When the OECD, World Bank, and the International Labor Organization agree on something, it’s a sign something serious is afoot. In this case, the three groups have issued a joint paper, G20 labour markets: outlook, key challenges and policy responses, which despite the anodyne title, gives a grim account of the prospects for workers in major economies.

The general outline of findings won’t come as much of a surprise to the cognoscenti. What is novel is having such authoritative bodies state in such an unvarnished manner how bad things are. For instance:

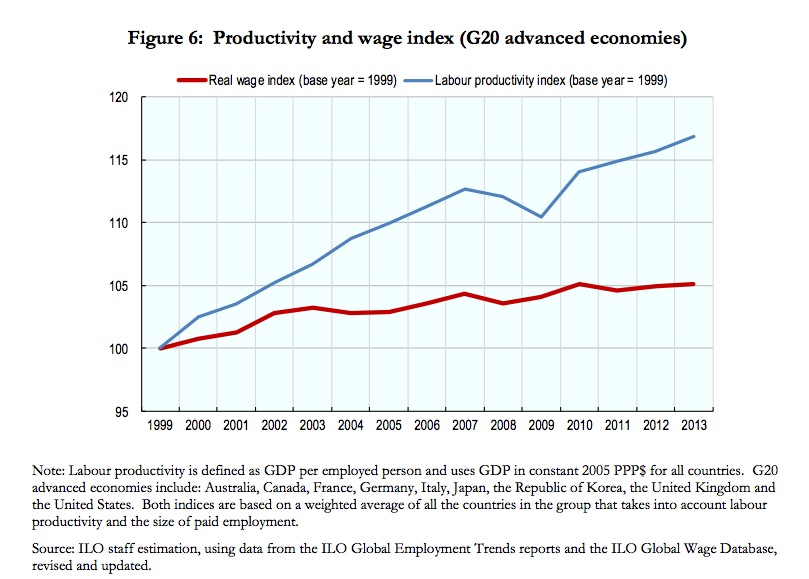

The deep global financial and economic crisis and slow recovery in many G20 countries

has resulted not only in higher unemployment but also in slow and fragile wage gains for G20 workers…The stagnation in wages cannot be explained solely by weak economic growth. This trend also reflects a widening gap between growth in wages and labour productivity. In the advanced G20 economies, the gap began before the crisis and has not narrowed since, apart from a short reversal during the depth of the crisis in 2008. The gap has grown wider since 2010, as wages in many advanced economies continue to stagnate while productivity has recovered in the group as a whole.

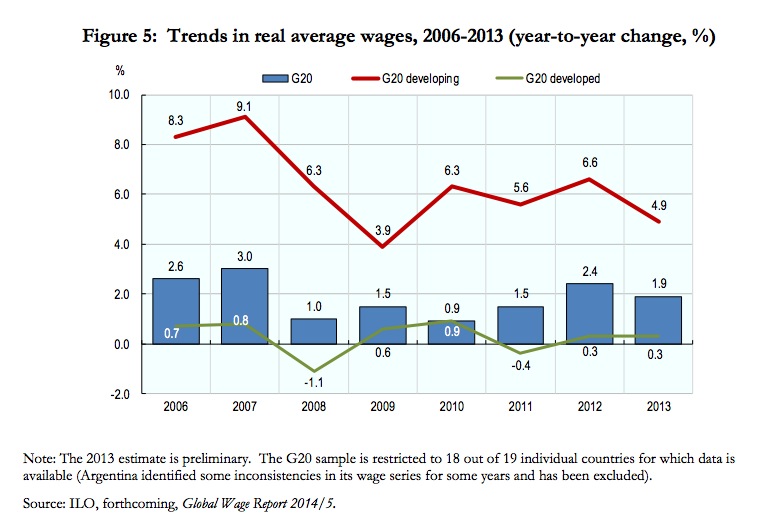

Real wage gains have been tepid in advanced economies:

Workers not sharing in productivity gains has become normal:

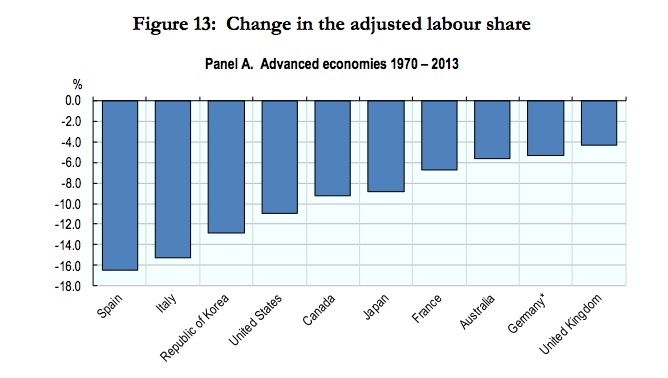

And that, which reflects reduced employee bargaining power, has resulted in a falling share of labor income relative to GDP:

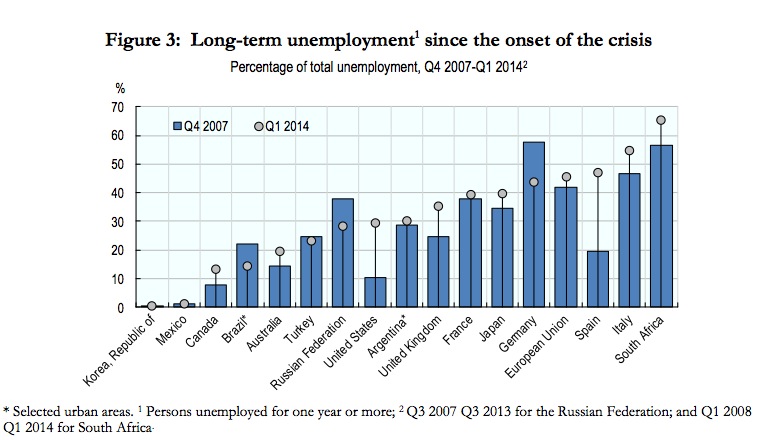

And one of the worst outcomes is the rise in long-term unemployment in many economies:

While the problem statement is compact and effective, the analysis and proposals are standard fare and thus well short of what is needed. The article focuses on superficial causes, like underinvestment, and skips over deeper ones, particularly, that the rules of the game have been successfully reengineered to favor corporations and investors over workers, and the results are no accident. Thus, for instance, the recommendations include the usual call for greater support for demand, as in more deficit spending, when the masters, um, business classes, have been firmly opposed. Similarly, the article discusses the danger of skill erosion and calls for more training. In fact, the evidence is overwhelming that employers don’t value formal (as in classroom based) training, particularly when provided in public programs). Bosses, whenever possible, hire the candidate who can “hit the ground running,” which means someone who has done precisely the same job for a similar employer. They can get away with shirking the formerly-required on-the-job training due to how slack the employment markets are. Thus it is quite likely that employers would be forced to revert to their former norms if unemployment were much lower than it is now.

Michal Kalecki’s 1943 Essay on Politics and Ideology gave a clear and cogent explanation of why the investing classes are opposed to full employment policies. In short form, it offends their ideology and undermines their social standing. This is an important section and I urge you to read it closelyIr i:

1. A solid majority of economists is now of the opinion that, even in a capitalist system, full employment may be secured by a government spending programme, provided there is in existence adequate plan to employ all existing labour power, and provided adequate supplies of necessary foreign raw-materials may be obtained in exchange for exports.

If the government undertakes public investment (e.g. builds schools, hospitals, and highways) or subsidizes mass consumption (by family allowances, reduction of indirect taxation, or subsidies to keep down the prices of necessities), and if, moreover, this expenditure is financed by borrowing and not by taxation (which could affect adversely private investment and consumption), the effective demand for goods and services may be increased up to a point where full employment is achieved. Such government expenditure increases employment, be it noted, not only directly but indirectly as well, since the higher incomes caused by it result in a secondary increase in demand for consumer and investment goods.

2. It may be asked where the public will get the money to lend to the government if they do not curtail their investment and consumption. To understand this process it is best, I think, to imagine for a moment that the government pays its suppliers in government securities. The suppliers will, in general, not retain these securities but put them into circulation while buying other goods and services, and so on, until finally these securities will reach persons or firms which retain them as interest-yielding assets. In any period of time the total increase in government securities in the possession (transitory or final) of persons and firms will be equal to the goods and services sold to the government. Thus what the economy lends to the government are goods and services whose production is ‘financed’ by government securities. In reality the government pays for the services, not in securities, but in cash, but it simultaneously issues securities and so drains the cash off; and this is equivalent to the imaginary process described above.

What happens, however, if the public is unwilling to absorb all the increase in government securities? It will offer them finally to banks to get cash (notes or deposits) in exchange. If the banks accept these offers, the rate of interest will be maintained. If not, the prices of securities will fall, which means a rise in the rate of interest, and this will encourage the public to hold more securities in relation to deposits. It follows that the rate of interest depends on banking policy, in particular on that of the central bank. If this policy aims at maintaining the rate of interest at a certain level, that may be easily achieved, however large the amount of government borrowing. Such was and is the position in the present war. In spite of astronomical budget deficits, the rate of interest has shown no rise since the beginning of 1940.

3. It may be objected that government expenditure financed by borrowing will cause inflation. To this it may be replied that the effective demand created by the government acts like any other increase in demand. If labour, plants, and foreign raw materials are in ample supply, the increase in demand is met by an increase in production. But if the point of full employment of resources is reached and effective demand continues to increase, prices will rise so as to equilibrate the demand for and the supply of goods and services. (In the state of over-employment of resources such as we witness at present in the war economy, an inflationary rise in prices has been avoided only to the extent to which effective demand for consumer goods has been curtailed by rationing and direct taxation.) It follows that if the government intervention aims at achieving full employment but stops short of increasing effective demand over the full employment mark, there is no need to be afraid of inflation.2

II 2. The above is a very crude and incomplete statement of the economic doctrine of full employment. But it is, I think, sufficient to acquaint the reader with the essence of the doctrine and so enable him to follow the subsequent discussion of the political problems involved in the achievement of full employment.

In should be first stated that, although most economists are now agreed that full employment may be achieved by government spending, this was by no means the case even in the recent past. Among the opposers of this doctrine there were (and still are) prominent so-called ‘economic experts’ closely connected with banking and industry. This suggests that there is a political background in the opposition to the full employment doctrine, even though the arguments advanced are economic. That is not to say that people who advance them do not believe in their economics, poor though this is. But obstinate ignorance is usually a manifestation of underlying political motives.

There are, however, even more direct indications that a first-class political issue is at stake here. In the great depression in the 1930s, big business consistently opposed experiments for increasing employment by government spending in all countries, except Nazi Germany. This was to be clearly seen in the USA (opposition to the New Deal), in France (the Blum experiment), and in Germany before Hitler. The attitude is not easy to explain. Clearly, higher output and employment benefit not only workers but entrepreneurs as well, because the latter’s profits rise. And the policy of full employment outlined above does not encroach upon profits because it does not involve any additional taxation. The entrepreneurs in the slump are longing for a boom; why do they not gladly accept the synthetic boom which the government is able to offer them? It is this difficult and fascinating question with which we intend to deal in this article.

The reasons for the opposition of the ‘industrial leaders’ to full employment achieved by government spending may be subdivided into three categories: (i) dislike of government interference in the problem of employment as such; (ii) dislike of the direction of government spending (public investment and subsidizing consumption); (iii) dislike of the social and political changes resulting from the maintenance of full employment. We shall examine each of these three categories of objections to the government expansion policy in detail.

