Last week’s Radio 4 piece on the abuse of Scottish Partnerships for large scale money laundering motivates a quick squint at a tiny corner of the UK’s huge and crackpot anti-money-laundering regime. Let’s first bring out some, ahem, striking contrasts between the various ways countries police their Anti-Money Laundering (AML) and Countering Financing of Terrorism (CFT).

Over in Australia, one agency, Austrac, overseas the whole field; their web site is a single source for compliance and due diligence requirements, and a single destination for enrolment guidance and for the filing of suspicious activity reports. That’s a pretty good starting structure, maximising intelligibility and minimising confusion about responsibilities. Obviously one could nitpick the details of the implementation, and one imagines the details will change as necessary over time, as vulnerabilities emerge and are exploited. Overall, though, the single-agency structure makes it seem relatively less likely that anything is going to fall through the cracks and cause some kind of AML/CFT compliance cataclysm; or at least, if there is a cataclysm, there’s a single point of contact for the emergency fixes.

It’s not like that in the UK:

The Treasury has 28 appointed AML/CTF supervisors which oversee eight broad sectors and a diverse range of firms which include financial institutions, credit institutions, law firms, accountancy firms, estate agents and casinos. For accountancy alone there are up to 13 bodies with regulatory responsibility for money laundering regulations.

That is from Transparency International UK’s 2014 response to the UK Treasury on their National Risk Assessment of Money Laundering and Terrorist Financing. Deadpan, Transparency International point out the blindingly obvious consequences:

Such a disparate regulatory structure is likely to lead to inconsistency in monitoring, detection, enforcement, sanctions, training and development and priority messaging.

TI follow up with more observations about how it is all working in practice:

HM Treasury requires that each money laundering supervisor has a good understanding of what it means to have a risk-based approach. However in the 2013 Anti-money laundering and counter terrorist finance (ML/TF) supervision report by HM Treasury, Supervisors were asked to report if the ML/TF risks varied across the firms they supervise. 52% of supervisors reported that the ML/TF risks do not vary across the firms they supervise.

There’s another deadpan punchline:

It is difficult to imagine the risk criteria those supervisors may be using to conclude that all firms face an equal risk, regardless of size, location, commercial focus, historical ML performance, and different performance (presumably) on compliance inspections.

Next, TI detects the expected inconsistencies in the enforcement of AML regulations:

In 2013, Supervisors were asked by HM Treasury to provide more information regarding their enforcement activity, including how they measure that this action is proportionate, effective, dissuasive, and adequately applied. The survey results demonstrated differing approaches by regulators to sanctions. Of the 522 reported enforcement actions taken by accountancy sector supervisors, 44% were action plans or warning letters and 3% were fines. Of the 1381 reported enforcement actions taken by public sector supervisors: 29% were action plans or warning letters and 11% were fines.

It gets better:

The banking conduct regulator has withdrawn its estimate of the scale of money laundering in the UK. There is therefore no current regulatory estimate of the threat faced by the banking sector.

Cue another deadpan punchline, really leaking sarcasm his time:

It is difficult to see how a risk-based approach to AML and a government focus on AML effectiveness can be sustained without an estimate of the threat.

Not only does nobody know how much money laundering is going on, hardly anybody’s trying to find out what the risks are and how well the regulations are working:

Out of the 28 regulators with responsibility for supervising UK Money Laundering Regulations 2007, only the FSA (FCA) has conducted a detailed thematic survey of AML and PEP risks and published it to the public. While the report indicated widespread failings, the remaining sectors have not examined and understood the money laundering risks to the same extent, and it is a strong likelihood that their sectors’ performance would be even worse.

There’s an aside on “gatekeepers”:

The sectors are seen as gatekeepers to the financial system, and their role is evident in most, if not all corruption cases. The Financial Action Task Force (FATF), an AML standard-setter, describes gatekeepers as individuals that “protect the gates” to the financial system through which potential users of the system, including launderers, must pass in order to be successful”. Gatekeepers include lawyers, estate agents, accountants, financial advisors, and trust and company service providers.

