Yves here. I know I should write about Janet Yellen’s confirmation hearing, but I can’t stand to do it. Markets cheer than the Greenspan and Bernanke puts will be succeeded by the Yellen put. There’s way too much gender-related commentary (female tribalism has been all over the media for the past 4 months. This is clearly not organic, and I suspect it’s early priming for the heavy use of identity politics to rally the Dems, since all they have to offer these days is tribalism). There’s both self-congratulatory hype from the girl ghetto and unseemly commentary on her wardrobe (feministas take note: efforts at positive stereotyping enable the negative type. You can’t have it both ways). And then we have reruns of past nonsense, like Yellen has been the Fed’s most accurate forecaster. While narrowly true, all that means, as the Japanese would say, is that she won a height competition among peanuts. We need Marriner Eccles right now. Instead we get an orthodox economist who makes gestures to the left a smidge more than Bernanke but otherwise is more of the same.

By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth, Cross posted from Automatic Earth

Don’t get me wrong, I’m not saying things will happen in this order and timeframe. Just that they’re going to if central banks and treasury departments don’t up the ante. But they will. The question becomes more important now whether it’ll be enough to continue keeping their – presumed – demons at bay. They can’t go on forever. You can inflate asset price bubbles only so much. And then people will lose faith. So the order and timeframe is definitely an option.

Deflation is already here. Everyone’s talking about lower inflation numbers than expected everywhere, but prices have been pushed up artificially in so many ways and in so many places that, even given the fact that they all ignore what inflation really is, it’s getting profoundly absurd. Ironically, a few interesting lines this week came from an unexpected corner, the Telegraph editorial staff:

The last thing highly-indebted Britain wants is price deflation

The drop in the level of inflation revealed by the Office for National Statistics took some analysts and economists by surprise. It had been anticipated that CPI inflation would fall from its 2.7% mark in September to just 2.5% last month. Instead, it plunged to 2.2%, with the biggest downward contributions coming from transport.

It sparked questions – with much of continental Europe spiralling towards deflation and risking a repeat of Japan’s own crisis – over whether the whole world could be moving into deflationary mode.

At a time of near-double-digit increases in energy bills, this might seem a rather hard case to argue, yet the fact of the matter is that even in traditionally inflationary Britain, price pressures are easing fast.

[..] … on closer scrutiny, the sort of inflation currently being seen is mainly down to so-called “administered prices”, or prices which are being deliberately pushed up by government diktat either as part of the deficit reduction programme or green agenda.

I’m indebted to the Telegraph for giving a name to something I have denounced several times in the past: governments raising “inflation” levels through taxes. My argument of course is that taxes should never be counted towards inflation, because doing so would mean inflation and deflation are easy as pie to control by governments (which they are very obviously not, or this “control” would be applied all the time and there would never be any inflation or deflation). Anyway, we can now call this phenomenon “administered prices”…

The paper neglects to note that this is one of the main ways in which Japan purports to fight its deflation: through higher taxes. That will not end well. Look, one more time: inflation means an increasing money supply and/or a higher velocity of money. No more, no less, and certainly not higher prices by themselves. If the money supply increases and/or the velocity of money does, prices will rise, but only as a consequence, and across the board. Nothing to do with taxes. And if for instance the Big Six UK energy companies raise their prices through fraudulent bookkeeping, that doesn’t – and shouldn’t – count towards inflation, but towards fraud.

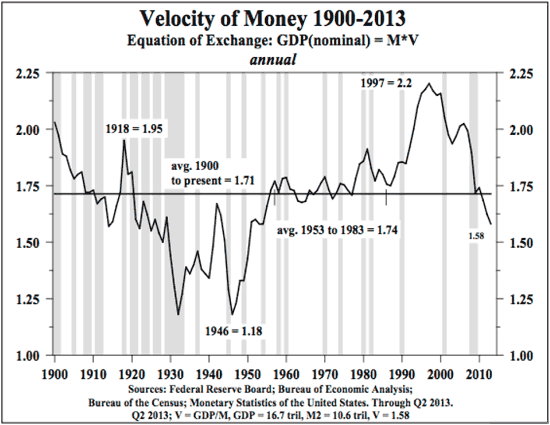

As for the velocity of money, you can see in this graph from Lacy Hunt and Van Hoisington (more on them later) that in the US, it’s come down in just 15 years from the highest point in more than 100 years to the lowest in the past 60 years. That is huge. That must have a tremendous influence on the economy, no matter what unemployment numbers are released, or what records stock markets set. As economic data go, the latter ones can only be entirely secondary to this:

When the velocity of money is that low, and we know there’s no huge increase in the money supply (though there may be in the monetary base), how can inflation numbers still be positive? Good question. You tell me.

That deflation (money supply and/or velocity of money shrinks and, only after that, prices and wages fall) is a growing worry, becomes clear through the following Bloomberg piece as well. It’s just that until now it remained hidden behind a veil of – mostly – central bank stimulus measures, which are behind various asset bubbles. Most of it is credit, backed by taxpayers, doled out to financial institutions and invested in stocks. Or, you know, the UK cabinet supplies cheap housing credit, people fall into the trap and buy their dream home, and, voila, “inflation” numbers go up. All nonsense designed to keep you from finding out what’s really going on, and to keep using your money to keep banks from going bankrupt. Bloomberg:

Central Banks Risk Asset Bubbles in Battle With Deflation Danger

Central banks are finding it’s easier to push up stock and home prices than it is to prevent inflation from falling short of their targets.While declining costs for everything from gasoline to coffee can be good news for consumers, disinflation makes it harder for borrowers to pay off debts and businesses to boost profits.

The greater danger comes when disinflation turns into deflation, which leads households to delay purchases in anticipation of even lower prices and companies to postpone investment and hiring as demand for their products dries up.

Federal Reserve Chairman Ben S. Bernanke and his central-bank counterparts are trying to avert the deflationary danger by pumping up their economies with lower interest rates and monetary stimulus. They have bet the run-up in stock and home prices they’ve engineered would boost consumer and corporate confidence and spur faster growth and higher inflation. Now they’re having to maintain or intensify their aid – running the risk those efforts do more harm than good by boosting equity and property prices to unsustainable levels.

“We have seen, in the last months, deflationary tensions building up,” Laurent Freixe, executive vice president of Nestle SA, the world’s biggest food company, said in an Oct. 17 conference call. “There is no growth in the marketplace, so everyone is fighting for a share of a shrinking pie.” [..]

It might be more accurate to say we increasingly have multiple claims to the same pieces of the pie.

The central-bank largess is buoying world stock markets, as investors seek higher returns than they can get with government bonds. Japan’s Nikkei 225 Stock Average is up 40% this year. The MSCI World Index, which includes both emerging and developed country markets, has risen 19%. [..]

Home prices also are rising. The S&P/Case-Shiller index of property values in 20 U.S. cities climbed 12.8% in August from a year earlier, the fastest pace since February 2006. U.K. house prices increased for a ninth month in October, while apartment values in parts of Germany have jumped by an average of more than 25% since 2010. [..]

The easy money lacks punch because the “pipes” that carry stimulus from financial markets to the rest of the economy are “clogged,” Mohamed El-Erian, Pimco’s chief executive officer, said in an interview.

So why don’t you explain to us what Bernanke has done to unclog those pipes, Mo?

Commodity prices have fallen as demand from China and other developing economies has ebbed. The Washington-based IMF forecasts oil prices will slump 7.7% next year while non-fuel commodities will drop 2.9% in dollar terms. It also projects governments will keep cutting budgets, with the aggregate deficit of advanced nations at 4.5% of gross domestic product this year and 3.6% next year.

The Fed has found that expanding its balance sheet — now at a record $3.85 trillion — hasn’t been a panacea. Since the U.S. recession ended in June 2009, growth has fallen short of its predictions, and in nine of the last 10 estimates for 2013, policy makers have lowered their forecasts. Inflation, too, is lower than projected and has undershot the Fed’s 2% target starting in May 2012. The personal-consumption-expenditures index, the board’s preferred gauge, increased 0.9% in September from a year earlier, matching April for the lowest since October 2009. The rate will stay low in 2014, at about 1.25%, according to Sinai.