2. We shall deal first with the reluctance of the ‘captains of industry’ to accept government intervention in the matter of employment. Every widening of state activity is looked upon by business with suspicion, but the creation of employment by government spending has a special aspect which makes the opposition particularly intense. Under a laissez-faire system the level of employment depends to a great extent on the so-called state of confidence. If this deteriorates, private investment declines, which results in a fall of output and employment (both directly and through the secondary effect of the fall in incomes upon consumption and investment). This gives the capitalists a powerful indirect control over government policy: everything which may shake the state of confidence must be carefully avoided because it would cause an economic crisis. But once the government learns the trick of increasing employment by its own purchases, this powerful controlling device loses its effectiveness. Hence budget deficits necessary to carry out government intervention must be regarded as perilous. The social function of the doctrine of ‘sound finance’ is to make the level of employment dependent on the state of confidence.

3. The dislike of business leaders for a government spending policy grows even more acute when they come to consider the objects on which the money would be spent: public investment and subsidizing mass consumption.

The economic principles of government intervention require that public investment should be confined to objects which do not compete with the equipment of private business (e.g. hospitals, schools, highways). Otherwise the profitability of private investment might be impaired, and the positive effect of public investment upon employment offset, by the negative effect of the decline in private investment. This conception suits the businessmen very well. But the scope for public investment of this type is rather narrow, and there is a danger that the government, in pursuing this policy, may eventually be tempted to nationalize transport or public utilities so as to gain a new sphere for investment.3

One might therefore expect business leaders and their experts to be more in favour of subsidising mass consumption (by means of family allowances, subsidies to keep down the prices of necessities, etc.) than of public investment; for by subsidizing consumption the government would not be embarking on any sort of enterprise. In practice, however, this is not the case. Indeed, subsidizing mass consumption is much more violently opposed by these experts than public investment. For here a moral principle of the highest importance is at stake. The fundamentals of capitalist ethics require that ‘you shall earn your bread in sweat’ — unless you happen to have private means.

4. We have considered the political reasons for the opposition to the policy of creating employment by government spending. But even if this opposition were overcome — as it may well be under the pressure of the masses — the maintenance of full employment would cause social and political changes which would give a new impetus to the opposition of the business leaders. Indeed, under a regime of permanent full employment, the ‘sack’ would cease to play its role as a ‘disciplinary measure. The social position of the boss would be undermined, and the self-assurance and class-consciousness of the working class would grow. Strikes for wage increases and improvements in conditions of work would create political tension. It is true that profits would be higher under a regime of full employment than they are on the average under laissez-faire, and even the rise in wage rates resulting from the stronger bargaining power of the workers is less likely to reduce profits than to increase prices, and thus adversely affects only the rentier interests. But ‘discipline in the factories’ and ‘political stability’ are more appreciated than profits by business leaders. Their class instinct tells them that lasting full employment is unsound from their point of view, and that unemployment is an integral part of the ‘normal’ capitalist system.

It is vital to understand that high unemployment and low wage growth are solvable problems. But powerful and well placed people believe it is in their interest to keep them unsolved. It will take considerable pressure to change their minds.

still using words like ‘Slow Recovery’…like an inch worm setting a 24hr goal for Mars.

“But ‘discipline in the factories’ and ‘political stability’ are more appreciated than profits by business leaders.” its what sociopaths do…the scorpion & the frog scenario

“He had never regarded other men as anything but puppets of a sort, created to fill up an empty world. He divided them into two classes: those he greeted because some chance had put him in contact with them, and those he did not greet. But both these categories of individuals were equally insignificant in his eyes.”

Guy de Maupassant

Your last paragraph is a good description of how narcissists think. People are objects, no different than a lamp or chair, to be moved around at the whim of the narcissist. Absolute evil.

“It is vital to understand that high unemployment and low wage growth are solvable problems. But powerful and well placed people believe it is in their interest to keep them unsolved. It will take considerable pressure to change their minds.”

True, but who is going to persuade them to change their minds? Working people have been disciplined and brainwashed into investing their entire beings into notions of ceaseless competition, meritocracy and mindless distractions. Just a conjecture, but I have to wonder feelings of solidarity are at an all time low.

The 1950s in the US, a period of great conservatism, was followed by the 1960s. Sentiment can change in a short period of time, particularly when people become desperate enough.

And when things get too ugly, the elites do have to tone it down. Look at how Ferguson has led to measures to roll back overly aggressive policing, like getting them to wear cop cameras (!!!) and proposals for legislation to severely limit the use of military toys. One or two more bad cop incidents in the next year (and it almost seems inevitable that one will happen) and there will be more calls for change and some of this will stick.

You need to change perceptions first. That is the hard part. Changes in willingness to act come much faster after that.

Yes, changing perceptions is the primarily fuel for changing the political economy. I’m not sure the cop cameras or the rest of it is going to change police conduct much, frankly, since most white people still favor the continuing violent suppression of minority groups and political dissidents.

As for the strange changes in the sixties much of it came from the state’s propaganda efforts. If you go back and listen to old radio/tv programs and PSAs and monitor public discourse there was a lot of anti-authoritarian and anti-fascist rhetoric with an emphasis of how the US is the ultimate home of civil liberties and democracy. Many people took that in and believed it but found out, by the sixties, that the authorities were attempting to impose authoritarian means to suppress dissent, racial minorities and that they lied about historical facts and the whole idealistic consensus created during WWII and the early Cold War dissipated. The power-elite realized that cynicism was inevitable so like the smart people they are they sought to increas rather than decrease cynicism and use fear, tribalism, greed and “competition” as well as TINA by buying up the Democratic Party starting, in a major way, in 1978. Thus whatever change is forthcoming will result for the ultimate collapse of even that regime.

Don’t underestimate the effect of the war in Vietnam + the draft on providing that fuel for political change.

Our dalliances in the Middle East may yet cause a return to that political change.

