Yves here. While the financial media is riveted with the spectacle of the ruble meltdown and the Russian government rate hike to 17%, and the investor rush out of all things emerging markets, another drama is playing out in Ukraine. If you’ve been following this drama, the Ukraine economy is substantially intertwined with Russia’s, and Russia was already subsidizing it by giving it a break on gas prices. When things got ugly, Russia revoked the subsidy, demanded repayment of outstanding gas debts, and cut off gas shipments. This made for an ugly situation, since 70% of gas to Europe goes through pipelines that transit Ukraine meaning Ukraine could simply steal European-bound gas if they got desperate, creating a conflict with one of their new patrons. Moreover, it raised the specter that any rescue of Ukraine would wind up routing funds to Gazrpom to pay off the gas bill, another outcome unappealing to a West determined to punish Russia every way it could (the dispute over the outstanding debt is being arbitrated, with a decision due next summer, which also allows Europe to wash its hands of money going to Gazprom).

This detailed account of the wrangling over what to do about supporting the basket case of Ukraine makes a couple of issues very clear: one, the amount of funding needed is much larger than the officials want to admit to, and two, the approaches under discussion are at best stopgaps. A default and restructuring look inevitable.

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

Multi-billion dollar lending to Ukraine by the International Monetary Fund (IMF) and World Bank has stopped amid growing doubts among country board directors at the two international organizations that the Ukrainian Government can meet repayment commitments and loan covenants for 2015, or deliver on reform promises and budget financing targets tabled in Kiev this week.

For the first time since the change of government in Ukraine last February led to civil war in the east of the country, European bankers and multilateral fund sources acknowledge that Kiev is now likely to default on its international debts, and will seek a reorganization of its bond debt. This will hit Franklin Templeton, the US investment fund which has accumulated up to $9 billion in Ukrainian bonds on a wager to make a $4 billion profit – if the US Government guarantees full and timely repayment.

IMF officials refuse to elaborate on the new terminology which the Fund began issuing last week to describe the suspension of cash disbursements under the Fund’s existing $17.1 billion programme, started last May. For the fine print of the IMF programme, read this and more.

David Lipton (below, left), the former US Treasury and White House official who is now deputy chief executive of the Fund, announced in Kiev on Friday: “A Fund team conducting technical discussions is expected to conclude its work by the end of the coming week. A mission to conduct policy discussions in the context of the Fund-supported program is expected to return to Kyiv early next year.” He said this after meetings with President Petro Poroshenko, Prime Minister Arseny Yatseniuk, Minister of Finance Natalie Jaresko, and Minister of Economy Aivaras Abromavicius. Jaresko (below, right) is an American national; Abromavicius, Lithuanian.

A spokesman for the IMF in Washington was asked to say who is in charge of the current “technical discussions”, who will head the delayed “policy discussions”, and what the difference is between them. The spokesman said this morning: “The head of the IMF technical mission, which is currently working in Kiev, is Mr. Gueorguiev, and he will also lead the mission for policy discussions early next year. Technical missions focus more on collecting data and discussing technical issues while missions for policy discussions focus on policy discussions.”

Gueorguiev (right), a finance ministry official in Bulgaria before he joined the Fund, was in Kiev on a two-week data -collection and “technical” negotiating mission in November. He returned on December 9, and is scheduled to remain there until December 22. He has confirmed that the IMF technical discussions cover staff analyses of whether the Ukrainian government can meet state financing and debt obligations, as they fall due. Gueorgiev’s record in negotiating compliance with IMF conditions, along with special favour for Igor Kolomoisky’s Privat Bank, can be read here.

Gueorguiev (right), a finance ministry official in Bulgaria before he joined the Fund, was in Kiev on a two-week data -collection and “technical” negotiating mission in November. He returned on December 9, and is scheduled to remain there until December 22. He has confirmed that the IMF technical discussions cover staff analyses of whether the Ukrainian government can meet state financing and debt obligations, as they fall due. Gueorgiev’s record in negotiating compliance with IMF conditions, along with special favour for Igor Kolomoisky’s Privat Bank, can be read here.

