Yves here. Only with the fullness of time will we know whether Ilargi’s “the end is nigh” headline will have coincided with the crack that signaled the sell-by date of the officialdom-induced post crisis rally. But Ilargi makes more interesting points than simply, as many done, point out that the bubble party has to end and the unwind is not likely to be pretty.

Ilargi makes two arguments: that the US is likely to suffer less badly than most other countries as the Fed starts removing its substantial support for financial asset prices, particularly compared to the emerging markets and the Eurozone. Ilargi also points out that on this front, Russia will come out relatively unscathed, since it was not much of a target of hot money piling into “risk on” trade.

However, given how recklessly the US central bank has behaved, the punitive history of the IMF bailouts in the Asia crisis (when the US blocked ANSEAN from providing emergency support) and the coincidence of the withdrawal of QE with the US becoming visibly more belligerent, officials and citizens in countries that suffer from the US letting air out of its asset bubble will have plenty of reason for looking for darker, stealth motives behind US-centric policies. That is the cost of abusing power. Even merely negligent action will be seen a malice aforethought.

By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth

Is the age of stimulus over? It may well be. That would expose global markets as the naked emperors they always were. From the point of view of America, it makes sense to taper. Not because of invented jobless and GDP growth data, though they do make it harder for the Fed not to quit QE. No, it makes sense because the negative impacts will be hugely outweighed by the positive ones. Or, to put it in different terms, the death of the bubble will hurt the US too, and probably badly, but it will hurt others much more. And that can be – seen as – a good thing.

Emerging economies, smaller and larger ones, have grown themselves over the past few years by gobbling up dollar-denominated debt, and using it as the foundation for highly leveraged credit instruments. Much of this (short-term) foundation needs to be rolled over on a regular basis. And that’s where the taper will start to bite something bad, soon. Because everybody on the planet is in the same predicament. Except the US.

Moreover, most commodities are traded in dollars. Countries may sign the occasional bilateral deal in other currencies, but that’s hardly relevant. The world’s life-blood, fossil fuels, will easily remain 90-95% traded in US dollars. And that at a point in time when everyone will at least start to fear a permanent shrinkage of supplies.

Shell, like its peers, announced large profits today. But Shell knows, as do Exxon and BP, that those profits look to be a fluke. And that’s before they’ve even considered their fresh Russian sanctions problems. The simple fact is, they’re running out of reserves, and they apparently have little hope more will be found anytime soon, even if they’ll never say it out loud. Look what they do, not what they say. The Guardian:

Shell To Spend $30 Billion On Share Buybacks And Dividends

Shell has committed itself to spending over $30 billion buying back its shares and handing out higher dividends over two years. The promise came as the Anglo-Dutch business more than doubled second quarter profits to $5.1 billion as measured on a current cost of supplies basis. The company has taken advantage of high oil prices and a better performance but took another almost $1 billion in writedowns for US operations that have fallen in value. These are believed to cover shale gas assets, some of which are being sold off along with other poor value fields in Australia, Canada and Brazil. Ben Beurden, the new chief executive, said Shell has already started to improve under his watch and had “huge potential” for growth.

“We are making progress with the priorities I set out at the start of 2014: to balance growth and returns by focusing on better financial performance, enhanced capital efficiency, and continued strong project delivery,” he explained. And he said the company would be increasing the payout to investors by 4% in the second quarter just ended. “We are expecting some $7–$8 billion of share buybacks for 2014 and 2015 combined, of which $1.6 billion were completed in the first half of this year.

“These expected buybacks and dividend distributions are expected to exceed $30 billion over the two-year period. All of this underlines the company’s recent improved performance and future potential.” Buying back shares reduces the number in circulation so should boost their value and be welcomed by investors. But some financial critics always argue that buybacks are of no proven value and a waste of money.

If Shell really had the “huge potential” for growth the CEO cites, it wouldn’t be wasting capital on buybacks and dividends, it would invest in developing new projects. But there ain’t any, or not nearly enough. Buying back shares at least makes a company look better short term, and dividends make shareholders hang on.

