It sometimes feels like a Sisyphean task to keep discussing how Americans were thrown under the bus in the various mortgage settlements reached in 2011 and 2012. The mortgage-industrial complex was deemed too big to fail and as a result, malfeasance and fraud were deemed to be mere “errors”, offensively low damages were paid, and the banks were told to adhere to current law, with a few new requirements thrown in (single point of contact, ending dual tracking, and processing modifications in a timely manner). Far more meaningful reform has occurred in states like California that offer stronger protections under newly-passed homeowner bills of rights.

The reason far more serious remedies needed to be implemented was that mortgage servicers have never had the systems in place to handle more than a trivial level of delinquent mortgages. Servicing delinquent mortgages well, or even adequately, and processing modifications is a high-cost, high touch operation, while servicing mortgages that are being paid on time is a factory: highly routinized, high volume, low cost. The only way to get servicers to invest in staff and systems to service delinquent mortgages and process mods properly would be to put a very big boot on their neck. And that never happened.

As, we need to belatedly stop and take note of the latest “nothing to see here” effort by the Administration with the issuance last week of the latest report of the monitor of the national/49 state settlement entered into in early 2012. The media made much of the fact that the large servicers had satisfied most of their financial requirements. Um, that wasn’t that hard, since the cash component was a steal. As we wrote last November:

As we and others have written at considerable length, the mortgage settlement was a big exercise in optics. The $26.1 billion number sounds impressive until you compare it to the size of the housing market and the damage done to homeowners. 40% of the value of the settlement can come from junk credits, things the banks would have done anyhow or should be doing in the normal course of business, like razing vacant homes, short sales, and giving homes to charities. And of the remaining part, which was a relatively small amount of actual cash payment ($5.8 billion, but that included over a billion of fines federal regulators rolled into that total), the rest is supposed to be reduction of mortgage principal. Oh, but wait, they can take credit for modifying OTHER PEOPLE’S MORTGAGES, meaning those owned by investors. And they’ve been doing that in more than half the cases.

The other bit, which Abigail Field dissected at length, is that the settlement also institutionalized fraud by allowing astonishingly high error rates in the various metrics, typically 5%. How would you feel if your bank or credit card issues was allowed to have a 5% error rate?

The part that the media underplayed is that in the categories where the banks fell short, it was above and beyond these “you can drive a truck through them” error rates.

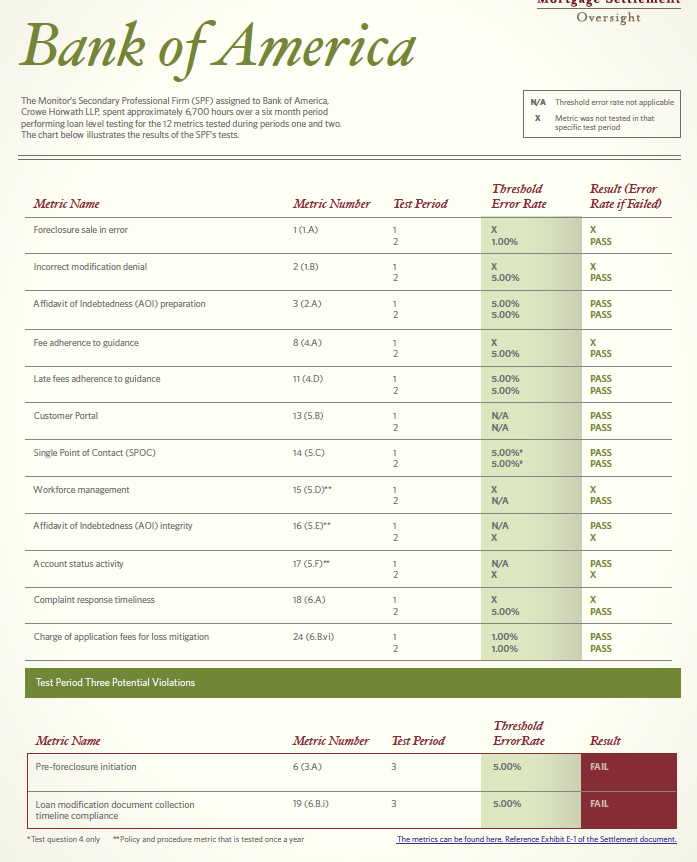

In fairness, the monitor’s report did at least make that clear if you looked at the various performance measures. For instance (click to enlarge):

