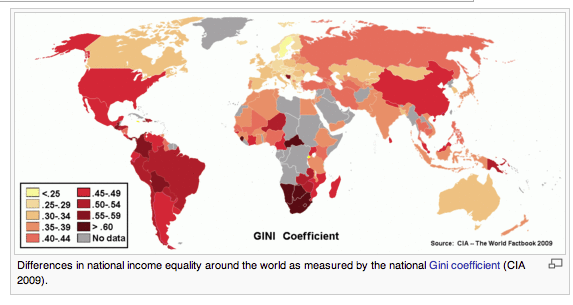

Yves here. While readers may think development policy has limited relevance to US and advanced economy readers, the IMF and World Bank have been and continue to be vehicles to make the world, particularly smaller or otherwise more influenceable regimes, more friendly to the interests of US multinationals. And at the same time US companies are taking down a record share of GDP in profits, the country’s ranking in inequality is worse than that of many developing economies. New York City is more unequal than China, and as the chart below shows, is also more unequal than Russia, famed for its oligarchs, and India, which still has hundreds of millions living in abject poverty.

So the World Bank’s efforts over time to exclude issues like corruption and inequality from its analysis have direct and obvious parallels to policy discussions here. Wade’s anecdotes of the way the World Bank refused to even allow the “c” word to be acknowledged are striking. It’s a near certainty that the big reason inequality is now a regular topic of conversation among economists, for instance, is that the rapid rise of a super rich class while average workers are left in the dust makes it impossible to ignore.

By Robert Wade, Professor of Political Economy, London School of Economics. Cross posted from Triple Crisis

On May 29 2013 James Wolfensohn, president of the World Bank from 1995 to 2005, gave the Amartya Sen lecture at the London School of Economics, on the subject, “Reflections on a changing world, 1950-2050”.

His reflections on the changing world were mainly reflections on what he achieved as World Bank president. He emphasised five.

• Re-focusing the World Bank – and the whole development “community” – on poverty as the central issue of development.

• Elevating “corruption” as a major development problem, instead of sweeping it under the carpet.

• Writing-down countries’ debt (especially African) – so that World Bank loans no longer went straight out the door to western banks and instead were used for investment in the country.

• Putting Bank operations in a particular country in the context of a broad vision of the economy’s future development path five to ten years ahead, in the format of his “Comprehensive Development Framework” (CDF).

• Decentralizing World Bank operations, so that more of the total staff operated from regional or country offices rather than from headquarters in Washington DC, and more meetings with shareholding states were held in borrowing countries rather than in Washington or Paris.

Here I comment on the first two: poverty reduction as the central goal of development, and corruption as an explicitly stated problem. I put them in historical context, not least because the World Bank operates without memory of its own history – as seen in the fact that most Executive Directors (the civil servants of member countries who constitute the 25 seat Executive Board, which governs the Bank on a day-to-day basis) and also most staff have never even heard of, let alone read any of The World Bank: Its First Half Century, the independently written but semi-official history published by Brookings Institution in 1997. For most of the time since it was published the World Bank book shop has not even stocked it, on the ostensible grounds that the Bank did not publish it. Or to be more exact, these are my findings from asking just about every staff member and Executive Director I’ve met since 1997 about the two-volume history, and from enquiring about its availability on every visit to the Bank. I have a vested interest, as author of chapter 13, “Greening the Bank: The struggle over the environment, 1970-1995”, volume 2, pp.611-734.

Poverty Reduction and Inequality

Wolfensohn’s elevation of poverty reduction as the central goal echoes then World Bank president Robert McNamara in 1973, forty years ago, who solemnly proposed in a speech in Nairobi, Kenya, a “new strategy”. The “ambitious objective” of the new strategy was “to eradicate absolute poverty by the end of this century” (that is, 2000). He explained that this goal was possible because “if courageous decisions are made, then the pace of development can accelerate”.

In fact much of what Wolfensohn and the Bank said about poverty reduction in 1995-2005 could have been taken almost verbatim from what McNamara said twenty to thirty years before; which raises the obvious question of why the world poverty problem looked as daunting when Wolfensohn re-asserted its importance as when McNamara identified it as the central objective of his “new strategy” in 1973.