Obviously, a lot of the cash involved is borrowed on the ultra cheap, and that softens the whole thing somewhat. But still, none of this is a good sign. And now they will have to deal with the sanctions headache. Shell has huge interests in Russia. Q2 2015 numbers could look a whole lot different.

And there’s even more trouble brewing. What happens when there’s no more cheap money for the taking? Wolf Richter does a good write up on the shale industry, which both Nicole and I have said for a long time is about monetary – land – speculation, not energy. We’ve known all along that there is the danger of the rapid oil and gas depletion in shale fields, but now we must add the danger of credit depletion:

Fracking Is Blowing Up Balance Sheets US Oil and Gas Industry

Fracking [..] is causing the balance sheets of oil and gas companies to blow up. Now even the Energy Department’s EIA has checked into it and after crunching some numbers found: Based on data compiled from quarterly reports, for the year ending March 31, 2014, cash from operations for 127 major oil and natural gas companies totaled $568 billion, and major uses of cash totaled $677 billion, a difference of almost $110 billion. To fill this $110 billion hole that they’d dug in just one year, these 127 oil and gas companies went out and increased their net debt by $106 billion.

But that wasn’t enough. To raise more cash, they also sold $73 billion in assets. It left them with more cash (borrowed cash, that is) on the balance sheet than before, which pleased analysts, and it left them with a pile of additional debt and fewer assets to generate revenues with in order to service this debt. It has been going on for years. In 2010, the hole left behind by fracking was only $18 billion. During each of the last three years, the gap was over $100 billion. This is the chart of an industry with apparently steep and permanent negative free cash-flows:

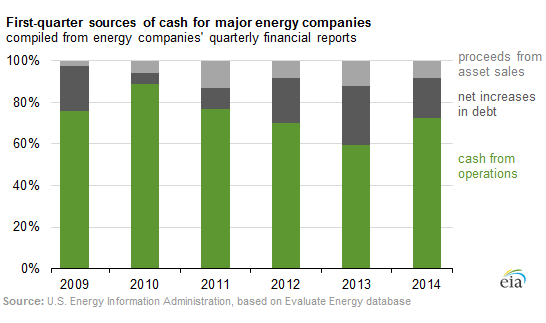

And those shortages in each year forced the companies to raise more debt and sell assets to fund more drilling, other capital expenditures, operational costs, dividends, and stock buybacks. Of the three sources of cash – operations, net increase in debt, and asset sales – during the first quarters going back six years, net increases in debt accounted for over 20% of the incoming cash since 2012. For instance, In 2013, cash from operations supplied only 60% of the cash needs; most of the rest was borrowed, and some was covered by asset sales:

How much longer can the shale industry survive? I’m convinced that the Americans who play today’s big power game have this wrong, like so many others. Shell played at least part of it smartly, selling off shale plays. But many others keep diving in deeper all the time. While the situation is just getting worse. Before interest rates start to rise.

The graph says things have been getting progressively worse for all 5 years running. In 2013, only 60% of operational costs could be covered with production (the 2014 bar should be ignored, that’s an EIA estimate, and therefore 100% unreliable). What happens to this industry when borrowing costs double or triple? It’s a scary thing to ponder. How does ‘get out while you can’ sound?

That the age of stimulus, and thereby the bubble era, may be nearing its end is a point brought home by Ambrose Evans-Pritchard. It’s not just the Fed that’s tapering, the People’s Bank of China does it too, though in a less overt fashion. Together they’ve been good for almost unimaginable amounts of stimulus over the past 5+ years ($20 trillion?), joined at the hip by the Bank of Japan when Shinzo Abe launched his tragic new domestic policies.

If China goes, that’s it, that’s all she wrote. The BOJ is failing miserably, Europe won’t pick up the slack in any serious way, and cheap credit in global markets will vanish. Then you can scrape the emerging nations off the black top one by one. Every single one of them will be screaming for dollars, and that will make them a lot more expensive than they are today. It’s not going to be pretty. Ambrose:

Global QE Ends As China Opens Second Front In Bond Tapering

The spigot of global reserve stimulus is slowing to a trickle. The world’s central banks have cut their purchases of foreign bonds by two-thirds since late last year. China has cut by three-quarters. These purchases have been a powerful form of global quantitative easing over the past 15 years, driven by the commodity bloc and the rising powers of Asia. They have fed demand for US Treasuries, Bunds and Gilts, as well as French, Dutch, Japanese, Canadian and Australian bonds and parastatal debt, displacing the better part of $12 trillion into everything else in a universal search for yield.

