Yves here. I have to say I’m still gobsmacked by the Fed’s belief that the labor markets are showing meaningful improvement, and the further “clarification” that this means the central bank thinks it’s on track to start easing up on bond buying this year. Cardiff Garcia at FT Alphaville does a good job of capturing why many investors were caught off guard:

Before the presser on Wednesday, Ben Bernanke’s vague definition of “substantial improvement” in the outlook for labour markets resembled the old line about porn: he’ll know it when he sees it.

The phrase was originally intended to represent the scenario under which asset purchases would end, not when they would be slowed (or “tapered”). And the purpose of this round of quantitative easing was to “increase the near-term momentum” of the economy until growth was self-sustaining, and conducted in the context of price stability….

Bernanke’s decision on Wednesday to confirm his earlier congressional testimony — when he said that the Fed would begin scaling back asset purchases later this year — can be understood as a move in the direction of such a variable policy.

The idea was that given the FOMC’s heightened expectation of better growth later in the coming years, a substantial improvement in the outlook for labour markets is likely to have occurred by roughly the middle of next year. And it would be represented by a 7 per cent unemployment rate.

But rather than continuing with the current pace of asset purchases until mid-2014, “it would be appropriate to moderate the monthly pace of purchases later this year”. Presumably by then, the near-term momentum will have increased such that fewer and fewer asset purchases are needed to sustain the quicker decline in the unemployment rate that the Fed is now forecasting.

7% would normally be considered a bad number on then way to a worse number. Now it’s some sort of victory. Help me. And the focus on headline unemployment, as we and numerous other commentators have pointed out, overstates the health of the labor market if you look at the pretty much any other metric (labor force participation, wage levels, trends in hours worked, quality of new jobs, etc.) The Fed looks to be cherry-picking data to validate its desire to get out of the QE business.

Another remarkable moment of Fed disconnect from the press conference was when Bernanke remarked, “The change in mortgage rates we’ve seen so far is not all that dramatic.” Huh? It’s been enough to slow down refis (a source of spending) sharply and send buyers racing to close deals out of fear of further rate increases. And perhaps most important, the signal that the Fed really wants to start tapering this year means even higher rates are coming soon. That means buyers who are homeowners (as opposed to investors/landlords) are looking at a lot less affordability, which can’t not have a price impact. MacroBusiness weighs in on this issue, and its broader ramifications.

By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Cross posted from MacroBusiness

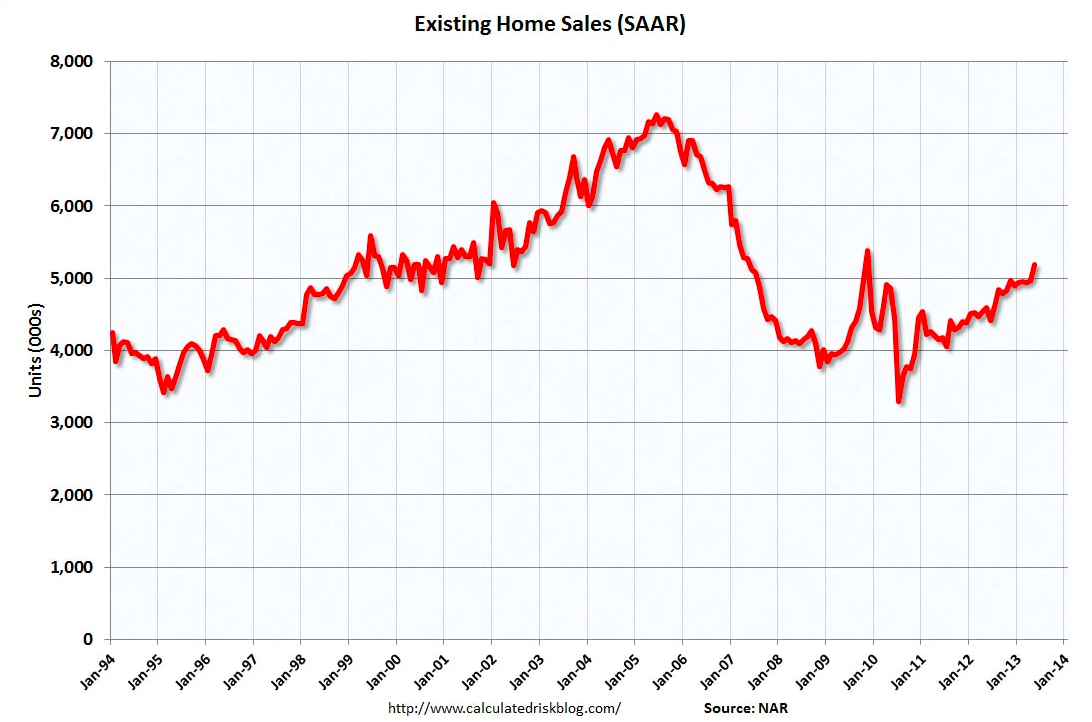

Last night US existing home sales went through the roof. From Calculated Risk:

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 4.2 percent to a seasonally adjusted annual rate of 5.18 million in May from 4.97 million in April, and is 12.9 percent above the 4.59 million-unit pace in May 2012.

Total housing inventory at the end of May rose 3.3 percent to 2.22 million existing homes available for sale, which represents a 5.1-month supply at the current sales pace, down from 5.2 months in April. Listed inventory is 10.1 percent below a year ago, when there was a 6.5-month supply.

House prices are now rising at double digit rates. It looks like a booming recovery and solid support for Bernanke’s taper.

But I just don’t buy it. You can’t fire off a US housing market recovery using historically low interest rates then expect it to be unaffected when rates suddenly revert to mean. It’s really that simple. Pimco’s Bill Gross agrees:

The real economy won’t follow the path the Fed thinks it will,” said Gross. “The chairman suggested yesterday that, once we get through this soft patch of fiscal austerity in the U.S., that the 3 percent growth number is indeed where we should be and where they expect we’ll be. We have our doubts at Pimco…“The chairman was rather dismissive in terms of mortgage rates,” Gross said. “To dismiss that increase in costs based on higher interest rates I think is not only dismissive but again not reflective of what may lie ahead in terms of housing prices and the real economy.”

And from housing specialist, Mark Hanson:

In 6 short weeks the market has priced out all of the Twist and QE-3 benefit and taken rates back to “nose-bleed” levels of mid-2010 through mid-2011.

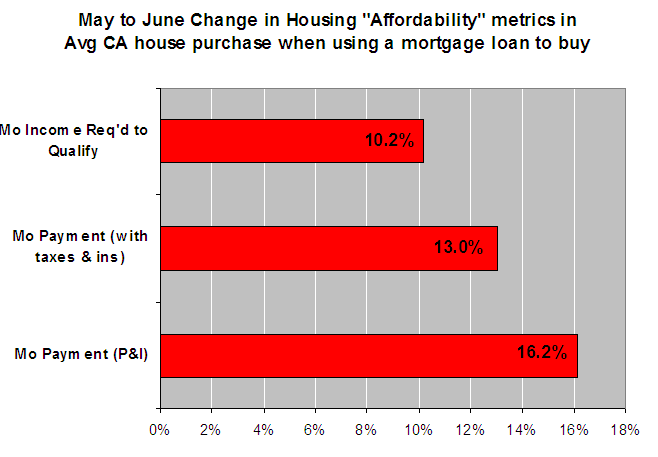

Based on the change in mortgage rates from 3.5% to 4.75% in the past 6 weeks, the median CA house price of $324k, and typical debt-to-income ratio of 45% the chart below captures how much the real change in cost of ownership has increased in the past 6 weeks:

These are huge moves especially considering — when purchasing a house using a mortgage – most people buy based on “monthly payment and the maximum allowable debt-to-income ratio”.