How did the press describe this, um, lapse? Let’s turn to the New York Times:

Bank of America failed two metrics, one regarding missing documents and the other regarding the pre-foreclosure letter.

That’s technically accurate but misses the significance. As we discusses at some length in our Bank of America whistleblower series, the sending of the breach letter is a key step, because it not only lets the borrower know the boom is about to be lowered, but also tells them how much is owed and where to send the money. The reviewers reported evidence that the letters weren’t sent or didn’t have the payoff amount and address, which would create a big impediment to getting matters resolved and make it far less likely that those borrowers who had a hope of salvaging themselves would have time to do so.

Similarly, the bland “not complying with document timeliness guidelines” is consistent with the charges that came to light via a class action suit filed against the Charlotte bank, alleging systematic mortgage modification abuses, including periodic “blitzes” to throw borrower documents out and various “dog ate my homework” excuses to claim the borrower hadn’t submitted the required paperwork. Dave Dayen gave an overview of the filing at Salon:

Bank of America’s mortgage servicing unit systematically lied to homeowners, fraudulently denied loan modifications, and paid their staff bonuses for deliberately pushing people into foreclosure: Yes, these allegations were suspected by any homeowner who ever had to deal with the bank to try to get a loan modification – but now they come from six former employees and one contractor, whose sworn statements were added last week to a civil lawsuit filed in federal court in Massachusetts.

Notice also that two of the seven affidavits were from staffers who continued to work at the bank after the settlement had been signed. The fact that abuses were continuing was confirmed by a current Bank of America who had worked in various modification-related areas before and after the March 2012 settlement who spoke to us:

Yves Smith: I’m assuming that you came forward because you saw the deck stacked against borrowers. I mean, is that a fair statement of where things – the way things were handled? I mean, do you think the bank was serious about wanting to do modifications, or were they only –

Bank of America Employee: (laughs)

YS: – willing to do modifications in very specific – No, I mean, that’s a serious – you know, were they serious or not?

BE: No, I’m laughing because I’m taking the stance of the bank if, they would be probably laughing at your statement because it was very clear that we did not want to give the modifications and it was built into our incentive structure.

YS: Mmm!

BE: I was in originally a, you know, regular non-MHA modification person. We would actually get paid for a decision, and a decision was considered either a decline of a file for a modification or an actual modification. Well, guess what, it’s a lot easier to do three declines in one day than one approval. So you would see agents and reps and they would be granted very luxurious leeway in declining customers and would do it routinely. There would be no follow-up process if one of them was done wrong, because there was no – the whole structure of the way that it was built, was built on very loosey goosey rules, and it was done specifically so that, you know – I can’t say you did it wrong because there’s no process, there’s no – nothing in writing in our guides or manuals that says it was wrong. It’s just, you know, we just feel like it is. (laughs). So –

YS: Wow, and that’s – I assume that’s particularly shocking for a bank like Bank of America, because one thing I’ve heard is that it’s very process driven, that it likes having everything kind of nailed down and written, much more so than most banks.

BE: Right. Well, as far as that’s concerned, they do do that, but, see, they do it in a very vague and open-to-interpretation process. You get a lot of the instructions and manuals, like, I may have a couple manual documents that kind of just show how they’re like, well, “in a situation where this may be called for,” and then it doesn’t define what the situation means or doesn’t define what may be called for or its limitations or its extremes. (laughs) It’s just vague material.

YS: So it’s process theater is what you’re saying. A lot of it is process theater.

BE: Exactly. Exactly.

