By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness

Manufacturing and PMI Data out for Europe overnight and, much like the flash data, the news is getting better but with some serious caveats.

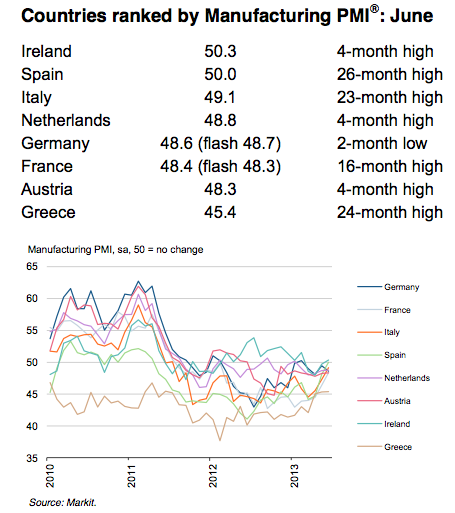

• Final Eurozone Manufacturing PMI at 16-month high of 48.8 in June (flash: 48.7)

• PMIs rise in all nations except Germany

• Price pressures ease further as input costs and output charges decline in JuneThe Eurozone manufacturing sector moved a step closer to stabilisation at the end of the second quarter, with rates of contraction in output and new orders continuing to ease.

The seasonally adjusted Markit Manufacturing EuroZone PMI rose to a 16-month high of 48.8 in June, up from 48.3 in May , and slightly higher than the flash estimate of 48.7. Over the second quarter as a whole, the average reading for the headline PMI (47.9) was the highest since Q1 2012. The PMI has nonetheless remained below the neutral 50.0 mark since August 2011.

Among the nations covered by the survey, only the German PMI failed to rise in June. Ireland saw a marginal improvement in manufacturing business conditions and Spain experienced a stabilisation, while rates of contraction eased in France, Italy, the Netherlands, Austria and Greece.

Comments from Markit’s chief economist given the overall all picture of a stabilising downturn:

Eurozone manufacturing is showing welcome signs of stabilising. Both output and new orders barely fell during June, and on this trajectory a return to growth for the sector is on the cards for the third quarter. Output rose again in both Germany and the Netherlands, but it is the “periphery” where the most encouraging signs are being seen.

Returns to growth were seen in Ireland and Italy, while the rate of decline in Spain eased sharply to only a marginal pace. Greece and France were the worst performers, though the latter saw a further easing in its marked rate of decline.

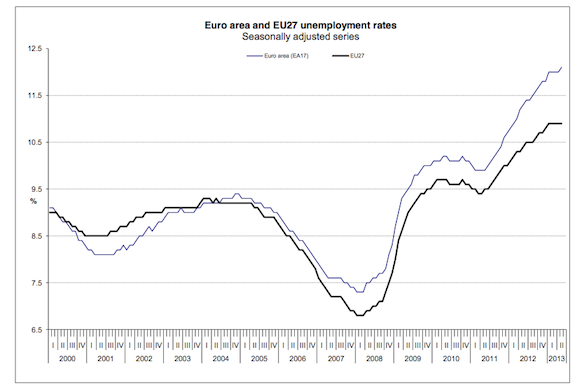

Falling commodity prices and intense competition meanwhile meant inflationary pressures remained well under control, posing few worries for policymakers. With the region suffering from record high unemployment, the ongoing decline in manufacturing headcounts is a disappointment, and suggests the jobless rate has yet further to climb. However, some consolation can be gained from the latest fall in employment being the smallest for over a year.

So, as I stated on the flash data release, we are seeing some positive news about of many countries in terms of rebalancing across the zone. Certainly a cease to the rise of manufacturing in Germany, led by falling new orders, against a rise in the rate of decline in the periphery is a positive in those terms. But as can be seen by the unemployment levels this adjustment is being forced on the economies by choking off internal demand. Once again the latest figures from Eurostat show unemployment continues to rise on trend:

The euro area (EA17) seasonally-adjusted unemployment rate was 12.1% in May 2013, up from 12.0% in April . The EU27 unemployment rate was 10.9%, stable compared with the previous month. In both zones, rates have risen markedly compared with May 2012, when they were 11.3% and 10.4% respectively.

