By David Dayen, author of Chain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure Fraud, releasing May 17. Follow him on Twitter @ddayen.

I suppose we’re going to have to deal with half-truths and logical stretches about Dodd-Frank right through until November, but Bernie Sanders’ laser focus on Wall Street has ramped this up of late. The trajectory appears to be: a show of proof of some sort, followed by a blog link from Paul Krugman, at which point the citation hardens into conventional wisdom. This one got rolling by Wonkblog’s Matt O’Brien, and while it has a level of truth to it, I don’t think it reveals exactly what its endorsers think.

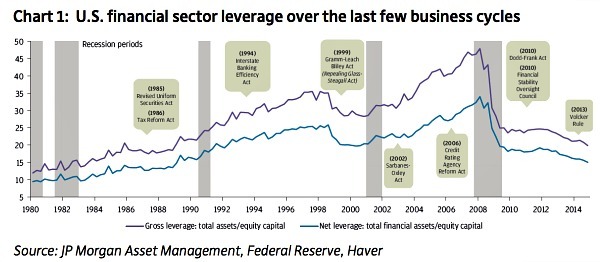

O’Brien keys off of the following chart, to show that leverage (I suspect everyone reading this knows what that means, but to be brief, the percentage of the balance sheet funded through borrowing) throughout the financial sector decreased during the recession and kept falling through the recovery.

Now, on the one hand, it’s not surprising that bank borrowing crashed during the, well, crash. But on the other, it’s at least a little surprising that leverage has continued to contract since then despite the fact that the economy’s been expanding and there hasn’t been another crisis. That hasn’t happened at any other time in recent memory.

OK, take a closer look at that chart. The part I bolded for emphasis isn’t true. It has happened at another time in recent memory. It happened, in fact, in 1998, as the chart shows. The chart bizarrely attributes this to the adoption of Gramm-Leach-Bliley, but really it can be explained by a credit crunch, from the East Asian and Mexican crises and the collapsed of Long Term Capital Management, which caused skittish market participants to reduce leverage. The general truism of this chart is that credit crunches cause rapid pullbacks in leverage, whether the economy is in expansion or not (indeed the ’98 leverage reduction came during the best economic growth period of the past 30 years).

I should add that I got Matt to admit this on Twitter last Wednesday, and he never updated the post to reflect that, nor did he changed the sentence “That hasn’t happened at any other time in recent memory.” It’s not even fatal to Matt’s point, but the inability to clean up the hyperbole kind of shows what the priority is here: to cheerlead for Dodd-Frank.

The thing is, you don’t need this chart to tell a story about leverage, and its close cousin, risk-based capital. A Boston Fed report out last week shows largely the same thing; capital and leverage ratios have nudged up since 2010.

Now you can make the argument that leverage is pro-cyclical; when asset prices rise, leverage decreases because those assets are more valuable, and when they crash, leverage jumps. It’s worth pointing out that Dodd-Frank tries specifically to correct for this, with language in Section 616 calling on the Fed to “make such requirements counter-cyclical, such that the amount of capital require to be maintained by a company increases in times of economic expansion and decreases in times of contraction.” (And the Fed has done this with a counter-cyclical buffer.)

But my question is why the many pundits and observers hyping the leverage evidence would solely call it a Dodd-Frank story.

Let’s remember that the Obama Administration worked very hard to keep statutory designations of capital requirements out of Dodd-Frank. Sheila Bair goes into great detail in her book Bull By the Horns about this. Susan Collins (R-ME) put forward an amendment that would set a floor for capital requirements (albeit with vague language: “generally applicable leverage and risk-based capital requirements” is the specific floor in Section 171, which means… whatever the banking regulators want it to mean). “As soon as he got wind of the amendment, Tim (Geithner) visited Collins and pushed back,” Bair writes, “saying that it would hurt smaller banks!” Geithner and the Fed didn’t want Congress having any input on capital requirements, and they go after the Collins provision continually.

Fortunately, they lost the battle, and the Collins amendment passed. But again, it just sets a floor, not a specific number. It also mandates that the SIFIs (systemically important financial institutions) have some manner of capital surcharge, but it doesn’t specify how much bigger it has to be than for non-SIFIs: technically it could be .00000001% higher. The hard numbers got filled in by the international Basel III process, and then deliberations by the Fed.

