therefore use the first form of the fundamental equation. If a person’s assets are $10 million and its liabilities are $9 million, then their equity is $1 million. Recording these all as positive numbers we get A = L + E. Equivalently: A – L – E = 0.

However, if we decide to use the second convention and record liabilities and equity as negative numbers, then we have assets as $10 million liabilities as -$9 million and equity as -1 million. Then using the second form of the fundamental equation, we get A + L + E = 0 or A = -(L + E).

Steve creates a little bit of confusion, because he first says that the fundamental equation is

“Assets equal Liabilities plus Equity”

but then adopts the convention of treating liability and equity as negative numbers. However, when he then applies the equation, he says:

The sum across the row that records the transaction is zero.

So I think everything is fine in application (although I haven’t worked through the rest of the piece). He is using the second convention in Minsky and he just misspoke when he gave his initial presentation of the fundamental equation.

By the way, the idea that equity is a negative number on the second convention, like liabilities, can seem confusing since equity is supposed to be what you have left over when you discharge your liabilities from your assets, and is therefor something “positive” for you. The way I understand the rationale for that convention (and maybe some corporate finance guys can tell me whether I have it right), is that we need to think of the company and its owners as two separate things. If the company’s assets exceed its liabilities, then the difference is the owners’ residual claim on the assets of the company. In other words, it’s what the company “owes” its owners. Since it is an amount owed, we can think of that as a negative thing from the standpoint of the company, analogous to the company’s liabilities, but a positive thing from the standpoint of the owners. When we call that amount “capital”, we tend to think of it from the point of view of the company, and when we call that amount “equity” we are thinking of it from the standpoint of the owners.

It doesn’t matter, as long as we use the appropriate equation given the appropriate convention. If, for example, we decided to record both equity and assets as a positive number, and liabilities as a negative number, then we would want to rewrite the fundamental equation in a third form as E = A + L or A + L – E = 0.

Yes, Dan. That explains it perfectly. I think the naysayers either really just didn’t or won’t (because of biases) think it through. It is really not that hard either. Steve admits that equity being a negative number is counterintuitive, but it became obvious to me early on that Minsky was set up to easily sum across the row. The sum should always be zero. If not, something was entered wrong.

“It sounds counter-intuitive when you first learn it, but it works to make sure you don’t make mistakes when tracking financial transactions.”

It sounds counter intuitive – really means that the reader(the one who thinks it is counter intuitive)’s POV is wrong. Kernick explanation shows the need not to confuse the company with the CEO with the stockholder with the bond holder with the …

and for the writer to anticipate his reader’s wrong POV and (gently) correct it.

Lordie.

QE does not have to be “unwound.”

The Fed bought mortgage backed securities.

They amortize. People refi or pay them off when they sell the house. Average duration 5 years. It will go longer, but not enormously longer in a rising rate environment.

The Fed just has to STOP QE. The unwind happens on its own.

Why does it have to stop? I see here that the conventional criticism of QE is wrong, and I don’t see any harm identified here? OK, so why can’t it just go on forever?

“Fascinating. So the level of indebtedness of the average punter is irrelevant to economic activity in Bernanke’s worldview. Amazing. Stupendous. Ludicrous. A five year old could do better understanding demand and debt.”

Yeah. Seconded.

Amazing isn’t it?

Back in the days when this sort of thing didn’t really seem particularly important, and we were content to leave it to the serious economist types, I never stopped to think about how delusional that assumption was.

What’s really scary is that some people still seem to think like that.

Kind of reminds me how people have priests tell them whats in the bible instead of bothering to read the damn thing…

Kind of dangerous to leave these kinds of things to people who will gain by completely obscuring accurate understandings of the issues.

of how*

Well back when the (catholic) church held serious power over Europe, the bible was hand-copied and in Latin. Making the act of sitting down and reading it, unless you were a monk or priest, highly unlikely. With the printing press came mass printed translations, and with it rapid erosion of church power in Europe.

My experience is that most bankers think like that. Especially when FDIC (or TARP or BARF) will bail them out if their borrowers’ indebtedness becomes beyond redemption.

Here’s Ramanan’s take on Steve Keen’s article. Ramanan is always worth reading since he tries to immerse himself in the intricacies of macro balance sheet accounting Godleyesque style:-

http://www.concertedaction.com/2013/05/30/dear-steve/

The aggregate level of private debt is certainly important, but so is the yearly personal interest payments on that debt. And those payments have dropped dramatically, from about 275 billion per year in in 2007 to about 175 billion per year in 2013. The reduction in interest rates, due to QE, has thus had a major impact on the economy.

