Yves here. Of course, if we still had revenue sharing, implemented by the great American socialist Richard Nixon, the weak states would be in better shape. Nixon recognized that the Federal government could collect taxes more efficiently but that state and local governments had a better grasp of their priorities and needs. He had the Federal government gives money to states with oversight to prevent corruption and self-dealing. The argument for revenue sharing became even more compelling after Nixon took the US off the gold standard in 1971, but Reagan abolished the program.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

During the Financial Crisis, it was California that made the headlines with “out-of-money dates” and fancy-looking IOUs with which it paid its suppliers. The booms in the stock market and the startup scene – the state is desperately hooked on capital-gains tax revenues – but also housing, construction, etc. sent a flood of moolah into the state coffers. Now legislators are working overtime to spend this taxpayer money. Gov. Jerry Brown is brandishing recession talk to keep them in check. Everyone knows: the next recession and stock-market swoon will send California back to square one.

Now Puerto Rico is in the headlines. It’s not even a state. And it’s relatively small. But look at wild gyrations by the federal government and Congress to deal with it, to let the island and its bondholders somehow off the hook.

But Puerto Rico may just be the model. Big states are sliding deeper into financial troubles, particularly New Jersey, Connecticut, and Illinois.

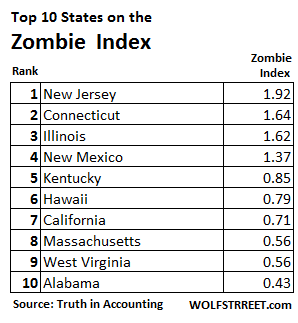

These three states hold the top positions in the “Zombie Index” that Bill Bergman, Director of Research at Truth in Accounting, developed two years ago. California has dropped to 7th place. Whew!!!

The Zombie Index for the 50 states is based on three main factors:

- Truth in Accounting’s “Taxpayer Burden” measure of state finances

- The timeliness of state financial reporting

- And the share of total debt effectively “hidden” off the balance sheet.

This “taxpayer burden” is not a reflection of actual state taxes paid, but of the state’s total liabilities per taxpayer – such as outstanding bonds and loans and off-balance-sheet liabilities such as for pensions.

In explaining the Zombie Index, Bergman writes in his article, “Zombie states deteriorating faster and further”:

The index is named after a term coined by Ed Kane, professor of finance at Boston College. Kane wrote two books warning us about the S&L crisis back in the 1980s and early 1990s, before we knew what hit us. Kane used the term “zombie bank” to identify insolvent firms that were allowed to stay open by regulators, frequently with the aid of false regulatory accounting principles that delayed the recognition of insolvency.

Many of these firms ended up “gambling for resurrection,” in Kane’s terms, and these incentives ended up trebling the cost of the S&L crisis when many gambles went sour.

In an article two years ago, when Bergman introduced the Zombie index, he wrote:

Kane’s careful history indicates that this risky behavior and the financial conditions of these zombie banks were hidden by less-than-truthful accounting practices. There are alarming parallels to the financial crises faced by many state and local governments today.

These questionable accounting practices have allowed hundreds of billions of dollars of pension debt to accumulate outside governments’ audited balance sheets.

This state of affairs is all the more ironic in light of the balanced-budget requirements that are widespread in state and local governments. Government leaders regularly proclaim their fidelity in living up to the spirit of these laws. But false accounting practices have allowed real expenses (and debt) to accumulate anyway.

Taxpayers and citizens have been left in the dark.

So here are the top ten winners on this honorable Zombie Index:

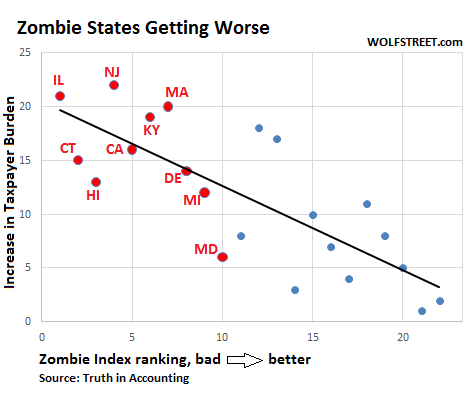

Based on the 2015 financial reports that are now available, Truth in Accounting did some digging and found two trends:

- Larger states tend to show greater deterioration in their “Taxpayer Burden” from 2014 to 2015, as well as from 2009 to 2015.

