Lambert here: This piece, given that it’s in essence an argument from the authority of a “model that incorporates new trade theoretic features,” is perhaps best situated in the ramping up of trade deal propaganda we’ve taken notice of lately. Notice the blithe, technocratic dismissal of the electoral process in paragraph two. It does, however, bookend today’s TTiP piece neatly. (Oddly, the second reference, to “Baker, Dean” in 2016, contains a broken link. Here is a working one.)

By Peter A. Petri, Carl J. Shapiro Professor of International Finance, Brandeis International Business School, and Michael Plummer, Director, SAIS Europe. Originally published at VoxEU.

The Trans-Pacific Partnership faces serious a political challenge in the US, with some viewing it as primarily benefitting the wealthy. This column argues that it will slightly favour middle- and low-income US households, while also generating substantial benefits for poorer developing countries. As with any trade agreement, the gains and losses will be asymmetrically distributed, but the gains should permit ample support for individuals adversely affected.

In the fog of the 2016 presidential elections, the US appears to be abandoning 70 years of support for international economic integration. Whether due to a bout of populism, the trauma of the recent economic crisis, or the amplified reach of anti-trade lobbies through social networks, immigration and trade have become prominent political targets. The debate has also taken a toll on the prospects of the Trans-Pacific Partnership (TPP) agreement, inopportunely concluded at this politically charged moment (Menon 2015).

More constructively, the debate has raised legitimate concerns about how TPP would affect vulnerable groups. We explore this issue by collecting results from recent work on TPP by us and other researchers. Much of this work is based on a global computable general equilibrium (CGE) model1 that incorporates new trade theoretic features, including monopolistic competition and productivity-heterogeneous firms, extensive detail on trade barriers and trade agreements, and on linkages between them.

On the whole, the results show significant benefits from TPP. We project member-country incomes to rise by $465 billion (1.1%) and exports by $1,025 billion (11.5%) annually by 2030, when the agreement is nearly fully implemented. The US will gain the most in absolute terms ($131 billion), led by a 9.1% increase in exports, and Vietnam will gain the most in relative terms, with an 8.1% increase in real incomes. But other members will also benefit, with substantial gains estimated for Japan, Malaysia, and Canada. The model suggests modest trade-diversion, with effects on non-members ranging from slightly positive for the EU to slightly negative for China.2

Despite potentially widespread gains, the ratification of TPP is not assured. In the US, opposition has coalesced around purportedly negative employment and income distribution effects. In fact, our results and work by Lawrence and Moran (2016) suggests that TPP will:

- Not significantly affect general employment levels;

- Raise productivity and wages for both skilled and unskilled labour;

- Displace some workers during implementation but also make it possible to compensate them generously from national gains;

- Improve the US income distribution slightly, by raising wages relative to capital returns and lowering prices particularly for low-income households;

- Prevent a “race to the bottom” in labour standards and improve labour rights in several economies; and

- Disproportionately benefit poor countries and labour within them.

Effects on Employment: Short- and Long-Run Considerations

Employment effects are prominent in the TPP debate, even though economists do not usually expect trade policy to change employment levels significantly (Krugman 1993). Rather, trade agreements both add high-productivity jobs in export-related firms and eliminate low-productivity jobs in import-competing firms. However, supporters of the agreement often claim employment gains, while those opposed expect unemployment. Our results project no significant general employment effects. In the long run, we assume that employment converges to normal trends with or without the TPP agreement. In the short run, macroeconomic shocks are of course possible, but the results suggest that significant US shocks via trade policy are unlikely. At the same time, they indicate that some workers will have to change jobs during the implementation of the agreement, and some may suffer unemployment and other significant adjustment costs. These costs have an important bearing on policy and will be discussed below.

Since trade agreements are implemented gradually—many changes under TPP will take ten years, and some as long as 30 years—our analysis is mainly conducted in a long-term modelling framework. In the long run, if the economy’s normal adjustment processes work, shocks encountered during implementation will fade away and employment and savings (which determine trade balances) will converge to fundamental trends. Critics have argued, however, that mechanisms that may have once restored equilibrium are no longer working in the aftermath of the financial crisis (Baker 2016). That view is not supported by data (from the Federal Reserve Bank of St. Louis). Since the exceptionally severe shocks of 2008, the US economy has recovered steadily and has now added 13 million jobs, reaching levels exceeding pre-crisis years. The unemployment rate and a broader variant (U6) that includes part-time and discouraged workers are again at or near levels in pre-crisis, non-recession years.