Yesterday, I was walking to my car in a neighborhood where there was a small Wells Fargo branch. Like I do every time I see someone using the exterior ATM at a criminal bank, I said, “People who continue to bank with the criminal financial institutions are perpetuating the problem!” The man shot back an angry insult, rather than thinking about his decision to remain at a criminal bank. What happened next was actually beyond me: The man ran to his car (as I was getting into mine to leave) and followed me to almost my home! He used his 3000 lb vehicle as a weapon to intimidate and frighten me. (Which it did!) I used my cell phone as a camera and caught all this behavior on camera, which didn’t seem to deter him! Finally, I yelled out that I was calling 911. Which I did. Talk about a whack job, but that is the crazy that is America these days.

You are both strange.

Both are strange? When one person asks the other to think about their decision to continue doing business with a criminal entity…..and the other follows that person in their vehicle? I believe we all need to call out others’ behaviors that allow for these criminal entities in our society to continue to rape us (i.e. criminal banks). And apparently YOU think that an appropriate response is to follow that person in a vehicle and threaten another? Jesus. I would say Bob, that you are a little more off than either of the people described above.

Great summary Yves,

You put a smile on my face this morning! It’s become fiscal policy not to solve these problems. Policies of austerity across the G20 is an offshoot and evolution of managing “Crisis” Capitalism (for we certainly are still in crisis – like chronic inflamation) and Naomi’s Klein’s Shock Doctrine.

On another note, Congress has shifted much of the burden and responsibility of full employment away from fiscal policy to monetary policy. As Senator Schumer told Bernanke in 2012 “Unemployment has been too high and is sticky…we’re having a much rougher time than we ever imagined getting unemployment down. So, get to work, Mr. Chairman!”

And so it is that the burden has shifted from the US govt fiscal policy to the Federal Reserve’s monetary policies – policies that have been found wanting and ineffectual at creating low UE and wage growth.

It’s not just about shifting the burden ‘from the US govt fiscal policy to the Federal Reserve’s monetary policies,’ per se.

When you’re courting your obscure object of desire who is not the least interested, you will hear all kinds of excuses.

So, too, is the situation here – the government is not ignorant of how much more military spending is versus domestic spending, and what it can do to achieve a happier society. Perhaps this obscure object of our desire is not interested… Giving it, or any obscure object of desire, more money will not soften the resolve. Alas, money can not buy everything :(

Besides, one never knows whom Fed’s monetary policies, in response to the ‘burden,’ might benefit..

Brilliant piece.

I’ve never seen the argument presented so lucidly.

” ….‘discipline in the factories’ and ‘political stability’ are more appreciated than profits by business leaders. Their class instinct tells them that lasting full employment is unsound from their point of view, and that unemployment is an integral part of the ‘normal’ capitalist system.”

Bullseye!

Kalecki’s 1943 essay is one of the better examples of simple, direct and concise usage of language—it is rare nowadays to read anything of such straightforward, unvarnished intelligence.

To what point do they determine unemployment, or specific long term unemployed, to be beneficial before there isrisk of social unrest ?

Look at Greece, Portugal and Spain and you’ll see that TPTB seem to feel they can live with quite a lot of unrest– and massively high unemployment. It’s our very difficult job to make TPTB feel it is in their best interests to start treating us better, or, if they remain obstinate, to topple them from power.

Adding to Kalecki on inflation, it is exceedingly common for people to misunderstand the relationship between spending and inflation in an economy with and endogenous money supply.

During the gold-standard era the money supply was exogenous (from without), injected entirely by the government sector through spending. If one wanted a bank loan there had to be sufficient savings accumulated to extend the loan, so any increase beyond the funds available for that purpose came from government (which was the logic behind QE: pushing more reserves onto banks would increase lending and expand supply). It is from this perspective the notion developed that government spending drives inflation by spending more currency into circulation than was demanded.

The U.S. and most countries in the world possess an endogenous (from within) money supply in which banks simply extend loans without concern for reserve scarcity; so long as the borrower meets lending standards the bank can always get what it needs to satisfy Fed requirements. This means rather than the money supply exceeding demand and sparking an increase in the general price level, money supply is a response to demand. If the price of a commodity rises (usually due to costs of production/scarcity of inputs) the money supply expands to accomodate this. That’s where austrians, monetarists and neoclassicals make their mistake: they see money supply and costs rising in tandem and assume causality runs from the former to the latter, because they still think in terms of an exogenous monetary system. In an endogenous system costs rise and supply expands in response.

What happened when costs rose in an exogenous monetary system without a dynamic money supply? Economic slumps in which there were insufficient quantities of currency circulating to purchase all the goods and services produced. The slump would then often lead to mass unemployment and a deflationary spiral with a fall in the price level and stagnating wages. That’s why government spending in a time of debt-slump/ tight credit is so important, as consumers are relucant to borrow more and banks are reluctant to lend. A pseudo-exogenous condition now prevails and can only be broken by deleveraging or expansion of the money supply through fiscal policy.

I hear what you’re saying Ben. But at the same time, it’s not really misunderstanding.

Rather, it is frustration with how tone deaf some intellectuals act toward the very real problem for the bottom 80% or so of households that Stuff Costs Too Much.

To make a long story short, we are pretending we are back on the gold standard.

What is inflation?

To the guy making less, the same price for milk is inflation, relatively speaking.

Everyone’s inflation is unique.

It’s like all those ants who were former Indras who came from Brahma’s eye when he emerged from Vishnu’s navel.

Again the disconnect between the environment and economics: create more money to facilitate growth!

“It is vital to understand that high unemployment and low wage growth are solvable problems.”

I think only within a narrowly defined scope. That is, if we ignore the environment. It is arguably the case that within a certain framework some resource constraints may arise much before others which would tend to limit full employment. Likewise, excessive waste production may equally have an inhibitory effect on economic growth well before full employment is reached. Not all resources reach their limits at the same time or in the same manner or to the same extent. The same is true for waste products (often present as externalities). Thus, from an ecological perspective, attempts to ensure full employment (in whatever way) will result in more damage and may ultimately fail if our existential framework does not change to align it with ecological imperatives.

