Yves here. Fedwatching has become more important than ever, with markets driven by aggressive central bank intervention, yet also often tedious, as the Fed has painted itself in a corner.

However, make no mistake that the Fed is eager to raise rates, or as the members of the Board of Governors and regional Fed presidents like to put it, to “normalize” policy. I was on an e-mail thread yesterday that included economists and financial writers who have a following. Some representative comments:

They want to hike but they can’t yet. I feel they believe they have conditioned the market enough to expect a hike when the data turn. So what is missing is better data. One quarter of 2% growth and PCE inflation at say 1% and they will pull the trigger. That’s what Yellen basically said today.

If they could hike without moving the stock market, or the dollar, sure, agreed without question. But I would be astonished if the regional presidents weren’t being inundated with complaints by big company CEOs about the dollar’s strength over the last two quarters, when S&P earnings, incidentally, were down 14% and 13% YOY, with the dollar certainly no small culprit in that. And the stock market is critical for them–isn’t that what the whole financial stability concern is about?– so unless they could create a groundswell of jawboning about how the economy’s strong enough, and the market cheap enough, to handle a rate hike and see it as a sign of economic strength, I don’t think they can chance even the smallest of drops. There must be people at the Fed who understand that the market structure is so fragile that a 4 or 5 percent drop could really snowball out of control, and though there’s been no wealth effect to speak of to the upside, and falling market would almost certainly produce a negative wealth effect, and have large negative psychological implications for the economy. Finally, given that confidence in the Fed is paramount in the pursuit of all its objectives, I think they fear having to turn around and take back the hike almost immediately, or rather fear what that might mean for perceptions of the Fed’s command and control capabilities. I do think they hate the thought of hitting the seventh anniversary of 0% interest rates, which I believe gets celebrated in December, so yes, they’d love to avoid that. But I think they’re scared to death, and not without reason.

In my conspiratorial mind, a rate hike — sooner rather than later — makes perfect sense. The slowdown/recession will coincide with tightening, thereby preserving the image of the Fed as the almighty driver of economic well being….I say they want to hike, but the data isn’t cooperating. I also say that they COULD make the case that people are underestimating the risk(s) of waiting. That, in spite of the data, things are, in fact, better than they appear to be and the Fed is now concerned enough about upside risks to justify a(n albeit unwarranted) hike. They can easily make a preemptive argument. I’m not saying they WILL, I’m just saying that I can imagine a scenario where this serves a dual purpose. They get what they so desperately want — “normalization” — and they provide cover against the growing body of evidence that monetary policy isn’t all that (even absent the ZLB). As growth slows/reverses, they actually get to take some credit for it. #HackLivesMatter #FedRelevance #ViveLaFOMC!

Mind you, this is not a beat I follow closely, but having seen regional Fed presidents pumping for “normalization,” my guess is that the the central bank will the first set of solid looking data, and that could be as little as two successive months, to start increasing rates. Remember, the Fed also has a bias to interpret data as proving that its policies have been working….and I don’t mean just for the banks. And the the Fed sees strengthening core inflation as a proof of success

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Inflation has not been a problem recently, according to the Consumer Price Index. Energy prices have plunged, which helped, and the rising costs of housing, which account for over one-third of the index, are purposefully mitigated via some elegant statistical twists, and that helped a lot.

Everyone has been lulled to sleep by the sheer absence of consumer price inflation. And the Fed has used this low inflation as pretext to keep its foot all the way on the accelerator of total interest-rate repression, though it isn’t accelerating much of anything other than asset price inflation.

But that was then, and this is now.

The headline CPI still looks benign, inching up 0.1% in April on a seasonally adjusted basis, the Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index declined 0.2% before seasonal adjustment, thanks to the energy index, which plunged 19.4%.

But the core CPI (less food and energy) rose 0.3% in April, its largest increase since January 2013. Some of the standouts:

Shelter +0.3%; rent, owners’ equivalent rent, and lodging away from home +0.3%; medical care +0.7%, its largest increase since January 2007; medical care services +0.9%, hospital services +1.9%; household furnishings and operations +0.5%, its largest increase since September 2008; used cars and trucks +0.6%; new vehicles +0.1 percent.

Heat is building up beneath the overall index.