I’ll readily admit that I’ve been behind the curve in the past twelve months on the US housing market recovery. But these kind of dramatic interest rate hikes are going to kill refinancing activity and retard new mortgages as well. That will slow the housing market. Stock market sell-offs come and go but housing slowdowns have deep impacts.

Perhaps if the global economy were stronger it would be smooth. But with a European recession, a deteriorating China and rising US dollar, I’m still not convinced that the Fed will even get to its taper.

I agree with you about the risks to the economy and housing from the premature tapering, but after all the backward bending and triple somersaults the Fed has done to save the financial system, is it really likely that they are simply choosing this path without understanding the implications?

I think it is either about trying to douse the speculative fires, which really were geting out of hand, or its the very real technical constraints on collateral. Or quite possibly a bit of both.

As Bill Gross also said, Bernanke is “deathly afraid of deflation”.

People are perplexed because he can’t speak the truth.

As for US housing, I’ve seen ample evidence to suggest it is just part of the speculative frenzy driving markets, with private equity leading the charge. But cashed up Aussie bogans are also talking about hopping on a plane to add an international element to their house investment portfolios.

Is that not the equivalent of the cab driver tipping stocks at the top of the market?

As one investor buddy stressed, Bernanke has not only a bad record as a forecaster but in recognizing contemporaneous data. I remember in 2007 when he said subprime losses would be around $50 billion. I gasped out loud because at that juncture, the lowest estimate from experts was $150 billion. He similarly (this was earlier) that zero to negative consumer savings rates (unheard of before) were fine because consumer balance sheets were good. And he and Paulson and Geithner went into “Mission Accomplished” mode after the Bear rescue, when anyone could see Lehman, Merrill, and UBS were next on the list.

He and his Fed colleagues are choosing to weigh heavily data that supports their view that the economy is on its way to a self-sustaining recovery and are dismissing data that says not (like falling inflation rates and falling corporate profits).

i can’t recall if the following link was part of the daily links.

http://www.huffingtonpost.com/2013/06/04/federal-reserve-inequality_n_3386877.html

excerpt

***Sarah Bloom Raskin, a Fed governor, ……. interrupted her daily commute to the Fed from her suburban Washington home one day to visit a job fair. …… offered little in the way of stable, middle-class jobs.

“This was kind of eye-opening to me,” Raskin said during a conference at the Roosevelt Institute, a progressive think tank.***

nice to see that she saw the light, but c’mon—her full excerpt makes her sound like she just discovered the Rwandan Mountain Gorillas.

I once went to Vegas and won every single bet I placed (not counting the ones I lost).

Again, you are starting from the assumption he is telling the truth. I know Bernanke gets razzed for the subprime call, but consider this- he was trying make reality conform to what he hoped would happen by stating it out loud as Fed Chairman. The call on subprime was another jawbone attempt, but one that failed to work.

Bernanke lives in a faith-based world. What dose it mean to tell the truth when you have no idea what reality is? Or even openly reject reality in favor of your own narrative?

commonly known as head in hiney hole. after all that has happend, the trillions, the bank subdies, the back door bailouts, amazingly the head is still in he hiney hole.

I live in an upper middle class western suburb of Chicago. Home prices in my area have rebounded some 40% since bottoming. There is little evidence to support the speculative meme, at least in this part of the country. Rather, I think, much of the appreciation is due to supply and demand. There just has not been a robust supply of existing homes being sold (too many still under water I suppose). Couple that with the dirth in new home construction and all of a sudden it’s a sellers market. Maybe So. Cal. is different. I don’t know. But in this neck of the woods I don’t believe speculators are the primary drivers of appreciation, if at all.

Malmo, what does demand mean when the government is backing mortgages and covering up fraud and ignoring money laundering and providing regressive tax deductions for mortgage interest expense and so forth?

If supply and demand are setting prices, then it shouldn’t be a problem to end the various forms of government subsidies.

You are describing the island effect. It is like living on a desert island with one other person and boasting that the number of riots is far fewer than when you lived on the mainland.

The upper middle class was caught in the general downturn in house prices and is now enjoying the benefits of the current surge in them, but overall it was far less affected by recent economic events than the bottom 80%-90% of the population. It had more wealth to start with, higher incomes, and lost fewer jobs. Put simply, where you live is not where most Americans are living and does not reflect what most Americans have been experiencing since the recession which began in December 2007.

I might be in the upper 10%, or 90th percentile if you will. That doesn’t make me privlidged or wealthy by any stretch of the imagination. Like most, we are a paycheck or two away from financial catastrophe. I’m in my 50’s and experienced many very lean years. I make no apologies on where I am financially, as it came through much sacrifice. I also won’t be guilted into not taking advantage of what’s out there, even if it’s a government incentive that benefits me in some relatively small way (and it’s not remotely fair to compare my situation to the 1% either). I’m still part of the 99%. I’m not that far removed from being in the bottom 50%.

Oh, and more on point, Even though I live in an upper middle class suburb, that doesn’t mean my town doesn’t have affordable home throughout. They have likewise appreciated. perhaps even more so. This is solidly middle class here, not NYC’s Upper East Side.

I am the Cat who walks by himself, and all places are alike to me.

Kipling

In a kleptocracy, advancement is a matter of luck and heredity. Hard work has nothing to do with it. You could have worked every bit as hard as you say and still been crushed and thrown away by the system. Tens of millions have.

If you are in the top 10%, you are a million miles from the bottom 50%. You see your top 10% world and think it is normal, instead of the aberration that it is, the spillover effect of the 1%. If we are going to build a society which benefits us all, we are all going to have to give up these fantasies that any of us arrived where we are in this thoroughly corrupt system either through virtue or a lack of it.

@Hugh

” If we are going to build a society which benefits us all, we are all going to have to give up these fantasies that any of us arrived where we are in this thoroughly corrupt system either through virtue or a lack of it.”

There are some things that may or may not be true, but that we are better off believing – like believing a stove burner is hot if I haven’t touched it yet. Do you really think I should tell my kids that virtue has nothing to do with whether they will be successful or not? I would rather have them believe that they will “arrive” because of their own efforts.

Ian, I think dealing with children is a unique set of circumstances requiring a level of gentleness and simplicity and dictatorship not applicable to the adult world. We all have different notions of how exactly that transition happens, but that there is a difference isn’t really in dispute.

At first you shelter kids and control their every move; over time, you expose them to more of the world and let them make more decisions and deal with more consequences, both good and bad, and teach them new ideas, both happy and sad, inspiring and scary.

If you want your kid to grow up believing he can be a professional baseball player, that’s fine; your prerogative as a parent. If your kid truly wants to do that, and is talented enough, and you can afford to support that dream, to deny that dream is quite cruel.

But I think helping children grow into people who can see the world for what it is is much better. It’s only with a firm grasp on what reality is today that we can realize a vision for what we WANT reality to be tomorrow. And the reality in our society is that for the overwhelming majority of people, the genes and socioeconomic status they inherit from their family has far more influence over their opportunities in life than all the hard work they ever do.

I think of Barbara Ehrenreich’s commentary when notions like this come up. It’s not that hard work isn’t important; of course it is. It’s just that this notion that being optimistic and happy and positive can overcome reality is actually quite unhealthy. It’s of the same realm as other reality-avoding techniques like substance abuse.

http://www.amazon.com/Bright-Sided-Positive-Thinking-Undermining-America/dp/0312658850

@Ian,

I’d start here: http://en.wikipedia.org/wiki/Continuum_concept

@Hugh,

Your respone doesn’t begin to capture my life up to the present in any way, shape or form.. You assume what you don’t know about me and construct a caricature. That’s real unfair. You also have little idea about how I feel regarding the plight of others or my views relative to our broken society. If we had a pissing contest on who had the most impoverished life in its toatality I’d run circles around most here in the states– probaly including you too. I might be in a relativly comfortable place at the moment (and it’s been a tiny moment by the way), but I am in no way content to see my brothers and sisters here in America suffering as they are. And, yes, most of where I’m at boils down to being in the right place at the right time. Some of it has to do with playing the game of life too. I don’t take myself seriously, like you imply above. Like I said, I’m hanging by a thread and any little misfortune could blow it all away. That outta make you hapopy I guess.

