Yves here. I continue to get requests to explain Modern Monetary Theory. It isn’t easily done in a few words, but fortunately, the academics and writers associated with the New Economics Perspectives blog keep publishing primers of various sorts. This one takes a different approach in using visuals to help illustrate the difference between how most people believe the money system operates versus how it really works.

By J.D Alt. Originally published at New Economic Perspectives

1. The “Unsolvable” Riddle of our National Budget

Being an architect, I’m fascinated by diagrams visualizing things which otherwise are invisible. In designing a building we usually begin with diagrams to explore and understand the functional and spatial relationships—the flows and often unexpected interactions—the architecture needs to accommodate. Getting the diagrams right is important—if they’re wrong or incomplete, the building we design could turn out to be a dysfunctional disappointment for its owners and users.

With this in mind, it occurs to me the reason our current Congressional leaders are having such a difficult time with our National Budgeting process is because they’re trying to design a “building” based on an incorrect diagram. No matter how they add up the numbers, they seem incapable of devising a budget that builds America forward in a positive way. In fact, their budgetary efforts more closely resemble the actions of a wrecking crew than a construction team!

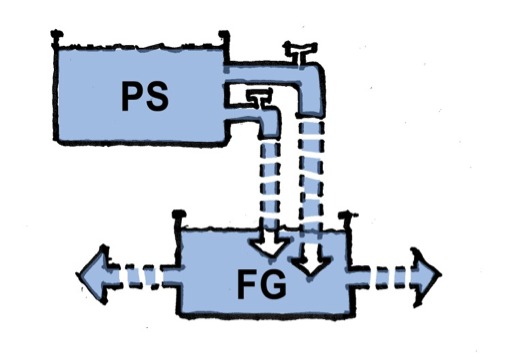

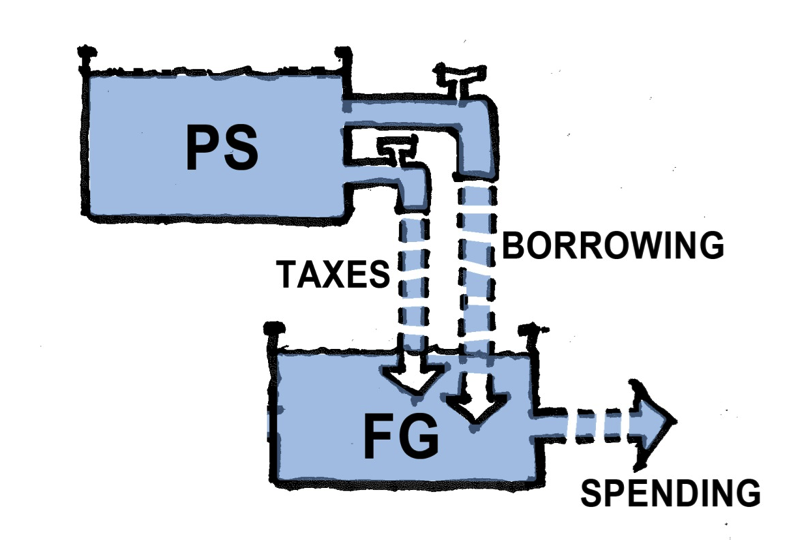

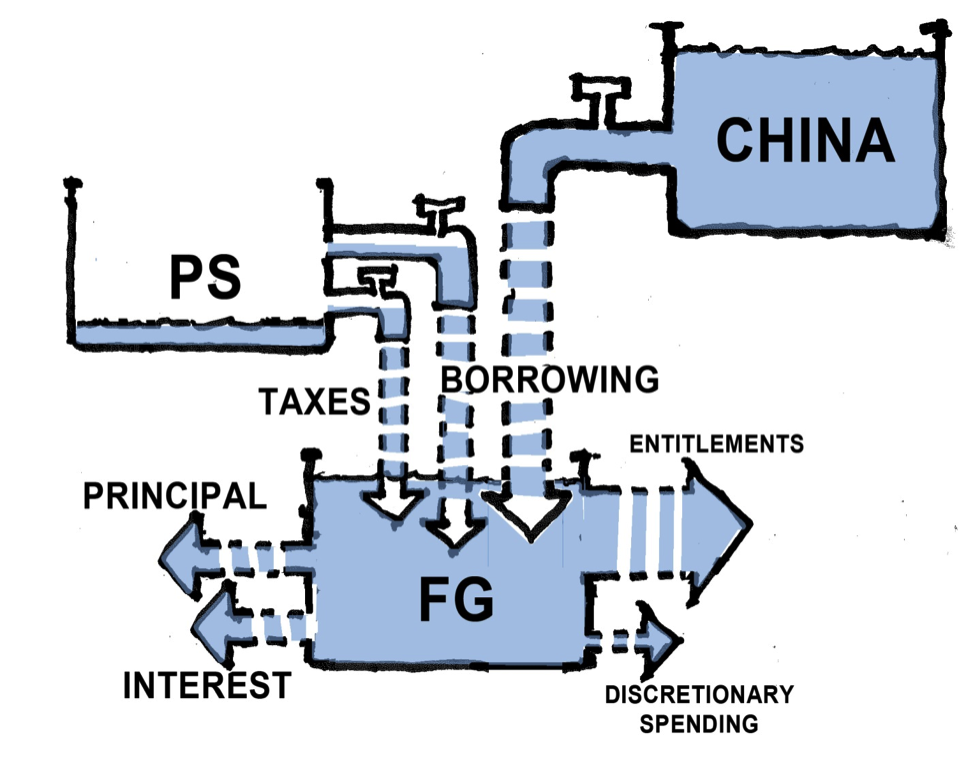

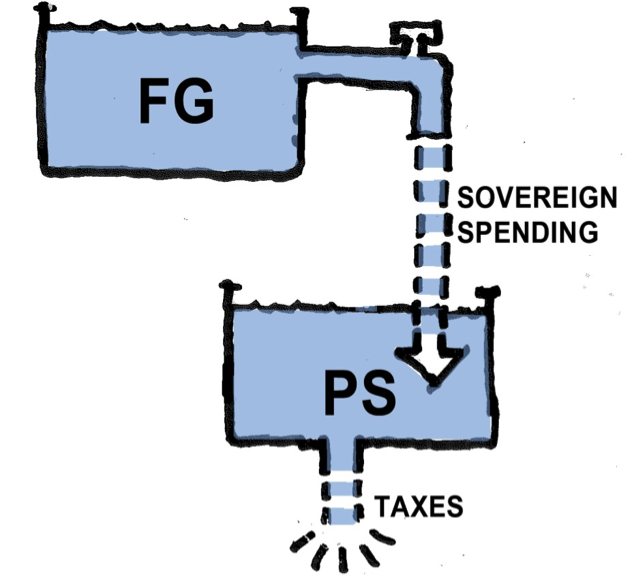

Here is my best effort to construct the diagram it appears the Congressional leaders are presently trying to use. I’m putting it together, as best I can, from the story they tell us, every day, about the fiscal dilemmas they are struggling to resolve. This diagram is also powerfully reinforced by a news media spinning and reporting daily on the politician’s seemingly futile efforts:

The main features of the diagram are two “pots” containing Dollars. One pot is labeled the Private Sector (PS). This is basically the national economy—businesses and corporations, families and foundations, state and local governments, etc. All the transactions that occur in the Private Sector (PS) pot add up to what is called the GDP (gross domestic product). The second “pot” is the Federal Government (FG), and the Dollars contained in this pot are SPENT to pay for public goods –weather forecasting, bridge repairs, Medicare services, etc.—and to make the “transfer” payments like social security, unemployment aid and food stamps that many Americans depend on to one degree or another.

The diagram shows that the Dollars in the Federal Government (FG) pot are obtained via two spigots in the Private Sector (PS) pot: one spigot is TAXES, the other is the “BORROWING” spigot through which the Federal Government (FG) obtains Dollars by “selling” Treasury Bonds to the Private Sector.

2. Diagrammatic Dilemmas

This diagram seems pretty straightforward and obvious, although there are aspects of it that are less than clear. For example, the diagram gives Congressional leaders the clear impression that the Private Sector somehow creates the U.S. Dollars we all use, though there is no exact articulation about how this occurs. The PS pot is clearly full of Dollars—they had to come from somewhere, right?—but the diagram shows no source other than the PS pot itself. There is a vague “story” about entrepreneurs investing Dollars in business ventures which make profits, allowing them to hire more and more workers, which enables them to generate more and more Dollars, etc. How the money is actually created seems to matter less than the “obvious” fact that if the two spigots draining Dollars out of the PS pot are opened too wide—if too many Dollars are drained out of the PS pot into the FG pot—the entrepreneurs won’t have enough money left to invest in creating jobs and making profits, and the Private Sector GDP (Gross Domestic Product), as a consequence, will begin to shrink.