…and yet another deadpan statement of the blindingly obvious:

…serious and organised crime groups will often target the weakest link when seeking to launder funds.

TI is particularly sceptical about the controls on one critical class of gatekeepers, the trust and company service providers (TCSPs) who register companies and other entities that may be abused in money laundering:

TCSPs are subject to AML requirements and Her Majesty’s Revenue and Customs (HMRC) is responsible for their registration on the basis of a ‘fit and proper test’. However, this demands no more of an applicant than compliance with a list of negative criteria involving the non-conviction of the applicant of a number of offences. There is no requirement of qualification, experience or competence.

To the relief of readers, no doubt, this blog has neither the desire not the capacity to investigate and document the efficacy of all 28 UK AML regulatory bodies and the various gatekeepers. But thanks to our research into the billion dollar Moldova bank fraud, we do have a more detailed idea of how it’s going with the UK’s TCSP system, so we’ll zoom in on that. One last word from TI sets the scene:

It therefore remains to be seen whether the system will be effective in catching those TCSPs who are complicit in facilitating money laundering.

Our own research suggests that it isn’t the least bit effective.

For one thing, there is a group of registered UK TCSPs with a continuing record of engaging in incorporation activities of a type whose money laundering potential is not only blindingly obvious in advance, but heavily confirmed in hindsight. No public sanctions have been applied to any of them, either because no effective sanctions actually exist against TCSPs with a track record of risky incorporations, or simply because officialdom isn’t paying the least bit of attention to what’s going on. After all, it’s a free-for-all: the most a TCSP has to do is register, and, as we see from the undemanding fitness and properness test, almost any fool can do that (and has done, I’d add).

To go with the feeble fitness and properness test, there are other spectacular deficiencies in TCSP oversight. Let’s zoom in even more.

The lucky old HMRC, who must have been standing in the wrong place at the wrong time, have landed the task of supervising any company formation activities that fall through the numerous scattered cracks between all the other AML supervisors in the UK. HMRC have the following guidance on who should register (my highlights):

You’ll have to register with HMRC if your business is a Trust or Company Service. The types of business covered by the Trust or Company Service Provider rules include:

-

company formation agents

-

providers of registered offices, business addresses, accommodation or correspondence addresses, or mail forwarding services to businesses (other than those run by sole proprietors)

-

any individual or firm providing nominee director services, nominee company secretary services or nominee shareholder services – or other similar services

-

any individual or firm arranging for another person to act as a director, company secretary, partner or professional trustee (‘arranging’ has the narrow meaning given in the section explaining what a Trust or Company Service Provider is)

-

any individual or firm offering professional trustee services (unless they relate to certain low-risk trusts)

-

any individual or firm providing their services as nominee shareholder (unless they are acting for a company whose securities are listed on a regulated market)

-

any firm providing their services as a company director, company secretary, or partner to another firm (unless the other firm is a member of the same group)

-

any individual providing their services as nominee director or nominee company secretary

-

any individual providing their services as a company director, company secretary or partner to certain high-risk firms

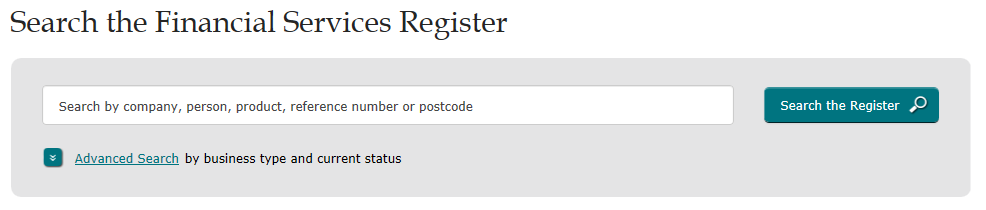

For perspective, other official registers already deal with a similar range of possible queries. For instance, here’s how the FCA deals online with the varieties of queries about their registered firms and persons:

Clear thought and neat design soon emerge from behind that screen (definite person example, help-you-refine-an-ambiguous-firm-name example). When it comes to registration-tracing, the FCA wants to get it right.

