By Eric Tymoigne. Originally published at New Economic Perspectives

Monetary Base and the Balance Sheet of the Fed.

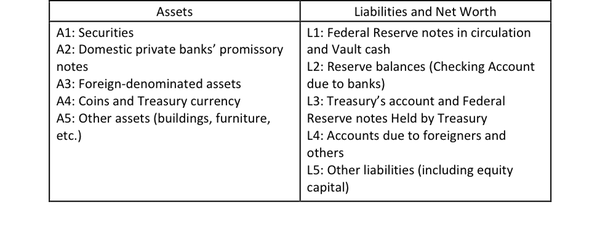

The previous post examined the balance sheet of the central bank:

Now that we have an understanding of how the balance sheet of the Federal Reserve works, it is possible to go into the details of how the Fed operates in the economy in terms of monetary policy.

To understand what the Fed does, we first need to define the monetary base and see how it relates to the Fed’s balance sheet. We will quickly look at the difference between monetary base and money supply, and we will also look more carefully at what reserves are.

The Monetary Base and the Money Supply

The monetary base (aka “High-Powered Money”) is defined as:

Monetary Base = Reserve balances + vault cash + cash in circulation

In its widest meaning “in circulation” means any Federal Reserve Notes (FRNs) outside the Federal Reserve banks and any Treasury-issued cash outside Treasury. Economists prefer to use a narrower definition and we will use it here. Cash in circulation is any currency outside Treasury, Fed, and private banks (“vault cash”)—what is held by “the public.”

Technically, cash means currency and coins. The Fed and Treasury use the word “currency” to mean paper money only. Currency in circulation includes mostly FRNs, but also some Treasury currency (United States notes, silver certificates) and national bank notes (issued prior to the creation of the Fed in 1913) that the Treasury will take in payment at face value. The distinction between coins and currency is mostly statistical and does not have any analytical power. As we will see later, the material of which something is made is irrelevant to determine if it is a monetary instrument. We will use the word cash and currency interchangeably.

To simplify, the U.S. monetary base can be reduced to:

Monetary base = L1 + L2

That is the monetary base is the sum of reserve balances, vault FRNs, and FRNs outside the Fed and Banks (the FRNs in your wallet, at the Treasury, held by foreigners).

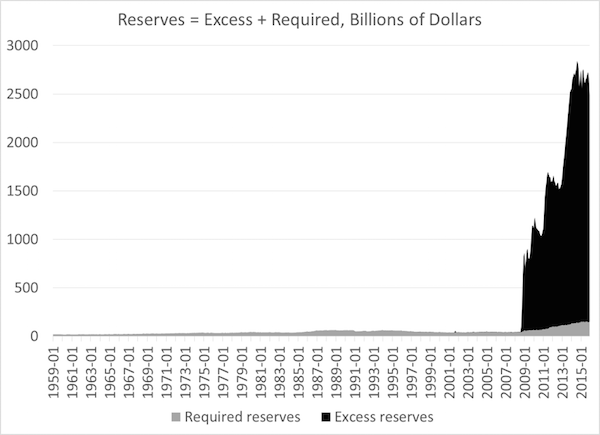

Until recently, currency in circulation was the largest component of the monetary base and it grew steadily to almost $1.4 trillion today, most of which are FRNs, and “between one-half and two-thirds of the value of U.S. currency in circulation is held abroad.” The global financial crisis led a large increase in reserve balances from about $24 billion on average from January 1959 to August 2008 to about $2.5 trillion today (Figure 1).

Figure 1. Sources: H3 series (for reserve balances and currency in circulation out of Treasury and Fed Banks) and H6 series (for currency in circulation out of Treasury, Fed banks and private banks) at the Board of Governors.

