By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth

I’m going to take a number of different sources to paint a portrait of China. I’ll take a great series of numbers from Ambrose Evans-Pritchard, whose analysis we can all do without, and leave the analysis up to David Stockman, who goes a long way but, in my proverbial humble view, seems to be stumbling a bit towards the end. That is to say, as I’ve written before, when I look at China these days, I see a bare and basic battle for raw power, economic as well as political power, between the Chinese government and the shadow banking system it has allowed, if not encouraged, to establish and flourish, and which now has grown into a threat to the central state control that is the only model Beijing has ever either understood or been willing to apply.

The Chinese shadow banking system, which you need to understand is exceedingly fluid and has more arms and branches than a cross between an octopus and a centipede, has become a state within the state. That this should happen, in my view, was baked into the cake from the start. Either the Communists could have maintained their strict hold on all facets of power and allow economic growth only in small increments, or it could, as it has chosen to do, push full steam ahead with dazzling growth numbers, but that would always have meant not just the risk, but the certainty, of relinquishing parts of their power and control.

As someone mentioned a while back, if you want to have an economic system based on what we call capitalist free market ideas (leaving aside all questions that surround them for a moment), the players in that system need to have a range of – individual – freedom that will of necessity be in a direct head-on collision with – full – central control. We bear witness to that very battle for power between Beijing and the ”shadows”, right now, as we see the most often highly leveraged shadow capital change shape and identity whenever the political leadership tries to get a handle on it through banning particular forms of borrowing, lending and financing.

There can’t be much doubt that the cheap credit tsunami unleashed in the Middle Kingdom has turned into an extremely damaging phenomenon, as characterized by massive overbuilding, pollution, but the government and central bank have far less power to rein it in than people seem to assume. The shadow system has made so much money financing empty highrises and bridges to nowhere that it will try to continue as long as there’s a last yuan that can be squeezed from doing just that. And when that aspect stops, it will retreat back to where it came from, the shadows, leaving the Xi’s and Li’s presently in charge with the people’s anger to deal with.

Increasingly over the past two decades, China has had two economies. That’s not an accident, it’s what has allowed it to expand at the rate it has. But that expansion is as doomed to failure as any credit boom, and given its sheer size, it’s bound to come crashing down much harder than anything we’ve seen so far in the “once rich” part of the world we ourselves live in. The odds of a soft landing are very slim, and one, but certainly not the only, reason for that is that Beijing has traded in control for faster growth. And that now the negative aspects of the growth process become obvious, it no longer has sufficient control to foster a soft landing.

On the way up, the interests of Beijing and the shadows were very much aligned for obvious reasons; going down, that is no longer true. Li and Xi will be held responsible for the downturn, the men behind the shadows won’t, because no-one will be able to find them. There’ll be middle men hanging from lampposts, but the big players will be retreating to London, New York, Monaco.

But I was going to let others do the talking today. Here are Ambrose’s numbers:

Chinese Anatomy Of A Property Boom On Its Last Legs (AEP)

So now we know what China’s biggest property developer really thinks about the Chinese housing boom. A leaked recording of a dinner speech by Vanke Group’s vice-chairman Mao Daqing more or less confirms what the bears have been saying for months.

It is a dangerous bubble, and already deflating. Prices in Beijing and Shanghai have reached the same extremes seen in Tokyo just before the Nikkei boom turned to bust, when the (quite small) Imperial Palace grounds were in theory worth more than California, and the British Embassy grounds (legacy of a good bet in the 19th Century) were worth as much as Wales.

“In 1990, Tokyo’s total land value accounts for 63.3% of US GDP, while Hong Kong reached 66.3% in 1997. Now, the total land value in Beijing is 61.6% of US GDP, a dangerous level,” said Mr Mao. “Overall, I believe that China has reached its capacity limit for new construction of residential projects”.