In this regard I tend to favor ‘hardish’ money to impose limits on growth before ecological damage becomes so severe as to be limiting. However, in such a system, much should be done to accommodate both merit and opportunity. Merit, because those that make a greater effort and employ more skill deserve some material recognition for their efforts if they wish that. Opportunity (e.g. universal health care, education), because everyone deserves a chance. And impose a transaction tax on every penny every time it changes from one account to another to limit the ‘merit’ of ‘talent’. No other taxes need to be levied.

In short, I think aiming for full employment within the current existential framework cannot be achieved.

Mind you, I have to admit that wealth/income inequalities create a hard money system. Thus I agree in part with Kalecki’s solutions. But even if they are adopted, environmental constraints will come into play, now more so than ever.

By the way, my favorite summary of economics comes from Kalecki: Economics consists of theoretical laws which nobody has verified and empirical laws which nobody can explain.

No duh! The problem is that they don’t understand the state of the world we live in, so the report ends up not providing much value.

“It is vital to understand that high unemployment and low wage growth are solvable problems.” in a non-resource constrained environment. That’s not possible now. There are too many people on the planet, and too many of those who are first world who consume way too much for that to happen anymore. By all economic measures the standards of living have to go down on average.

The real question is are these policies the result of an elite conspiracy to grab as much as possible in the face of collapse? That is, do the elite buy in to the Club of Rome while pretending they don’t.

Sorry, just saw your post. You beat me to it. And, of course, I agree that the state of the world is not understood. The remedy appears to provide just more money. Even if that money is known not to trickle down, but fall up. Sometimes there is a small nod to resource constraints in the form of mentioning inflation, without a good grasp on what it is. In my view, inflation is not necessarily a system-wide phenomenon, but it may be a local phenomenon indicating that a constraint is already occurring locally. Thus system-wide inflation may only become manifest if numerous cases of local inflation have already emerged. And by then the system is in pain.

By design governments picked winners from the Great Recession. It is pretty straightforward, although folks like Ollie Rehn (and many others) would want you to believe debt levels were the number one problem that needed fixing.

Of course, the reason why the winners were picked in the first place was because Great Recession proof industries like banking, legal, agricultural, etc…. provide plum jobs for those who get through the revolving door.

As for salaries…. what I see is companies taking pride in losing a position only to rehire someone else in the same role at substantially less pay with considerably more education. Temp hires is becoming the normal as well.

I saw minimum wages job postings in Spain — €650 per month — or $840. Hundreds of people applied. This is the kind of ‘reforms’ government folks champion: low, unsustainable wages. This is the course governments are pursuing: crappy wages for everyone except for the privileged, protected sectors.

Plantation economies. Work the mules to death on minimum feed and water — there’s more mules waiting to take their place.

I think the objection has to be mostly about political control. I say this because we increasingly see private contractors skim cream off of what was formally public only expenditures. How many publicly owned hospitals remain in the US? Here in Massachusetts, massive corporate overlords with premium brands are hovering up once nominally regional and public hospitals. Schools are increasingly given over to charter companies that will skim profits off of a formerly non-profit enterprise. Prisons is for profit. War is for profit (contractors). There may be some capitalists who object to this, but there is a whole cadre of “entrepreneurs” that are more than happy to suckle off Uncle Sammy’s teat. And we lose as services decline, costs for public goods rise, and ethics take a back seat to profit.

It has to be that capitalists want total control over labor. Since Vietnam (I think), budget deficits have been the norm. Michael Hudson lays out the case over and over that the United States has created a global economic system that witnesses the U.S. issuing securities to foreign countries that have little choice but to recycle the dollars it gets back from exports into more securities. A cycle that leads to net exporters funding our global military footprint. And it’s mostly deficit spending that I hear very few business leaders objecting too. No doubt a large portion of this spending has created jobs, but not on the level or of the type that we need to sustain an economic recovery. This is no WWII role out the barrels effort. And that is probably why we don’t hear more business leaders objecting to it.

Because business leaders love having political control more than they love having profit, we will see no major policy changes that would advance employment in this country (and probably around the world).

The only thing that will change this is ground up political action. Their system is cracking, obviously, but still stable thanks to government intervention. The Market Basket story in New England woke people up to the power of labor to bring down a seemingly powerful corporate entity. Fast food workers are at the start of a rebellious movement. The smattering of wildcat strikes will hopefully be the kindling of a bigger movement. I can only assume that the upcoming vote in Scotland will be a warning shot to Brussels regarding their precious Euro and it’s non-political union.

But in the end, business leaders like control. They hold the political power. They end up buying the assets of nations at low cost. It is unlikely they will soon give up their control.

business leaders

likelove controlBusiness leaders would happily eat roadkill, as long as the rest of us are forced to eat out of a ditch beside the road.

“The only thing that will change this is ground up political action.” Absolutely right. We also need to be prepared for intense attempts to quell our rebellions. Nearly a hundred years ago, the battle of Blair mountain showed the extreme savagery the fatcats were willing to use to prevent workers from improving their lot. This hasn’t changed. No change for the betterment of workers has ever come easily in human history. We will prevail, nonetheless, if we remain united and relentlessly focused on getting ourselves a better deal as workers.

I am very encouraged that we have succeeded in making some inroads against corporate greed even in these very difficult times. FraudEx is a very tough anti-union nut to crack, but that doesn’t stop my friends in the I.B.T. from taking the fight to them:

“It is with great pleasure we announce that the South Newark, NJ Hub (SNW) has joined the campaign in Bringing the Teamsters to FedEx Freight and filed a petition with the NLRB today. SNW is the eighth terminal to file and brings us to 1100 employees in the fight for representation and a better place to work.

The South Newark, NJ (SNW) facility is a hub and rail terminal as well as P&D covering North Jersey and New York. Congratulations to everyone at SNW!!!

CIN, EPH, SBR, NEW, RCH, NHS, CLT, and now SNW

Together We Stand, Together We Win!”

http://www.changefedextowin.org/

The G20 has performed an admirable diagnosis only to fall back on their usual medieval theory for the treatment: more bloodletting.