People are not spending, i.e. the velocity of money has fallen. A lot. And no, tempting them into more cheap credit is no solution for that. Because that means more debt. And it’s debt that is dragging economies down in the first place.

In Japan, the BOJ has had some success in battling deflation after swinging into action in April, when it pledged to double the monetary base through purchases of government bonds and other assets. Consumer prices excluding fresh food rose 0.7% in September from a year earlier, down from 0.8% in August, the fastest increase since November 2008. The yen has dropped about 20% against the dollar in the past year, boosting prices of imported goods. “Core inflation is now no longer negative,” said Jerald Schiff, deputy director of the IMF’s Asia-Pacific Department. That “is a major victory in the Japanese context.”

Yeah, but Japan does this through “administered prices”, prices which are being “deliberately pushed up by government diktat”. Again, if that could work, everybody would be doing it, and all the time.

While the aggressive actions that central banks have taken haven’t done all that much for global growth, they have boosted asset values worldwide, pushing home prices from Canada to Australia and Sweden to China to levels that may turn out to be unsustainable. Some Fed officials have pointed to costlier homes, farmland and bonds as causes for concern.

“We’ve seen real bubble-like markets again,” Laurence D. Fink, chief executive officer of BlackRock Inc., the world’s largest money manager with $4.1 trillion in assets, said at an Oct. 29 panel discussion in Chicago.

See, what these people are saying is in essence that Fed policies have not had the desired effect, or not enough of it, and now things are getting even worse, because they were so wrong, and deflation looms (even if many prefer for now to call it disinflation).

I have a problem with that. Which is that I, and others with me, have said for years that this would happen, that QE wouldn’t “help” the real economy. Just look up what debt deflation is, and it all becomes clear. It’s embarrasingly simple.

I mean, what exactly is the idea? That Ben Bernanke honestly tried to fight unemployment by stuffing the accounts Wall Street banks have with his own Fed, full of excess reserves? Because that’s all QE has resulted in in practical terms, isn’t it? I know that it has probably affected the “mood” in the markets somewhat as well, but is that really something Bernanke should fake? Is that part of his mandate as well, to fool people into believing things? I don’t see how.

Really, how wrong can a man in his position be before he’s pushed to look for alternative employment? And don’t look for any relief from Janet Yellen either, she’s been part of that same Fed all these years that continues to hand out $85 billion a month and has nothing to show for it other than some perceived moodswing and those bloated excess reserve accounts. Here’s what Yellen will say today in her nomination hearing before the Senate Banking Committee:

“A strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy tools such as asset purchases … I believe that supporting the recovery today is the surest path to returning to a more normal approach to monetary policy. [..] … the Fed has “made progress in promoting a strong and stable financial system, but here, too, important work lies ahead.” “Her approach is let’s do more QE now to get the job done faster,” said Laura Rosner, a U.S. economist at BNP Paribas SA in New York … “Yellen is repeating her commitment to getting the job done.”

In other words: Yellen’s not going to change a thing, despite that fact that everything the Fed has done so far has been a huge and costly failure as far as the real economy is concerned, which is what the Fed claims to be execute QE for.

I am not kidding you: this is a real problem for me. Because either those who keep claiming that Bernanke and the rest of the Fed board have made nothing but honest mistakes for years are right, and I am profoundly stupid – which I don’t think I am -, or I am right and the Fed is loaded with really stupid people. And I don’t believe that either.

There is a third option, however and of course: that the Fed has not at all been doing what they say they have, and it wasn’t a long line of mistakes, but something else altogether.

Found a fitting description of that too. In a highly interesting must read piece by Yanis Varoufakis. Fitting, also, because what the Fed does is the same thing the ECB does.

Ponzi Austerity – A Definition and an Example

Ponzi austerity is the inverse of Ponzi growth. Whereas in standard Ponzi (growth) schemes the lure is the promise of a growing fund, in the case of Ponzi austerity the attraction to bankrupted participants is the promise of reducing their debt, so as to liberate them from insolvency, through a combination of ‘belt tightening’, austerity measures and new loans that provide the bankrupt with necessary funds for repaying maturing debts (e.g. bonds).

As it is impossible to escape insolvency in this manner, Ponzi austerity schemes, just like Ponzi growth schemes, necessitate a constant influx of new capital to support the illusion that bankruptcy has been averted. But to attract this capital, the Ponzi austerity’s operators must do their utmost to maintain the façade of genuine debt reduction.

The obvious thing to do, under the circumstances, would be for Athens to default on the bonds that the ECB owned. But this was something that Frankfurt and Berlin considered unacceptable. The Greek state could default against Greek and non-Greek citizens, pension funds, banks even, but its debts to the ECB were sacrosanct. They had to be paid come what may. But how? This is what they came up with in lieu of a ‘solution’: The ECB allowed the Greek government to issue worthless IOUs (or, more precisely, short-term treasury bills), that no private investor would touch, and pass them on to the insolvent Greek banks.

[The creation of the first Ponzi Austerity scheme in Greece] is but one example of the vicious cycle of Ponzi Austerity that is being replicated incessantly throughout the Eurozone. Its stated purpose is to reduce debts. But debt is rising everywhere. Is this a failure? Yes and no. It is a failure in terms of the EU’s stated objectives but not in terms of the underlying ones.

Great article. Great novel view of things. And a great quote. Let’s get back to the Fed.

We can say for the Fed what Varoufakis says about the ECB (and the troika):

Fed policies. A failure. Yes and no. A failure in terms of stated objectives but not in terms of the underlying ones

Is the Fed trying to revive the US economy? If they are, they have been making lots of mistakes. Lots. Too many. All they’ve done is make mistakes. Other than creating a moodswing. But those are notoriously temporary. And this one depends on financial markets expecting more and more “free money“, not on an improving economy. What do they care, if the money keeps coming anyway?

This QE game has raised the Fed balance sheet by well over $3 trillion. And ballooned the too-big-to-fail-but-dead-broke banks’ accounts with the Fed by about the same amount.

But still, you have these respected analysts who keep on hammering the same single tune: it’s all mistakes, none of it happens on purpose. Like Lacy Hunt at Hoisington:

Federal Reserve Policy Failures Are Mounting

[..] … when an economy is excessively over-indebted and disinflationary factors force central banks to cut overnight interest rates to as close to zero as possible, central bank policy is powerless to further move inflation or growth metrics. The periods between 1927 and 1939 in the U.S. (and elsewhere), and from 1989 to the present in Japan, are clear examples of the impotence of central bank policy actions during periods of over-indebtedness.

[..] … the Fed’s forecasts have consistently been too optimistic, which indicates that their knowledge of how Large Scale Asset Purchases (LSAP) operates is flawed. LSAP obviously is not working in the way they had hoped, and they are unable to make needed course corrections. [..]

If the Fed were consistently getting the economy right, then we could conclude that their understanding of current economic conditions is sound. However, if they regularly err, then it is valid to argue that they are misunderstanding the way their actions affect the economy.

During the current expansion, the Fed’s forecasts for real GDP and inflation have been consistently above the actual numbers.

One possible reason why the Fed have consistently erred on the high side in their growth forecasts is that they assume higher stock prices will lead to higher spending via the so-called wealth effect. The Fed’s ad hoc analysis on this subject has been wrong and is in conflict with econometric studies. The studies suggest that when wealth rises or falls, consumer spending does not generally respond, or if it does respond, it does so feebly. During the run-up of stock and home prices over the past three years, the year-over-year growth in consumer spending has actually slowed sharply from over 5% in early 2011 to just 2.9% in the four quarters ending Q2.

Reliance on the wealth effect played a major role in the Fed’s poor economic forecasts. LSAP has not been able to spur growth and achieve the Fed’s forecasts to date, and it certainly undermines the Fed’s continued assurances that this time will truly be different. [..]

The standard of living, as measured by real median household income, began to stagnate and now stands at the lowest point since 1995. Additionally, since the start of the current economic expansion, real median household income has fallen 4.3%, which is totally unprecedented. [..]