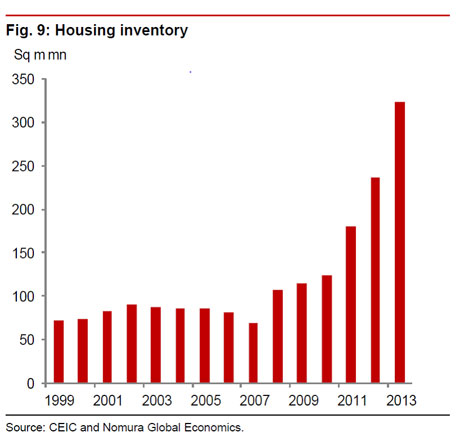

• China’s house production per 1,000 head of population reached 35 in 2011. The figure is below 12 in most developed economies “even when the housing market is hot; no country has a figure of greater than 14”.

• “By 2011, housing production per 1000 people reached 30 in Tier 2 cities, excluding the construction of affordable houses.

• “Many owners are trying to get rid of high-priced houses as soon as possible, even at the cost of deep discounts.

• “In China’s 27 key cities, transaction volume dropped 13%, 21%, 30% year-on-year in January, February, and March respectively.

• Among the 27 key cities surveyed, more than 21 have inventory exceeding 12 months, among which are 9 greater than 24 months.

• 42 new projects for elite homes in Beijing will be finished in 2015, hitting the market with an extra 50,000 units that “can’t possibly be digested”.

• China will have 400 million people over the age of 60 by 2033. Half the population will be on welfare by then.“

• Nomura: “We believe that a sharp property market correction could lead to a systemic crisis in China, and is the biggest risk China faces in 2014. The risk is particularly high in third and fourth- tier cities, which accounted for 67% of housing under construction in 2013 … ”

• Land sales and property taxes provided 39% of the Chinese government’s total tax revenue last year, higher than in Ireland when such “fair-weather” taxes during the boom masked the rot in public finances.

• The International Monetary Fund says China is running a budget deficit of 10% of GDP once the land sales are stripped out, and has “considerably less” fiscal leeway than assumed.

• Credit has already grown to $25 trillion. Fitch says China has added the equivalent of the entire US and Japanese banking systems combined in five years.

David Stockman points out what may be the biggest bull in the China shop: because of the massive debt expansion it’s undergone, its economy is inherently unstable. And it’s nonsense to presume that Beijing can, in Stockman’s nicely puts it, “walk the bubble back to stable ground”. This is in part due to the sense of entitlement government policies have instilled in the population, and in part to the rise of the shadow banking system that the Communist party not only has far less control over than it likes to make us believe, but that it fights an active economic war with over control of the economy. Unfortunately Stockman’s analysis, good as it is, glazes over that last point.

Beijings Tepid Efforts To Slow The Credit Boom Are Springing Giant Leaks

China is a case of bastardized socialism on credit steroids. At the turn of century it had $1 trillion of credit market debt outstanding – a figure which has now soared to $25 trillion. The plain fact is that no economic system can remain stable and sustainable after undergoing a 25X debt expansion in a mere 14 years. But that axiom is true in spades for a jerry-built command and control system where there is no free market discipline, meaningful contract law, honest economic information or even primitive understanding that asset values do not grow to the sky.

Nor is there any grasp of the fact that the pell-mell infrastructure building spree of recent years is a one-time event that will leave the economy drowning in excess capacity to produce concrete, steel, coal, copper, chemicals and all manner of fabrications and machinery, such as backhoes and cranes, which go into roads, rails and high rises.

At bottom the fatal error among China bulls is the failure to recognize that the colossal boom and bust cycle that China is undergoing is not symmetrical. The much admired alacrity by which the state guided the export boom after 1994 and the infrastructure boom after 2008 is not evidence of a superior model of governance; its only proof that when credit, favors, subsidies, franchises and speculative windfall opportunities are being passed out freely and to everyone, when there are all winners and no losers (e.g. China’s bankruptcy rate has been infinitesimal), a statist regime can appear to walk on water.

But what it can’t do is walk the bubble back to stable ground. The boom phase unleashes a buzzing, blooming crescendo of enterprising, investing, borrowing and speculating throughout the population that cannot be throttled back without resort to the mailed fist of state power. But the comrades in Beijing have been in the boom-time Santa Claus modality for so long that they are reluctant to unleash the economic gendarmerie.