Macroeconomic shocks due to TPP could generate employment effects in the short run, along the implementation path. For example, if changes in exports and imports failed to offset each other along a segment of the path, they would generate net positive or negative shocks in aggregate demand. But the scale of such effects is likely to be very small in the US. Exports and imports are projected to change by 9% each by 2030, or about 1.3% of GDP. If these changes occur gradually, they would imply annual changes of around 0.1% of GDP. Even these small export and import changes will tend to be balanced by policy design and by exchange rate and other equilibrating forces. Remaining net imbalances are not likely to have perceptible demand effects.

Although general employment effects are unlikely in either the long or short run, structural changes due to the TPP will imply adjustment and transitional unemployment. Research warns that these adjustments can weigh heavily on some workers (Autor et al. 2014). We estimate that the number of jobs affected—in the sense of jobs lost in import-impacted industries and gained in export-impacted industries—could range from 18,900 to 160,700 jobs per year, depending on assumptions about how far structural adjustments extend beyond directly affected firms into other sectors of the economy. Lawrence and Moran (2016), using somewhat different methods, estimate a range of 23,800 to 169,000 jobs. These numbers increase the ongoing flow of employment changes in the US labour market, or job churn. Given 55.5 million job changes in 2014, a typical number for non-recession years, mid-point estimates of the effects of the TPP would increase job churn by less than 0.1%.

Based on worker experiences following layoffs (e.g. Reed 2013), Lawrence and Moran (2016) estimate the cost of employment dislocations due to TPP at 1.4 years of the salaries of affected workers, representing both periods of unemployment and lower wages in new jobs as job-specific human capital is sacrificed. Using this estimate and the national gains derived in our study, they calculate benefit-cost ratios for TPP ranging from about 3:1 to 20:1 (depending on the displacement scenario used) during the agreement’s most intense implementation period. The ratio rises to 100:1 over the full 2015-2030 projection period. However, US experience with adjustment assistance has been spotty, and better policies are needed to improve the fairness and flexibility of labour market outcomes given accelerating change in technology and globalisation. An important class of such policies involves wage insurance (Brainard et. al. 2005).

Effects on Real Wages and Income Distribution

As already noted, our modelling incorporates new trade theoretic features such as productivity gains associated with scale economies, shifts in output toward more productive firms, and gains from access to wider varieties of products. Thus, factor return results are not restricted to the famous Stolper-Samuelson prediction that more trade leads to lower wages in countries like the US. Rather, as TPP increases productivity, it raises returns for all three factors (skilled labour by 0.63%, capital by 0.39%, and unskilled labour by 0.37%). In the US skilled wages make up 60% of labour income and wages overall increase relative to capital returns.

Lawrence and Moran (2016) trace the effects of changes in factor returns and product prices to household quintiles in order to examine changes in the US income distribution. They find that households in all quintiles benefit from TPP by similar percentages, but the middle three quintiles benefit slightly more than the lowest and highest quintiles. On the expenditure side, low-income households spend more on TPP-imported products than high-income households (the lowest quintile spends 8% more than the top quintile). Overall, they conclude that TPP will have a marginally positive effect on the US income distribution.

Implications for Labour in Developing Partner Countries

Fostering growth and reducing poverty in developing countries through market-oriented reforms has been a long-standing global priority for the US and other developed countries. Nowhere has this policy approach been more successful than in the Asia-Pacific, with results that have lifted more than a billion people from poverty. Curiously, however, the role of the TPP in sustaining integration has received virtually no attention in the US, even from some prominent international and development economists. Their commentary, fuelling the criticism of the TPP, has focused almost entirely on current US interests. This is short-sighted, even from a strictly US perspective.