Over-indebtedness is the primary reason for slower growth, and unfortunately, so far the Fed’s activities have had nothing but negative, unintended consequences.

Another piece of evidence that points toward monetary ineffectiveness is the academic research indicating that LSAP is a losing proposition. The United States now has had five years to evaluate the efficacy of LSAP, during which time the Fed’s balance sheet has increased a record fourfold.

It is undeniable that the Fed has conducted an all-out effort to restore normal economic conditions.

No, Lacy, that is not undeniable. I just did. And I have to wonder: why would you say that? Why would anyone? Do you really believe all you said there? That this entire group of more than average intelligent people make all these mistakes, and misinterpret all of these signals, despite having more and better access to data than anyone else, and you still don’t wonder if perhaps they’re not trying to do what they say they are? How can you claim to be an analyst if you don’t even question your most basic assumptions? How is that analysis and not apologism?

John Hussman writes some good market opinion, but he sort of falls into the same apology trap:

It’s fascinating to hear central bankers talk about the economy, because in the span of a few seconds they can say so many things that simply aren’t supported by the evidence. [..] quantitative easing essentially proposes that rapid increases in the monetary base can achieve reductions in the unemployment rate. But when we examine the data, we find very little to support this view, regardless of whether the relationship is posed in terms of growth rates, levels, changes, coincident changes, or subsequent changes in unemployment. [..]

In my view, most of the response to quantitative easing reflects psychological factors rather than mechanistic ones. Certainly the scale of QE has been enormous, and suppressed short-term interest rates have undoubtedly motivated a reach-for-yield in more speculative assets. But it remains true that the amount of credit market debt in the U.S. is roughly 19 times the current size of the monetary base (with an average maturity of about 5-6 years), while the value of U.S. equities is easily over 6 times the monetary base.

So quantitative easing effectively relies on the extent to which investors shun zero-interest cash amounting to less than 3.9% of that available portfolio. In any environment where low-interest but liquid and non-volatile securities become desirable as even a small part of investor portfolios, quantitative easing is likely to lose its presumed ability to “support” financial markets. [..]

The truth is that Fed policy has the capacity to do enormous damage by adding fuel to asset price bubbles when investors are already inclined to take risk, yet has very little power to “support” asset prices when investors are inclined to avoid risk. The confidence that the Fed can, in all circumstances, drive asset prices higher is largely psychological – mostly due to misattributing the 2009 recovery to monetary policy instead of the move to end “mark to market” accounting. Yet even to the extent that stocks have been driven higher, there is very little evidence that the “wealth effect” on jobs and economic activity has been large. This is something that the Fed should have understood years ago. [..]

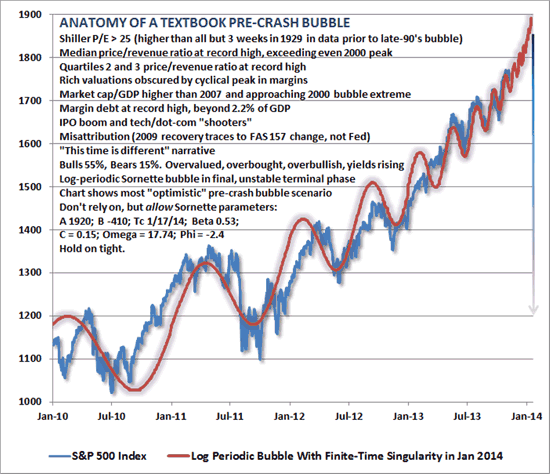

I continue to believe that it is plausible to expect the S&P 500 to lose 40-55% of its value over the completion of the present cycle, and suspect that whatever further gains the market enjoys from this point will be surrendered in the first few complacent weeks following the market’s peak.

See? they’re doing everything wrong. Ergo: boy, must they be stupid. Only, that second part is left out.

What I do find interesting is Hussman’s last claim: that it’s plausible to expect the S&P 500 to lose 40-55%. And he’s got a nice graph to show where things stand:

What can hold off a crash? Probably only more asset purchases by the Fed, and temporarily at that. Enter Janet Yellen stage left. Or does anyone doubt that the S&P would look completely different if QE had never happened? But even then. The people at the Fed are aware of the velocity of money data, they’re not nearly as thick as the analysts make them out to be. They know they’ve long lost the deflation battle. Maybe they can move people to take some of their money out of stocks and into something else, something that moves money around a bit more. Or maybe they can push some money or credit into the real economy through real estate prices. The problem there is that increasing credit doesn’t do much, if anything at all, that can be seen as positive. Not in an already hugely overindebted economy.

At some point you need to ask: stock market crash? What stock market? How is it still really a stock market if it hinges to such a large extent on the Fed pumping money into Wall Street banks? At the very least, you might question if the S&P still reflects an actual market at all, if that market is supposed to reflect what goes on in the economy, and obviously doesn’t. You might want to ask what purpose such a largely illusionary stock market has, what its use is within the larger economy. And while you’re at it, you might also want to answer what use the financial system as a whole is to the real economy, if all it does is squeeze money out of it.

We know the Fed can prop up the S&P for a while, and though we don’t know for how long, we do know that they’re running out of time. That’s what Hussman’s graph says. And wouldn’t we perhaps be better served by a market, and by data, that better reflect what’s going on in the real economy? So we know where we actually stand, and not what some moodswing or another says about that? The entire market, the entire financial system, has turned into a zombie that feeds on the American people’s life blood.

Let’s redefine all this talk, and call a spade a spade: The Federal Reserve defines and executes policies aimed at aiding the banking system, not the overall US economy. And although the Fed may claim that these are one and the same, it could have known – and it does – that they are not. The idea that supporting the banks equals supporting the US people, is just that: an idea. The Fed, more than anyone else, has access to the data that prove this. It knows how badly off the banks are.

So quit propping them up, throw open their books and let’s start restructuring. If you choose not to – here’s looking at you, Janet – stop pretending you’re acting on your dual mandate, that you have the people’s best interest at heart. There’s no evidence of that anywhere to be found in anything but words.

We may make it to Christmas without a market crash, with lots of happy expectations for record sales and a last bout of happy moodswing. That’s not that interesting. What is, is what’ll happen after that. We already have deflation, once you look past the words. And we have a stock market so grossly overvalued it can only be labeled a zombie. Record holiday sales are not going to materialize with the velocity of money at a 60-year record low. And then what, Janet? Increase QE? Double or nothing for the most costly “failure” in US history? All it takes is for people to keep believing, right?

Yellen’s bone-headed game plan is to triple down on steroids. We’ve seen what that can do to athletes.

Like so much verbosity, this can be summed up by an apocryphal Twain quote:

“Sometimes I wonder whether the world is being run by smart people who are putting us on, or by imbeciles who really mean it”

It could be both!

Seems the vast majority of contributors to this site connect, both technically, and emotionally with the dire macro themes and data which are discussed daily here.

What are the alternatives in a circumstance where total credit market debt has risen exponentially for decades. out of scale growth has resulted. Excess capacity, masses have been pulled from abject poverty, people have been educated, and extreme waste and injustice have been leveled upon the population and planet.

Isn’t it likely that we are in for a long, hard, bumpy ride down? How do you effectively manage same? People who believe they are exposing the underhanded, or disingenuous desires or adventures of a small minority in the managing of the dark trajectory we are on….perhaps they delude themselves, and those of us who listen?

Could it be that this thing has been taken to such an unmanageable place, and the consequences of corrective action are so dire, that the only way to cushion the nasty outcome is manipulate it over time, doing whatever is necessary to buy time, in hopes that some transformational idea, or industry or leadership will emerge and help light a path which is, if not a complete turnaround, at least a softer negative outcome????

I think that is how the thinking is going in ruling circles. I don’t think they have much confidence that things will right themselves in the medium- or long-term. I don’t see a crash coming anytime soon but agree with a slow bumpy ride down.

FWIW, that was my assumption in 2007 as to how our credit bubble would resolve because that was what happened in Japan 20 or so years prior. But we still have a world of fast-moving international capital flows.