- And states ranking high on my Zombie Index have been getting worse, as well.

Here’s a chart of 22 states for which Truth in Accounting analyzed the 2015 financial results. It compares their five-year average Zombie Index rankings (so not the most recent rankings as in the table above) to the change in their “Taxpayer Burden” from 2009 to 2015. It shows that the worst states on the Zombie Index (red markers, 5-year average rankings on the Zombie Index axis) are also those states whose “taxpayer burden” has increased more (left axis).

Bergman paralleled these trends to the current “regulatory issues in banking”:

Sadly, and perhaps alarmingly, these findings may point to a “too-big-to-fail” problem in state government finances, similar to a TBTF problem in banking. We may have a significant moral hazard problem operating, if larger states are assuming their failures may be cushioned by federal resources.

Especially if Uncle Sam has already been pursuing, in the words of the Financial Report of the U.S. Government, “unsustainable” fiscal policy.

Politicians can kick the can down the road for many years. It works for an amazingly long time. They can adjust accounting practices to where the biggest problems – such as obligations related to pensions and other retirement benefits – are neatly swept off the balance sheet and thus out of the public eye.

So politicians cycle through their offices, and they’re kicking the can happily down the road for someone else to kick down the road even further. But at some point, they’re going to run out of road. And then, like the S&Ls, they may end up “gambling for resurrection.”

They’re already doing it: For example, governments are issuing “Pension Obligation Bonds” – they’re borrowing money from Wall Street to fill the holes in the state’s obligations to the already underfunded pension systems, and they’re gambling that total investment returns are 7.5% for evermore, even after the most phenomenal stock, bond, and real estate booms in memory.

And then, much like the banks, they’re counting on a bailout from the Federal government or better yet the Fed. Because who can stomach seeing Illinois go bankrupt?

Now subprime mortgages are moving into the crosshairs of regulators, who’re fretting about “astronomical” default rates. Read… NY Fed Warns about Booming Subprime Mortgages, now Insured by the Government

I for one am shocked that New Jersey turns out to use shady accounting practices. Nothing in that state’s history prepared me for that.

I have been a fan of Sheila Weinberg and Bill Bergman at Truth in Accounting for a number of years. I spoke at their Chicago Pension conference several years ago. They uncover lies in accounting from politicians of both parties.

The general public has close to zero numeracy and is completely clueless about something like pension accounting so it’s hopeless to expect any meaningful degree of public understanding of these issues.

As a former Illinois resident, I’m not terribly surprised. Disappointed, but not surprised. The fiscal mess there is decades in the making. It is bipartisan, so an honest evaluation affixes blame all around. Even more frustrating is that the new idiot Governor is using the budget crisis to strongarm neo liberal policies which attack ordinary working people while avoiding any semblance of dealing with the 800lbs gorilla; namely the underfunded pension system.

I think actual defaults are going to have to happen before the folks in Springfield actually make any progress.

Weinerdog43: Agreed. The Democrats control Cook County and have made a mess. The Republicans have dominated state government, and they have made a mess. It didn’t have to be this way: In part, the residents of Illinois are much too passive in the face of corruption. The reality of the two Madigans, Dad and Li’l Lisa, or the Burkes, Eddie the Vandal and Justice Annie, is a signal of how tolerant the voters have been. Then you throw in historic figures like Big Jim Thompson, whose fiscal practices were a version of a game of pretend.

And this is going on in one of the richest states in the union. Northern Illinois, from Chicago to Savanna, Rockford to Peoria, is a major center of wealth.

Nailed it.

It’s the “I’ll be gone, you’ll be gone” principle, ported for government rather than Wall Street.

So the entity in the worse shape, the USG, will be forced to bail out the worst state governments?

HAHAHAHAHA

The right to print fiat trumps everything else in this situation.

Right wing prpopganda. Illinois had no trouble selling bonds despite the political chaos. Illinois like nj us burdened by paying much higher medicaid than states that are just loved by these people like Texas. Toal Illinois debt is 125 billion in a 700 billion economy. We have the mist regressjve tax system in the country so if Ken Griffen wants to leave and pay more taxes in NY it wont impact us much . Illinois does not need revenue sharing it needs the same deal Texas gets on medicaid. But this nknsense is not about facts its about pushing an agenda.

David: And the Rahm/Rauner love-fest? No effect on state finances?