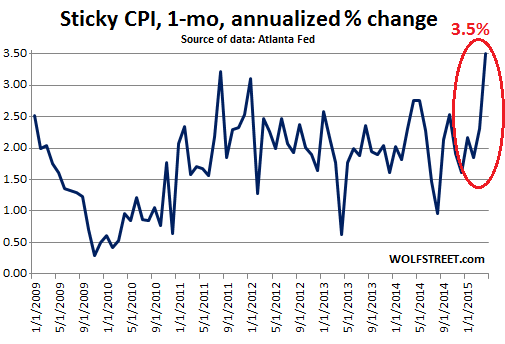

To shed more light on this phenomenon, the Atlanta Fed releases a “sticky-price consumer price index,” the “Sticky CPI,” which consists of a weighted basket of items that change price relatively slowly. And in April, annualized, it soared 3.50%, the sharpest increase since July 2008! “Core Sticky CPI ex-shelter” soared 3.83%, the highest since August 2008.

This puts the Sticky CPI at 2.1% above where it was a year ago, even though the overall headline CPI, thanks to the plunge in energy, actually declined over the same period. The Sticky CPI is not supposed to jump like this; it consists of items that change price “relatively slowly,” as the Atlanta Fed describes it. Now they’re in lift-off mode.

This chart, going back to January 2009 shows the sudden spike of inflation, as expressed by the Sticky CPI:

Fed Chair Janet Yellen said today that “it will be appropriate at some point this year to take the initial step to raise the federal funds rate target and begin the process of normalizing monetary policy.” To support this sort of revolutionary activity, she would have to be “reasonably confident that inflation” – for her, that’s the PCE index – “will move back to 2% over the medium term.”

Energy is not going to decline much further from where it was in April. Other prices are rising and some are soaring. What gives?

This puts the Fed way behind the curve – as many experts have long predicted. So here is former Fed Governor Lawrence Lindsey, who was right before in a big way and got fired for it. He said that the Fed has “almost no credibility” with his clients about “staying on top of ticking monetary bomb.” Read… Former Fed Governor Predicts “Wrenching” Market Adjustment

Jesus of Nazareth once said “A single data point maketh not a trend.”

agree with Jesus on that one…but the sticky CPI is a new one on me…

Is the price of sticky wicket included this new sticky-CPI?

War stagflation is about to take its toll. Welcome to Weimar Germany where all options are lousy.

If the Fed is looking for some signs of core inflation in the system, just tell them to look at Texas property taxes. Local CADS have bumped home values (and property taxes) by the 10 percent state cap for consecutive years now. Nothing like compounded interest! :)

http://aaronlayman.com/2015/05/stakeholders-in-texas-broken-property-tax-system-cannot-absolve-themselves-of-responsibility-for-its-failure/

China or Greece or something else will blow up in the meantime and make all this discussion moot. Right now the Fed is in the sweet spot where they still get to pretend they are in control. They want to raise rates now so they can lower them later. What’s more important the journey or the destination? Either way, we are still at zero two years from now. They define success by declaring “normalization.” High Fives all around around the mahogany table. They are in a hot hurry to outrun the tsunami.

Normal would be 3.5 to 4% fed funds rate with 2% inflation. Does anyone believe that will ever be achieved? The truth is, unpalatable as it may be, that the FED has destroyed the financial system and with it the economy and nation. The future holds only disintegration for decades, even centuries, to come. Them’s the cards. Read’em and weep!

From the Cleveland Fed:

Median CPI is already over 2%. Whip Inflation Now, Mr Yellen!

If Yellen believes that jobs and growth will trigger wage-price inflation and it is the hardest kind to control and so (while Congress adamantly refuses any fiscal measures) she sets a goal of 2% inflation based on fudged employment stats it only makes sense that just a small increase in employment and or wages could send inflation soaring. But it is as false a reading as the underlying labor stats. The only truthiness theses days is the fact that we are promoting austerity as fast and furious as is the EU. How can we continue to do so, and keep it in balance, if the Fed raises interest rates? I’d be skeptical of the sticky index.

Don’t overlook the need to appear to do something regardless of the situation. QE has failed as any sane person would predict, but a growing number in DC want results from the Fed which promised success. Now many of the supporters of the easy path the fed promised want results or action. Yellen’s position is dependent on her doing something. Much of this mess can still be traced to Obama and Congress back in 2009 and general Republican policies, but taking responsibility isn’t chic.

The Fed claimed credit for the new financial wealth inequality and promised results, and a growing chorus wants to collect. Yellin has been around at the Fed long enough that she is responsible for shenanigans from previous chairs, and if she can’t offer up a policy change, Congress will come after her. She isn’t a manly man who appeals to the Lindsey Graham types. Obama is a lame duck, and the fraudulent feminists (as opposed to real ones) are too busy trying to foist Hillary on the country instead of working for women’s rights, developing female candidates, stopping rape in the military, or pressuring female senators to challenge Hillary. Yellin has no natural allies as a democratic only appointee right now.