A Polish financial source monitoring these negotiations comments: “So now Gueorguiev & Co. are collecting data. And they had been doing this already during their mission in November. This is a lot of data collecting, especially in modern times where everything can be shared electronically without leaving DC. It looks like the IMF is cornered with their program in Ukraine and they are buying time.” Poroshenko will make a state visit to Warsaw later this week to ask for Polish financing for the Ukrainian military.

Ahead of Lipton’s visit to Kiev, William Murray (right), a spokesman for IMF managing director, Christine Lagarde, revealed that because of doubt that Ukraine can meet current IMF financing requirements, conditional lending by the Fund may be suspended, while a fresh bailout is pursued outside the Fund’s member states without conditions. According to Murray, “we need financing assurances, programs have to be funded, and it’s a 12 month horizon… it’s really important that the donor community step up and provide financing to Ukraine.”

Ahead of Lipton’s visit to Kiev, William Murray (right), a spokesman for IMF managing director, Christine Lagarde, revealed that because of doubt that Ukraine can meet current IMF financing requirements, conditional lending by the Fund may be suspended, while a fresh bailout is pursued outside the Fund’s member states without conditions. According to Murray, “we need financing assurances, programs have to be funded, and it’s a 12 month horizon… it’s really important that the donor community step up and provide financing to Ukraine.”

Gueorgiev and Murray were asked overnight to clarify that the “policy discussions” planned for January are to consider the request from Kiev for a new programme of unconditional grants without compliance with the IMF programme. A request for $15 billion in grant money was announced by Yatseniuk, after Gueorgiev’s arrival and before Lipton’s landing — “ in order to prevent a default, we need an international donor conference”.

Gueorgiev and Murray refuse to say what this means for the IMF conditions, on which the Fund directors have been insisting before a new tranche of the agreed loan can be released to Kiev.

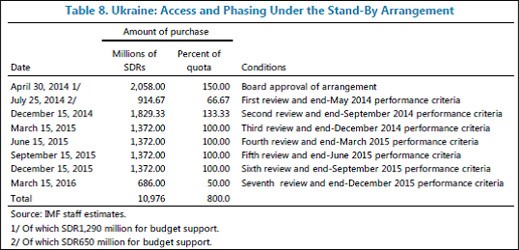

Source: IMF, FIRST REVIEW UNDER THE STAND-BY ARRANGEMENT, REQUESTS FOR WAIVERS OF NONOBSERVANCE AND APPLICABILITY OF PERFORMANCE CRITERIA, AND A REQUEST FOR REPHASING OF THE ARRANGEMENT (August 18, 2014) – page 47.

To date, converting Special Drawing Rights (SDRs) in the table into US dollars, $4.3 billion in IMF transfers scheduled between July 25 and December 15 have now been put off. Another $2.1 billion had been scheduled by the IMF for release by next March 15 on condition that the IMF staff and board agreed by the end of this month that Kiev was meeting the “performance criteria.” Altogether, a third of the IMF’s financing agreement with Ukraine has now stopped because the Ukrainian Government is failing the “performance criteria”. In IMF lingo, performance criteria, loan covenants, programme conditionality, and financing assurances are all synonyms for what staff and directors believe to be in violation right now.

According to a Fund spokesman early today, “I have nothing to add to Mr. Lipton’s statement and to Mr. Murray’s briefing.”

At the World Bank, officials are clear that negotiations for a new $500 million loan to support failing Ukrainian banks through the Deposit Guarantee Fund (DGF) have been postponed until next February at the earliest. The officials are less certain about how much money has actually been turned over to date. For details of what the World Bank is calling its “First Programmatic Financial Sector Development Policy Loan” (FSDPL1), read this.

