By Zoltan Pozsar, Member of the Shadow Banking Colloquium, Institute for New Economic Thinking. Originally published at VoxEU.

Regulatory reform has focused on banks and how much liquidity and capital they should hold, rather than on the evolution of the broader financial ecosystem that banks are only a part of. However, understanding this ecosystem is imperative, as it can influence the types of activities banks engage in and the types of liabilities they issue.

The financial ecosystem can be understood on two levels: first, by profiling the institutions that modern banks interact with on both their asset and liability sides and the needs of these institutions (questions of “who” and “what”), and second, by identifying the global macro drivers behind these institutional needs (questions of “why”).

Risk Intermediation

Our analytical framework to understand what modern banks do is muddled by trying to draw parallels with what traditional banks do. Traditional banks engage in credit intermediation by issuing loans and insured deposits, linking ultimate borrowers with ultimate savers.

Modern banks do something quite different. Modern banks are dealer banks (Mehrling et al. 2013 ) that finance bond portfolios with uninsured money market instruments, and rather than linking ultimate borrowers with ultimate savers, they link cash portfolio managers and risk portfolio managers who in turn manage ultimate savers’ savings.

Cash and risk portfolio managers are ‘natural’ complements to each other. Cash portfolio managers are cash rich but ‘safety poor’ since they are too large to be eligible for deposit insurance. This drives them toward insured deposit alternatives such as collateralised repurchase agreements (or repos; see for example Pozsar 2011 and 2012 and Pozsar and McCulley 2012).

Risk portfolio managers, on the other hand, are securities rich but ‘return poor’ in the sense that they are mandated to beat their benchmarks. To that end, they employ the techniques of leverage, shorting, and derivatives.

In each and every one of these cases, risk portfolio managers repo securities out and cash in, and on the other side, cash portfolio managers repo securities in and cash out. Cash portfolio managers have their safety (thanks to the securities posted by risk portfolio managers as collateral) and risk portfolio managers have their enhanced return (thanks to the funding provided by cash portfolio managers in exchange for collateral).

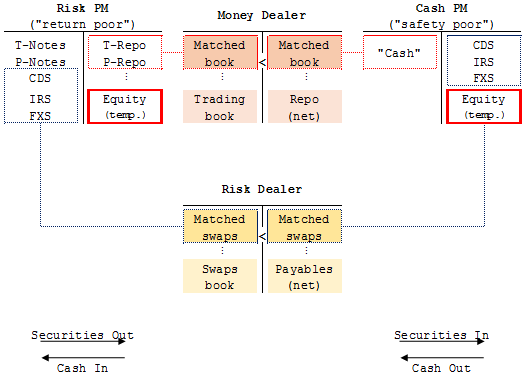

Dealer banks are intermediaries between risk portfolio managers and cash portfolio managers. Risk portfolio managers interface with dealers on the asset side of dealers’ balance sheets and cash portfolio managers interface with dealers on the liability side of dealers’ balance sheets. In this process dealers intermediate risks (credit, duration, and liquidity risks) away from cash portfolio managers and toward risk portfolio managers using repos and derivatives. This is risk intermediation (see Figure 1, and Checki 2009, Pozsar and Singh 2012, and Claessens et al. 2012).

Figure 1. Risk intermediation

Source: Zoltan Pozsar expanding on “Bagehot was a shadow banker” (Mehrling et al 2013).

Dealers and the Global Financial Ecosystem

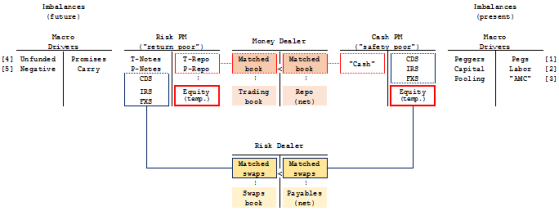

Turning to questions of ‘why’, the secular rise of cash portfolio managers seeking ‘safety’ and risk portfolio managers seeking ‘alpha’ has been driven by macro imbalances – both global and local, and present and future (see Figure 2).1

Firstly, the secular rise of cash portfolio managers (or institutional cash pools – see Pozsar 2011) can be attributed to three factors.

On the global level, managed exchange-rate arrangements vis-à-vis the US dollar explain the rise of cash pools at foreign exchange reserve managers (in the form of foreign exchange reserves’ so-called liquidity tranches to the tune of roughly $1 trillion), and the secular increase in capital’s share of income explains the rise of cash pools at the largest global corporations (to the tune of $1.5 trillion).

On the local level, the rise of cash pools within the asset-management complex (around $3.5 trillion) is explained by consolidation among asset managers and the secular rise of outsourced portfolio management, the centralised liquidity management of fund complexes, securities lending, and derivative overlay investment strategies.

These examples reflect imbalances in the distribution of present incomes – between countries with structural current-account surpluses and deficits, and between capital and labour – and that ever more individual savers’ portfolios are managed by ever fewer asset managers.

Secondly, the secular rise of risk portfolio managers (or levered investment strategies) reflects imbalances between the present value of future pension promises that exceeds the expected present value of unlevered, long-only investment incomes. This is the principal driver of the trend that pension funds and endowments allocate an increasing share of their portfolios to hedge funds and custom-tailored separate accounts at asset managers. In an ever-lower yield environment, asset managers resort to techniques of leverage, shorting, and derivatives – with an aim to enhance returns and avoid major portfolio drawdowns. They are all aiming to provide equity-like returns with bond-like volatility.