And this system to make it hard to get modifications produced the desired results:

YS: Yeah. So the first layers you’re describing – let’s go through the layers of how they impeded. Because I just want to get all the mechanisms down that they had for making it hard for customers to get modifications. One is the one we’ve heard about a zillion times, and you’ve confirmed that it happened. It was basically almost impossible for a customer, you know, to get straight information and get their paperwork in. It already seems like a huge hurdle.

BE: Right.

YS: And then the next one was that, even if they somehow miraculously got their paperwork in, the frontline personnel were paid to process more files, which basically meant they had a huge incentive to reject modifications since it’s harder to evaluate one and recommend one than just nix someone.

BE: Absolutely.

YS: Now, let’s say there’s a deviant person there (laughs) who actually approves a modification. One of these frontline people doesn’t get, isn’t with the program and actually approves a mod, or recommends a mod. Then what happened? Then what would happen?

BE: Well, basically, either that responsible person basically will lose control of that file. Because at that point it may go to a third party, and if there’s any issues, they will not get answers. They’ve now made an excuse, since the supposed order that they have one person one agent, they have now split up the process. So many different people are now on a file that there’s no communication between person #1 and person #10, whereas before the order there was only about three people, three to four people involved. After the order, they made sure that it was ten people and they made it even more difficult.

This employees stated that he was forced to dual track two people, which resulted in them losing their homes. Recall that when the class action suit was filed, the bank denied its allegations vociferously. So how did the bank think its behavior was kosher? By taking the position that the modification process was not underway:

BE: What the bank does is the bank takes the liberty of defining what “in a modification” is. If a customer has submitted to me all their documents – okay? – and I need an underwriter to review the file? They are not in a modification. Nor are they under review for a modification. They make that explicit point that they are not in review for a modification if our underwriters have not approved or – no! I take – did not approve the file.

YS: Wow.

BE: So what they have filed in – say, a file is in underwriting, I have a foreclosure date coming up in two weeks – oh well. It’s probably going to foreclosure because if I don’t have a response back from the underwriter, I am not able to postpone the foreclosure or make the request.

Now remember how the settlement metrics work. They are self-scored, but the results are checked via sampling by “independent” consultants. But it is a virtual certainty that the consultants won’t be able to unearth behavior like this employee is describing, that of not entering a modification as being under consideration until a huge number of internal steps have been taken, well beyond the borrower getting all of his documents in on a timely basis (and that’s before you get to the other widely-attested problem of documents mysteriously going missing).

In other words, it’s a virtual certainty that the monitor isn’t capturing the degree of failure to comply with the settlement because the servicers have plenty of room to game the system. Welcome to the rule by bank in America.

Next step will be to make the latest fix a matter of national security and charge anyone who complains with economic terrorism

I’ve a mind to report you to the NSA for saying unpatriotic things like that!

You just did!

And each of us who responded to this article just got “tagged.”

One minor quibble: you mention the “widely-attested problem of documents mysteriously going missing,” but iirc, Simone Gordon testified that scans of the relevent documents were often right there on the computer. She was told to lie to customers and say the documents had not been received, but in point of fact, the ‘missing’ documents were (and are) not actually missing.

Picking nits, it’s what we do here…

Yes, at BofA the temps were usually able to find the borrower docs during the IFR review even when they read claims in the notes that they hadn’t been received but the workers in the class action filings also said documents were thrown out in operations called a “blitz”.

The locution of “borrower documents going missing” does imply they were sent and received.

Is that objectivity? They were sent and received, period.

“Banks couldn’t handle it cause they weren’t set up for it?”

Dubious, they won’t set anything up if it doesn’t make them money.

You must not have an office like mine. I have documents in my possession go missing all the time (as in ones I most assuredly got and thought I wanted to keep). Sometimes they rematerialize, sometimes they don’t.

I made it clear enough places (reference to dog ate my homework excuses) that this “going missing” was a convenient fabrication, and the MSM and even Congress has taken that issue up too. I don’t need to keep pounding the point every time I make reference to it within a piece.