It is fear of this shrinkage that appears to constrain the number of Dollars that Congress can allow to flow into the FG pot, and this, of course, constrains the amount and kind of public goods and services that can be planned for in the National Budget. This fear is exacerbated by another which can be visualized by looking at the diagram in more detail:

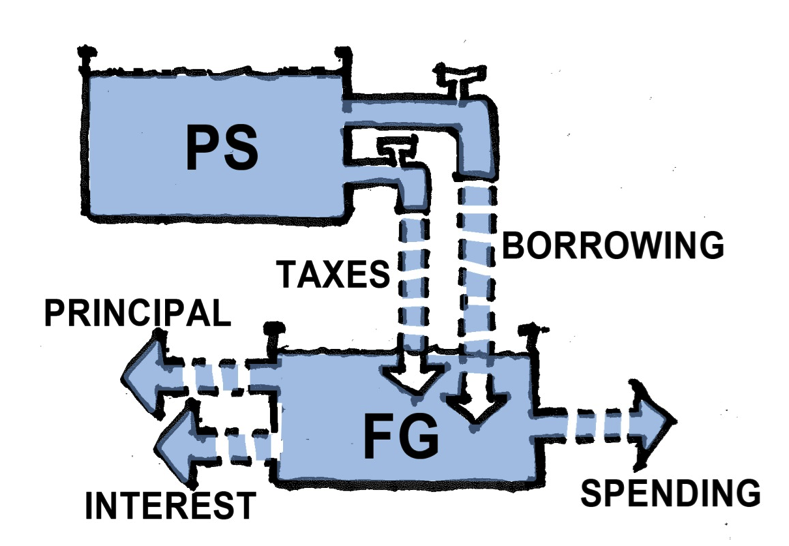

As illustrated, the “BORROWING” spigot appears to require that the Federal Government not only to pay back the Treasury Bond’s principal at some point in the future, but also to pay interest on that principal. Following the logic of what we’re looking at, it appears the Federal Government will be forced to collect even more taxes at some point in the future (to pay the principal plus interest) creating a huge financial burden for our children and grandchildren. As a result, it seems clear to Congressional leaders that the “BORROWING” spigot must be carefully constrained to not exceed a certain percentage of the Private Sector pot, or else—it seems mathematically obvious—the TAX spigot ultimately will have to drain the P.S. pot completely just to pay for the government’s debt! This is what is meant when the Congressional leaders say the Federal Government’s debt is “out of control” or “unsustainable”.

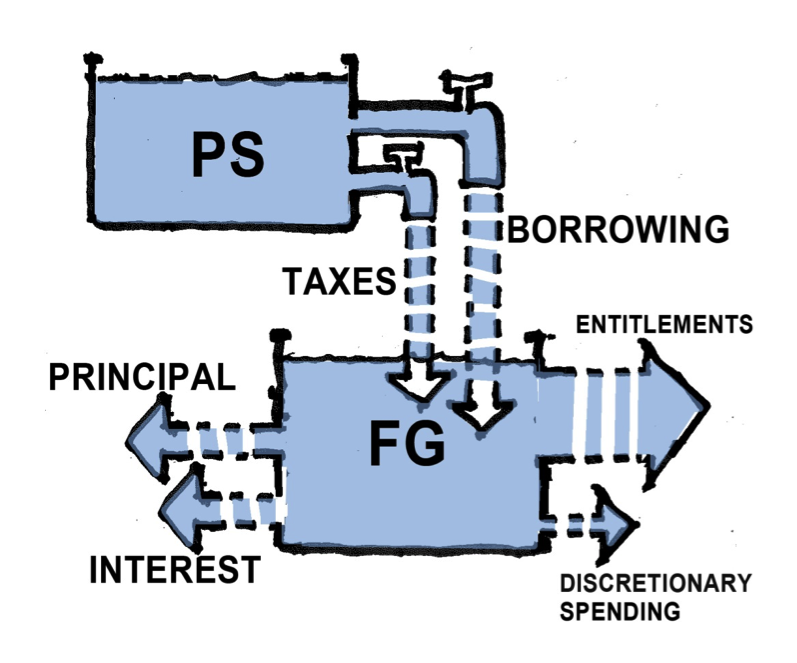

We can also look at a close-up of the FG spending side of the diagram, the side which generates the Public Goods and Services we collectively benefit from.

Looked at more closely, that spending is really of two kinds: “Entitlement” spending and “Discretionary” spending. Here too the diagram seems to illustrate the enormity of Congress’ fiscal dilemma: As Entitlement spending (Social Security, Medicare and Medicaid, Food Stamps etc.) grows larger, it has to compete with the Discretionary spending (infrastructure, education, medical research, etc.) for the limited number of Dollars that can be allowed to flow into the PG pot. Thus, if we plan to take care of our elderly, under-nourished, poorly housed, accidentally disabled, under-educated and unemployed citizens—which somehow seems an ever-growing need as the population increases and ages—our airports, highways and bridges, our water and sewer systems, our electrical grid and public transit systems, all of that (and more) must inevitably fall into disrepair.

Or, as many Congressional leaders warn us against, we’ll be forced to borrow even more Dollars from China, hastening the inevitable wreckage and bankruptcy of our economy:

It is easy to see how, using this diagram as a guide, it is literally impossible for our Congressional leaders to come up with a rational and constructive budgetary plan to build America’s future. This has got to be a big part of why, whenever they appear on television, our Senators and House Representatives are wearing such pained expressions. And, no doubt, this diagram is a large part of the reason they so relentlessly fight and bicker over every topic imaginable, because every topic imaginable seems ultimately tied to the frustrating fact that we simply don’t have enough “money”.

3. Diagram Reality Check

In order for a diagram to be useful, it has to be accurate. But how do we know if a diagram is accurate—that it reflects the actual realities we are dealing with? First, we could ask if all the “parts” have been accounted for. Maybe some important things have been left out. Then we could ask if the relationships and flows are correctly portrayed. Since our diagram seems to naturally follow a “plumbing” metaphor**, we could ask, in essence, have we got the “plumbing” right?

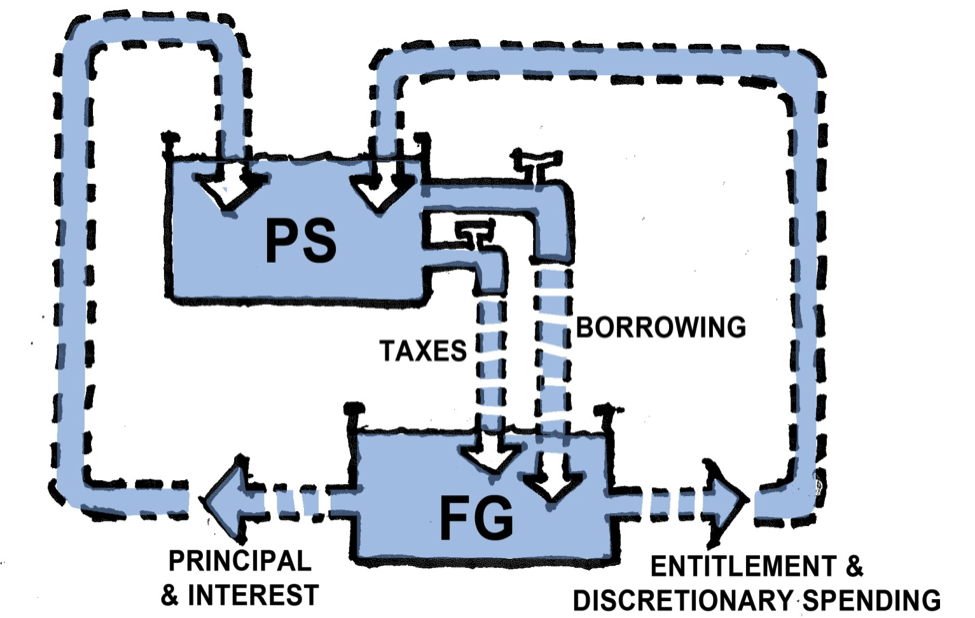

The first thing we can see pretty easily is that the diagram has, indeed, left out some key parts of the fiscal “plumbing”. The Dollars that flow out of the FG pot to pay for public goods and services—either entitlement or discretionary spending—don’t just disappear into the right page margin after they are spent. They go somewhere. They are paid to somebody. And who might that be?

In fact—and when you think about it, it’s obvious—the Federal Government buys its public goods and services from the Private Sector. Aircraft carriers and submarines are built by Private Sector shipyards. Weather and GPS satellites are designed and built by private engineering laboratories. And while the space-launch facilities at NASA are a “public” enterprise, all the scientists and technicians who work there are private citizens. Even the Navy’s Vice-Admiral in charge of sea-recovery operations, when he goes home on weekends and changes into his gardening clothes, is a private citizen.

With the exception of some payments that go to foreign contractors, the Dollars for discretionary spending, then, flow into the bank accounts of private U.S. citizens—into, that is, the PS pot. Obviously the same is true with entitlement and transfer payments: Social Security checks are directly deposited into private bank accounts, food-stamp Dollars flow into the bank accounts of farmers and food processors and distributors. Dollars for unemployment aid are used by the unemployed to buy shoes and subway tokens and cups of coffee—all going by some direct or indirect route into the private bank account of a U.S. business or citizen.

I don’t want to be overstating the obvious here, but if we change the “plumbing” of our fiscal diagram to reflect the realities just described, as shown above, it makes a significant difference in what we see.

Please note that I have also changed the plumbing on the other side of the FG pot: the “principal & interest” payments on the Federal Government’s “debt” also are deposited into private bank accounts as well—the overwhelming majority of which belong to private-sector U.S. citizens.

We still have a hopeless budgetary problem, however. Even though we can now clearly see that the government’s spending goes back into the Private Sector pot—benefiting U.S. citizens and businesses with both public goods and Dollar deposits—the amount of Dollars available for government spending is still limited to what can be “safely” taxed or borrowed out of the Private Sector pot in any given budget-year. Even though we have a better picture of the complete cycle of the fiscal flow, we still have the dilemma that if we open the TAX and “BORROWING” spigots too wide, the private entrepreneurs won’t have enough Dollars left to start ventures, create jobs, and make the profits that generate the PS pot’s money in the first place.