Eurostat estimates that 26.405 million men and women in the EU27, of whom 19.222 million were in the euro area, were unemployed in May 2013. Compared with April 2013, the number of persons unemployed increased by 16 000 in the EU27 and by 67 000 in the euro area. Compared with May 2012, unemployment rose by 1.324 million in the EU27 and by 1.344 million in the euro area.

Member States Among the Member States, the lowest unemployment rates were recorded in Austria (4.7%), Germany (5.3%) and Luxembourg (5.7%), and the highest in Spain (26.9%) and Greece (26.8% in March 2013).

Compared with a year ago, the unemployment rate increased in seventeen Member States and fell in ten. The highest increases were registered in Cyprus (11.4% to 16.3%), Greece (22.2% to 26.8% between March 2012 and March 2013) and Slovenia (8.6% to 11.2%). The largest decreases were observed in Latvia (15.5% to 12.4% between the first quarters of 2012 and 2013), Estonia (10.0% to 8.3% between April 2012 and April 2013) and Lithuania (13.3% to 11.7%).

Unemployment aside, which is quite an ask I know, this is a far rosier picture in terms of the macro-settings across the zone than a year a go. Downturns in manufacturing appear to bottoming, aside from The Netherlands. Combined with the latest retail PMI, there ongoing signs that the slow rebalancing is taking shape. In my opinion France still remains a concern, given the structure of the economy and it’s susceptibility to government sector austerity, and The Netherlands is now a major economy to watch as high private sector debt make the continuing rise in unemployment a major issue.

We are also seeing improvements in Italian manufacturing, however this again appears to be coming at the expense of internal demand as the retail PMI continues to fall away at pace. Cyprus is, of course, a basket case, and remains so.

It is another positive to see renewed export sector strength out of Spain, but there is a long way to go before that translates into employment and the country now has a greater unemployment issue than Greece. The big outstanding question now is whether all nations can continue to rebalance. As I stated in my previous PMI assessment:

The issue for the Eurozone was never whether one or two countries could successfully implement a rebalancing, it was whether all of them could at the same time. As I’ve stated before Italy and France together have a GDP in excess of that of Germany, and although we are witnessing some improvement in the macro settings of some of the periphery nations, with the exception of employment, the problems have now made their way to larger economies which will require much larger compensating factors to counter-act these downturns.

In reality what is required is a further re-balancing from the creditor nations of the zone and, although we have seen some action in wage inflation in Germany, the country is still running massive trade surpluses which have to, in part, be recycled through opposing deficits within the Eurozone. The Eurozone has also been counting on an improving global economy to stimulate external demand, however after yesterday’s China PMI and what looks to be a possible credit crunch looming in the country that hope is looking increasingly shaky.

I’m a little more positive now than I was when I made that assessment, but the core premise is the same. The data looks good, but there are many risks still evident, as improvements in the export sector and the expense of internal demand risks flaring up new issues in the banking sector and the broader economy.

In short, the news is getting better, but there is a long way to go.

I think that in the case of Spain most of the improvement is seasonal, and that seasonality is weighting more than usual in the current situation. This does not prevent spanish government to announce everyday that “Spain has bottomed” although it migth well be that the bottom is downwardly inclined. We will see.

I find it difficult to understand how people can be so sanguine about a 25% unemployment rate among youth, like Spain has.

The situation is destroying lives in massive quantities and because it is assuredly worse somewhere else in the world the public is brainwashed into not seeing the individual and collective social damage.

There will never be enough “jobs” for all asking going forward in our world. We need to deal with that as a society or understand that we are relegating some to a sick form of genocide because we are selfish at the core.

