It’s been creepy to see economists and the financial media cheering the re-levering by American households as a sign that they economy is on the mend and consumers are regaining their will to shop. But ordinary Americans took huge balance sheet hits in the crisis: the loss of home equity, which only in some markets has come all the way back; job losses and pay and hours reductions, which led many to run down savings as they readjusted; declines in stock market portfolios; lower income thanks to ZIRP for retirees and other income-oriented investors.

While the top wealthy are borrowing, in contrast to the behavior of the rich predecessors, on the other end of the spectrum, many are still struggling for survival. The latest job report showed that the number of long-term unemployed, reflected in the level of people who’ve given up looking for work and are counted as no longer in the workforce, only continues to rise. Food stamps and extended unemployment benefits have been cut. And with soup kitchens under stress too, one wonders how people who are in such dire financial straits manage to get by.

Before the crisis, if someone was hit with a financial emergency, like an accident or sudden job loss, those who had houses could often draw on home equity. With that piggybank depleted or non-existent, the last-ditch financial fallback is accessing retirement savings.

Now admittedly, this does not necessarily take the form of partial or full liquidation of a 401 (k). Some plans allow for borrowing against 401 (k) assets, but it’s no free lunch. Borrowing is limited to a maximum of half of plan assets or $50,000, whichever is lower. While the borrowing is interest free, the funds need to be repaid in five years. If someone is already under economic stress, what do you think the odds are that he will be able to repay the loan, particularly since it comes out of after-tax dollars?

And the alternative is even more costly. Withdrawing money from a 401 (k) before age 59 1/2 incurs a 10% penalty. On top of that, the taxpayer also has to pay income taxes on the withdrawal.

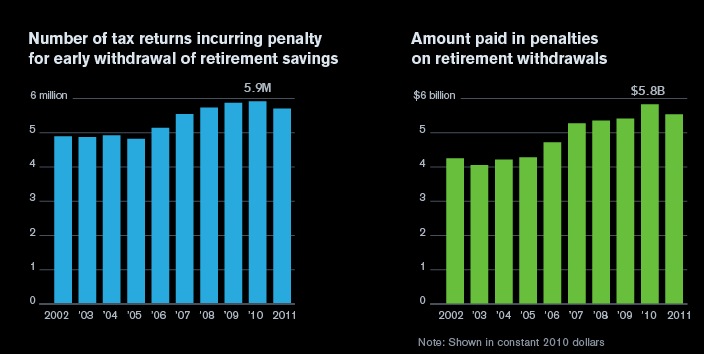

A Bloomberg story gives the sobering details of how prevalent 401 (k) withdrawals have become. For the latest year in which data is available, 2011, 4% of all households paid early withdrawal penalties. A Federal Reserve study found that 9.3% of taxpayers with retirement accounts paid early withdrawal penalties, an increase from 7.9% in 2004.

Admittedly, a Bloomberg graphic shows that the amount of penalties was slightly lower in 2011 than 2010. But the fact that it’s higher than the levels seen during the financial crisis years shows that economic stress is still high (click to enlarge):

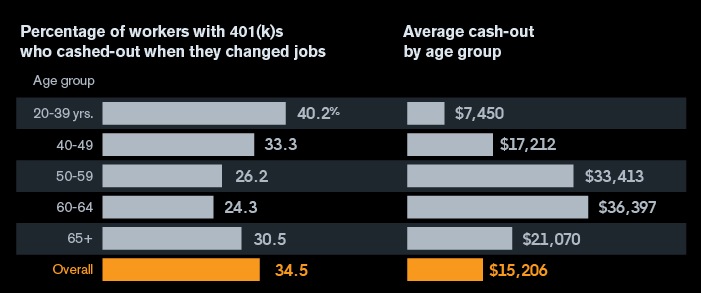

The article points out that one-third cashed out their 401 (k)s when they changed jobs, which they argue shows that many workers, particularly the young, don’t appreciate the true cost of early withdrawal. But I suspect the picture is more complicated. One of the few ways you can escape early withdrawal penalties is a first-time home purchase; at least a portion of the younger individuals may be buying a home. Conversely, others may need to pull money out simply to finance a move.