I think the major weakness in Keen’s modeling is that he emphasizes overall debt, and not the yearly payments on that debt. I think that more attention should be paid to the flow of funds than to the debt to GDP ratio. When a homeowner refinances, they probably spend a large fraction of those savings in various retail purchases. This should be a stimulant to the economy, and it has indeed led to inflation in some areas that are sensitive to extra available cash, such as travel, entertainment, luxuries, etc. And this stimulant will largely remain even when interest rates go back up, because many people have fixed rate mortgages.

The story is more complicated, of course, since only a subset of the population has a home mortgage, and only a subset of those with mortgages have been able to refinance at a lower interest rate. And a significant fraction of the population is burdened by other types of debt that can not be refinanced at a lower interest rate.

Where does the money come from for the interest payments?

My reference is the St. Louis Fed. See http://research.stlouisfed.org/fred2/series/B069RC1

Actually, I am not sure what this interest payment includes. It seems to small a number to include mortgage payments.

Thanks, @SteveB. The data source is the BEA, which indeed shows “Personal interest payments” as “Non-mortgage interest paid by persons.”

Moreover, it’s a measure of interest paid, not interest accrued. The drop is precipitous, and the trend predates the official recession, let alone QE. So it’s the story of consumers prioritizing, keeping the electricity on and trying gamely to save their houses. Not a depiction of the easing manageability of interest payments as a consumer benefit of QE. And not a mortgage story at all.

@SteveB >And those [yearly personal interest] payments have dropped dramatically, from about 275 billion per year in in 2007 to about 175 billion per year in 2013.

I’d appreciate seeing your source for those numbers. Did foreclosure contribute a bit to that drop?

Stop attributing the drop in consumer rates to QE. As I indicated above, QE has had impacted Treasury yields, but less than most people think. You had huge deflationary pressures in the wake of the crisis, and in deflation, the place you want to be is in cash and high quality bonds. So the Fed is getting a lot of credit (or taking a lot of blame) for what would have happened to a considerable degree without its intervention.

The one place it has had a serious impact is on mortgage rates, as a result of the Fed buying GSE debt. That would not affect other consumer borrowing rates since the duration is very different.

The bigger deal is still ZIRP. Banks borrow short to fund consumer lending like credit cards. And have banks lowered THOSE rates? You still see rates on purchases on credit cards at 19is% and default rates at 24.99%, 29.99%, even 34.99%.

In fact, you saw BETTER credit card deals the last time the Fed drove short rates below inflation, in the 2002-2004 period. I regularly got “Transfer your balance” (which you could do to a credit card that was CURRENT, so you could fund spending “and get XYZ rate FOR THE LIFE OF THE BALANCE.” Rates were under 10%, I think the lowest I saw was an astonishing 4%, and I saw lots at 5, 6, 7, 8%. Finally started creeping up to 10% before they stopped doing that.

Now there is ALSO a school of thought that the Fed is manipulating the stock market….Citadel is usually cited as the party through which it is working. That still sounds a lot like conspiracy theory but a ton of sane, seasoned investors at very large firms believe it. If true, that would also mean the stock market prices aren’t so much due to QE as to more brute force measures.

You see no life of the balance offers now, just teaser rates of 6 months to max 24 months.

Most of the total debt in those plots of Keen are mortgage debt. So if we are going to analyze whether this total debt is too large compared to the GDP, then we also need to look at the interest payments on these mortgages. And as you note, the QE has reduced the mortgage interest rates. Thus the interest burden has been coming down much faster than the level of total debt. And I have seen it among my contacts. People have been repeatedly refinancing their mortgages, and using the extra money for daily living.

The Fed’s QE is an asset swap that takes assets onto the Fed’s balance sheet from the financial sector and exchanges that for additional Reserves in the Fed reserve accounts of Financial sector entities. If this money is to be used to purchase shares, it seems to me that it would only be from other financial sector entities that have Fed reserve accounts. After the Fed asset swaps with the financial sector, the financial sector asset swaps among itself.

I suspect that the principal effect on asset prices seen by real economy actors is a yield effect. As bond yields are suppressed by QE, other riskier assets also rise in price as investors are willing to pay more for what little yield there is.

@Samuel Conner

If this [QE] money is to be used to purchase shares, it seems to me that it would only be from other financial sector entities that have Fed reserve accounts.

Of course the sellers will be anyone in the market that day. The sellers’ banks will gain reserves as a result of the share sale, and the sellers will gain infusions of deposit money, which will immediately set about seeking a return. There absolutely is a channel from QE to deposit accounts.