There were a lot of countervailing pressures on regulators before and after Dodd-Frank with respect to capital. An intellectual movement, bipartisan in nature, coalesced around the idea of capital as a vital and necessary financial reform. Academics like Anat Admati were skillful in challenging regulators to go well outside their comfort zones. They had allies inside the agencies, like Thomas Hoenig at FDIC.

In the end, the Fed tightened leverage and risk-based capital requirements, not to the degree that Admati and her allies wanted, but well beyond initial expectations. But critically, that was their decision to make; they could have done essentially nothing beyond Basel and been perfectly within the confines of Dodd-Frank.

Also, the banking regulators already had the authority to impose capital requirements; Dodd-Frank reshuffled those authorities and perhaps gave the agencies some direction. But the die was already cast. According to informed sources, people like William Dudley at the New York Fed were resolved to raise capital for the largest banks as early as the beginning of 2010, months before Dodd-Frank passed. By that time there were white papers, but remember that Geithner wanted capital out of the bill – Dudley wasn’t influenced by something that wasn’t there. The regulators realized they let things get far too loose before the crisis, and thought the best way to unobtrusively protect the system at minimal public cost was to force the industry to absorb their own losses. And they wanted to keep that prerogative to themselves.

Note that Krugman, who jumped all over O’Brien’s story, hedges his bet by saying that falling leverage was “probably because of Dodd-Frank.” He has to reach for the rule classifying SIFIs to tighter capital restraints to explain the leverage situation. But this is absurd: the SIFI designation presents an incentive to get below the $50 billion asset threshold, as we are now seeing. That’s generally an good thing, but it has nothing to do with leverage – if anything it would increase it for the financial institutions that slide under $50 billion, because they have less restraints. And again, the SIFI premium is discretionary.

Bill Black, in his Bank Whistleblowers Group plan for stiffer prosecution of financial fraud, has as a major plank the imposition of individual minimum capital requirements, which he cites the authority for back to 1989. Black believes regulators could make these so big to prevent financial firms from engaging in particular activities.

The point is that we should not point to falling capital/leverage and praise Dodd-Frank. We should praise individual regulators for using long-held authority, and the outside movement that brought their voices to bear to ensure that the regulators followed through. That’s the real lesson here.

And what does that mean for the future? Well, you would want regulators who would be responsive to that bipartisan movement for capital standards, who wouldn’t supplant that trend with one from Wall Street, who wouldn’t backslide. In other words, personnel as policy, something Sen. Warren has stressed the entire past year. And the candidates for staffing the federal banking agencies should be assessed on that basis.

Finally, it’s important to make clear that a decent leverage ratio is not enough to declare victory in financial reform. If you prevented banks from lending entirely they’d have a leverage ratio of 100%. What we want is a system where productive lending activities are privileged and de facto gambling is wiped out. We want a resilient system where market discipline can allow institutions that make bad decisions to fail, without risking a cascade of other failures. Capital can make all this easier but cannot be seen as a substitute for system design.

And that’s especially true if the capital and leverage standards come in too low, which is currently the case, even if they are working in a modest fashion today. The way we got the successes we have come from regulators mindful of the last crisis being pushed by outside forces. We should want that to continue to work, rather than shouting about triumphs and averting our gaze to something else.

“de facto gambling”. Please define.

If we define investment as taking risk, then it is de-facto gambling. Only investors pretend then can somehow identify and quantify the risk (and thus manage them), but in reality card counting in poker and blackjack is much more precise quantitative strategy than say VaR or any capital requirement is ever going be – so by that measure, professional poker players are less gamblers than your fund manager. Indeed, you can argue that one run massive risk just with retail lending.

I think that what you mean is that we should set up banking (and ideally all of finance) so that it stops being an option we give to the financiers and at the same time pay them to take it (also known as tails I win, heads you lose).

TBH, I don’t care if bankers (and I write bankers vs banks consciously, let’s go after people, not institutions) gamble, but I care if their gamble can sink the system and they _still_ walk away with the money.