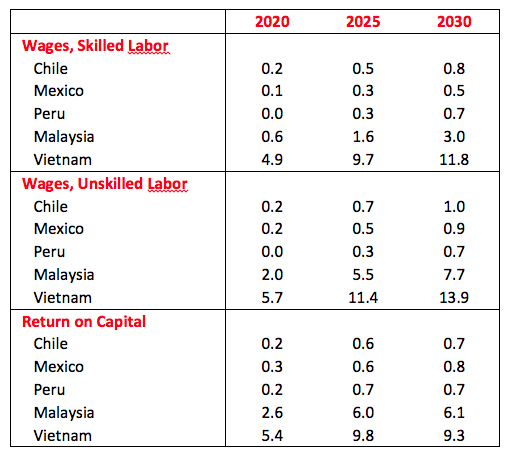

Our results suggest that the agreement will strongly benefit its poorest members, including Vietnam, with income gains of 8.1% of GDP, Malaysia with 7.6%, and Peru with 2.6%. (Effects on non-members, which are negative in some cases, are small compared to these gains.) Several economies also see TPP as a tool for strengthening internal reforms. In addition, as Table 1 shows, in all of TPP’s developing economies unskilled labour would gain the most among all factors of production. In Vietnam, for example, 93% of garment and textile production is semi-skilled- or unskilled-labour intensive, and 52% of unskilled workers are female (see Plummer et al. 2014 and the 2010 National Labour Market Survey of Vietnam). The expansion of such sectors is particularly advantageous in reducing poverty.

Table 1. Changes in factor returns due to TPP (%)

Source: Authors’ calculations. See: www.asiapacifictrade.org

The labour chapter of TPP represents the state of the art in free trade agreements between developed and developing economies. The agreement commits parties to the ILO Declaration on Fundamental Principles of Rights at Work, guaranteeing freedom of association, the right to collective bargaining, and the prohibition of forced labour, child labour, and discrimination. The labour provisions are actionable and their implementation is spelled out in side letters between the US and Vietnam, Malaysia and Brunei, respectively. Such provisions are understandably controversial in developing countries, but they will benefit workers in the long run and, most importantly, enable trade relations to deepen despite rising expectations for labour standards in developed markets.

Conclusion

As are all modern trade agreements, TPP is controversial. But recent opposition in the US has grown especially strong, with concerns focused on the economic effects of TPP on vulnerable groups. Our analysis is reassuring in this regard. The gains from TPP appear to be fairly distributed—labour will gain relative to capital, and cost reductions will favour low-income households. Some workers will need to change jobs, but they constitute a small fraction of normal job churn in any given year, and the national benefits argue for generous compensation for their adjustment costs. The agreement will also benefit workers in TPP’s poorest member countries.

Still, the distribution of gains and losses will be unequal, as is often the case for efficiency-enhancing policies and innovations. This is not an argument against TPP—the ratio of benefits to costs is highly favourable—but underscores the need to manage it. TPP crystallises a central challenge of contemporary economic life; various current labour market outcomes are unfair and, absent more effective policy responses, undermine support for economic integration even in traditionally market-oriented economies like the US.

References

Autor, DH, D Dorn, and GH Hanson. 2014. “The China Syndrome: Local Labor Market Effects of Import Competition in the United States.” American Economic Review..

Baker, Dean. 2016. “Peterson Institute Study Shows TPP Will Lead to $357 Billion Increase in Annual Imports”. Medium. Retrieved from https://medium.com/ .

Brainard, Lael, Robert E. Litan, and Nicholas Warren. 2005. “Insuring America’s Workers in the New Era of Off-shoring”. Brookings Policy Brief no. 143. Washington: Brookings Institution.

European Commission. 2012. 20 Years of the European Single Market. Brussels: European Commission.

Menon, J. (2015), “TPP unveiled”, VoxEU.org, 10 January

Krugman, Paul R. 1993. “What Do Undergrads Need to Know About Trade?” American Economic Review 2 (May): 23–26.

Lawrence, Robert Z., and Tyler Moran. 2016. “Adjustment and Income Distribution Impacts of the Trans-Pacific Partnership”, PIIE Working Paper 16-5, March.

Petri, Peter A., Michael G. Plummer and Fan Zhai. 2012. The Trans-Pacific Partnership and Asia-Pacific Integration: A Quantitative Assessment. Washington, DC, DC: Peterson Institute for International Economics.

Petri, Peter A., and Michael G. Plummer. 2016. “The Economic Effects of the Transpacific Partnership: New Estimates,” Ch. 1 in PIIE Briefing 16-1, Assessing the Transpacific Partnership: Volume 1, Market Access and Sectoral Issues (Peterson Institute for International Economics, Washington), February 2016, pp. 6-30

Plummer, Michael G., Peter A. Petri and Fan Zhai. 2014. “Assessing the Effects of ASEAN Economic Integration on Labor Markets”, ILO Asia-Pacific Working Paper Series, September, pp. 1-54.