Kalecki’s piece was very packed nice to see so many of the shibboleths (confidence fairy, ethics of sweat government investment driving out business investment, evil of consumption support) of classical economy placed in the perspective of the business class’ political (i.e. power relationships) interest. The countervailing power to this political interest, Kalecki realized is down at the grassroots and the fast-food floor:

I, however remain cynical as to the ability of the “masses” to organize effectively against the continued depredations of the ruling classes and of the ruling classes will to use force – police, security firms and the army – to quell citizens mass organizations and confrontations. The only hope in our addled democracy is to provoke a sufficient fear among a significant faction of the ruling classes to achieve “democratic” changes. (i.e. government mandated changes with the appeasement of the ruling classes a la FDR) changes to the capitalist way of doing things). In the end these things, such as a $15 minimum wage, are a mere sop to the working citizens of US. And the business class can play off the wage differential among the other G20 countries to continue the race to the bottom for the working peoples.

All the organizing in the world does nothing so long as they control the money supply. Why do you think we are forbidden by law from creating our own, parallel supply? Because then we wouldn’t need their capital, and they couldn’t get our labor. They would be broke, and we would have everything.

This is about as good an explanation of gov’t income policy as I’ve read anywhere–very good precis!

The opposition, as Larry above says, is political and you have noted the major points of that. If you look at the HC “debate” in 08 it was obvious that, for the vast majority of enterprises, a nationalized Medicare for all sort of system was directly beneficial to corporate bottom lines. So why did U.S. businesses big and small oppose single-payer? One answer: if such a system were to work than people would have confidence in the Federal government to actually do things that benefits the people and this would seriously undermine the political authority of the corporate sector. Since the corporate lobbying has tried to stop all government involvement in the “economy” other than “defense” spending. They have partially succeeded and hope to ultimately succeed by directly sabotaging the Federal Government through ridiculous Congressional mandates, bribery, privatization, lack of funding and so on to destroy the confidence of the American people in their government.

There is no “economy” there is only politics. If corporations can keep the people in fear and ignorance (they have succeeded in both) their power is assured. My experience is that managers and executives, on balance, are in their positions not to accomplish some great transcendent work but to lord or lady over others. They like walking into a room and everything stops–they like making people quiver with fear–the icon in all this are all those reality-show fascists everyone loves. But the sad thing is that one can understand the love of being a royal a-hole and getting money and getting laid with first class sexual partners is appealing–why do the worker bees seem to love that arrangement? Why do we love to watch the dominance submission games on reality TV shows? Why do we love to see others humiliated and crying with a few elites smiling?

More important in critiquing the system and the oligarchs that happily run our lives and would rather make a few dollars less if they can make us that much more miserable–why do the rest of us enjoy being dominated. And we do–I see this directly. We like the idea of a alpha male cracking the whip and we submit–there is great security in that–we know where we stand, we don’t have to decide what to do because someone else a manager a preacher will decide for us–this is what the majority seem to gravitate towards and we have to face up to that fact before we can effectively address the problem of living in an oligarchy.

They like walking into a room and everything stops–they like making people quiver with fear

Narcissists. They are attracted to politics of any kind, like flies to shit.

‘There is no “economy” there is only politics.’

I can’t remember how it happened, but at some point in the last fifty years it dawned on me that “economics” (seemingly some dreary bit of haruspicy) had become the master category in public discourse: the authoratively real in terms of which all else would henceforth be explained. Somewhat latter I realized that the word “consumer” had achieved the same normative ring that “citizen” had once had, and that “citizen” had become merely quaint.

Part of the genius of “economics” is that it obviates what the passive voice simply obscures: appeals to personal agency or responsibility. Allowing perflectly transparent (which is to say, Invisible) politics.

Exactly. We also need to understand that if the economy is the chief dispenser of power then democracy has no meaning. If we think about it most of us who work for others spend half our time on a job and they are completely authoritarian with a few exceptions.

That was the other thing you mentioned in the OP, hierarchy. I’ve lived in America all my life in a dozen cities and towens. I’ve never been a part of what might even loosely be termed a “democratic” organization. Family, school, workplace (including music, theatre, tech) have all been pyramidal in shape. Not necessarily autocratic, but surely not democratic by any stretch of the imagination. I simply mention this in passing.

But I gather that one of the sustaining perqs of life in the pyramid, after you have given up on your hopes and dreams and resigned yourself to humiliating work-rules and/or interminable meetings held in double-speak, gobbledy-gook, and numbers numbers numbers, is pissing on the heads of those beneath you. It’s a small pleasure, but profoundly corrupting.

From Reuters today: “Bank of Japan Deputy Governor Kikuo Iwata “countered the view that wage rises have been slow, saying it [just] takes time for companies long used to deflation…to increase wages.”

If one plays chess at least two moves ahead, one can see the demand for higher (human) wages will just lead to Science coming to the rescue of Big Business by offering the most ‘efficient’ robots ever.

Oh, well.

Perhaps the third move will turn the tide.

“Low Wage Growth, High Long-Term Unemployment Recognized as International Problem”

Well it’s election time and Dems are down in the polls so they have an answer to that (and creating jobs). Tonight, O-bomb-er is scrapping his bomb bomb plan with a radically different bomb bomb bomb bomb plan to fight (or create?) “terror.”

“A successful U.S.-led campaign to eradicate ISIS requires several years, direct military action on both sides of the Iraq-Syria border, billions of dollars, and tens of thousands of troops, according to counterterrorism expert Brian Fishman. “And even then,” Fishman said, “success hinges on dramatic political shifts in both Iraq and Syria that under the best of circumstances will require years.””

See? Lots and lots of people making bomb at great expense and no certainty of success, how long it will take, or how anyone can know it worked. Perfect!

http://finance.yahoo.com/news/heres-massive-challenge-over-isis-110800616.html

Think of those jobs created (but don’t think of the profits it’s not fashionable in Dem circles) by all those little people making bombs so we can kill them over there instead of them killing us over here.

