Yves here. This post is important because even though the Fed is focused on the impact of QE (and hence the taper) on the domestic economy, it’s been getting enough of a hard time from central bankers of leading emerging markets economies that it least has to feign concern credibly.

The Eichengreen/Gupta paper summarized in this post concludes that, quelle surprise, the countries most vulnerable to changes in Fed policy (which really means hot money in and outflows) are those with the biggest financial markets relative to GDP. Curiously, Eichengreen and Gupta fail to note that this means the orthodox advice to developing economies, that financial “deepening” is a Good Thing and therefore should be supported by government policy, in fact reduces financial stability and makes them even more vulnerable to the moods of fickle foreign investors.

By Barry Eichengreen, Professor of Economics and Political Science at the University of California, Berkeley, and Poonam Gupta, Reserve Bank of India Chair Professor, National Institute of Public Finance and Policy. Originally published at VoxEU

Fed tapering has started. A revival of last summer’s emerging economy turmoil is a real concern. This column discusses new research into who was hit and why by the June 2013 taper-talk shock. Those hit hardest had relatively large and liquid financial markets, and had allowed large rises in their currency values and their trade deficits. Good macro fundamentals did not provide much insulation, nor did capital controls. The best insulation came from macroprudential policies that limited exchange rate appreciation and trade deficit widening in response to foreign capital inflows.

In May 2013, Federal Reserve officials first began to talk of the possibility of the US central bank tapering its securities purchases from $85 billion a month to something lower. A milestone to which many observers point is 22 May 2013, when Chairman Bernanke raised the possibility of tapering in his testimony to Congress. This ‘tapering talk’ had a sharp negative impact on economic and financial conditions in emerging markets.

Three aspects of that impact are noteworthy:

- Not only was the impact sharp, but in the view of many commentators, it was surprisingly large.

The most alarmed (some would say alarmist) commentators raised the possibility that some emerging countries might be heading towards a full-blown crisis like those in Mexico in 1994 and Asia in 1998.

- The impact was not felt uniformly; different countries were affected rather differently.

- There were complaints from policymakers in the developing world about the Fed’s turn to tapering that were seemingly hard to square with earlier criticisms of quantitative easing by the US central bank as a form of ‘currency war’.

New Research

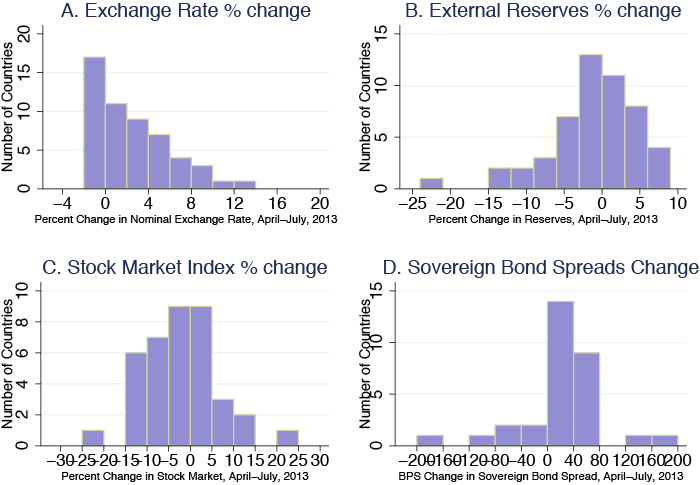

In a new paper, we attempt to shed light on these issues (Eichengreen and Gupta 2013). We use data for a cross-section of emerging markets to analyse who was hit by the Fed’s tapering talk and why. We focus on the change in exchange rates, foreign reserves, and equity prices between April 2013 (just prior to talk of tapering) and August 2013 (by which time the response was largely complete). (In September, new data on the condition of the US economy led Federal Reserve officials to make statements that moderated prior expectations of tapering).

In addition, we calculate composite indices of overall financial market pressure. These indices are constructed as a weighted average of changes in exchange rates, reserves, and stock market yields. They are constructed in a manner analogous to the exchange market pressure index of Eichengreen et al. (1995), where the weights were the inverse of the standard deviation of each series. We first create this index using data for exchange rate and reserve losses, and then add the negative of the change in stock yields (denoting the two versions Index 1 and Index 2, respectively).1 For weights, we calculate the standard deviations for each series using monthly data from January 2010 to August 2013. The weights are then the inverse of the standard deviations.

