By Jomo Kwame Sundaram, an Assistant Secretary General working on Economic Development in the United Nations system during 2005-15, and was awarded the 2007 Wassily Leontief Prize for Advancing the Frontiers of Economic Thought. Originally published as a Global Development and Environment Institute Policy Brief

The Trans-Pacifc Partnership (TPP) Agreement, recently agreed to by twelve Pacifc Rim countries led by the United States,1 promises to ease many restrictions on cross-border transactions and harmonize regulations. Proponents of the agreement have claimed significant economic benefits, citing modest overall net GDP gains, ranging from half of one percent in the United States to 13 percent in Vietnam after fifteen years. Their claims, however, rely on many unjustified assumptions, including full employment in every country and no resulting impacts on working people’s incomes, with more than 90 percent of overall growth gains due to ‘non-trade measures’ with varying impacts.

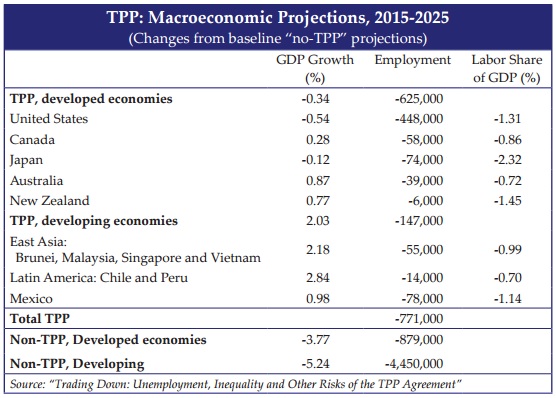

A recent GDAE Working Paper finds that with more realistic methodological assumptions, critics of the TPP indeed have reason to be concerned. Using the trade projections for the most optimistic growth forecasts, we find that the TPP is more likely to lead to net employment losses in many countries (771,000 jobs lost overall, with 448,000 in the United States alone) and higher inequality in all country groupings. Declining worker purchasing power would weaken aggregate demand, slowing economic growth. The United States (-0.5 percent) and Japan (-0.1 percent) are projected to suffer small net income losses, not gains, from the TPP.

This GDAE Policy Brief is intended to help clarify the differences with other modeling studies and to present our findings in a less technical manner.

Flaws in TPP Economic Projections

Optimistic claims about the TPP’s economic impacts are largely based on economic modeling projections published by the Washington-based Peterson Institute for International Economics.2 Its researchers used a computable general equilibrium (CGE) model to project net GDP gains for all countries involved. These figures have been widely cited in many countries to justify TPP approval and ratification. Updated estimates, released in early 2016 and incorporated into the World Bank’s latest report on the global economy,3 now stress income gains for the United States of $131 billion, or 0.5 percent of GDP, and a 9.1 percent increase in exports by 2030.4

The projections methodology assumes away critical economic problems and boosts economic growth estimates with unfounded assumptions. The assumption of full employment is particularly problematic. Workers will inevitably be displaced due to the TPP, but CGE modelers assume that all dismissed workers will be promptly rehired elsewhere in the national economy as if part of labor ‘churning’. The full-employment assumption thus inflates projected GDP gains by assuming away job losses and adjustment costs.

The modelers also dismiss increases in inequality by assuming no changes to wage and profit shares of national income. Again, this is not supported by empirical evidence, as past trade agreements have tended to reduce labor’s share.

Finally, foreign direct investment (FDI) is assumed to increase dramatically, which contributes a significant boost to economic growth in the Peterson Institute projections, accounting for more than 25 percent of projected U.S. economic gains in the recent update. This assumes that: 1) income to capital owners will be invested; and 2) this will result in broad-based growth. Neither is supported by the evidence. A U.S. Department of Agriculture study,5 which did not assume such FDI-related investment gains, found zero growth for the United States and very modest growth elsewhere at best.

The methodology of the Peterson study is flawed; consequently, growth and income gains are overstated, and the costs to working people, consumers and governments are understated, ignored or even presented as benefits. Job losses and declining or stagnant labor incomes are excluded from consideration, even though they lower economic growth by reducing aggregate demand.

Some economists have pointed out6 additional misleading findings in the most recent Peterson Institute update:

• U.S. income gains of 0.5 percent from TPP in 2030 – This is raised from the institute’s previous 0.4 percent, mainly by extending the implementation period from ten to fifteen years. In any case, added growth of 0.5 percent is very small, about 0.03 percent per year over fifteen years.

• Exports rise by 9.1 percent, but so do imports, because the model assumes fixed trade balances. This excludes, by assumption, the problems associated with rising trade deficits, which have been common after previous trade agreements.

• All displaced workers are absorbed immediately and costlessly in other sectors – again, by assumption. The paper does acknowledge that manufacturing employment will increase more slowly because of the TPP, and that some 53,700 more U.S. jobs per year will be “displaced” annually. But they view this as a small addition to normal labor market “churn.”