I am, too, aghast about an unemployment rate of 25 percent.

How can a nation sustain this?

But then again, these numbers seem to be normal for Spain, at least pre-Euro:

http://www.wirtschaftsfacts.de/wp-content/uploads/2010/05/Arbeitslosenquote-Spanien.jpg

I’ve read that there is now a big shadow economy in Spain, with a huge black market for labor.

So, could it be that there is simply massive tax evasion going on in Spain, like perhaps in old times?

Can somebody shed light on how these high numbers of unemployment can be sustained in Spain for years, and even decades in the past?

I don’t think the numbers in the main post say anything important about whether or not Europe is recovering. The same numeric mumbo jumbo justified the credit bubbles that produced the economic implosion. Plus ca change …

I don’t have the chart at hand to check the number, but based on a presentation I saw recently the unemployment rate for under age 25 in most of the EU countries other than Germany was running from 30-50%. I was thinking the number for Spain was around 30%. Extended unemployment at that age has an enormous effect on lifetime economic prospects. This type of unemployment has to create an enormous social crisis.

“I was thinking the number for Spain was around 30%”

It’s around 56 or 57%, from memory.

Your memory is good. I think The Atlantic is right, this is probably the scariest chart in the world. How do you have a functioning society with over half of the working age population under 25 chronically unemployed?

http://www.theatlantic.com/business/archive/2013/05/europes-record-youth-unemployment-the-scariest-graph-in-the-world-just-got-scarier/276423/

On top of the youth problem is the demographic problem with a declining number of workers per retiree in the EU (also in Japan and the U.S.) which makes it tougher to fund pensions and healthcare.

“On top of the youth problem is the demographic problem with a declining number of workers per retiree in the EU (also in Japan and the U.S.) which makes it tougher to fund pensions and healthcare.”

That’s partly why we need infrastructures, skills, innovative technologies,… Exactly what austerity is currently killing. We’re living in sociopathic societies.

That being said, demographic situations in EU are very contrasted. For example, France (i’m french) should be more populated than Germany starting from 2045. That explains a lot about policies imposed by Germany in Europe, IMO.

The official unemployment rate in Spain is 27%. Although unemployment is unbearably high you have to take the number with a grain of salt. Unemployment rates in US and Spain is no apples to apples comparison although the current rate is an historical high (and really unbearable in the long run). We would rather compare participation rates.

The big big problem is that I don’t see any recovery strong enough to create more than 2 million jobs required to reduce the unemployment to some reasonable participation rate.

Perhaps, those unemployed youth in Spain and elsewhere in Europe, are unemployed because they’re shiftless like their counterparts in the U.S. of A.

According to a study from a Georgetown University, the current level of economic inequality is due to a lack of educated workers.

Whether it condons credentialism or attempts the case for more?(young) people to obtain a master’s degree in a high-demand field, you figure it out. I decided to bring it up since many people revere and respect higher education.

http://cew.georgetown.edu/recovery2020/

According to Georgetown’s study, cashiers with a bachelor’s degree make more cashier’s without them. The same pattern is observed with other occupations that don’t require a college degree. The assumption is that the college educated worker brings more to the table.

“the current level of economic inequality is due to a lack of educated workers”

“a high-demand field”

That’s what’s called all hat and no cattle. Spit and Shinola. Pure 100% Grade A manure.

rotfl

I agree with Washunate. Thats all bullshit and you know it.

The unemployed are lazy? Because… They dont go to college?

So you want people to go 50 thousand in debt to become cashiers?

Good luck with that.

I think its satire, well done satire.

-“A Real Black Person” handle

and

-comparing college educated cashiers to non-college educated cashiers

are giveaways. I thought it was real at first.

If you did your homework, not Timothy Geithner, you’d realize that the the study is real, in the sense that it exists, and that the cashier example I used is DEFINITELY in the study.