But McNamara showed awareness of a closely related issue that remained eclipsed in the Wolfensohn era: income and related inequalities. He said in 1973, “despite a decade of unprecedented increase in the gross national product of the developing countries, the poorest segments of their population have received relatively little benefit [because] rapid growth has been accompanied by greater maldistribution of income in many developing countries”. He went on to say that “the growth of GNP is essentially an index of the welfare of the upper income groups. It is quite insensitive to what happens to the poorest 40%, who collectively receive only 10-15% of the total national income”. McNamara’s nondescript successors – Clausen, Conable, Preston – displayed little interest even in poverty reduction, let alone inequality reduction.

In 2005, when a group of World Bank staff proposed to write the next World Development Report 2006 on “inequality and development”, their proposal was rejected by the Executive Board, on grounds that “inequality” (in contrast to “poverty”) was inherently a “political” subject, which the Bank as an “apolitical” organization should not become involved with. Executive Directors from Russia and China made this argument particularly strongly. And so the group redrafted the proposal to focus not on inequality of outcomes but inequality of opportunities. The Board said, “expanding opportunities, that’s not political”, and gave permission for what became World Development Report 2006: Equity and Development, to be written. The team had to write it in a way which pretended it was all about opportunities, though much of the data and argument was about outcomes.

Why this asymmetry of attention? Partly because taking “poverty reduction” as the central objective makes the elites (at the Bank, in the western “development community”, in developing countries) feel good about themselves. Whereas taking inequality reduction as a central objective comes uncomfortably close to home, because it raises questions about the legitimacy of the overall structure of income distribution of which elites are prime beneficiaries. Not just the Bank but the whole development community and the whole of the western economics discipline has given far more attention to poverty reduction than to inequality reduction, even as income concentration at the top has soared in the West and in most developing countries since the 1980s. Wolfensohn on 29 May made no mention of inequality as a problem.[1]

Statistically, differences between countries in the incidence and severity of poverty are explained much more by differences in average GDP than by differences in the degree of income inequality (as conventionally measured). But the degree of inequality does affect the magnitude of the effect of growth in GDP on poverty incidence – the higher the inequality the smaller the effect of GDP growth on poverty reduction. This is not only from the arithmetical point made by McNamara above – that in high inequality countries the growth of GDP is sensitive mainly to the growth of the top decile or two in the income distribution. It is also, more substantively, that the high degrees of inequality typical in developing countries plausibly worsen a whole range of economic, political and social conditions, including through the positive feedback from inequality to social prejudice. Those at the top stereotype those lower down in ways that justify their superior riches, their low taxes, and their decisive influence across broad swathes of public policy, in a positive feedback loop. These issues continue to be remarkably understudied in development economics, including at the World Bank.

Corruption

On corruption, I begin with my own engagement with the Bank. Having done research on the operation and maintenance of large irrigation canals in India, I was invited to give a seminar about this subject to the India Irrigation Division at the World Bank (in Washington headquarters) in 1981. The India Irrigation Division at that time was lending more than any other division in the whole of the Bank, and it and its division chief enjoyed high prestige. The day before the seminar I conferred with the staff member who organized the seminar, and explained that I was going to show how the engineers operated and maintained the canals in line with the incentives of a well-institutionalized system of bureaucratic corruption (based on auctions for the franchises to particular posts in particular places, at each rank); and that the resulting practices lowered the productivity of canal-irrigated agriculture. The staff member blanched, and implored me not to mention corruption. He said, “Michael Cernea [the Bank’s sole sociologist at that time, dealing with resettlement of people affected by a World Bank project] covers that sort of thing. If you want to talk about corruption, get Michael to organize a seminar in his part of the Bank. Tomorrow we want you to concentrate on the institutional aspects of canal operation.”