Foreign exchange reserve managers’ needs are somewhat similar to those of pension funds, for whom the maintenance of foreign exchange pegs is a negative carry proposition – the bonds issued to sterilise the exchange of foreign currency to domestic currency yield more than the foreign-currency bonds reserves are held in, which is a fiscal cost.2 To minimise these costs, reserve managers also employ the techniques of leverage, shorting, and derivatives – as well as securities lending – to enhance their returns.

Figure 2. Dealers and the global financial ecosystem

Source: Zoltan Pozsar.

Four Goals Shaping Dealers’ Balance Sheets

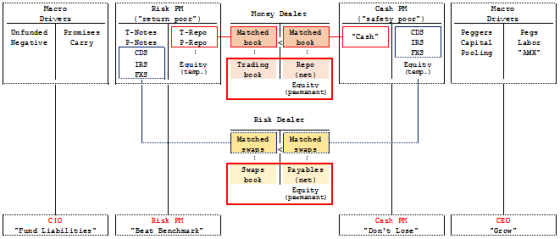

Thus, from a bird’s-eye perspective the modern financial ecosystem has five groups of players, each with a well-defined goal.

CIOs at pension funds, foreign central banks and sovereign wealth funds – the first group – are tasked with reducing their underfundedness. They do this by allocating more of their portfolios to hedge funds and separate accounts – the second group – whose managers (risk portfolio managers) employ leverage, shorting, and derivatives in order to beat their benchmarks.

Treasurers (or cash portfolio managers) – the third group – are tasked with not losing any money on the cash pools they manage. They shun credit, duration, and liquidity risks, and invest cash on a collateralised basis. Importantly, these cash pools are the byproducts of the decisions of sovereign and corporate CEOs – the fourth group – who are tasked with generating growth in the real economy and profits, respectively.

The goals of these market participants – asset-liability matching for CIOs, beating benchmarks for hedge funds (risk portfolio managers), liquidity at par for treasurers (cash portfolio managers), and growth for CEOs – represent nominal rigidities in the system that drive what dealers – the fifth group – do.

Dealers’ role is to make markets and intermediate risks away from cash portfolio managers and toward risk portfolio managers – enabling them to preserve their wealth in the present and to help meet their promises in the future, respectively.

Dealers for the most part engage in risk intermediation through their matched book positions, and only engage in risk transformation through their inventory positions (either in the form of a portfolio of securities or derivatives), which – as more than ‘just’ brokers – dealers accumulate through their market-making activities. These risk positions are the key determinants of dealers’ equity needs (see Figure 3).

Figure 3. Four goals shaping dealers’ balance sheets

Source: Zoltan Pozsar.

This is the broadest perspective in which we can understand the rise of the shadow banking system. It explains why it is misleading to think about credit, duration, and liquidity transformation, and more appropriate to think about the intermediation of these risks between cash and risk portfolio managers across the financial ecosystem and – by inference – the real economy. That is, credit to the real economy is extended either through dealers’ securities inventories or via credit intermediation chains that go from cash portfolio managers through dealers’ matched repo books to risk portfolio managers to fund leveraged bond portfolios.

A Three-Level Policy Problem

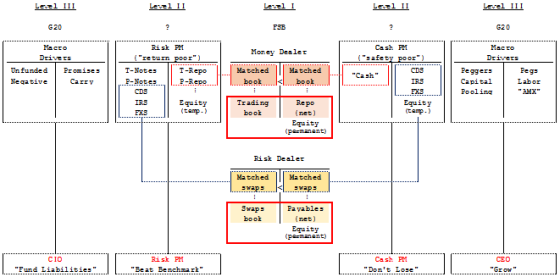

On the regulatory side, one can approach the financial ecosystem at three different levels: the dealer level, the portfolio manager level, or the global macro level (see Figure 4). To date, however, regulatory reform has mostly focused on dealer banks – their capitalisation, funding, proprietary trading activities, and separation from retail banking.

However, focusing on dealers only – while leaving risk and cash portfolio managers’ and their CIO and CEO masters’ needs unaddressed – will only shift problems around without solving them. Ultimately, the policy extremes are:

- Aiming to reduce the imbalances in present and future incomes, or

- Accommodating the system as it is by giving the dealers at its core access to official liquidity (dealer of last resort – see Mehrling 2010 and also Pozsar et al. 2010, Carney 2013, and Bank of England 2013).

In either case, the fundamental problem we are dealing with is a financial ecosystem that has outgrown the safety net that was put around it many years ago. Today we have new types of savers (cash portfolio managers versus retail depositors), new types of borrowers (risk portfolio managers to fund pensions versus ultimate borrowers to finance investments and consumption) and new types of banks (dealer banks that do securities financing versus traditional banks that finance the real economy more directly via loans) to whom discount window access and deposit insurance do not apply.

These twin pillars of the official safety net were erected around traditional, deposit-funded banks to address retail runs. In contrast, the crisis of 2007–09 was a crisis of institutional runs where cash portfolio managers ran on dealers, and dealers ran on risk portfolio managers. But importantly – as the examples above demonstrate – beyond the institutional façade of the ecosystem it is ultimately real wealth and promises that are at stake.

Therefore, if neither of the above policy options (that is, shrinking imbalances or broadening the safety net) are palatable, the third option is to offer partial solutions and to recognise that the ecosystem’s existing needs will be met by new structures that need to be understood and monitored to avoid new systemic excesses.3

However, we cannot monitor what we don’t measure. The Flow of Funds accounts don’t address the measurement of the ecosystem described above.