More Realistic Economic Projections

We employed the UN Global Policy Model (GPM) to generate more realistic projections of likely TPP impacts. Unlike most CGE models, the GPM incorporates more realistic assumptions about economic adjustment and income distribution, assessing the TPP impact on each of them as well as on economic growth over a ten-year period. Importantly, it does not assume large unexplained FDI surges or investment, growth and income gains due to nontrade measures. The modeling results are summarized in the table.

To facilitate comparison, we used the Peterson Institute’s projected estimates of the TPP’s impact on exports, applying the macroeconomic model to assess the efects of projected TPP trade increases.7 The GPM analyzes macroeconomic sectors – primary commodities, energy, manufacturing and services – but does not contain data on single markets (such as car parts or poultry).

The main fndings include:

• The TPP will generate net GDP losses in the USA and Japan. Ten years after the treaty comes into force, US GDP is projected to be 0.54 percent lower than it would be without the TPP. Similarly, the TPP is projected to reduce Japan’s growth by 0.12 percent.

• For other TPP countries, economic gains will be negligible – less than one percent over ten years for developed countries, and less than three percent over the decade for developing countries. Chile and Peru’s combined gain of 2.84 percent comes to only about a quarter of one percent per year.

• The TPP is projected to lead to employment losses overall, with a total of 771,000 jobs lost. The United States will be hardest hit, losing 448,000 jobs.

• The TPP will also likely lead to higher inequality due to declining labor shares of national incomes. In the United States, labor shares are projected to fall by 1.31 percent over ten years, continuing an ongoing multi-decade downward trend.

Conclusions

In sum, the TPP will increase pressures on labor incomes, weakening domestic demand in all participating countries, in turn leading to lower employment and higher inequality. Even though countries with lower labor costs may gain greater market shares and small GDP increases, employment is still likely to fall and inequality to increase.

In fact, most goods trade among TPP countries has already been liberalized by earlier agreements. Instead of promoting growth and employment, the TPP is mainly about imposing new rules favored by large multinational corporations. The TPP greatly strengthens investor and intellectual property rights (IPRs), while weakening national regulation, e.g. over financial services.

The TPP will strengthen IPRs for big pharmaceutical, information technology, media, and other firms, e.g. by allowing pharmaceutical companies longer monopolies on patented medicines, keeping cheaper generics of the market, and blocking the development and availability of similar new medicines.

The TPP would also strengthen foreign investor rights at the expense of local businesses and the public interest. The TPP’s investor-state dispute settlement (ISDS) system will oblige governments to compensate foreign investors for losses of expected profits in binding private arbitration.

These pro-investor measures impose significant costs, especially on developing countries. They will exert a chilling efect on important government responsibilities to promote national development and protect the public interest.

Our modeling suggests that TPP skeptics, concerned about the agreement’s impacts on growth, labor incomes, employment and inequality, have good reason to doubt optimistic projections. Our results show negative impacts in all these areas, particularly in the United States. Legislatures in TPP countries should carefully consider these findings and their implications before approving the agreement.

Endnotes

1 The participating countries – Canada, United States, Mexico, Chile, Peru, Japan, Vietnam, Malaysia, Singapore, Brunei, Australia and New Zealand – have finalized and signed the text of the agreement, but the treaty must be ratified in all of them before it can come into force.

2 Peter Petri, Michael Plummer and Fan Zhai (2012). “The Trans-Pacific Partnership and Asia-Pacific Integration: A Quantitative Assessment”. Policy Analyses in International Economics 98, Peterson Institute for International Economics, Washington, DC. The Peterson Institute study has also been criticized by others, e.g. http://www.sustainabilitynz.org/wp-content/uploads/2014/02/EconomicGainsandCostsfromtheTPP_2014.pdf.

3 See Global Economic Prospects, Spillovers Amid Weak Recovery, January 2016, The World Bank Group, Washington, DC.

4 Peter Petri and Michael Plummer, “The Economic Efects of the Trans-Pacifc Partnership: New Estimates”, January 2016, Working Paper 16-2, Peterson Institute for International Economics, Washington, DC.

5 See http://www.ers.usda.gov/media/1692509/err176.pdf

6 See, for example, Dean Baker, “Peterson Institute Study Shows TPP Will Lead to $357 Billion Increase in Annual Imports”, January 26, 2016.

7 A robust debate over such modeling followed the release of the GDAE paper, with a critique from Robert Lawrence for the Peterson Institute (“Studies of TPP: Which is Credible?”) and two responses from GDAE: “Are the Peterson Institute Studies Reliable Guides to Likely TPP Effects?” and “Modeling TPP: A response to Robert Z. Lawrence.” GDAE clarifed that the GPM is fully documented in the UNCTAD publication, “The UN Global Policy Model: Technical Description.”