I brought the study up because it is from a highly-ranked research university and because higher education is revered by many readers of this blog.

“The unemployed are lazy? Because… They dont go to college?”

According to the Georgetown University Center on Education and the Workforce, The unemployed are unemployed because they lack a college degree and the skills that come with one. The study’s list of demand skills include “leadership, communication, analytics, and administration.” There’s such a shortage of people with those skills, that the shortage is holding the economy back from full recovery.

So you want people to go 50 thousand in debt to become cashiers? The study claims a four year degree still pays off because employers end up paying people with college degrees more money for the same exact work–even if that work is low skilled.

“The unemployed are lazy? Because… They dont go to college?”

According to the Georgetown University Center on Education and the Workforce, The unemployed are unemployed because they lack a college degree and the skills that come with one. The study’s list of demand skills include “leadership, communication, analytics, and administration.” There’s such a shortage of people with those skills, that the shortage is holding the economy back from full recovery.

“So you want people to go 50 thousand in debt to become cashiers? “The study claims a four year degree still pays off because employers end up paying people with college degrees more money for the same exact work–even if that work is low skilled.

I agree with Ignacio. If a Northern Hemisphere economy can’t do well in June, it’s already dead and gone. On top of this, I would think that the fall in input costs is a clear sign of weakness, especially given the ongoing high rates of unemployment.

In the larger sense, Europe can’t have a recovery. Because the disease it has is kleptocracy. Kleptocracy is a parasitical disease that will kill its host if the host does not rid itself of the parasite first. So no recovery until the disease is dealt with.

I think the author needs to be more careful about drawing conclusions from only one or two data points. There were periods of “good” economic news during the depths of the Great Depression but they were noise, not signal. An increase in manufacturing (as we have seen a number of times in the U.S. over the last five years) can be nothing more than transient inventory restocking.

I agree, and ditto for the stories of the U.S. “housing recovery”, as if touching off another wave of real estate speculation and debt will fix our economy. Until there is improvement in labor force participation among working age people (as opposed to the published unemployment rate) and improvements in personal income below the upper 1% we can’t have an economic recovery with any staying power.

This gloom about rebalancing (rebalancing to what?) could have been imposed at any time in the last 200 years. Now is an opportune time apparently, because of global warming. All the other excuses tend to fall apart. This all makes me think about yesterdays link to the story in ohmynews about Svarnhold Denmark. The town where you live well in a sustainable community where everyone gives up 80% of their income and keeps 20%. The EU will never advocate that. In fact it looks like they are running away from anything like that as fast as they can just to maintain the illusion that capitalism will work as the economic model. It won’t of course. It isn’t capitalism. It’s completely controlled by the puppeteers.

Ok, a few points.

PMI is a first derivative of growth (i.e. speed of increase/decrease). Sub 50 is decrease, 50 stable, 50+ increase.

Any function with a lower bound – but one that’s only in limit, not approachable (GDP of 0 is possible only when all are dead) will have a negative derivative (PMI <50) but one that's slowly increasing (i.e. PMI increasing but staying under 50). Moreover, given that the function is not truly monotonic (i.e. only decrease in GDP, w/o any blimps), as the nominal value decreases, even small blimps have large impact – the volatility is increasing. Increased volatility != trend has changed (derivative and volatility

In other words, slowly "increasing" PMI, but howering around 50 (on either side) can be evidence of a bottom (but can be a temporary plateau as well). But is no evidence of anything else, like taking off from the bottom.

But hey, we're rationalizing, not rational animals (bonus points for spotting the author). And endless optimists – if we weren't we would never dropped off the trees in the first place.

GDP is for the little people who actually live off the production itself. Liquid capital lives off the derivatives.

That’s why Estonia can be seen as a success. If it takes years, or even decades, for production to return to what it was, who really cares as long as that first derivative is positive?

I find it interesting that your software rejects everything I post on this article, but permits me to comment on Das’ book review.