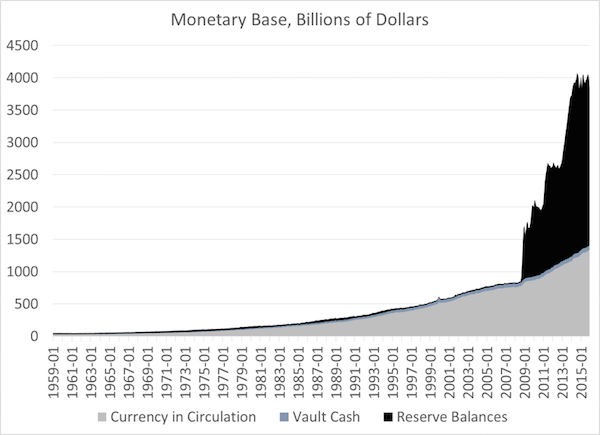

The monetary base is not the same thing as the money supply. Money supply means money held by non-bank economic units and outside the Treasury and other official foreign institutions. There are several ways to measure that and monetary aggregate M1 is the narrowest (Figure 2):

M1 = Cash in circulation + Private-bank checking accounts of non-banks, non-federal, non-official foreign economic units + others

M1 relates to the Fed’s balance sheet only via part of L1. FRNs in circulation have represented about 40% to 50% of M1 from the mid-1990s, 20 to 30% before that.

Figure 2. Source: Board of Governors, Series H.6

It is important to make a difference between the money supply and the monetary base because the central bank has no direct influence on the money supply. The Fed does not deal with the public directly, private banks do. Even for FRNs, private banks are in charge of injecting FRNs in the economy and they do so only if customers want to withdraw cash. In a 2010 interview Chairman Bernanke noted regarding the announced purchase of $600 billion of treasuries (“quantitative easing”):

“One myth that’s out there is that what we’re doing is printing money. We’re not printing money. The amount of currency in circulation is not changing. The money supply is not changing in any significant way.”

Translated in what we have seen above, he is saying that L2 has gone up dramatically but that M1 has not changed. The Fed did not issue FRNs to the public (L1 is not going up), it just credited the accounts of banks by buying treasuries from them and, as we have seen in the previous blog, banks can’t do much with reserve balances.

You should note that the Treasury’s account at the Fed (L3) and its accounts at private banks (called Treasury Tax and Loans accounts (TT&Ls)) are not part of the monetary base or the money supply. They are “funds.” The amount of dollars in the Treasury’s accounts are not accounted in any definition.

Reserves: Required, Excess, Free, Borrowed, Non-borrowed

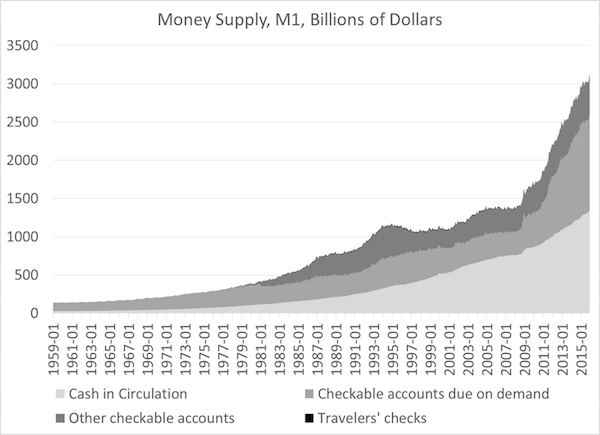

Within the monetary base, reserves are central to monetary-policy operations so let’s look a bit more carefully at the reserve-side of the monetary base. Total amount of reserves is:

Total reserves = Reserves balances + applied vault cash = L2 + part of L1

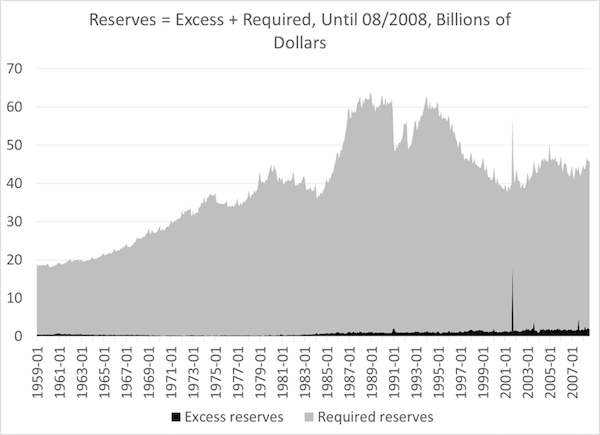

Applied vault cash are the FRNs that banks decided to use to calculate the amount of reserves they report to the Fed (the rest of vault cash is called “surplus vault cash”). Since the 1990s and until the Great Recession, applied vault cash represented the majority of total reserves and peaked to about 80% of total reserves. Since August 2008, reserves balances have been, by far, the main component of total reserves (Figure 3).