It’s also worth comparing the magnitude of these withdrawals to median 401 (k) balances: $24,000 overall, and $65,300 for those over 55 (click to enlarge):

Some excerpts from the Bloomberg article:

Adjusted for inflation, the government collects 37 percent more money from early-withdrawal penalties than it did in 2003. Meanwhile, the amount of home-equity loans outstanding was $704 billion in 2013, down 38 percent from the 2007 peak, according to Federal Reserve data.

“They didn’t have access to the home equity that they had in the past,” [Reid] Cramer [of the New America Foundation] said. “And families looked around for what was left and they actually drained the value from the 401(k).”

The article discusses the divergent policy views: make it easier for people to access their retirement accounts, recognizing that they may be under duress, or make it harder to force them to keep their savings intact. Of course, you don’t hear any mention of the notion that what is really needed is a stronger job market, with better paid work, so more people can build up a saving buffer.

It’s hard to imagine, for instance, how higher penalties are going to change the behavior of those in dire straits, like Cindy Cromie:

Cindy Cromie…needed the money to rent a U-Haul and start a new life. Her employer, the University of Pittsburgh Medical Center, had outsourced Cromie’s medical transcription work..,

So, last year, at age 56, she moved about 90 miles from her home in Edinboro, Pennsylvania, into her mother’s basement. To make ends meet as she moved and then quit the job, Cromie pulled out $2,767 from her retirement savings. Still unemployed, Cromie is trying to avoid tapping what’s left of her retirement savings — $7,000.

As Michael Olenick remarked via e-mail:

This reads like a Dickens novel. Her retirement savings, in her mid 50’s, were less than $10K but she tapped 1/4th of that. She had to pay a 10% tax penalty plus the funds were treated as ordinary income. In contrast, the executive who outsourced her job probably has investments that will be treated as long-term capital gains and taxed at a much lower rate and the people managing her paltry retirement fund are probably taxed at carried interest rates too.

Welcome to the world of markets uber alles.

We’ve just been allowed to do pension draw-down by our loving caring Chancellor. Given everything the man does is evil, I can only think this is to do with us paying off bank mortgages and living in penury. This stuff is as plain as the nose on our faces (I don’t mean in the sense of ‘why publish it’). The breakthrough to sensible public discussion seems as far away as ever, let alone a politics facing up to what is really going on. I walked Maxwell in town this morning and could have recorded the reality and pain without any conversation. No sign of Yves on the BBC yet, though we do get Keiser flogging gold occasionally (gee whizz). Keep it up everyone.

“It’s hard to imagine, for instance, how higher penalties are going to change the behavior of those in dire straits”

Of course it won’t change anything, except to inflict more pain on the near-poor and drive them over into poverty.

But the exercise will demonstrate to our overlords two things:

1. They tried to “do something” about the problem by addressing the symptom.

2. Having “done something”, they can claim the moral high ground of acting responsibly, while deriding the victims as irresponsible, and therefore undeserving of any real help or voice.

“While the borrowing is interest free”

Not on any plan I have had, But the rates are low.

As for the early withdrawal penalty, I’ll bet that many have no clue about it until they either are told by their tax preparer, or get a letter from the IRS down the line. Most Americans, as we know, are pretty ignorant of important personal finance matters.

Besides, on average, nobody has any money saved anyway. This, sad to say, is a problem for maybe the top 25%. And I’ll bet the attitude is pretty fatalistic as they use up the money. WTF, they probably say, It’s not even enough to buy a used car, let alone pay for retirement.

Yes, interest is owed but you are paying yourself. But if your need for the money is “operations” as opposed to “capital investment” it isn’t a lot of comfort.

And hey the climate reports say the planet will be toast by that time anyway …

The world’s about to be destroyed

There’s no point getting all annoyed

Lie back and let the planet dissolve around you

…

So long, so long and thanks

for all the fish

I’m on the verge of borrowing from my IRA, penalty or no. If the choice comes down to saving my house and raiding my retirement savings, the house is going to win.

Yes, that’s a short sighted plan but that’s what most people do. We hold dearly on to what we already have and pray that the future will be better – it won’t, but we have to live on hope. In my case, I know I will figure something out and replace those funds. But I doubt very few of the people who work “regular” jobs (ie are not entrepreneurs) will do that?

We’re replacing middle class wage jobs with low end retail jobs and this trend is not showing any signs of stopping. Where are the jobs that will allow people to replace those drawn down savings going to come from? Software is eating the world and robots are making more and more of it. Businesses everywhere are racing to reduce labor costs on their books. Labor has become a dirty word and the “labor force” is an army of low paid serfs that suck up more resources than they create for business.