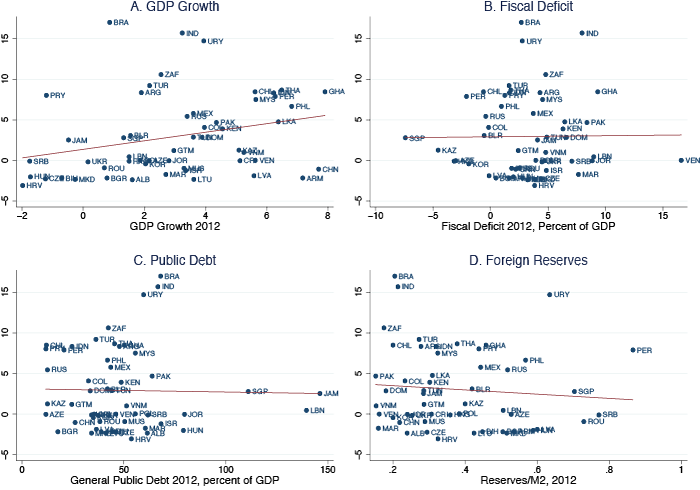

We relate the reaction of these variables to several classes of potential determinants:

- Observable macroeconomic fundamentals like the budget deficit, public debt, foreign reserves, and GDP growth rate in the prior period.

- The size and openness of a country’s financial markets.

- The extent to which capital flow sensitive indicators like the real exchange rate and current account balance had been allowed to move in the prior period when quantitative easing was underway, there had been no expectations of tapering, and policymakers in emerging markets had complained of currency wars.

Results: Who was Hit by Tapering Talk and Why?

On the basis of this analysis, our answers to the questions posed above are as follows:

- There is little evidence that countries with stronger macroeconomic fundamentals (smaller budget deficits, lower debts, more reserves, and stronger growth rates in the immediately prior period) were rewarded with smaller falls in exchange rates, foreign reserves, and stock prices starting in May.

- What mattered more was the size of their financial markets.2

Investors seeking to rebalance their portfolios concentrated on emerging markets with relatively large and liquid financial systems. These were the markets where they could most easily sell without incurring losses, and where there was the most scope for portfolio rebalancing. The obvious contrast is with so-called frontier markets with smaller and less liquid financial systems. This is a reminder that success at growing the financial sector can be a mixed blessing. Among other things, it can accentuate the impact on an economy of financial shocks emanating from outside.

We also find:

- The largest impact of tapering was felt by countries that allowed exchange rates to run up most dramatically in the earlier period of expectations of continued Federal Reserve easing, when large amounts of capital were flowing into emerging markets.

- The largest impact was in countries that allowed the current account deficit to widen most dramatically in the earlier period when it was easily financed.

Countries that used policy – and in some cases, perhaps, enjoyed good luck – that allowed them to limit the rise in the real exchange rate and the growth of the current account deficit in the boom period suffered the smallest reversals.

Nations Complaining about QE and Suffering from its Withdrawal

These results provides some intuition for how it was that the same countries could complain about quantitative easing while it was underway – QE had large, disconcerting impacts on local markets – and then also complain about tapering talk. Since their asset prices had been allowed to run up sharply and their current accounts had been allowed to widen relatively dramatically in the earlier period, talk of tapering now had a relatively large negative impact on local markets.

We interpret changes in real exchange rates and current account deficits as picking up the impact – positive, negative or neutral – of macroprudential policy broadly defined. Recall that we control for the stance of fiscal policy (since fiscal tightening can also limit the appreciation of asset prices in a period when capital is flowing in). In addition, we control for the intensity of capital controls in the prior period; these, similarly, do not appear to have exerted a consistently significant impact on the effects of tapering. Nor does their inclusion alter the estimated effect of the change in the real exchange rate.