Unfortunately it’s clear from HMRC’s registration enquiry system that, when it comes to TCSPs, not even the HMRC takes any of its own registration requirements seriously. Consider the attributes associated, out there in the real world, with the words highlighted in HMRC’s registration requirements:

- A business has a business name and address, which has a post code.

- A firm has a name, a registered office address, potentially-different places of business and trading names, and an official public identifier (for instance a company or partnership registration number).

- An individual has a personal name (a first name, optional middle names and a surname) and an address (which has a post code), and may operate as a sole trader, or move from firm to firm.

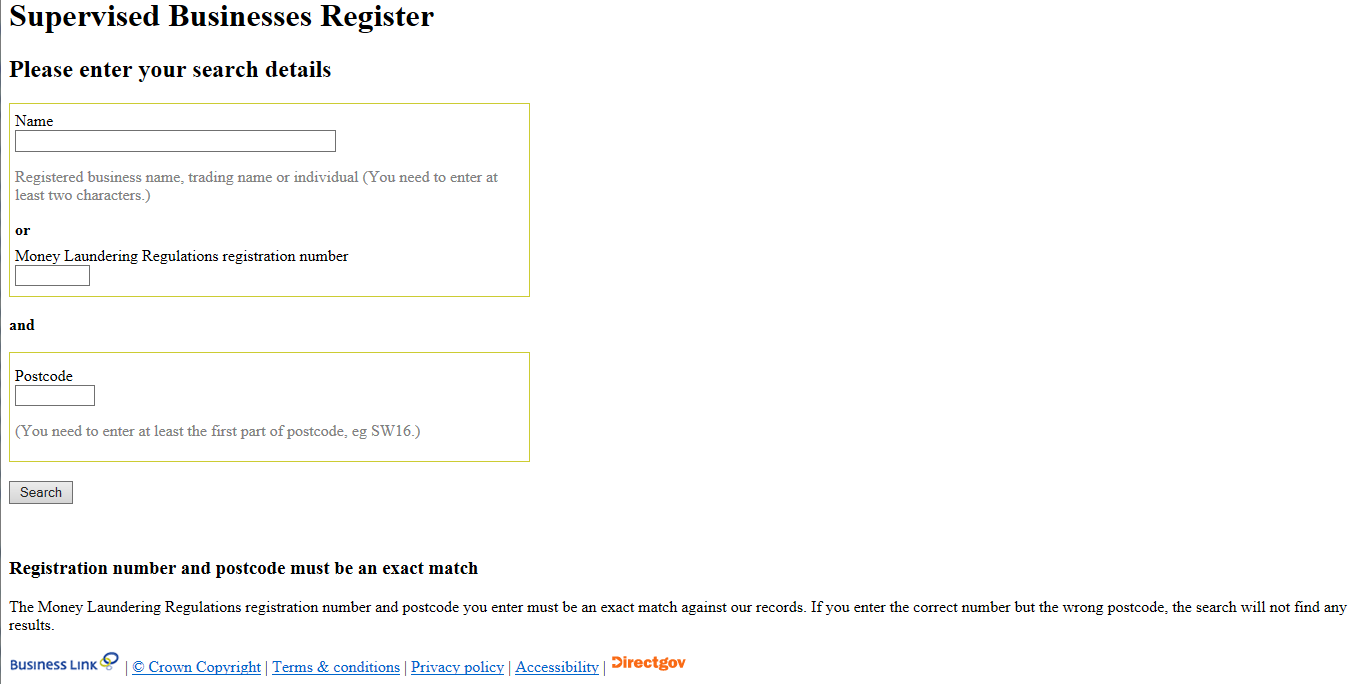

So you’d expect the HMRC’s online TCSP enquiry to be pretty similar to what the FCA provides. Oddly, though, HMRC’s TCSP Enquiry World has nothing to do with either HMRC’s own registration requirements, listed above, or with the real world. This is what they serve up instead (click the pic for a big sharp version):

In TCSP Enquiry World:

- A business has a business name or a trading name, no address, and a post code.