Well, apparently not everything.

I had interminnent problems with comments on the site recently (today as wel). Often I get “you already posted this post” (or similar)only for the comment never to show up.

Just a question if anyone can answer.

I want to know whether it is really inevitable that a Eurozone member will leave.

Will it reach a point were it is simply not possible for a country to stay in.

I’m not talking about the pain a population will suffer forcing a member out. This is obviously already happening and it has not forced the hands of the populations yet to put in an anti-euro elite party.

So I guess what I’m asking is if there is a point economically were even with a euro elite party in power and not leaving anytime soon that it is inevitable it will have to go?

John,

based on what we have seen sofar, my guess is that it won’t happen.

Did you read the transcripts of the Irish bankers phone conversations in the week after Lehman (transcripts only recently published at http://www.independent.ie)? “Another day, another billion”, arrogantly misquoting the german anthem, “You need to sucker them (i.e. taxpayers) in, bit by bit”.

Something like this has been happening the last couple of years in the eurozone. Bit by bit the people that do pay taxes are suckered in by their governments. First a loan to southern europe, then a loan into eternity, then a write-down. Next will be OMT, stealth eurobonds etc.

Bit by bit the creditor nations will give away their claims, till in the end the credits and the debts are cancelled.

The Eurozone serves elite interests in all member countries, without regard to the pain imposed on individual member populations. For this reason, I don’t think any country will leave until a spectacular crash forces the entire fantasy to disintegrate. When this happens, I would expect Germany to resume its role as a bastion of sound money, provoking higher interest rates throughout the international world.

Of course we might all be living in tents by then, reading by the light of Ipads and smart phones and traveling by bicycle.

It makes sense for Germany to stay in because everyone is a slave to them and it keeps the Euro down which is good for their exports.

The PIIGS are in a tough spot where they don’t all want to end up like Cyprus and Greece so right now it still makes sense to stay in. They made a deal with the devil and they can’t yet see a way out that would clearly be advantageous.

France although much weaker than Germany still has a lot of dry powder. IMO, it could clearly gain by exiting at the right time. I guess it will depend on how much the others are willing to cave in to France’s desires. Right now it feels that the Euro is stronger than it should be… they might decide they want to be able to print their own currency.

France has never let itself get excluded from global strategies. The one building up is currency devaluations. If England Japan and the US are in, France will want to play.

I guess time will tell.

“The issue for the Eurozone was never whether one or two countries could successfully implement a rebalancing”

The author does not seem to get the problem inherent in the Euro.

It is not a national unit of account.

There is & can be no internal rebalancing within the Euro.

Countries must export to import & to pay interest to the BIS ,IMF & other organizations.

Internal short range commerce implodes.

No more Butcher’s, baker’s or candlestick maker’s.

At least in the North they are getting painted on shop fronts Dork!

I think there are some short term conditions which may be aiding European Manufacturing.

1) There has been a push by high end manufacturers to export to China.

2) The Fed and China have popped some of the froth out of the commodities market helping margins.

3) Ramping of household utility costs (gas, water etc) as abated helping the consumer a little.

4) The rise in the dollar has helped exports a little, but since the Reminbi is linked to the dollar this has cut down on imports as european industry becomes more competative.

5) Oil price drops due to new inventory in the US and expansion of the export channels in the US.

These might be trasitory due to.

1) The clamp down on frivolous spendind by party officials in China.

2) Commodity prices are likely to stabilise.

3) Utility costs have a distinctly polical flavour in Europe and that has not gone away.

4) The rise of the dollar is probably premature and Fed tapering will not occur.

5) The dollar rise will cause deflation in the US and the FED will be forced to counteract it along with the dip in exports.

France has some hard choices to make and they do not want to subsidize the other countries (it’s always someone else’s fault when things go bad). They believe the Euro is higher than it should be because of Germany. Therefore nationalism is building up.

If it gets ugly and they drop out of the Euro no spreadsheet regression model will mean a thing.