Jens Nordvig, from Nomura, said net foreign reserve accumulation by central banks fell to $63 billion in the second quarter of this year, from $89 billion in the first quarter, and $181 billion in the fourth quarter of 2013. [..] “There are major shifts going on in global capital markets. People have been lulled into a false sense of security by low volatility and they haven’t paid attention.

The world superpower in this game is China, with reserves just shy of $4 trillion. Mr Nordvig estimates that China’s purchases dropped to $27 billion in the last quarter, down from $106 billion in the preceding quarter. This looks like a permanent shift in policy. Premier Li Keqiang said in May that the reserves had become a “big burden” and were doing more harm than good, playing havoc with monetary policy, as global economists have been warning for a long time. China’s policy of holding down the yuan for mercantilist trade advantage caused it to import excess stimulus from America at the wrong moment in its own cycle, causing China’s credit boom to go parabolic as loans rose from $9 trillion to $25 trillion in five years.

The implication of the global reserve data is that this form of QE is being run down just as the US Federal Reserve runs down its own QE by tapering bond purchases, and then prepares to tighten. The global central banks have been buying around $250 billion of bonds a month in one form or another for most of the past three years. This is being cut to a fraction.

Global reserve accumulation works like QE by the Fed, which openly admits that the purpose is to drive up asset prices [..] … the global variant [of QE] has been much larger, soaring from 5% to 13% of world GDP since 2000. Edwin Truman, from the Peterson Institute in Washington, says the figure is nearer 22% – or $16.2 trillion – if sovereign wealth funds are included.

[..] A recent survey of central banks, wealth funds and government pension funds by the monetary forum OMFIF estimated that they have $29 trillion invested in global markets, and that they too have joined the scramble for yield.

We should add that, on top of the PBOC’s stimulus, a lot more fresh credit was created in China’s shadow banking system, through highly leveraged loans, investment funds, debt instruments and creative solutions such as the multiple collaterizations of – ghost? – commodities that we’ve seen (or did we?) in the warehouses of Qingdao. These things tend to add up.

Why China pulls out now is not immediately clear. But when European bonds yields are the lowest since before Columbus first sailed west, why should they bother any longer? Maybe the Chinese have dreams of empire just like the Americans. And maybe they just feel that it had to stop somewhere, so why not here, why not simply follow suit? Maybe they, realizing there’s no way out, just don’t want to make things even worse than they are.

The Chinese, too, will be naked emperors to an extent. But not as much as Brazil, Turkey, and some of the other major emerging nations. Perhaps not even as much as Europe. As for Putin, he may well be the odd one out. Russia has much less of a financial bubble than just about anyone out there. And it has massive resources, certainly compared to its population numbers.

Still, for everyone, you’re looking at the beginning of the end of the biggest bubble in history. Say bye! And then grow some veggies. And make sure you have your dear ones near. It’s going to be a wild ride.

“Russia will come out relatively unscathed.”

Wrong … The price of oil, nat gas and all other commodities will drop … and that is Russia’s strong suit – commodities.

The fact is every country in the world will be devastated by this “strong dollar play”. This America’s “Sampson Option”, a last gasp attempt to reorder the world along bankster neoliberal lines and as Ilargi notes they will accomplish this by crushing international trade and by the number of insolvencies-bankruptcies worldwide denominated in dollars. Their goal of course is to once again steal assets, public and private, for pennies on the dollar … Is the court case against Argentina debt a “one off” or the template for worldwide serfdom?