So our plumbing changes haven’t really solved the budgetary riddle that has Congress—and the President as well—tied up in knots. Many people will conclude that the optimum solution is to close the PS spigots as much as possible, allowing just enough Dollars to trickle into the FG pot to pay for the absolute minimum public goods and services necessary to maintain public order (and a strong military). Allowing the Private Sector to keep vastly MORE of the Dollars it creates through entrepreneurial ventures, they argue, will enable those private ventures to create more and more jobs, so there will be less need for government assistance programs like unemployment aid and food stamps. Small government and free markets are the ticket—and the diagram (even the “complete” one we are now looking at) seems to support this perspective.

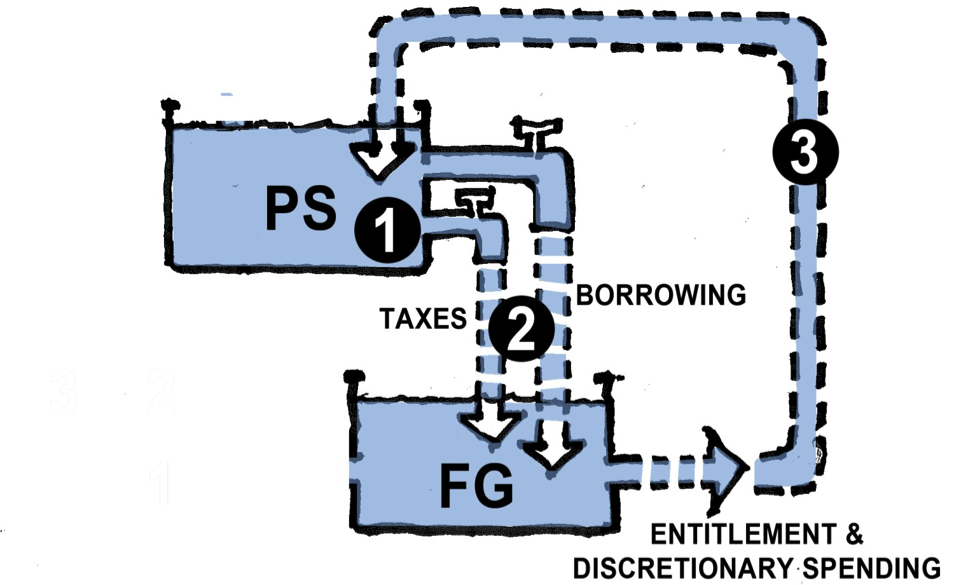

Except for one problem—one fundamental flaw in the diagram’s most basic logic: it is not possible for the Private Sector pot to “generate” its own U.S. Dollars! This is because, by law, a U.S. Dollar can only be created—printed or issued electronically—by the U.S. sovereign government. Anyone else who tries to create or issue a U.S. Dollar is a counterfeiter and subject to imprisonment. This simple, undeniable, fact forces us to look at the diagram again and wonder if we really understand what is happening in it.

Here’s a simplified version that focuses on the direction of flow:

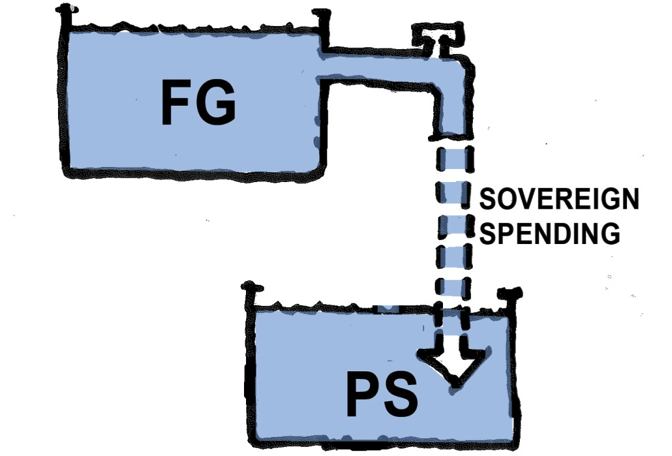

What we think we are seeing is this: Dollars get created in the PS pot and flow into the FG pot, from which they then flow, by means of government spending, back into the PS pot. The key thought-phrase here is “Dollars get created in the PS pot…” because it suggests that the PS pot is the “driver” or “generator” of the flow of Dollars. But if it is an unequivocal fact that only the sovereign U.S. Government can issue U.S. Dollars, then it must be the case that the FG pot is actually the “driver”—which means, first of all, we’ve got the diagram upside down! Basically, it should look like this:

4. Hmmmm…?

What we are seeing now is a completely new fiscal perspective: The sovereign government issues U.S. Dollars in the FG pot and then spends those Dollars through it’s own SPENDING spigot into the PS pot! Entrepreneurs in the Private Sector then use the Dollars the FG has issued and spent—leveraging them with bank loans and creative financing—to launch business ventures that generate private sector jobs and wages. Can this possibly be the way it actually is? Let’s see.

Before looking at this new diagram in more detail, let’s consider its most basic implication: As the FG spends, the number of Dollars in the PS pot grows. If the number of goods and services available for people to buy in the PS pot does not grow by an equivalent amount, the additional Dollars flowing in will cause prices to go up—perhaps dramatically. This is the “inflation” that Congressmen and economists are constantly warning against. To prevent this from happening—or to prevent the rate of inflation from getting disruptively high—there has to be some means for taking Dollars out of the PS pot.

This essential REMOVAL operation is accomplished with two pieces of “plumbing” we can now add, one at a time, to the new diagram:

The first plumbing addition is a “drain” that simply takes Dollars out of the PS pot and destroys them. This drain is Federal Taxes. Drained out and destroyed, Dollars paid in Federal taxes are no longer available for Private Sector spending—and, therefore, can no longer contribute to price-inflation.

Obviously, this plumbing feature—the TAX DRAIN—needs some further explanation: Why would the Sovereign Government destroy the tax Dollars it collects? Doesn’t it need those tax Dollars to pay for its spending? Shouldn’t the “drain” really be a sump-pump that lifts the tax Dollars back up and dumps them into the FG pot?

It would be a mistake, though, to add the “sump-pump” plumbing to our diagram. The reason is the underlying reality of what a U.S. Dollar actually is: It is simply a promise, by the U.S. sovereign government, that it will accept the Dollar as payment for a Dollar’s worth of taxes. That’s it. A Dollar—whether it’s a paper Dollar or an “electronic” Dollar—is nothing more than that promise. The sovereign government doesn’t promise to exchange a Dollar for gold or silver, or for anything else of intrinsic value. It promises only to accept the Dollar in exchange for the cancellation of a Dollar’s worth of taxes due. In other words, a Dollar is the I.O.U. of the sovereign government. The Dollar says: “I owe you one Dollar’s worth of tax credit.”

This I.O.U. means a lot more to all of us in the Private Sector (households and businesses) because we also use this I.O.U. Dollar for our MONEY—we use it to buy goods and services from each other, to invest in business ventures, and to save for future spending in our retirement. But at its most official heart, the U.S. Dollar is simply the I.O.U. promise of our sovereign Federal Government.

This underlying reality of what a Dollar actually is has a lot of importance for our new Diagram. First, it tells us why we (all of us citizens working in the Private Sector) are willing to accept Dollars in exchange for our very real goods and efforts: Because we need those Dollars in order to pay the taxes we owe the Federal Government! We can’t pay our taxes with apples or Pesos. We can only pay our U.S. Taxes with U.S. Dollars. So that’s why the FG SPENDING spigot works in the first place—because all the citizens and businesses in the Private Sector are willing to provide goods and services to the Federal Government in exchange for the Dollars they need to pay their Federal Tax bill.

The second thing the underlying reality explains is why the Dollar is “destroyed” when it is used to pay U.S. Taxes. You give the Federal Government back its I.O.U., the FG declares your taxes paid, and the I.O.U. is cancelled. That I.O.U. is of no further use to the Federal Government. It is illogical for the FG to “keep” an I.O.U. that says it owes something to itself. It could recycle the I.O.U. and use it to buy new goods and services from the Private Sector. But even that is illogical, because it is far easier and more efficient, when the Sovereign Government needs to spend again, for it to simply issue a new I.O.U. This is especially true since the vast majority of Dollars issued and spent are electronic—simple keystrokes on a computer screen.

So the “TAX DRAIN” really is the correct diagram! Federal taxes drain Dollars out of the Private Sector pot and—POOF!—they’re gone. How many Dollars should be drained every year to keep price-inflation in check is a crucial question, but we don’t need to answer that to get our diagram right. We do need to add some additional plumbing pieces, however. This is because there is a another, very important, means for taking Dollars out of the PS pot to control inflation.

**I am indebted to L. Randall Wray for first illustrating his “bathtub” metaphor in his book, “Modern Money Theory”.

Yves, are many of the questions you receive on this subject from non-commentors?

Yves — Thank you for reposting this. NEP does not get nearly the readership that NC does and this information needs to be spread as widely as possible. One of the greatest barriers to moving this country forward is the widespread ignorance as to how our modern fiat money system actually works and education is the key.

J.D. Alt says:

“[I]t is not possible for the Private Sector pot to ‘generate’ its own U.S. Dollars! This is because, by law, a U.S. Dollar can only be created—printed or issued electronically—by the U.S. sovereign government. Anyone else who tries to create or issue a U.S. Dollar is a counterfeiter and subject to imprisonment….

The key thought-phrase here is ‘Dollars get created in the PS pot…’ because it suggests that the PS pot is the ‘driver’ or ‘generator’ of the flow of Dollars. But if it is an unequivocal fact that only the sovereign U.S. Government can issue U.S. Dollars, then it must be the case that the FG pot is actually the ‘driver’….”

But what constitutes “money”? Is it merely coin, currency, and T-bills, as Alt implies? Or is it something else?

And is not this argument over what consitututes “money” one of the main areas of contention between MMT and the numerous other new monetary reform movements?