Figure 4. A three-level policy problem

Source: Zoltan Pozsar.

We Cannot Monitor What We Do Not Measure

The Flow of Funds have been designed to show who borrows, who lends, and through what types of instruments. However:

- It offers no hints as to the asset–liability mismatches at pension funds and foreign exchange reserve managers;

- It does not cover hedge funds and separate accounts, which make up an increasing share of institutional investors’ portfolios;

- It does not provide a breakdown of dealers’ matched repo books to gauge the volume of funding passed on to hedge funds and asset managers, or the purpose of that funding – whether it was to fund a bond position, to post cash collateral for securities borrowed, or to raise liquidity for margin.

Moreover, the Flow of Funds accounts end where derivatives begin – derivatives effectively separate the flow of risks (credit, duration, and foreign exchange risks) from the flow of funds – and hence looking at exposures to bonds without looking at accompanying derivatives makes the Flow of Funds accounts’ usefulness somewhat limited. Furthermore, without a sense for these measures, our ability to understand asset price dynamics is also limited.

To improve on this, the Flow of Funds accounts should ideally incorporate measures of structural asset–liability mismatches, and be augmented with a set of Flow of Risks satellite accounts and a set of Flow of Collateral satellite accounts in order to tabulate the types of collateral that back the flow of funds and risks across the ecosystem.

Disclaimer: The views expressed here are those of the author and do not necessarily represent those of the institutions with which he is affiliated.

Author’s note: I am grateful to Elena Liapkova-Pozsar for very helpful discussions and comments on earlier drafts.

References

Bank of England (2013), “Liquidity insurance at the Bank of England: developments in the Sterling Monetary Framework”, October.

Carney, Mark (2013), “The UK at the heart of a renewed globalisation”, speech at an event to celebrate the 125th anniversary of the Financial Times, London, 24 October.

Checki, Terrence J (2009), “Beyond the Crisis: Reflections on the Challenges”, rxemarks at the Foreign Policy Association Corporate Dinner, New York City, December 2.

Claessens, Stijn, Zoltan Pozsar, Lev Ratnovski, and Manmohan Singh (2012), “Shadow Banking: Economics and Policy”, IMF Staff Discussion Note 12/12.

Mehrling, Perry (2010), The New Lombard Street: How the Fed Became the Dealer of Last Resort, Princeton University Press.

Mehrling, Perry, Zoltan Pozsar, James Sweeney, and Daniel H Neilson (2013), “Bagehot was a Shadow Banker: Shadow Banking, Central Banking, and the Future of Global Finance”, working paper.

Pozsar, Zoltan (2011), “Institutional Cash Pools and the Triffin Dilemma of the U.S. Banking System”, IMF Working Paper No. 11/190.

Pozsar, Zoltan (2012), “A Macro View of Shadow Banking: Do T-Bill Shortages Pose a New Triffin Dilemma?”, in Franklin Allen, Anna Gelpern, Charles Mooney, and David Skeel (eds.), Is U.S. Government Debt Different?: 35–44.

Pozsar, Zoltan and Paul McCulley (2012), “Does central bank independence frustrate the optimal fiscal–monetary policy mix in a liquidity trap”, Global Society of Fellows Working Paper 26.

Pozsar, Zoltan and Manmohan Singh (2012), “The Nonbank-Bank Nexus and the Shadow Banking System”, IMF Working Paper 11/289.

Pozsar, Zoltan, Tobias Adrian, Adam Ashcraft, and Hayley Boesky (2010), “Shadow Banking”, Federal Reserve Bank of New York Staff Report 458.

1 Excess returns can come in two basic forms: pure alpha (through smart portfolio selection, market timing, and hedges) or alpha masquerading as levered beta.

2 Unlike foreign exchange reserves’ liquidity tranches discussed above, this section refers to foreign exchange reserves’ long-duration segments, where search for yield is more prevalent.

3 Partial solutions include increased Treasury bill issuance or access to the Fed’s full allotment reverse repo facility to absorb some of cash portfolio managers’ money demand. However, these policy measures only address cash portfolio managers’ needs, but not those of risk portfolio managers.

So the existence of derivatives is like the design of Fukushima, totally insane from a long term view but marketed into existence to meet the short terms financial goals of some global plutocrats.

Our species is showing a serious lack of enlightened evolution. It seems to be bringing us to the edge of extinction, one way or another.

And we all wonder, How did the Mayans know this? ;-)

This analysis relies solely on an exogenous money creation theory — the neoclassical loanable funds model. To wit:

While this may be a partial truth, most of what commercial banks do, as Michael Hudson puts it, is to “make money out of thin air by the stroke of a keyboard.”

Pozsar fails to redeem himself as he continues:

Once again, what Pozsar regurgitates here is just another manifesto of the neoclassical loanable funds model.

I think folks like Hudson, Steve Keen, and the MMT crowd, and especially Stephanie Kelton with her “hierarchy of money” theory which has a place for both bank-created and government-created money, come much closer to the reality of how banks and money work than what folks like Pozsar and Paul Krugman with their neoclassical theories do.