This War on ISIS is the fiscal stimulus we will get.

You ask for it, you get it…the first and last resort.

Keeping workers in fear of starvation is how capitalism was born anyway. See for instance “The Great Transformation” (K. Polanyi) or Prof. Michael Perelman who has been a distinguished guest poster at NC:

http://www.nakedcapitalism.com/2012/04/yasha-levine-recovered-economic-history-everyone-but-an-idiot-knows-that-the-lower-classes-must-be-kept-poor-or-they-will-never-be-industrious.html

So, it is hardly surprising that to keep going on, capitalism must keep workers in fear of unemployment.

I’ve been reading and thinking about the Great Transformation the last several days. I’m struck by Polanyi’s characterization of Liberalism as at root a species of experimental utopianism. Although insisting itself to be science-y and muscularly rational, it is always a kind of cold-blooded romance. A mysticism of clockworks. A dream of what KP calls “machine civilization.”

And I was reminded of an acquaintance in college who “converted” to a species of Cartesianism, who defended vivisection and animal experiments generally by arguing that animals are simply machinery (purely res extensa, no res cogitans) which only appear to us to suffer pain.

“If the government undertakes public investment (e.g. builds schools, hospitals, and highways) or subsidizes mass consumption (by family allowances, reduction of indirect taxation, or subsidies to keep down the prices of necessities)…”

The “if” is the key word. There has been a pretty consistent set of articles appealing to political rhetoric over the past few years that simply assume additional deficit spending would satisfy the conditions.

Yet the evidence is exactly the opposite. We have spent the past decade and a half spending massive amounts of money, but not for public investment or mass consumption. Rather, it’s going to the interests of the top 1% specifically, and just as importantly, the top 20% or so more broadly whose outsized privileges depend upon public policy continuing to not invest in the public commons and social insurance.

Our systems of academia and medicine and law and finance and housing and media and so forth are fundamentally out of control, way too costly relative to the public benefits they provide.

Anyone saying that inflation is not a problem today is not living on the median wage or subject to the more authoritarian aspects of the legal system or dealing with a chronic mental health condition or any of the other real-life challenges facing the great unwashed masses.

“It is vital to understand that high unemployment and low wage growth are solvable problems. But powerful and well placed people believe it is in their interest to keep them unsolved. It will take considerable pressure to change their minds.”

Indeed. But who will provide that pressure? Certainly not organized labor – which barely exists – or the Democratic Party – which is in thrall to the plutocrats. Not the Tea Party or working class whites, whose lack of class consciousness and racial bias causes them to align with the bosses against their own economic self interest. If the 2nd Great Depression hasn’t motivated them, I don’t see anything likely to.

My theory is that the Modern Man is a vastly superior breed.

His pain threshold is higher or perhaps his pain-numbing ‘medicinal knowledge’ is better. Combined with food-science-abetted, life-force draining ‘bread’ and ‘the best ever’ circuses available 24 hours a day, it’s hard to get off the couch and stir to action.

Everyone (or nearly) must have my experiences: I know quite a few people of varying ages (from recently graduated from Univ millenials to aging Boomers & all in between) who’ve lost jobs over the past decade mainly due to economic circumstances (the crash, businesses going under, etc). Most people I know are either having to work 2 to 4 part time jobs to barely make ends meet or perhaps get some kind of lower wage full time job that tends to be insecure as to how long it will last. There are a few exceptions.

Many are just barely making ends meet. On top of that I know several elderly people – 75 & older – who are in pretty dire straights. Some are still trying to work but often not having much luck in finding even a pt job. I am helping one neighbor who is 86 and barely getting by (her sons & grand kids are not in much better shape financially than she is & they don’t have enough money to pay for gas to come visit/help her more than once per month if that).

Yet I witness prices of necessities such as food, utilities, gas, etc, constantly rising. Recently I was visiting family on the east coast and was shocked at how high some of the tolls on the I-95 had risen; some had doubled or even tripled since 2010 (I had old receipts).

I am lucky enough to have a public sector job & I make decent money plus what passes for “good” benefits. Yet my health care costs continue to rise. While I am considered “fortunate” to get an annual COLA, that has only been 1.5% for each of the past 5 years. Yes: better than nothing, but pull the other one to say that the cost of living has only risen 1.5% per year for the past several years.

I am doing fine, but I definitely find myself having to watch expenditures much more than I ever did before (and I’ve always been frugal). It’s awful what I see some friends, relatives and acquaintances going through. Even IF the min wage was raised, it would still be just the tip of the iceberg.

Frankly, the whole situation has crept into levels of obscenity combined with insanity. Agree with some prior comments. It’s not just that the 1%/business owners appear to have NPD, but they seem to be abject outright sadists as well. It’s not just about grinding the 99% under their boot heels, but how to do so while inflicting the most pain as possible.

Another commenter asks why the 99% *appears* to enjoy this situation. I concur. Seems to me that many in the 99% LIKE the situation mainly bc they may have “just enough” to make themselves comfortable (for now), so they get to look down on those less fortunate & laugh, mock & point at their suffering. IOW, are we just sadistic beasts with NPD? We’ve become so propagandized to not care a flying fig about anyone other than me me me, and what’s more, it makes me HAPPY to see the poor suffer because that’s what they deserve! They had it coming.

It’s a very weird and cruel time. Per usual, this Joint Paper points out accurately what’s wrong but per usual stops from providing truly real solutions. And so? Then what?

Massive insurrection, imo, may well not be in the cards. I’ve lived in several third world countries. People do end up so ground under by poverty and the associated issues – hunger, disease, etc – that they go along to get along, and nothing much changes. I’m not holding my breath, but I’m open to suggestions for real, positive change.

Sentences like ‘Why do we love to see others humiliated and crying with a few elites smiling?’ and ‘why do the rest of us enjoy being dominated. And we do’, strike me as patronizing and counterproductive.