It is possible for reserve balances (L2) to go negative, i.e. the Fed allows banks to have an overdraft; however, the Fed expects that banks will close any overdraft at the end of each day. If a bank cannot do it, the Fed charges a very high interest rate (because the overdraft is a form of uncollateralized advance contrary to Discount Window advances) and, if the overdraft persists, the Fed may take a closer look at how the bank runs its business.

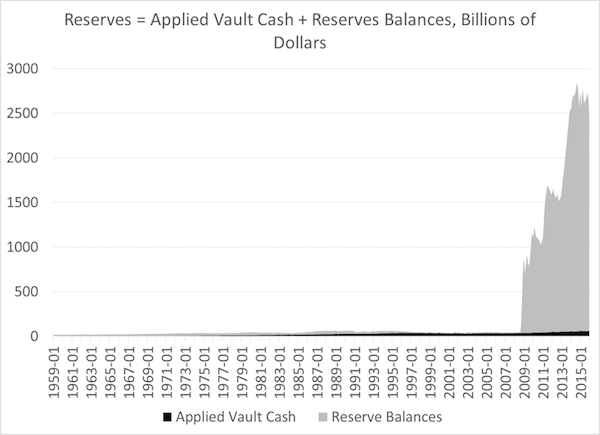

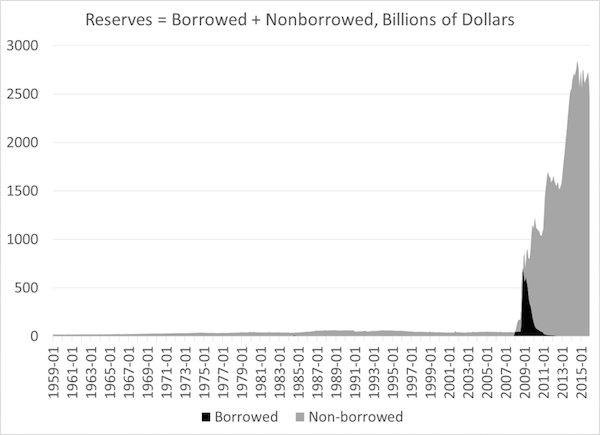

Total reserves can be decomposed into other categories than the form they take. One may also be interested in how banks obtained their reserves. The Fed is the monopoly supplier of reserves and there are two ways for the Fed to inject reserves:

- Fed’s Discount Window advances funds by swapping promissory notes with banks (see previous post): “borrowed reserves”

- Fed buys some assets from banks either permanently (“outright purchases”) or temporarily (“repurchase agreements”): “non-borrowed reserves”

Total reserves = borrowed reserves + non-borrowed reserves

Non-borrowed reserves have been the main source of reserves (Figure 4) because the Fed discourages the use of the Discount Window (interest rate is higher and Fed may increase supervision if a bank comes to the Window too often). The stigma of going to the Window is so strong that, during the crisis, the Fed had to change its Discount Window procedures to entice banks that desperately needed reserves to come.

Finally, the total amount of reserves can be decomposed in terms of the use of reserves. Banks in the United States must have a certain proportion of reserves relative to the amount of bank accounts they issue:

- Required reserves: amount of reserves banks must hold in proportion of the bank accounts they issued

- Excess reserves: whatever banks have in excess of required reserves.

Total reserves = Required reserves + excess reserves

Up until the crisis, required reserves were the overwhelming amount of total reserves (Figure 5). Excess reserves was virtually zero (we will see why in part 4). Up until the crisis, the amount of reserves was also relatively stable over decades and averaged $40 billion (Figure 6).

You will sometimes encounter the word “free reserves,” which just means the difference between excess reserves and borrowed reserves. Our most important categorization will be the last one: excess vs. required reserves.

Figure 3. Source: Board of Governors, Series H.3

Figure 4. Source: Board of Governors, Series H.3

Figure 5. Source: Board of Governors, Series H.3

Note: Non-borrowed reserves is negative during the peak amount of borrowed reserves. Non-borrowed reserves is measures by L1 – A2. A2 is borrowed reserves. For reasons we won’t discuss in this blog, L1 became smaller than A2.

Figure 6. Source: Board of Governors, Series H.3

How does the monetary base change?