And one more thing. I like your thoughts on most of what you write about here. I don’t think I’ve disagreed with you even a little. I associate much of your thought on these matters with my own. Does that make you myopic, like you think I am, being that I agree with you?

I work, in Chicago for one of the large, national hedge fund formed companies moving into single family home rental…You’re absolutely off your rocker.

Unless you’re a troll, prove it.

LMFAO, what a reply…

“Supply and demand” LMFAO again…you have no idea the amount of properties just sitting on bank rosters. Ive had bulk lists of 200 properties dropped on us for inspection within 3 days. The supply is hugely obscured and the demand is coming from companies like mine. The amount of properties my company alone has bought is staggering, not to mention other companies doing the same…and now small fish realizing it and buying first to flip to us. There is a massive amount of speculative cash buying and hoping to rent/flip in Chicagoland. Maybe you’re the troll? Ive wondered about you before, the way you parrot on, but Im guessing youre more likely just a sad paragon of your generation…thats a wall of cognitive dissonance I cant crack. G’Day Boomer.

I’m still waiting. You stil haven’t proved your assertions.

….and, dan h, you are incredibly rude.

Malmo,

The evidence is nationwide that anywhere from 30% to 50% of homebuying IS by speculators, either rental conversions or literally, hoarding.

There is ALSO a lot of evidence of servicers keeping supplies tight to support prices.

Honestly if you as an individual and not a real estate professional (and within that group, you need to discount information, since brokers put on their perpetual selling faces) you can’t comment authoritatively on the state of the market.

Malmo, speaking of waiting, you never answered my original question to you.

washunate,

What I said regarding supply and demand was accurate, as far as I know. The mechanisms at work influencing this interplay certainly have various elements within, such as what you and others claim. If this dynamic is artificial–being engineered by the government–why is that necessarily wrong? Are so called free markets sacrosanct? Is the net benefit from this intervention good or bad on blance? Should we do, as many Austrians insist, let the cold hand of the market here sort out the dead from the living?

Yves,

Yes, I’m not even close to being an authoritatve expert on these matters. I didn’t mean to come off that way. I really only know my neighrborhood, which is exclusivly owner occupied. Others near me I admittedly am not as familiar with.

Mary Umberger, In the Sunday Trib, reports 24% of the market is investor driven, which I think is no small number, but I don’t really know that. Nonetheless, the latest move in rates will obviously temper their enthusiasm going forward, and if these investors now become sellers prematurely then it’s game over. Not sure when the rate threshold will be crossed, however?

Link to article: http://www.chicagotribune.com/classified/realestate/sc-cons-0620-umberger-20130621,0,7668849.column

Malmo, perhaps you are unfamiliar with supply and demand curves. That’s fine, conceptual ideas can be difficult to grasp until the notion ‘clicks’.

The basic idea is that the (infinite) range of preferences of buyers and sellers intersect at a specific price (well, or multiple prices, but let’s keep it simple). This meeting of marginal demand and marginal supply is the market price, the equilibrium price, whatever you want to call it (where the price pairs of buyers and sellers intersect).

Any price level is possible (ANY level, from zero to infinity – some very interesting things happen at the extremes). But when some factor sets the price level to be something other than the market price, it is no longer a market price. It is artificially high or artificially low.

There is nothing inherently wrong with that. For example, child labor laws prevent market clearing prices of child labor. That’s a Good Thing if one believes that children should not be working (and a Bad Thing if one believes children should be working).

But the key point is that a competitive market of buyers and sellers freely engaging in transactions with each other does not describe a price level at any point other than that market clearing price. It is nonsensical to describe such a market as being determined by supply and demand – the exact opposite is true. Some external force is PREVENTING the market from clearing at a price where supply and demand intersect.

http://en.wikipedia.org/wiki/Supply_and_demand#Equilibrium

I allowed that the dynamics here were being influenced by differing forces including the government. I appreciate what you are saying but no matter what be the supressive forces hindering the clearing mechanism it’s at base merely semantics regarding supply and demand.

Malmo,

Not sure how much is “speculators”, but in the Bay Area prices are back to or exceeding bubble peaks. Co-workers today were talking about a Berkeley house that went 40% OVER ASKING.

Incredibly restricted supply, cheap money are certainly the driving force (and non-US money as well). But these aren’t trophy properties. Ordinary houses that an airline mechanic bought new now require two engineer incomes.

Prices are up 40% off the “bottom” — so prices went from absurd to merely expensive to absurd again.

yup

“Incredibly restricted supply”

That’s sort of what I said above. The reasons for this supply shortage I didn’t address. Others know better than I.

I would suggest that Ben(Fed) have ulterior motives behind the latest remarks. While I’m not a conspiracy theorist, the facts don’t add up. Ben can’t be stupid enough to not see that unemployment and underemployment are still huge problems. They are taking cover behind the headline data feeds to give the appearance they actually have a clue as to how they’ll unwind this mess.

I think Gross was spot-on with his analysis of the situation and the fact that Ben is scared shitless of the deflationary monster staring him in the face. He’s been pushing on a string and he knows it, because the problems aren’t just cyclical. There are deep structural problems well beyond the reach of the Fed’s impotent tool box.

Taking into account JPMorgan’s dwindling supply of registered, it fits with the theme that the central bank and the bullion banks are indeed talking to each other to mitigate damage to both their books and their reputations while they’re simultaneously considering additional alternatives to support an anemic economy. Remember, if it looks like a duck….

For anyone who thinks this side-show wasn’t planned, I’ll leave you with this latest iteration of comedy from the Comex, which is now apparently standard disclosure:

“The information in this report is taken from sources believed to be reliable; however, the Commodity Exchange, Inc. disclaims all liability whatsoever with regard to its accuracy or completeness. This report is produced for information purposes only.”

See my comment above, about Fed forecast error (large and on growth, biased towards optimism. Fedwatcher Tim Duy discussed this at greater length yesterday).

I have to disagree. Central banks don’t need to worry about losses. They do only if they losses are so ginormous that “printing” would interfere with their inflation mandate. Paul de Grauwe (who was very good in the runup to the crisis) just published a paper that says in a liquidity trap there is no limit to how large a balance sheet a central bank can run. The MBS is only 5 year paper (typical five year duration) the Fed can let it run off. Over the life of the bonds, tell me how the Fed will suffer losses? It’s holding to maturity and has no real funding cost (although for grins you can treat it as the Fed funds rate. Tell me when you think the Fed funds rate will get over, say, 3.5%, which is probably the lowest yield at which it bought the paper?).

The economy is booming in DC (it stinks of prosperity) and pretty decent in NYC, and it looks better than it is if you limit your travels to Manhattan. SF is hot and the tony areas of Seattle and LA are strong. NC readers on a large, active recent thread gave the image that there are strong pockets in the economy despite overall sluggishness and signs of underlying decay and underinvestment. And those hot pockets happen to be the places the top dudes at the Fed would be most likely to hang and have friends.

The elites are doing well. Who do you think gives the Fed informal input? Where they go things look good and the people he meets with are doing well. So all of the informal data is things are a lot better.

I think there is a political piece here we are missing somehow. The Fed is pretty unified in wanting out. I don’t see the justification in the data, even though the Fed is asserting that. Bernanke seems to be persuading himself it’s there. I think this is confirmation bias. They can’t accept the idea of QE forever, which is what they’d be faced with if they were honest about where they got things. It would be an admission of big time failure and they’d get increasing political heat as the Fed balance sheet continued to grow. The banks lose if interest rates go up so the banks most assuredly aren’t pushing for this.