There’s no need to appeal to the sadism and/or masochism of the masses to explain our current situation. Fear, laziness and misinformation are sufficient explanations. That’s the reason why control of the police, the court system, the press and the schools is so important: to impose fear, to make redress/change via legal means hard and time-consuming, and to keep the people misinformed.

On the need for “considerable pressure” to fight this problem, I would add that the rediscovery of Kalecki has been going on for quite a while now among what Larry Summers would call “insiders”, so the obstacle is emphatically not that insiders (well-meaning and not-) are unaware that this dynamic is real and has real growth-dampening effects.

For example, in 2009 the very mainstream neoclassical Brad DeLong wrote in his blog:

“Back in the 1930s there was a Polish Marxist economist, Michel Kalecki, who argued that recessions were functional for the ruling class and for capitalism because they created excess supply of labor, forced workers to work harder to keep their jobs, and so produced a rise in the rate of relative surplus-value.

“For thirty years, ever since I got into this business, I have been mocking Michel Kalecki. I have been pointing out that recessions see a much sharper fall in profits than in wages. I have been saying that the pace of work slows in recessions–that employers are more concerned with keeping valuable employees in their value chains than using a temporary high level of unemployment to squeeze greater work effort out of their workers.

“I don’t think that I can mock Michel Kalecki any more, ever again.”

http://delong.typepad.com/sdj/2009/11/zomfg-wtf-95-third-quarter-productivity-growth-number.html

Actually, “stuff” is cheaper than it used to be. If anything that was probably the idea — let wages fall but offset it with cheap imports. But the basics of middle class life (housing, education, medical care) have to be obtained locally at the going rates, which have skyrocketed. So we end up having a lot of stuff but not being able to afford a house.

Sorry, meant as a response to Washunate’s 11:13 AM post.

Junk stuff costs too much.

I’m not sure where you shop & what “junk stuff” you are finding to be so cheaply.

I am a huge bargain/coupon shopper (for things I really need; not impulse stuff). My anecdotal observation is that clothing and shoes are more expensive these days, sometimes quite a bit more. Yes, one can go to the 2d hand store, but even there, not always that cheap.

Food has gotten very expensive in CA, even shopping at farmer’s markets, coupon shopping, etc. I help several elderly people go grocery shopping, and it’s horrible. They go to the horrid 99 cent/dollar stores and similar; get out of date crap; horrible “food;” still not that cheap.

Yes, the average citizen can no longer afford to buy a house, much less even a used car. But what I’m seeing is people having a hard time making the rent and buying food. Who has anything left over even for “cheap junk”??

Cheap junk will cost you twice.

First, it’s not cheap, as you say.

Second, you will pay for it again when (your pick – you get sick from eating it, you have to buy another soon, etc).

Transport, Propulsion, & Motorization

We want the universe to transport us, but until we can see the transport mechanism, we need transportation, to learn to navigate, education. Building transportation to comb every inch of the planet, to kill every living thing on it, and compete for the spoil of natural resource exploitation, on a one-way trip, under the guise of human social justice, or capitalism, in a closed system that can only result in short-term thinking and a quick return to the DNA churn pool, is not the goal.

The journey is the adventure, not the destination, but there has to be some level of graduation, and money is obviously not a reliable measure of value. Currency proffers to provide information as the basis of decisions, as a common denominator for ‘modern’ society, but fails the majority every time, because the purported means becomes the destination, in a public education system built for the purpose, by civil marriage with civil law.

Each iteration of empire begins with a noble and scientific quest, and each ends in complete and utter disaster, because the originators ignore the works of nature, assuming natural resources to be exploited, and their societies compound the error assuming that human labor, in the form of capital stock, can be pitted against human labor on the margin, leaving the empire with only exploitation of diminishing return to support sunk costs as the remainder.

The social ruins of nearly every ‘civil’ society in History can be seen evaporating to this day, as memorials to their stupidity, based on the assumption that humanity is somehow a superior species, yet the assumption persists. Whether all the resulting connections in the human brain have been busy work remains to be seen, but assuming infinite do-overs is certainly not a path to the future.

A global fiat currency without independent community economies trading surplus can only fail, for all the reasons being discussed, which all amount to a gravitational gradient in favor of the past, repeating itself more efficiently. With the best education and healthcare its money can buy, for legacy, by the upper middle class, all that remains of the exceptional edifice, America finds itself always at war, always on the brink of world war, playing defense with offense and cajoling Russia for doing the same – so much for higher education on a Bell Curve, feeding incorporation into the global city, again.

You have to aim a bit higher, and the longer the zombies persist, the higher you have to aim, to avoid the gravity of stupidity. That’s just plain physics. But fortunately for you, as an individual, gravity can be levered against itself, giving you propulsion, even if all you do is cut the string. The critters have bid propulsion up to $50T already, with no end in sight, which is just a relative number, but it tells you how far in the hole they are. The real question is where do you want to go.

The empire majority pits itself against nature, appearing as a damsel in distress in the middle of the street, making alcohol for a drunk serving as the scapegoat. Pay it no mind. Because America has found a few hundred million ways to grow debt against its children’s future, like its predecessors, does not make it the leader of the free world, and you its slave. That is History. Your future is yours.

There is plenty of capital stock to recycle, and natural resources per capita are increasing on demographic bust. Focus on your development and the economic motor will present itself, as the empire is recycled.

Let me get this right; the women doing the jobs of sidelined men, for far less pay, are going to support the women doing make-work, so they can make as much as men doing make-work. That should work, after it has failed for fifty years.

wow, to think it is that raw that the corporations have to sink their teeth in and make the killl

is that what Hitler was all about?

brought to you by your low priced corporation

Put a cap on market capitalization of listed companies.

$ 86 Pay of an average employee in the United States today

$ 29,452 Pay of a S&P500 C.E.O today

http://www.moneymeters.org/