The monetary base will go up or down depending on what happens to the other items in the balance sheet of the Fed. Following the point that balance sheet must balance we have:

L1 + L2 = A1 + A2 + A3 + A4 + A5 – L3 – L4 – L5

So monetary base will be injected when:

- The Fed buys something (i.e. acquires an asset) from banks or the public

- Higher A1: Buying securities (T-bills, T-bonds, etc.)

- Higher A2: Advances of Federal Funds

- Higher A3: Buying foreign currency from private banks

- Higher A5: Buying a pizza, a building, or a service from someone

- The other Fed account holders spend in the US economy and Fed pays dividends to banks

- Lower L3: Treasury Spends

- Lower L4: US Exports

- Lower L5: Fed pays dividends to banks

The monetary base will be removed when opposite transactions occur. Let’s take a few examples:

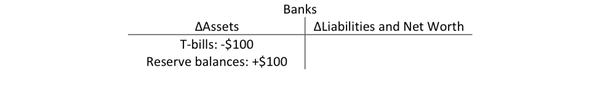

Case 1: The Federal Reserve buys T-Bills worth $100 from banks

You have just witnessed monetary-base creation: The central Bank credits the account of banks by typing “100” on the keyboard of a computer. The fed could also have printed bank notes (ΔL1 = +$100) but purchases from banks are done electronically because of convenience.

Case 2: Dr. T pays his income taxes worth $1000.

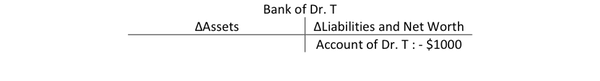

Assume that Dr. T still mails his income-tax paperwork with a check for the U.S. Department of the Treasury. The Department receives the check and brings it to the Fed (we will ignore TT&Ls because that would just complicate the analysis without adding any insights at this point. We will look at Treasury-Fed interactions in a later blog). The Fed sends the check to the bank of Dr. T. and so the bank debits the bank account of Dr. T by $1000.

What is the offsetting operation on the bank’s balance sheet? The $1000 have to go to the Treasury. Given that we assumed that the Treasury only has an account at the Fed we know that the offsetting operation CANNOT BE (it would be if TT&Ls had been included):

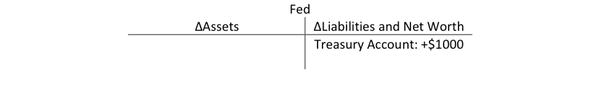

The Treasury only has an account at the Fed so the following will occur when the $1000 are transferred (which would be the second step if TT&Ls were included in the analysis):

But that again begs the question: What is the offsetting accounting entry on the balance sheet of the Fed? It can’t be “Account of Dr. T: -$1000” because Dr. T does not have an account at the Fed.

The answer is that when the Fed receives the check, it has a claim on Dr. T.’s bank. The bank settles that claims by giving up reserves and the funds are transferred into the account of the Treasury. Interbank claims (claims between private banks, and between the Fed and private banks) are always settled with reserve balance transfers.

Note that you have just witnessed monetary-base destruction: TAXES DESTROY MONETARY BASE. The central bank deleted $1000 in the reserve balance and keystroked an increase of $1000 in the account of the Treasury.

Of course if the Treasury spends, then reserve balances are credited and if Treasury spends more than its taxes then there is a net injection of reserves: FISCAL DEFICITS (government spending larger than taxes) LEAD TO A NET INJECTION OF RESERVES. Keep that in mind for the next blogs.

As a side note, one may note that Dr. T’s balance sheet changes as follows when taxes are paid:

Can the Fed issue an infinite amount of monetary base?

Yes it technically can given that the monetary base is composed of liabilities of the Fed. In practice though, the ability to inject reserves is constrained by the objectives of monetary policy. As we will see in the next blog, if the central bank issues reserves regardless of the needs of banks, it won’t be able to achieve specific policy targets it sets for itself unless it changes its operational procedures (which it did during the recent crisis).

