Yves here. Repo is a critically important mechanism by which major dealer banks finance themselves, and repo is therefore often a major topic in bank reform discussions. We thus thought it would be useful to post this overview.

By Daniela Gabor, an associate professor in the Faculty of Business and Law at the University of Western England-Bristol and Cornel Ba, an assistant professor of International Relations and Co-Director of the Global Economic Governance Initiative at Boston University. This is an excerpt from a recent paper that was originally published in the Journal of Common Market Studies

The ‘repurchase agreement’ (often referred to as ‘repo’) has become a key financial device for contemporary capitalism. Though the legal and formal definitions of a repo transaction can make it sound quite complex, it most simply can be thought of as a (usually short-term) secured loan. In a repo transaction one institution (the lender) agrees to buy an asset from another institution (the borrower) and sell the asset back to the borrower at a pre-agreed price on a pre-agreed future date (a day, a week or more). The lender takes a fee (repo interest rate payment) for ‘buying’ the asset in question and can sell the asset in the case that the borrower does not live up to the promise to repurchase it. The fundamental purpose of this circular transaction is to lend and borrow funds (and, in some cases, securities). While financial institutions use it to raise finance, central banks use it in monetary policy.

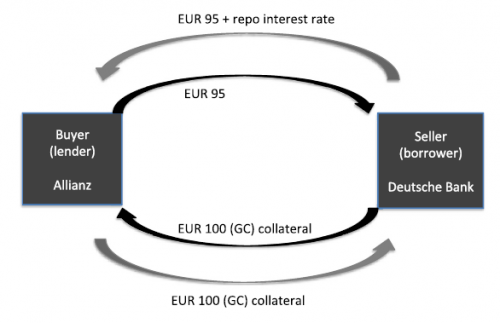

To illustrate, suppose Deutsche Bank (DB), acting as a borrower, sells assets to a buyer (Allianz), acting as a lender, and commits to repurchasing those assets later (see Figure 1). Allianz becomes the temporary owner of the assets, which also serve as collateral, and Deutsche Bank has temporary access to cash funding. DB and Allianz also agree that the purchase price is less than the market value of collateral (€100) – in this case a 5 per cent difference, known as a haircut. This provides a buffer against market fluctuations and incentivizes borrowers to adhere to their promise to buy securities back. In our example, DB provides €100 worth of collateral to ‘insure’ a loan of €95. When the repurchase takes place, DB pays €95 plus a ‘fee’ or interest payment in exchange for the assets it had sold.

Figure 1: How General Collateral Repos Work

For DB, the repo is an SFT (securities financing transaction). DB uses its portfolio of marketable securities to raise short-term market funding without giving up the returns on those assets. Because repos are structured legally as sales/repurchase (of collateral) agreements and in economic terms as cash loans,1 Allianz does not assume the risks and returns on the assets it owns temporarily, but rather has to send all returns on those assets to DB. Financial institutions like to use repos to raise finance because the use of collateral makes them at once less costly and less risky than borrowing from unsecured money markets.

The presence of collateral also enables cash-rich non-bank institutions such as insurance companies, pension funds and non-financial corporations to participate in money markets (Pozsar, 2014). In our example, Allianz can use the repo to increase returns on its cash; further, it can also reuse the collateral (‘repo it out’) if it needs cash before the repurchase with DB is executed.

It should be noted that there are different kinds of repo agreements and the kind we have just described is known as a GC (‘General Collateral’) repo. This is a funding-driven repo. What makes GC repos distinctive is that the parties to the repo transaction agree what kind of securities can be considered equivalent as collateral and accept any or all those securities. In other words, any security that belongs to a certain agreed-upon category will do. We visualize this in Figure 1: assuming the agreed-upon GC basket above includes AA-rated Belgian and AAA German bonds, Allianz would accept €100 of German bonds, or €100 of Belgian bonds, or any combination of the two. A typical repo contract would allow DB to replace some or all of the bonds in the GC portfolio on any day of the repo contract, as long as they are of equivalent value, as determined by the so-called ‘mark-to-market’ technique, which requires that the value of collateral portfolio be constantly updated according to market fluctuations.

