By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

The Merchandise World Trade Monitor by the CPB Netherlands Bureau for Economic Policy Analysis, a division of the Ministry of Economic Affairs, tracks global imports and exports in two measures: by volume and by unit price in US dollars. And the just released data for January was a doozie beneath the lackluster surface.

The World Trade Monitor for January, as measured in seasonally adjusted volume, declined 0.4% from December and was up a measly 1.1% from January a year ago. While the sub-index for import volumes rose 3% from a year ago, export volumes fell 0.7%. This sort of “growth,” languishing between slightly negative and slightly positive has been the rule last year.

The report added this about trade momentum:

Regional outcomes were mixed. Both import and export momentum became more negative in the United States. Both became more positive in the Euro Area. Import momentum in emerging Asia rose further, whereas export momentum in emerging Asia has been negative for four consecutive months.

This is also what the world’s largest container carrier, Maersk Lines, and others forecast for 2016: a growth rate of about zero to 1% in terms of volume. So not exactly an endorsement of a booming global economy.

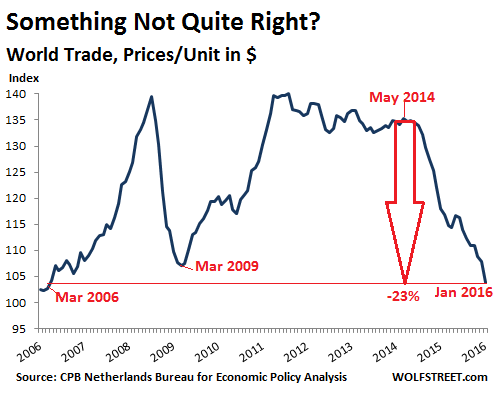

But here’s the doozie: In terms of prices per unit expressed in US dollars, world trade dropped 3.8% in January from December and is down 12.1% from January a year ago, continuing a rout that started in June 2014. Not that the index was all that strong at the time, after having cascaded lower from its peak in May 2011.

If June 2014 sounds familiar as a recent high point, it’s because a lot of indices started heading south after that, including the price of oil, revenues of S&P 500 companies, total business revenues in the US…. That’s when the Fed was in the middle of tapering QE out of existence and folks realized that it would be gone soon. That’s when the dollar began to strengthen against other key currencies. Shortly after that, inventories of all kinds in the US began to bloat.

Starting from that propitious month, the unit price index of world trade has plunged 23%. It’s now lower than it had been at the trough of the Financial Crisis. It hit the lowest level since March 2006:

This chart puts in perspective what Nils Andersen, the CEO of Danish conglomerate AP Møller-Maersk, which owns Maersk Lines, had said last month in an interview following the company’s dreary earnings report and guidance: “It is worse than in 2008.” [Read… “Worse than 2008”: World’s Largest Container Carrier on the Slowdown in Global Trade.]

But why the difference between the stagnation scenario in world trade in terms of volume and the total collapse of the index that measures world trade in unit prices in US dollars?

The volume measure is a reflection of a languishing global economy. It says that global trade may be sick, but it’s not collapsing. It’s worse than it was in 2011. This sort of thing was never part of the rosy scenario. But now it’s here.

The unit price measure in US dollars is a reflection of two forces, occurring simultaneously: the collapsed prices of the commodities complex, ranging from oil to corn; and the strength of the US dollar, or rather the weakness of certain other currencies, particularly the euro. It didn’t help that since last summer, the Chinese yuan has swooned against the dollar as well. So exports and imports from and to China, measured in dollars, have crashed further than when measured in yuan.

And these forces coagulated at a time of lackluster global demand despite, or because of, seven years of QE, zero-interest-rate policies, and now negative-interest-rate policies. It forms another indictment of central bank policies that have failed to stimulate demand though they have succeeded wonderfully in stimulating asset prices, malinvestment, and overcapacity.

World trade in goods is just one factor in the global economy. Now the global financial sector is getting hit too as the artful QE bonanza is bumping into real-world limits. And for global investment banking revenues, a key income source for “systemically important” banks, it has been one heck of a terrible first quarter. Read… The Big Unwind Hits Investment Banking

It boggles my mind that people insist that the economy has fully recovered.

Which people?

I provided a list, but Skynet seems to have eaten it. Short version: NBER, BLS, S&P index. They’re all wrong, of course.

Poor analysis: collapse of commodity prices.

Lack of demand causes a collapse of prices.

Not a mention of the inequality gap, and it’s consequence, a demand gap.

Unwinding of financial leverage used with commodities is more relevant at this juncture… than demand… unless you want to argue it supplied the demand over use in the first place….

Although I generally agree, I think the lack of demand didn’t just show up, it’s been here all through the GFC, but has been masked by the leverage allowed/encouraged by QE and now the chickens are home to roost, pension funds, insurance companies, and of course most importantly banksters need the rates to rise but that will kill someone else. I also wonder about the impact of healthcare spending on final demand. Another program to save an industry from cutbacks, the ACA forces the population to subsidise the health care sector at the expense of other sectors because unlike gov’t budgets, household budgets are constrained by wages so I agree with skippy that the trouble is on the supply side (as in supplying loans to stimulate demand, which works until the malinvestment is exposed, as it is now)

The ZIPP did not boost consumer demand. It provided money for speculation. The lack of a demand driven fiscal policy let to a monetary speculation bubble. The root cause was still a lack if fiscal stimulus (keeping people in their homes, housing the poor, and paying welfare to the poor).