Agree with the confirmation bias issue. Strong pockets in the economy for sure, but when you peel back the curtain there’s plenty of stress surrounding it. Also agree that the Fed wants out, and they’re trying to talk their way out of it if they can.

“the fraud and looting will continue until confidence is restored”

Maybe the message is more of: QE has healed what it can heal, but to expect more improvement or sustainability of any economic recovery from QE is imprudent. I think the pressure has to be put back on the political actors to encourage employment, rather than the expectation that the Fed bears the entirety of the responsibility for job recovery.

Could it be that Bernanke, who knows better than anyone how relatively meaningless QE is in terms of foundational economic effects, has concluded that the markets have developed an unhealthy and totally irrational addiction to the pronouncements of the central banker, and has decided its time to start breaking the spell. It has nothing to do with whether the economy is recovering well or is still weak. I think it’s still very weak. But having millions of economic players sitting around gazing with slavish, slack-jawed dopiness at their computer screens for reports of the latest central bank information fart, and basing huge decisions each weak on exactly how Bernanke moved in his seat when he relieved the lower-intestinal pressure, makes the economy weaker. We can’t run an economy on placebo effect forever.

My guess is that for most of the people who play around in the markets, “quantitative easing” just means “something the Fed is doing to prop up the economy”. So even if Bernanke said he was going to taper his program of incantations over boiling cauldrons of pig bladders, markets would still get the vapors. That’s a totally unhealthy situation.

There is no maestro!

can anyone describe the mechanism whereby QE4ever is supposed to achieve the Fed goals of full employment and 2 1/2 inflation?

employment hasnt improved since 2009 and core PCE inflation was at a record low in April…

seems they want to get out before everyone realizes what an abject failure their policy has been..

Sounds right to me. Benny is strictly supply side. IMDO (in my dubious opinion) QE has only ever been about rescuing and enriching casino cartel members, foreign and domestic, with unemployment nothing but a transparent fig leaf. Ben doesn’t give a fig about it and unlike Barack Herbert Hoover Obama (apologies to Hoover) is powerless to affect it anyway. And as Hugh has shown repeatedly, the stats are cooked, seriously overcooked, merely amorphous noodle paste.

QE is only heroin for speculators without any significant demand-side stimulus — in equities, Asian sweatshops, FX, houses, REO REITs (even synthetic CDSs are back, FCS!)),yachts, student loans, paper gold short bets, and so on. It does little for jobs, and the sooner it’s gone, the sooner we can get on with a proper purgative collapse of the greatest bubble in history. (IMDO)

A jobless recovery has been the objective all along.

i find that hard to believe…a jobless recovery may be the result of their using crude tools they dont fully understand, intending to bail out the financial system before anything else, but it makes no sense for anyone to purposefully leave a fifth of the working age population unemployed or underemployed…

I guess you’ll just have to tell that to congress; prolly have to leave em a phone message.

Keeps wages low, lots of hungry and desperate people snapping at whatever low pay temp jobs are offered. Maybe you don’t see that effect but I do. Every day. Give me your email and I’ll forward the offers to you.

I believe that forcing a segment of both the American and EU labor force into Asian labor rate jobs is part of the long term plan along with gutting the social safety nets of both.

It is not fun to watch from the “higher” and sicker level of whoooocooodannode.

Farewell to the mighty QE

A ship for The Powers That Be

Ben keeps her afloat

‘Till Elites board their boat

While sheeple sink into the sea

The Limerick King

http://www.flickr.com/photos/expd/7074102433/

I think we should stop worrying about confirmation bias and just start saying that Bernanke is incompetent. Confirmation bais, among other failings, are just the symptoms of his lack of ability.

But I wonder a few things about the Fed’s rush to declare victory and get the hell out of QE:

1. Is Bernanke, the so-called expert on Japan’s lost how-many-decades-now, beginning to worry that he’s fallen into the same trap and needs to prove he hasn’t?

2. Is legacy-obcessed Obama anxious to declare that he’s the guy who saved the economy?

3. Is there an angle for 2016 in which remaining on QE is seen as a liability for the Dems, since the GOP-Tea Party will campaign on “inflation” and “dollar devaluation”? (But of course, they wouldn’t change anything if elected.)

How about something a little more simple: Bernanke is operating on the theory that the only way to fix the economy is to convince enough people that it has been fixed.

They are working hard to get the confidence fairy to take another toke of whatever it is they are currently selling.

They managed to con a number of people into believing that securitized housing rentals was the hext big wave. Those conned have figured out that it doesn’t work and they are in a desparate search for the greater fool.

Someone broke the gold market, so now there is a lot of loose change looking for another home and some of the fools in town will wind up betting on stocks and commodities.

Bernanke is betting on the confidence fairy and Wall Street is hoping to cash out by convincing Main Street that once again it’s all good.

All of this is a complex way of saying that Bernanke and crew are completely clueless, and the greater fool has already been fooled once.

No good can come of this.

Nailed it again, Gerard.

Frankly, I believe that they are attempting to engineer a crash big enough for them to take advantage of and impose more draconian control and hierarchy measures.

There is conscious malice in their efforts to support the inherited plutocracy.

LOL! Damage control has already begun…

http://www.stlouisfed.org/newsroom/displayNews.cfm?article=1829

I’ll need to recheck (really busy now) but I think this is only “attempted damage control”. There were 2 votes against the statement, and I believe one was Bullard for this very reason, he’s been worried that his colleagues are underweighting what low/falling inflation is saying.

If my recollection is right, this isn’t damage control (as in no new info content) this is Bullard double underlining that he’s distancing himself from this decision.

Agreed, I think Bullard has generally been more supportive of accommodative monetary policy. Perhaps this is laying the groundwork for the next set of measures after markets throw their hissy fit this year and Yellen or whomever replaces Bernanke.

Two hypotheses:

The first, more generous to the Fed, is that they realized their policies were inflating another asset bubble, and they (finally) moved to prick it before it got so large it enveloped the solar system.

The second is that they actually believe their Potemkin recovery is real; that a “wealth effect” recovery, confected by further gilding the 1% and propping up house prices on sawhorses, can magically metamorphose into a durable fundamental recovery. Some part of Bernanke must simply want to declare victory and go home.

The ultimate QE…..is/was to give time for the ultra-rich to recover fromt he 2008-09 crash hangover…..

It appears that many of them have…..

Now they can plan the next move for the global economy, which in lieu of past experience will be another giant bubble……

I do believe that Bernanke is trying to let the air out of this mess slowly, but again in looking back in history when a few more realize the game is up…..stay away from the exit or be trampled to death.

This is nothing more than the Fed declaring victory and going home, a completing of the circle before Bernanke leaves this Jan. What makes this so dangerous is that the PBOC is trying to slow their shadow banking system at the same time. If there is a “Lehman moment” in China, will US treasuries be a safe haven or will the Chinese be net sellers?

Howard

MMT teaches that taxes alone are sufficient to drive the value of fiat so, strictly speaking, a de facto government and banking cartel monopoly on private money creation is NOT necessary.

So why do we tolerate a single failure point in private money creation? Why does the world hang on the Bernanke’s every word?

This seems to be part of the paradox we are in. There is a way out but it involves a different mind set. Such as essentially getting private health insurance out of the medical system. I was just visiting a nursing school in Galway, Ireland and they said they are running into cutbacks on getting their excellently trained nurses hired. Not that there is a limit for their need. I said that Ireland seems similar to the US in that when the really important members of society such as bank executives need money there is no limit but when it comes to such things as medicine and education we see austerity measures. There also seemed to be ‘man on the street’ support for getting off the euro. Similar to US citizens they take some responsibility for their economic woes similar to ‘household budget’ type thinking but are increasingly seeing the main problem with the banking and political sector.