This is only true to the extent that the powers that be, who do see it at least somewhat the way you describe, have refused to do what needs to be done to fix the economy: they are blinded by ideology and a “save the banks” mentality that refuses to see the banks as a tool of the economy rather than its prime mover. They see things this way because that’s what they’re paid to do. If they didn’t see things “the correct way” they would be working at the U. of Kansas with Bill Black instead of running the Fed. And so we get ponzi austerity instead of debt jubilees and bank nationalization/restructuring because the people that have been placed in charge have blinded themselves on purpose so they can do the job they were hired to do: keep the banks running for as long as they can, at all costs.

Bernanke’s phd thesis was this very topic: if they’d have saved the banks in 1929 the Great Depression would’ve been averted. Hogwash of course, as anyone who knows anything about the GD, and who doesn’t subscribe to the idiotic dogma of neoclassical economics knows; we now see saving bankrupt banks is too costly and frankly impossible, especially when what you are saving is essentially a criminal cartel that will double down on its predatory bets long enough to keep getting those juicy bonuses. The idea that this was simply a banking problem all along is insanity, yet that’s what they’re paid for at the Fed: to see the banks as the be all and end all of the economy, and to focus all their efforts on keeping that wheezing and exhausted train running as long as possible so the looters can finish their looting.

So instead of cleaning out the waste and corruption, bad debts and insolvent banks, we get QE. And this train is wheezing and chugging slower every day. Its just a matter of months now, not years, before this all comes to a pathetic, wheezing… something.

Ideology is certainly part of the problem–but the main thing is power. Those that have their levers on power do not mean well which is due, or so I believe, to the confusion and division in the body politic.

I think the elite want to keep steerage calm and below deck while they climb into the life boats.

KH –

I believe you are right, some do, certainly. But they definitely delude themselves. If their lifeboat is more money than others, they are foolhardy indeed, for if this…. thing…. truly sank, there would be no hiding at sea. The french peasants, the Bolsheviks, Mao, the Cambodians…..they instruct well on how extreme economic imbalance plays out and is exploited.

This is why I am reasonably confident that the next 3-5 years are going to be positive in certain categories…..we don’t have any choice, we have to use EVERY near term tool in the box to stimulate.

Fact is … cheap is the new cool. People are enjoying doing with less, realizing a lack of need is liberating a sense of independence, and self-reliance that is giddy exciting! Acquisition of stuff has been unmasked for the self-imprisonment-to-obligation … it really is. Of course we are deflating … and so we should.

Dear brazza;

I think you’ve got the cart before the horse. People are “embracing” ‘cheap’ because they have to, not out of some transformational economic epiphany. As in depressions everywhere and everywhen, falling real wages cause falling standards of living. Notice in the article where one of the quoted sub authors uses median instead of average measures. That’s a tell that something is very wrong with the distribution of wealth today. Maldistributed wealth equals greater extremes of wealth and poverty. (I may be wrong, but that’s how it looks from down here on the street.)

necessity is definitely a part of it, but it is also true that people are taking alot of pride in doing things for themselves, such as growing food, home improvements, etc, that in a generation past were not even a consideration – someone else would have been paid to do those things. Alot of people are realizing the satisfaction and benefits that comes with this change of attitude.

Yes Tim, a lot of people would have been hired to do those things–so what are they going to do now to earn a living? Are we going to each get 40 acres and a mule and a smiling “good luck” from Uncle Sam? There are 310 million Americans. That number was predicated on a certain kind of economy. Unless you want to herd the excess population into elimination centers, you’ve got to find gainful employment for those masses. I’m waiting for anyone in the self-reliance camp to tell me how we are going to manage deflation via the mechanism of self-abnegation.

gainful employment (haha that’s hilarious how much employment is really gainful these days?) or job sharing or guaranteed income

My hunch Tim … is that the days when we thought we could manage more than our own reactions to the circumstance personally facing us … are history. Management requires experience (data) based on past events, and we’ve pushed beyond known territory. I simply don’t buy ANY theory in the market because none consider the only acceptable outcome to the planet: de-growth.

Amrit – I accept that my rather upbeat sentiments with respect to financial apocalypse may not be widely shared – and I concur that people are “embracing cheap” initially because as you say … they have to. What I’m suggesting is that after the initial shock comes a surprising euphoria at the realization that one is able to make do without what previously thought as absolute requirements for a decent life. Occasionally the sense of well-being and freedom is such as to make one ultimately question the whole enchilada we’ve been programmed into.

Yes. De-growth or Contraction as James Howard Kunsltler would put it.

We have a distribution problem which was masked by growth. Growth did provide opportunities for most in society to get enough money to not revolt and get too upset (at least in the industrialized countries).

We now must solve this distribution problem and we must keep in mind the dwindling fossil fuel supplies which has powered our material production/modernity so far.

I suggest the following:

A) we start a social credit/Social dividend/guaranteed income program and give every U.S. citizen $500 per month regardless of income or regardless of any public assistance they currently receive.

B) Increase taxation to keep inflation in check. Increased taxation should include stiff consumption tax to discourage too much consumption by the rich and upper middle classes.

D) Start stringent energy conservation and run a low-grade industrial civilization with less yearly fossil fuel consumption.

C) This will buy us time to develop another cheap energy source and possibly resume growth or if we don’t find another another cheap energy source we will have time to learn how to live without machines, fertilizers and pesticides.

http://aquinums-razor.blogspot.com/2013/02/the-banking-system-and-economic-growth.html

Brazza is not incorrect in my opinion, but neither is Lambert. Both are happening simultaneously. America is moving downmarket and many are finding new ways to make do with less because they have to but there are other Americans who are often very affluent who are consciously choosing to make do with less and live simpler but fuller lives that don’t focus soley on consumerism. Americans (often younger, but not always) are waking up to the pitfalls of consumerism and greed. I see it in my profession (airlines) frequently. Older guys are always focused on their paycheck and increasing their take home pay at any costs. They will work themselves to death (literally) to bring home an extra 20-30k a year mainly so they can afford their outsize lifestyle, vacation homes, boats, expensive cars, toys, multiple college aged kids etc. Many among the Gen-X, and Y crowd see it the other way- they want more time off and less work so they can enjoy their lives. They would rather spend two weeks backpacking in central America than a few days on their gigantic gas-guzzling motor yacht. Why own something with all of the fees, taxes, insurance, maintenance and headache when you could just rent it for the weekend? They would rather live in a tiny studio apartment in a nice urban area with many amenities than a gigantic McMansion on the end of a cul-de-sac. DIY projects save money but the skill-building and sense of empowerment are the attraction for these kinds of people.

Professional Americans in their late twenties and thirties are much more debt adverse these days because they have already had such bad experiences. I am thirty-eight and I just paid back Sallie Mae this year. If anyone is unaware, she is a really awful and crooked bitch. I live happily as a renter in a studio apartment and the last thing I want is a mortgage or more debt of any kind. I am debt free finally and I plan to keep it that way hallelujah. There are many more people like me and many more coming up behind me who will be even more traumatized by our debt-cropping system. This country is producing a huge generation of debt-adverse Americans who want to check out of the cycle of debt/consumerism.

Jerry D,

You said it. Debt-free is a long way towards stress-free.

whenever i’ve wanted to know the ‘real’ unemployment temperature… i glance the VoM chart. folks with full time work are showing up in homeless shelters…the ‘pink-slip’ fear out there is real. im not sure what tulip field your pick’n from but i bet your listening to Tiny Tim.

All hail, Delusion! Were it not for thee

The world turned topsy-turvy we should see;

For Vice, respectable with cleanly fancies,

Would fly abandoned Virtue’s gross advances.

Mumfrey Mappel

If everyone decides to stick to essentails only, we are in for a nasty drop.

Yep. That “simplicity” talk is real nice, real homey, but where are the jobs going to come from if everyone adopts “austerity chic”? And from whence the investments in a dodgy infrastructure?

People have gotten way too used to the idea that they can adopt lifestyle choices at will. When poverty is enforced by circumstances beyond their control, when it is obvious that their children have nothing but a bleak future of chronic underemployment to look forward to, the self-satisfied game of “imagine a healthy life back in nature” some play while reading the Arch Druid won’t look so rosy.