Using mark-to-market is meant to protect lenders like Allianz from the failure of counterparties like DB. In effect, through the repo contract Allianz becomes the legal owner of collateral so that it can sell the collateral and recover the cash. For this system to work without disruption, Allianz needs to ensure that the market value of its collateral portfolio remains equal to the cash loan. This typically leads to a preference for high-quality collateral, such as investment-grade government bonds. These trade in liquid markets and generally experience less price volatility, therefore making the repo funding cheaper. Indeed, before the global financial crisis, market haircuts on government collateral were typically zero (see CGFS, 2010). Additionally, repos collateralized with government bonds also enjoy preferential regulatory capital treatment (ECB, 2002a). In the event that the market value of the collateral falls before the day of the repurchase, the legal right to make a margin call protects Allianz. In other words, Allianz requires DB to provide more collateral to make up for the shortfall in value. Conversely, if collateral increases in price, Allianz returns the difference back to DB, allowing it to raise further funding and increase leverage (Adrian and Shin, 2010).

Repo transactions have also altered the policy toolbox of contemporary central banks. Repos have overtaken the traditional outright sale and purchase of assets as monetary policy instruments (see ECB, 2013b). Central banks use repos to meet banks’ demand for reserves and thus influence interest rates on unsecured inter-bank money markets where they implement monetary policy. Of critical importance, the central bank’s collateral framework – the terms on which it lends to banks, including the potential use of haircuts, collateral acceptability and margining practices – is not exogenous to how repo markets work. Indeed, the following sections show that it can have systemic, if poorly understood, effects on how repo markets treat and manage collateral, on liquidity in collateral markets and on banks’ ability to preserve access to (repo) market funding in crisis (Whelan, 2014; CGFS, 2015).

OK, I’ll play the rube: why would you go through all this nonsense, executed by exceptionally well paid functionaries, when you can go to the Discount Window and borrow money for virtually nothing? And where does all this “liquidity” go when the world economy has been contracting in real terms for perhaps 8 years? Certainly not into plant, equipment, R&D, and inventories–the only places where chartered bank-lent money should ever go.

The regulators and legislators everywhere should understand one thing and ignore all the obfuscation and special pleading: with the cost of money at historical lows, the only reason why these deals exist is because they are some kind of scam. Everything else is persiflage.

1) The Fed encourages repo because they don’t want to service the whole system with the discount window. Usually this means they set discount window rates a tad higher than market repo rates. The other reason is there is a stigma attached to banks going to the Fed for money – like they aren’t credit worthy or something. Bankers keep an eye on this and will try and steal clients from competitive banks by ratting on them and implying that the client may be dealing with an insolvent bank. This is why when Hank Paulsen did his bailout he required all big banks to participate whether they wanted to or not – just to avoid the stigma and subsequent client stealing attempts.

2) Liquidity now goes where Glass Steagall said it shouldn’t go – because boom, crash and burn.

3) The Fed decided they wanted to pump up asset values because wealth effect. Also pump up real estate because over paying for housing is good. Scam is such a negative word.

That’s just craaazzzzzzyyyyy….uh, sorry, I mean illogical.

I’m with James Levy on this.

First, the whole rigmarole strikes me as a refutation of the market rationale of an “efficient” system.

I would like to see an example with numbers. How in the world, at interest rates as low as they are, can it be economically viable to pay…(how MANY) functionaries (I assume high paid) for a ONE DAY LOAN???

“…1 Allianz does not assume the risks and returns on the assets it owns temporarily, but rather has to send all returns on those assets to DB.”

So, I would assume accountants and auditors on both sides to make sure that these 1 day or more assets returns are working and being paid to make sure that the returns while owned by the other party are properly accounted for? This makes sense financially???

Also, are these assets “insured”? I mean, they are supposed to be “high quality” …hmmmm, where have I heard that before??? Well, I shouldn’t worry about default, cause our top men, aka, best and the brightest, know exactly what they are doing. I mean, its just preposterous to believe there could be some mass, spontaneous default of bonds that are rated triple AAA….I mean, when has that ever happened with bonds???????

Also, these are…banks. I would assume they have a bunch of assets and liabilities. I would assume that they have some idea of their cash flows. They really conduct their financial affairs such that they have to get a loan on a day to day basis? Even the United States government, that knows that it has to raise the debt ceiling periodically but always waits till the last possible minute to do that, and is composed of seriously demented people, does not to it on a day to day basis.