- There’s no such thing as a firm.

- An individual has a name of some unspecified kind and a post code; the individual’s connection to the nonexistent firm, or to the business, if it exists, is impossible either to specify or to retrieve.

In other words, the TCSP enquiry form simply doesn’t correspond to the real world, and can’t satisfy HMRC’s own requirements. It’s almost useless.

The small print at the bottom of the enquiry form doesn’t inspire confidence either:

The Money Laundering Regulations registration number and postcode you enter must be an exact match against our records. If you enter the correct number but the wrong postcode, the search will not find any results.

Huh? Is the MLR registration number not unique? If not, why not? If it is unique, why require the user to divine the post code and input that too?

This blogger gets the distinct feeling that no-one at HMRC ever paid much attention to the inept design of this form. If anyone had ever tried to use it more than a couple of times, they would have blown a fuse and got the dreadful thing sorted out long ago.

In another rebuff for traceability and accountability, Companies House’s don’t even insist that agents always record their AML registrations details when registering companies or making filings. However idiotic it may appear not to record the submitter’s details, rigorously and unambiguously, when a company is registered or maintained, gate-keeping the gate-keepers isn’t part of Companies House’s time-hallowed remit; so it doesn’t happen.

Combine that with the deficiencies of the HMRC enquiry, and with the fact that companies may also be formed by lawyers, accountants, tax advisors and doubtless others of the vast crew supervised in the UK’s fragmented and sometime non-public registers, and you get a turbid mess. Tracing the agent, manually, should be a matter of looking up one number on a single screen. Instead, hours of error-prone guesswork and stabs in the dark ensue. Our painfully-constructed list of the connections between companies abused in the Moldova bank fraud and UK-registered TCSPs is still, therefore, slightly tentative:

| Entity | Type | Agent | Type | HMRC M/L ID |

| Trimms Green Limited | LTD | R M Company Services Limited | UK | 12284783 (00000) |

| Danley Impex LP | Scottish LP | Small Firms Services | UK | 12311507 (00000) |

| Drensler LLP | English LLP | Quick Access Formations Limited | UK | 12414136 (00000) |

| Fortuna United LP | Scottish LP | Royston Business Consultancy Limited | UK | 12751197 (00000) |

| Novland Ltd | LTD | Royston Business Consultancy Limited | UK | 12751197 (00000) |

| Avenilla Commercial LP | Scottish LP | Administrative Providers Limited | UK | 12580464 (00000) |

| Lerson Ltd | LTD | Arran Business Services Ltd | UK | 12803149 (00000) |

| Pondmarsh LLP | English LLP | Companies Plus | UK | Not HMRC |

| Ayden Management Ltd | LTD | Lawsons & Co | UK | Not HMRC |

| Carmondean Development Ltd | LTD | Lawsons & Co | UK | Not HMRC |

| Dixon Corporation Ltd | LTD | Lawsons & Co | UK | Not HMRC |

| Harrogate Consulting LP | Scottish LP | Lawsons & Co | UK | Not HMRC |

| Harwood United LLP | Scottish LLP | Lawsons & Co | UK | Not HMRC |

| Manitoba Management Ltd | LTD | Lawsons & Co | UK | Not HMRC |

| Owen Trading Ltd | LTD | Lawsons & Co | UK | Not HMRC |

| Rosslyn Trade LP | SLP | Lawsons & Co | UK | Not HMRC |

This bunch deserve, and will probably get, a post to themselves, in due course.

Since the Kroll report named 48 companies, and the table contains just 16, there’s obviously rather a lot of “dark matter” still to track down: all the agents that defied this blogger’s effort to track down a UK AML registration.