This economy that’s been created by and for the ultra wealthy who demand more shareholder value is driving what’s left of the middle class off a cliff.

I’m pretty sure you can’t borrow from an IRA. Only a 401k, if the plan allows that.

Yea but I think ROTH IRAs have less penalties for getting at the money (just taxes and sometimes not even that).

You can take your money out for 2 months and return it. That’s all you can do with an IRA. You have 2 months to do a rollover, so you tell your custodian you are rolling it over and then send the money back. And you need to be very clear as to exactly when you need to get it back to your custodian.

Definitely do your research or talk to someone over your individual situation. There are reasons that assets in an IRA can be better than assets owned outside of it, especially if you have a substantial enough portfolio that it can keep a house that would otherwise be lost. There are also ways of getting money out of an IRA for specific purposes that aren’t subject to additional penalties. Just to give a hypothetical example, if you happen to have incurred higher ed expenses, thanks to the fungibility of money, you could take money out of the IRA to pay those costs penalty free, then use the money that was going to pay those expenses toward the house.

Of course, all of this complexity is unnecessary and wasteful, but that’s a different point about our friendly tax code :)

As far as software and robots, I know that’s a common meme, but it’s not what is happening. Technology is one of the favorite bogeymen of the TPTB and their enablers. It has nothing to do with why tens of millions of jobs are of the low-paid, demeaning crap variety.

“Labor has become a dirty word and the “labor force” is an army of low paid serfs that suck up more resources than they create for business.”

Yup. As I’ve been saying since 2007, employees are the new welfare queens. The blood hasn’t even been mopped up on the Obamacare exchanges and they’re already floating things like this, (from today’s links):

http://globaleconomicanalysis.blogspot.com/2014/05/end-of-employer-provided-healthcare-by.html

“A new investor report predicts that Standard & Poor’s 500 companies could shift 90 percent of their workforce from job-based health coverage to individual insurance sold on the nation’s marketplaces by 2020.

If all U.S. companies with 50 or more employees followed suit, they could collectively save $3.25 trillion through 2025, according to the report by S&P Capital IQ, a division of McGraw Hill Financial.

Standard & Poor’s 500 companies could save $689 billion over the same period if they did likewise, the report found.”

My wife and I are young and fairly well off.

We’ve talked over cashing in our 401k’s and using them to pay off her student loans in one fell swoop, and perhaps to also pay down the principal on our new mortgage with the remainder. Hardly frivolous things, but we’d still pay a penalty.

Neither of us believe that the money is going to be there when we retire in 30-40 years, and we have enough stored up in those accounts to really put a dent in our debt.

“Neither of us believe that the money is going to be there when we retire in 30-40 years”

Well, it certainly won’t be there if you do what you are planning. Why otherwise? How would it vanish on it’s own?

I read it like SS in 40 years. Sure the amount is there, but inflation will have made it’s purchasing power useless. Gas might be $10 gal. by then. How much was a brand new car 40 years ago?

SS is inflation indexed.

http://www.sott.net/article/278567-A-Deeper-dive-into-inflation-numbers-Why-poverty-is-still-miserable-even-if-everybody-can-own-an-awesome-television

Of what use is indexing if the wrong index is used?

Our political leaders have expressed every interest in reducing such indexing, not increasing it.

Maybe it won’t be there because there are a multitude of ways to bleed anyone dry. Sky high health care premiums, huge deductibles, outrageous public and private college tuition, job losses, downsizing, kids’ needs. All these can consume every last penny and then some. I realize that a 401k can be considered a protected asset in many cases, but it’s still a resource people consider leaning on in tough times. I’m not advocating that people withdraw their 401k money, but pessimism (or some might call it realism) isn’t unwarranted.

Pretty much this, though I’d like people to consider what 30 years of decline in America will do to pension systems.

Hell, I can’t make a good prediction of what this place will look like in 10, let alone longer.

” I’d like people to consider what 30 years of decline in America will do to pension systems.”

Public pensions and some private are hurting, but, that would be even more reason to save. If America is “declining”, as you say, and I agree, then deflation will be the order of the day, so holding solid and safe investments with that in mind would actually be a great defense.