It’s strange to see so many people woridwide accept these austerity measures and things like asymmetric QE when MMT has many answers of getting money allocated in many better ways.

http://neweconomicperspectives.org/2013/06/myersons-newest-model-tax-poor-workers-to-subsidize-rich-bankers.html

There is a way out but it involves a different mind set. financial matters

Even MMT advocates will fight fanatically for the notion that money can ONLY be debt YET no one can show me where there is any NECESSARY debt with the use of common stock as private money. They’ll either deny that common stock is a money form or claim the “debt” is from the company to the company owners (duh!) The latter is true, of course, but misses the point that common stock requires no debt to OTHERS, especially the banking cartel.

At the 1876 Centennial Expo in Philadelphia, with the Civil War behind us, there was an optimism that the economy was virtuous. The logo of the expo was a stock certificate, elegantly engraved with all the national symbols from George Washington to Ulysses Grant to industrious, self reliant stereotypes. Implying everyone had a share in America. That is basically what MMT is. Too bad it didn’t work out in 1876. Instead corporations (stock companies) went off the rails in a greed fest and we wound up with the Gilded Age. Enforcing the common good is no small task.

So long as the government-backed credit cartel exists, common stock companies will be among the most so-called “creditworthy” and thus the enemy. Abolish that cartel and they must become friends instead.

Yes, it’s “MMT for me; austerity for thee” (from Mexico)

Or better yet, where one is the diametric antithesis of the other: Capitalism for me; Christianity for thee.

I very much agree that we need a new mindset.

But it’s kind of funny that you use higher education and healthcare as examples of austerity. Those two areas represent massive bloat and waste in the American system.

Our problem is distribution, not austerity.

I agree both are bloated but still necessary. I think both are overrun by administrative rentier type costs. I would like to see a comprehensive basic medical coverage for the entire population so that insurance isn’t tied to employment. I would like to see government sponsored higher education for employment that is useful. I agree it’s a distribution problem.

I heartily agree except the bit about making education about employment. We don’t have a skills gap in this country – in fact, we have far more capable workers than we have private sector work for them to do.

Also, the notion that government should subsidize private sector training is just another part of the public losses and private gains mentality. If employers actually needed more trained workers, they would train them (and pay higher wages to people who already possess these newly scarce skills). It really is that simple.

Fair claims. If you look at it from more of a developing country standpoint it makes sense for their govt to promote a sustainable local economy which includes good infrastructure and appropriate education of the workforce. Then they have a workforce that can afford to buy their own products in a more sustainable manner. I think the IMF and World Bank don’t encourage this but instead foster more dependency on developed countries.

The point we are reaching now in the US is that education is not worth it at any price. So there should be a natural tendency to look for more value. Hopefully though it won’t be available only for the elite.

The theory of Jeff Gundlach, a bond manager whose track record is as good or better than anybody I know of, is that despite whatever comments Bernanke has made, what the Fed is really doing is funding the fiscal deficit with buybacks of government and mortgage backed debt securities. The deficit has come down so buybacks are being reduced.

Of course, if interest rates continue to go back up (and the economy likely weakens) it will drive up the fiscal deficit as the government rolls over outstanding debt at higher rates and by Gundlach’s theory that would cause the Fed to increase bond purchases again.

Whether Gundlach’s theory is correct, I find the idea that the words of Bernanke can be taken at face value to be laughable. Bernanke believes that you cheerlead the economy to drive up asset prices which will hopefully cause people to be more optimistic, spend more money and boost the economy. All Bernanke has done since 2008 is to launch another bubble in asset prices and transfer more taxpayer money (from future taxpayers) into the pockets of bankers and the upper 1/10 of 1 percenters.

The securities the Fed buys come mostly from non-bank financial institutions: pension funds, hedge funds etc. The reserves end up in the reserve accounts of those institutions’ banks, but doesn’t make it to the Treasury’s reserve account.

When the Treasury issues a treasury security this is ultimately bought by the Fed through primary dealers and thus converted into federal reserve notes (US dollars). These federal reserve notes are a liability of the Fed but an asset for everyone else. Other bonds also such as MBS of questionable value are also converted from this type of collateral asset to a financial asset. (ie claim on government, USD, federal reserve note)

The Fed creates the reserves that the banks use to buy the treasury securities in the first place.

Ultimately, it is government deficit spending that adds to the bank deposits of the recipients. Net financial assets held in the private sector are increased by the amount of the deficit.

The main question is whether this creation of wealth is used to bolster assets such as housing and equities or used for education and other productive economic development.

The latest round of QE continues to include MBS purchases, and the rest is less than amount of the deficit, even with the forecast lowered. It has been (per the Fed) lowering mortgage spreads, but most investors believe (and recent market action confirms) that the effect has also been to lower Treasury yields.

Could you explain your thoughts on this at some point when you have some time to organize a post? I’m a little lost whether you are making a specific technical point or a larger contextual one. Clearly it’s a busy week with everything going on.

We know empirically that the Fed has added to its holdings of Treasury Securities. Either that, or the Fed is blatantly lying in printed materials, which seems much too obvious of a deception.

Of course the Fed doesn’t buy directly from the Treasury; almost nothing is bought directly, from computers to corn to coffee.

Furthermore, even the MBS portion impacts government liabilities precisely because the government assumed the liabilities of the GSEs. That is a huge part of the overall bailout strategy – something like more than 9 out of 10 mortgages issued in the entire country are being backed by the federal government.

And isn’t it true that when the Fed buys mortgage-backed securities, the purchases drains just about as much money out of the economy as it injects into it? All of those securities are attached to cash flows. When the Fed buys them that cash flows out of the private economy onto the Fed balance sheet.

Can someone please explain to me:

1. Where that 85 billion Bernanke is pumping into “the economy” comes from?

2. Why it wouldn’t better be spent on a comprehensive jobs program?

I’m sure both these questions must sound monumentally naive to economists, but I have a feeling most Americans have no idea anymore how any of this stuff actually works. I sure don’t.

1. Do you use U.S. dollars? The answer is the full faith and credit and the monopolization of violence. The U.S. is a continental-wide power with access to the Pacific and Atlantic oceans which lets the U.S. create money because if you want to play in North America one has to play by the U.S. rules. Money exists because the government says it exists. Prior to one of the proto-Persian empires, money was usually just clay chips. Gold was only used to show how awesome a particular emperor was when he was trying to make a point about his power among the aristocrats and merchants of the old empire.

2. Hahahahahahahahahaha. How would that make the rich richer for doing nothing? If anything a jobs program would empower little people. If there was a serious jobs program, the country would be awash in whistle blowers and sexual harassment suits. Wal-Mart and other abusive companies would find it difficult to keep stores staffed.

The ideas are out there but are definitely not in the mainstream of economic policy. Randy Wray has done a lot of work in the area and has an excellent primer on MMT http://www.economonitor.com/blog/author/rwray/

Michael Hudson has done great reviews of the history of economic thought and how it has come to be dominated by neoliberal ideas over the last 40 years or so and also a lot of insightful work on the FIRE sector and rentier segment of the economy. http://michael-hudson.com/

Keep in mind that you don’t hear a lot about having to raise taxes to come up with this 85 billion/mo. That only takes center stage for such things as making education more affordable so we don’t create debt serfs and social safety nets like healthcare and social security.

As you know of course, the $85 billion a month ($1 trillion a year), is conjured from ether, a digital netherworld. And no, it would not be better spent on “a comprehensive jobs program”, not if you want a neofeudal plantation economy. Shock Doctrine requires the traumatic disempowerment of the working and middle classes and the concentration of wealth and violent power, and QE is one tactic among many toward that end.

I agree that this is the intention of QE but it is hiding an even more insidious intention………

Which is time to plant “derivative IEDs” around the globe set to create a jack boot of ongoing global financial control when the US dollar bubble blows up.