Walker, W. Reed. 2013. “The Transitional Costs of Sectoral Reallocation: Evidence from the Clean Air Act and the Workforce”. Quarterly Journal of Economics 128, no. 4: 1787–835.

Zhai, Fan. 2008. “Armington Meets Melitz: Introducing Firm Heterogeneity in a Global CGE Model of Trade.” Journal of Economic Integration 23 (3): 575–604.

Endnotes

[1] See Petri et al. (2012) and most recently Petri and Plummer (2016). The model was developed by Zhai (2008) and is based in part on GTAP data. Additional information is available on www.asiapacifictrade.org.

[2] The simulations assume that 20% of non-tariff barrier reductions are on a non-preferential basis, as in several studies of by the European Commission (2012), often with a higher spillover factor. The rationale is that some agreement provisions—for example, intellectual-property protection, regulatory transparency, trade facilitation—cannot be restricted to members alone.

Oh well, the experts have spoken, thats settled then.

“Productivity increases” is neoliberal speak for layoffs, piling the excess workload onto remaining workers without increase in pay or benefits.

The other way of “productivity increase” is offspring work to slave labor countries. Same work done for FRACTION of pay. Instant “productivity increase”.

In what alternate dimension will the people who lose 1.4 years worth of their lives ever be made whole?

And it’s supposed to be good for low income people because they can buy more imported poisonous crap at dollar stores?

I can’t help but wonder what it’s like to sit in an ivory tower and decide how many lives it’s okay to destroy, but I’m glad I’ll never be in a position to know for myself.

“Market-oriented reforms (are a) global priority for the US in Asia Pacific ….. results have lifted more than a billion people from poverty.” Did I read that right?

This is not the dream of Utopia that the authors espy just around the corner, it purports to be historical – a billion people hoisted from something to something else, who knows what.

Models, models, models: the future is ascertained

Future, future, future: no model is constrained

“Our results suggest that the agreement will strongly benefit its poorest members, including Vietnam, with income gains of 8.1% of GDP, Malaysia with 7.6%, and Peru with 2.6%.”

Quick back of envelope calculations:

Vietnam: 1740 to 1881 dollars per year.

Malaysia: 4680 to 5036.

Peru: 4207 to 4316.

Super-cheap human rentals! Super low labor costs for international corporations!

Question: Are you an international corporation? Are you on the cui bono or cui malo side of the equation?

You are making an assumption.

The devil is in the details. Who will be getting the gains? (I suspect the peasants are not on the list).

This is a general comment about services liberalisation. (good search term- “progressive liberalisation”) For a good description of the economics and what is redistributed- see pages 278 and 279 here

http://siteresources.worldbank.org/INTRANETTRADE/Resources/C13.pdf which is talking about GATS, which is more modest in its aspirations being positive list- opt in- TiSA is negative list, everything in by default, very dangerous- often called GATS on steroids- millions of jobs HERE could be turned into guest worker jobs- the changes wil be just as much or more here than elsewhere- they will mean many Americans will lose jobs ad be replaced by much lower wage guest worker professionals- Mode Four-

Basically, the “movement of natural persons” services deals effectuate a huge redistribution away from the current members of the middle class (not just professionals) in developed countries mostly upward, to large multinationals and staffing firms, Those currently employed in hgh value services lose their jobs, they are framed as being overpaid protectionists- see the foot of page 7 here for how the alleged domestic protectionism is framed- http://www.ictsd.org/downloads/2008/06/dom_reg.pdf

this is a good video on TiSA which also applies to TTIP and TPP, as they all use the same definition of scope borrowed from GATS Article I:3 (b)(c)

https://www.youtube.com/watch?v=GmFzbVVl6iE

Small companies wont be able to compete –

Also, “services liberalisation” pretends to be helping the less developed country service professionals but largely wont, because their employers, the services firms will take most of the profit. Services liberalisation is a means of social control, it exploits the economic situation and sets up a mechanism which clearly will lead to a race to the bottom on wages which helps nobody, but it will maintain the status quo by divide and cnquer, it will pit two groups that have shared interests against one another by design.

It helps perpetuate the longevity of corrupt regimes on both sides of the north south divide by causing economic disruption and loss of income which would be attainable at home were there not corruption.

Oh, but the man says it will “Displace some workers during implementation but also make it possible to compensate them generously from national gains”. Not that it would happen (I mean, f**k the losers), it would just be “possible”.

How can there be productivity increases in Malaysian slave labor?