Well, it certainly was the case that Treasuries were the ‘safe haven’ global preference when the last crisis hit (or fuse was lit) and will presumably be so again, with the Fed/Treasury in the strongest position by virtue of the US still being a behemoth relative to other global players. We already know the US has gone way out of its way to pick a fight with Russia while already involved in a gigantic 21st century disaster from Libya to Pakistan, so it’s not as if global hegemony is off the table. A more-directed, controlled implosion of global capital would be a trump card – the PR campaign will sell it as the solution to Climate Change this time.

Of course, the Pentagon did its own famous study pretty much reflecting a shrinking planet view with potential for war by 2020, which would put the seriousness of the US decision to go after Russia into something resembling an appropriately weighted case for doing something so potentially dangerous – especially if, as I think the case, Putin was essentially suckered.

Still waiting for a explanation of this event ( perhaps its a event horizon)

http://www.tradingeconomics.com/united-states/terms-of-trade

The theory implies that it is the very structure of the market which is responsible for the existence of inequality in the world system. This provides an interesting twist on Wallerstein’s neo-Marxist interpretation of the international order which faults differences in power relations between ‘core’ and ‘periphery’ states as the chief cause for economic and political inequality (However, the Singer–Prebisch thesis also works with different bargaining positions of labour in developed and developing countries). As a result, the Singer-Prebisch Thesis enjoyed a high degree of popularity in the 1960s and 1970s with neo-marxist developmental Economists and provided a justification for import substitution industrializing (ISI) policies and even an expansion of the role of the commodity futures exchange as a tool for development.

http://en.wikipedia.org/wiki/Singer%E2%80%93Prebisch_thesis

Don’t agree with the above marxist view but it is interesting that it went out of fashion post 1980.

WTF is happening lads ???????????

Yves, slightly off topic, but not really, in my opinion this paper linked at FT Alphaville on financial profits goes a long way to explaining the dispute from a few months back on Picketty’s r > g.

http://www.peri.umass.edu/fileadmin/pdf/working_papers/working_papers_301-350/WP347.pdf

Kingston University lecturer Iren Levina says: “”The wealth transfers associated with founder’s profit are not a zero-sum game, which in turn explains how the gain can be sustained over significant periods of time. Accepting different rates of return on future cash flows allows both parties to profit from the transaction. Sellers receive an immediate gain (founder’s profit), whereas buyers acquire a claim on future cash flows generating return on their investment. In this sense founder’s profit can be seen as a positive-sum game.”

That is ultimately how $16 trillion can accumulate so quickly!

I was thinking Picketty too. But more along the lines of the laws of nature. Profit is a mirage that cannot be sustained even at very low gains. Picketty was a little bit timid and couldn’t quite make the big, bold claim that the entire basis for human capitalist adventures, aka profit, has been death defying for centuries and is now death itself.

Yes! More people need to be willing to make this leap. The environmental critiques of Capitalism are very rational and very material. It’s hard not to acknowledge that the only species that can claim any benefit from this grand economic experiment is Homo Sapiens, and the benefits were fantastic (I mean fantastic as in not real or out of touch). A Star Trek like utopia will not come to us by infinite growth and consumption.

One of the things I’ve noted recently is the torrent of equity buy-backs. I suspect this is one of the main levers corporations have been using to increase profits per share in a low-growth environment. But anyone who knows finance will tell you that a smaller equity base implies higher equity volatility, doubly so if those buy-backs are funded using debt.

So a dwindling equity base, combined with record low interest rates, combined with record low wages as a % of GDP, and widespread tax evasion, erm, I mean a friendly tax environment, yields, guess what: record equity profits per share. I believe the current environment is probably “as good as it gets for equities”. I’m not saying this is the top — yet. I don’t know. But I think this perfect climate for equities is bound to cloud over at some point, which is why Grantham et al say equities are now substantially overvalued.

My point is, that given the shrinking equity base of US corporates, when the next downturn comes, its impact will be magnified in equity prices. But not many are worrying about that today.

I think that’s right. Corporations have earned record profits through a combination of stock manipulation, accounting exercises and cost reductions (layoffs and offshoring). The old way of doing things, making customers and expanding market share, seems to have become a secondary priority and why shouldn’t it be? Chief executives aren’t rewarded for successful products, they’re compensated for pleasing capital markets which comes at the expense of the corporations they control. As Yves has explained to us this should have been the obvious outcome of the investor cult, but no one wanted to hear it.