Even though Naked Capitalism has published several posts on endogenous money creation, I think the following lecture by Steve Keen titled “A Primer on Endogenous Money 1” does a great job of explaining it:

http://www.youtube.com/watch?v=YKDicjsiHrY&feature=player_detailpage#t=602

In another Keen interview, he compares folks like Pozsar and Krugman with the Ptolemaic school:

http://www.nakedcapitalism.com/2012/04/keen-vs-krugman-cage-match-will-there-be-a-round-2.html

And in addition to building his house of cards on a questionable loanable funds theory foundation, he also (again, as per the neoclassical script) meanders around completely ignoring (or seeing but omitting) the agency problem.

By which I mean, he assumes that all agents in the construct illustrated in the feature are acting a) rationally and b) honestly.

Sometimes they don’t act rationally — e.g. pretty much every western financial institution you can think of piling into sub-prime when it was clearly a bubble.

And even more often, they are acting fraudulently e.g. CDO originators stuffing their securities with known toxic crud.

Then there’s the neither technically, to the letter of the law if not the spirit, dishonest nor plainly irrational (indeed, they are by some measures very rational, if completely immoral) who are nevertheless socially destructive like Magnetar. They play the system, amplify it’s structural issues and don’t give a stuff if they blow the whole lot up.

Pozsar’s heart is in the right place. But insisting on looking at today’s dynamic through yesterday’s lens (while, oddly, pointing out how it’s all changed since earlier theories were devised) is like diagnosing an outbreak of illness in a cohort being caused by “crowd poisoning” many years after the discovery of carbon dioxide’s harm-inducing concentration threshold.

Clive and from Mexico are a bit like a building architect who throws out a set of decent drawings for a building because they are based on Newtonian and not relativistic physics–the difference between the two models of reality hardly matters for purposes of the project in question. It also makes it easier to discard the whole post rather than sort through the relatively large amount of technical detail in it.

However there are a set of analytical concepts in the post that are valuable for anyone trying to make sense of modern finance and that do not depend on whether money is endogenous or exogenous, such as the intermediation role that dealer banks play between cash portfolio managers and risk portfolio managers, and that derivatives enable risk to be divorced from fund-flows, and that monitoring these aspects of the system requires data capture and reporting of these aspects of the system.

Well even if I bought into your assertion that a faulty theory of money is unimportant to the issues Pozsar addresses, which I don’t, I think I would still prefer an architect who doesn’t believe the earth is flat or the earth revolves around the sun.

Oops!

or the sun revolves around the earth

JC,

But why place faith in the analysis of anyone who claims to believe the financial system “outgrew” its regulatory framework rather than that the regulatory structure was attacked and destroyed by the very entities Regulated?

I am not making a theological commitment to Zoltan Pazsar. I only trust the author to the extent I can see what he thinks, but at least he appears to be someone who does not buy the neoclassical crap about self-regulating markets.

@ from Mexico

Anybody speaking the language of ‘neoclassical economics’ deserves to be censored, beaten, incinerated, and expelled off planet earth. Right? Well, I’m glad were all agreed on that. Sort of. Meanwhile, I read Zoltan Pozsar’s article, and somehow it explains much about about shadow banking. The guy has some good ideas, along with a few highly impure thoughts (such exogenous money creation).

So I have a question for you. Is it okay to drink from an ideologically impure well? I’ve even got one of Ken Rogoff’s books on my shelf, and he is much worse than Zoltan. Do we need to be ideologically correct in what we consume?

I don’t buy into the relativist or construcivist epistemology that all knowledge is ideologically constructed.

“that all knowledge is ideologically constructed”

Bravo Mr Mex Bravo

skippy… the changelings out there are working overtime… methinks.

“The new America is fast becoming a vast ghetto in which all of us, conservatives and progressives, are being bled dry by a relatively tiny oligarchy of extremely clever financial criminals and their castrato henchmen in government, whose main job is to be good actors on TV and put on a good show.” – Matt Taibbi, Griftopia – A Story of Bankers, Politicians, and The Most Audacious Power Grab in American History

Why is the vampire squid smiling?

Measuring the shadow banking industry…

The size of the shadow banking system is hard to measure because of its hidden and impenetrable nature. Economists at the University of Pisa in Italy have developed a way of determining the size of the shadow banking system, using the emerging discipline of econophysics.

By this measure [Shadow Banking Index], the shadow banking system is significantly bigger than previously thought. They estimate that in 2007, the year before the financial crisis, it was worth around $90 trillion. This fell to about $70 trillion in 2008 but has since risen sharply to be worth around $100 trillion in 2012.

“The True Size of the Shadow Banking System Revealed (Spoiler: Humongous)” @

https://medium.com/the-physics-arxiv-blog/5e1dd9d1642

“Shadow Banking and Financial Instability,” Lord Adair Turner, now former Chairman, United Kingdom Financial Services Authority, reviews what is known about shadow banking, how to best define it and the range of possible policy responses .

“Any system this complex will defy complete understanding and any belief that we can precisely calibrate our response to it will therefore be a delusion. Given the enormous cost which instability can produce, and given the uncertain benefits which this complexity has delivered, our regulatory response should therefore entail a bias to prudence – a bias against complex interconnectivity, against procyclical market contracts, and against allowing maturity transformation or high leverage to develop in unregulated institutions or markets.”

http://blogs.law.harvard.edu/corpgov/2012/04/16/shadow-banking-and-financial-instability/

However, shadow banking has not been brought under regulatory oversight. Instead, the shadow banking system is significantly bigger and pushing the system closer to disaster. The banksters and their Washington poodles have made mincemeat of Dodd-Frank.