Funny thing. For well over 150 years main stream economists have argued that freeing up international trade by pulling down trade barriers increases the prosperity of the nations concerned, with plenty of examples to show how right this conviction was. But now opinion seems to have swung the other way. Deals such as TPP are “proved” to be menace to all concerned. Can we expect that the next twist in this tale will see a revival in economists arguing that the world needs more trade barriers?

“with plenty of examples to show how right this conviction was”

plenty? that seems like a dramatic overstatement.what examples are you thinking of?

Exactly. There are no such examples. The benefits of such deals ALWAYS and EXCLUSIVELY goes to the 1%, the CEOs, the rich shareholders. It never ever goes to real humans.

ISDS alone is enough to kill any such deals. The people, scientists, the voters, have the absolute right to set regulations and environmental protections. Period. No exceptions. Ever.

Torquemada is coming to the neighborhood, and it’s like everybody is heating up his tongs for him in advance. Yes, please, please do everything to screw me some more, here, here’s a nice chair to sit in while you apply the thumbscrews

Um…that’s still what most economists are saying, based mostly on the extremely abstract model of int’l trade that David Ricardo came up with. There aren’t many (or any) examples of “free trade” working out as promised because, as it turns out, there is much more to take into consideration than just comparative advantage in production.

The Ricardian “Comparative Advantage” is predicated on fixed labor and capital. Neither applies currently, and (unsurprisingly) Ricardo’s calculations don’t apply either.

If I recall correctly, economists were arguing back in the 90s that under Pareto optimality, free trade would expand the economic pie such that a country could compensate the losers and still come out ahead. Of course, the losers didn’t get compensated, they got training.

The premise that the TPP pulls down trade barriers is dubious.

Per Dean Baker, the increased copyright protections, etc. that come with the TPP could have greater effects than lowering what are already modest tariffs between the countries involved.

It’s a multinational corporate government deal.

http://cepr.net/blogs/beat-the-press/the-tpp-and-nonsense-on-trade

~

“Free Trade” agreements are not about trade really. When you actually get the chance to see the damned things you find they’re almost always more about investor and corporate rights, privilege really, and putting restraints on the ability of nations to rule themselves democratically. They always sell them as “free trade” because it sounds better.

I take it you never heard of the Lipsey Lancaster Theorem, published in 1953, in a paper called The Theory of the Second Best. They argue that moving towards an unattainable ideal state can make everyone worse off, that you can’t just assume that moving closer to that ideal will be beneficial, you need to look at the actual proposal and evaluate its impacts. They example they use in the paper of trying to move closer to the idea and producing worse outcomes is from trade.

Thanks for mentioning this theory. While in graduate school I stumbled upon it accidentally while doing some research. When I asked one of my professors about it, he dismissed it as being inconsequencial. And we went on merrily studying (and being indoctrinated into) the wonderful world of neoliberal/neoclassical economics where any government intervention is bad and free markets are good

The prominent economist Ha Joon Chang has shown how protectionism was the norm for nearly all successful economies in the 19th century.

How about a realistic projection?. When a plant closes, it never reopens and the former workers never re-enter manufacturing the workforce. Calculated that way, NAFTA probably cost 10 million jobs or more.

Yeah, but a lot of those people now get to work at Walmart or in a hellish Amazon.com warehouse. And Chinese people get to be wage slaves in massive Foxconn warehouses where there are suicide prevention nets. There are people on the payroll of the Koch brothers and other billionaires who could explain to us just how good that is!

The proposed TPP/TISA/TTIP regime is, quite simply, “democracy insurance.” The transnational kleptocrats wish to ensure that no meaningful challenge to their power will, ever again, arise from the messy struggles associated with popular politics.

Of course this is insane! These kleptocrats seem to feel that they will be able to enslave the entire world without anyone daring to rebel. Ancient Egypt, and other regional examples, do show that hierarchical repressive regimes can be remarkably stable over long periods. Yet humanity is far too varied for an oppressive world-wide empire to endure for very long.

“democracy insurance.” +1000. That’s brilliant framing.

Oscar Wilde: I wish I’d sad that.

James Whistler: You will, Oscar, you will.

The high Monty Python literacy rate here at NC is only one of the many reasons this site rocks!!

https://www.youtube.com/watch?v=UxXW6tfl2Y0

Actually, I didn’t know that a Monty Python sketch had used the quote! So my own literacy is not that high… I love the way the sycophantic laughter goes on and on.

By mid century, computers will become self aware. long long before then they will be able to do all jobs. Thats always the most dangerous stage for a planet. its been known for billions of years.

So, by then the world will be as unequal a place as the human mind could ever imagine. Or not.