The next day, to the elite staff of the division (predisposed as engineers to be suspicious of a so-called social scientist), I sketched an outline of what I was going to say. Ten minutes into the talk the division chief — a hard-charging Israeli irrigation engineer named Gabriel (Gabby) Tibor, held in awe in the whole South Asia region of the Bank because he was reputed to be the only division chief with a direct line to McNamara — pushed back his chair, rose to his feet, and stormed out, slamming the door behind him, notwithstanding that he was chairing the meeting. Other senior figures soon followed. The more junior staff who remained, embarrassed, made no comments at the end, though a corpulent Pakistani irrigation chief engineer visiting the division, adorned with gold chain, gold rings and a Rolex, remarked with satisfaction that while the sort of things I described might go on in India he had never heard of such things in Pakistan. [2]

Despite this inauspicious start, I worked as a World Bank staff economist from 1984 to 1988. One day in 1986 a British Young Professional (YP) at the Bank rushed into my office (in the Agriculture and Rural Development Department) waving a copy of his newly published World Bank Discussion Paper. He exclaimed jubilantly that his Discussion Paper was the very first World Bank publication to be allowed to include “corruption” in the title. In 1986.[3]

Fast forward to Wolfensohn on 29 May. He told us that early on in his presidency (which started in 1995) he prepared a draft speech to a major meeting of Bank shareholders, in which he talked about corruption as a major development problem. He sent the draft to the chief legal counsel. The latter soon appeared in his office, saying that he wanted an urgent word with him – outside in the foyer. Wolfensohn pointed out that his office was perfectly comfortable, and suggested they sit down and talk there and then. No, said the legal counsel, we must talk outside. Outside in the presumably bug-free foyer the legal counsel whispered to him that he must on no account use “the c word”. “Why?”, asked Wolfensohn. “Because half of the people you will be speaking to are up to their eyeballs in it”, replied the legal counsel, or words to that effect. Wolfensohn went ahead and spoke about corruption, then and throughout his presidency.

Earlier in his talk Wolfensohn told us that as a young employee of an American multinational company in 1960 he had gone to newly independent Nigeria to explore business opportunities, and specifically to meet with the chief justice of the Western Region in that connection. While taking photographs in the parliament he was detained by the police and put into a holding cell. Frightened, he asked to make one telephone call. Permission granted, he rang, of course, the chief justice of the Western Region, who promptly secured his released. No hint of corruption in Wolfensohn’s dealings with the chief justice, apparently. Whereas had a Nigerian businessman the same ready access to the chief justice, then we westerners ….

These anecdotes make the point that “corruption” is one of the most misused words in the social science vocabulary – misused because treated as inherently bad, as the source of all manner of development problems, while given no analytical boundaries. Its use becomes tautological, almost as elastic as “It is god’s will”.

The evaluation of corruption as inherently bad is sustained by stopping the enquiry at the point where corruption takes place, and not continuing to ask what the recipients do with the illegal payments. That reflects the assumption that if private resources go illegally to public officials, the transfer represents a transfer from “more productive” to “less productive” uses, the private sector being inherently more productive than the public sector. But the developmental effects must depend on whether the public officials use illegally obtained private resources to invest in enterprises, or children’s education, or to buy higher status in the after-life through temple donations, or to buy their next post.

Corruption is normally defined as a violation of public trust. This builds-in the assumption that corruption does not exist in private-private transactions, on grounds that privates are responsible only to their shareholders, not to the public. And corruption is commonly identified with the activities of domestic firms (in developing countries) in their dealings with government. Whereas international (American, European) firms operating in developing countries – doing what Wolfensohn did in Nigeria – tend to be given a free pass. Here we see the truth of the Swahili proverb, “Until the lions have their own historians, the history of hunting will always glorify the hunters”. (Thanks to colleague Professor Ken Shadlen, also at Wolfensohn’s lecture, for this point about the presumed locus of corruption with domestic firms.)