I think Yellin wants to head off a “audit the fed” campaign because she will be dragged through the mud and no one will want her around corporate boards or universities if she just sits around allowing herself to be a do nothing figure head.

She lacks the character to chastise Congress an the White House for failing in 2009, but Yellin may just be acting in her interests. Much of Yellin’s audience (The Congress) are barely literate.

Well, since the Guardians of US Official economic macro data have in their wisdom decided to ‘doubly seasonally adjust’ GDP to make the ugly Q1 contraction go away by going back to 2012 and revising everything going forward, it would hardly surprise that the Regional Fed that spilled the beans on Q1’s weakness with its ‘real-time’ reporting model would find a way to regain the good graces of Ms Yellen et al – perhaps the Atlanta Fed just ‘doubly seasonally adjusted’ core CPI for April to accommodate the sudden appearance of 1.8% growth in Q1 (and by extension, at least 2%+ in Q2)?

With this move to hide the fact the US economy has so deteriorated it is now at best a ‘Christmas’ economy (production/’growth’ ramps in fall run-up to holidays, then plunges as consumers pay down gift debt) ‘official’ information is now as worthless as ‘market’ information. Business and investors are going to fly straight into a mountain obscured by an impenetrable layer of BS.

http://www.zerohedge.com/news/2015-05-22/us-department-commerce-officially-jumps-shark-will-double-seasonally-adjust-gdp-data

A previously posted comment has apparently floated away. Here’s another article with the same, extremely important information:

http://www.zerohedge.com/news/2015-05-21/fallacy-unequivocal-faith-feds-babbling-bubble-blowers

http://www.zerohedge.com/news/2015-05-22/us-department-commerce-officially-jumps-shark-will-double-seasonally-adjust-gdp-data

A another poor attempt. Notice their was deflation in the winter that when you average it out, doesn’t look near as impressive. More of a oil based rebound.

The Fed will be a loser once again and

Will drive us into another recession

Please look at this guys forecast and it seems to fit into the next failure for FRS

It is like looking at a slow train wreck

http://www.zerohedge.com/news/2015-05-23/steen-jakobsen-warns-brace-next-recession

Is the Fed’s anxiety to raise rates in any way related to concerns about pension funds? Seven years of ‘famine’ must start to take their toll on pension funds experiencing both lower yields and more retirees. Does anyone know how widespread and how serious a problem pension liabilities have become as a result of Fed interventions? Are pension problems systemically negligible or not?

My pension plan administrators are muttering that growth of 7% are unrealistic and that 5.75% is nearer the mark. Personally, I think even 5.75% is optimistic and 3.5% is more accurate.

I think most of the pension funds’ problems are from the below average yields they get from putting their money in hedge funds. Besides the funds getting below average returns, the managers charge very high fees, so the pension funds are hit from both sides. I know Chris Christie in New Jersey has been moving more of the state pension funds to hedge funds like the one his wife works at, which also make substantial “campaign” donations to him. The new governor of Rhode Island the same, and I think Rick Snyder in Michigan. I don’t recall whether or not Scott Walker, Rick Scott, and Sam Brownback are also doing it, but I’m pretty sure Rahm Emanuel is.

Thanks. Indeed, my pension plan has divested from hedge funds for that exact reason. I wonder to what extent pension funds are in distress and, given the large sums involved, to what extent this may influence the Fed’s actions.

uhhh, i think the Fed wants inflation. They’ve been trying to “make” inflation for almost a decade now. Why would they kill inflation with a rate hike? Inflation is the only thing that can save their economic model.

C’mon, you actually believe these figures, ‘sticky’ or not?

I live in the Sierra foothills in northern California. My family’s true price inflation rate is running between 8 to 9% this year, depending on just when I measure gasoline prices. I bet it’s the somewhat the same ballpark all over the country, adjusting for local conditions like heating costs, rent increases, etc.

Official figures are all lies. Inflation, unemployment, GDP, whatever. Our rotten leaders and opinion molders been lying so long they have come to believe their own lies. Life inside the Washington/Wall Street bubble is quite different from life outside, but naturally they can’t see that, which is why it’s accurately called a bubble. They simply have no idea, they have come to believe their own propaganda, and can’t conceive that rational human beings outside the bubble can see the crap they spew for what it is.