Oh those 2 have waned this cris to shove through union busting and pension cuts. The supreme court ended the pension attacks and there is big split between those two. Rauner is preteding to be a downstate and talking like he is the Scottish national party. It isn’t working he is polling worse than Trump by far.

David, I don’t disagree with your larger point about Illinois and other states paying way more than their fair share of federal taxes, but Illinois’ budget problems are almost completely self created.

For decades, the State government has been using revenue to pay for all kinds of things (often very good things) instead of funding the pension system. It has been going on for decades and both Republican and Democratic adminstrations have done it. Instead of addressing the constitutionally required pension issue, the legislators simply wished the problem away. We are now talking approx. $100 Billion with a B in unfunded liabilities.

Idiot Rauner thinks kicking State employees will fix it. Idiot Madigan thinks big tax increases as far as the eye can see. Meanwhile, the debts just keep mounting. Eventually, something will break.

You are right on everything except Madigan on taxes. He actually hates raising them and has been a big part of the past budget tricks. He finally came around to either a constituational amendment for a graduated tax or a bigger flatvtax with a large exemption. This needs to be done to both pay on pensions and pay for schools and cut property taxes. But Madigan has a property tax business……..

Nailed it

All of the states on the “Zombie States” on Top 10 list except for KY & AL, are states that send way more in taxes to the Federal Government than they get back. Eventually the blood & entitlement vampire states that are all Republican bastions of idiocy will have to get cut off. If NJ could get back most of what it sends to the Dept. of Treasury, the state would be fixable…

Yes

As an obvious Jersey Boy, I totally associate myself with that sentiment. There are lots of great people here in New Jersey, so you smartasses who look upon our troubles with glee can go suck it. You think your state is clean? It’s most likely because you haven’t been looking closely enough. Or maybe your state is being propped up by tax revenues wrenched away from New Jersey residents to fund your little shit show instead of taking care of our inescapable corridor state financial necessities.

I am a worker at Rutgers, and have watched with dismay as administration after administration, Republican or Democrat, with the willing connivance of the legislature, have failed to properly fund the PERS system. Yeah, lots of it has been extend and pretend, and for that I hold them responsible. But some of it is that our enterprise and creativity are being vampirized by Red State crooks working the Federal government to keep their own states’ scams running.

I am the clerk for government documents at Rutgers Law in Camden, and boy-oo, do I ever see some 10-volume House Documents going over my desk reporting some Army Corps of Engineers project, and almost always in a Red State. Funny, I can’t recall such a report on any project in my home state ever being processed by me in 10+ years on the job. Anecdotal? Yes, but not something that you can just poopoo as if it weren’t a reality.

Unlike Illinois the nj supreme court cut your pension. They said the COLA was a loophole. Our supreme court said the retirement benefits are untouchable.Period. Nice but itrelvat that there is a fund. Is Rutgers part of the state fund?

Yes, Rutgers The State University of New Jersey participates in the state Public Employees Retirement System.

Copying this link and pasting into browser will give you the basic document and links to others: https://uhr.rutgers.edu/public-employees-retirement-system-pers

You need to watch https://www.youtube.com/watch?v=TVS6pZBQ9c4 by Harry Shearer and then you’ll be proud to say I am glad that the Army Corps of Engineers comes nowhere near where I live.

The myth that Red States somehow feed more at the Federal trough than Blue States is a persistent one. If you removed military bases and highways from the equation, then I doubt there would be much difference. Interstate highways have a military purpose–moving troops quickly–but are also farm to market roads, which keep everyone’s food costs low. Also, residents of red states are twice as likely as residents of blue states to serve in the military. There are legions of military retirees in Southern states, all getting a check from the Federal government.

The states with the most generous welfare systems tend to be Blue. California has a third of the nation’s welfare recipients.

Why don’t military bases count as part of the Federal trough?

Because they’ve got to be somewhere. You don’t want them around population centers because they’re noisy and dangerous, and the Blue states have too many people.

Yves I was surprised Michigan was not on the top ten list. Maybe because this was done after the bankruptcy of Detroit?

And I don’t expect a bailout by the federal govt; again look at Detroit, no bailout there. Bankrupting the states will be similar to Greece. Slash pensions & benefits, lower taxes, restructure debt to benefit creditors.