At the origins of the Fed, some constraints were also put on the type of securities that the Fed could buy or that banks could pledge as collateral with their promissory notes to get an advance from the Discount Window. There was a fear that the Fed would over issue monetary base given its broad monetary power. Here is the language of the preamble of the 1913 Fed Act states:

“To provide for the establishment of Federal reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes”

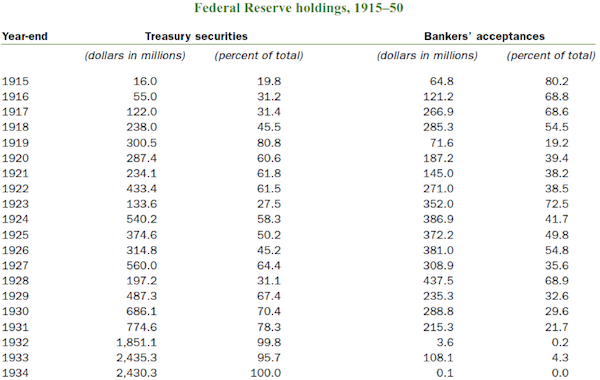

“Elastic currency” just means that the Fed is able to create (and withdraw) monetary base at the will of banks and the public. However, until 1932, the Fed operated under the Real Bills Doctrine (RBD). What that meant is that the Fed ought to only accept in A1 and collateral for A2, securities that were issued to finance private-sector production. The idea was that by tying monetary-base creation to production financing, the Fed would avoid inflationary tendencies that could come from an elastic currency. Monetary base (and so money supply as the thought of the time went) would grow in-sync with production.

In practice, RBD never worked out well for both theoretical and practical reasons. WWI led to a large amount of treasuries held by the Fed. The Great Depression led to the elimination of the doctrine and the 1932 Banking Act widened dramatically the type of securities the Fed could accept if needed.

Source: Marshall’s Origins of the Use of Treasury Debt in Open Market Operations: Lessons for the Present

One of the problem of RBD is that it relied on private-indebtedness (issuances of securities by companies to finance production, “real bills”) for monetary policy to work. During a recession, banks did not have enough real bills to sale or pledge to the Fed because economic activity was dead so private issuance plunged. This is problematic because the scarcity of real bills limited the ability of banks to obtain reserves, just at the time when banks desperately needed some to counter bank runs and make interbank payments.

More recently, Dodd-Frank amended the Federal Reserve Act to constraint the capacity of the Fed to use “emergency power,” i.e. its ability to accept any type of securities from anybody. This was a reaction to the advance of funds provided to AIG that was not part of the Federal Reserve System and was not supposed to have had access to the Fed. It was also a reaction to the opaqueness of the Discount Window operations during the crisis and how questionable some of the transactions were.

The Fed needs to be able to fight panics and the ensuing liquidity crisis when everybody and every banks are trying to get their hand on the currency. This is why the Fed was created. It can only do so by being able to buy, or accept as collateral, a wide verity of securities.

This leads to a final important point. Given that the Fed provides a safety valve in the financial system, it may lead to moral hazard. Financial-market participants may take more risks knowing that, if things go south, the Fed will intervene to avoid a collapse of the financial system. As a consequence the Fed must do two things:

- The Fed should also have ample regulatory and supervisory power, AND it should use it (that’s what the last bit of the preamble is all about).

- The Fed should discourage moral hazard and promote safe banking practices by accepting only securities that are of quality (that is based on sound underwriting and not in default) and from solvent institutions: The fed is there to squash banking liquidity crisis (temporary inability to access funds) not to squash banking solvency crisis (permanent inability to pay creditors).

Unfortunately, these two conditions have not been met recently and moral hazard has increased dramatically.

The alternative is Andrew Mellon’s advice to Hoover: “liquidate labor, liquidate stocks, liquidate farmers, and liquidate real estate…it will purge the rottenness out of the system.” However, this belief in the self-cleansing of market mechanisms does not work, especially so in times of financial crisis and panic. More about that later.

Done for today! Next blog will dive into monetary-policy implementation by looking at the pre- and post-crisis monetary policy operations.

LS wrote: ” Given that the Fed provides a safety valve in the financial system, it may lead to moral hazard.”

Not only moral hazard but breaking the FED´s own rules by i.e swaping toxic papers and financing AIG.

Yes it was the wars and depression that created the growth of GB-reserves but not the lack of commercial papers after these events. Guess there were enough of high rated papers(from let´s say 1950) to buy and an ability to lower the market interest rates if needed. Of cource banks later prefered “risk free” reserves. This also led to the expansion of statebudget-deficits and larger debts without direct investments(production). Government spending without intention of paying back debt must be counter-productive in the long run(sooner or later). Are we there now? What is worse? Capital flight from GB or from corporate bonds.