@ James Levy

You’re raising an issue which I think doesn’t get raised nearly enough, and especially with a New Left that tends to be elitist and hardly ever quesitons its own assumptions.

The doctrine of asceticism – the principles and practices of self-denial and austerity — runs through Western civilization like a thread, and it has become a distortional mainstay of New Left thought. Here’s how Bryan Ward-Perkins describes it:

I think this causes a great deal of confusion, because people don’t know how much of the call for a low carbon future is informed by the dogma of ascetism and how much is informed by reality: reaching the real limits of the biosphere.

There is the very real possibility that an antinomy exists between Keynesian economic theory and the demand for a low carbon future, this antinomy being manifest in spades on this thread.

There is no country in the world that has less “asceticism” running through it than the USA. Its society is set up to waste resources. Other “Western” countries do the same thing, but obviously not as “well”.

Americans who truly are content to live a frugal life (i.e. are not forced to by impoverishment) are a small minority.

But how could it be otherwise. Though there are individual exceptions, great wealth (such as the industrialized world acquired) leads to wastefulness. Only when we find key resources becoming scarce will we see a change in the habits of the majority.

Excuse me, JL, FM, but where is this “dogma of ascetism” you speak of? Surely not in the USA. If anything we (and much of the rest of the emerging world) operate 99.9% under the dogma of rabid consumerism, which is tearing this fuckin planet apart. A call to cool down the ethos of only living to buy more and more things isn’t the same as going back to the bygone era of the Dark Ages. Claiming we make and do too much doesn’t mean folks are pinning for the life of the Luddite. All it means to most of us is finding a healthy balance between the excesses of the present age and, say, when I grew up as a boy in the not so distant past of the 60’s. If that’s excessive ascetism, then so be it. Sorry, but I’d rather collectively choose a rationally thought out route to a sustainable way of living than let nature dictate a default Hell on us all, even if some label it the dogma of ascetism..

Only disingenuous critics of genuine environmentalism would attempt to portray its genesis as an aescetic impulse – the problem lies with people who claim to accept the reality of threatened biosphere, but don’t, as much or more than those in denial altogether.

And indeed, you will find that adherents of Keynes, i.e., “liberals” on the economic front, have effectively refused to engage the full meaning of the planetary reality that stares us straight in the face, and from which we cannot “grow” our way out, or even forward.

We face an imperative: radical transformation of the entire complex of production/distribution systems away from the current, suicidal “goals” of “recovery” then “solid growth” – repeat, repeat, repeat – towards truly sustainable and truly just practices across the board, and immediately, as we have no more than 20 years to effect this entire transformation, nor can humanity withstand later what another 20 years of this stupidity will inflict. We may well fight a final war over the next decade or so just to see who is “boss” over Mankind’s last ditch effort, way too late.

The oceans are dying and the process is accelerating. That now means pre-2050. Eco-capitalism is an oxymoron. I suggest an ecologism which operates as an integrating principle through which we can formulate a new economics, new politics, new social “contracts” for living – and including forms of “rights” for every other species and the natural Earth itself. “Growth” is the mindless destroyer the 20th century ‘liberal’ mind created in order to not have to give up accumulating far more “wealth” than those down the ladder – as much “wealth” as possible is fine, just so long as it’s not “obscene” – I remember when a pro athlete making $50,000 a year was in that category for most people. And now?

The problem, the way I see it, is that ‘simplicity’ isn’t simple. And you are right, millions of barefoot ex suburbanites hoeing rows of vegetables isn’t going to happen. So it’s a problem of how do we get from here to (your choice of Utopia) there.

Start with food (next clothing). Industrial agriculture has simplified growing crops to the point where “the D students can do it”, to paraphrase Wendell Berry. It’s the same with anything that needs doing: we have embedded the knowledge of the craftsman in tools and materials. What we end up with is complexity forgetting that complexity contains contradiction. Feeding 310 million Americans can be done in different ways. Assuming that the only “practical” way is the way it’s done at present is correct if one is willing to ignore the contradictions inherent in present systems. Getting from “here to there” is going to have to involve entertaining radical ideas like decommodifying our economies, reversing the structure of employment–labor hiring capital instead of our present capital hiring labor–deeply questioning what it is we expect from technology and it’s present trajectory based on reductionist science, examining our evolving Western identity (for someone Luther’s age, the issue of the basic moral frame orienting one’s action could only be put in universal terms. Luther was concerned with condemnation and irremediable

exile, we moderns are more concerned with meaninglessness, or lack of purpose, or emptiness.)

I sure don’t have any answers but just because I don’t doesn’t mean I’m willing to continue in a system that’s spewing radioactivity into the Pacific, predicates energy use on waste (only 1-5% of thermal energy locked in fossil fuels or enriched uranium emerges at the other end of the pipeline as a laser beam, or cool conditioned air or 400 pounds of 50mph mom and kids. All the rest goes into purifying, conditioning, and tailoring power. Properly insulate every building in America and we don’t have to import oil etc etc.

I don’t think it’s people have chosen a lifestyle as they have taken the path of least resistance and accepted the one handed to them. We need to make some impractical choices. The “practical” ones have gotten us in a mess.

I’ve found this useful: http://r.duckduckgo.com/l/?kh=-1&uddg=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3DN7oz366X0-8

as well as Charles Taylor’s Sources of the Self the Making of the Modern Identity

defunct paradigm: distribution of goods and services must be delivered only in exchange for work. Economy no longer requires so much work to support a population. needed now, alternative tickets. A substantial per capita dividend, expanded from the Swiss model, might provide a way to start.

To accomplish that without drastic tax hikes (not necessarily such a bad idea) first we have to shake to householder meme for government spending. then let the good times roll.

imagining infinite growth on a finite planet is also a self-satisfied delusional game (and that’s what most “we need to reinflated” the existing economy is).

Well, for starters, James, we’ve retained the structure of “employees” with “jobs” as organizationally necessary long after technology made alternative forms possible. But all have been attacked immediately, regardless of nominal “ideology” by the existing elite and its consensus construct of “capitalism”, which has given itself the right to appropriate everything possible so far as its practitioners are able, geographically and through time.

A rather spectacular change is coming whether we want it or not, and it’s very likely our response will be panic and war, after we whistle past the last stone in the graveyard. We need a committment on the order of WWII psychologically, but without the blood and guts.

“Look, one more time: inflation means an increasing money supply and/or a higher velocity of money.”

This is not the generally accepted definition of inflation, it’s an austrian/goldbug definition.

Well, Ben, hoping that this is not too disappointing, but I’m neither Austrian nor a gold bug. The reason I use this definition is so we can continue to be able to see where price movements originate. We can’t if we throw a whole bunch of them on one big heap and then stick an inflation or deflation label on the entire heap, the dumbed down version most often used to define inflation these days. It leads to empty terms like consumer inflation, price inflation, food inflation, and it’s only when you get to cookie inflation that people start asking questions.

As for things being generally accepted or not, I don’t care much about that. It’s also generally accepted that the Fed is trying to save and revive the economy, and I don‘t believe that for a second.

Isn’t the real issue whether the FED can actually increase the quantity of dollars?

Not increase the “money supply,” which is a definition of money created by economists that doesn’t appear to reflect reality, e.g. the FED has increased the “money supply” but has not produced inflation,

But increase the actual number of dollars out there. I’m certain that Mosler is correct and the number of dollars out there can only be increased by the Federal Government spending those dollars into existence.

The real measure of the quantity of dollars is the size of the Federal Government’s debt. Like with inflation, I suspect, it’s the change in the rate of growth, (The second derivative of the function as they used to say in calculus class ;-) ) that causes problems, not the so much the direction of growth.

The rate of growth of the Federal Debt has been decelerating, thus monetary deflation.

The solution to all this, is Warren Mosler for FED Chair.