That’s partly because their arrogance blinds them to the great house of cards which is China today, and partly because they undoubtedly understand that the party’s popularity, legitimacy and even viability would be severely jeopardized if they actually removed the punch bowl. [..]

In short, the Chinese population “can’t handle the truth” in Jack Nicholson’s memorable line. They by now believe they are entitled to a permanent feast and have every expectation that their party and state apparatus will continue to deliver it. As a result, Beijing has resorted to a strategy of tip-toeing around the tulips in a series of start and stop maneuvers to rein-in the credit and building mania. But these tepid initiatives have pushed the credit bubble deeper into the opaque underside of China’s red capitalist regime, meaning that its inherent instability and unsustainability is being massively compounded.

The credit bubble is now migrating into the land of zombie borrowers such as coal mine operators who have always been heavily leveraged but now face plummeting demand and sinking prices owing to Beijing’s unavoidable crackdown on pollution and the rapid slowing of the BTU-intensive industrial economy. Moreover, the $6 trillion in shadow banking loans are the opposite of long-term debt capital: they are ticking time bombs in the form of 12-24 month credits that are being accumulated in a vast snow-plow of maturities that will only intensify the eventual crisis.

There’s no-one debating that Beijing walks a very tight line between growing its economy and bringing that growth back to earth. That would have been a severe challenge no matter what. But its biggest problem now is that there are many buttons and switches and levers in the economy that it effectively no longer even has access to. The shadow state within the state will, as long as there’s a profit in it, behave like water in the sense that you can build a dam at one place but it will find another route to flow down through. This Wall Street Journal article provides a nice example of the how and why of that process:

Entrusted Lending Raises Risks In Chinese Finance

With credit tight in China, companies in industries beset by overcapacity are turning to an unconventional source for cash – other companies – in a new rising risk for the country’s financial system. These company-to-company loans, known as entrusted lending, have emerged as the fastest-growing part of China’s shadow-banking system, which provides credit outside of formal banking channels. Net outstanding entrusted loans increased by 715.3 billion yuan ($115.4 billion) in the first three months of 2014 from a year earlier, according to the most recent data from China’s central bank.

The increase in entrusted loans last year was equivalent to nearly 30% of local-currency loans issued by banks – almost double the portion in 2012. The jump is all the more pronounced since China’s total social financing, a broad measure of overall new credit, shrank 561.2 billion yuan over the same period, largely because other forms of shadow credit declined as Beijing sought to rein in runaway debt growth. [..]

Officials at the People’s Bank of China, the central bank, have warned that much of the intercompany lending is flowing to sectors where the regulators have urged banks to reduce lending: the property market, infrastructure and other areas burdened by excess capacity. In central Shanxi province, 56% of entrusted loans in the past few years have gone to power producers, coking companies and steelmakers, among others, according to a recent paper by Yan Jingwen, an economist at the PBOC. Access to entrusted loans allows struggling companies to hang on longer than they otherwise could, delaying the consolidation that the government and some economists say is needed in a swath of industries.

Big publicly traded companies with access to credit – such as the shipbuilder Sainty Marine and specialty-chemicals producer Zhejiang Longsheng – are among the most active providers of entrusted loans. These companies, instead of investing in their core businesses, lend funds at hand to cash-strapped businesses at several times the official interest rate.

In an analysis for The Wall Street Journal, ChinaScope Financial, a data provider partly owned by Moody’s Corp., found that 10 publicly traded Chinese banks disclosed that the value of entrusted loans facilitated by them reached 3.7 trillion yuan last year, up 46% from the previous year. Compared with 2011, the amount was more than two-thirds higher.

It’s only a matter of time before the Communist party tries to assert control over, and ban, theses entrusted loans. But the people who initiated them will simply move on to other forms of shadow lending, ones that they probably already have waiting in the wings. There are many thousands of party officials and heads of state enterprises who are many miles deep into leveraged debt and will grasp onto any opportunity to double down on their wages in order not to be exposed as gamblers, to hold on to their positions, and to avoid the tar and feathered noose. Beijing will let them, lest the Forbidden City itself fill up with tarred feathers, and try to deflate the balloon puff by puff. As the shadows simultaneously re-inflate it just as fast, if not more.