Given how dreadful the checking process is, one naturally suspects that nobody, apart from one crazed blogger, is spending any time checking whether TCSPs are registered. We can start to back up that suspicion by providing another list: verifiably high-volume UK company agents (creators of thousands of vehicles), that created companies involved in the Moldovan bank fraud, but appear not to be registered at all:

| Entity | Type | Agent | Type | HMRC M/L ID |

| Fairmac LLP | English LLP | IBFS United | UK | Unidentifiable |

| La Costa Trade LLP | English LLP | IBFS United | UK | Unidentifiable |

| Hansa Investment LP | Scottish LP | “S. G. Cox” | UK | Unidentifiable |

| United Technologies LP | Scottish LP | “S. G. Cox” | UK | Unidentifiable |

| Westland Alliance LP | Scottish LP | “S. G. Cox” | UK | Unidentifiable |

| Zenit Management LP | Scottish LP | “S. G. Cox” | UK | Unidentifiable |

A necessary caveat: in theory, they might be registered with any of the dozens of other AML supervisors. Either way, this group of agents should get a post to itself too, and we still have 26 companies and agents unaccounted for.

Next, consider another indication of the nonchalance with which the UK approaches TCSP supervision: the case of offshore company agents, who, by way of egregious AML-supervisory loophole, don’t have to be registered at all. As TI would deadpan, this is “most surprising”, but it does seem to be the case.

It isn’t spelled out by HMRC guidance. Another of the shoal of UK AML supervisors, the Chartered Institute of Taxation, does spell it out though, in their AML FAQ (PDF):

I do not work in the UK, do I still need to register with the CIOT/ATT for AML supervision?

No you do not as the MLR apply only to businesses operating in the UK.

I suppose that if you wanted to tear open the biggest possible loophole in your AML supervision, opening up your company register to any offshore rogue whatsoever would be one great way to do it.

In fact even if you are actually onshore, all you have to do is pretend to be slightly offshore: why would anyone bother to check? Variants of that kind of offshore/onshore rules arb are pervasive. As soon as someone (the BBC) did check a specific case, they found that Royston Business Consultancy, a properly registered onshore TCSP directed by Remigijus Mikalauskas and Viktorija Zirnelyte , was registering, entirely legally, hundreds of entities controlled by two companies in the secretive Seychelles, where company control and ownership is not routinely disclosed. That should have been a brick wall, but the BBC got a break. Ms Zirnelyte, whether caught off-guard, or judging that owning up was prudent, admitted that the two Seychelles companies were directed by none other than Royston Business Consultancy’s Remigijus Mikalauskas and Viktorija Zirnelyte, as nominees of undisclosed parties. You can read the story of that disclosure-dodging pantomime at the BBC, and admire Viktorija ZIrnelyte’s amazing signature.

Anyhow, the other agents who built the known Moldova Scam companies all stampede through the gaping “offshore agent” breach. Here are the remaining companies and their shadowy agents:

| Entity | Type | Agent | Type | M/L ID |

| Jet-Tech Industries Ltd | LTD | Corporate Management and Secretaries Limited (GT Group) | Offshore | None required |

| Intratex Sales LP | Scottish LP | Trinity Services, Panama | Offshore | None required |

| Metalforum LP | Scottish LP | Trinity Services, Panama | Offshore | None required |

| Swedtron Alliance LP | Scottish LP | Trinity Services, Panama | Offshore | None required |

| Trademarket Networks LP | Scottish LP | Trinity Services, Panama | Offshore | None required |

| Expovision Logistics LP | Scottish LP | Unidentified 1 | Offshore | None required |

| Tennant Shipping LP | Scottish LP | Unidentified 1 | Offshore | None required |