I don’t know if it will be France but in my mind, the day France is forced to make huge cuts in pensions is the day they will revolt.

Marine Le Pen just lost her immunity for speaking against Muslims. Obviously nationalism is picking up speed and not jut in France.

We’re in the first innings where money printing has given some illusion of stability. But the reality is that nothing has changed in Europe since 2009 except the reality of further cuts.

Retaliation for this?

http://www.telegraph.co.uk/finance/financialcrisis/10151286/Frances-triumphant-Joan-of-Arc-vows-to-bring-back-franc-and-destroy-euro.html

“The leader of France’s Front National vows to smash the existing order of Europe and force the break-up of monetary union, if she wins the next election”

That’s my impression.

On the one hand, I dont like the euro.

On the other hand I am scared shitless of pseudo-nazi right wing hyper-nationalists like Le Pen…

Anyone who tries to scapegoat foreign ethnicities for domestic problems is terrible news in my book.

People are going to use whatever it takes to get what they want whether they believe in it or not. The pendulum has swung too far and there will be repercussions.

This is the moral hazard that no one is talking about anymore. It can take 5 to 15 years to come back to haunt us. However most human beings have trouble grasping consequences if they are not instantaneous.

We are not recovering and cannot until we realise we need to be free of the elite. If it seems harsh we should cull the lot of them (put them to work in jobs paying median wages)then grow up and think what we have already done to a generation of young people and many others through unemployment and our celebrity societies.

And if all Europe becomes like Germany (it does have better systems) what happens in the rest of the world? We need some new economics. In fact we need economics as the current much can’t even tell us how much work we need to do to have good basics and then be able to do what we want once this contribution is made.

What do we need a recovery for, when governments will pay banksters trillions to crash the economy and keep it crashed – and rob the middle class out of existence to pay for it besides?

Don’t you know anything about banking? Or class war?

Just look at the equity markets. The financial industry thinks the economy is doing just great, and the opinions of the sheeple are just so much bleating.

Another shearing is due, by the way:

http://www.marketwatch.com/story/new-doomsday-poll-98-risk-of-2014-stock-crash-2013-06-29?link=MW_popular

Excuse me, I meant “fleecing”.

Naturally the real economy cannot recover. I predicted in 2008 that it would never recover because the financial industry would prevent it by extracting wealth faster than the real economy could generate it.

And so it is. It was an easy prediction.

That’s why the Fed wants to taper down QE: the financial industry is booking the extraction of wealth that the real economy will never be able to create because finance is bleeding it to death.

Catastrophe is inevitable:

http://www.guardian.co.uk/commentisfree/joris-luyendijk-banking-blog/2013/jun/19/banking-britain-beyond-control

The financial industry is out there. It can’t be bargained with. It can’t be reasoned with. It doesn’t feel pity, or remorse, or fear. And it absolutely will not stop, ever, until it has converted the last scrap of the planet’s remaining resources into ones and zeroes in an account in the Caymans.

Banksters: “Well, duh!”

“We’re not going to make it, are we? People, I mean.”

“It is in your nature to destroy yourselves,” said The Machine.

Guess it depends on the definition of Europe. And Recovering.

And “is.”

Mais oui! Quelle grande epee Mr. l’Economie.

I’m looking at Germany in the 1930s. They go from massive (50% ish) levels of unemployment through a recovery to WW2. Of course, recoveries at this time involved putting loads of poor sods into uniform and having a godawful war, talked of as a means of balancing the books. The parallels with today are distressing.

The Nazis coincided with a private debt jubilee and their economists stated two main aims:

1. To free the economy from disproportionate financial overhead charges

2. to find an outlet for the enormous productive potential of modern industrial systems in such a way that remuneration, profit and interest would not be wholly eroded.