Do not the other new monetary reform movements use a broader definition of “money” than mere coin, currency, and T-bills? Don’t they argue that the vast majority of money is in fact bank-created money? And don’t they further argue that the Federal Government has in effect abdicated its money-creation role to the private sector, and that it is the private sector, and not the government sector, that has made such a royal mess of things monetary?

Good points. Part 2 is now also out http://neweconomicperspectives.org/2014/01/diagrams-dollars-modern-money-illustrated-part-2.html

“We now understand this Sovereign Spending is necessary to get U.S. Dollars into the PS pot where entrepreneurs and businesses then leverage them with bank loans to create goods and services, jobs and careers.”

“What is important is what we actually decide and agree to achieve with that spending.”

I think what is useful about these diagrams is to get us to think about where the money really comes from and to even attempt to change the terminology we use to think about it.

“”My first attempt at a more useful term for describing the difference between what the Federal Government plans to spend in a given budget-year, and what it plans to drain away in taxes, is “Net Spending Achievement”. Economists may not like it much but, as an architect, I find this phrase appealing for the simple reason that it strongly suggests the purpose of Sovereign Spending, first and foremost, is to actually build something concrete and useful for our collective good. The emphasis of the phrase is not numerical but visionary. The actual “net number of Dollars” spent is unimportant (unless price inflation is a problem). What is important is what we actually decide and agree to achieve with that spending.

Please imagine, for a moment, how our political discourse might change if everyone understood the discussion was no longer about the size of our national “budget deficit” but, instead, was about the concrete goals of our annual “Net Spending Achievement”. This is what our new diagram is asking us to do.””

the “National Debt”. This term competes aggressively with “National Deficit” to sow confusion and chaos in our Congressional budgeting process.

The “clock” then, is not measuring “borrowed” Dollars that have to be “repaid” or “replaced” in any logical sense of those terms. It is simply measuring the real financial wealth which U.S. citizens, businesses, state and local governments have moved into a savings account (Treasury Bonds) at the Sovereign Central Bank. Semantic logic, therefore, would have us give it a new name: It is, in fact, the “National Savings Clock”!

Now when New Yorkers walk down Sixth Ave., rather than panic at the financial hole they’re in, they can actually feel a sense of security at the enormous wealth they have collectively earned and saved.”

I think it’s interesting to view Treasuries as similar to taxes in that they both serve as ‘inflation fighters’ by taking US dollars out of circulation so they act a curb on too much sovereign spending.

It gets us thinking in terms of what we are capable of.

Financial matters quotes J.D. Alt as follows:

“We now understand this Sovereign Spending is necessary to get U.S. Dollars into the PS pot where entrepreneurs and businesses then leverage them with bank loans to create goods and services, jobs and careers.”

That is an empirical claim, but is it true?

Speaking in strictly descriptive terms, are there any de facto external (regulatory) limits currently imposed on the amount of leveraging or deleveraging the private financial sector can do in order to create or destroy “money”?

And where does the real action – money creation and destruction, and the ensuing spending or not spending – take place? Does it take place in the public sector? Or does it take place in the private sector? Which is the dog and which is the tail, and who’s wagging who?

From your previous comments you seem to indicate the real action takes place in the private sector. To wit:

”The government (Fed/Treasury) creates money and distributes it into the economy. This creates fiscal deficits but puts the money into the hands of private households and corporations. This is the real ‘public purse’. I like to think of this as ‘taxpayer money’ because it is owned by the people (the government).

If the government decides to guarantee MBS then that is a use of this public money to support an asset price. Why can’t this be done in the traditional manner of good underwriting?

And this seems to be leading to a slippery slope if the Fed is going to support more assets of even more dubious quality. At first blush supporting money market funds seems like a good idea. But what if these money market funds are supporting a liquidity pyramid of ‘cotton candy’.

((In his book ‘Extreme Money: Masters of the Universe and the Cult of Risk’ (2011) Satyajit Das talks about the ‘Liquidity Factory’.

On an inverse pyramid at the bottom little pinnacle are the central banks, 2%, then there are bank loans, 19%, then securitized debt, 38% and then derivatives 41%.

This is all considered liquidity ie the lubricant that allows the global economy to run. And 79% of it is derivatives and securitized debt which are largely unregulated and full of fraud. And the $16 trillion of US Treasuries used as collateral to back it all up is a small little fraction.

This is financialization run amok and what he calls ‘cotton candy’ which is spun sugar composed mostly of air.}}”

http://www.nakedcapitalism.com/2013/12/steve-keen-oh-paul-krugman-edition.html#comment-1734820

If we use the broadest possible definition of “money,” then even derivatives fall under the rubric of money.

So again I ask, speaking in strictly descriptive terms, are there any de facto external (regulatory) limits currently imposed on the amount of leveraging or deleveraging the private financial sector can do in order to create or destroy “money”?

If you agree there are not, should there be?

Does MMT have a proposal to rein in the amount of bank-created or destroyed “money”?

I think the best thing MMT has to offer in this regard is to try and negate the need for financial leveraging. As in this video of Pavlina Tcherneva promoting growth as a byproduct of employment rather than trying to make employment a trickle down effect of growth..

http://www.youtube.com/watch?v=Bhros6jImt4

But what is the moral and ontological argument for making either economic growth and/or employment the alpha and omega of human existence?

What do you have to say to the policy that Brazil began implementing in 1995? Maria Ozanira da Silva e Silva discusses it the following paper at length. The policy guarantees every Brazilian a minimum income, whether they work or not:

“FROM A MINIMUM INCOME TO A CITIZENSHIP INCOME: the Brazilian Experiences”

http://www.usbig.net/papers/128silva.pdf

It looks like Switzerland now wants to get in on the act:

“Switzerland to vote on $2,800 monthly ‘basic income’ for adults”

http://news.yahoo.com/blogs/sideshow/switzerland-to-vote-on–2-800-monthly-%E2%80%98basic-income%E2%80%99-minimum-for-adults-181937885.html

Should it come as any surprise that Glencore, the company that Marc Rich — the tax-evading felon who Clinton pardoned in the last days of his presidency — founded and later moved to Switzerland, is one of the most vocal opponents to the guaranteed basic income, whether one works or not? To wit:

“At least one of Switzerland’s biggest CEO’s has said if the measure passes, he would consider moving his company out of the country .

“I can’t believe that Switzerland would cause such great harm to its economy,” Glencore CEO Ivan Glasenberg told the Swiss Broadcasting Corporation. “And I say that not just as the head of a company, but as a Swiss citizen.”

Glencore said the measure could have a disastrous effect on other Swiss companies, including Nestlé, Novartis and Roche.”

The sordid history of Marc Rich, Ivan Glasenberg and Glencore is told in the video documentary, Stealing Africa , which can be seen on the internet here:

http://www.youtube.com/watch?v=WNYemuiAOfU

Is it really all that difficult to see how money and neo-imperialism go together like Thelma and Louise? Is it really that difficult to see that there are people out there doing a much more radical and fundamental critique of the satus quo than the MMTers are doing?

I don’t have a problem with that. I liked Jesse Myerson’s ideas.. http://www.rollingstone.com/politics/news/five-economic-reforms-millennials-should-be-fighting-for-20140103

“”We live in the age of 3D printers and self-replicating robots. Actual human workers are increasingly surplus to requirement – that’s one major reason why we have such a big unemployment problem. A universal basic income would address this epidemic at the root and provide everyone, in the words of Duke professor Kathi Weeks, “time to cultivate new needs for pleasures, activities, senses, passions, affects, and socialities that exceed the options of working and saving, producing and accumulating.”

Put another way: A universal basic income, combined with a job guarantee and other social programs, could make participation in the labor force truly voluntary, thereby enabling people to get a life.””

People like to slander this sort of thing as communism but as David Graeber points out ‘communism’ is actually pretty common if we just look at it as people helping each out in a community oriented fashion which in fact we all do every day.

The article also brushes on tax reforms oriented against rentiers..

“They just claim ownership of buildings and charge people who actually work for a living the majority of our incomes for the privilege of staying in boxes that these owners often didn’t build and rarely if ever improve. In a few years, my landlord will probably sell my building to another landlord and make off with the appreciated value of the land s/he also claims to own – which won’t even get taxed, as long as s/he ploughs it right back into more real estate.

Think about how stupid that is. The value of the land has nothing to do with my idle, remote landlord; it reflects the nearby parks and subways and shops, which I have access to thanks to the community and the public. So why don’t the community and the public derive the value and put it toward uses that benefit everyone?”

This also fits in with the article by Alt which points out that ‘entitlements’ are also fed into the private sector.. rather than this sort of either/or austerity attitude

“”Looked at more closely, that spending is really of two kinds: “Entitlement” spending and “Discretionary” spending. Here too the diagram seems to illustrate the enormity of Congress’ fiscal dilemma: As Entitlement spending (Social Security, Medicare and Medicaid, Food Stamps etc.) grows larger, it has to compete with the Discretionary spending (infrastructure, education, medical research, etc.) for the limited number of Dollars that can be allowed to flow into the PG pot. Thus, if we plan to take care of our elderly, under-nourished, poorly housed, accidentally disabled, under-educated and unemployed citizens—which somehow seems an ever-growing need as the population increases and ages—our airports, highways and bridges, our water and sewer systems, our electrical grid and public transit systems, all of that (and more) must inevitably fall into disrepair.””