Corruption is often conflated with “rent-seeking”, and the two concepts certainly overlap. But rent seeking can be perfectly legal; it refers simply to non-directly-productive use of resources aimed at obtaining privileged access to public resources – such as the importer who wines and dines the licensing authority, or gives his daughter in marriage to the same. See Anne Krueger’s seminal article in the American Economic Review 1974, which purports to show that the private gains from rent seeking are roughly equal to economy-wide losses.[4]

But Krueger is a neoliberal economist trying to understand a political economy phenomenon. The cost of corruption is (probably) not mainly its direct effects on resource allocation to non-productive ends, but its swamping of normal incentives to economic and political action. As Michael Lipton says (personal communication), corruption corrupts, and in the same process empowers. Much the same applies to inequality. As suggested earlier, higher inequality reduces the effect of growth on poverty not mainly by the arithmetic translation of growth into poverty reduction, but by creating and sustaining economic and power structures in which the poor have few income opportunities and few competitors for their political support. Corruption helps to perpetuate these economic and power structures.

The Rise of the Rest

Wolfensohn ended by emphasising the shift in economic weight in the world economy. For decades before 2000 the West plus Japan (the old OECD) had around 80% of world GDP for less than 20% of the world’s population; the rest of the world had around 20% of world GDP for more than 80% of the world’s population. By 2050 the West plus Japan will have about 35% of world GDP, and the rest will have 65%. The future of many of you – he told his very international audience – lies out there in the Rest, and you better get used to it.

To illustrate the western resistance to the idea of the inevitability of radical shifts of wealth and power away from the West, Wolfensohn told of a G8 meeting in France in 2003. The G8 graciously invited the presidents of several big developing countries to address them — for not more than 12 minutes each. President Lula of Brazil proposed to them that they hold the next G8 meeting in Brazil, because pretty soon three or four of the existing G8 would no longer be at the top table and their seats would be taken by some of the presidents now addressing them, or their successors, and so the surviving members of the G8 better get used to travelling into the developing world for their get-togethers. Lula said it as a kind of joke, but several of the G8 heads of government did not laugh.

Wolfensohn’s confidence in his figures for the rise of the Rest reminded me of J. K. Galbraith’s dictum, “Astrology was invented in order to make economic forecasting look good”. Serious analysts in the 1950s to the 1970s forecast that the Soviet Union would overtake the US in average income by 2000.

The rise of the Rest is generally presented in statistical terms, as Wolfensohn did. But a distinction should be made between (a) increases in the relative size of GDP and GDP per capita in some populous developing countries, and (b) a different balance of power between capital, labor and other social interests in those rising developing countries. If the rising powers bring the same political economy balance as in the West – heavily tipped towards capital, especially financial capital – then their ascent to global political influence will bring less change to the structure and functioning of the world economy than if they bring a different political economy balance into international circles. So one has to scrutinize China, Brazil, India, Russia, South Africa and some others to find signs of an existing or emerging difference in class balance from the West. Likewise, one has to scrutinize the “faltering center” of the world economy for signs that it itself is undergoing changes in class configuration as it falters. Economics as a discipline has virtually nothing to say about such structural changes.

Governance of the World Bank

Wolfensohn said little about the present-day Bank. I asked him in the Q & A what he would say now to borrowing country and non-borrowing country governments, if he were still president, about how they might break the American monopoly of the presidency ever since 1945. I had in mind the appointment of the current president Jim Yong Kim, an American citizen, over the heads of two candidates from developing countries who were almost everywhere – including in European governments – considered much better qualified than Kim. Behind my question lay my argument that however much the member states of the World Bank chorus that the selection of the president should have no nationality restriction the American monopoly will endure as long as:

1. The US government retains its veto over certain kinds of decisions in the Bank (the only government to have a veto);

2. The West and East Europeans together wish to keep the European monopoly on the Managing-Directorship of the IMF (and so support whoever the Americans nominate for the World Bank, knowing that the Americans will reciprocate);

3. The Bank’s “high income” (non-borrowing) countries maintain a majority of the votes. Even after the arduously negotiated “voice reforms” of 2008-2010 the high income countries keep a large majority – their share fell from the pre-reform 65.3% to the post reform 61.6%.[5]

_____________

[1] See further, Robert Wade, “Why has income inequality remained on the sidelines of public policy for so long?, Challenge, 55, 3, May-June, 2012, 21-50.