One thing to keep in mind, with regard to Oil & Gas companies buying back their shares: Reducing the number of shares is key (though only a short term game) to keeping their reserves to shares ratios up. This is key because they are struggling to grow their reserves.

So by not creating a trillion dollars a year from thin air the strong dollar is going to come raging back? Forgive me but this simply makes no sense. I suppose relative to the impoverishment of everyone else America may look good. I really don’t see how that square peg fits into a round hole when the US manufactures so little and must rely on global trade to maintain its standard of living. So lets smash the global economy!

Strong dollar, my foot! If anything, breaking trust like this with undermine the dollar’s credibility and hasten its demise as the reserve currency. As for all these helpless victims, I mean other countries, you don’t think they’ll have options to take in retaliation?

America has been playing a weak hand since 2008. The old shell game might work over a very short period of time but everyone knows there is no pea to be palmed. I have to think the more extreme actions the US ruling elite take the more disasterous the consequences for all Americans.

The vast majority of big players including sovereign funds want to keep the world economy on the dollar. Their support of the dollar is, in part, due to the natural desire for stability–it’s a known quality, the U.S. is one of the most politically stable countries in the world but we must not forget what other countries gain from supporting the dollar. They get the U.S. as world policeman guaranteeing trade routes, protecting oligarchs from populist governments, guaranteeing that the Middle East remains politically weak and easily exploitable and so on.

People here have asked why Europe has, it appears, given up its sovereignty and now follows direct orders from Washington–well one reason, among many others, is that the U.S. guarantees world-stability and security for its vassals. The idea of American decline is just not, yet, the case because even if the U.S. appears to falter the oligarchs of the world count on it. They know that, despite massive fraud and corruption in various sectors the American people may grumble but are happy to keep the status-quo mainly due to the most sophisticated mind-control regime ever devised. Even the left in the U.S. is conservative.

By your logic 2008 never should have happened. Yes, elites have been able to paper over the losses at the top. But they have done so at the cost of building even greater instabilities and weaknesses into the system. I do not think this is a robust system, only one with enormous inertia. It may keep rolling, slower and slower, for some time, but it is a system that is operating on past impetus and no longer can generate forward momentum. By greasing the runway with fantastic amounts of liquidity and leverage, the elites have bought themselves six, perhaps as many as ten, years (my guess would be 8.5, for that was roughly the interval between the tech bubble bursting and the housing bubble bursting). But this sucker will eventually grind to a halt, and resuscitating it again may prove impossible without injections of cash so great as to make a new Weimar inevitable.

Hence 2 quadrillion in derivatives. It’s like “everybody knows” the whole thing is illogical. I don’t fault the Fed. I just don’t like it that they are a private organization playing with the fate of billions of people. Not that governments have a corner on sainthood. What the Fed does, what all CBs do, is “provide liquidity”. What an interesting term. It is for the politicians to decide policy. And none of them can stand up and say the whole economic system is a farce with dire and immediate consequences. Providing liquidity is no problem, it is just like fiat, just like creating money which reflects nothing more than human cooperation. Liquidity is cooperation. But the kind of cooperation, the method, the scope and the vision is the important thing and nobody is addressing it because, imo, politicians are all just too damn dumb.

After 2008 the system established more ground rules to reign in excesses. The fact is that, despite the stunningly dangerous situation that faced the international system by the unprecedented fraud that preceded the crisis, the system took in some water, weathered the storm and moved on quite well considering the downside risk that was present in 2008.

Nope. If anything they believe they’re even smarter now, these money men and women. Yet they can’t see it’s a huge political problem, not a monetary one, they simply must engage more intelligently.

I wonder if the left that you speak of that is conservative is really centrist (the Dem Party and the mouthpieces on MSNBC) while the real left, e.g., Occupy, or what’s left of it, is penetrated and degraded from within and outgunned from without by the massive police power of TPTB and outspent in influence (lobbyists and media infrastructure ownership) by the oligarchs.