I also think there is a lot of useful work that needs doing and shoud be paid a decent wage..

http://www.economonitor.com/lrwray/2014/01/07/bop-a-mole-2-jg-workers-will-do-nothing-useful-the-jg-program-will-not-be-manageable/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+GreatLeapForward+%28Great+Leap+Forward%29

“”Possible JG jobs include:

Companion for the elderly, bed-ridden, orphans, mentally and physically disabled

Public school classroom assistant

Safety monitor for public school grounds, areas surrounding schools, playgrounds, subway stations, street intersections, and shopping centers

Neighborhood cleanup/Hiway cleanup engineers

Low income housing restoration engineers

Day care assistants for children of JG workers and others

Environmental safety monitors

JG artist or musician

Community or cultural historian

Obviously, this list is not meant to be definitive, but is only to suggest that there are many jobs that could be done by JG workers. We have not listed the more “obvious” jobs, such as restoration of public infrastructure (patching holes in city streets, repairing dangerous bridges), provision of new infrastructure (hiway construction, new sewage treatment plants), and expansion of public services (new recycling programs) that should be carefully considered because they might reduce private costs and increase private profitability. These are types of social spending that should be done even without a JG program, and that might be better accomplished by non-JG (including unionized) workers. However, it should be noted that WPA employees did indeed engage in this sort of work.””

totally loved your comments today FM

Likewise! +1

Agree, I understand all this. Just hope some of the MSM start to spruke it

@ financial matters

But here’s the question: Is a guaranteed basic income one of the policy proposals advocated by MMT? And if not, why not?

F Mexico,

I’m pretty certain the answer is no. Not sure why though. Perhaps they postulate it’s too inflationary? I don’t think it would have to be, however. C. H. Douglas thought it a good idea. His idea is a variant of a BIG, which he called a National Dividend and a Compensated Price Mechanism. :

“Social credit is an interdisciplinary distributive philosophy developed by C. H. Douglas (1879–1952), a British engineer, who wrote a book by that name in 1924. It encompasses the fields of economics, political science, history, accounting, and physics. Its policies are designed, according to Douglas, to disperse economic and political power to individuals. Douglas wrote, “Systems were made for men, and not men for systems, and the interest of man which is self-development, is above all systems, whether theological, political or economic.” Douglas said that Social Crediters want to build a new civilization based upon “absolute economic security” for the individual, where “they shall sit every man under his vine and under his fig tree; and none shall make them afraid.” In his words, “what we really demand of existence is not that we shall be put into somebody else’s Utopia, but we shall be put in a position to construct a Utopia of our own….According to Douglas, the true purpose of production is consumption, and production must serve the genuine, freely expressed interests of consumers. In order to accomplish this objective, he believed that each citizen should have a beneficial, not direct, inheritance in the communal capital conferred by complete access to consumer goods assured by the National Dividend and Compensated Price. Douglas thought that consumers, fully provided with adequate purchasing power, will establish the policy of production through exercise of their monetary vote.In this view, the term economic democracy does not mean worker control of industry, but democratic control of credit.Removing the policy of production from banking institutions, government, and industry, Social Credit envisages an “aristocracy of producers, serving and accredited by a democracy of consumers.””

http://en.wikipedia.org/wiki/Social_credit

Malmo,

On of justifications for “sharing” C. H. Douglas gave was something like: The accumulated knowledge Capital of humanity which the industrial system uses to create goods and services should benefit humanity as a whole.

He also referred to this kind of a system as “Practical Christianity”

http://www.michaeljournal.org/dobbs.htm

Mansoor H. Khan.

Mansoor,

My alluding to Social Credit was not so much advocacy for said doctrine, but rather to point out the fetish for a JG falls far short of dispensing with class society, which is my main thrust. A JG, by itself, is incremental at its worst. It’s the status quo ante from the New Deal. Reactionary nonsense. No thanks.

Malmo,

Get rid of usury (which social credit/100% currency can do) and money will not be worshipped as much. Class should be based on knowledge, wisdom, honor and contribution to the community and money.

Mansoor H. Khan

meant to say:

“and not money”

MMT is not a monolithic school of thought run by a priesthood in a centrally located temple. Google some of the writings of L. Randall Wray, who is one of the more forward spokespersons for MMT, and you will find that he does strongly advocate putting the Federal Government in the role of the employer of last resort; in short full employment is possible. If the Job guarantee were tied into fiscal policy most people who wanted an income would have one. Congress could establish a minimum wage that is livable (say $25k/yr for one person). That should address concerns about adequate income to place our economy on a stable basis.

By the way, economic growth does not have to be cast in a negative light. We can have growth for example, without destroying the health and well being of citizens and our environment.

But why is employment a requirement for survival, at least for those who lack capital?

Who made that rule, and why?

But why is employment a requirement for survival, at least for those who lack capital?

Who made that rule, and why?

It seemed to come along with the invention of money since money to a large extent turned out to be “permission” for how you spend your time. In short it gave power to a few to dictate the terms of your survival and well-being. Prior to the invention it was group consensus that worked best to determine the terms albeit at a more fragile chance of survival and less bountiful material well-being.

Vast and massive democide would also solve the problem.

That will be the Global Overclass’s preferred policy. Will the prospective targets of this vast and massive democide include organized bodies of people ready and willing and able to carry the democide to the Overclass?

“But what is the moral and ontological argument for making either economic growth and/or employment the alpha and omega of human existence?”

I see a tendency to exaggerate greatly in this statement. I don’t see anyone but you making this statement. It is however the purpose of government to take care that the already existing orderliness within the economy not be allowed to deteriorate if that is possible. MMT says that we can have a better ordered society through wise fiscal policy and that the possibilities for achieving full employment while restructuring and rebuilding the disorderly aspects of the infrastructure. There is no need to call up visions of Armageddon in order to achieve that goal.

“Ordered society”? No thanks.

Also… Some MMTers can be extremely strident in pushing their particular agendas. It’s a BIG turnoff.

So I’ll put the question to you: Is a guaranteed basic income one of the policy proposals advocated by MMT? And if not, why not?

Hi, FM. Just want you to know that I live near Chicago and rub elbows with marginalized people everyday, and have for some 50 years. A JG alone will never emancipate them from hard labor and the drudgery it brings. They will be stuck in their lower castes forever. IF MMT doesn’t see this and act accordingly in a radical fashion well beyond a JG then I question everything they front for. Everything.

Well, why not ask these “marginalized people” what they think? Ask whether a BIG – lots of free money for everyone – could work? What could go wrong with that? Wonder why nobody thought of it before?

A JG alone will never emancipate them from hard labor and the drudgery it brings. Hey, I’m (pretty much alone) a bit to the “left” of the academic MMTers in this regard. I say it damn well will. Not “alone” in ANY society, of course. But in today’s USA & “advanced” societies, with today’s technology, it will.

As for liberating from hard labor and drudgery: well, there is a good deal that must be done – e.g in hospitals, janitors etc – and why on earth should the people who do it not be paid well? Good money for hard labor is damn real liberation.

OK, then pay em well–like Professor Wray rakes in for starters.

So why should some people have to work for the money to buy food or pay taxes, and others don’t have to work, but instead live off their rents and other people’s work?

Or better yet, why do the bankers get to créate money with the stroke of a keyboard, and others have to work for what piddling amount of money they get?

Does MMT desire a classless society or not? Does it offer a program to effect this? Calcagus?

Does MMT desire a classless society or not? Does it offer a program to effect this? Calcagus?

Does relativity desire gravitational redshift and black holes?

That a Job Guarantee would eliminate inflation and unemployment, and improve human welfare is pretty much “pure descriptive science”.

It would directly remove an enormous cause, a primary cause of class divisions and inequality and imho indirectly this would only accelerate subsequently. Completely classless? That’s for people to define the meaning of and work toward themselves.

It would be a giant step toward it, because once they’re well-fed, slumbering lions might notice they were bound only by chains of dew.

I really dig your new Socratic style.

“It is however the purpose of government to take care that the already existing orderliness within the economy not be allowed to deteriorate if that is possible.”

I’m sure that the idea that the purpose of politics and governance is the maintenance of creaky Old Regimes will come as a great surprise to the founders of modern governments.

Even those who take a dim view of what they did in actuality will concede that much.

So again I ask, speaking in strictly descriptive terms, are there any de facto external (regulatory) limits currently imposed on the amount of leveraging or deleveraging the private financial sector can do in order to create or destroy “money”?

If you agree there are not, should there be?

Does MMT have a proposal to rein in the amount of bank-created or destroyed “money”?

In short “no” other than a call for regulation and the recognition that a sovereign government “Liquidity Factory” can always offset the excesses of the private sector “Liquidity Factory”.

But what constitutes “money”? Is it merely coin, currency, and T-bills, as Alt implies? Or is it something else?

Money in the modern context can be defined as the currency which is universally accepted for exchange due to the power of the state to drive its use. In the broader sense anything at all can be money, the problem is getting people to accept it.

Do not the other new monetary reform movements use a broader definition of “money” than mere coin, currency, and T-bills?

I don’t think so. The difference lay in how we get everyone to accept the money, which other reform movements, while some of them have interesting ideas, don’t yet appear to have an answer for.

Don’t they argue that the vast majority of money is in fact bank-created money?

They do, which I think is misleading. When we say banks create most money all this means is money bounces between accounts. If the government buys something the dollars get deposited in an account at a bank which is said to “create” the deposit. That money could be split up into many paychecks, each of which would be considered money creation as they are again deposited. Then those people spend the money again as they buy groceries, fuel, vacations, etc. and the money is “created” into other accounts. This happens to the tune of trillions of dollars per day, the same dollars cycling around until lost to various financial leakages. It would be exactly the same process even if we moved to a public banking system.

I think you’re referring to ‘high-powered’ money here which are true government backed iou’s. Then one step lower are bank iou’s and then lower still non-bank iou’s. Which is what diptherio is referring to below. Bank iou’s get their credibility by being able to draw on government backed iou’s. But they can default and get over-leveraged and need to be managed and regulated.