| Manos Alliance LLP | Eng. LLP | Unidentified 2 | Offshore | None required |

| Reynosa Management Ltd | LTD | Unidentified 2 | Offshore | None required |

| Roseau Alliance LLP | Eng. LLP | Unidentified 2 | Offshore | None required |

| Spectra Ventures LLP | NI LLP | Unidentified 2 | Offshore | None required |

| Sunrise Cotton LP | Scottish LP | Unidentified 2 | Offshore | None required |

| Vercell Solutions LLP | NI LLP | Unidentified 2 | Offshore | None required |

| Winefarm Alliance LP | Scottish LP | Unidentified 2 | Offshore | None required |

| Pace Global Energy Limited | LTD | Unidentified 3 | Offshore | None required |

| Tintel Project Ltd | LTD | Unidentified 3 | Offshore | None required |

| Wall Trend Ltd | LTD | Unidentified 3 | Offshore | None required |

| Ardooks LLP | Eng. LLP | Unidentified 4 | Offshore | None required |

| Dastinger LLP | Eng. LLP | Unidentified 4 | Offshore | None required |

| Formisold LLP | Eng. LLP | Unidentified 4 | Offshore | None required |

| Genyral Trade LP | Scottish LP | Unidentified 4 | Offshore | None required |

| Hostas Level LLP | Eng. LLP | Unidentified 4 | Offshore | None required |

| Investos Buenos LP | Scottish LP | Unidentified 4 | Offshore | None required |

| Jasterport LP | NI LP | Unidentified 4 | Offshore | None required |

| Welentas LP | Scottish LP | Unidentified 4 | Offshore | None required |

There will have to be another post on that lot, I suppose. So we now have three deep dives lined up for future posts.

To conclude, I have two further observations about ‘offshore’ that imply, once more, that the current TCSP registration regime is a vast exercise in point-missing that, unimproved, will simply continue to have as much impact as an excessively complicated fart in a very fast-growing thunderstorm. Remember that besides the Moldova 48, there are at least 20,000 UK entities exploiting these loopholes, and the total continues to rise.

The first observation is that the three groups of companies I’ve identified actually have a lot in common:

- Every single Limited Company is directed either by professional “nominee” directors appointed by the very agents who created the companies, or by offshore directors.

- Every single Limited Partnership and every single Limited Liability Partnership has only corporate members, and each of those corporate members is registered in a jurisdiction that discloses the identity of the directors and beneficiaries only with the utmost reluctance, if at all (“secrecy jurisdictions”).

- Each of the agents that I have identified has registered hundreds or thousand of other UK entities in a similar style

You might think that HMRC would have identified mass production of entities that have offshore corporate members in secrecy jurisdictions, or nominee directors, or offshore nominee directors, as risk points well worth watching out for and relatively easy to spot (hell, I’ve managed it). And indeed, they do (page 10), for those are “complex business ownership structures with the potential to conceal underlying beneficiaries”. Yet the company agents who “miss” this risk, hundreds and thousands of times, don’t seem to be accountable for their “obliviousness” in any way.

Lastly, there’s this. In its guidance document, HMRC directs the risk-managing company agent to FATF, in order to identify countries with lax money-laundering controls. There, one finds the following list of “high risk and non-cooperative jurisdictions”: Algeria, Angola, Bosnia and Herzegovina, Ecuador, Guyana, Iraq, Laos, Myanmar, North Korea, Panama, Papua New Guinea, Sudan, Thailand and Uganda.

Most of these high risk and non-cooperative places don’t have anything to do with UK company registration or the Moldova bank scam, but one of them does: Panama. R M Company Services of Hitchin, who supplied one of the companies, is none other than the UK arm of notoriously louche Panamanian company agent Mossack Fonseca, provider of shell companies to associates of the tyrants Assad and Mugabe, to allegedly corrupt Argentinian oligarch Lázaro Báez, to Siemens AG as a channel for bribes, to bent Ukrainian ex-president Yulia Tymoshenko, to allegedly bent Israeli billionaire Beny Steinmetz, and to Stuart Gulliver, CEO of the Sinaloa drug cartel’s money-launderer in chief, HSBC.

Still, I doubt that the well-connected RM Company Services will face any retribution in the UK, despite the new indication that it’s one of the go-to TCSPs for Moldovan crooks looking to mount a one-billion-dollar bank fraud.