So, from my perspective, the main thing is not so much about capital, leverage or whatever, but to start enforcing things like sarb-ox misrepresentation of account (and believe me, just about any bank with sufficiently large portfolio – not even a derivative one, would fail this). Jailing Dimon for the London Whale trades would have done more to banks being better run than any amount of tinkering with capital requirements.

Great summary and dissection of the issue. Thanks.

One slight problem with the language in the second paragraph: In

“leverage [is] to be brief, the percentage of the balance sheet funded through borrowing”

it should be changed to “the ratio of balance sheet funding to equity”, or something similar,

to be in agreement with the terminology the chart uses.

If those numbers in the chart were percentages, there would be nothing to worry about!

“Frenzied Financialization

Shrinking the financial sector will make us all richer.

By Michael Konczal

If you want to know what happened to economic equality in this country, one word will explain a lot of it: financialization. That term refers to an increase in the size, scope, and power of the financial sector—the people and firms that manage money and underwrite stocks, bonds, derivatives, and other securities—relative to the rest of the economy.

The financialization revolution over the past thirty-five years has moved us toward greater inequality in three distinct ways. The first involves moving a larger share of the total national wealth into the hands of the financial sector. The second involves concentrating on activities that are of questionable value, or even detrimental to the economy as a whole. And finally, finance has increased inequality by convincing corporate executives and asset managers that corporations must be judged not by the quality of their products and workforce but by one thing only: immediate income paid to shareholders.

The financial system has grown rapidly since the early 1980s. In the 1950s, the financial sector accounted for about 3 percent of U.S. gross domestic product. Today, that figure has more than doubled, to 6.5 percent. The sector’s yearly rate of growth doubled after 1980, rising to a peak of 7.5 percent of GDP in 2006. As finance has grown in relative size it has also grown disproportionately more profitable. In 1950, financial-sector profits were about 8 percent of overall U.S. profits—meaning all the profit earned by any kind of business enterprise in the country. By the 2000s, they ranged between 20 and 40 percent. This isn’t just the decline of profits in other industries, either. Between 1980 and 2006, while GDP increased five times, financial-sector profits increased sixteen times over. While financial and nonfinancial profits grew at roughly the same rate before 1980, between 1980 and 2006 nonfinancial profits grew seven times while financial profits grew sixteen times.

This trend has continued even after the financial crisis of 2008 and subsequent financial reforms, including the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. Financial profits in 2012 were 24 percent of total profits, while the financial sector’s share of GDP was 6.8 percent. These numbers are lower than the high points of the mid-2000s; but, compared to the years before 1980, they are remarkably high.

This explosion of finance has generated greater inequality. To begin with, the share of the total workforce employed in the financial sector has barely budged, much less grown at a rate equivalent to the size and profitability of the sector as a whole. That means that these swollen profits are flowing to a small sliver of the population: those employed in finance. And financiers, in turn, have become substantially more prominent among the top 1 percent. Recent work by the economists Jon Bakija, Adam Cole, and Bradley T. Heim found that the percentage of those in the top 1 percent of income working in finance nearly doubled between 1979 and 2005, from 7.7 percent to 13.9 percent.

If the economy had become far more productive as a result of these changes, they could have been worthwhile. But the evidence shows it did not. Economist Thomas Philippon found that financial services themselves have become less, not more, efficient over this time period. The unit cost of financial services, or the percentage of assets it costs to produce all financial issuances, was relatively high at the dawn of the twentieth century, but declined to below 2 percent between 1901 and 1960. However, it has increased since the 1960s, and is back to levels seen at the early twentieth century. Whatever finance is doing, it isn’t doing it more cheaply.”

http://www.washingtonmonthly.com/magazine/novemberdecember_2014/features/frenzied_financialization052714.php?page=all

Skippy…. dated tho reinforces the trend…

Financial sector leverage is a ratio. The numerator and denominator work together to produce an outcome. To the extent that banks destroyed the credit-worthiness of their borrowers through predatory lending in 1998 – 2006— a point alluded to in the quote above, the numerator has fallen. To the extent that bank equity (denominator) is market based, equity values have been raised by 1) the too-big-to-fail implied guarantee and 2) equity markets driven higher by Federal Reserve policies like Quantitative Easing.

Claiming victory over recurring financial crises only works until the next crisis.