[2] I published my analysis of the corruption system – which operated in other government departments too and not just the Irrigation Department – in “The system of political and administrative corruption: Canal irrigation in South India,” Journal of Development Studies, 18(3), 1982, 287-328; reprinted in Development Studies Revisited: Twenty Five Years of the Journal of Development Studies, (eds.) Charles Cooper and E.V.K. FitzGerald, Frank Cass: London, 1989 (one of 19 papers selected from 700 papers published by JDS in the first 25 years); and “The market for public office: Why the Indian state is not better at development,” World Development, 13(4), 1985, 467-497. Reprinted in Corruption, Development, and Inequality: Soft Touch or Hard Graft?, (ed.) Peter Ward, London: Routledge, 1989

[3] Richard Jolly, former director of the Institute of Development Studies (IDS) at Sussex University relates (personal communication) that in 1975 an IDS Fellow, Bernard Schaffer, proposed to run a study seminar on corruption. (IDS study seminars normally lasted several weeks, and brought participants from around the developing world.) The permanent secretary at the Overseas Development Agency (the UK aid agency) rejected the idea, telling the IDS decision-making body that ” corruption isn’t a subject”. So someone was dispatched to the library and returned with five books on the topic. “Well, even if it is an academic subject, it would be an embarrassing one”, replied the permanent secretary. Schaffer persisted, pointing out that Nigeria had recently set up a commission on corruption. The permanent secretary announced, flatly, “Well, ODA still won’t support a study seminar on the subject.” IDS went ahead and funded the study seminar out of reserves.

[4] Anne Krueger, “The political economy of the rent-seeking society”, American Economic Review, 64, 3, 1974: 291-303.

[5] Vestergaard, J. and Wade, R. (2013). Protecting power: How Western states retain their dominant voice in the World Bank’s governance reforms. World Development, http://dx.doi.org/10.1016/j.worlddev.2013.01.031. Also, Jakob Vestergaard and Robert Wade, 2012, “Establishing a new Global Economic Council: governance reform at the G20, the IMF and the World Bank”, Global Policy, 3, 3, September, 57-69. Robert Wade, 2013, “The art of power maintenance: how western states keep the lead in global organizations”, Challenge, 56, 1, January-February, 5-39. Robert Wade, 2013 (forthcoming), ”Protecting power: western states in global organizations”, David Held and Charles Roger (eds), Global Governance At Risk, Cambridge: Polity.

Excellent excerpt. The press, of course, takes their cue from institutional avoidance of discussing “corrpution.”

In light of the post just below on this blog, I wonder how relevant the World Bank will be in a world where future economic development can only come at an environmental cost high enough to endanger the human race, and at any rate may be impossible eventually anyway due to resource depletion.

I liked this because it fits in well with the interpretative framework I use of kleptocracy, wealth inequality, and class war. It is important to understand that corruption and inequality are not problems in the system. Corruption, that is looting, is how the system works, inequality is the goal, and class war is how the inequality is maintained. By not addressing these issues the World Bank fosters them. This is unsurprising. The World Bank is an institution set up by the rich and elites to aid their thefts.

The author does not mention this, and it kind of makes my point, but the person who succeeded Wolfensohn as President of the WB in 2005 was the god awful Paul Wolfowitz. After Wolfowitz left due to his sex scandal there, he was succeeded by Robert Zoellick. Zoellick was a Goldman alum. He was a charter member of the neocons having signed the PNAC letter to Clinton. An ardent free trader, he played a central role in the negotiations getting China into the WTO and setting up the Doha round of WTO trade negotiations. And just to top it off, he pushed hard for GM agriculture. Wolfowitz and Zoellick are basically what you would call twofers. They are both neoliberals and neocons. The current President Kim I don’t know much about, except that he started out working in various international health programs and ended up as president of Dartmouth before becoming president of the WB. I have the feeling Obama picked him as a way of keeping the WB presidency in American hands without to creating too much of an uproar. And of course, since Obama chose him, it is safe to assume that Kim, if he has any economic views, will be neoliberal or guided by the neoliberal views of his staff.

Interesting post. Good point: where does the money go for corruption and is it always “bad”, what purpose does corruption serve, besides the stated reason for doing it, etc.