The Fed just alters digits in accounts. To buy bonds it debits a securities account and credits a reserve account. The result is simply a swap of financial assets with no increase in aggregate financial wealth.

So you are saying there is a “security account” somewhere in the bowels of the Fed, containing trillions of dollars and it simply debits that account? Well, where does the money in the “security account” come from?

I appreciate the various cynical responses, which reflect my own take on this as well. But what I’m looking for is the official explanation. In other words, if I were a reporter at a Bernanke press conference and I were to ask him where all that money came from, what would be HIS response?

There are all kinds of securities accounts held by many different institutions. China, for example has a securities account devoted to U.S. Treasurys. China buys these Treasurys using dollars it earns via its trade surplus with us: we get manufactured goods and they get our currency.

But let us look specifically at QE. A pension fund holds $50 billion in government securities (Treasurys), which it purchased through a bank. At the time of purchase the bank debited the pension fund’s checking account and the Fed debited the bank’s reserve account. In exchange the pension fund’s securities account was credited with $50 billion in Treasury bonds. One account was marked down by someone at a keyboard, another was marked up.

Now the Fed decides to try and stimulate lending by loading up banks with reserves. It can’t simply give it to the banks because this would violate its charter, so it “purchases” those Treasurys by debiting the pension fund’s securities account $50 billion and credits the bank’s reserve account by $50 billion. The bank then credits the pension fund’s checking account by the same amount.

The reserves used to purchase government and government-backed securities, whether by the pension fund initially or by the Fed via QE, get into the banking system by Fed operations and Treasury spending. All those dollars and dollar-denominated assets are basically summoned into existence as needed by someone entering values.

“So you are saying there is a “security account” somewhere in the bowels of the Fed, containing trillions of dollars and it simply debits that account? Well, where does the money in the “security account” come from?”

Exactly. Where does the “security account money” come from?

And dollars are obviously a lot more liquid than securities. Thus those dollars can bid up assets in a way securities can’t.

The Fed supplies reserves to maintain its target interest rate. When the Treasury spends it credits reserve accounts. Those reserves can be used for three things:

1) clearing payments between banks

2) Buying bonds

3) Obtaining cash for customers (think ATM)

Are you saying Treasury is financing QE?

The Fed is the monopoly issuer of reserves. The bond market uses Fed-issued reserves to purchase treasury bonds. Those reserves are then credited to the Treasury’s reserve account, which drains reserves from the banking system.

When the Treasury draws on its reserve account to spend those reserves are then transferred back into the banking system, a reserve add. So while Treasury spending adds reserves to the system, those reserves are ultimately provided by the Fed. In this sense the bond market serves as an end-run around the rules preventing the Fed from directly funding Treasury.

Ben, here’s what you said: “The securities the Fed buys come mostly from non-bank financial institutions: pension funds, hedge funds etc. The reserves end up in the reserve accounts of those institutions’ banks, but doesn’t make it to the Treasury’s reserve account”

Cash for securities. Where did the Fed’s money come from? Out of thin air?

@docg: a good place to learn some of the technical issues of the Fed’s work would be at Bill Mitchell’s website Billyblog. He’s very adept at explaining the inner workings of the Fed.

The dollars come from nowhere. The Fed emits them by spending them. However, they do count as liabilities on the Fed balance sheet, and so they count against the amount that is remitted to the Treasury out of Fed earnings.

Thanks everyone. I’m too tired to try to figure all this out tonight, but I’ll get back to it tomorrow.

Thanks, Dan. Finally some clarity.

Seems my attempts at explanation were more opaque than I’d hoped. I’ll have to work on that.

@docg

It really isn’t as complicated as it seems when first grappling with the subject. The problem is we’re trained pretty much from birth to think about it in the wrong way. Once we unlearn that conditioning the reaction is usually something along the lines of, “This makes so much sense, how could I have not known this?”

Hmm. I’m one of the outcasts but I’d like to see housing plummet and become more afordable.

“most people buy based on “monthly payment and the maximum allowable debt-to-income ratio”.”

I thought during our most recent swindle the mafia just said “Sign here! You’re good for it!”

according to Colin Gordon, a historian at the University of Iowa, the average autoworker could meet monthly mortgage payments on a median-priced home with just 13.4 percent of his take-home pay. Today a similar mortgage would claim more than twice that share of his monthly earnings…

Yeah, this seems to be a huge conflict in my mind. It seems to me houses were way overpriced, and the economy would be better off if their priced had just fallen and stayed fallen.

But instead of thinking of a house as a product like a lawnmower or a car – a big machine that provides shelter, cooking facilities, sleeping arrangements, etc., modern America thinks of it as an investment asset, and mainstream policy seems geared at inflating their value to generate bubble-icious wealth effects.

I believe that the percentage of home ownership will go down significantly in the next decade or two as the neoOrwellian multi-class system emerges.

At the bottom are the American part time/minimum wage folk competing with similar around the globe. Their existence will be subsidized like now with WalMart by the rest of us. They will all rent.

As what remains of the current middle class implodes, home ownership will dwindle as the majority get sucked into the bottom level and a few migrate to the new “operations/keep things running” class.

Under the evolving inherited elite top end there is the operations/keep things running class that will be paid relative to their criticality in keeping the social control intact……it includes military/police. Many but not all of these folks, especially at the bottom margin may continue to own homes but the ratchet will continue to limit ability to afford only for the “most deserving”.

I agree. But to me this is like QE. Scaling back really isn’t an option once implemented. In other words one can never go back.

Agreed. Prices are way too high, particularly in areas heavily supported by the government, like stocks, housing, healthcare, and higher education.

However, I have much enjoyed the irony of listening to liberals preach the gospel of trickle down economics and the worthlessness of Constitutional rights over the past few years.

Washunate:However, I have much enjoyed the irony of listening to liberals preach the gospel of trickle down economics and the worthlessness of Constitutional rights over the past few years.

Tried to finish replying to you many times at that old thread, but NC just won’t let my comments appear. If you are talking about MMT: Its main proposal is the JG. A latter day WPA. How on earth can one consider the WPA to be “trickle down”?

And what do you mean by “worthlessness of Constitutional rights”? I personally think we should, and that MMT proposals do, protect and conserve rights from the Constitution and the Universal Declaration of Human Rights etc.

Yeah, keeping conversations going longer term seems tricky.

I’m talking about specific mindsets that get advocated around the interwebs in political discourse that can roughly be categorized in these five ways:

1. Spending money is good even if the activity is unconstitutional.

2. Spending money is good even if the benefit entrenches wealth concentration rather than being targeted at who needs it (ie, trickle down economics).

3. Spending money is good even if the project has a negative NPV. Ie, we should build a massive monument not because we want a monument, but just for the sake of strip mining coal and copper and making laborers work all day and so forth.

4. Claiming that politicians oppose deficit spending when they continually support it. This one isn’t as substantively important as the first three, but it is so bizarrely wrong that it severely undermines the credibility of those who advocate this.

5. Claiming that inflation isn’t a problem without defining what they mean by inflation.

It would be better if we were discussing how to spend money rather than how much to spend; what kinds of projects to fund – for example, is JG a good idea or not – but this idea that net deficit spending is sufficient in and of itself, without regard to the massive looting of the public commons, to address the problems in our society is so out of touch with the reality of wage stagnation and the two-tiered justice system that it’s really shocking that people like Joe Firestone continue to advocate such drivel.

It’s particularly shocking that other MMTers not from this trickle down inflation denying wing don’t correct the record.

Because if MMT really is about bailouts and corporate welfare, thanks but no thanks. I’d rather have a tight fisted libertarian than a free spending authoritarian. We’ve had the latter for years and it’s not working.