My thoughts too. But I thought the bit about the stock market not being a market, and the disconnect between the productive economy and the financial economy an important point. As is the fact that central banks are not working in the best interests of their respective nations, they are working in the best interests of the private banks they interact with. To assume that propping up ponzi finance is synonymous with ‘saving a nation’s economy’ is foolish, indeed.

Unless the nations fulcrum is ponzi finance……

In truth the solutions have been there for many many years …. recently (the last 100 years)submerged by Keynesian stimulus until the debt has reached a event horizon as a result of the physical economy following monetary transactions over 100s of years and not the other way around.

Ponzi finance is actually the scarcity merchants trying to manage the physical economy for their own narrow benefit.

Its a pyramid scheme with them guys at the top again.

Economic sabotage is treason the last time I checked.

Yep.

And when it comes to Ponzi finance, it looks like nobody does it better than the UK, as Steve Keen explains here:

Yep. This was not one of Ilargi’s better efforts.

And if we cite the entire passage, it gets even worse. To wit:

The UK has monetary sovereignty, and as such its government has complete control over monetary, fiscal, and regulatory policy. The notion that inflation and deflation can be controlled completely with monetary policy, and that fiscal policy (and regulatory policy) are not useful in this regard, is historical (and hysterical) fiction, a la Milton Friedman.

And what’s this talk of “governments raising ‘inflation’ levels through taxes”? Higher taxes — if they are not counterbalanced by increased spending thus resulting in lower deficits or a fiscal surplus — mean less inflation. The idea that raising taxes causes inflation is taking reality and turning it on its head.

Ilargi not only misses the target with this one, but he turned on his heel and fired his arrow 180º in the opposite direction.

And then people wonder why the proles don’t understand economics.

Sorry, this makes no sense to me. Maybe because I never said either “inflation and deflation can be controlled completely with monetary policy” or “fiscal policy (and regulatory policy) are not useful in” whatever “regard” you mean.

Not when you talk about sales taxes, which of course is what I do vis à vis Japan, don’t think there’s a planned income tax raise under Abecomics. And needless to say, this holds only when using the dumbed down “inflation equals any and all rising prices” definition. Or actually, it’s more a non-definition. But I already explained that.

Did you or did you not say?

Taxes are fiscal policy: taxes and spending. The net of taxes and spending is either a fiscal deficit or a fiscal surplus.

Milton Friedman argued that sound economic policy could be achieved by using only monetary policy: the control of interest rates and money supply. The other two tools in the policymaker’s toolbox — fiscal policy and regulatory policy — he eschewed. Actually what Friedman did was to revive pre-Great Depression thinking. All the lessons of the Great Depression Friedman erased from memory and from the economic history books. He rewrote the economic history of the Great Depression and replaced it with fiction.

This citation from your post has a great deal to do with what is causing the deflation or disinflation or whatever one wants to call it:

I am in complete agreement in that I prefer progressive income and inheritance taxes to regressive sales or VAT taxes. But that fails to fully address the question as to whether or not taxes impact upon inflation and/or deflation.

Here’s how John Kenneth Galbraith explains it:

This from John Kenneth Galbraith’s book might also be helpful:

Yeah, I did, but I was not referring to the “inflation equals any and all price rises” definition, but to inflation=M*V. As long as we’re clear on that, cool.

And sales taxes do tend to raise prices, an important part of Abe’s attempt to fool people into thinking he’s conquering deflation. It has effect only under the first definition, while Japan’s deflation is very much due to the V in the second. Japan tried the same tricks Abe does now back in 1997, and it backfired painfully. It will again.

That is from Bloomberg, where they have no idea what deflation even is. And it doesn’t say much about what causes deflation. You can put that down almost entirely to falling V these days (that first graph is devastating, and really tells you just about all you need to know), and since consumers are 70% of US GDP, they are the leading agents, not governments.

“…governments will keep cutting budgets, with the aggregate deficit of advanced nations at 4.5% of gross domestic product this year and 3.6% next year.”

To which you assert: “it doesn’t say much about what causes deflation.”

Well, I suppose you and I will just have to agree to disagree.

Ilargi says:

Galbraith also addresses the fact that the relationship between taxes and inflation/deflation are so counter-intuitive:

From Mexico– Many thanks for these quotes from JK Galbraith. Together, they provide a clear picture of economic history over the last 100 years or so! So concise and informative…

Yves,

To me, the most striking element to the Yellen Fed is Yellen’s belief that the UE rate is a cyclical and not a structural problem.

Yellen is quite sensitive to the Fed mandate of full employment. On Feb 11 2013, she claimed that the “increase in UE since the onset of the Great Recession has been largely cyclical and not structural.”

Under this belief set that the UE rate is not a structural problem or that the natural rate of unemployment has shifted upwards, the Yellen Fed may effectively move the goalposts set by the Bernanke Fed by lowering the threshold at which point it would tighten policy. Instead of seeking to tighten at 6.5%, because she views the UE problem as merely a cyclical issue, the full employment threshold, should be closer to 4% to 5% in line with other post WWII economies.

By moving the goalposts in this manner, Yellen was able to say to the Senate Banking Committee yesterday that “the Fed has more work to do”…UE at 7.3% is still too high, reflecting a labor mkt performing far short of their potential.” Her cyclical views on the natural rate of unemployment will provide plenty of cover for her to accomodate, accomodate, accomodate the financial markets.

The woods are lovely, dark and deep.

But the Yellen Fed has promises to keep,

And miles to go before they sleep,

Moving the goalposts by lowering the UE threshold to signal mission accomplished and to warrant a tightening of policy will set her apart from the Greenspan and Bernanke Fed.

What is most troubling are 1) Yellen’s point of view that the UE problem is largely cyclical. 2) that she doesn’t see a buildup of financial risks by driving asset prices higher with QE. 3) that she sees only limited evidence of a “reach for yield” amongst investors as a result of their unconventional monetary policies.

Yellen is a smart lady, and for better or worse, she has intentionally equipped/insulated herself with a set of horse blinders to keep her focused on the race/goalposts and from being distracted or spooked by any information or evidence that would suggest the FOMC monetary policies are creating disequilibriums throughout the financial markets or are incapable of steering the economy back to the 4% to 5% unemployment rates of previous post WWII economies.

It’s deflation for everything you don’t want or need. It’s inflation for everything you do.

Even soup now costs $7 in New Yawk. WTF? They’ve got about 15 different soups. The cheapest is $4.50 which isn’t too bad. But usually it’s pretty plain, like tomato and rice.

if you want the good stuff — like Thai Curry Coconut Chicken or Shrimp and Corn Bisque or even Angus Beef Chili with Cheddar and Sour Cream — hit the cash machine ’cause you’ll be forking over a $10 spot and getting $3 back.

Then health insurance. Need we say more. Or how about going to college? Wink. Wink. Call Jacob Lew! he’ll get you a loan.

What else? How about telecommunications. Back in the old days you had one big black telephone with a dial. That’s what you needed to stay connected. Now, you need cable broadband, an iphone, a tablet, voice, data, texting — you’re talking at least $200 a month. That’s why I’m disconnected. Or one reason anyway.

If you have a phone, somebody might call and then you’d have to either talk to them or listen to a voice mail. forget it.

What else is inflating like the universe right after the big bang? I bought something at the store the other day that came in a box and when I opened it up, the thing inside was only half the size of the box. I forgot what it was. Food of some kind. The thing shrinks but the box remains the same.

If you need a T-shirt or a plastic spoon made in China for your kitchen. Whoa! Deflation!

That may be the way be the way you see it, craazyman, but I listen to the Fed folks now and then and they say it is the “general price level” that is what is important. That is, if the price of “general” inflates or deflates. They know what that is too! Plus they can manage it with the “Fed Funds Rate”*. So now I hoped you learned something.

BTW: Did you mention gas, electric, water and housing? Or is that flat in NYC?

* Irwin Fisher is rolling over in his grave saying “My MV = PQ formula is correct – your data and your economy is f*cked up!)

everything in New Yawk is going up except my investment profits, those are going down.

rents are going waaaaay up. In my price range, they’ve gone up 30% in 3 years. My price range is low — loooooe. Do you want a sandwich for lunch? If you don’t make it yourself it’s $8.