@ Ben Johannson

But to reiterate, is not the battle over the definition of “money” at the heart of the schism between MMT and other new monetary reform movements?

For instance, here’s what Joseph Huber, one of the leading lights of the NCT movement, has to say:

“MMT claims to be a chartal theory or state theory of money. Most people will understand ‘state money’ or ‘sovereign currency’ as money issued by a state authority such as a national central bank. MMT, however―and in line with banking doctrines and national-liberal ideas of old in the vein of Knapp and Mitchell-Innes―understand by ‘sovereign currency’ that the state just defines the national currency unit and for the rest accepts the money denominated in that currency issued by private banks rather than a public agency. This creates misunderstanding from the beginning.

MMT does not recognise a need for monetary reform. Central bank and government together, it is assumed, exert effective control over banks’ creation of credit and deposits. Fractional reserve banking on the whole is seen as efficient and benign. To NCT this is just another example of fictional economics, for the actual situation today comes close to one of capture of the state’s monetary sovereignty by the private banking sector. Realities today, far from representing a sovereign currency system, represent a state-backed banking rule. In spite of a long list of dysfunctions of fractional reserve banking―from lack of money safety via the distortion of economic and financial cycles, to monetary and financial instability and proneness to crisis―that system is maintained on grounds of an almost inextricable mutual dependency of government and banks; with governments running high levels of deficits and debt, and banks creating overshooting money supply and BIP-disproportionate levels of financial investment (asset inflation).”

http://static.squarespace.com/static/51ab60bee4b0361e5f3ed7fb/t/51ee76bfe4b0cc8c8b66ed72/1374582463955/MMT%20and%20NCT.pdf

from Mexico

MMT does not recognise a need for monetary reform. Central bank and government together, it is assumed, exert effective control over banks’ creation of credit and deposits.

I see movement to public banking as an enormous reform of the monetary system, which is why I don’t quite understand that particular criticism although I’ve heard it many times. We will always need some sort of financial infrastructure whether we call these entities banks or depository institutions or money vaults; changing the current infrastructure to a series of fully public non-profits would, I think, accomplish the goal with relatively minimal disruption to the real economy.

MMT, however―and in line with banking doctrines and national-liberal ideas of old in the vein of Knapp and Mitchell-Innes―understand by ‘sovereign currency’ that the state just defines the national currency unit and for the rest accepts the money denominated in that currency issued by private banks rather than a public agency.

I see us as the sovereign. We’ve allowed banks to act as private agents, have their fun, snort their coke and generally raise hell and now it’s time to take away the keys to the printing press. The misdeeds of the financial sector have been allowed to occur not because they are inevitable or we’re powerless but because we’ve been asleep at the wheel and the kids started pumping the accelerator.

• Ben Johannson said:

“I see movement to public banking as an enormous reform of the monetary system….”

But other new monetary reformers do not. Some, including Michael Kumhof, would put banks completely out of the money-creating business, as he explains here:

http://www.youtube.com/watch?v=tnehf-U527g

The reform of the monetary system as advocated by Kumhof and others is far more radical than that advocated by MMT. And that is why you have heard the criticism so frequently that “MMT does not recognise a need for monetary reform.”

These reformers would of course agree with you that “We will always need some sort of financial infrastructure.” However, they argue that money-creation should be done by the government, not banks. The idea is to hold the politicans fully accountable for money creation, and put a stop to this shell game the Fed, the bankers and the politicians play whereby they all point the finger at each other, thus avoiding blame and accountability for their misdeeds.

• Ben Johannson said:

“I see us as the sovereign. We’ve allowed banks to act as private agents, have their fun, snort their coke and generally raise hell and now it’s time to take away the keys to the printing press. The misdeeds of the financial sector have been allowed to occur not because they are inevitable or we’re powerless but because we’ve been asleep at the wheel and the kids started pumping the accelerator.”

And how has that worked out? Again, you’re merely reiterating your argument against serious structrual reform of the monetary system.

from Mexico,

And how has that worked out? Again, you’re merely reiterating your argument against serious structrual reform of the monetary system.

That’s silly. Firstly, one could also say of virtually anything you’ve advocated “And how has that worked out?” It’s a polemical trick that does not advance a discussion. Secondly the conversion of banks to public utilities is by definition a structural reform. Just as Kumhof suggests, it would mean a 100% deposit guarantee and the end of private credit creation by leveraging of government reserves. The Chicago plan is not what you think it is:

(1) Much better control of a major source of business cycle fluctuations, sudden increases and contractions of bank credit and of the supply of bank-created money.

We got that when we moved from the gold standard.

(2) Complete elimination of bank runs.

When was the last time this was a problem?

(3) Dramatic reduction of the (net) public debt.

Who cares, but entirely within the neo-liberal debt-phobic paradigm.

(4) Dramatic reduction of private debt, as money creation no longer requires simultaneous debt creation.

Nope. Monies issued by government are still debt-based and always will be.

We study these claims by embedding a comprehensive and carefully calibrated model of the banking system in a DSGE model of the U.S. economy

This alone means the plan can’t be taken seriously. DSGE models have proven their utter uselessness for economic forecasting. Completely discredits Kumhof’s claims for its soundness.

What you are saying now is quite different from what J.D. Alt said above. Here’s what Alt said above:

“The sovereign government issues U.S. Dollars in the FG pot and then spends those Dollars through it’s own SPENDING spigot into the PS pot! Entrepreneurs in the Private Sector then use the Dollars the FG has issued and spent—leveraging them with bank loans and creative financing—to launch business ventures that generate private sector jobs and wages.”

Now compare that to what you just said in your description of the “movement to public banking” which you advocate:

“[T]he conversion of banks to public utilities is by definition a structural reform. Just as Kumhof suggests, it would mean a 100% deposit guarantee and the end of private credit creation by leveraging of government reserves.”

That sounds to me like it puts you on a different page than Alt, but almost the same page as Kumhof, who states his position as follows:

“At the height of the Great Depression a number of leading U.S. economists advanced a proposal for monetary reform that became known as the Chicago Plan. It envisaged the separation of the monetary and credit functions of the banking system, by requiring 100% reserve backing for deposits. Irving Fisher (1936) claimed the following advantages for this plan: (1) Much better control of a major source of business cycle fluctuations, sudden increases and contractions of bank credit and of the supply of bank-created money. (2) Complete elimination of bank runs. (3) Dramatic reduction of the (net) public debt. (4) Dramatic reduction of private debt, as money creation no longer requires simultaneous debt creation.”

http://www.imf.org/external/pubs/ft/wp/2012/wp12202.pdf

So are you agreeing with Kumhof and his plan to put the banks completely out of the money-creating business by requiring 100% reserve backing for deposits?

MICHAEL KUMHOF said: (1) Much better control of a major source of business cycle fluctuations, sudden increases and contractions of bank credit and of the supply of bank-created money.

BEN JOHANNSON SAID: We got that when we moved from the gold standard.

I think Steve Keen would disagree, and he’s done the research and got the empirical data to back it up. Just take a look Keen’s graph of private debt to GDP for the past 90+ years:

http://www.creditwritedowns.com/wp-content/uploads/2012/04/Steve-Keen-INET-Debt-to-GDP-US.png

MICHAEL KUMHOF said: (4) Dramatic reduction of private debt, as money creation no longer requires simultaneous debt creation.

BEN JOHANNSON SAID: Nope. Monies issued by government are still debt-based and always will be.

Well again, other money reformers disagree. For instance, here’s what Joseph Huber has to say on that subject:

“MMT has it that money is credit and debt by its very nature and history. MMT adherents ridicule the notion of debt-free money as ‘dry water’.5 This again is banking doctrine rather than chartal currency teaching. Money certainly is a medium for paying debt, i.e. to get rid of debt, and thus has of course developed historically in a context of debt of various kinds. Debt and credit existed before monetary units of account were developed, just as such units of account existed long before coin currencies came into existence; yes, and this is another teaching NCT and MMT have in common vis-à-vis classical commodity theories of money. MMT, yet, misrepresents 2,500 years of coin currencies when money typically was not lent into circulation against interest, but spent into circulation by the rulers of the realm free of interest and redemption. Debt money, i.e. the false identity of credit/debt and money, isn’t a natural necessity at all. Modern money can freely be created, and of course it can be spent into circulation debt-free— pure water, so to say, not contingent upon credit and debt at source.”

http://static.squarespace.com/static/51ab60bee4b0361e5f3ed7fb/t/51ee76bfe4b0cc8c8b66ed72/1374582463955/MMT%20and%20NCT.pdf

From Mexico: MMT is not a “monetary reform movement”. Basically it is pure descriptive science. I’ve read Huber, and he doesn’t understand what he is talking about. He is confused about the old-fashioned, universally understood, primary dictionary meaning of “debt” = “credit”, and makes everything so much more complicated and confusing than it really is.

“Monies issued by government are still debt-based” is not perfectly precise. Government monies, a dollar bill, a coin, keystroked computer entries are not “debt-based”. They are debt. (Are “money-things” indicating a debt to be completely precise.), Absolutely as much, and in the same way as government bonds. Once upon a time everyone knew this vaguely at least. To quote someone who had better than a vague understanding: “Government credit & government currency are one & the same thing” (FDR’s 2nd fireside chat)

CALGACUS said: MMT is not a “monetary reform movement”. Basically it is pure descriptive science.

Well that’s certainly not what Stephanie Kelton, who I think most would agree is one of the leading lights of MMT, says:

INTERVIEWER: What do you think the government should be doing, or should not be doing?