Still, once it’s clear that you’ve greatly overbuilt, overborrowed and overleveraged, the only way forward is down. The “water always seeks the least resistance” analogy holds up there as well. At some point, in economics like in physics, gravity takes over. And this time around the China avalanche as it moves down its slope has a good chance of burying the rest of the world in a layer of dirt and bricks and mud and mayhem too. So we might as well try to understand this for real, not quit halfway down.

Ilargi,

Debt is a liability on a balance sheet. With a flick of the proverbial switch the Chinese government could simply settle every private debt in the country with no significant disruptions and no inflation. The liabilities and and their corresponding assets, the loans, simply net out to zero and go away. China probably won’t do this given their economists were mal-educated in the West, but it does have the capability to make the problem go away.

Flipping the switch as you say would necessitate upsetting a large number of extremely wealthy and powerful people–since every private debt represents real claims on real, albeit relatively scarce, resources. Given that actual purpose of society is to serve the perceived interests of powerful people, what you have said there is very similar to saying “pigs could fly if only they had wings”. Removing the assets of the elites would only be coincident with collapsing the society they control.

In other words, I am all in favor of giving your scheme a try. Let’s do it. And if they give us some trouble about it, we can start handing out pitchforks and oil up the guillotines.

The good thing about the Chinese model is that the populace will be able to move into all the vacant cities after they make good use of their pitchforks, unless they burn down the empty cities before they roll out the guillotines.

The corruption crackdown is being directed by the younger members of the Communist Party, and due to the run of the mill greedy types entering the business world instead of the Party, every day that elapses the number of believers in charge of the mechanisms of state grows.

For example, the police aren’t paid off. The sheriff’s and commissioners are. They may allow thuggery and stealing, but the police tend to be paid by the state, not the wealthy. What does this mean? The powers that be may not care about upsetting the wealthy in China. The most popular man in China is a non political general with more pro lefty tendencies who led the successful earthquake responses. I don’t know if the young communists and the general have a relationship, but there is a potential, popular strong man out there. The loyalists to the top of the pyramid in China work in foreign offices and are buying homes in Canada, not attending to the Central Committee.

Nixon went to China 40 years ago. Times change especially without elections.

They could, in theory. Easier said than done. Does that include money borrowed to buy houses? Private debts to private bankers? Money borrowed by companies that trade at a permanent loss? What about money that’s been stolen by corrupt officials and has already left the country?

Anyway, lets assume for the moment it’s practicable. So all debt get paid off.

That still leaves them with a loss of 39% of their revenues that they get from property sales and taxes, with vast numbers of unsold houses, with huge excess capacity in construction related industries, and millions of unemployed former builders.

They’ve already HAD their infrastructure boom. They don’t NEED any more expensive houses or fancy shopping centres. What they need for more growth is something resembling a western style services orientated economy, which in turn needs a prosperous middle and skilled working class, with money in their pockets. But that’s exactly what they don’t have, as the consumption share of the economy keeps declining, which means they can’t afford themselves to buy the sort of crap they send over here in such vast quantities.

This seems to be the main point and as Ilargi so well illustrates demonstrates again the problem of growth for the sake of growth and not linked to sustainability and social utility.

Money can be made available but I think the key point in the below quote is ‘useful things to accomplish’. In a true developed economy I think that would include health, education and the arts.

“Big numbers, apparently, frighten us. We couldn’t possibly get our hands on the giga-billion Dollars necessary to buy all the wonder drugs that are rapidly becoming technically feasible. But this is the real fallacy of composition—the cognitive dissonance that prevents us from rationally understanding and managing the most fundamental aspect of our socio-economic contract: MODERN MONEY. The big numbers we should be frightened of are the millions of American citizens who are under-nourished, under-housed, under-educated, and under-cared for—and the massive number of our citizens who are sitting idle beside stacks of available materials and arrays of available tools while uncounted lists of useful things need to be accomplished. Those big numbers mean the thing we thought we were creating when we agreed to form “a more perfect union” is beginning to fail.”

http://neweconomicperspectives.org/2014/05/fallacy-composition.html

Thank you fm. Alt’s Fallacy of Composition is pretty obvious – it’s just that money has taken on a life of its own. Temporarily. Nice to read this.