That is not the only possible conclusion. There is a second conclusion one might offer in the opposite direction: the Fed’s role should be limited to the mechanics of implementing monetary policy. Some other body, independent of the Fed, should be responsible for bank regulation/supervision.

In fact, it seems to me the two roles create aconflict of interest – as we’ve seen in the NY Fed’s failure to regulate the Wall St. banks.

A good example is the 3-part solution Gordon Brown created in the UK where nobody was responsible for anything and the banks raped us.

Right. If the fed does not want to do it then another regulator should exist. Today FDIC is probably more willing to step in

‘WWI led to a large amount of treasuries held by the Fed.’

WWI certainly led to a huge surge in the Fed’s holdings of discounted commercial bills and loans. But T-bills and T-bonds (shown in orange and dark blue in linked chart) were a single-digit percentage of its assets. Chart:

http://tinyurl.com/zjyvhbk

It was only in 1945 that government securities rose to more than half the Fed’s assets, and carried on rising from there. By no coincidence, that is when ingrained inflation became a chronic feature of the 2nd half of the 20th century.

Fiat currency is institutionalized fraud.

Exactly how would a fiat currency with a zero inflation target be fraudulent?

Irredeemability.

It is redeemable (the gov will take back its currency in payment at face value), it is not convertible.

If it was not redeemable and not convertible then fair value of currency would be zero. Will do a post on this later when I arrive at the “money” part

Fiat money has value whenever and because the government forces plaintiffs to accept it in settlement of civil lawsuits. That is one thing that “legal tender” means. Probably, it was originally the main thing.

Generally speaking, if you sue a private in a civil lawsuit, and you are win, your remedy will be a “compensation in money” for the detriment you suffer, which is called “damages”; generally speaking, you will not be entitled to specific relief that orders the defendant to do something, like conveying identified property to you: specific relief is considered extraordinary and is administered only in special cases.

Entry of judgment for damages against a defendant in a civil lawsuit creates a “judgment debt” for the damages; in this context, “debt” means “an obligation to pay money.”

So, even fiat money has value if you have it and you lose a lawsuit and thereby incur a judgment debt–if you have fiat money, you can can tender it to the plaintiff in the amount of the judgment and the judgment will be discharged–the plaintiff cannot compel payment in anything else.

This story of money is an old story. In Rome, it’s over 2700 years old, back to the days when Rome was just another small city. That makes the story older than Lydian stamped coinage. That makes it older than the story of Roman emperors paying soldiers in money and taxing suppliers in the same money, so that suppliers would be obliged to accept it in payment for stores in order to raise the wherewithal to pay Roman taxes.

Legal tender laws only widens acceptance.

In the same way an issuer must accept its bond back at face value when they mature, the government must accept is currency back at face value when they mature. Otherwise there is a default and bond (and security) would circulate at a discount.

So if tomorrow, US government says it will only accept a $100 Federal Reserve Note at $50 in settlement of taxes or other payments, the $100 FRNs will trade at $50 in the economy regardless of legal tender laws. A 50% percent discount: you will go to the store and hand a $100 and the teller will only take it for $50.

The most dramatic example of that is of course when a government demonetize its currency (recently eurozone countries). Then in that case the fair value of their currency goes to zero immediately unless they allow for a time of conversion in the newly adopted currency. In the case of the eurozone, there was a 10 years in the case of euro (at least for France where I am from). A friend of mine discovered a stash of Franc banknotes worth $10000 hidden by his wife before she died. She did not tell him about it and he discovered the banknotes after the 10 year conversion period. Guess how much they are worth?

Eric, you need to be clear currency is redeemable only in the sense that the government issuer of money will accept it for tax payments. That is where a currency’s fundamental value originates.

In any case fiat currencies are very dicey systems. They work fine if prudently managed but they are recipes of abuse and disaster which is what is playing out right now.

Right, it is a jail-free coupon that you can redeem when you need to pay the gov.

Accountability is needed in any form of government. Fiat currency just allows gov to be more flexible in meeting the needs and wants of its population. It removes the financial constraints, it does not remove the need for check and balance and for accountability and transparency.

Right Eric, but as you know the “flexibility” of our fiat currency system isn’t being used to meet “the needs and wants of its population”. Rather it is being used to meet the needs and wants of the banksters and financial grifters, i.e. hedge funds and pirate equity shops, who have learned how to feast off the credit creation process. In due course historians will come to grips with what transpired over the last thirty years; in the meantime a bunch of misfits will have to find solace on sites like Naked Capitalism where these things can be discussed.