Some points to think about and research over. In today’s world knowing your enemy is the first step of change.

This piece fits in nicely with today’s NYU article.

Corruption breeds corruption, it’s true. We’re “fortunate” here in the US that the corruption mainly stays in the upper-echelons of the public service sector, where it is endemic. In Nepal (and many other places, I imagine) the culture of corruption is spread throughout the entire civil service hierarchy, with expectedly poor results.

Anyone in Nepal who gets a government job is assumed to also engage in some graft to supplement their state salary, which is often quite low. I get the impression that some amount of graft may be necessary to make ends meet for some state employees. But plenty of “public servants” don’t stop at just making ends meet, and no one really seems to care. One common joke, on seeing a new house being built, is to comment “he must have got a government job.” Often enough, it turns out to be true.

And if some young idealist takes a government job and doesn’t bring home some baksheesh, s/he’ll be ridiculed. The joke about these sorts of people, rare though they are, is “some people walk through the forest and don’t see any firewood.” You’re assumed to be a little dumb if you don’t use a public office to enrich yourself as much as possible.

But, on the other hand, everyone also complains about having to pay for every signature from every bureaucrat on every form to do anything official. The cognitive dissonance is something to behold…

But here, as there, the overall effect is to make everything done by the government needlessly expensive (which is not say the private sector isn’t just as bad), besides leading to all kinds of poor decision-making. The Wire is the best depiction of this dynamic that I’ve seen, especially the last couple seasons with the Tommy Carcetti character’s machinations as mayoral candidate and then mayor.

The question that we must answer, imho, is how to arrange a system that simply does not allow for public office to be used for private gain, since it seems like if it can be, it will be.

Great read. It amazes me it’s been four years since Simon Johnson and Thomas Hoenig tried to give ‘insider’ perspectives on what’s been happening in the context of the most recent crisis.

Not that the elite don’t want to surrender their privileges, that is unremarkable. But rather, that educated liberals get so smarmy in their net deficit spending preaching that they ignore the actual nature of the problem – distribution.

David Hume pointed out that wealth creates poverty quite awhile ago. You can lead a horse to water…

Agreed. IMO, what has changed with the GFC is that comfortable Democrats are starting to be affected personally by the much longer trend of declining living standards.

This creates some hilarious cognitive dissonance (when one is in the right frame of mind to laugh at it all, of course).

Historian Swinney Salutes President Clinton for::

CARING FOR—

Children

Elderly

Poor

Students

Educational infrastructure

Disabled

Small businesses

Americans who suffer losses in disasters

For 22.4 Million new jobs

For better paying jobs

For increasing the Minimum wage

For keeping our servicemen and women out of harms way

For making America a beacon of hope for other nations

For having a popularity rating of 98.5% in Moscow.

For being an active church attendee all your life.

For saying-“I will never use my religion for political purposes”.

For being a devoted and successful father

For giving us Hillary to serve all Americans.

For trying to de-politicize politics.

For not having a mean bone in your body.

For never being vengeful toward those who try to destroy you

For your sincere faith in a living God.

For praying in private meetings with Vice-President Gore and not

publicizing it.

For being polite and gracious to all persons you meet.

For a sincere, caring attitude toward my family.

For being a worse golfer than I.

For having, in eight years, only one member of your administration

convicted of a felony which was committed while working for you.

For standing tall, without whimpering, to the congressmen who spent $110,000,000 trying to destroy your administration.

For “working for life not a living” as a true Lifeaholic.

Just know for certain President Clinton America LOVES you.

And thats Swinneys Democratic Party Propaganda Message for today.

Thanks Swinney.

I like how half the message was about Clintons religion, which is ENTIRELY irrelevant.

i can always count on a giggle when the sweeny whirls like a dervish but when you chime in i double over…thanks

I worked in a minor position at the World Bank in the 80s but I was able to find out quite a lot about WB politics and corruption within the Bank. In short, it is an organization with many small kingdoms and fiefdoms. Some organizations are fairly honest and some are not–some parts provide excellent studies on a number of important topics, others just lay out the usual BS that governments and the media express. I can give you specific information on specific projects that had built in corruption that the upper reaches of the WB may have suspected but probably had no clue about. The internal politics of the Bank are extremely complex as I found out in my stint there.