I would also like to mention buried in this is another example of why term limits are bad. A politician comes in, passes a bunch of time bombs that will go off after he’s out of office.

Come on yves, I wouldn’t think u would miss such an obvious fleecing of the common folk.

…. the Great National Socialist, Richard Nixon.

There, fixed it for ya!

“…. the Great National Socialist, Richard Nixon.”

Our last liberal President

Gary Wills wrote a book with that descriptor-phrase for Nixon right in the title.

Nixon Agonistes: the Last Liberal

http://delong.typepad.com/sdj/2005/11/gary_willss_nix.html

I was a little surprised to see Massachusetts in the list.

But, once in a while the liberal commies in MA elect a Republican governor, such as the one we have now, Gov Baker who advocates austerity for dealing with the State budget.

https://digboston.com/austerity-budget-baker-hits-students-homeless-poor-everybody-but-the-rich-with-fy17-budget-proposal/

Maybe I shouldn’t be surprised MA is on the list after all.

Last month, Massachusetts passed a proposed constitutional amendment that would crank the state’s maximum marginal income tax rate from 5 to 9 percent:

After all, the smash-and-grab approach is working so well for New Jersey and Connecticut!

And Minnesota. Oh wait…

CT won’t touch big business or rich. Just numerous small taxes on services & purchases. Malloy & dems love their gold coast peeps, god forbid they leave.

The situation in Connecticut is particularly acute because the state is beginning to take on the characteristics of a third world country: (1) Expensive and corrupt bureaucracy in all three branches of government; (2) Deeply regressive tax structure; (3) Extreme disparities in wealth distribution and incomes; (4) Seriously deteriorating infrastructure. Won’t get into questions about public education on all levels ; that’s just too radioactive.

Massachusetts has relatively low property taxes. The eastern part of the state is doing well, and land values are booming.

Do you really think you can stuff that much money in landowners’ pockets and not expect any negative consequences?

Now that zombie states have got themselves in a pickle, the GASB is cracking down with tighter accounting standards:

ERISA requires private pension plans to make up funding shortfalls in 7 years. As usual, governments cut themselves a special, sleazy deal, taking up to 30 years to amortize shortfalls.

We know how to run pension and benefit plans responsibly. But governments refuse to follow their own rules. Now they are drowning in their DIY septic tanks, for which they failed to obtain a building permit.

Illinois resident here. My uncle is mentally disabled and lives at a medicaid-funded nursing home. This kind of shit hurts real people. :(

Ellen Brown has been spearheading the public banking movement. It looks like state banks, which the Bank of North Dakota is the one and only in this country, could solve some or a lot of the financial problems that this article describes. One of the points that the Public Banking Institute makes is that roughly 40% of the cost of running projects or programs, whether government run or private, go towards commercial banks who lend money for these projects. If North Dakota can bypass that 40% cost because they have their own bank and return those savings to the local economy, wouldn’t it be wise for other states to follow suit? There’s more to the story too, such as how commercial and community banking is thriving in ND, contrary to the claims by the banking lobby that state owned banks would kill competition.

What’s the big deal? When the state governments whose Solons have been kicking the can of funding obligations down the road default, the losers/creditors/suckers are workers and retirees. Lambert’s Laws of Neoliberalism will no doubt offer them comfort:

1. Because Markets!

2. Go die!

Pensions in Illinois aren’t touched because most politicians are double and triple dipping in the state pension system.

Hey I got an idea, you go to the computer type in $100 billion and put it in the plus side of the ledger column!. It’s so simple!

Here in Massachusetts the situation is grim indeed. We have all sorts of programs that help. However, we MANDATED that the legislature (and governor) not raise tuition at the state colleges above a certain amount. Their solution: fees. Yes, they have put fees into overkill. These “fees” are the new tuition. So even the scholarship programs from the state that reward high performers on the SAT’s no longer gain any real benefit.

The reason I mention the college fees is that the state government is likely to try similar tactics with all of its other “obligations”. I read some (rather misinformed, imho) people who blamed the workers of automobile companies and teachers for the lack of money in their pension funds. The writers insisted that it was the responsibility (or at least significantly so) of those workers to realize that what they were promised was not going to happen! WHAT???!!!! Pensions are supposed to be funded! Our law-makers allowed these pension funds to be raided by top management! Now people want to force retired people to accept pennies on the dollar for RETIREMENT? How? Teachers don’t even qualify for Social Security!