Evidently, neither capital controls, nor fiscal tightening, nor even a combination of the two, sufficed to dampen the effects of financial inflows. Instead, a broader array of macroprudential policies which moderate the upward pressure on the exchange rate and the widening of the current-account deficit – limits on the rate of growth of bank lending, loan-to-value regulation for the mortgage market, and similar measures – may have made a difference, and may therefore be called for in the future.

Figure 1 Cumulative effect of ‘tapering talk’ on exchange rates, reserves, stock prices, and bond spreads, April–July 2013

Figure 2 Factors that mattered for effect of ‘tapering talk’ on exchange rates, April–July 2013

Figure 3 Factors that didn’t matter for effect of ‘tapering talk’ on exchange rates, April–July 2013

Our exploration of the effects of the Fed’s tapering talk in the summer of 2013 yields the following conclusions. First, emerging markets that allowed the largest appreciation of their real exchange rates and the largest increase in their current account deficits in the prior period of quantitative easing saw the sharpest currency depreciation, reserve losses, and stock-market declines when talk turned to tapering. Second, measures of policy fundamentals and economic performance (the budget deficit, the public debt, the level of reserves, and the rate of GDP growth) do not indicate that better fundamentals provided better insulation. An important determinant of that differential impact – in addition to the prior run-up of the real exchange rate and current account deficit – was the size of a country’s financial market. Countries with larger markets experienced more pressure on the exchange rate, reserves, and stock market when talk turned to tapering. We interpret this as investors seeking to rebalance their portfolios being able to do so more easily and conveniently when the target country has a relatively large and liquid market. This suggests that having a large and liquid market can be a mixed blessing when a country is subject to financial shocks coming from beyond its borders.

Finally, there is little evidence that the presence of controls or their tightening in the prior period provided insulation from talk of tapering. More important, we suspect, were macroprudential policies broadly defined, where these were used to limit the appreciation of the real exchange rate and widening of the current-account deficit in response to foreign capital inflows.

These patterns thus point to which countries will be vulnerable to external pressures once tapering again comes around.

See original post for references

Yves wrote, “the orthodox advice to developing economies, that financial “deepening” is a Good Thing and therefore should be supported by government policy, in fact reduces financial stability and makes them even more vulnerable to the moods of fickle foreign investors.”

Global stock markets are booming and booming profits means businesses are investing to take advantage of all those great opportunities. These signs point to a global economy that is inching towards full recovery. 2014 will be the “Year of the Boom.”

Let’s forget all our troubles? Let’s get happy? Shout hallelujah?

Businesses aren’t investing. Instead they are handing those profits back to shareholders. American companies invested 15 times as much in the early 1970s as they distributed to shareholders. Presently the ratio has dropped to below two.

Andrew Smithers in his book “The Road to Recovery: How and Why Economic Policy Must Change” argues that the main cause has been management incentives. Corporate executives now receive their financial compensation in the form of bonuses rather than salary, which are frequently tied to share price, which in turn rests on the ability of the company to meet its quarterly earnings-per-share target. Share buybacks [the Golden Egg of shareholder value] tend to raise earnings per share, while investment plans may lower them.

Smithers writes, “The result of the increased importance of bonuses and the use of these measures of performance is that managements are now less inclined to take short-term risks, such as cutting profit margins, and more inclined to take the longer-term risks involved in lower investment and the possible loss of market share that will result from higher margins.”

More evidence for Smithers’ assertion:

This NBER study revealed that financial executives would not proceed with a profitable long-term project if it meant missing the consensus forecast of profits in the current quarter:

http://www.nber.org/papers/w10550

The authors of this Social Science Research Network study state, “Our results are most consistent with the view that public firms’ investment decisions are affected by managerial short-termism.” When executive compensation is linked to the stock market and share prices and their stock options, companies invest considerably less and are less responsive to new investment opportunities.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1603484

Smithers’ argument is that corporations are taking on debt because it is cheaper than equity and using their cash flow to buy back shares.

He writes, “The proportion of cash being generated from depreciation and profits after tax that is currently being invested in plant and equipment is the lowest in the US that it has been in the post-war era, and the proportion being returned to shareholders is nearly 55 per cent.”