I wrote papers long ago making these assumptions with no clue they had been so central to this particular escape from recession. The real scare for me is that my analysis of our current plight, money concentrations look very similar to those in (really outside) Germany in 1930. The growth model is little different. I’m up to the gills in stuff like Mefo bills which had a paltry equity base, no gold backing, a non-existent organisation and banking complicity. It’s all a bit like teaching junk bond takeovers.

My interest here is I see no recovery possible without debt jubilee and full employment. I want this without big government or war and with growth very different from current, idiot exploitation. I hope to learn from this particularly stupid time. It is interesting that banking dodges have not really changed much.

Debt jubilee implies cutting pensions or devaluating the currency to deflate them.

Capital markets and promised entitlements are too big for GDP. Either they get cut or GDP soars.

Debt jubilee implies cutting pensions or devaluating the currency to deflate them. Moneta

Not necessarily. A ban on new credit creation would cause MASSIVE deflation (an increase in the value of money).

So at least a temporary ban on new credit creation plus a metered, universal bailout with new fiat could greatly reduce private debt WITHOUT devaluing the currency.

If you print without creating debt, chances are you won’t have proper checks and balances. This will lead to a lack of confidence, lower productivity and inflation.

What checks and balances are there now? The Fed since the meltdown has injected trillions into the financial sector. This has blown up bubbles but the only inflation it has caused is secondarily through commodity speculation.

Since the wealthy rentier class holds most of the debt, destroying debt would simply help to reduce the massive inequality in wealth which currently exists.

Indeed.

Either we produce enough to provide food and shelter to everyone, or we don’t. I happen to believe we do, but either way, the answer doesn’t depend on what we do with the outstanding debt (at least not to first order). Debt is a question of allocation of claims on future production, not on the quantity of that future production itself.

If the political will were there, we could declare a jubilee and ensure workable retirements and social insurance in some other way.

Needless to say, the political will is not there.

Actually a huge percentage of the debt is owned by pension plans that are already underfunded.

We actually have a good idea of what the debt it… that is what the financial markets use to assess the health of countries. If we do not use the semblance of a balance sheet and print money, it will get worse than it is now. Already, we have been knocking down rules to print. What you are proposing is a complete system overhaul with zero oversight.

A change in the financial system always means a sacrificed generation or 2. You are dreaming if you think retirees can get their pensions through such a change. Every print fest will lead to a currency devaluation and more theft. And everyone would jump on hard assets.

You are dreaming if you think the current system, merely because it uses some accounting sophistry*, is just or sustainable.

*How, for example, is the immediate creation of purchasing power for a 30-year mortgage properly balanced by the destruction of that purchasing power in, say, 10 years by loan repayments? But IF it is properly balanced, then surely the banks don’t need ANY government privileges to succeed with that scheme? And if it isn’t properly balanced accounting wise then surely you don’t want to subsidize poor accounting methods, do you?

Fiat creation does not require borrowing. Sovereign debt is a reserve drain to keep interbank lending rates from dropping to zero. But why the heck should the monetary sovereign care what interbank lending rates are? I believe Warren Mosler says go ahead and let em fall to zero since that’s the “natural rate” any way. I disagree with zero being the natural rate but agree that there should be no sovereign borrowing.

But the credit creation I was talking about is when “bank loans create deposits.” We could forbid that temporarily to allow a massive universal bailout with new fiat.

Let’s print and distribute this money to a bunch of people who don’t work anymore. It’s what we have been doing but with no tab.

I can already see how this will work wonders.

The banks “print money” every time they make a loan! But bank money MUST be repaid (hence the “bust” after the “boom”) and comes with a heavy usury burden too.

Fiat, OTOH, can be issued without borrowing, much less usury, and can be used to deliver people from unjust debt.

When your trade is complete, you don’t need money.

Money is what you get when only half the trade is completed. It’s an IOU.

Money is DEBT.

So you will never be able to print money without generating some kind of debt.

So what you are asking for is accounting without keeping track of the liabilities side of the balance sheet.