You said that you’re young. Fine. Watch what’s happening today. 73 million Boomers are sliding into the end game with not much. Half have nothing, and only maybe one quarter of the other half have substantial savings to help pay for old age. Don’t be one of those people. You have been forewarned. It’s not as though we’re going to elect representatives who will give a damn in your lifetime. They’re busy killing Social security, the only source of income half of the Boomers will be buying their cat food with. You have youth on your side. Savings plans started in one’s twenties compound much more powerfully than those started in the late 30s and 40s. Furgetabout the 50s.

The main issue, for me, is that we have debt that is sucking away at our earnings every day.

Paying off debt is a huge emotional relief that benefits quality of life significantly. It does not have a price but it certainly has value that is worth taking into account.

Thanks, that’s a great way of putting it.

Student loans on top of the mortgage payments just suck. When staring at that pool of money that I don’t trust to be there, I connect the dots.

I think you are doing the right thing to either pay off, or put a large dent in the student loan. Not only are you getting rid of non dischargeable debt, but you’ll be freeing up additional monthly income that can be plowed right back into savings if you like. Debt serfdom is something to avoid in my opinion as quickly as you can.

Ask generation X about how well that compounding has worked our for them. A decade of compounding were wiped out in 2008 (true some has come back). The boomers actually were at least born at the right time to benefit from compounding plus they mostly have pensions and Xers and Millienials don’t. Which makes the whole situation even more depressing really.

So the starting in one’s 20s or early 30s, what if that period of time represents the decade before 2008? Is one kind of just hopelessly screwed then? You were born too late, I was born too soon …

If you seriously think pensions, IRAs, 401K, etc., will be there in 10+ years – be there in a size big enough to matter, and liquid enough to be used – then I have a bridge for you.

Unless you are military or police, nobody’s pension is safe – ask the teachers and firemen about theirs.

Cocomaan–

You are certainly right to wonder if pension systems will collapse utterly. Certainly they will. The only question is when, and that nobody really knows.

All assets are becoming high-risk, but those you intrust to institutions to hold for you are riskier than those in your direct possession.

Paying off debt is probably the best thing you can do. Collection agencies will be among the very, very last of financial institutions to go. You definitely want to be off their radar one way or another!

–Gaianne

markets. i’m gen x and have lost almost half my 401k twice now – the dot com implosion and 2008. no way i will ever make up for those losses because now i can’t afford the riskier investments. those losses were also comprised of maximum contributions because i could easily afford it at the time, now not so much.

Sounds like a troll. This education obviously was not in personal (or any other sort) finance or history. Nor has this apparently expensive education enabled the recipients to learn-how-to-learn about subjects outside of their narrow fields of specialization. Although I have heard many ignorant YOUNG people/ditto-heads state the same nonsense about SS, despite the fact it is the only thing keeping their parents in their homes or putting food on their tables, they would be wiser to reconsider SS as an equivalent to “bonds” in their retirement saving schemes so that they can allocate aggressively into equities, REITs, BDCs, and make a few hail-Mary wagers on bio-techs and other wildcatters. But, it seems youth is wasted on the young, and in some cases education too.

On the mortgage do not do it. On the student loan, if the rate is very high, maybe. If you feel compelled you might stop contributions and use that against outstanding debt, but if you have an employer match, that’s painful too. Probably most sensible is simply to scale back on general spending and probably send it against the student loan first and mortgage after that. If you have parents who are planning on (and demonstrably capable of) providing you an inheritance, you might want to talk to them about “pre-distributing” some of it as gifts, which has tax advantages. Again, only if their finances are very sound, but it worked in my family to the advantage of even the following generation where you can easily trace the minimal student loan balances for granchildren on programed gifts from grandparents to their children and consequent reduced debt servicing over many years.

Read you loud and clear on the mortgage front. We got a phenomenal interest rate on that. The student loans are less ideal. Not crippling, but still a few hundred a month as we try to pay down principal as fast as possible.

As for parents, they are worried about their retirement, as many boomers are. Even a conversation about their retirement standing would be good, just to make sure I can account for possibilities as they get into that time of their life.

Thanks!

“Of course, you don’t hear any mention of the notion that what is really needed is…better paid work…”

Right on. The interesting question continues to be: why do things cost so much in a world where wages are so low for most people?

Something I think that is notable is that cash outs haven’t increased that much. People have been hurting since long before the intellectual class noticed there was a crisis. There were only about a million more cash outs in 2009 than in 2005.