The World Bank, IMF and all international organization are there for the benefit of the most powerful agents in the world and always support the particular ruling elites of any country as long as that country basically is friendly to the West–all these organizations are deeply political. I used to think that these organizations were the hope of mankind until I experienced them directly–now they are merely institutions that maintain the Empire.

Denial?

Hah hah, that’s a good one. “Our leaders are fine, otherwise-holistic humans who are engaged in the Kubler-Ross grieving process. They deny it now, but when they’ve finished their ethical bargaining, when their anger subsides and their acceptance allows their consciences tor return to normal function, they’ll admit it, and the world will be egalitarian once more.”

Precisely. Brilliant thesis.

How about apathy? Too impossible to fathom or analyze? No, actually, it’s just hard to write 15 paragraphs with charts, graphs and data pies when it’s as simple as apathy.

Looks like you didn’t bother reading the piece. You might do that before you opine so authoritatively.

Wade describes how he did a study on corruption in what was then the WB’s biggest, sexiest initiatives, and all the senior people blew and up left the room. That’s not apathy, that’s active suppression of evidence. Ditto on inequality, it was ACTIVELY excluded from analysis.

MILITARY INVOVEMENT (INITIATED) BY PRESIDENT

CARTER=0

REAGAN=Nnicarauga-El Salvador- Hondurss-Lebanon

BUSH I—- Iraq—Kosovo-Somalia

CLINTON =0

BUSH II=Iraq—Afghanistan–Pakistan

OBAMA—Libya-Syria

How many innocents were killed due to our involvement?

Carter-The Carter Doctrine.

Don’t let these people off because they are folksy or not as bad as the other guy.

Clinton had no military involvement?!!

WHAT IN GODS NAME DO YOU CALL BOMBING THE LIVING CRAP OUT OF YUGOSLAVIA?

Your propaganda never ceases to amaze me.

Oh and I like how you only started under carter, conveniently leaving out LBJ starting the Vietnam war.

This is utter nonsense! Bill Clinton issued sanctions on Iraq that resulted in the deaths of 500,000 children! The man is without doubt a war criminal. Let’s not forget Jimmy Carter’s role in East Timor and Nicaragua. If the Nurumberg principles were applied to every post WW2 president, they would all be hanged….

How about Operation Eagle Claw? Granted it wasn’t a full blown invasion or week long bombing campaing, but it was still a military operation in a foreign country by Carter.

http://en.wikipedia.org/wiki/Operation_Eagle_Claw

Or Operation Desert Fox in 1998 that set the precedent for ignoring UN weapons inspectors:

http://en.wikipedia.org/wiki/Operation_Desert_Fox

The most salient point in this piece is the author’s assertion, with reference to the changing structure of power and class relations within and among states, including the core of capitalism in the US is:

“Economics as a discipline has virtually nothing to say about such structural changes.” – which is why economists as a group are no better than barbers when projecting future events, including “ecomomic” events.

I would also note that the author apparently accepts the false dichotomy of US “dominance” of the World Bank vs Europeans “in charge” at the IMF. The US holds the largest share of votes at the IMF, and is effectively run out of the US Treasury. This has been true from inception to this day. I make this point only to clarify for those who believe, for example, that the US and IMF were of two minds in handling any of dozens of financial crises over the years, most recently vis a vis the hard-line Troika positions re the various Euro crises in Greece, Spain, Portugal and Italy, accounting as well for the easier path provided to Ireland. Chatter now at the IMF about “mistakes made” with respect to Greece mirrors changes at Treasury reflecting the (false) belief that the US financial system and WS banks are now “safe”.

I find it interesting how the US framing of corruption is indeed very much based around payment and favours to public officials.

The framing in Europe is rather different. The UK Bribery act specifically includes bribes, kickbacks and other corrupt acts between private parties. The FCPA only covers payments etc to public officials, public servants and the like.