I need to make up for what I lost in GLD. Even Central Park would work with a tent if I wouldn’t get arrested. I’d put the rent money into options.

The electric bill has a mind of its own, mostly it goes up slowly but steadily, but I use so little of it there’s no problem. I don’t know about water. it comes out of the faucet every day. that’s all I know.

The biggest problem is the 10-bagger. It’s like hunting for an invisible turkey running around someplace in Alaska. You can run out of ammunition before noon and there’s thousands of miles of woods where it could be.

Holy rentier, craazyman! New Yawk sounds really faacked up. With GLD deflating too!

Around here rent seems to be the only thing going up at the fed inflation target. At least someone listens.

Bad news is rice and beans went up about 50% over the last 3 years. But only poor people worry about eating – so no biggie there.

Hear ya about finding a 10-bagger. I can’t even find 1%.

Maybe things will get better in 2114 once Yellen has the Fed seat and the Sarah Palin/Hillary Clinton campaign takes off.

I really think Sarah should produce a remake of the old Flying Nun TV series staring herself as “The Sistahh With a Vista”. Fox would run it and the exposure would be priceless!

I bootlegged an appropriate promo here on youtube. With footage like this you can write in any script you want – Sarah in search of 10 baggers for Americans, Sarah on a turkey shoot (dub in the predator drone escort for that one) or just some vapid drivel about Sarah has a vision for America!

http://www.youtube.com/watch?v=rbwwk_k5-dw

I hear the 2114 campaign was a blast. Literally. Someone set cyborg Mccain loose and we lost half of Washington.

Agreed. There is a great deal of inflation in the things one has to have to live, e.g. fuel to heat your home, gasoline to drive to work, food. And it looks like inflation in the cost of housing is well underway, once again, too. That’s why the burden of the kind of “deflation” we are now experiencing falls heaviest on the poor, because a disproportionate amount of their incomes goes to pay for these necessities.

In wages there is stagnation. But if one makes enough to have money left over after all the necessities are paid for, then one can take advantage of the cheap imports from China and other slave-wage countries.

But the rich have never had it better, since there is a great deal of asset inflation. It truly is the Golden Age for the owners of capital.

If one were to have set out to intentionally design a system to penalize the poorest and reward the richest, he or she could not have done a better job.

FM~ “But the rich have never had it better, since there is a great deal of asset inflation. It truly is the Golden Age for the owners of capital.”

when conversing with Fable American believers…’the rich create jobs’ has been the sickest mantra i’ve dealt with. they can’t heat their homes, grocery shop at the dollar store and grow ulcers dodging revenue seeking police… but dam the torpedoes when their ‘loot comes in’ if they’ll pay the lazy welfare bumpkins.

But they do create jobs! They need crews on their boats, servants for their daily needs, waiters at high-end restaurants and sexy people for their beds–what could be wrong with that? You just need the right skilz.

The price of gasoline, at least in Massachusetts where I live, has been going down for four months. Or are you going to tell me I can’t read a sign or my credit card bill?

The big rises I see are in the price of food, specifically meat and some kinds of produce. What has hurt my family is falling income due to the end of a contract and my inability to find work, any work, to compensate. Housing prices here are stagnant or slightly declining. Inventories seem to be large and moving slowly. From Syracuse through Springfield unemployment is high and has been for decades. New and revived farms are doing pretty well.

From my perspective, deflation combined with chronic unemployment and a collapsing social safety net are the threats most looming on my horizon. I fear them more than I fear rising prices. I can get by on beans and rice, but my mortgage has got to be paid in cash.

My heart goes out to people caught in your situation.

I’ve been there, so I surely know what it feels like.

Just remember, what’s happening to you is not your fault. There are structural factors at work which are far greater than you, and which you have no control over.

What more can I say? God bless you and your family, and I wish you the best of luck, and hope your situation improves rapidly.

And if you’re succeptible to bouts of depression like I am, get mad. Don’t get down and out.

Forgive my defensiveness, and thank you for your kindness and good wishes. I had 19 solid years of good employment and now….It’s troubling.

“If one were to have set out to intentionally design a system to penalize the poorest and reward the richest, he or she could not have done a better job.”

What do you mean “If” ?

Forget rents, real estate brokers in New York are partying like it’s 2005. And maybe it is, in which case we’re looking at stock market crash two years later, so is it Christmas 2015 or 2016?

Telecom? Don’t get me started. Choosing between Time Warner and Verizon is not unlike choosing between gallows pole and ‘lectric chair. That is, when you have a choice, which I don’t – must stick with Time Warner.

But in basic stuffs, that’s another picture. Beer’s been $6 for years… until this very week at my favorite watering hole, it’s now $7… but I can stomach that, the place is bloody good and cheap anyway. And I swear Heartland Brewery used to sell theirs for $8, and I recently went there and it was $7.

Meat prices have moved sideways over the last 5 years at least. Ditto milk, eggs, and bread. As I’m sure have been the incomes of the people who produce and sell this stuff. Gasoline’s been up and down, but still cheaper than 2008.

What we’ve had over the last 5 years is another asset bubble, just like Ilargi says. This is the worst kind of inflation, which does not reduce the debt burden nor rebalances the economy, it only pulls income to the top. Hence the boom in NYC, where a lot of the global top is.

Bernanke is a hero.

“Crimes are made innocent, even virtuous, by their number and nature; hence public robbery becomes a skillful achievement and wrongful seizure of a province is called conquest. Crime has its heroes no less than virtue has.” – La Rochefoucauld

Dr. Hussman is a great teacher. One can learn a lot from reading his weekly columns.

But as long as he’s shaking his fist and hurling feces at the rising market, it likely will carry on rising.

It’s only another 12% rise to reach the fat round number of 2,000 on the S&P index. Pump that Bubble!

Great piece. Summarizing several other articles which I’ve recently read. It is overwhelmingly clear now that overt policy (in stark contrast to the dual mandate rubbish and other press releases) is that the fraud and looting will continue. Reform will take a back seat, while they continue throwing more money at known criminals. They are too far down the credibility rabbit hole to reverse course at this point. Hell, watch the gold market and it becomes clear that this entire charade is nothing more than an all-out effort prop up institutional failures and an economy now based on fraud. It’s all connected, and it’s all a giant Ponzi scheme based on misinformation and a compliant populous which is apparently still willing to hold out for their piece of government cheese, or in the case of the wealthy few, some really nice asset inflation.

FYI, claims per deliverable ounce at the COMEX now up to 63, which brings me back to an article by Rik Green a few days go.

“All I want for Christmas is for just 10% of the December contract holders to stand for delivery and publicize when the COMEX forces them to settle for cash instead of bullion. This charade has gone on long enough!”

Actually just 5% would do. LOL!

I could nitpick here and there with some of the points made in the article but I think that the basic tenant is a baby which shouldn’t be thrown out with the bath water.

Namely, in the sort of dynamic we’re living through right now, sooner or later (and you can’t tell exactly when only that, like Ilargi points out, it’s always a case of “when” not “if”) in comes a girl and her dog who pulls back the curtain and the show is over.

Changing the subject, back to a point made by Yves in the overview, it is interesting to study and dissect the gender stereotyping which is accompanying Yellen’s impending installation. The MSM coverage I’ve seen is certainly heavy on the “Earth Mother” figure implicit characterisation. The unseemly rush to assume that, being female, Yellen will be more “caring” — without any supporting evidence — is gender bias and not in a good way. If it were true, I’d be happy. But past actions don’t suggest that it is particularly true. Certainly not to any significant degree. It is unlikely that anyone gets to the position that Yellen has got to without an element of ruthlessness. It just goes with the territory.

And yes, positive stereotypes are a treacherous double-edged sword. In the wake of the most recent Olympics, many agencies — not least the UK government — sought to big up the achievements of the successful Paralympics medal winners. Now, there’s nothing wrong in principle with acknowledging when individuals have overcome some physical adversity or other. But when the people bestowing admiration are simultaneously attempting to cut a social security budget and specifically targeting disability benefits then suddenly the notion that “any and all disabled people are superhuman” has an altogether different implication. After all, if you have a disability but then some disabled are demonstrably able to triumph over this, the nudge theory is that all disabled people should too.