Anyway, even if there were sanctions against RM, Mossack Fonseca could simply pile in from offshore via the aforementioned offshore agent loophole. A couple of sightings make the point:

a) four of our Moldova scam companies were registered by Trinity Services, who are offshore: lately, in Panama

b) the signatory of many of the documents submitted by “Unidentified 4” in the list of offshore agents is one Gloriela Agragel, who turns out to be holding down not only a dozen or so live UK directorships, but an athletic further 1,327 board posts in Panama. One might reasonably suspect that Gloriela has something to do with Panama, and just might be a professional nominee. She and very, very closely related anonymous chums have chipped in another 8 companies that contributed to the Moldova mess.

In other words, the offshore loophole in the UK’s TCSP regime is so permissive that, as best we can tell, at least 13, just over 1 in 4, of the known Moldovan bank scam shell companies were created by agents from one of the worst jurisdictions in the world.

Perhaps HMRC would like to think a bit harder about offshore company agents as a risk factor. Without reforms in that area, the UK’s never going to be significantly better at this AML lark than Panamanian lawyers, and they’re the pits.

Updates: Post revised 26/10/2015 to include the AML registration number of Administrative Providers Limited, 25/4/2016: plus some rather belated proofing for clarity.

Thank you for digging into this. Is a condensed version going to appear In The Back of Private Eye? It needs as much exposure as possible.

Confirming Shaxson’s conclusion (Treasure Islands) that the epicenter of worldwide money-laundering is London.

I am curious, is laundered money thus subject to taxes? Or is it loop-de-loopholed?

Ironically, having dirty money pass through a phony legitimate business and in the process being liable for taxation is an oft-used method of cleansing it. That tax take serves a purpose of adding extra legitimisation. In essence, it gives the impression of “well, they declared taxable income on this transaction, so it must be clean”.

Thus there is a perverse incentive to not look too closely into money laundering operations which generate significant tax revenue. The U.K. property market being a very good example of this. I suspect too similar for high-end U.S. real estate.

UK is (and has been for some time) the most corrupt place in the world. Everyone, including Brits, would benefit from the UK establishment being utterly crushed.

I’m not entirely sure about being the most corrupt, but it certainly, like a rotten mackerel by moonlight, shines and stinks at the same time. The main problem is, not unlike Japan, the corruption isn’t the in-yer-face blatant money-for-favours kind of corruption (though of course it does go on). Rather, the corruption is of the sort that Richard brings to us in his articles — dishonesty, theft and fraud where the payoffs for those who enable it are well concealed and sometimes the payoffs are in the form of soft power and influence peddling rather than cash.

Corbyn is of course trying to offer an alternative. Hence the ire being heaped on him in the media (and mainstream media capture and what they get in return for being captured is a good demonstration of the sort of corruption we have here). Whether he’ll succeed, time will tell. I can’t say I’m massively optimistic. But even if he fails, what he will without fail achieve is that the establishment is forced to show its hand in the counteroffensive it will be required to launch.

The establishment is like the Bene Gesserit https://en.m.wikipedia.org/wiki/Bene_Gesserit in that it knows that to operate overtly is to give an entry point for its own destruction (“that which rises must also fall”). So having to fight a rearguard action against Corbyn will inevitably weaken it if only through giving everyone else better visibility of how it operates. Not that the establishment is a coherent, organised, single entity, mind you. But that’s a longer story.

The UK has “mature” corruption where the state is so old that they have had time to encode the corruption into the law.

Completely agree on the point of the establishment showing it’s hand. They can print as much fiat as required however they are having to spend credibiility which is not so easily synthesized.

It’s been an expensive time for the establishment. First 2008 when they had to admit that they could just “make” money, which was news to most people. The the 2011 riots, now this. Drip drip.

I would partially blame perverse influences of the EU: everything has to be made complicated. The more complicated the better. Complicated is excellent!!!