Days after that was published, the World Bank official in charge, Alexander Pankov, returned to Washington; Pankov is Russian. He was replaced by Lalita Moorty (right), an Indian. World Bank documents fail to show that a terms and conditions document for FSDPL1 was signed, following authorization of the loan by the World Bank board. Bank sources confirm, however, the money was paid out “in early September”.

Days after that was published, the World Bank official in charge, Alexander Pankov, returned to Washington; Pankov is Russian. He was replaced by Lalita Moorty (right), an Indian. World Bank documents fail to show that a terms and conditions document for FSDPL1 was signed, following authorization of the loan by the World Bank board. Bank sources confirm, however, the money was paid out “in early September”.

Awkwardness over what the National Bank of Ukraine (NBU) and the Ukrainian commercial banks have done with the cash has increased the need in Kiev for the second $500 million loan (FSDPL2). But in Washington lack of confidence at the board level, and uncertainty among bank staff, have slowed down negotiations. As early as July 18, a World Bank staff report, signed by Vice President Laura Tuck, had warned that the risk of default on the FSDPL1 was “high”. The paper also conceded “the risk of lack of follow-through action after FSDPL1 is significant considering that Ukraine’s previous financial sector DPL series in 2009-2010 was not satisfactorily completed after the first operation.”

In charge of Ukrainian bank bailouts in Washington is an Indian, Jinku Chandra; he was earlier in charge of World Bank bailouts for Balkan and Baltic banks.

In September Chandra was promising the Ukrainians to accelerate the bailout cash. A month later, a World Bank report on the status of exposure to Ukraine claimed there would be a Board review of the first loan performance, and compliance at the Ukrainian banks, in December. As for the second $500 million, that is now “expected in the third quarter of FY15”.

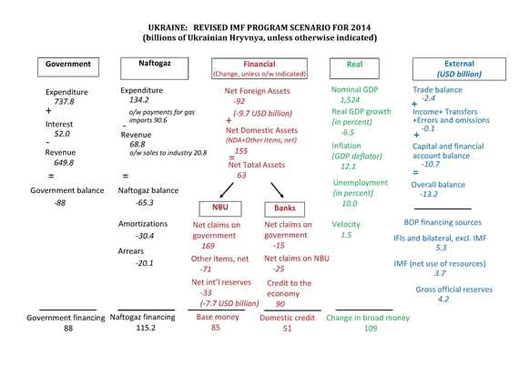

The so-called “technical discussions” by the IMF and World Bank have been analysed by Andrei Kirilenko, a well-known Ukrainian-American professor of finance at MIT’s Sloan business school. In September he illustrated the shortfalls in Ukrainian cash to meet IMF targets this way:

Source: http://www.huffingtonpost.com

The tabulation shows that even drastic cuts to the government’s budget would cover just 88 billion hryvnia ($5.5 billion), substantially less than the shortfall of UAH115.2 billion ($7.3 billion) for the domestic energy source, Naftogaz. “The financing needs of Naftogaz,” according to Kirilenko, “are nearly twice as large as the available financing capacity of the entire domestic financial system, including the National Bank of Ukraine. Another domestic financial system of about the same size and capacity needs to be built just to finance Naftogaz.”

The combination of state budget and Naftogaz is dwarfed in Kirilenko’s display of the IMF technical estimates by the overall negative balance requiring external financing: that’s $13.2 billion. “For now, it looks like the short-term solution is to patch up the Naftogaz financing gap using the IMF standby money. In fact, the IMF standby program looks more and more like the bailout of just Naftogaz. According to the revised IMF program, during 2014-2015, UAH 151.4 billion is needed for Naftogaz (115.2 billion in 2014 and 36.2 billion in 2015). This amount [at the August rate of exchange] is about equal to 10.8 billion dollars that IMF plans to inject into the country during the same two years (3.7 billion dollars in 2014 and 7.1 billion dollars in 2015). For this to work out while leaving no IMF money for anything else, the exchange rate needs to be about 14 – probably a rather optimistic number given how massive the issues are elsewhere.”