Yea really. We are continually told things are becoming 3rd world in the U.S.. Well ok maybe the 3rd world isn’t all that great, but at least the 3rd world is cheap (or aligned with prevailing wages there). Housing is cheap, medical care while not always the very best, is cheap. The U.S. seems to want to become the land of 3rd world wages and 1st world prices.

In the doomosphere, 401K withdrawals is considered to be a good idea for two reasons. First, there is no chance they will generate a positive investment return for decades (the doomosphere expects no economic growth). Second, to deal with the loss of tax revenue caused by no economic growth, the government will find someway to raid them, probably by hiking taxes on retirees taking their money out of non-Roth IRAs when they come of age. So the idea is to just pay the penalty and salvage something from the IRA by getting the money out.

The smallest cash out when they changed jobs is more than 25% of the population in that respective age group – 1 in 4 – which means no other “cash” sources to me and that is the people who have the tax sheltered accounts to tap – huge number have nothing

if Medicare, Obamacare, Medicaid is seriously changed by the Republicans in 2015 – these people will not survive – incredible to witness this point in history

Do your part to save American jobs.

Last week we went to reserve a hotel room in L.A. I called the number that showed up online and got some pleasant woman on the line who sounded like a robot. “Where are you?” I asked….long pause. “Where are you?

“I am in the Philippines sir”.

“I don’t want to talk to you, please give me the phone number of the front desk of the hotel, I want to talk to them directly.”

She couldn’t provide it. I looked it up with attention to the area code. Called the front desk of the (small) hotel.

“Hi, is this the front desk? …Do you have a room for next Wednesday?”

“We can’t check, our internet is down, can you go online?”

“You mean don’t have a ledger or an in house system?”

“We use Instareservations” (can’t remember the exact name).

I had a nice conversation with the gal about her job, those of her friends, the state of the economy and then I told her to read Naked Capitalism. I am trying to piss off and radicalize everyone I talk to about the state of things and point them to sites like this. There is a lot of discontent out there.

On the other hand, traveling to Europe is so much easier with the help of the internet these days. I wouldn’t want the old world back with that one.

To have some fun with another post from earlier in the queue; What would the opportunity cost of withdrawing ones’ 401k funds be if the stock market does tank in the near future?

It is, after all, just another financial asset to be used when needed. (Remember when “Due Diligence” was a cornerstone of Business Ethics?)

Good point Ambrit. Some pundits are saying pensions may be worth as little as 15% of current book values, but as they often follow this up with ‘buy gold’, who knows? Doesn’t it all depend on whether you psychologically value a Dillon concert you can get in for $40 at $50? After that you intercourse Brownian motion as a stochastic exemplar with all known world events as variables and your Uncle Bob gets hay-fever from the pollen grain regression. Given the opportunity cost link of choice and scarcity you sell because your cash is scarce and you want the choice of being able to pay your rent or not, rather than live in your car. I will publish worked examples in next month’s Aardvark Business Review, expressed in non-commutative geometry and 4-d, 2-t space-time. Send money now to Craazyman (Offworld Finance) for the advance spreadsheet before everyone gets in the act and your pension provider runs out of cash.

Sirs;

I have my US Passport ready and am awaiting your reply concerning a visa to travel to Magonia for the Economics summit. Since all Money (TM) is fiat now, allow me to send you my personal Notice of Intent to Create some Money (TM) in the near future. (Said Money (TM) to be used to pay for travel and incidentals in Magonia.) By the way, is it true that Magonias’ Anthem was written by Schoenberg? Hope to see you all at the Venue!

I’m young, don’t make much, and haven’t put a dime in a 401k. Rent cleans out slightly less than half of what I take home after tax in a month, which doesn’t leave a lot of breathing room for anything else. Even if I could siphon off a small amount to put away, what are the odds my finances would stay good enough that I could avoid touching it until the age of 60? On top of that, at this point I have a hard time trusting financial markets and would only be comfortable with the most conservative options they had available…

I suppose I should, my parents lecture me about it when they get the chance….

Well, quite simply, don’t be old and poor. Young and poor is one thing. You can take on physical work, if offered, and sometimes that work feels great. Heck, If I was 25 and laid off, with no bites on my resume, I’d head out to the Rockies and learn to be a ski patroller. It would be a blast. Problem is, there are 50 year old ski patrollers making nearly the same as 25 year olds, with no benefits. Not much of a future in that.