Agree.

>> Its critics oppose it because they believe this massive amount of ‘money printing’ must inevitably lead to ruinous inflation.

I’ve lost half my purchasing power. “Ruinous” enough for me.

It may well be that I don’t get this.

If the treasury issues bonds and the banks buy them they hold bonds instead of cash. If then sell them to the fed, they get the cash back and are square.

But where did the cash come from for the fed to buy them? It seems either reserves or printing.

The missing part seems that the banks and the fed include cash as well as loans as assets.Swapping cash for bonds or loans is only a change insofar as they are not equivalent i.e some loans are bad and some adjustment is made for that possibility of loss as part of the interest.

However cannot the fed print and the money go to the treasury albeit through the banks as intermediaries? This might square as long as the bonds are seen as money equivalents. If they crash they are not.

You are quite right QE is a “Mooching for the Rich” program to reinflate bad asset calls. Nevertheless as a good Mooching Libertarian you must participate in making as much anti-government propaganda as you possible can to stop government devising anti-mooching laws particularly against the creation of “bubble dreck”!

You don’t need an education in DEB to realize this is just one giant money laundering operation. They’re pushing on a string, attempting to re-inflate assets which should have been written off or marked to market long ago.

http://aaronlayman.com/2012/10/the-federal-reserve-where-fraudulent-mortgages-go-to-die/

Smart man Aaron. Valuing things at what they are worth in your balance sheet was where the finance world was heading until USA decided that perhaps it wasn’t really necessary.

Everyone can see the US stock market is overvalued. Only the smart ones will profit, those in the club. The last ones last through the door, the cab drivers and elderly, those with the least clue about what is going on, will lose their money.

If a bond should get a haircut or be written off but gets bought up by the Fed, I call that printing because the entire system should have shrunk and not stayed equal.

If a bond is not impaired but gets bought up by the Fed so the new cash can be used to purchase other securities, I call that printing because it keeps the prices up higher than what they should be, once again keeping the total market value of the system higher than it would be without the intervention.

I agree. While its not ACTUALLY ‘money printing’, its an easy way to explain whats happening, even if its rather innacurate.

Care should be taken while calling it that, but its an easy explanation with some basic uses. I mean lets face it, the average person will NOT understand complicated definitions of what QE does. Hell, im not sure I do!

Keen’s claim that Bernanke’s critics imagine him ‘printing greenbacks and mailing them in little brown envelopes to everyone on Main Street’ is a ridiculous straw man.

It is the process of reserve creation via the Fed’s purchases of securities in open market operations to which critics object.

Ever get the impression that we’re being talked down to? Fortunately it’s in print, so we don’t have to be subjected to the Crocodile Dundee strine which has become so bloody tiresome in the flipping Geico ads.

Yep, the unwillingness to acknowledge that the market price and the price paid by the Fed are two different prices is remarkable.

Steve – I think you do great work. How could you miss the monetization of federal deficits? The govt borrows 40-50% of every dollar it spends. This goes directly into income. QE keeps this game going. QE also stacks the deck by distorting the plumbing of the modern collateral system, which further distorts rates.

In a monetary system when the government issues a freely floating non-convertible fiat currency the central bank always monetizes debt. The fact that it is not transparent is sad. Prior to QE there were basically ZERO excess reserves in the system. Only reserves can be used to buy US Treasuries. If there were no excess reserves in the system where did the reserves come from (without the central bank losing control of its target interest rate) to buy the debt? The only place they can come from, the central bank. The issuance of debt instead of currency/reserves is a policy choice, but in the end the money comes from the central bank!

150 comments and no one has disputed your basic premise that the government is monetizing its budget deficits.

Good post.

I took DEB in high school. It’s method, not theory. It helps and it sensistizes one’s BS detector whenever an “economist” is explaining his latest theory.

http://www.ehow.com/how_7516235_double-entry-accounting-tutorial.html

http://www.dwmbeancounter.com/tutorial/Tutorial.html

QE is not designed to stimulate lending to the public and thus reflate the real economy. QE is designed to put deployable assets in the hands of the major banks by which they can replenish their nonexistant capital reserves through profit seeking _by any means they choose_. Speculation in jiggered (if not completely rigged) markets offers far more in profits faster without the risks of lending into a deflationary real economy where there is little demand for high margin loans. We don’t really need to parse or debate a question of why the money injected hasn’t stimulated the real economy, since QE was NEVER designed to stimulate the real economy.