I read many explanations, but I don’t believe Bernanke pulling his foot off the pedal (his metaphor) has anything to do with domestic (un)realities.

The truth may be found in the global currency situation. Foreign central banks started to take a closer look at foreign currency reserves and the imbalances being created in the system weren’t pretty.

I’m not sure what leverage China has on The Fed, but my guess is they’re not happy campers these days. Despite the trade imbalances, could they or other central banks be threatening to pull out of U.S. Treasuries if Bernanke doesn’t start to wind down QE? Can any legitimate threats be made without endangering their already large holdings in U.S. dollars?

I don’t think its a case of managing a taper. I think Bernanke used QE far too long, and it never produced the results he expected. At some point, large scale investors with conservative portfolios (pensions and life insurance companies) are going to have significant problems. My guess is this is already occurring.

We’ve gone from “QE Infinity” to taper talks in a few months. Going back to the Great Depression and “The Longer Depression” (I saw it on this site; its brilliant), those events didn’t start because of calculation errors or the failures of central banks. They started because the little people stopped making payments on debt for one reason or another. At some point, even supply-siders like Bernanke have to recognize a lack of customers is going to wreck his banks.

It may be too fast, but my guess is this is a panic move and Bernanke has moved too late. The large scale problems of ignoring the real economy in favor of confidence are coming home to roost.

Suffice it to say, the concentration on rising house prices as a good thing is diametrically opposed to a recovery in the economy – a ‘high standard of living’ is not defined by how much something costs – like a house. A high standard of living is a measure of how much disposable income is available after expenses for living (shelter, food, water, clothes, energy, transportation, taxes). Trading in assets (like housing) that already exist… pushing up prices on existing assets does not expand wealth because, the asset has previously been converted to wealth through the employment of labor to produce it.

Asset inflation (bubble inflation in assets) only makes the outgo for living and producing go up while leaving less earned income for a higher standard of living … it depresses demand.

For instance, China.

They could induce deflation in the real estate sector, thereby wiping out the shadow banking sector (foreign currency flows) and increase internal demand while surging exports based on their commodity holdings and advancing production facilities. To do this, they would allow land/real estate to be price controlled by central authority – ie make all the empty cities affordable to the masses – screw the rent extraction part of the economy – creating a frontier like rush, somewhat like our old land rush. This would make production facilities, new manufacturing etc. much cheaper compared to the rest of the capitalist world – after all, they have the printing press and huge foreign reserves. Once the rush is under way – a rush that would put workers next to the production facilities – controlling land prices would allow the economic base (what it costs to live and produce) to remain lower than most of the rest of the world.

Anyway, just some of my musings on economics – however uninformed they may be

Well, when you put it that way … TomDor for Fed Chairman!

If only Bernanke and Greenspan had such vision and clarity. It amazes me that, despite the manifest failure of Greenspan, people now similarly hang on his acolyte’s every utterance as if it were the voice of Yahweh. A few divine quotes from BS Bernanke:

Benjamin Shalom Bernanke is a perfect example of the Peter Principle, of failing upward. But BS Bernanke does seem to have timed his own personal exit well enough. No doubt he has a non-extradition retirement country already picked out. Obama may wish for early retirement as well.

Although it is entirely possible that Bernanke was operating in good faith – because he didn’t know about or yet understand the devastating nature and extent of the securitization fraud which was the foundation of “subprime” and therefore the entire housing finance industry. Which is why, now that he has come to understand the problem, he is generously buying up all the MBS, regardless of the totally messed up paperwork, missing note and incomplete mortgage allonges without proper recordation. He is buying up these assets because nobody else will and the banks have been devastated by their self-destructed mortgage market. The latest is that the Fed will keep these MBS and just run them off. It is highly unusual, no? But who has made much of it?

I don’t buy the ignorant/incompetent good-faith effort for a nanosecond, just as I don’t now with Obama. I saw the housing bubble clearly in ’05, even when I knew squat about finance.

They are engineering disaster capitalism. But of course they’ll use all the same excuses: “whocouldanode?”; “mistakes were made”; “it was illegals, minorities, Euro-socialists”; and “we all did it; no one’s to blame”. Get a rope.

But as I ask, every time this topic comes up, but never receive an answer: what does the Fed DO with the MBS it buys up?

Does it foreclose on the houses and add them to the housing supply [depressing prices]?

Does it negotiate with the borrowers, lowering their interest rate and occasionally effecting a cram-down?

Does it let the mortgages continue in limbo, with servicers adding fee after fee, and borrowers chasing a paper trail, trying to figure out who owns their mortgage?

The only folks this little dance seems to benefit are the banks, who get this crap off their balance sheets, without ever having to mark it to market.

WHAT HAPPENS TO THE MBS once the Fed buys them?

This is a great question. It puts these dicey securities into a quasi federal agency which would seem to be a good place to pick them apart for fraud of various sorts.

7% unemployment is the new normal. Maybe the government can manipulate the number lower but the reality is that this is the new benchmark that’s going to be used. Expect to hear this more on the talking points circuit as they have to get the public used to it now.

Why should we fear the tapir? Tapirs are endangered vegetarians and seem quite harmless to me. Bernanke is to be applauded for introducing one on Wall Street, though it may not last long among such predators.

http://www.zooborns.com/zooborns/2010/03/watermelon-a-perfect-name-for-a-baby-tapir.html

Nice one, Doug.

No need to fear tapirs.

On the other hand, when a blind man uses a taper to light a candle, so others may leave, he’s liable to burn down the dark palace and everyone inside, being unable to see where the exit is.

Yves,

Your mistake is starting from the assumption Bernanke is telling the flat out truth as he sees it. I think he is attempting to jawbone the speculation down, but has no intention of actually removing the stimulus. For one, I don’t think his 7% headline UE rate will even be hit by the middle of next year. Any actual improvement in job creation will immediately be met by discouraged workers immediately reentering the active market for jobs. My only real question is what he will say if the market takes him at his word and craters over the next 3 months, taking what recovery we have along with it. My prediction is the next move in monthly injections will be up, not down, and will expand the range of assets purchased.

It is

CARDIFF GARCIA (NOT CLIFFORD)

http://ftalphaville.ft.com/meet-the-team/cardiff-garcia/

The Fed is there to mislead, not to lead.

I just don’t get it, which regular Dick and Jane is persuing an obsolete 30 year mistake right now? Men and women like Booze’s Snowden can purchase homes to live in, one would suppose – being members the 800k+ people in the DC area who has a top secret clearance and is employed by the Corporate Pentagon Complex – but no ones’ job is stable unless they are “made” men or women. No one has any security at work. The vast underclass of service sector drones, strip mined during the last housing bubble, can’t even rent affordably where the jobs are.

It angers me to read complaints about rising rates dampening refis and mortgage-debt issuance. Low rates spur housing price increases and make them just as unaffordable.

Of less importance, it prices responsible/non-reckless borrowers out of the market sooner and yields greater instability when prices do start to fall.

I have to wonder whether this site’s authors are already sufficiently well-off (e.g., already own condos, homes, and/or other assets) such that you interpret rising housing prices (from expensive levels) as a good thing.

Especially, refis — if people can’t afford to keep the house based on the original loan terms, what kind of person thinks its good to hurt savers’ purchasing power in order to keep people in homes they couldn’t afford in the first place?

I think it had nothing to do with the economy etc. I think for once Ben was scared… what with everyone hollering (and concerned too about bubbles, given Fed’s penchant to miss them) that it was time to take the foot off the pedal from within FOMC and without (Greenspan et. al).

Obviously he could not have said that it is not because of economy but because he was running scared.

Also the plug had to be pulled on QE sometime at some point of time and it was going to be tougher to do it as time progresses. So essentially he just went ahead and did it when he felt it was getting too risky.

The problems that could ensure on pulling the plug were going to be there anyway.

what does nostradamus say?