Kirilenko (right) doesn’t attempt to say why the government in Kiev has failed to address the Naftogaz problem since it took power inFebruary. For a practical alternative, Kirilenko recommends a combination of “inviting the Vikings, i.e. foreign strategic specialists” and “volunteer experts”. Both, according to Kirilenko, must be insulated from domestic Ukrainian politics. “Since the political repercussions of such a decision would be particularly massive, the political leadership is likely to only commit to do it if it could somehow be insulated from blame for the aftershock.”

Kirilenko (right) doesn’t attempt to say why the government in Kiev has failed to address the Naftogaz problem since it took power inFebruary. For a practical alternative, Kirilenko recommends a combination of “inviting the Vikings, i.e. foreign strategic specialists” and “volunteer experts”. Both, according to Kirilenko, must be insulated from domestic Ukrainian politics. “Since the political repercussions of such a decision would be particularly massive, the political leadership is likely to only commit to do it if it could somehow be insulated from blame for the aftershock.”

Kirilenko’s technical discussion was based on the IMF’s August numbers for the Ukraine. Gueorgiev won’t say so, but his data collection in November and last week reveal the financing shortfall for 2015 is much worse. Yatseniuk has announced the shortfall estimate is now $15 billion.

Jaresko, one of the Vikings Kirilenko recommended to take over, was reported last week as proposing expenditure cuts below the August IMF target of 33% — from UAH 737 billion to 496 billion. The leaked cuts from Jaresko’s ministry reportedly include reducing the number of parliamentary deputies from 450 to 150, cutting obligatory schooling from 11 to 9 years, abolition of constitutional guarantees of free education and medicine, raising the pension age, and cancelation of pension indexation for inflation.

This week Jaresko issued a denial, claiming “we are in the midst of a process within the government and with our coalition of brainstorming, debating and discussing everything on both the revenue and expense side of the balance. We are in the middle, so no final draft has yet been agreed. Ideas that have been published in the Internet or discussed are simply that — ideas. Until we finalize and agree within the government on drafts to submit to the parliament, I ask for the press and public’s patience. “

Jaresko has also announced: “We are not in a state of default and also not in pre-default state. This question is not even being considered in the government. But no one is hiding that the situation is very serious – Ukraine needs urgent stabilisation of the financial system in particular the banking sector.”

Herself under investigation for running a $150 million programme of US cash for Ukrainian political targets, Jaresko’s Kiev company, Horizon Capital, has taken down the corporate website disclosing details of where the money has been placed. The website is now inaccessible. According to a source inside Horizon’s Kiev office, the website will be back online by “Thursday or Friday”, or perhaps not until “the week thereafter”.

Another major American stakeholder in Ukraine’s default status is currently denying reports it authorized a few days ago that it is risking almost $9 billion in value on a US Government guarantee to prevent Ukraine from defaulting on its bonds.

According to reporting by the California-based Franklin Templeton Investments group, it is currently holding about $8.8 billion in Ukrainian bonds. The number appears in advertisements placed by Michael Hasenstab (below, at company headquarters), the chief government debt trader for the group, in The Economist and Wall Street Journal.

The Journal reported, and Hasentab confirmed, that as of September 30 the Ukrainian bond value held by his group was $8.78 billion. But missing from his media placements is the price Franklin Templeton paid for its Ukraine bonds. Market sources believe the outlay was less than $4 billion. If it can collect face value at the scheduled maturity, the profit would be roughly 100%. But if there is a bond default, followed by a long-term extension of the maturity date and a cut in redemption value, Franklin Templeton stands to lose most of its outlay.

According to Hasenstab, he’s indifferent to the IMF support for the Ukraine. “Their presence or lack of presence does not solely direct our investments.” He told The Economist that even if the Ukrainian bailout fails, the impact will be small on Franklin Templeton’s portfolio because Ukrainian paper makes up “only 4.5% of their holdings”. The percentage of Ukrainian paper held on March 31, according to a group publication, was half as much – 2.3%. Since then, Hasenstab appears to have been selling Russian bonds to buy Ukrainian.