So what happened to the inflation?

Post-1945 (my own youth) is sometimes called America’s Golden Age (eg, by Gore Vidal). Present theory is that mild inflation (and it was rarely high, let alone severe) is desirable. Indeed that was a long period of rare prosperity and equally rare near-equality of income.

I agree that fiat currency is essentially a confidence game, but history suggest that is not a bad thing.

Inflation reached 20% in 1947, 12% in 1974 and 15% in 1980. It was massively unpopular. Both owners and renters were howling about housing unaffordability. Nixon was ousted in 1974 and Carter in 1980.

By some measures, the U.S. Golden Age was over by 1971, when Nixon floated the dollar because accumulated inflation had rendered its gold link untenable.

Promises that the central planners will hold inflation at ‘only’ 2 percent are not credible. Longer term, one of these days they will start another war, such that runaway arms spending and Federal Reserve accommodation of war deficits trumps any notion of capping inflation.

Now land price inflation is not fully accounted for in inflation figures, so when we speak of “low inflation” it’s only as meaningful as the measurement.

In the UK we have inflation near zero yet house prices are up 10% on the year.

Present theory holds that some positive degree of inflation is desirable because the present theorizers are debtors and the agents of debtors. Fiat currency is a debt; the central bank that issues the fiat currency is a debtor; and its inflation target announces the intentions of a debtor–intentions concerning the degree to which it plans to renege on its obligations, by giving back in the future less than it takes in the present for issuing its debt. The macroeconomists it employs serve the interests of a debtor.

Interesting graph. Could we get the link to the paper please?

Glad to read these articles. I don’t know enough about the subject to comment intelligently. I read to learn. Thanks.

It’s pretty simple, just read up on Galileo and the unassailable orthodoxy that prevailed at the time that the Earth was the center of the universe. An immutable and eternal fact. Many complex formulas were concocted (see above) to prove it.

The same is true today, the monetary and economic priesthood has no idea what money is or how it is created. No idea. They think banks are just financial intermediaries, when in fact banks themselves create money using their monopoly right to employ an accounting fiction that their liabilities are really assets.You might research Steve Keen, he understands.

The following explains it pretty well:

http://www.washingtonsblog.com/2016/01/loophole-allows-banks-not-companies-create-money-thin-air.html

Nowhere better than the old whore of threadneedle to read it.

From the Bank of England blog:

http://bankunderground.co.uk/2015/06/30/banks-are-not-intermediaries-of-loanable-funds-and-why-this-matters/

Banks are not intermediaries of funds. As this blog says the fed don’t directly control money supply.

so true! My head wants to explode every time I read that banks are “intermediaries” who take in deposits on behalf of savers and lend them out to borrowers. NON-SENSE! They create money out of thin air when they agree to make loans. And as you note, almost nobody understands what money is. It’s all debts, claims against a bank or claims against the sovereign in the form of its central bank. The Bank of England came out and published an excellent paper explaining the money creation process a couple of years ago.

I’m still trying to figure out a few things:

1. When a depository purchases Treasury securities what happens to reserves. I’m 99.9% sure that if it’s in an auction that it removes reserves, not so sure about outside of an auction but I have a suspicion that the answer is the same.

2. How do reserves find their way into the repo market? I’m pretty sure they do, I just don’t know the mechanism.

3. What was the thought process of increasing the interest on excess reserves (IOER). Given that it didn’t change the Fed’s balance sheet one iota what was the Fed attempting to do and did that 25bps change actually change liquidity anywhere in the system. Given the markets reaction it would seem that the answer must be yes, but again I’m not sure how.

This series is great Yves. Part 1 was unnecessary but parts 2 and 3 have been helpful, I am looking forward to part 4. The only thing I would say is that there are few places where the wording isn’t as concise and clear as it needs to be. This stuff isn’t that complicated but it is esoteric. There is so much misunderstanding about reserves, where they come from, how they can come and go. Using the T accounts to show the accounting is the key to understanding how central banking works. This stuff is written about all the time and most of those writing about it don’t have a clue what they are talking about. I can’t count the number of times I have read something about turning reserves into loans which can’t be done.