STEPHANIE KELTON: Well, OK, so there are two sides to that question. One is the prescriptive side, what should the government be doing. And the other is the descriptive side. And we focus at least as much on the former as we do the latter.

http://www.youtube.com/watch?feature=player_detailpage&v=-i7O791RkvU#t=230

Personally, I appreciated Kelton’s moment of unguarded honesty and frankness there. Economics has never been a “pure descriptive science,” and I have my doubts it ever will, or even should be.

MMT is not economic theory – cough – sociopolitical theory and if you have been watching, you will have noticed from the onset the massive push from all quarters to attach sociopolitical theory to it. The JG was largely a response to that. What you might want to consider is what will happen when folk try to create an ideological movement out of MMT.

That’s right – one more bloody tower on an already over crowded ideological battlefield for everyone to snipe at each other.

skippy… at the end of the day all MMT needs to do is remove the excuse for austerity, nothing more, nothing less. The rest just gets sorted on the battlefield in sun light rather than in darkness.

FM (& Skippy): I said “basically”. Adequately untangling that particular knot is something I don’t feel like right now – and it was said in contrast to “monetary reformers”, who are largely cranks.

The JG is the primary supposedly “prescriptive” part of MMT. It was not a response to anything happening recently. MMT gets it from Minsky, but it is much older, both in practice and in theory.

Bill Mitchell’s presentation is the most accessible imho. Economists (& the general public) all have the same “prescriptive” goals, the same problematic, or at least pretend to – they are the only ones which can be said in public, on Tee Vee. Full employment, low unemployment is a Good Thing, and low inflation is a Good Thing. Mitchell says something like – these aren’t idiosyncratic MMT obsessions, but universal. What is important is the “pure descriptive science” of MMT that says the JG IS a simultaneous solution to both problems. (I’d say, with reasonable assumptions, it is the only genuine solution.) Other economists may disagree that it is a / the solution to these problems – but they are wrong in a pure descriptive science way – like somebody who thinks the earth is flat, or that pi = 3.

It is very much like plumbing. There is the goal of delivering drinking and bathing water and removing waste. This is assumed. MMT & the JG in particular says that you should deliver water to everyone – especially those who have paid their water bill, and not link the sewer lines to the water lines. Simple, natural, unmysterious. Nothing but plumbing, fluid dynamics, accounting and engineering.

Modern main stream theory says NO, NO, NO: This ignores transgressive quantum hermeneutic ricardian effects known to every schoolchild. Sewer lines must be linked to the drinking water lines – should really be identical. Otherwise the bottom floors thirst would cause everything to go backward and there would be too much water everywhere. In particular, the bottom floors must drink from the sewer lines of the top, and everyone will then drink perfectly pure water, without the destructive intervention of plumbers, water pumps, pipes, rain or even water. All that just messes things up, and promotes “the shit illusion” that there is such a thing as waste aside from that caused by evil artificial subsidized plumbing intervention. This was proved by Slaveman & Sacul(a) long ago, refuting the charlatan Senyek.

I think you found the sophist at 11:07.

I think there are a few fine distinctions that need to be made here.

Besides the three forms of money that you mention, there are also reserves with the Fed. While it is true that only the Fed has the ability to create new reserves, it is also true that the Fed’s interest rate targeting policy forces them to create new money (in the form of reserves) whenever the Fed Funds rate threatens to rise too far above target.

So lets say (as a goof) that the Wall Street banks get rid of all their underwriting standards and just start giving loans to everyone who walks in the door. They get the dough to fund those loans from the Fed funds market, i.e. borrow it from other banks who have reserves in excess of requirements. The more loans the WS banks make, the fewer funds are available in the Fed funds market, which causes the inter-bank interest rate to start to climb. The Federal Reserve then steps in and buys securities from banks by crediting their reserve accounts, which is essentially creating new money.

So, while it is true that the US Gov’t has the sole authority to create US currency, it is also true that the current design of our financial system allows private banks to force the Fed to create additional currency, ex post facto, by draining the Fed Funds market.

Money growth (or decline) under our current system is both exogenous and endogenous, as I’m pretty sure Alt and other MMTers recognize.

“Money growth (or decline) under our current system is both exogenous and endogenous, as I’m pretty sure Alt and other MMTers recognize.”

That is my understanding as well. A distinction is made between horizontal (banks) and vertical (govt) money. And Keen (economist) and Matheus Grasselli (mathematician) are working on a model that takes into account vertical and horizontal money.

There is two forms of money (defined to be what you can use in the grocery store to buy food): fiat money and credit money. Full stop. The federal government can and does issue both types, while banks, under charter from a government agency, issues credit money.

@ diptherio

The current reality is that the only purpose the Fed serves, its raison d’être, is to provide plausible deniability for all the sh*t the bankers and the politicans do. They would have us believe that the Fed is not a creature entirely of their own creation, and that it does not serve solely at their pleasure.

1.That money is IOU is the one of hypotheses of MMT. But MMT’ers suck at describing and explaining when it comes to critics; they just say idiotic things like “MMT is not a theory, but a description of how fiat money regimes work”. Every theory descibes some slice of the world; one can have multiple descriptions of that slice of that world. One can describe that slice at multiple levels of abstraction just like the way physics, chemistry, and biology provide multiple descriptions of, say, human beings. One can have competing descriptions of that slice: that’s when we need to evaluate which description is better. In my opinion, MMT is better than competing descriptions.

2. The alternative description is a transaltion of Ricardian equivalence. This equivalence works for money users, but not money creators.

3. Mish and zerohedge crowd thinks that banks create money out of thin air; it is true. But they miss the other side of the coin: banks also destroy the money when loans are paid back. Mish/libertarian/zerohedge crowd misses this; even the mainstream economics doesn’t get it. In Post Keynesiansm, it is known as ‘endogenous’ money.

4. What MMT does is to combine many things:

(a) endogenous money (horizontal circuit)

(b) exogenous money (vertical circuit)

(c) Abba Lerner’s functional finance

(d) stock-flow consitency (esp Wynne Godley and Lavoie’s work); the mainstream is not stock-flow consistent.

(e) wage-led regime (instead of export-led regime sold by the mainstream).

As a consequence of (e), you gotta have some or another version of Job Guarantee. That’s why Mosler and others say that exports are good and that imports are bad. You are exporting ‘real’ resources for ‘financial’ resources.

Pedro Alvarez said:

“That’s why Mosler and others say that exports are good and that imports are bad. You are exporting ‘real’ resources for ‘financial’ resources.”

Didn’t you mean to say that “Mosler and others say that exports are bad and imports are good. You are exporting ‘real’ resources for ‘financial’ resources”?

But here’s the question: Is this sort of trade deficit sustainable over the long run?

Marshall Auerback, for instance, raises the specter of potential problems of chronic trade deficits for even those countries with monetary sovereignty and the reserve currency, that is the United States. He expresses the view that the Bretton Woods II monetary system is inherently unsustainable. Bretton Woods II, he writes

“is less a monetary ‘system’ and more monetary fiction, articulated to rationalize the dollar’s perverse resilience in the face of America’s increasingly parlous debt build-up and America’s seeming immunity to Third World style debt-trap dynamics….

“The U.S. has been perfectly happy to accede to the current state of affairs [the U.S.’s chronic trade deficits] in spite of the immense economic damage it has inflicted on its domestic manufacturing sector (and the concomitant evisceration of its middle class) because it has provided the country with a cheap form of war finance, a particularly important consideration as it has gradually militarized its energy policy.

[….]

“The U.S. has acceded to this arrangement because it has served to boost U.S. asset prices and lower risk spreads, thereby helping to facilitate America’s ‘guns AND butter’ foreign policy. In the absence of its Asian creditors acting as ‘dollar sub-underwriter of last resort,’ it is hard to envisage a chronic debtor country like the U.S. mounting successive wars with little financial strain and an absence of tax increases.”

–CHRIS P. DIALYNAS AND MARSHALL AUERBACK, “Renegade Economics: The Bretton Woods II Fiction”

And aren’t the sort of trade deficits Mosler is urging the very hallmark of late-stage empires identified by Giovanni Arrighi, as Benjamin Kunkel explains here?

“In his final book, Adam Smith in Beijing (2007), the late Giovanni Arrighi expanded on Harvey’s concepts of the spatial fix and the switching crisis to survey half a millennium of capitalist development and to peer into a new, probably Chinese century. In Arrighi’s scheme of capitalist history, there had been four ‘systemic cycles of accumulation’, each lasting roughly a century and each organised on a larger scale than the one before, with a new polity at the centre: a Genoese-Iberian cycle; a Dutch cycle; a British cycle; and an American one. A systemic cycle’s first phase, of material expansion, came to an end when the central power had accumulated more capital than established trade and production could absorb. This was followed by a second, financial phase of expansion in which capital overaccumulated at the centre of the system promoted a new nucleus of growth. Ultimately the rising centre came to finance the expenditures, often on war, that the old and now declining centre could no longer cover out of its mere income.

It fits Arrighi’s scheme that the US, having (along with the Chinese diaspora) once led international capital onto the Asian mainland, had now become dependent on Chinese credit. For him, this announced the greatest switching crisis of all time, as China prepared to assume the hegemonic role being reluctantly relinquished by the US, and to inaugurate a new cycle of accumulation.”

http://www.lrb.co.uk/v33/n03/benjamin-kunkel/how-much-is-too-much

My bad, there was a mistake. I meant “Exports are bad; imports are good”

The JG gets murky rather quickly, though, both at a philosophical level of why the inherently authoritarian structure of employer-employee relations should define society’s safety net and at the practical level of what is a JG.