Yes, that’s the size of it though I consider the Democratic Party as a genuine Conservative party while the republicans are a mixture of more radicals qwho appear to want a complete transformation of civil society.

People on the left and right have been predicting financial/economic/budgetary disaster for some time since 2008 and it just has not happened. I think the system is much more ordered and more robust than what you can find on a spreadsheet. Yes, the rich are getting richer and the poor and middle classes are declining in wealth and power but that is the plan–current economic woes of civil society are, in some areas like Detroit, substantial but very limited and the country can easily absorb it. I suspect there is far more coordination, internationally, between sovereign funds, financial institutions, major corporations, militaries, intel services, criminal gangs (an often neglected part of the world economy) and so on. These arrangements are hidden from view for obvious reasons but what else would explain the robustness of this now five year old bubble “recovery” based on no traditionally sound economic principles?

” but what else would explain the robustness of this now five year old bubble “recovery” based on no traditionally sound economic principles?”

Part time jobs counted the same as full time jobs, measure of inflation a joke, phantom exports and as much cheap money as you would like … if you have deep pockets.

Fed money printing juices assets while actual services and production stagnate and fall … The recovery is a hoax on every front … the real economy has been in or near recession for the last 5 years.

Banger,

Can we then consider China as the empire’s most powerful Baron, but still a vassal state that will follow orders when push comes to shove.

China is not a vassal but it sometimes plays the part. We have to remember how stunningly large is–I don’t think we can easily characterize or classify China in any way–at least I can’t.

“”The world superpower in this game is China, with reserves just shy of $4 trillion.””

World superpower or world chump? I don’t really mean this in a demeaning way as I think China is a powerful country and has done a lot of things right. But it has traded away real goods and services to accumulate this stockpile of USD and Euros. It can buy Treasuries and Eurobonds with this currency to earn some interest. If it wants to buy real goods and services it has to find someone willing to sell them in these currencies. The US and Europe can enact tariffs or otherwise increase their prices.

China doesn’t print USD or Euros. The US and Europe can finance themselves. Rather than use money to bail out the banks and feed speculation though they would be wiser to use this money for the public interest.

China does have more of a ‘public banking system’ with more flexibility with credit but it too is neglecting its labor force and internal demand by focusing too much on asset appreciation and its own elite problem.

I think the wildcard in China’s development was a post-Mao cynical generation who only wanted the ability to skim some of the financial flows into their own coffers. You have an incredible mismatch between the traditional Chinese State and its goals and the goals of the top party people and their families. Demand-led growth would mean cutting the working class in and way less profits to skim for the elites. It would be much better in the long run for Chinese goods to be bought and used by Chinese people, but the incentive is to pay the workers peanuts, export the goods, and pocket the profits. We see this everywhere. It is a form of capture by elites of the apparatus of State to the extend that State interests are neglected in the quest for individual accumulation. Historically you see some of this in places like Genoa, Venice, and Holland, where the merchant princes become the State and then get confused as to which interests should prevail (the advantage of a landlord-monarch is that he knows where his bread is buttered).

Yes, from Shock Doctrine: “In China roughly twenty-nine hundred of these party scions -known as the “princelings” – control $260 billion.”

The AutoEarth team is like a broken clock…at some point they’ll be correct in their predictions. Then everyone will hail them as geniuses. So far zilch.

Perhaps true, but I think a more valuable clock than the one that has no hands; written across its face is “Capitalism is the best, and provides the best of all possible worlds.”

…actually the worst possible system except for all others that have been tried. Maybe Dem Socialism will finally succeed one of these years.

Any system will go to hell if its people are too easily led; after that, said system usually falls when people realize there is no steak to go with that sizzle.

It just so happens that capitalism outcompetes others. Which is a terrible reason to keep the predator alive and very good reason for all hands to euthanize it, at least if one pays more than lip service to ecology and diversity.

He’s right this time. S&P peak was probably July 3, earlier R2000. The latter down 70% in 18 months?

Thank The God(ess)(e)(s) Of Your Choice, If Any, that somebody knows how to time the market!

We’re in a bull market.