I’m guessing the Chinese authorities are giving all this some creative thought. The advantage they have, of course, is that they are not inhibited by civil liberties and the population has a historical memory of the grand upheavals of the Mao years. Traditionally, the Chinese do not like disorder and the population, in my view, will tolerate mass executions of profiteers and shadow bankers which will probably occur and, I imagine, are already in the planning stages in government departments who would be in charge of that sort of thing. Of course there will be bribes paid and the major culprits will get away but the problem will be resolved–China has proven in can turn on a dime if it has to.

Plutarch, in his life of Sulla, describes the law by Cinna and his co-consul Flaccus which reduced all outstanding private debt by 75%. The law is noted with approval by Plutarch as well as Cicero and Sallust in regards to its beneficial economic effect. This was not the debt of the state which was negligible, it was private debt contracted among and between financiers, citizens and non-citizens. Debt instruments were apparently denominated in silver and the expedient was to change the denomination to copper which was valued at 25% of silver. The solution is the soul of Roman efficiency.

You present us with one of the tragedies of our time–the illiteracy of the ruling elites and public intellectuals–I’m sure few people are aware of that or other examples in history that point in the same direction. Debt has become a very serious problem in not only our own society, but societies throughout the world such that we as societies can no longer react to any crisis without the need to keep “growing” to pay debts. Thus we cannot act on environmental problems or realistically restructure our lives because we are in debt. There are many ways we could relieve the burden of debt without completely impoverishing those that hold debts–but that discussion has not even started.

It’s also a measure of the depth of “The Disorder” (TM) — that peculiarly economic malady that relies purely on numeration to navigate reality, that unobserved, unrecognized and, were it asserted, vehemently suppressed by the conscious mind, postulate (since it can never be proved, except on its own circular terms, which is a tautology) that Quantity is Form.

When things are indentified solely by quantity, when Form becomes a Quantity, then any disruption of the efficiency of the system that assigns quantity is a form (no pun intended) of ontological apostasy.

When thought becomes so constrained by its inherent concepts and perceptival llimits, the destruction of Quantity in the name of Form becomes an intellectual impossibility. This is a prison of thought that innervates action and circumscribes possibility into a narrow and claustrophobic set of predestined failures. and so we grind down, slowly at first, and then at some point, so rapidly that Form will assert itself as the only reality, since quantity on the terms in which it is familiar will become incomprehensible.

One will also note that in physics, upon which economics enviously models its methodologies, quantity succeeds an method of inquiry and ontology, since the forms themselves are identified by virtue of the quantities they produce when subject to empirical experiment. Such a felicious state of affairs is denied economic inquiry, which faces a form of randomness, if not chaos, in its attempt to discern Form through empirical analyses. QED from the profeser, hahahah.

should be “quantity succeeds as a method of inquiry” as long as were beeing presise.

Watched some youtube by Leonard Susskind (Stanford, string theory guy) where he tried to explain the difference between intuitive and abstract thinking. He digressed down to the elements of his thought process and I lost the point completely. Some nexus where abstract is intuitive?

for me, I think abstract thinking is when you’re consicously aware of the formal structure of the ideas and relationships you are manipulating, and the animating rules that govern their manipulation. Intuitive thinking is when you are not, and when ideas/images/epiphanies present themselves to the mind seemingly from nowhere, but with a validity that often results in their successful ascension to valid abstractions.

I expect the brakes on my bike ain’t fixed again Craazy.

I feel a need to address two fallacies that keep being repeated in the China discussions: first, that they can just cancel their debts; and second, that they can just print their way out of it, because they have their own currency. This is not meant to be didactic.

When money is created, on the ledger there are two entries: a debit and a credit that are equal. One is for the new money, and one represents the debt that backs the money. When the debt is repaid, the money vanishes, but there is always more money creation going on and so the total quantity of money is a pool. If the owners of a debt default, and the money is not redeemable, then the value of the specific money that was created goes to zero. In the pool, the average value of the currency relative to other currencies declines. The quantity of money in the pool does not matter. In China, if there was a debt jubilee, the value of the yuan would crash to zero (the yuan is already falling against the dollar representing a consensus that the debts backing the yuan are iffy), and the people would have to move back to the farms and barter for food.