Half as many slaves (cost of food) same output.

Slaves are not free.

No mention of the possible impacts of ISDS.

If anybody wants to make a case for the benefits of an International Trade agreement for “vulnerable groups”, they’ll need to explain why it will work out differently than NAFTA, or argue that NAFTA was good for working folk whether they realize it or not. Enumerating the results spit out by a model of unknown design ain’t kgonna convince anyone who saw their job move to Mexico in the last 20 years.

Was also put off by the conflation of an anti-trade movement with an anti-inflation one.

And referencing a 1993 Krugman study presumably opining that trade deals have little net effect on employment isn’t very convincing.

Correction to the above: conflation of anti-trade with anti-immigration

Or China. Don’t forget China. Wray is definitely not immune to all of the distortions of perspective that come from spending too much time in ivory towers. He’s definitely a smart guy, and I think his heart’s in the right place, but I don’t think we should be depending on him to do all the critical thinking about economics for us just yet….

There is the magic sentence. Even if we accept that all the rosy predicted gains will be realized, when have the winners compensated the losers from trade gains in the last 40 years?

Only an economist could write a single sentence that casually references “the trauma of the recent economic crisis” and “anti-trade lobbies” in a single sentence and make no connection. And only someone who worships his models above all else could waive away the clear challenge to neoliberalism posed by both Senator Sanders and Mr. Trump as “fog.”

In many respects this feels much like Rogoff’s criticism of Piketty’s work. He did not argue that Piketty was wrong, no it was worse than that, he said that Piketty had no model a cardinal sin in a profession where having a clean model and following it is more important than anything even human lives.

I was going to quote that same line….

“Whether due to a bout of populism, the trauma of the recent economic crisis, or the amplified reach of anti-trade lobbies through social networks, immigration and trade have become prominent political targets.”

It seems the dogs won’t eat the dog food today, here are some ideas why, but we don’t really know what the issue is today.

Also, “reach of anti-trade lobbies through social networks”? Did I miss the slick PR firms wandering the halls of Congress and pressing the flesh to try to torpedo these deals? Are these non-existent lobbyists hiring armies of social media trolls to whip up irrational sentiment against these deals?

This is, to me, the nut of the whole argument. “Free” Trade leads to net gains. However, we have never designed a scheme that actually succeeded in distributing those net gains in such a way as to make everyone better off. This is the aspect I focused on in my recent podcast, which I apparently named after a pre-existing book…

Economics for the Rest of Us — Ep. 1

No, those gains ignore the velocity of money and so are totally lost to society- and devastating to our future world- they concentrate at the top-

Of course, FTAS do not allow anything which might compete with banks for the profitable destitution of the soon to be poor.

Anything that might have the effect of adversely effecting banks and insurers profitmaking off of the misery or slow the race to the bottom they are anxiously awaiting – is prohibited explicitly-

FTAs are all about creating and then milking a global race to the bottom, as quickly and aggressively as possible. Its a race against knowledge, people are figuring out what they d fast, despite their efforts to hide this.

Jobs that pay well are under attack, of course, the deals divide and conquer as best as tyey can- The deals will set up a huge global guest worker system (to increase “consuming nations” trade leverage with the developing world “producers” which can be used to control them. It likely will become a system of near slavery like that in the Middle East within which a growing number of jobs are done by very low wage foreigners who will be captive in their jobs and unable to negotiate for anything, let alone better working conditions. They likely will be paid a quarter or less of what current workers in those jobs make today. In the US they likely will carry L-1 visas.

I think that somebody would have to be very naive to think that the powers that be would not USE the global system for trade in services they have devoted 20 years and likely millions of man hours into planning–

*How can anyone anywhere ever compensate an entire generation of young people for the loss of potentially millions of entry and middle level jobs (as well as a great many top level jobs) which they never will get? or even aspire to!

(Instead we’ll have a ghetto of hopelessness both here and in the countries supplying the workers- but the ever more unequal status quo will be preserved- the whole aim!)

How can you compensate a country for the loss of an entire category of work, instead most Americans will simply be forced into debt and systematically, intentionally forced out of the country, the US will by design, become a redoubt for the very rich, the most right wing country, a place for wealthy extremists to enclose themselves and exclude creative thought or unpredictable ideas. by means of trade deals we will try to remake the rest of the world in our image but that likely will fail, due to our dishonesty with others as much as with our own people.