“Dodd-Frank is groaning on its deathbed. The giant reform bill turned out to be like the fish reeled in by Hemingway’s Old Man – no sooner caught than set upon by sharks that strip it to nothing long before it ever reaches the shore….It’s bad enough that the banks strangled the Dodd-Frank law. Even worse is the way they did it – with a big assist from Congress and the White House.”- Matt Taibbi, Rolling Stone, “How Wall Street Killed Financial Reform”

As Hugh often says, “Kleptocracy along with wealth inequality and class war define our times.”

The issue you raise is the one that renders Krugman, this fellow, and virtually all mainstream economists irrelevant, and that is the culture of criminality pervading today’s uber-financialized capitalism where “getting caught” doesn’t mean going to jail, it means your firm is bailed out, then stuffed with free money for 5 years.

We are all gonna get rich!

Lucky for us, the Lizard People Mother Ship has been beaming Dark Wave Polarization beams at the earth helping to drive this system forward by forcing a greater spread between “cost of money” and risk asset value.

They have a Special Knob on the Mother Ship they call “inflation target”. Just set it on 0,1,2,3,4,5,etc.. and the earth system adjusts accordingly.

Praise be the Lizard People!

God almighty this is complicated. I can’t believe anybody can understand this. Where’s Mr. Dittmer. I’ll trust him to explain this, but I won’t trust anybody I don’t know. Didn’t the NC Fundraiser bring in enough money to hire him to explain things once a week? how much money does he want? I’ll kick in a few bucks.

It looks to me like the money’s being thrown around willy-nilly and if it doesn’t stick they go back to the govermint for more.

Shouldn’t there be a box and line on this graph for the Govermint? Hovering over everthing like a gigantic UFO with a 1/2 inch thick black arrow pointing in one direction, down toward the entire chart.

You can also call it The Mothership and credit CB if you don’t want to call it the Govermint, since that would be socialism. And if somebody has a senser of humor they can draw a few reptiles like a cartoon in the boxes where the money goes.

If I weren’t already a craazywomaan before I read this article, I am now! I just saw a great funnel hoovering up all the wealth from pensions into the maws of the banks via the shadow banking system. Yeah, yeah, yeah! Please translate this article and I will gladly read it again.

The main point of the article is that the current set of financial regulations are based on a poor model of the financial system.

The model is poor because it ignores the different goals, strategies and investment structures that different types of portfolio managers have, and the way that dealer-banks intermediate those differences. A lot of this occurs in the “shadow banking system,” which includes derivatives and repos, and there is little to no collection and reporting of what occurs in the shadow banking system, so it is difficult to analyze much further empirically, let alone properly regulate.

One has to ask more about the system rules about why this model has been constructed versus calling for more information about its decay.

And really, how many of us are struggling with the summary point that “that the current set of financial regulations are based on a poor model of the financial system.” This is pretty apparent.

No, I think Don & JEHR have stated it (co-option of language). Locating Shadow Banking in the greater ecology of banking might have been a more fruitful start as we have over 40 million in this country along who are “unbanked” or use fringe banks (jargon for payday lenders).

Again, I do not see this as an intrusion by environmental science as much as I do an appropriation by financial experts of a few ecological concepts with which to draw an analogy or paint a picture. It is very limited.

More Urie Bronfenbrenner, less Neoclassical Economics.

John Mc:

“One has to ask more about the system rules about why this model has been constructed versus calling for more information about its decay.”

Sorry, what does this mean?

“Locating Shadow Banking in the greater ecology of banking might have been a more fruitful start as we have over 40 million in this country along who are “unbanked” or use fringe banks (jargon for payday lenders).”

“Shadow banking” doesn’t generally refer to what you call “fringe banks,” or any sort of retail activity, other than perhaps money market funds. The term refers to non-bank flows of credit primarily via repos and derivatives.

“One has to ask more about the system rules about why this model has been constructed versus calling for more information about its decay.

Sorry, what does this mean?”

The authors’ thesis of two levels: a)global macro-drivers and b) the needs of new institutions (i.e. modern banks) hardly comprise a global financial ecology. This narrow interpretation ignores more relevant system themes. Especially since, macro-drivers that do not include endemic fraud, game theory and financial innovation are openly misunderstood by all sorts of professionals. Who is included in this dialogue? Who is not? The issue is who has the power to create these systems, and why?

“‘Shadow banking’ doesn’t generally refer to what you call ‘fringe banks,’ or any sort of retail activity, other than perhaps money market funds. The term refers to non-bank flows of credit primarily via repos and derivatives.”

I realize this. My point is that the author makes a distinction between modern and traditional banking practices, while specifically not addressing one of the largest inequities of most people in America – fringe banking. Surely, paydal loan industry bottom feeders are a part of the global financial ecology with nearly tens of millions of Americans unbanked? One financial system is predatory. Another system (shadow banking) is mostly hidden. What does this say about the those who constructed it?

I think all that is needed is a small fix to the article title.

From:

Shadow Banking and the Global Financial Ecosystem

To: Shadow Banking in the Global Financial Ecosystem Metaphor

Or because the prefix “neo” allows much modification of whatever word follows as the suffix, Financial Neo-Ecosystem

At the risk of being ridiculed I have a Ph.D. in History, have done enough good work to get elected a Fellow of the Royal Historical Society, and studied International Political Economy in grad school, and I still haven’t got a clue what this guy is talking about. He defines NONE of his terms. He prattles on to what can only be an international audience in the hundreds who know precisely what he is saying. It is as if he is deliberately trying to lose his reader. Or is he so obtuse as to think that everyone knows what he is talking about.