The print their way out strategy replaces short term debt with longer term debt to get the payments down, rolling the debt over, until taken to extreme only the interest is being paid. This buys time, but in China they have already been doing that. When I noticed that exported products were selling for less than what I thought they should cost, it clued me to that. They are selling at a loss for cash flow to supposedly support more debt, and it will eventually unravel when one company after another can’t make full payments. They need hard currency to buy food and oil, so they are willing to sell products at a loss to get it. The trillion dollars in hot money invested in China by the West since 2008 for generous interest rates, if it is ever paid back, will necessarily depreciate in value with the yuan.

A third strategy would be to call in the debts to defend the currency. That is what the liquidationists in the Hoover administration supported, and as a result nobody had any money and we had a depression in the US after 1929, to oversimplify. In China, people would be back to the farm, bartering for food, just the same if that were tried. Some economic miracle.

The dictator for life Sulla and opponent of the descendents of the Grachian Party was more enlightened than modern neoliberals.

I’m guessing that when this law was passed, the plutocrats Cicero and Cinna had large net private debts.

I don’t know. Sallust approved, and he belonged to the Caesarian party which was better for the 99% than the majority of the Senate who opposed redistribution efforts, increasing the power of non Senate offices, and expanding citizenship.

Sallust will admit he was a drunk himself as a youth. A renter society existed with people choosing slavery to get out of debts did exist.

If I recall* Cicero was a new man or from a new man family, he was wealthy enough to let him be a citizen when not many people were citizens, and Cicero’s family officially wasn’t involved with Gaius Marius who was rich enough to not adopt a Roman naming practice of 3 names despite being a hick from Arpinium. My guess Cicero was loaded enough to buy the consulship despite a minimal staff officer war record and during a period of oligarchs ruling. He may have liked because it’s a tax on the wealthy without the difficulty of collecting.

Those religious festivals instituted by JC and Augustus weren’t paid by church collections. The wealthy had to pay state owned temples if they wanted to achieve status, and the money was used to hire masons, artists, etc. without raising taxes officially. Christianity mucked this up.

*I read this stuff in high school and first year along with Colleen McCullough’s books, so I don’t remember what is what anymore.

If you haven’t read it The Assassination of Julius Caesar By Michael Parenti has more on this subject–Cicero is one of the villains of this book.

I may have to check this out. Of course, Marc Anthony didn’t like Cicero, but Augustus probably agreed because Cicero was on a prescription list despite a certain association. Cicero’s son made it in the new order.

Sallust put Cicero and JC’s ovations against Catiline side by side in his own history of the event which isn’t kind to Roman oligarchs, and Sallust was in the Caesarian party. I think he was pretty high on Cicero, but Sallust admitted he was a lay about at the time despite his views.

You couldn’t really call Cicero a plutocrat. More of a smart-arse lawyer made good.

He was a school chum of Gaius Marius jr., the son of the 6 time consul.

But that axiom is true in spades for a jerry-built command and control system where there is no free market discipline, meaningful contract law, honest economic information or even primitive understanding that asset values do not grow to the sky.

We can say that about ourselves.

I was thinking that almost from the first sentence. Entrusted loans like 5 billion from uncle Warren to Goldman Sachs? And an economy so melted down that well intentioned regulators could destroy what’s left of it. And I am trying to understand why we’ve just put China and Russia into a cage together – because they are both once-and-future communistic countries. And we are patrolling eastern Europe with a conviction that has heretofore been missing within NATO. We are ready to sit back and watch China implode and bring Russia down with it; but we don’t want Europe to be contaminated. And then what?

Thinking hard, after phoning some guy Craazy put me in touch with, I have come up with the solution. EMP! Electro-magnetic pulse. All we need to do is get rid of the records. This what most criminal enterprises do when under pressure. So why should we be any different? Once the degaussing has been done people can register the properties they live in as their own. We all get a standard 3 months pay in Post Office accounts. Gosh! With a little refinement this could work.