I think it (repo) has a lot more to do with path dependency

https://en.wikipedia.org/wiki/Path_dependence

Back when I used to believe the market was efficient and rationale, I would have thought that bond buyers of mortgage backed securities were sophisticated enough, especially when dealing with large amounts of money, to understand flaws in the bond rating process (used care lots, whoops, I mean bond SELLERS pay someone to say that the used car salesman….whoops, I mean bond salesman, is telling the TRUTH)

Well, they weren’t. OK, itsy, bitsy flaw in the system.

BUT YOU KNOW WHAT??!!!??? They are still using the SAME system.

Its like they rebuilt the Titanic, and say they are gonna get the same type of captain (cause I think the first captain went down with the ship), and sail with the same care, at the same speed, on the same course, with the same paucity of lifeboats, that they sailed with the first time. And I believe, people being people, that people would buy tickets (and I would bet money, at a premium)!!!!

So its being done, for some reason, but that doesn’t mean the reason is rationale…

Seriously, what strikes me here is that the financial system wants to take all volatility out of the system. The problem with that is that the system, or market, is composed of emotional, irrational humans – it is volatile because it is composed of volatile humans.

They keep saying the boat is unsinkable (hey, perfect collateral!)

These are ALL electronic assets.

So most of the functionary duty is performed by CPUs at blazing speed.

&&&

You might want to read up on the Real Bills Market of London — which is where this scheme gained world scale standing.

That market died with the Guns of August, 1914. It has never come back — except as today’s Repo Market.

A Real Bill was settled in gold, gold specie, or good as gold British Pounds Sterling.

A Real Bill was initiated by invoice, consequent to a major trade — typically a commodity. ( The relevant invoices had to become due and payable in 90 days or less. (Nintey-day paper) This magic term became embedded in the US Treasury bills market, too. ( Eventually T-bills were extended out to a year. )

The only makers of such invoices acceptable in the ‘Bills Market’ [ aka Trade Bills ] would be the biggest players: Conagra, Ford Motor, Boeing, et. al. And the paying party would likewise be restricted. ( The bill// invoice would usually be insured by a major trading bank — for payment. The importer would have had to placed full payment into an escrow account — or have a credit arrangment with the trading bank. This activity was a steady income stream for bankers. )

So, you can see where the repo market actually got started: the 19th Century (Trade) Bills Market. Government paper simply replaced banker’s pledges. ( for payment inre the commodities.)

A repo is identical in every way — except that only digital financial assets are deemed suitable.

Thank you for that excellent reply. But unless I misremember, the Fed rate was zero–how can the Repo market rate be lower than zero?

Repo’s date way back. Even back before 2008.

Banks don’t want to go to the Fed Window unless they have to. If a bank goes to the Fed Window too often the regulators start asking questions.

in fact in the 2008 time frame the Fed promised anyone that came they wouldn’t be concerned about it and had a couple of big banks that didn’t need funding show up at the window for a time as a favor to show all the other banks it was okay.

It is no longer okay.

James Levy

October 30, 2015 at 10:53 am

I agree about the rate being lower than zero. Kinda of reminds me of the saying that if your in a poker game, and you don’t know who the mark is, its you.

http://www.mauldineconomics.com/editorial/outside-the-box-the-financialization-of-the-economy

The whole of economic life is a mixture of creative and distributive activities. Some of what we ‘‘earn’’ derives from what is created out of nothing and adds to the total available for all to enjoy. But some of it merely takes what would otherwise be available to others and therefore comes at their expense.

Successful societies maximise the creative and minimise the distributive. Societies where everyone can achieve gains only at the expense of others are by definition impoverished. They are also usually intensely violent….

Much of what goes on in financial markets belongs at the distributive end. The gains to one party reflect the losses to another, and the fees and charges racked up are paid by Joe Public, since even if he is not directly involved in the deals, he is indirectly through costs and charges for goods and services.

The genius of the great speculative investors is to see what others do not, or to see it earlier. This is a skill. But so is the ability to stand on tip toe, balancing on one leg, while holding a pot of tea above your head, without spillage. But I am not convinced of the social worth of such a skill.

…..

Boeing’s launch of the 787 was marred by massive cost overruns and battery fires. Any product can have technical problems, but the striking thing about the 787’s is that they stemmed from exactly the sort of decisions that Wall Street tells executives to make.