I was taught that when I introduced a new idea, I was obliged to clue the reader in. How he thinks this article is going to further the cause of putting pressure on those who control the shadow banking system so that it can be understood, measured, and regulated I can’t guess at.

His audience is people who understand what he is talking about.

here’s the site it was cross posted from

http://www.voxeu.org/article/global-financial-ecosystem-0

It is the most concise summary* I’ve seen of what is called “shadow banking”. It is a short post, so there would be lots more detail to add, if you wanted to write a book – but he just describes the main moving parts, then makes some conclusions about there is little quantitative data here and the Fed Flow of Funds report completely misses the point of describing what is going on.

*I’ve been reading about it in little bits and pieces as it came dribbling out over the last 5 years.

Let’s say I’m describing the action that took place between the British battlecruiser Renown and the German battlecruisers Scharnhorst and Gneisenau on April 9, 1940. It’s my job to explain to the reader what a battlecruiser was, what was the size, speed, and armament of the three ships, what their commanding officers where trying to do, and under what circumstances. This can all be done using the English language. The above does no equivalent job of explaining any facet of what the author is talking about. It is obfuscatory horseshit, not an attempt to inform readers of what the hell he is saying. It is the intellectual equivalent of jerking off (or to be generous, showing off–see all the cool obscure jargon I can cram onto the page; see how stupid I can make the non-initiates feel!).

Agreed. He’s writing to policy people. I understood everything he was talking about. VoxEU is a specialist blog and academics and people who are serious regulators and at major institutions are among the people who post there.

Basically, if you don’t already understand sovereign wealth funds, corporate treasurers, and pension funds do, you aren’t in the target audience for this piece.

And blogs aren’t newspapers. Felix Salmon said one of the reasons he preferred blogging to being a journalist was he didn’t have to say “Ben Bernanke, the Chairman of the Federal Reserve”. He could just say “Bernanke”. He (and blogs generally) write for niche audiences.

Since the people in the know have done such a terrible job of understanding and fixing these problems, perhaps it is time to inform educated outsiders who are on your side what is going on in non-specialist language. This is not calculus and the fact that economists like to hide behind impenetrable jargon is part of the reason we are where we are.

I couldn’t agree more, which is why I am so irritated by folks dismissing this piece because it does not scream “endogenous money” from the rooftops rather than trying to understand it on its own terms.

I have passed your plea on to him. Andrew is helping Harvard fix how it teaches calculus, which is keeping him very busy.

wow. they’re still struggling with teaching calculus after 300 years. Holy Smokes.

All kidding aside, the post above is a pretty good depiction of the anatomy.

Since you’re a celebrity, can you get Russell Brand to play Captain Jack Sparrow in the next Pirates of the Carribean? I’ve written a treatment for a screenplay and it’ll be a blockbuster of progressive inspiration. We can figure out how to bring the diagrams in this post into the movie when the filming starts.

Are shadow banks and credit default swaps Wall Street’s

method to circumvent regulation? “If we don’t call it insurance then it can’t be regulated as insurance.” Keep the (unconventional) banking invisible and it won’t be regulated either.

Yes, yes, and yes.

Two major problems here. Agree with craazyman above, the complexity prevents a vast majority of readers access to material. Well, I suppose I suck it up and read more, look up the corresponding financial concepts and start to peruse his references as I have a background in human ecology. But, is this not how neoclassical theory has tended to introduce concepts – using complexity and wordsmithing?

Also, I am less enamored with the teaser in the title (Global Financial Ecosystem). This is hardly a complete systemic analysis of the financial ecosystem, but more of a loose framework to discuss shadow banking using a few concepts. The limits of the topic prevent in 7-8 paragraphs should be taken into consideration. While false advertising is in research articles occurs quite a bit, this particular venture is distressing for three reasons:

1) Global Financial Ecosystem – opaque and incomplete

2) Game Theory & Control Fraud – system rules omitted

3) Neoclassical Summary – measure/monitor emphasis

4) Fill in the blank ________________________

I do appreciate multiple level analyses and an admission that multiple systems (often interlocking) are providing hidden inputs and toxic outputs (risk, homeostatis, feedback loops, and balance sheet maladaptions). However, the financial ecology in this article needs more explanation, clarity and description.

Dealers for the most part engage in risk intermediation through their matched book positions, and only engage in

risk transformation (transformation? magic trick)

through their inventory positions (either in the form of a portfolio of securities or derivatives), which – as more than ‘just’ brokers – dealers accumulate through their market-making activities. These risk positions are the key determinants of dealers’ equity needs (see Figure 3).

Above, the ‘risk transformation’ sounds like a magic trick….now you see it and now you don’t.

Neo-classical Economics as a Stratagem

against Henry George

Mason Gaffney

“To most modern readers, probably George seems too minor a figure to have warranted such an extreme reaction. This impression is a measure of the neo-classicals’ success: it is what they sought to make of him. It took a generation, but by 1930 they had succeeded in reducing him in the public mind. In the process of succeeding, however, they emasculated the discipline, impoverished economic thought, muddled the minds of countless students, rationalized free-riding by landowners, took dignity from labor, rationalized chronic unemployment, hobbled us with today’s counterproductive tax tangle, marginalized the obvious alternative system of public finance, shattered our sense of community, subverted a rising economic democracy for the benefit of rent-takers, and led us into becoming an increasingly nasty and dangerously divided plutocracy.”