1. stop the economy

2. water, feed, house all people

3. work out what is fair

4. start again.

Let’s have a world vote on this, one breath one vote. Result — 7 billion to 360,000.

Yep, the West does not use command and control and therefore things are obviously “better”.

I like somebody else’s description i.e. it’s not about capitalism, command and control,etc, the battle has always been between savers and debtors.

Also a lot of people have been harping about the bubble for quite some time now, and yet nothing has burst and even if it does, it’s possible that China will just follow the path of Japan which is not bad. And the power of the rich is somewhat overstated in China. If they are so powerful, why couldn’t they prevent the Communist takeover in the first place?

That quote is from David Stockman.

My impression of what he is implying, is that the Chinese have a “jerry-built command and control system” and our “command and control system” is so much superior, because it was built by the finest minds we have, and not Jerry.

One question I have is, how can our “command and control system” have resulted in a system whereby the earth’s resources are shipped to China, processed into finished goods and then shipped back, all over the world?

Western countries would often come into these resource rich countries and develop the infrastructure to ‘mine’ them and ship them out. Certain elites in these countries were made rich. The money was not used to develop the local economies but rather that labor was exploited. And they took out loans denominated in US dollars instead of using their own currency.

Cheap employment was found in China, again exploiting labor while making certain exporters rich.

The US came in to supply the markets for these goods helped by the fact that it had the global currency. This hurt its domestic markets for production again exploiting labor. Money that could have been used to build factories was used for asset appreciation. This caused the wage destruction to become less noticeable especially for those able to leverage this asset appreciation which included much of the ‘middle class’ as long as it lasted. It ended with the banks being bailed out and given the assets.

That’s my short version anyway.

For a more detailed examination I would suggest Michael Hudson

SuperImperialism (1972), Global Fracture (1977). Trade, Development and Foreign Debt (1992, updated 2009) and the recent Bubble and Beyond

Hi Yves:

This is just a confirmation of what I have seen within companies and around Shanghai (Nanjing, Wuxi, Haimen, Ningbo, Hangzhou, Shuzhou, Wuzhen, etc) and Shenzhen, China. Literally there are acres of empty stores and apartments. I visited numerous plants also. Two were very impressive $1 billion (as told to me by company officials) investments for Forgings/Castings and another for Machining. We are talking bearings from small to greater than 2 meters and castings for CNC bases.

I did not get the impression banks were operating independently of the government

Good morning Run,

One issue I haven’t seen mentioned is the fact that young Chinese seem to believe their country’s economy is a miracle reflecting their virtue.

I would be very concerned that in the present environment, a crash would ignite a hysterical hunt for ‘wreckers’ probably foreigners, maybe Americans?

Considering what’s going on in Ukraine, it’s hard to blame them.

So how would a debt jubilee work? Your debt is wiped out, credit cards and all, and then what? You get to keep your house, your cars, and the bankers are then solvent too? How does it work?

See Steve Keen’s “A Modern Debt Jubilee.”

I’ve spelled out in more detail how it could be done but goggle it yourself; I’m tired of repeating myself to deaf ears.

Hi Backward one,

The debt jubilee idea is a biblical one (at least that far back) see: http://en.wikipedia.org/wiki/Jubilee_(Biblical)

It seems to me several parts must come into play:

1. THere has to be a great debt overhang where debts are not being repaid in the normal course of things.

2. The state power has to intervene somehow

3. The debts that won’t be repaid have to be identified – your query was US centric – so let’s just same that the Obama Administration had said that everyone who got a HAMP would have any 2nd or 3rd mortgage wiped out.

4. How the Creditors are treated must be settled. I.e. do you let them fail or somehow make them partially or fully whole (i.e. let them declare/pretend somehow that they still have some or all of the principle in their accounts even after the debt is cancelled. That is what a “bailout” is.