Go paperless man. I don’t work at a Bank, I have Brother Printer MFC7860DW all the bills and what not go in, and then get further processed and archived. Banks have the equipment, and they foamed.

Groups like NACA (I think) touted completely paperless attempts at a modification which the information technology companies (Banks) outright ignored also or claimed were incomplete.

Simon,

The banks’ systems are a mess. It was not easy for the temps to find the docs when they found them. And the point was as the whistleblower suits indicated, BofA was using every excuse to pretend it had not gotten complete documents. So you have chicanery (mainly) plus some incompetence.

As for me, surely you jest. First, most paperwork become irrelevant in 3-4 months. Scanning then and tagging them is much more work (therefore much less efficient) than processing them and throwing them out. Plus for some stuff (like fights I’m having now with Cigna) having actual original documents give me a monster upper hand. I can refer to records of their practices beyond their record retention time frame. They could claim I;d fabricated them if I didn’t have originals, which they happen to have printed on hard to fake blue stock.

Second, I had a hard disk fail catastrophically and found my backup disk also had major (irreparable) disk errors. So this “oh just upload it”is no panacea. And do you want your records on your disk in this surveillance state world? You’ve got more personal security with paper copies.

Oh right, the blitzes…forgot about those.

That is a classic headline. Truly timeless.

Thanks for keeping the focus on another example of our morally bankrupt system.

so Now we all know why Obama was chosen to be President

HYPOCRISY

Congressmen called for repeal of Obamacare then plead for its dollars for their

constituents. Senator Chambliss—Rep. Paul Ryan—the Nation magazine has identified 22 other Obamacare-bashing GOP lawmakers who have pleaded for money from Obamacare.

If you took just the money that’s spent on the war in Iraq and Afghanistan you could build beautiful free homes for every non-white family in the US and for millions of the poorest whites. Camden, Baltimore, Detroit, Atlantic City – you name the slum and voila, gone. And la di daa!

But they won’t do it, it isn’t profitable. Mortgage servicing isn’t something that needs to be fixed, but we can pretend some banking schmutz is looking over things.

This reminds me of my old days working at Wells Fargo. I was what they called a “home preservation specialist.” It’s Orwellian. As our behaviors were exactly the same described above. Systematic indoctrination of the employees and implicit incentives to make the phone calls with borrowers shorter…

Well, they didn’t say who they were preserving the homes for. Let’s be reasonable, here.

Here comes “bail in.” So much easier to steal when “everyone” agrees you have been on your best behaviour trying to amend your “former,” thieving ways.

I noticed Ocwen – the most openly criminal servicer in he country – is set to own the servicing rights to nearly every mortgage in the country. The U.S. made a half hearted attempt to thwart their RESCAP purchase…but like every single regulator intervention regarding Ocwen, they quickly backed down. Their foreclosure M.O. for newly acquired loans is to inform borrowers that their former servicer did not collect enough in Escrow and then raise the monthly payment …if you refuse to pay the new amount you get a rolling late…which prompts them to quickly foreclose. They do this even if you pay your own taxes and insurance. They are diabolical and even the CFPB won’t touch them.

Yes Dolly you are correct, but did you know this?

(* Pay attention to the Financial Services section below)

Homeward Acquisition – On October 3, 2012, Ocwen entered into a merger agreement between O&H Acquisition Corp., a wholly-owned subsidiary of Ocwen (the Merger Sub), Homeward Residential Holdings, Inc. (Homeward) and private equity firm WL Ross & Co. LLC. Pursuant to the merger agreement, the Merger Sub will merge with and into Homeward, with Homeward as the surviving entity (the Merger). Upon consummation of the Merger, Homeward will continue its existence as a wholly owned subsidiary of Ocwen. In the Merger, Ocwen will acquire approximately $77 billion in UPB of MSRs as well as Homeward’s existing origination platform and certain other ancillary businesses.