You also have relatives to fall back on. Your parents are probably still alive and working. When you’re 60, they’re a memory, along, maybe, with siblings and others.

Read some horror stories of those over 50 who are living a devastated life after the “Great Recession”. They were on top of their little worlds at one time. Good job, nice house, cars, toys, trips. Now they can’t buy a job. ANY job. Age discrimination is rampant in hiring. They are looking at a miserable old age, hopefully surviving off the kindness of friends and some strangers. Don’t be that person. You will not be able to bounce back at 60 like you will at 25 or 30. The body won’t do it, and society will discard you like so much trash.

Ptup, you (correctly) said:

This is one of the reasons why this article from today’s Links section is so important:

http://bangordailynews.com/2014/05/05/opinion/contributors/billionaires-try-to-convince-americans-its-good-to-import-foreign-workers-increase-immigration/

Yea but if one is going to be unemployable at 50 or so anyway, I don’t think most people earn enough to fund the rest of their life from a mere 30 years of working. Early collection on SS is still available at 62, but how they”ll ever afford paying for their own medical care until 65. I think they simply won’t. Hope for national healthcare before that point?

This framework is entirely backwards, one of the most successful Big Lies told by our bumbling technocratic elites in their ongoing obfuscation of just how bad things really are in our country.

1) That’s absurd to argue that poverty isn’t a concern if one is young. You are really saying that with a straight face?

2) Do you know the cost of a decent standard of living in places like Denver and Salt Lake City? It is much higher than that paid by any easily obtainable physical outdoor jobs. The mean annualized wages of “Lifeguards, ski patrol, and other recreational protective service workers” as reported by our own government’s BLS is $20,890 a year.

3) This notion that older workers have it more bad than younger workers is false. It is completely inconsistent with the actual data. A higher percentage of the workforce is over 50 today than a decade or two ago. The GFC hasn’t changed this trend at all; if anything, the past five years show that matters for younger workers are even worse than for older workers.

Society hasn’t discarded old people. It has discarded everybody. That’s a key difference.

Dude, I was 22 in 1974. You know, gas lines, inflation, the draft, crappy economy. Interest rates would almost hit 20% by ’81. Our cities were literally burning. Japan was stealing our industry, and doing it very well. But, I was young and healthy, and had a working class family to bail me out every now and then between jobs. I could easily do construction, and kinda liked it, and later could take shift work until dawn that led to a very well paying trade. I didn’t need much but a room with a bed in the big city. I was pretty poor, I guess, but I could give a damn. Well, maybe, but, it didn’t wear me down much.

I could never live like that today, and I’m in pretty good shape for my age. The body is shutting down, and the right knee and foot are going first. I would be a social outcast, too. You know, the weird old guy sleeping on the couch. Thank god I ply my trade sitting down, but, that brings it’s own problems, too. I don’t think I’ll be doing a lot of physical activities in ten years, let alone work hard. Fortunately, I don’t have too. That’s what I was getting at. It’s just damn hard to be old at times, you don’t want to make it worse with poverty and/or hard work. Young guys can live on pizza and hard work and hustle for years.

And Salt Lake City is actually a pretty reasonably priced city to live in, not that I would live there. Not my kind of people. Great snow, though. The best.

@Roquentin

. . . and would only be comfortable with the most conservative options they had available. . . ”

Like those sure-thing AAA MBS? And those great PE funds that CalPERS invests in?

Hmmmmm.

It seems to me, and I would welcome correction from those who know better, that the only (non-Roth) retirement accounts worth having–for working/middle class people like me–are the ones where an employer is matching whatever you put into it. These accounts are all about how you pay (or avoid paying) taxes on income and investment earnings during your working life and your retirement. Since nobody lobbies for tax legislation to help ordinary people, ordinary people have to find ways to take advantage of tax breaks that were set up the rich and for industries (like the real estate industry) who control our Congress.

Withdrawls from traditional IRAs and 401ks are taxed as ordinary income, which is not true of much of the income from investments. High earners, who will be in a lower income tax bracket when they retire, have a greater incentive to save this way, and I think the traditional IRA and the 401k may have been designed mostly for their benefit or for the brokerage houses and mutual fund companies that needed business. Poor people, who expect to pay little or no income tax in retirement may also be better off saving this way, For people who are in, let’s say, the 28% bracket and hope to stay there in retirement, the benefits are less clear.