This is a really interesting topic. I wish the graphs in figures 2 and 3 were better annotated and better described. As it is, I confess I do not understand them.

We and the world need long term fiscal planning. I don’t buy the implied conclusion that because this research observed that capital controls and fiscal tightening made no difference in bubbles and crashes that everything is a mixed blessing and we can’t control it. I think this research was suffering from short-termism itself. It is a big shrug of the shoulders for controlling finance – it could even be used to advocate bubble economics. Which itself is unproductive extraction by short term speculation and escaping hot money seeking refuge elsewhere. The fact that smaller financial markets fared better is pretty clear evidence bubbles cause trouble in an exponential manner creating a huge swath of devastation if the financial market is big enough. Witness the USA: The banksters, frantically seeking profitable investment vehicles for the inflow of money here in the 2000s, invented extra-legal MBS stuff, gave mortgages to everybody, blew out the housing market in short order by skyrocketing prices in a country without an economic base but with an enormous financial market, and then proceeded to just foreclose on the entire country. Gee. Let’s export that model.

You mean the “free” trade and “free” capital flows absolutism being imposed by the “free” market Gestapo isn’t all it’s cracked up to be?

Oh well, as Mme Roland exclaimed as she was being led to the guillotine: “Oh Liberty, what crimes are committed in thy name!”

I object. Madam Roland was a great lady, a mid-wife to the free French republic. There is nothing in the Libertarian free-market, and the global gestapo tactics employed by the likes of the IMF that has the slightest sense of egalitie. Were she alive today, I suspect the good lady would recognize them as part of the ancien regime, and join occupy.

Perhaps I misinterpreted your analogy.

I agree with Yves that this is a very important issue, though I have to say you would not know it from the authors’ presentation.

Once the initial panic response by the Fed was complete, and particularly once the impacts of QE1 were becoming obvious, the negative reviews for Bernanke’s policy in virtually all emerging/developing markets and some developed markets were non-stop, creating a major substantive reason for gold’s moon shot. All felt and essentially said that the Fed had a gun to their heads and had no option but to devalue their own currencies – capital controls were not widely used, so I’d suggest their efficacy is not disproven. Many had to adjust food and energy subsidies, some imploding in the process. Plans for the launch of an alternative reserve/payments currency were seriously discussed more than once in real meetings between real Governments. A very good case could be made that a major rift was created between the US and the BRICS, with a developing world increasingly aligning with the latter, a rift with serious impacts on relations overall, especially with Russia, China, Brazil et al – so much so that the last G20 represented the US hitting a political wall of disdain with US policy on a broad front.

Eichengreen at best confirms there was/is a problem. But he fails completely to make clear its scope, its duration, the real impacts in any nation under discussion (why not pick the largest 10 and do a full treatment on each one?) or how being continuously ignored on vital concerns sits in places like Moscow, Beijing or Brasilia.

And last, some important questions not addressed: How much “hot money” in total went into these markets? How much is still there (remember, immediately after his “flub” Bernanke had all his minions out walking it back)? How much did it cost those economies in real terms to date? How long will they put up with QE going forward – especially, as is highly likely, another big bust splatters the US within the next 12-18 months?

Not enough western economists have paid attention to the Asian Crisis that started in 1997. Of particular relevance to this debate is Dr Mahathir’s (PM of Malaysia, in Somerset Maugham’s word “very sensitive to injury and ridicule, passionate and revengeful) belated realisation of the adverse impact capital inflows that suddenly turned into damaging outflows. His response, capital controls, were greeted with outrage by those with money trapped inside the country but did ultimately benefit the country. In my view, the mistake Dr Mahathir made was to allow too much money into the country, the point to intervene is before the disaster, not after. The other “shocking” incident of that period was the Hong Kong government’s decision to intervene in the stock market. Speculators were attacking the HK$ and by the rules of the game, the government’s scope for action was nil. So, brilliantly, it decided to intervene and push up the market, hurting the speculators. The rationale is clear: governments must act to counter speculative or other activities that harm the economy. In the case of Hong Kong, the currency squeeze had driven overnight rates as high as 45% at one point. So pragmatism dictates and justifies intervention.