Thanks Ilargi, you’ve crystallized the tensions within the power elites here. While the interests of factions in the power elites e.g. in this example Politicians and Financiers, are the same in some cases they differ in others. This difference on the way down will lead to elite power struggles. It remains to be seen how much dislocation this will entail. I think it will be bloody and relatively short with the Party winning out and the financiers and ponzi schemers dead. The debts that some worry about will be in many cases repudiated and left unpaid. Leaving those holding debts without a recourse to any physical assets to seize (such as most foreigners) out in the cold. This could stoke foreign capitalists to try to topple the Communist Party under the guise of protecting their “interests” (as in the interest on their debts owed…) and this scenario could prolong the “disharmony” as some might want to put it.

Free market discipline?

What’s that?

Ignacio – “Free market discipline? What’s that?” I think it’s when bankers, corporations and consumers who rack up too much debt get wiped out when things unravel as opposed to when governments step in, with the help of their central bankers, and stop the unraveling. It’s when you take a risk, and if you lose, you really do lose.

Damnit folks, I’m off to China soon and hoped to find out something about it. Instead, you have yakked on about the difference between abstract and some thought Craazy gets up to when the cleaning lady has broken his bong and fresh supply may take a while. Fairly obviously this led to ancient Rome. I had to divert to Wiki to find out where China was and who supplies its drugs. Turns out it is next to Hong Kong where I used to work. This explains all those little yellow people. Hong Kong was an extremely corrupt place, mostly because of British police officers, or so it seemed. Now it looks like we had underestimated the Chinese and they were formulating a plan to spread their corrupt practices across the mainland. I was only there by mistake. Any Scot would be attracted to a job with an apartment overlooking Aberdeen harbour. One always bumps into lots of Americans in these backwaters of old empire. Affable chaps with a gold bracelet, strong handshake and gym-honed bodies. Never understood what they did and was more interested in the women, who always claimed to be cultural attaches, thinking Shakespeare something one did at the end of the withdrawal method. Surely they can’t have had anything to do with world depravity and the collapse of the financial system.

On the Chinese, one would need to know just who controls who can send the boys round and the extent to which the banksters have replaced Party in handing out patronage. My own knowledge stops with a short film in which they intend to conquer the world via vaginal deodorant spray distributed by laundries and take-aways. Do I know enough to teach them economics?

I’m actually stuck in limbo in Hong Kong courtesy of our benevolent Tory masters in Westminster – that said, at least here in HK we have the Independent Commission Against Corruption, which sometimes does at it says on the can – I can attest too this fact because a well known barrister I know fell fowl of the ICAC, who seem to have gotten a bit carried away with their mandate.

It should trouble you though, that as a UK citizen – Welsh – I’m now treated better in Hong Kong than I am in the UK – at least my family are welcome here and we don’t have the NSA or GCHQ spying on us – the Chinese spy on us, but that’s okay as they don’t send around unmanned drones to direct Hellfire missiles at you – freedom of speech and expression being greater in Honk Kong, than the USA and UK, this despite having no democracy.

On a negative note, 90% of all money floating around in Hong Kong finds it way, one way or another to six ruling dynasties in HK, our housing market is in extreme “bubble” territory and it ain’t cheap to live here – cheaper in Wales, but banned from living in Wales by the Tories – so an exile no less.

On the Aberdeen side of the equation, not changed too much, although the power station is now a property development.

Much as I am tempted to get into a side discussion of whether string theory is really physics or whether the Roman-historical emperor-mandated debt-haircut approach might help prevent the China credit bubble implosion from becoming catastrophic, I’ll stick to the here and now and the data: Bloomberg’s take on yesterday’s latest China PMI and home-sales numbers:

China’s Stocks Fall on Holiday Home Sales, Manufacturing Report – Bloomberg

I found the new-home stats especially interesting:

New home sales fell 47 percent over the holidays to the lowest level in four years in 54 cities, Centaline Group said in a report dated yesterday.

Prediction: This is gonna be one ugly credit-bubble bust. No amount of monetary manipulation tactics (which is perhaps a more-apt usage of the initialism MMT, in terms of how the economic theory gets applied in the real world) can magically undo the massive real-economic and financial-system distortions which have accumulated from the most wanton and large-scale credit expansion in human history. The “social instability” aspect of what is coming is what worries me most deeply.