Saving some of your income for the future, and for retirement, is essential, especially for working people without inherited wealth. Granted, this gets harder and harder to do, but if you are lucky enough to have a job and to somehow dodge all of the traps and lures set up to make you poor, it may be better to put whatever after-tax, post-consumption money you have left into a residence (which comes with a generous tax break if its value goes up while you own it) and into a brokerage account where you hold blue chip stocks that accrue capital gains and improve your net worth (and your credit score) without generating much taxable income. Houses and stocks, like tax rates, go up and down in value, sometimes drastically, but that is a fact of life that also applies to IRAs and 401Ks.

If you need money for something important, you can refinance your residence (and get a tax break on the mortgage interest). Or you can sell some stock and take long-term capital gains at a lower tax rate, or sell losers to offset gains, and avoid paying taxes at higher income-tax rates. If you have to sell stocks to live in retirement, and you don’t have any losers to offset your gains, your earnings will be taxed at a lower capital gains rate. This is what rich people do.

If you somehow die with a positive net worth, you can pass it on to your kids tax-free. They will get your house and your stocks with an adjusted basis, which means nobody in your family will ever pay much tax on increases in value that happened while you were alive. If you are a world-class stock picker and somehow get really rich, your estate may have to pay an estate tax, but politicians are working hard to eliminate this tax. If you had bought these stocks in a 401k, you or your heirs would have to pay about income taxes at whatever the highest rate is at the time to cash out before looking for ways to avoid estate taxes.

Borrowing from a 401k means you will be taking income that you probably paid taxes on to pay interest to yourself ( at a 4 to 5% interest rate, in my experience) in an illiquid account , so that you can someday pay income taxes on it again (and any investment earnings it produces, including long term capital gains) when you take it out.

Paying an early withdrawl fee to take money out of a retirement acount, like paying 14% interest on a credit card, means that you are either living beyond your means or have had some bad luck and need to do something unwise. I know the latter happens, and, if it happens to you, I hope your luck changes so you don’t need to keep doing it.

Just what the F* are you talking about? Do you think there is a significant number of middle and upper middle class people left in the CONUS? You sound like a 1980s grad, the future’s so bright I’ve got to wear shades!

Who the heck has this kind of financial stuff? Who has money left over to “save” for retirement. More importantly, just what info do you have, that I missed, that makes you think the long range future will be better than tomorrow?

And please, take your last paragraph and shread it. Moralizing behind anoniminity is cowardly.

Well said H, And thought of in basics, who would hoard green bits of paper in holes to provide food and shelter once the back can no longer turn sod? Money like this enslaves children. We don;t see the depth of the farce.

“Just what the F* are you talking about? ”

-I’m suggesting that tax-deferred retirement accounts may not be the best way to save for retirement for many of the people who use them.

“Do you think there is a significant number of middle and upper middle class people left in the CONUS?”

–Yes, I think there are still many millions of people left in both classes.

“You sound like a 1980s grad, the future’s so bright I’ve got to wear shades!”

–I haven’t graduated from anything since the 60s. I think the future is scary, especially for retired people. I’m 70 years old and very lucky to still be working full time, trying to increase my fairly modest savings before I retire.

“Who the heck has this kind of financial stuff? Who has money left over to “save” for retirement. ”

–Anyone who is putting money into an IRA or a 401k.

“More importantly, just what info do you have, that I missed, that makes you think the long range future will be better than tomorrow?”

–I never said anything close to that. My long range future is about 20 years, and I expect to see and experience serious hard times.

“And please, take your last paragraph and shread it. Moralizing behind anoniminity is cowardly.”

–Anonymity lets me say what I think, including the thoughts in the last paragraph, without having to worry that a confused person like you will decide that I am a coward and come after me. You need to get a grip on your anger. It makes you say things that don’t make sense.

Another thing to consider: If boomers had been plowing money into their 401(k)s and IRAs the way they supposedly should have been over the past 30 years — especially given the exorbitant heads-I-win-tails-you-lose fees charged by various and sundry money managers and funds — consumer spending would’ve gone to pot and we’d be 30 years into a depression right about now.

My retirement plan is a bottle of vodka and a shotgun.

I believe 401ks allow penalty-free withdrawals for certain medical expenses (?)- this might skew these figures.