A good piece of work about the kind of scorched earth world we’re pushing for, kind of a new slavery is Serving Whose Interests?: The Political Economy of Trade in Services Agreements by Jane Kelsey Big parts of it are on the web, its worth looking for. Its about all trade in services agreements and the world of extreme rich and poor they create. Especially disturbing are the US’s policy of waging what amounts to a global war on provision of essentials like public education (and by extension on science itself) and of course, health care. A good place to learn about that are the extremely well written publications by the CCPA, here is an example, this is about the TPP https://www.policyalternatives.ca/publications/reports/major-complications They have probably at least a hundred well written book sized publications on trade deals including tons of info on everything from NAFTA and GATS to TiSA and TPP. Another good source- http://www.Ciel.org has a great deal on TTIP and chemicals and food, and the environment especially.

As you will see, virtually everything said about them is a lie, don’t be fooled!

While you read, watch this video with Sanya Reid Smith about the TiSA- and other services FTAs- https://www.youtube.com/watch?v=GmFzbVVl6iE its one of the best videos on it Ive ever seen. From an expert.

One of the things that irritates me about free trade is the derivation of the name. As many readers know, it comes to us from Robert Peel in 1830s when the British Government was no longer able to raise a revenue from merchants whom it had encouraged to smuggle against Napoleon to the point they felt taxes were optional.

It was rather like today.

Free trade described international trade with no Customs or Excise taxes – the merchants were invited to reduce their prices or take larger profits accordingly and in return they picked up the cost of collecting a new income tax on their workers’ wages.

In light of the impossibility of closing tax havens or administering a fair revenue system today, I think governments should go back to a tax on trade (or turnover, or numbers of employees, anything except profits which is such a meaningless figure)

Why do we (citizens) continue to allow a State-Created entity (corporation) to have more political power than a Nature-Created human?

Same reason why Malia Obama going to Harvard is the number one read story this weekend across the major news sites—-lots of people don’t like to think/rationally debate about the hard topics.

Ignorance is bliss and life’s just easier stuffing your face with cheap sugar/carbs and binge-watching TV—-until you run out of bread and circuses….after that point society has a nasty habit of falling apart at the seams (see 1789, 1848, etc).

Cypher: “HEY..WHAT HAPPENED TO MY STEAK ??”

Benefits of 46 years free trade, adopted by Nixon, proposed by Friedman in USA.

Doubling of those in poverty some sectors of the population.

Trade deficits that look like a hockey stick since 1980.

Prior to 1970 the USA was a creditor nation, were paying down nation debt, even had federal tax brakes, could pay for second longest ignorant war, created Medicare, and build a strong middle class.

What we have now is a nation that is in debt with interest on national debt soon to consume a large part of national income.

Have I been banded from posting?

I have include name and email.

As Yves has pointed out, being a provider of the global reserve currency ensures that the US will be a major exporter of jobs. However, interest on the national debt is not something the Feds need to be worried about (or the citizenry), as all of that debt is denominated in US dollars (which we create) and additionally is a financial asset to those who hold it. See “MMT” for further details…

You all, or I should say we all, are riding in a Ford Pinto with a smoking gas tank while pretending it’s a Cadillac Sedan. This system is so rickety and unstable that it has to take a wilful suspension of disbelief to put faith in it. The reserve currency status thing is just about kaput, and when it’s gone the US will be just another ungoverable third world banana republic with a dysfunctional economy and rotting infrastructure.

aka Haiti

“Still, the distribution of gains and losses will be unequal, as is often the case for efficiency-enhancing policies and innovations. ”

Efficiency of what? Energy and natural resources? It remains to be explained how “economic integration” enhances efficiency of anything. Quite the opposite seems to be the case when long distance “integration” is considered something to be encouraged – whatever for?

They likely mean the total amount of money made but they discount the huge losses to everybody other than them. An example of that would be pages 278 and 279 here- the area around the graphs and the global redistribution of wealth thats described- : http://siteresources.worldbank.org/INTRANETTRADE/Resources/C13.pdf

See how the losses to our whole country’s workers are just shrugged off.

And of course they ignore the fact that automation and exponential growth in technology make those workers likely unable to bounce back – due to the fact that the education and health care and everything else they would need to stay in the game under those circumstances are being systematically privatized – and changing back in the future made impossibly costly – basically irreversible- at the very same time.

These “trade” deals (thats just a phony pretext to gut democracy) are potentially the biggest and most obscenely stupid policy mistakes in modern human history.