Before its 1997 merger with McDonnell Douglas, Boeing had an engineering-driven culture and a history of betting the company on daring investments in new aircraft. McDonnell Douglas, on the other hand, was risk-averse and focused on cost cutting and financial performance, and its culture came to dominate the merged company. So, over the objections of career-long Boeing engineers, the 787 was developed with an unprecedented level of outsourcing, in part, the engineers believed, to maximize Boeing’s return on net assets (RONA). Outsourcing removed assets from Boeing’s balance sheet but also made the 787’s supply chain so complex that the company couldn’t maintain the high quality an airliner requires. Just as the engineers had predicted, the result was huge delays and runaway costs. … Boeing’s decision to minimize its assets was made with Wall Street in mind. RONA is used by financial analysts to judge managers and companies, and the fixation on this kind of metric has influenced the choices of many firms. In fact, research by the economists John Asker, Joan Farre-Mensa, and Alexander Ljungqvist shows that a desire to maximize short-term share price leads publicly held companies to invest only about half as much in assets as their privately held counterparts do.” …

That’s from an article in the June, 2014, Harvard Business Review by Gautam Mukunda, “The Price of Wall Street’s Power” also cited in the Forbes article. This is the link; it is worth the read though you may not agree with parts of the conclusion: https://hbr.org/2014/06/the-price-of-wall-streets-power

The upshot to this type of behavior is that the balance of power … and ideas … then migrates into domination by one group.

Smaller glimpse: Over-financialization is what happens when a company generates cash then pays it to shareholders and senior management which m.o. also includes share buybacks and vicious cost cutting. This is one way, as you can see, in which the real economy is excluded from the party!

You are alluding to “agency costs” — as the insiders are working to an entirely different motivation than those stumping up the risk capital.

We are seeing the SAME agency cost nightmare with Congress — and the Presidency.

What’s good for the President or for a Congressmen — may be very costly for the polity.

In the President’s case, luxurious vacations are great for himself — while everybody else has to pay for them.

In the case of Congress, favors to NBC, CNBC, and MSNBC may be sweet indeed. Yet the collusion of media propagandists and politicians is a crime against the polity.

The “Fed Rate” and “Discount Window rate” are actually two different rates set by the Fed. The Fed sets the discount rate higher so that the banks have incentive to use repo between themselves.

As Crazyboy has pointed out, the Federal Funds Rate and the Discount Rate are two separate rates, Additionally, the overnight Federal Funds Rate is unsecured borrowing. REPOs by definition are secured borrowing. They have their place in asset and liquidity management.

Right. We also had a post at NC recently where, IIRC, the author said the Fed Funds market collapsed post GFC. In other words, the banks won’t lend to each without collateral anymore.

Good post, helpful. Thanks

Nice discussion. The repo you outline sounds a lot like a margin loan. It would be interesting to consider the tri-party repo where you include JP Morgan as an intermediary between Deutsche Bank and Allianz where JP Morgan has the right to keep both the cash and collateral if they start to smell a rat or start to see the deal go south. Which it eventually will in this game of musical chairs.

In this regard, it is concerning to see the central banks enter this arena. As you say:

‘they can have systemic, if poorly understood, effects on how repo markets treat and manage collateral, on liquidity in collateral markets and on banks’ ability to preserve access to (repo) market funding in crisis’

It seems to me that this could be a venue to provide massive amounts of liquidity to lots of poor, derivative oriented collateral.

So when Ben said, No we don’t print money, it just floats out there in Fedland and the banks can use those “reserves” whenever they need funds for a loan… So what sense does it make for a bank to scrape together all its T-bills as collateral to get cash from the Fed if they just turn around asap and redeem their collateral? Very pawn shop. I’m assuming a speedy turnover is important so the banksters can sell things in a secondary securitized market to pension funds, etc. and get out with fees earned and repos settled. Its a churn engine.

Thanks so much for posting this.

I’ve been running head-first against the wall of understanding repo ever since becoming a creepy fan of Mark Blyth, but, even at the best of times, I always feel like Bertie Wooster’s friends when Jeeves explains a scheme to them: “I think I had it there for a second, but then it sort of flickered.”