“Once a paradigm is well-ensconced it becomes a power in itself, a set of reflexes to sort the true and false.”

“Here are some dismal dilemmas that neo-classicals pose for us today. For efficiency we must sacrifice equity;

to attract business we must lower taxes so much as to shut the libraries and starve the schools; to prevent inflation we must keep an army of unfortunates unemployed; to make jobs we must chew up land and pollute the world; to motivate workers we must have unequal wealth; to raise productivity we must fire people; and so on.”

“George showed that a tax can be progressive and pro-incentive at the same time. Think of it! An army of neo-classicalists preach dourly that we must sacrifice equity and social justice on the altar of “efficiency”. They need that thought to stifle the demand for social justice that runs like a thread through The Bible, The Koran and other great religious works. George cut that Gordian knot, and so he had to be put down.”

“JOHN B. CLARK

No single figure personifies the change from classical political economy to neo-classical economics, but J.B. Clark exemplifies it. His aim was to undercut Henry George’s attack on landed property by erasing the classical distinction of land and capital. His method was to endow capital with a Platonic essence, a deathless soul transcending and surviving its material carcass. Some characterize Clark’s concept as “jelly capital”, some as “plastic,” some as “putty,” but those concrete images rather trivialize the abstract, even spiritual element, and the power of mystical traditions he could marshal to support it. There was an element of reincarnation, evoking Hinduism, transcendentalism, and Rosicrucianism. Clark even uses “transmutation,” evoking alchemy. Capital was an immaterial essence, a spiritual thing, that flowed from object to object.

There is nothing inherently mystical about noting that capital turns over:

every storekeeper and banker experiences that routinely. A remarkable quality of Clark’s capital, however, is that it can ooze (“transmigrate,” in Clark-ese) into land, becoming land itself. That is the only apparent reason for the mysticism, smoke and mirrors.

Clark’s capital being deathless it is just like land, and theorists after Clark have made land just another kind of machine. The economic world was thenceforth divided into just two elements, labor and capital. “…that destroys the equality of capital to accumulated savings, and dismisses all Ricardian and Malthusian problems in one fell swoop” (Tobin, 1985). He might have added, it dismisses all Georgist, conservationist, spatial, temporal and environmental questions. It put blinkers on economic theorists which they wear to this day.”

Ecosystem refers to the interaction among biological life forms. Use of the term “ecosystem” as applied to finance networks reflects the extent to which finance has impregnated language, having thus become increasingly hegemonic.

If you thought about it for a moment, you would see that this is actually evidence of the degree to which environmental science has “impregnated the language.”

In a world where big predators are the most threatened of extinction, the concept of finance as predatory is merely a metaphor, suggesting nothing biological.

I agree, don. An ecosystem is a healthy thing (when not blasted by man’s development) and provides the means for sustenance of life forms both big and small. The Financial “ecosystem” is a death form–death to equality, death to the middle class, death to a healthy environment and death to a healthy society.

This article proves only that language it being co-opted for the use of the wealthy elite!

But think of it al, both financial and biological, as economies of limited resources. ‘Ecosystem’ is the best word. Because if you say something like ‘Finance System’ it’s just kind of a circular argument. But not a circulation of resources.

One of my favorite Naked comments was by a biologist making a point about efficient use of critical resources. He used the example that in an amoeba colony, if a handful of neo capitalist amoebas hoarded all the adenosinetriphosphate the rest of the colony would fail. To my thinking finance can be reduced to something just this simple – but on an enormous scale.

remember in an ecosystem animals are eating other animals every day. so that means it’s cannibalism when there’s a human financial ecosystem. people don’t think about it like that since they think about ecosystems like they’re a place Bambi lives in immortal bliss.

the ecosystem metaphor came from library scholars and university classroom types. If they got out there like Cornell Wilde in Naked Prey they wouldn’t think about ecosystems, they’d think about civilization. hahahaha

faaaaaak they’re boneheads — every one of them — there in the library with the books piled 2 feet high, not even understanding the meaning of the words.

If it’s a shadow banking system, where does the shadow come from? something has to cast the shadow. maybe it’s Pontius Pilate in the sun.

For argument’s sake, let’s throw endogenous money into the picture. Now you have dealer-banks performing the shadow banking intermediation of risk and cash portfolios without being constrained on the asset (lending) side of the balance sheet. OK, what do you get?

You get what we have: a shadow banking system that periodically blows up when dealer-bank credit officers decide they’ve had enough of inflation of the price of financeable assets, the dealer-banks stop lending, swapping and repoing those assets, the music stops, assets crash, banks take them, and the global inherited rich have once again swapped fiat currency with real assets.

Just because Zoltan Pozsar doesn’t focus on endogenous vs. exogenous money doesn’t mean he doesn’t have something interesting to say about what’s going on. It is intellectually lazy to use that as an ideological litmus test and it does no service to the MMT cause to dismiss thoughtful arguments that happen to disagree with that point.

You get a very good explanation of what we had happen in the GFC. Including gaming and fraud because, after all, this is in the shadow and not measurable easily so even if we had regulators that wanted a look see, they have a hard time putting together a picture.

Then by definition, the financial intermediaries cannot access systematic risk, or even the risk of what they are trading in because it’s invisible – so their decision making is crap. When they finally realize it’s crap we get what the author calls the “institutional run on banks”.