ResCap Asset Purchase – On October 24, 2012, Ocwen Loan Servicing, LLC and Walter Investment Management Corp. (who bought Green Tree July/Aug. 2011) were jointly awarded the highest and best bid for the mortgage servicing and origination platform assets of Residential Capital, LLC (ResCap), a wholly-owned subsidiary of Ally Financial Inc., in a bankruptcy court sponsored auction. The bid, with a purchase price of $3 billion, is subject to definitive documentation and Bankruptcy Court approval. Ocwen’s portion of the purchase price is approximately $2.46 billion of which $0.83 billion is for MSRs, master servicing contracts and subservicing contracts, and $1.63 billion is principally for advances acquired at a discount from their par value of $1.72 billion. Ocwen will add to its servicing portfolio loans with $203.7 billion of UPB at August 31, 2012 including $126.6 billion through the acquisition of MSRs, $31 billion through subservicing contracts and $46 billion through master servicing contracts.

Genworth Acquisition – On October 26, 2012, Ocwen and Genworth Financial, Inc. (NYSE: GNW) entered into an agreement whereby Ocwen will acquire Genworth Financial Home Equity Access, Inc. for approximately $22 million in cash. The company, which will be renamed Liberty Home Equity Solutions, Inc. is the number one reverse mortgage originator based on September 2012 industry data with strong positions in both retail and wholesale originations. The acquisition is expected to close in the first quarter of 2013.

http://shareholders.ocwen.com/secfiling.cfm?filingID=1019056-12-1156&CIK=873860

OCWEN merger agreement with O&H Acquuisitions Corp. merged with Homeward Residential holdings and WL ROSS & CO, LLC – Owns Investco. – their strategy = Control-oriented distressed securities/restructuring. HOMEWARD WILL BE THE SURVIVING ENTITY.

ALTISOURCE PORTFOLIO SOLUTIONS, SA – (OCWEN)

Altisource Portfolio Solutions S.A.( Altisource), incorporated on November 4, 1999, together with its subsidiaries, is a provider of services focused on technology-enabled, knowledge-based functions related to real estate and mortgage portfolio management, asset recovery and customer relationship management. The Company operates in three segments: Mortgage Services, Financial Services and Technology Services. In April 2011, the Company acquired Springhouse, LLC (Springhouse). In July 2011, the Company acquired the assembled workforce of a sub-contractor (Tracmail) in India. In December 2012, the Company completed the spin-offs of Altisource Residential Corporation (Residential) and Altisource Asset Management Corporation (AAMC).

Mortgage Services consists of mortgage portfolio management services, which span the mortgage lifecycle from origination through real estate owned (REO) asset management and sale. Financial Services consists of unsecured asset recovery and customer relationship management. Technology Services consists of modular, integrated technological solutions for loan servicing, vendor management and invoice presentment and payment, as well as providing infrastructure support. The Company conducts portions of its operations in all 50 states and in three countries outside of the United States.

Mortgage Services – The Company’s Mortgage Services segment generates revenue by providing services, which loan originators and loan servicers typically outsource to third parties. Its services are provided using its national platform and span the lifecycle of a mortgage loan. Its services are centered on its relationship with Ocwen Financial Corporation (Ocwen), but we also have relationships with capital market firms, commercial banks, hedge funds, insurance companies and lending institutions. Its services begin with a default management referral from a customer, which results in a pre-foreclosure title search, property inspection services and non-legal back-office support services in connection with managing foreclosures. Upon receipt of an asset management referral after a property has been foreclosed, it provides REO preservation, REO asset management, REO valuation, REO brokerage, REO closing and REO title insurance services. The Company’s Mortgage Partnership of America, L.L.C. (MPA) is the manager of a national alliance of community mortgage bankers and correspondent lenders, which does business as Lenders One.