We need to focus on root cause, not intermediary attempted fixes and their consequences.

A decade ago, I dropped out of the economy. Even if I had the income, I wouldn’t joint it again. I buy most everything used. I’m finding that genuine antiques were actually a far better value than imported crap. I can’t afford to live in the neo-liberal dream of the market “always going up” (thank goodness).

Nature needs more conscientious objectors.

That’s pretty much what happened to me too, and what I was driving at in the above reply. Before the GFC the cost of everything was too high, remember dark lord cheney’s proclamation that the economy could withstand $4/gal gas? I worked constantly back then and scraped by mostly unsuccessfully, but you don’t just up and die when there’s not enough money, you don’t pay the least impact bills, etc…eat crappy food on the fly for lunch, shop at goodwill, watch free tv, etc. So in ’07 I started to change everything, got a high mpg car and started renting trucks, basically switching that cost onto the customer where it belongs, got a cheaper place to live (not possible now seattle is comical on that front) and reduced my demand and like you don’t want it back, wouldn’t take it, it wasn’t that great. It’s still pretty bad now just for different reasons, and I’m grappling with the anguished thought that if hillary wins it will double down on worse, almost like she’s the final piece in the puzzle for the globalist cartel. A world wide web of evil controlled from wall st, leading to the worlds first trillionaire.

Is the second sentence mis-spelled, or are you saying that you can’t afford to smoke pot any more?

Oh, shit….. thx for catching that, it was definitely a typo

As consumables go, water > rolling papers.

“I buy most everything used…” Speaking as a confirmed thriftshopper myself, this is a feasible approach only so long as enough other people buy stuff new and then donate it sometime later. A person can do this, but not a whole society.

What we need to do, however, is stop obsessing about growing the economy, and instead find ways to create a steady-state economy.

Easy-peasy. /sarcasm

Noni

As long as there continue to be estate sales, there will continue to be items of value at thrift stores and consignment shops.

Mmm, good stuff at the thrift stores has dried up considerably since the GFC. People hang on to stuff longer, sell rather than donate, and Goodwill et al. sell the better stuff online. The same with our local (and very good) Flea Market. I only became a reseller after ’08, and I wish I had been doing it for the past 30 years. Used to see incredible stuff.

So, do I have to hurry up and load up my Amazon cart with more cheap stuff or will the Engines of Production keep spewing out crapified “possessions” until the fokking planet looks like the world of WALL-E? http://m.youtube.com/watch?v=ZisWjdjs-gM

The Economy needs more conscientious objectors.

Whenever we get rid of something that someone else could use, repair or cannibalize, we put it on TOP of the garbage can. Tape the manual and any instructions to it.

It’s gone before the trash pickup.

We grab useful stuff from the neighbor’s trash and donate it to thrift stores.

Learn about your local thrift store. Use it and donate to it.

I watched exactly that in action a month ago. A neighbhour across the ‘alley’ behind us cleared out his work shed. Piled it all up in the back for the weekly ‘large’ trash collection late one evening. Being sleepless, I watched overnight as a quite large cohort of ‘scavengers’ picked that pile down to nearly nothing. Everything from beat up ’70s Nissans to new Avalanches paraded by, slowed down, occasionally stopped and picked something up and then drove on. It made me want to have a copy of Aaron Coplands “Music For A Great City” playing in the background.

I’ve been known to “Dumpster Dive” for my own use.

It’s really the theme for Easter, after all: “Everything that is old will be new again.”

In Toronto we have what we call here “neighbourhood recycling”. People put usable stuff out a day or so ahead of garbage collection (weather permitting) sometimes with notes, eg, “works”, “needs power cord” or, once, “bedbugs” — needless to say, we avoided that one. People who need the stuff take it, and other people collect it up and sell it on CraigsList or Kijiji. It doesn’t get trashed. We also have Freecycle — like Craigslist but all free. Works very well, so much, *soooooooo* much usable stuff gets taken to the dump, that is wrong in so many ways. I have a bunch of nice vases, dishes, cutlery, a lawnmower (push-type), some really nice lamps, my squeeze mop, the Wellingtons (rubber boots) that I have worn for the last two winters and a gorgeous oak and chestnut burl veneer headboard ca 1880. Most of my crockpots (without lids) came from neighbourhood recycling after yard sales; the lids came from the aftermath of other yard sales. Oh, and a really cute little desk, maybe 1860, that is now my sewing table — the sewing machine, I don’t have to tell you, picked up off the curb.

And the kids’ plastic slide and the pool that are now our little backyard pond and ‘stream’, the storm door, the iron table frame that will become a potato-growing container this spring, the garden chairs and the little table (they don’t match, but who cares?) and even the cats are all second-hand.