If a banks makes a secured loan against collateral, and the borrower files for bankruptcy protection in the United States, the secured lender loses its right to execute its security interest on the collateral–because of the “automatic stay”; the bank has to wait and lmay have to liitigate with a trustee in bankruptcy. If the bank buys the security in a repo transaction, it is in a much better position under United States bankruptcy law than if it had just made a secured loan.

But these loans are incredibly short-term. You mean to say all this effort and energy and expense (in terms of the men and women who operate these markets) is expended because JP Morgan thinks Allianz or DB or Citibank are all about to go bankrupt so we better take out loans from them with bankruptcy laws in mind?

I like first order questions:

Why do the banks need to borrow so much and so often from each other? The global economy is not growing.

Why don’t they just live within their means, i.e. lend money based on their deposits and other assets, and leave it at that? This whole repo thing seems to be a scam designed to hide/get around how badly their liabilities are out of whack with their assets and reserve requirements.

Why should we give a shit what the banks want (unlimited ability to lend with nothing backing the loans)? I would like a credit card that had a zillion dollar limit that I never had to pay back. So what. It would be idiotic to give it to me, just as it is idiotic to give anyone a blank cheque and say “go to it.”

It can be very important who has control of the assets at any given time.

(musical chairs). This is what bothers me when money markets lend money to brokerages mediated by JP Morgan.

http://www.theautomaticearth.com/2013/10/still-feel-confident-about-collecting-your-pension-after-this/

“Thanks to changes to bankruptcy law in 2005, holders of financial derivatives are not subject to the ‘automatic stay’ provision intended to prevent a disorderly grab for collateral by competing creditors. As such, they are able to press their claim immediately, prior to bankruptcy proceedings and therefore before claims by competing creditors are considered. “”

The Fed’s various lending facilities are only available to banks and bank holding companies. The Fed cannot transact with the entire capital market, although the Fed has been extending its reach through use of its new Reverse Repo Facility (RRP).

Many types of financial intermediaries dont have direct access to Fed facilities, so the Fed’s rates dont matter to them directly. That’s why they continue to use the repo market for funding instead of going directly to the window (in addition the reasons described by craazyboy above).

Thanks – this term had remained opaque to me till now.

OTOH: Now I’m with the first few commenters: for heaven’s sake, WHY?

Section 559 of the Bankruptcy Code, that’s why

My understanding of repo remains rudimentary, and like so many others, I don’t understand what could ethically or legally justify this practice. Of course I understand at least one very important reason why banks use repos: they want to rearrange their assets and liabilities prior to publishing their quarterly and annual reports. Lehman Brothers did this, and there was no risk of criminal penalties. Sure, they went out of business, and there were civil lawsuits, but up until their bankruptcy, the senior employees got their lucrative bonuses. Isn’t that what really matters?

At top level, the reason for repo is on any particular day, some banks will have excess reserves at the Fed and some banks will need to borrow to get their reserves up to the Fed mandated level. The Fed doesn’t want to be involved with routine daily “book squaring”, (only be lender of last resort) so they want banks to do it between themselves. Then there are two options – Unsecured Fed Funds lending which is really between banks – not the Fed. The Fed’s only involvement is setting the Fed Fund Rate. The other option is collateralized Repo.

So there is nothing really wrong with repo. If we had boring “utility” banking, they would still do repo. Although banks would be more likely ok with doing more unsecured Fed funds lending because the environment would be saner. The problem is how banks operate today and what they are using the money for.

Thanks for your lucid explanation. However, only 3 days later, on Nov. 2, there’s an article in Naked Capitalism called ‘Foreign Banks Such as Deutsche Using Variant of Lehman “Repo 105” Balance-Sheet Tarting Up Strategy’.

Something needs to change. Either fix the repo system so that Repo 105 schemes are impossible or a lot more difficult to carry out, or prohibit repos entirely. Perhaps there needs to be a heavy tax on repos, so that there’s a penalty for failure to manage a bank’s reserves properly. That might also inhibit the use of repos to mask the levels of a bank’s liabilities. A high tax will reduce profits, which in turn will reduce the all important executive bonuses.

Repo has other functions/effects. One, it sets short-term prices for financial assets, based on the mix of collateral offered. Some institutions that participate in repo don’t have access to the discount window (or window of the liquidity form/currency needed). It is private global financing; the process does not require national central banks. Institutions are basically trading their short term liquidity requirements, so an information market on institutional liquidity is generated as a result.