Asset management services – include property preservation, property inspection, REO asset management and REO brokerage. It provides property preservation services and pre-foreclosure inspection services. Origination management services include MPA, its contract underwriting business, and its origination fulfillment operations is under development. Residential property valuation services provide its customers with appraisal products through its licensed appraisal management company, working with its network of appraisers and ordering system. Customers may also order alternative valuation products through its system and network of real estate professionals. It also offers customers the ability to outsource all or part of their appraisal and valuation management oversight functions to it. In closing and insurance services the Company provides a range of closing services and title services applicable to the residential foreclosure process and the sale of residential property. Default management services provide non-legal back-office support for foreclosure, bankruptcy and eviction attorneys, as well as foreclosure trustee services.

Financial Services – The Company’s Financial Services segment provides collection and customer relationship management services to debt originators and the utility and insurance industries. This segment is focused on disciplined floor management, delivering more services over its global delivery platform. Asset recovery management provides post-charge-off consumer debt collection on a contingent fee basis where it is paid a percentage of the recovered debt. Its customer relationship management provides customer care and early stage collections services, for which it is compensated on a per-call, per-person or per-minute basis. In addition, it provides insurance and claims processing, call center services and analytical support, for which it is paid based upon the number of employees utilized.

Technology Services – Technology Services consists of REALSuite of applications, as well as its information technology (IT) infrastructure services. It provides its IT infrastructure services to Ocwen and the Company. The REALSuite platform provides a set of applications and technologies, which manage the end-to-end lifecycle for residential and commercial servicing, including the automated management and payment of a distributed network of vendors.

The Company’s REALServicing is an enterprise residential mortgage loan servicing product, which offers an efficient and effective platform for loan servicing, including default administration. This technology solution features automated workflows, a dialogue engine and robust reporting capabilities. The solution spans the loan servicing cycle from loan boarding to satisfaction, including all collections, payment processing and reporting. It also offers REALSynergy, an enterprise commercial loan servicing system.

The Company’s REALTrans is an electronic business-to-business exchange, which automates and simplifies the ordering, tracking and fulfilling of vendor provided services related to mortgages. This technology solution, whether Web-based or integrated into a servicing system, connects multiple service providers through a single platform and forms a method for managing a network of vendors. REALRemit is an electronic invoicing and payment system, which provides vendors with the ability to submit invoices electronically for payment and to have invoice payments deposited directly to their respective bank accounts. IT infrastructure services provide a range of IT services, for which it performs remote management of IT functions internally and for Ocwen.

Sorry for the length of this post.

Good God its even worse than I thought…they are the Borg. Just TONIGHT heard from a friend whose mortgage is now serviced by ocwen – they called him and demanded he prove that he spent an insurance check on the repair listed – from 1999!!!! They want before and after pics, reciepts, etc. it was to repair a floor he has since replaced. They want a refund!! You cannot make this sh*t up…

Thank you for fleshing out evn more of this story about industrial scale racketeering that impoverishes God knows how many Americans.

Oh, it’s FIXED all right…

Just not in the flesh and blood citizens’ interests.

Big, immortal, artificial people? Another story.

And, we’re concerned about the NSA?

One of the few good things I have done for anyone outside of myself in the last three eyrs is helping the famiy across the street save their home. They started recording their phone calls to their mortage “provider.” They started letting that bank know that they were in touch with the Congress man from our district. They started lying to the bank and saying they had had witnesses to all the major phone calls prior to when their situation got serious. So that they had witnesses (in the bank’s frame of reference anyway) available when they had been told that their documents were received.

It was still a huge struggle, but the tactics worked, for them at least. But why citizens in any “democracy” on earth would need to go through all this is beyond me. And every week, I read of others who have been ripped off, including the man whose home was seized by Wells Fargo, because he had made paymetns ahead of schedule!

What I really really want to see/hear is an interview with the judges that are allowing this travesty. how come no one has been able to interview them and get to the bottom of their treasonous rulings for banks clearly at fault – like the case of the man who overpaid his mortgage getting FC on? Why is noone holding them accountable?

Barack Obama was a creation of Franklin Raines, Director of Central Planning, as a writer I read anointed him while he was head of FNMA. Home America, the corporate structure, owns the President.

What I understand is there should be no room left for error in finance.