By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Cross posted from Testosterone Pit.

The financial crisis was brutal for Germany, but the recovery was steep, and in 2011, the gloating started. They called it the German “success recipe,” a system that was somehow superior to any other. It would keep the economy growing even as Eurozone mayhem was breaking out all around. That optimism has endured, and stocks have hit new highs in May, but the German economy has diverged sharply from that scenario.

A key element in that “success recipe”- much to the chagrin of Germany’s beleaguered neighbors – is the relentless drive to export. The whole political and economic machine is geared that way. Foreign policy decisions are made on that basis. As are domestic policy decisions. In return, the economy has become dependent on exports and outsized trade surpluses.

But exports tumbled 4.8% in May from a year earlier, to €88.2 billion, the worst month so far this year. For the first five months of 2013, exports were below the same period last year. Exports to non-euro EU countries, such as the UK, dropped 2.4%. Exports to Eurozone countries – in a magnificent display of the fiasco that the euro has become – plummeted 9.6%.

For the month, the Eurozone bought 36.6% of Germany’s exports and the non-euro area 20.0%. While periphery countries have been struggling for years, with demand collapsing in some, it’s France that Germany is most worried about. It buys about 10% of Germany’s exports, more than any other country, but it’s slithering deeper into a full-blown economic crisis with unemployment at record highs, with the auto industry – a key export sector for Germany – in a death spiral, and with consumer demand flagging. Even exports to the rest of the world skidded 1.6%. It was the worse May decline since 2009.

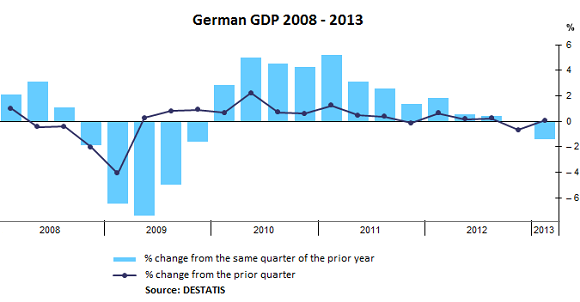

Alas, 2009 brings up peculiar memories. In the first quarter that year, GDP plunged 4.1% from the fourth quarter of 2008, when it had already plunged 2.0% from the third quarter. Annualized, those two quarters added up to a double-digit swoon in GDP, the worst in the history of the Federal Republic. German exports had come to a halt.

Turns out, the economy was saved not by the sweat of German workers or the ingenuity of their managers or the German “success recipe,” or whatever, but by the drunken stimulus and money-printing frenzy in the US, China, the EU, and eventually other countries, and German companies sucked with all their might on a wide variety of programs worldwide, ranging from green-energy boondoggles to cash-for-clunkers debacles.

That binge is coming to an end. The Fed is threatening to pencil the word “taper” on the calendar for September. In Congress, “stimulus” has been replaced by “sequester.” China is cracking down on overcapacity, capital misallocation, and a financial system gone haywire. And the Eurozone is mired in a deep recession. So the German economy is responding. After the fourth quarter drop of 0.7%, GDP edged up only 0.1% in the first quarter, but was down 1.4% from a year earlier. What that “success recipe” looks like:

The world has staked its hopes on Germany, the powerful locomotive that would pull the Eurozone out of its funk. Yet imports, precisely what is needed to do the pulling, fell 2.6% in May, compared to May 2012, on declining demand even in Germany.

Any glimmer of hope for June? Not very bright. A harbinger of future business, namely new orders, dropped 1.3% in May from April, after having dropped 2.2% the month before. Domestic orders dropped 2.0%, export orders 0.7%, with orders for consumer goods down 3.1%. For the April-May period, orders fell 1.2% from prior year, with domestic orders down 3.7%. The world’s dream of the German locomotive has popped.

Yet, despite such nagging details, the 7,000 or so business executives who participated in the Ifo survey in June were gung-ho about the economy, pushing the Business Climate index up to 105.9 and the Present Situation index to 109.4. While below the euphoria level of 115 in early 2011, it’s enough for Ifo to claim that companies were “increasingly optimistic with regard to their future business outlook.” Manufacturers were “clearly more optimistic about future business developments. Export expectations in particular have increased sharply.” That was two weeks ago.

The reaction to today’s export debacle? German stock jumped on the news, or on some other news, or on no news, with the DAX closing at 7,969, up 2.1%, but still off its all-time la-la-land high of 8,558 achieved in May – more evidence of the absolute separation of the financial markets from economic reality, which will go down in history as the greatest accomplishment that central banks around the world have ever achieved.

So Chancellor Merkel is likely to hang on to her job following the September elections unless a major debacle blows up. Therefore, no debacles will be allowed to occur until after the election, not even the economy. But just then, new revelations about NSA spying blew up and landed in Merkel’s lap. Read…. ‘Total Surveillance’ Officially Brushed Off In Germany.

Like the rest of us, Germans live in a kleptocracy. Germany’s export expansion came at the expense of German workers under the Hartz “reforms” and its neighbors by adoption of the euro which made German goods less expensive in the eurozone and non-German goods more expensive.

It is too early to say the lights are going out in Europe, but they are beginning to flicker. What can not be sustained will not be sustained. When the lights do go out, the peoples of Europe will find other uses for their lamp posts.