Then the only limit on the system is a 3% capital ratio, and capital is exceedingly difficult to price accurately, or the price changes. So the foundation is extremely wobbly. Then there appears to be no limit to the amount of “insurance” type products you can create(supposedly to hedge risk) because of no cash holding requirement there.

This is anything but neo-classical economics. All economics has fallen far short of describing the present system.

The other point the author makes is our idiot Fed thinks that feeding this system creates jobs! Or so they say.

s/b financial intermediaries cannot assess systematic risk

Also, consider subprime and securitization – here we have “bank money” fueling credit creation that was securitized and used as “risk assets”. Same with ABS securitization of everything from credit cards to car loans.

Yikes – our “Capital” is all fake!!!!

Are we entangled, or am I crazy?

Money isn’t a direct resource, but it is a vital meta resource. If we could account for resources without the money – if we could get rid of “price discovery” stuff altogether – because we have very sophisticated stats now telling us much more than this medieval protocol – then the shadow banking system, based on hysteria and swaps and hot potato risk trades, would settle way down. Steve Keep has got to be the world’s most compulsive economics analyst… if he can reduce a lot of this stuff to differential equations that sometimes do not zero out in double entry bookkeeping ledgers what does this tell us about our control of vital resources?

that is Keen…. but he does Keep Keen track of the logic of it all.

The Risk Evaluation Tools and the Systems they enable – remind me of the alien walkers in War of the Worlds.

skippy… picking up humans and fertilize the orb with their essence, a crop to be harvested.

Yves above is at pains to explain that this analysis has as its audience the highly technical experts in various banking or financial regulatory positions. I expect that explains why this statement:

“In either case, the fundamental problem we are dealing with is a financial ecosystem that has outgrown the safety net that was put around it many years ago.” is unexamined nonsense his rarefied audience lets pass without the tiniest tick of eyebrow.

Terming illegal or theoretical scams “financial innovations” of no use to “meet the needs” of this or that portfolio manager until made legal through complete regulatory capture is to drink deeply from the official myth-making meade. Or better, when the author sets out:

“Ultimately, the policy extremes are:

1) Aiming to reduce the imbalances in present and future incomes, or

2) Accommodating the system as it is by giving the dealers at its core access to official liquidity (dealer of last resort – see Mehrling 2010 and also Pozsar et al. 2010, Carney 2013, and Bank of England 2013).”

Option (1) receives not a further word. After all, this is a “technical” paper dealing with the “financial ecosystem” that can only hint at “income imbalances” and even then, only as between future and present – not a discussion referencing a real world wherein giant financial predators have since 2007/2008 extorted several tens of trillions from Central Banks and States, to gorge first on all other investors’ holdings, then to inflate those holdings across the board to the silly levels we again see today.

Now 5 years later, this chap has mapped some parts of the reef visible above water. What goes on in the derivatives world is the huge structure lurking in the depths. Macro events like the creation of a US-based global corporate State through the TransPacific and TransAtlantic “trade” deals, are weightless, while the “needs” of portfolio managers are critical.

Apart from the author’s wariness of complexity, which I would state far more strongly, I can only see this work as supportive of the same disastrous outlook that brought us to this point.

“US-based global corporate State”… I’m not even sure that’s true. I think these market state guys would like to shed the nation state entirely.

Lambert,

They need the US State to both “lead” (as in pre-determine the selected path re any given issue) and to “enforce”.

The US State itself has pursued precisely the same goals since the late ’30’s, i.e., not to make the world “safe” for “democracy” or even “capitalism”, but to make the capitalists “safe” from “democracy”. It’s all spelled out in the official public records.

Now, if some other capitalist State could produce greater gains for the capitalist class, they would jump ship. There is no contender for that role at this time – it will have to wait at least until the looming (inside the next decade) showdown with the Asian mainland is settled.

Well, you can wait for Noam Chomsky to write a textbook about derivatives and repos in order to maintain your ideological purity, or you can learn about those things from the people that understand them in their own terms and help to further the discourse, or revolution, as the case may be.

Chomsky hasn’t had a new thought in decades, though he was essential in removing the public facade mask from the deeper US State.

I do not seek “ideological purity”. I seek solutions to crucial global problems. This guy is of no value on that score, and will prove himself a tinkerer even in your dimly lit vision.

I agree that he is not suitably radical but unless radicals speak or at least understand this vocabulary, their powers of persuasion will be limited, because this is the language that currently dominates the discourse. I only take issue with those who dismiss it out of hand because it does not rest on endogenous money theory or meet some other litmus test.

Using theoretical Physicists and M-theory’s weakness to rationalize economics’ failures is not much of an argument, but it does reveal a kind of insensitivity and indifference to the results failed economics has had on humanity which are nowhere near to what a theory in Physics can possibly do. All sciences which deal with humans need to show this concern, and economics most of all. H/T AA

skippy… Until economics can utilize – incorporate living system[s theory[s, it will always lose against the immensity of time.

Ad homenum attack ahead, delete if it’s out of bounds…

To those who complain about the complexity of the posting or the simplicity of the posting, or are whining that you don’t understand it, screw you!!! Honestly, sometimes I lose my patience with you people. If you don’t understand it, read it again and draw your own damn diagrams, I will. If it’s too simplistic for you, you are a shadow banker lost in the weeds, and if you are a whiner, go out to the garden and eat worms.

Thank you for your interest in national security. :-)