Beware then self serving positive messaging. Not that I am suggesting a pervasive victim mentality for any and all minorities. More that when you encounter it, you consciously evaluate who is pushing that agenda and what their motivation is.

More that when you encounter it [positive -sterotype- messaging], you consciously evaluate who is pushing that agenda and what their motivation is.

Right! No Left! D’oh,Spot On!As Yves said two months ago, “It’s important not to labor under any delusions about Janet Yellen,”

http://www.nakedcapitalism.com/2013/09/why-you-should-not-be-enthusiastic-about-janet-yellen-as-fed-chairman.html

And also Hugh, “Yellen is a highly placed officer in an institution critical to looting us…she still works for and upholds a system at war with the needs, wants, and dreams of most of us.”

As Dean Baker said, “The problem is that the Federal Reserve Board and the economics profession as a whole functions more like a fraternity than a real forum for debate and truth seeking. Those whose views are taken seriously mimic the views of those with status and power within the profession, they do not think independently.”

The ridiculous gender-typing around Janet Yellen reminds me of a conversation I had just yesterday with my neighbor who was lamenting Obama’s failures and arguing that Hillary would be better. When I said she was just the same sort of neo-liberal he replied that at least she didn’t have cojones. What? ROFLOL! She has the biggest set in town.

To determine inflation, I look at purchasing power of households. This means looking at household disposable income and comparing it to reported CPI. Since it has barely budged while the CPI is still existent, this means a loss of purchasing power.

How can you get inflation while velocity is low? Capacity destruction or obsolete capital can do that. This is what you get after decades of printing and malinvestment. Since we are basking in a TBTF environment, for me it is clear that we are entering the hockey stick mode of capacity destruction.

After 5 years of propping up and recovery, I believe we are due for a slowdown. Margins are at an all-time high… this means there is room to cut. As the economy weakens, I would not be surprised to see margin compressions and layoffs which would still give us the appearance of deflation. I say appearance because behind all this will be a loss of purchasing power which will be masked by boomers retiring.

We should expect a surge in bankruptcies and more M&A leading to an acceleration in TBTF. Therefore, more capacity destruction. This would be the last inning in this 30-yr interest rate cycle which would finally bring us into a new paradigm.

What is money?

Where do investors’ and banks’ profits come from?

Ex nihilo nihil fit!

All of finance has never been anything but a pyramid scam … a Ponzi!

Perpetual motion of finance is as impossible as making the goods we need to live out of money itself. ie. out of no thing.

It’s all imagination. And therefore it’s certainly not a suitable phenomenon to be mapped by physical Newtonian metaphors — like “velocity” or “quantity” — which require the idea of mass and only predispose the resulting thought construction to flounder in a swamp of misapprehension and error.

but by what laws, if any, does it operate? Or more precisely, by what laws do the forms it animates operate, since it, itself, is merely a type of mental energy?

I channel-surf on that nowdays staring out the window and the vistas surprise me. So surprising I’m speechless. I’m working on answers in “the Lab” and pretty soon it’ll all be there like Frankenstein. Then I’ll let it walk out the door so it doesn’t waste any more of my Youtube time. It cuts in to Youtube time and it’s better to check out things like old Led Zepplin songs than think about stuff like this.

Page is my favorite guitarist. His guitar part whether rhythm or a solo always advanced the song. And I always loved the way he and Plant would echo eachother. All too often in those ’70’s classic rock songs the guitar solo is a part just stuck in there.

Many very smart observers of the financial and economic system have been predicting some crash some time soon since we saw the basic outline of the response to the economic crisis, i.e., limited stimulus (to avoid melt-down) and feeding the finance sector indefinitely. Max Keiser, for example, predicted a certain crash to occur in March of this year–not even close!

But disaster has not happened–there have been no crashes, no serious bubbles crashes. Why? It looks to me like we have a series of small bubbles such that when one pops another one is born to take its place this keeps the money players and con-artists busy without causing more serious systemic risk. Also many of us miss the forest for the trees. This system, first of all, is not limited to the financial markets or prices on commodities or even jobs. This system is holistic and not limited to metrics seen in this article or any other we see here. We live in a complex culture that is growing in complexity as rational predictable systems break down and are replaced by emergent (coming out of situations) systems we haven’t yet discerned. We are hungry for a rational Excel spreadsheet view of the world when we have moved on to the “laws” of complexity and chaos. An indicator like employment might show that economic activity is down but, as I’ve seen in some countries, that’s not taking into account the informal economy which is growing by leaps and bounds, IMHO.

People expect the Fed to do “something” sensible that puts money into what we might call real investment but that can’t happen for a number of cultural and political reasons. Few people want the government or the Fed to choose which industries should prosper because, as a culture, we are deeply divided not just between left and right but within those classifications. This is why the administration and Congress can do nothing–not because they are particularly “bad” and corrupt as individuals but because the culture being what it is they have nothing else to do! How can you move in contradictory directions at the same time? And that’s who we are.

To sum up, the institutions we have cannot act in any other matter and act in narrow largely ineffectual ways not because Yellen or anyone else doesn’t care about people but because people don’t know WTF they want! We don’t know who we are or where we want to go–we just drift along confused and, increasingly, becoming marks for predators.

Few people want the government or the Fed to choose which industries

———

That’s why they want helicopter chutes for the masses or debt jubilee.

The thing is that we have to get away from consumer consumption and now focus on social assets. And debt jubilee or helicopter chutes would perpetuate the consumerism and the maintenance of the lifestyles that has led us into this mess.

You can only cut down so much. People are in debt these days not because they couldn’t help themselves and just had to redo their kitchen in stainless and travertine, but to put food on the table and the roof over their heads. The impact of two paychecks to one and one paycheck to none has been devastating to millions. Our response to this crisis has to entail giving those people and many who are at or below the poverty line remunerative work that pays the bills. Attacking consumerism is all well and good, but I think that only perhaps on in three households today are in that place–two-thirds are in survival mode. This is basic triage: first, deal with those most at risk of going under. That the whole Establishment approach has been ass-backwards since “trickle-down” became the dogma doesn’t change the need to help those in most need of help first. And their problem is not rampant consumerism.

Look at how the average Indian and Chinese live and look at how North Americans live. The difference in energy/resource consumption per capita is how much it could potentially shrink in N.A.

Will it? I think it has to. I think we are consuming too much energy per capita and we will be forced to cut. Will it happen overnight? Nope. We’re going to keep on pretending that there is more than enough. Unless, by a sleight of hand, we manage to keep the ROW in abject poverty and end up keeping all the resources for ourselves.

Or maybe I am completely wrong and there is more than enough energy for everyone to keep on increasing materialism on a global scale.

I believe in consumerism but not the American kind. I like to call it the massage economy.

“I believe in consumerism but not the American kind. I like to call it the massage economy.”

I could get on board with that :)

Energy, more than enough or not, explains nothing. It takes energy to move a car as well as to stop it. We use energy to air condition a room because it has a surfeit of energy in the first place making us want to cool it.

Only 1-5% of thermal energy in fossil fuel or enriched uranium emerges at the other end of the pipeline as a laser beam, or cool conditioned air, or 400 pounds of 50mph mom and kids. All the rest goes into purifying, conditioning and tailoring Power.

Energy supplies are unlimited. Energetic Order is very limited. Energy demand–what we use energy for, mainly, is to extract, refine, process, and purify energy itself. What permits Energetic Order (or Power-the capture and release of energy) to increase is is not input of high grade energy but the dumping of low grade energy. To increase power density–to produce more well ordered energy faster, in less space, one must throw away more energy faster. The key to Watt’s steam engine was the condenser, the cold side. It’s the temperature Difference that lets you extract useful work.

We can’t keep using inefficient systems (automobiles but also infrastructure arrangements etc) because of the “condenser ” problem.

“It takes energy to move a car as well as to stop it.” Then we should have a measure for “stops per gallon” in addition to miles per gallon.