Franklin Templeton executives, including Mark Mobius, executive chairman of the emerging markets division of the larger group, were asked to confirm the published data on their Ukraine bond holdings and Hasenstab’s remarks. Spokesman for Franklin Templeton’s Eastern Europe division, Adnan Abdel-Razzak, now claims the publications weren’t authorized; Hasenstab didn’t mean to talk about Ukraine; and “as a matter of policy, we do not disclose aggregate holdings of country exposure.” He provided links to dozens of fund reports but refuses to confirm the aggregate value of the Ukraine debt the group has bought.

European bankers differ on what this means for the effort US Government officials are now making to get German and other European Union donors to stump up the $15 billion in extra cash to prevent a default. One source says the US Government will have to commit most of the money first. If it doesn’t, the Europeans will delay their commitments. The longer this delay, the more protracted the IMF “policy discussions”, the more certain the default.

With an outlay of at least $4 billion and a profit of more riding on the outcome of the Ukrainian bailout, Mobius and Abdel-Razzak were asked to comment on the Ukraine government’s request for an external grant programme from the “donor community” to prevent a bond default. They were also asked if Franklin Templeton has discussed the default options with US Government officials, with Finance Minister Jaresko and with other Ukraine Government officials. They refuse to say.

Russia has made a number of large loans (~ $35 billion) to Ukraine. These loans include the option for immediate repayment should Ukraine’s debt exceed 60% of GDP. My understanding of a Russian article is that a Russian bank has made a call on a ~$900 million loan. The backing assets for the loan include underground storage of ~5 billion cubic meters of gas. If the loan isn’t repaid, Russia will go for the assets. That is only the start.

Sensible Ukrainians should secede from Ukraine and join the Novorossians, leaving a rump Nazified state for the US/EU to gloat over.

US / EU and IMF have caught a cold! They expected Russia to pay for this, but it turned out Russian ‘loans’ were Internationally backed and can’t be defaulted or bankrupted. Putin has experience of Ukraine and their failure to pay, he will walk away with the lot for a song, as US get weary of Ukraine’s underhandedness.

On another note, did anybody catch this from Syria yesterday?

http://www.veteranstoday.com/2014/12/13/historic-speech-in-damascus-sends-shockwaves-around-the-world/

Duff explained that what is going on in Iraq and Syria with ISIS is not Terrorism, it is simply CRIME. That is, it is the works of an international Crime Cabal which has gotten control of the American Congress. Yes, this is a large Organized Crime problem that must be understood at its simple root cause.

Nice! And of course it goes much, much further than that. Pull the string and watch the whole shooting match come undone. It’s like something straight out of those cheezy Bond flicks of yesteryear. Gonna take a lot more than a few superstar secret agents to solve it though.

I just wonder what the capital outflow from Ukraine has looked like over the past five or ten years. I suspect the oligarchs have run out of short-term plunder and are getting ready to retire to their “offshore” havens. The rest is theater … which is sad for the victims … or all types.

Not only is the new American shake-and-bake Ukrainian Finance Minister Natalie Jaresko’s former company Horizon Capital under investigation, but her Canadian pal, Lenna Koszarny, co-founder of Horizon and its new CEO, is also arousing some interest for various activities on behalf of the Canadian Prime Minister Stephen Harper, including ‘representing’ Canada in the distribution of ‘aid’ to the Ukraine military such as winter-gear for the notorious Neo-Nazi ‘Aidar’ Batallion, recently cited by Amnesty International for atrocities and war crimes in Eastern Ukraine.

http://maidantranslations.com/2014/12/12/wings-phoenix-the-first-shipment-of-ukrainian-humanitarian-aid-is-now-closed-in-full/

Koszarny and Jaresko were apparently also principle actors in arranging support from the Atlantic Council, a well known integrated propaganda arm of the US State Department, for something called the Ukrainian World Congress.

http://www.atlanticcouncil.org/news/press-releases/atlantic-council-and-ukrainian-world-congress-partner-to-advance-a-european-democratic-and-united-ukraine.