Nicely put.

Yes, very nicely put. Wonder why nobody in the corporate American media talks about the high rate of poverty in Germany (higher than in France by the way).

I am surprised that the author thinks that the too-small stimulus of 2008-2009 was “drunken”. Yes, only government stimulus and free spending by the central banks kept things from collapsing, and this money propped up the world’s economy, benefiting Germany in particular. But if anything, too *little* money was spent and it went to the wrong people.

Par for the course with this writer. In this article alone government action is described in terms of :- “drunken stimulus”, “money-printing frenzy”, “green-energy boondoggles”, “cash-for-clunkers debacle”. The man’s obviously a liquidationist.

Sorry, I forgot to issue my usual caveat about Richter’s deficit hawkery.

Even the US was hectoring Germany to spend more, although that was partly due to a lack of understanding of how large their automatic stabilizers are.

Talking of optimism — and also a lesson in how simplistic the level of debate and reporting is in the Mainstream Media — here in Britain we’ve had a stead trickle (turning into a bit of a brook) of happy talk and boosterism.

What gives, then, for all this cheeriness ? Isn’t this still the same Austerity Britain 2.0, complete with declining real wages, utility/food/housing cost inflation, stubborn unemployment and bloated, barely reformed extractive financial sector and so on ? Yes, indeed it is.

So, has someone found a platinum mine under Anne Hathaway’s cottage ? No. There’s a few trillion cubic metres of frackable gas which we can look forward to having come on stream in 5 years or so. Great. But that’s not the reasons being touted. Nope, here’s what’s going to drag us out into the sunlit uplands. As Lambert would say, we’ve found some sparkle ponies !

* The current heatwave

* A mini-housing boom in some local markets (yes, really, that’s A Good Thing apparently)

* A British winner at Wimpledon

* and… er… that’s about it.

Co-ordinated attempts at perception management it might be in the mass media but I think it’s more a case of dumb arguments put in front of a population who are taken for a load of dummies.

I think though that people are smarter than they are given credit for. I don’t think we’ll fall back into the old borrow and spend trap based on consumer credit. My hunch (it’s no more scientific than that) is that people know that will end up in an even bigger bust for the majority of the population with the gains skimmed off by the already wealthy.

Time only will tell if my belief in fundamental human intelligence is justified. I wonder though whether Germany and its population can resist trying to keep (misguided) faith in it’s own PR… It took Britain and the British people best part of half a centaury to get over the end of Empire, mercantilism and hegemony. The job still isn’t 100% complete either.

*

*

On the contrary The UK trade deficit with Germany is increasing when looking at multi year & quarterly trends and indeed I believe May was a record trade deficit month.

The UK is clearly taking the up some of the eurozones slack as Sterling appears to be the master currency within Europe.

Yes, you’re quite correct in that respect Dork, given half a chance, a sizable chunk of the UK population will — given suitable encouragement — revert to type and leverage up to splurge on German cars and property.

So all credit to Germany for switching its outsourced provider of proxy- loose monetary policy from the EU periphery to the UK.

Is this a Good Thing ? For me, no. The UK government has simply reactivated and re-enabled the TBTF skimming machine. It’s now even worse than it was in the bubble years though — much of the risk has been offloaded from the banks to the sovereign through various lending guarantee schemes. The banks keep the profits, the taxpayer suffers first losses on any defaults. And the consumer spending part of this splurge goes in part to Germany who can carry on regardless safe and secure in their marvellous “economic miracle”. The real estate “wealth creation” most benefits those (like me) who’ve already been handed a good bag of candy out of property “investment” in the past 20 years and don’t really justify getting any more sweeties at other’s expense. Looks like I’m going to get it anyway.

All of which is fine and dandy so long as it can be kept going for longer than the next 5 minutes. Not likely given the wobbliness in risk assets and moaning from the TBTFs about not being able to lend at the merest mention of monetary tightening by the Bank of England.

So, in summary, yep, there’s life in the old UK zombie yet. But how much life — and for how long ?

the headline is bad timing, with the recent plane crash involving a stall at low speed

There is little puzzlement here. Germany’s economy is stalling out because it’s an export-based model, and the EZ/ECB imposed severe austerity policies on key German sovereign export customers. Those Austerity policies have in turn caused catastrophic economic consequences in Germany’s customer nations, including France.

Evidently German policy makers are so attached to their ideological views and Austerity policies coupled with asset liquidation-privatization that they are willing to sacrifice the economic well-being of their manufacturers and the economic and social well-being of the people of much of the continent. It seems to me that the failures of the economic theory on which they were hanging their hat, which includes the now debunked Reinhart and Rogoff study [See: http://qz.com/92855/economists-looked-even-closer-at-reinhart-and-rogoffs-data-and-the-results-might-surprise-you/%5D, have been studiously ignored.

Going forward, it will need to be about abandonment of the austerity regime, increased fiscal spending, and broad distribution of that money. And also, perhaps a new monetary and financial system.

… unless other policy objectives are in play that Hugh alluded to in the first comment on this board.

Longer time scales make for better analysis. The euro has a bright future, and that’s why it is being supported by the Eurozone countries’ leaders. One the role of the CEB has been reformed, with the declining growth in China and India, manufacturing and employment will rise.