Economic integration is basically buying off the poor countries with soon to be poor developed country= though- peoples jobs.

Its to pay back the debt incurred by 20 years of empty promises at WTO

It’s May, oil is roughly 45 and Nasdaq is roughly 5000. Had you bet $5k with the calculus provided, you would be a millionaire, and a billionaire if you had done so when we began at the crash, but all you would have accomplished is removing wealth and further disincetivizing work. The internet has only increased layers in the bread and circus shshow.

San Fran is the ultimate boom bust economy. What kind of moron makes it the prototype for global finance. All that leverage coming out of central banks to inflate RE feudalism with pension backed hedge funds to maintain an actuarial ponzi assigning debt to future generations to maintain the status quo has accomplished what.

Even now, after proving they have connected the global economy into a MAD closed system, they argue that the tech bubble is contained, like the nuclear power plants in Japan are not connected to the ring of fire. By specializing in disease the good doctors have unleashed degenerative disease on the population, because recursive RNA is modular, employing the same proteins in concentration frequencies to produce form, itself subject to PVT perturbation with a unique stem cell clock for each individual.

If you had six classes per day, putting all the nine year olds in one class out of the six wouldn’t be bad, but segregating by age is dumber than segregating by color. And the notion that a teacher, let alone an administration, is smarter than the kids is just bat sh crazy. Because most adults are conditioned to empire is no reason to enforce such compliance on babies in early childhood empire education.

Parenting is distilled to the minority at the end of an empire cycle for a reason. The choice between big public and Big private corporation, profit and nonprofit, Hillary and Trump is false. Kidnapping our kids, confiscating our assets and taxing our income at 100% merely proves that the foundation of empire is insecurity and its securitization is worthless.

And there you have it.

If it is such a beneficial deal with broader benefits for most Americans, then why is it not simply publicly vetted? Say what you will about NAFTA and the effects it has had on Americans (as well as Mexicans and Canadians), there was vigorous, lengthy, and contentious public debate for well over a year.

There hasn’t remotely been a similar attempt to do this with TPP because the power brokers that be know the majority of the American public realizes that they have largely gotten shafted by previous trade agreements. There can’t be a public vetting similar to NAFTA because there is no chance that TPP passes as even white males will largely abandon those among the GOP who vigorously support it.

There’s a lame duck congress this fall.

Yup, they plan to sneak them through during the lame duck, people need to realize that the loss of fast-track was half the battle, it lasts for five more years, and basically the entire future can be locked down in those five years, making it a hopeless situation for generations.

I am sure the plan is – like CAFTA- another midnight vote – feint one way move in the other- thats the deal. Or maybe they will just quietly move it through sooner- Although Hillary will most certainly be as gung ho as anybody could ever image on FTAs- As shown by her real “health care plan” GATS, which blocks affordable health care and education, globally – see http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.405.5725 This is why we should see them as having a lot to hide already. Which they do, they do it well. Every single FTA caused blockage has a cover story attached to it.

Senators and congresspeople likely would not be there if they did not want these corrupt deals- they just want plausible deniability. They want to pretend they did not know.

because of the lying about FTAs effects already, and its covering up, (please read the paper at the citeseer URL above) our government has become increasingly complicit in what amounts to a huge crime. The only way this gets changed is by exposing everything that can be exposed and demonstrating in any peaceful way that can be effectuated to illustrate the huge costs we are paying. For example there have been as many as two million excess deaths due to the big lie on health care, so far. Perhaps twenty years of deliberate dysfunction so that a phony crisis could “demand” the replacement of middle class jobs with a new slave labor economy- justifying that with several phony manufactured unnecessary ‘crises’ – lots of data here: http://www.pnhp.org/resources/pnhp-research-the-case-for-a-national-health-program shows that they already knew what they have been doing again and again would fail. GATS locks them and us in. Its only going to get worse if we give them any slack. They are addicted to lying and we have to say no more. Instead we need to follow the advice at the ends of these two papers- http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.405.5725 and http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.678.59 Now, before its too late-

Jobs and political power are vanishing fast- soon inherited wealth will be most of wealth and democracy will vanish- the people will be invisible soon-

Thank you all, be well!

Take care!

Why peaceful? The only successful revolutions that spring to mind weren’t peaceful. Just sayin’.

Now that our betters no longer care to maintain even the pretense of democracy, all bets are off. Allow me to illustrate: imagine ghandi tries some peaceful resistance in say, Saudi Arabia. What do you think happens?