There’s this potentially significant verse from Century I Quatrain 14:

***

From the enslaved populace, songs, chants and demands,

while Princes and Lords are held captive in prisons.

These will in the future by headless idiots

be received as divine prayers

**

I didn’t just make this up either! It’s for real.

http://www.nostradamus.org/qbrowser.php

It’s amazing how prophetic this is. I ran a correlation and covariance matrix and came up with 87.9. That’s an astonishing number.

That means interest income from higher rates will offset 87.9% of the extra buying costs. Home sales will go up 12.1% less than they would have if Bernanke hadn’t said anything. If you predict they would have gone up by “Y” if he hadn’t said anything, then the new number is .879Y. If Y is greater than 1/.879 you don’t have to worry.

Y did I just read that?

Methinks this is nothing to do with anything financial or economic … its political. Mr Bernanke is sending a message that he & the Fed are now at the limits of what they can do with monetary policy; QE(n) is becoming less & less effective in the “real” economy (if it ever had any effect there in the first place ?).

He’s saying to Congress: We can do no more, Now its your turn.

Since he knows there’s nobody listening this has to be a sign that after 5 years he’s just had enough.

Never been a big fan of Q.E…except maybe the first round. The idea that creating bubbles and forcing people to dump bonds and buy stocks in the hope that they’ll feel rich and spend more, seems mis-guided. Maybe Bernanke was getting a little unfomfortable with the ongoing criticism about creating bubbles and hurting pensions and those on fixed incomes, and which have more and more merit in light of the economy no longer requring intensive care.

Add to that refis had played out, and the stock market was going through the roof with Fed policy a clear cause, that is the market was going up leaps and bounds until just recently.

That the 10 year is now 2.5% should give people pause. 2.5% is rediculously low, and a 4% mortgage also rediculously low.

I don’t believe Bernanke will truly end Q.E. in 2014. He set so many conditions and gave himself “outs” to re-evaluate. However I do hope that the tapering is real, since the Fed has done a terrible job on the bubble front and has already harmed pensions, the elderly and those on fixed incomes.

You have to consider the view from Bernanke land. The banks are on there way to steal and cheat their way out of insolvency. The stock markets have recovered. Housing prices have stablized and unemployment is declining. As a result, it is perfectly reasonable to consider dialing back the Fed’s aid programs.

That all of this is a house of cards which he has largely constructed through his own ZIRP and QE policies would never occur to him. He has come to believe his own propaganda. I want to emphasize that this in no way supports the assertions that Bernanke is incompetent or acting in good faith. He is not. He has quite competently defended the interests of his class, the elites and the rich. Nor has he acted mistakenly but in good faith. A good faith mistake requires that one acted in accordance with what one might be reasonably expected to know. As a supposed expert in the field holding the top position at the largest central bank in the world, Bernanke should have seen the housing bubble coming, the failure of laissez faire deregulation, the menace of derivatives, the march to meltdown, the need to restructure and reform the banks in its aftermath, the bubble blowing in stocks and commodities, the transfer of wealth to the rich of his policies, and their failure to in any way restore the jobs and fortunes of ordinary Americans mired in a recession that never went away. Bernanke should have seen all of this, but it isn’t just that he didn’t see it. He has persisted in not seeing it for years now. Such consistency in evil is not good faith, but its opposite.

And just when I was beginning to like Ben Bernanke….

I don’t quite understand the idea that the economy is some kind of delicate hothouse flower that has to be “managed” – God, what have we become? Maybe the pain is simply something that people have to go through. Maybe Bernanke, on some level, realizes that all he is doing is buying time, and that nothing fundamental is really changing – and that he is the only one trying to do anything.

My take – he’s either fed (no pun intended) up or scared.

Let’s take Bernanke at his word- I’ve never ascribed the evil machinations that many comment-ators on this site or many others assume- I actually believe he’s quite earnest and apolitical-(many sources who know him support this assessment)

And let’s also agree that 5 years now post-ZIRP and 3 QE’s that this economy, while clearly not robust, is NOT anywhere near the kind of emergency state that warrants anything close to the Blue Lagoon monetary policy (“Water is everywhere”)….I assume that Bernanke sees the trajectory of the unemployment rate (and since he hasn’t commented on participation rate- I assume he just ignores it) and believes that it takes another 18 mos to drive another 100 bps decline in the rate (absurdly simplistic linear assumptions)-Couple all this with discomfort about the market’s bubbly levitation over last 6 months and that Bernanke HAS to be concerned by the fireworks wrought by the BOJ and their tightrope attempts to keep things under control and the latest strategy makes sense from his perspective..

Now back in real world- Bernanke’s forecasting failures are well documented, and there’s no reason to assume this time is any different…In fact, given the orgy of monetary distortions he has unleashed on markets over the last few years,any changes from this faux glide path policy we’re currently on will undoubtedly prove this latest batch of forecasts wrong again.

However, his “data dependence” and consequent linear extrapolations about future employment improvements seem inconsistent with recent history (QE1, QE2 and now QE3) where “tapering” or pauses in accommodation have led to swift declines in markets and noticeable falloffs in economics activity, and this latest episode seems even more dangerous than others owing to the stunning rise in interest rates..

Putting it all together- this experiment is about to get very interesting

IMHO, it is extremely political…Dems can’t afford a crash, if it is deemed in hindsight another bubble of epic proportions was blown………….republicans win the whitehouse no matter what…………add in the fact, again, imho, retirees with bond ladders are not rolling, no reason to, thus, interest rates must go up because, or dems have another problem, it’s one thing to accept no interest for the greater good for 4 years, but if banks and the rich become insanely richer, another political problem, again very big imho……………..

also, just imho, I think ben was nieve about the street, ie, oh, just bad luck, i’ll help them get out of the mess, and it’s finally dawning on him how pathological the corruption of free money is, and I think the guys basically honest to a fault and would not point fingers, thus, in a certain way he must right the wrong thru actions

I think after QE exit, liquidity can increase significantly from moving from excess reserve nearly 1.8TrnUSD into lending and investment activity. Now everyone expect rate normalization around 2015 and long term bond yield and real rate increase sharply.

The problem of no timeline of QE is that money will sit at excess reserve on Fed balance and people are happy with long term and TIPS bond investments. If people change to understand QE exit plan, the will adjust their investment and portfolio. Surely, under rate normalization or higher expected return from risk free rate, fund managers and banks must shift their portfolio into higher risky assets like start to lend and investment for banks and more overweight in equities from fund managers and they must reduce less risky investment like deposit on fed balance for banks or Bond funds and gold investment for portfolio managers.

I think Fed is happy with 1% real rate for 10year TIPS bonds after rate hike; therefore, real rate at 0.55% is quite overdone during before QE exit. I think market are panic on what they know on QE exit and when they realize that all cash from selling all assets get no return, they will move back to market but I think equities will be only choice from investment not bond or commodities.

The problem is that most economists concern on economy will not strong enough after QE exit. I think QE3 have little impact on economy because 75% of QE is parking on excess reserve on Fed balance. If the QE exit plan cause rising return on investment and banks start to lend and investment, the liquidity will increase more than QE. This is what Fed want and we will see if banks are willing to lend and invest, we could see stronger economy in 2014 and 2015.

For emerging market, I think they can sustain economy with lower growth trend. China is on property bubble and overinvestment temporary and if they can rebalance economy effectively, they will survive. I think they still have monetary and fiscal policies that can stimulate economy but they are careful on policy action. That is good news to contain problem. At some pont, PBOC will lower Reserve requirement ratio at 20% that is too high to improve liquidity in banking system after they are successful to tackle shadowed banking growth.

I think emerging market stocks will be good spot during rate normalization with high beta assets and underweight position from global investors.

I am sure this article has touched all the internet viewers, its

really really fastidious piece of writing on building up new web

site.