Whoa, no addition to GDP!! Fine by me : ).

I think supply of quality stuff at thrift stores is size related to a large extent, the clothes people grow out of don’t get worn then get donated. Lopez Island dump has a large free stuff area for everything deemed still useful which is cool but I’ve never taken anything with me. i like the archaeological aspect of thrift stores and really like browsing, it’s a get out of the house activity and if you’ve got troubled people it’s a good place to take them, too, lot’s of variety and stimulus and inexpensive as well. Hand sanitizer is recommended. Knick knackery rules ,

You don’t want to go digging in my trash. You’ll come up with un-recycleable plastic wrap crap, dog poop, and used kitty litter. Usable stuff…I HATE to toss out. It goes to Goodwill if at all possible. The main problem (around here) for me is electronics. No convenient place to dump old/dead electronic components. There used to be a recycle computer store downtown but it closed up shop. They would take old electronics, use what still worked, dispose of the rest properly. Now…my car has a pile of broken routers, video cards, memory simms, etc, that I cannot figure out how to get rid of.

I think Wolf always wants it both ways. QE was good for propping up world trade because the dollar was cheaper and it circulated better in emerging economies. But QE has been a failed experiment because the underlying economy got no benefit, just the banksters and traders and high-level middlemen stockpiling commodities, etc. and now that it has been taken away the economy is crashing. No demand because the dollar is expensive. But Wolf does not recommend another round of QE because he seems to blame it for everything. It is to blame for funneling all the money to the banks and corporations – but free market capitalism, Wolf’s truly beloved thingy, is to blame for the depression. So reading Wolf is always an exercise in parsing.

Not sure I follow your line of thought in your comment . I like what Galbraith has to say, drop the word free and just call it trade. The word ‘free’ is a distraction.

I’m glad the word “doozie” is making a comeback. It’s so apt in describing something that is great in its awfulness.

So, we’re bouncing along the bottom. Thomas Palley just pointed out, in Bernie Slanders: How the Democratic Party Establishment Suffocates Progressive Change, http://www.thomaspalley.com/?p=816

“Ironically, a recent issue [of Brookings Papers on Economic Activity] contained an article by elite Democratic economists Larry Summers and Brad DeLong invoking a similar mechanism as Professor Friedman [the U Mass / Amherst prof who ran the numbers on Bernie Sanders’ policies and found a huge increase in employment and GDP]. Summers and DeLong argued a large negative temporary demand shock can permanently lower output: Friedman simply reversed that and argued a large positive temporary stimulus can permanently raise output and growth.”

But, back to world trade. Someone on ZeroHedge has pointed to the collapse in the Baltic index of maritime freight rates a few times the past few months. Me, being the wild eyed radical with hair afire that I am, would like to contrast the sorry picture of world trade, with what might be happening if you abandoned the global trade regime set up by multinational corporations, and began working on building a new world economy that was entirely based on renewable energies instead of fossil fuels:

a crash program of $100 trillion in new construction of:

3.8 million 5-Mega-Watt wind turbines;

49,000 300-Mega-Watt concentrated solar plants;

40,000 300-Mega-Watt solar power plants;

1.7 billion 3-kilo-Watt rooftop photvoltaic (PV) systems;

5,350 100-Mega-Watt geothermal power plants;

270 new 1,300-Mega-Watt hydroelectric power plants;

720,000 0.75-Mega-Watt wave devices; and

490,000 1-Mega-Watt tidal turbines.

Providing all global energy with wind, water, and solar power, Part I: Technologies, energy resources, quantities and areas of infrastructure, and materials

http://web.stanford.edu/group/efmh/jacobson/Articles/I/JDEnPolicyPt1.pdf

Providing all global energy with wind, water, and solar power, Part II: Reliability, system and transmission costs, and policies.

https://web.stanford.edu/group/efmh/jacobson/Articles/I/DJEnPolicyPt2.pdf

We could build a really wonderful future if we could just get rid of the banksters.

“… the QE bonanza is bumping into real-world limits.” Why is it anathema for economists and for human civilization generally, to acknowledge those limits? Must we strain them until they break us by destroying the stability of our planetary ecosystem and the web of life that we depend on? Always more growth — never enough — leads to our demise and it won’t take much longer.

Speaking of used .My old computer died last fall . I salvaged 2 CD/DVD RW/DVD ;CD drives The C: drive SSD and a memory card reader. I had a regional electronics store use my Old parts for new custom built pc . I must 400 to 500 us dollars off the price of my Computer. I will try refurbish my old loudspeakers in the Future. Kudos, to the people who buy used or dumpster driving for used stuff

This post deserves a new comment tag for practical advice surviving post-GFC. I especially like cannibalizing useful parts of older computers for a new custom built. As with TVs with built in VHS slots, critical machine parts often have wildly different useful lives.

Also, the buffet unwanted useful things on the sidewalk on / before trash day let my poor student friend enjoy fine TV when he was otherwise scraping by in Germany in the early 1908s. (No fridges appeared, but the winter was cold enough that the north facing windowsill was enough.)