I do enjoy bold policy prescriptions, but they have to stand up to scrutiny to be worthwhile. How much does a JG job pay? What about benefits? What does it do? What training do workers receive? What protections from harassment and discrimination? What supervision? What evaluation (of both workers and projects)? What is the difference between ‘permanent’ public employees and JG employees? Are NSA spies and university econ professors going to be on the JG payscale?

And at any rate, somebody has to manage all of that – overseeing tens of millions of workers and projects in a system where institutional governance is one of our most glaring weaknesses.

I agree-doesn’t “bank created money” i.e. credit, once transferred to the borrower become “money” that can be used just like federally issued IOU’s?

Eye opening. Keep up the great work.

‘Federal taxes drain Dollars out of the Private Sector pot and—POOF!—they’re gone.’

When you or I pay taxes, we make out the check to ‘United States Treasury.’ Treasury deposits the check in its Federal Reserve account. The balance in the Treasury’s account (a flush $162.4 billion as of Jan. 1st) is shown in the Federal Reserve’s weekly H.4.1 report, as a liability of the Federal Reserve.

http://federalreserve.gov/releases/h41/Current/

Ultimately, ALL of this Treasury account is re-spent. On a flow basis, deposits into and subsequent payments from the Treasury account will reach about $3 trillion this year. Meanwhile, before QE began (and perhaps again post-taper), the Federal Reserve was creating about $60 billion a year in new currency via POMOs (Permanent Open Market Operations).

Sixty billion is two percent (2.0%) of $3 trillion. That is, currency creation is a distant second-order effect, compared to the ordinary flows of taxation and subsequent spending. MMT’s obsession with the ‘magic’ (which is merely squalid fraud) of seigniorage is bizarre and fetishistic. Why can’t MMTers just stick to harmless kinks like dressing up in latex suits, instead of messing with the damned currency? Oy …

So the dollars don’t go POOF after all? They do eventually get re-spent?

Malmo,

I’m glad you showed up on this thread, because you and a handful of others bring a different moral and ontological perspective to the debate than that of MMT.

Did you catch Warren Mosler’s presentation over the holidays?

http://moslereconomics.com/2013/12/22/mosler-barnard-tour-2013/

The first question that entered my mind was this: Who gave the British the right to burn the natives’ huts down if they didn’t work to earn the money to pay their taxes?

This whole money thing seems to be built upon the use of a whole lot of violence (and necessity under the less flagrant version) to extract forced labor.

It does seem like the “classical” protection racket, only supra-scaled and somehow “legalized”. Civility without honesty needs an extra coat of maquillage to hide the ugliness.

I’ve become skeptical of anything that gives credence to unaccountable power. Whoever said that power corrupts, was imo, only half right. Unaccountable power corrupts and power that is absolutely unaccountable corrupts absolutely. Isn’t TBTF and TBTJ by definition unaccountable? Havent bankers, abused bankings assumed “stewardship” of the payment system in this way?

http://en.wikipedia.org/wiki/Protection_racket

“Government protection rackets”

“Government officials may demand bribes to look the other way or extort something of value from citizens or corporations in the form of a kickback. It need not always be money. A lucrative job after leaving office may have been in exchange for protection offered when in office. Payment may also show up indirectly in the form of a campaign contribution. Stopping governments agencies as a whole, and buying protection in the government is called regulatory capture.”

Well that’s certainly my impression. It’s the same old wine of classical economics poured into a new bottle.

The metaphysical materialism and utilitarianism of classical economics are still there, as well as the Platonic realism and instrumental rationality.

The sectoral approach, as if the private sector somehow exists in a separate universe independent of the government sector, is the perfect example of Platonic realism. But as Noam Chomsky and many others have pointed out, there is no line in the sand between the private sector and the public sector. At the higher orders of society, they meld together almost seemlessly. The Fed is the perfect example. Does it fit in Alt’s FG box? Or does it fit in his PS box? Or is it somewhere in between?

Correct. The only occasion on record when dollars went POOF was during 1929-1932.

When depositors withdrew their funds in cash, the money multiplier worked in reverse, obliging banks to liquidate loans (i.e., assets) and shrink the deposit base even more.

Also, uninsured bank failures caused deposits to go POOF overnight.

Theoretically, the Federal Reserve could shrink the money supply by liquidating its securities holdings for cash. But with banks holding $2.4 trillion in excess reserves as a result of QE, this theoretical mechanism is nullified until the Federal Reserve dumps $2.4 trillion of its $4.0 trillion stash. All hell would break loose long before that level of liquidation could be accomplished.

I rubbernecked this piece in a state of horrified amazement that the author can miss something so obvious. In a FRACTIONAL RESERVE BANKING SYSTEM money is created by the banks, NOT THE GOVERNMENT. This is a statement of fact. It takes an act of willful blindness (or a university course in economics) to miss it.

When you use your credit card to buy a coffee at Starbucks you are creating money that did not exist before you swiped your card. The primary dealers are the Treasury’s credit card. In this system money is credit, nothing more, and that is why it will collapse under its own weight.

For the MMTers who think gold is no longer money you need to explain 1) why oil, the most precious commodity on earth, is priced in gold through the petrodollar arrangement and 2) why gold has been spending weeks at a time in backwardation. This means that gold is withdrawing its bid on the dollar. And when the gold stops flowing the Treasury market will not be worth one silver dime.

For those who are interested: http://www.youtube.com/watch?v=C4X65TYo51U

You’re not thinking at the next level. Bank credit is only as valuable as the government’s willingness to back it. It is the government, not fractional reserve banking, that creates currency. Any bank that creates currency unbacked by either the existing credit of borrowers or new credit from the government will quite quickly go out of business.

Also, for my two cents, money is a concept, an idea, one of the mental activities that separates us humans from other bits of the universe. Its purpose allows us to compare the labor costs of otherwise unrelated pursuits and transport that labor value across time and space.

Gold is a physical object, an element on the periodic tables. It is an asset, and assets are part of the idea of money, but they aren’t money any more than a fingernail is an animal or red paint is art. Gold could be currency if a government chooses to use it as currency, but then you simply have a metal fiat instead of a paper fiat. It is the government that is the common denominator, whether the currency is gold or platinum or dollars or yen or eyelashes or salt or whatever.

The FED is the US governments credit card. The primary dealers are just the processing agents.

Prior to QE the financial system had basically ZERO excess reserves in the system – fact. Where did the primary dealers come up with the necessary reserves to complete the Treasury auctions if there were no unspoken (excess) reserves? You can’t have a reserve drain (treasury auction) without first having a reserve add. In order for the FED to have, hold and defend a target interest rate it must fund Treasury auctions by providing the primary dealers with the necessary reserves to complete the auction.

Per Former FED Chairman Eccles (1947): “…if the Treasury has to finance a heavy deficit, the Reserve System creates the condition in the money market to enable the borrowing to be done, so that, in effect, the Reserve System indirectly finances the Treasury through the money market…and as they will have to continue to be in the future. So it is an illusion to think that to eliminate or to restrict the direct borrowing privilege reduces the amount of deficit financing. Or that the market controls the interest rate. Neither is true.”

True, but see my piece “Hyper-Endogeneity.” Bank money is a liability of the issuing bank that is a derivative of the money issued by government:

http://neweconomicperspectives.org/2013/08/hyper-endogeneity.html

I’ll back gold when all the gold bugs put their gold where their mouth is and come together in a coalition to to to Fukushima and clean up our latest mess. Pay up now.

MMT does not miss it. They recognize two things: (a) banks create money; (b) banks destroy money. This is the thesis of endogenous money, developed by many Post-Keynesian folks. The mainstream misses it. Libertarians/Mish/Gold bulls/Zerohedge/ recognize (a) and don’t want to learn about (b).

“With this in mind, it occurs to me the reason our current Congressional leaders are having such a difficult time with our National Budgeting process is because they’re trying to design a “building” based on an incorrect diagram.”

I would argue that your premise is flawed.

The ‘difficult time’ is not due to an incorrect diagram. Everyone in Washington knows that the USFG creates dollars and spends them into the economy. Whether it is called corruption or bribery or theft or tax loopholes or subsidies or corporate welfare or entitlements or the War on Terror or money printing or whatever – it goes by many names – everyone knows the government prints dollars and then gives those dollars to interests that are special to the government. No one in a position in power in DC uses a different diagram.

Rather, the reason the time is difficult is due to the inherent stresses that decades of inequality and oppression have placed upon the system. Authoritarianism has advanced so far now that the concentration of wealth and power itself is rotting the system. The predation has reached such a stage that there is little left upon which to prey.

Hello Yves.

I am one of the non-commenters who visit your site daily. I take every chance I get to share what I learn from this site (and others on the blog roll) with friends and family. Like me, sometimes they don’t ‘get it’ but more importantly, sometimes they do and apply their understanding to what is going on in this country. I greatly appreciate this post and any others that present complicated but important info in a such a digestible manner. I know this an economics blog and others may feel insulted to have discussions dumbed down but you seem to realize that most people are ignorant to the economic and financial dealings that affect us all greatly. I appreciate your acknowledgement of that. I still and will have more questions so please keep up the great work.

Thank you.

Thank you for parting the Curtain of Illusion on the bogus “Shortage of Money”; “Federal Deficit”; “National Debt”; and “Entitlements” massive “Big Lie” propaganda and persuasion effort that has been perpetuated. However, I have wondered if there aren’t real pressure valves; i.e., cheap and abundant energy, arable land, environmental degradation, etc. that are being reflected in the Austerity meme.

Chauncey Gardner said:

“I have wondered if there aren’t real pressure valves; i.e., cheap and abundant energy, arable land, environmental degradation, etc. that are being reflected in the Austerity meme.”