These are the typical sort of shadowy hijinks with such an operation as the takeover of Ukraine by Western financial and geopolitical interests, and also typical are the chequered cast of characters involved. Too bad the mainstream media is so unwilling or unable to dig deeper into this pungent and greasy dungheap. Perhaps if there’s anything good that can come out of the financial shambles in Ukraine, it might be to encourage peace talks and scuttle any offensive plans for a continuation of the awful civil war against Ukraine’s east. Let us hope so.

Ah, another one in the making, a fiasco/mess, that shouldn’t have been. The question: “when will they ever learn”, seems to be repeating its self over and over again. Crime, certainly seems so, steal everything that isn’t nailed down, then steal the hammer too.

I don’t think Franklin Templeton has anything to be worried about. As the last part of the article hints at, this has nothing to do with the IMF/World Bank and everything to do with Europe and America deciding how to split the bill for their Ukrainian mess. But either way that bill will get paid. This is now a prestige issue for American and European politicians: they need Ukraine to succeed to show Putin they can still throw their weight around in Russia’s backyard. And what’s a few billion dollars of taxpayers’ money to help a few overgrown schoolyard bullies win a pissing match?

Besides, Ukraine’s debt is held by American and European banks, not retail investors. Do you really think the Treasury is *not* going to socialize their losses? The only people who would be the losers are US/EU taxpayers, and Ukrainian citizens who will be saddled with increasing amounts of debt, the proceeds of which will be used to pay foreign banks while never even touching their soil. But hey, it worked so well in Greece so…

Again, economics is politics by another name. So let’s stop looking at the numbers and talk about the politics of bailing out Ukraine:

1) Give Putin another black eye

2) Bail out the banks

3) Impoverish the actual citizens

Sounds like a win-win-win to me. Easily worth billions of OPM…

Despite what you say, the US has been extremely slow to pick up the tab. We broke it, but we are pretending we don’t own it. The US may be pressing the Eurozone authorities to rely on forbearance or (hahaha) let banks pledge Ukraine debt to the ECB in the LTRO.

I think that slowness and resistance was due to the elections. Even the most hardcore neoliberal still places his/her own election above any idealogy. Now that that messy business is over and done with, they can get back to the task at hand. I’m pretty sure a Congress that just authorized military assistance for Ukraine, thereby risking a Putin escalation, combined with an incoming Congress that will be even more subservient to Wall St, means that odds are very good that the U.S. will pony up soon.

According to [IMF spokesman] Murray, “we need financing assurances, programs have to be funded, and it’s a 12 month horizon… it’s really important that the donor community step up and provide financing to Ukraine.”

This post is another well-researched gem from John Helmer, who deserves a medal for plowing through the thick fog of IMF euphemism.

Not mentioned by Helmer, perhaps because it happened after his deadline, is that the U.S. Congress (the very same Congress that’s so gung-ho for the US to aggressively defend the Ukraine) failed to authorize a doubling of quotas for the IMF.

William Murray’s allusion to ‘the donor community’ stepping up almost surely can be translated as ‘the United States.’ That is, the Ukraine is now a bargaining chip in a hostage drama. This quote is from April, but nothing has changed:

http://www.lowyinterpreter.org/post/2014/04/15/G20-US-ultimatum-IMF-reform.aspx?COLLCC=2179699070&

And among the “conditions” are the requirement for loans to be removed from the chaos of Ukrainian politics. Which is hilarious. Irate Ukrainians are now roaming the streets (of Kiev?) and grabbing politicians, picking them up and tossing them in the nearest dumpster. Then they tape them climbing out, all filthy, and walking away in humiliation.

The level of supporting detail of the article is excellent. This is as good as, or better than the Financial Times at its best. Good work.