Not a word on “Regulation Harmonization” and “Investor State Dispute System”.

Summary: Trade is good for you Peasants, So there.

Without enumerating who exactly gets the “gains” and who exactly gets the “losses”.

and this wonderful line:

Please describe the law, tp be passed as an integral part of TPP passage, which guarantees this program.

I can’t say I’m impressed they have a model and they can interpret its results to mean exactly what they wanted it to say, that the results aren’t all bad for American workers, because, after all, the same was said about NAFTA, but with even greater projections of prosperity being bestowed on America. I guess it’s good the powers that be realized they need to dial it back this time around, given the screwing NAFTA inflicted on America.

Cutting through the gilded B.S. that is the article, the authors’ retort in defense of TPP, in playground terms, boils down to: “Is so!”

No, it is not.

But as we all know, the real purpose of this steaming pile is that it was created to be quoted authoritatively, to give members of Congress and the President something to more to cite and use to defend their vote.

Trade Deal propaganda is too polite a term.

The TPP is not a trade deal, it is a corporate empowerment tool to give a few men authority which supersedes national sovereignty. A tool conceived by these few men and which exists solely for their enrichment of themselves, and which is to be imposed on countries over the objections of their populations by corrupted leaders of these countries (and yes that includes Obama).

Where is the authors’ model showing us how much these few men stand to benefit from the TPP? Given our trajectory in the growth of inequality, Isn’t it just as likely that what the few richest will reap from TPP will exceed what everyone else in the world reaps? Of course it will: Is too!

true. I offer:

Trade Candy?

Trade Porn?

Candy is more appropriate. There is noting supposedly attractive to look at in the trade deal.

Trade porn is more apt, due to the copious amounts of masterbatory economic modeling.

Well said! The kleptocrats’ hubris has grown to the point where they feel they can dispense with subsidizing the political classes of various nations through bribery. Their insane vision is of a world in which there is no law higher than that of guaranteed profits for them. A priestly caste, of corporate lawyers, will “harmonize regulations” for the new pharaohs– who will delight in lording it us over the rest of us.

This must never come to pass! The proposed TPP/TTIP/TISA regime, if actually installed, would make Orwell’s dystopia seem like the land of the Smurfs.

It’s all about maintaining RE inflation from the global cities out, and a small income gain is a step backwards relative to the agenda, creating magnets for stupid. With or without consent, law or no law, judicial reinterpretation or not, feudalism must have RE inflation, and the majority will learn nothing about power generation, the control of which enables stupid.

You are missing 2 important point, one historical, and one current:

Tariffs do not appear to impede economic growth in an economy. One only need look at Hawley Smoot, which not fully repealed to (IIRC the late 1940s), or the fact that all of the major industrial powers to make it out of the “Middle Income Trap” did so with high tarrifs.

Trade barriers to real goods have been reduced to the point where they are irrelevant.

What the TPP is about is to allow rent seeking activities, Patent, Copyright, Finance, Speculation, and Insurance to dominate the trade equation.

Allowing the MPAA to go after a file sharer in Singapore, or allowing teh Martin Shkrelis of the world to extract their unearned pound of flesh is not a plus to the general weal.

TPP will wok out, our models tell is it will, and they are always correct. so ignore what your life history has shown you so far, as that doesnt mean any thing

The utter devotion and fealty the Obama regime is showing to its corporate masters deserves an obligatory mention here. True it may be passé already, but with the prospect of a Clinton pridency looming it should never be ignored; I’m sure you all here are just as eager as I am for Obama’s legacy to be continued, which Clinton would not only guarantee, but double down on.

Globalism is based upon trade arbitrage via leveraging the wholesale preferences of a developed nation with the exploitative advantages of slave production Over 50% of trade is recycled imports via transnationals producing from outsourced slave sites . Accordingly, a lifted tariff is actually an inverted tariff by which the same monopolies that were protected from Asian dumping in the Seventies are now being protected from the costs of developed-nation production via stealth dumping.

Beyond the linearized perception management of neoliberal propaganda, America is subsidizing an illegal dumping practice against itself via mercantilistic trade circularity. Free trade is perceived as flat competition between nations, when in reality it was devised via systems theory for market rigging among an international investment order. All swindles are conceived from systems thinking: the good ones never reveal a perpetrator, and the best ones never reveal a crime.