If its hell, it will be a hell of a hell. I think we are overestimating our usefulness to the children of man and the rest of the planet and all the others in that situation. They have to cut their losses. Even after all their time and investments. At least they saved the children.

Our young and immature progeny may eventually decide in favor of termination. (And regret that decision very deeply later. )

We should have listened to their advice

I think this was on NC yesterday:

“In the first decade of this century, America lost 56,190 factories, 15 a day.”

http://inthesetimes.com/working/entry/18911/murdering_american_manufacturing_TPP

Yes, in Water Cooler.

What White Collar White People don’t get yet – is they are not imune from the Clinton – Obama Scam.

With “unlimited” H-1b, the job losses in software, systems and accounting alone will be in the millions. Disney current wholesale removal of employees in Florida and replacing entire departments is the tip of the iceberg when it occurs across the board.

Exports? beyond Boeing, movies and the MIC there is nothing with substantive labor content that can overcome a strong dollar.

The jobs will go, H1’s, or not. Meet the real internet of things.

Yes, but -You’re both confusing H1B and L1 visas.

One thing that I suspect will impede the best laid profitmaking plans of all, is automation. the accelerating rate of change. So the economies on both sides will shrink much faster than anticipated. And of course no New Deals allowed, so all the traditional means of generating jobs will only serve to create jobs elsewhere..

SO, both American and others- companies wil rush to fully automate so they can continue to win contracts. The ubcontracting game will carry risks, huge risks and moral hzards, because of the extended families and stress – Starving people are a security risk.

H1Bs have wage parity requirements and have necessity tests, economic means tests, etc. they might pay as much as $70k or more a year. Thats not what Mode Four workers use.

With L1, there are as far as I know no wage parity requirements at all. There may not even be any requirement that the higher of the two country’s minimum wages be paid (although I think that was proposed at some point, perhaps by the US, many countries oppose it because they feel that high minimum wages in the US would be used to cheat their staffing firms and their workers out of the long delayed payback from globalization.)

Also, laws and licensing requirements have to be changed if they have the effect of acting as a barrier to market entry, even if its not intentional. Basically there are legal standsrds such as ‘no more burdensome than necessary to ensure the quality of the service’ and ‘fair and equitable treatment’.

Its assumed that the indigenous workers in the US will oppose it. Everybody involved clearly has understood for decades that this transition is a very sensitive subject.

Thank you for this fantastic post.

A well-known local private college recently decided to discontinue selling energy drinks like Red Bull on campus, in favor of kombucha and other natural drinks, saying it wanted to promote healthy food. Could they be sued by Red Bull or the other brands they discontinued under ISDS for lost future profits? It’s sad that this is the first thing I thought of when I read it in the school newspaper this morning, instead of “That sounds great!” which was my second thought.

Since this is a private college, they might be immune from ISDS. If this were a state college, then I think they could be sued successfully in an ISDS tribunal.

thanks, good to know

No, they could not be sued.

Note the second word in “Investor State Dispute Settlement”.

The changes in government procurement and the mandatory privatization of a very large chunk of the public sector followed by it being put up for international public bidding means that some huge number of jobs will likely be won by the lowest qualified bidder in the international context. So- TiSA will likely lead to many millions of jobs lost to globalized subcotractors performing their work under L1 visas, , and substantial decrements in wages for those who manage to hold on to their jobs, a real race to the bottom. Obviously, with public spending all being internationally bid on, a large percentage of any spending will go elsewhere, and not back into the US economy.

(For a preview in a related area, see here – http://www.iatp.org/blog/201602/obama-undermines-climate-efforts-in-solar-trade-dispute )

Wages here will be forced down. That is unless we totally automate everything! Which will create significant numbers of good very high skill jobs somewhere, but not ones that most Americans could do within a few years. And they may be in other countries. Wherever the hardware used comes from.

To get any job, Americans will need an advanced education like never before.

The only place this deal can be stopped is in the US – nobody else has a realistic option once their Government has already signed off – but since Obama is so determined to proceed even knowing nobody anywhere likes this thing, I have to believe it’s a lot more important to the US than simple GDP or ‘jobs’ – or even the exorbitant gift it is to corporations for this or that sub-clause to appear. It goes deeper than that.

It’s about locking as much of the world as is still possible into a US-centric financial/commercial/resource/production bloc capable of a Cold War/World War replay – including Cold War levels of paranoia when it comes to control of information (I expect the Internet to be subject to a form of purge within the first year of passage) – while providing the possible platform for the next level of wealth and power concentration and integration. It is about making permanent for too many an utterly ruinous way of doing things in a world that will soon enough refuse to bear further human folly.

Sundaram’s post is brilliant. It is exceptionally clear.

More, please!

Endnote 1: ” … the treaty must be ratified in all of them before it can come into force”.

This is not the case. A majority, based on a number of factors, of ratification will bring the treaty into force.