ZIRP and a flat yield curve are leading to all sorts of imprudent behavior. The latest, flagged by the Office of the Comptroller of the Currency, is profligate commercial real estate lending. The OCC warned that the rise in risky real estate lending is far more dangerous than subprime auto loans, which have been a pet worry of analysts for some time.

The reason commercial real estate lending is so hazardous is banks routinely lose more than 100% of the loan when the projects go bad. Not only do all the loan proceeds go “poof,” but when they foreclose, they are typically stuck with a completed or partially completed project. If it is completely and not fundamentally unsound (say an office building in an up-and-coming area), it’s possible to get a partial recovery. But for a white elephant or a half-finished building, the bank will need to clear the property, which means throwing good money after bad, and is stuck with land plus perhaps some general previous owner improvements (if a subdivision, getting zoning and running in plumbing; in an urban setting, doing the assemblage).

Moreover, commercial properties are idiosyncratic, so liquidating them is also inherently time-consuming.

Finance-savvy readers will notice the signs of froth in the article, such as the far-too-borrower-permissive terms, like interest only loans (!!!) and the fact that the commercial mortgage backed securities market, the normal exit for bank loan originations, was looking toppy a couple of years ago and has recently dried up. From the Financial Times:

A top US regulator has sounded a new alert over banks’ commercial real estate lending, adding to concerns that bubbles may be forming in parts of the country’s property market.

Thomas Curry, comptroller of the currency, used the watchdog’s twice-yearly report on financial risks published on Monday to warn about looser underwriting standards and concentrations in banks’ CRE portfolios….

CRE loans originated by banks in the first quarter leapt by 44 per cent from the same period in 2015, according to Morgan Stanley. Banks’ share of CRE originations has risen from just over a third in 2014 to more than half in the first quarter of 2016 — a record…

“Our exams found looser underwriting standards with less-restrictive covenants, extended maturities, longer interest-only periods, limited guarantor requirements, and deficient-stress testing practices.”…

The impact of low oil prices and the rise of online marketplace lending were “not at the same level of risk”, Mr Curry added.

Banks have pushed into CRE as other lenders — notably capital market investors — have retreated from the market. Issuance of commercial mortgage-backed securities has dropped to four-year lows.

The Financial Times story also discusses a Morgan Stanley analyst report, issued the same day, that argued the party must continue, that if regulators intervened, commercial real estate prices would decline. Gee, to preserve market values, officials must allow likely-to-be-bad loans to be made? How well did that work out in the runup to the financial crisis?

The report pointed out that lending to retail properties was at risk. Given that the US has been overinvested in retail space for decades (even in the early 1990s, selling space per capita was way out of line with other advanced economies, and only continued to grow from there) and bricks-and-mortar retailers have been hit hard by competition from the Internet, it does not take much in the way of powers of observation to discern that lending to retailers is not a smart place to be, unless there is a solid case for a particular property (real estate is always and ever local).

Morgan Stanley also indicated, somewhat contradicting its “regulator back off” pitch, that big banks were already becoming more stringent. But not their smaller brethren:

While two-fifths of banks with more than $20bn in assets said lending standards for apartment blocks had “tightened somewhat”, for instance, only one-fifth of smaller banks said they had…

Morgan Stanley identified 25 institutions that “may face pressure from regulators given rapid growth and high concentrations”. This “could lead smaller banks to pull back on CRE lending, raise equity and/or drive M&A”, said its report

Mind you, these warnings are not new. Wolf Richter pointed out that commercial real estate had started to stall out in the first quarter, which makes it look like Morgan Stanley may be trying to finger regulators for a downturn that was baked in. From a May post:

Commercial real estate has experienced a dizzying price boom since the Financial Crisis. It goes in cycles. Rising rents and soaring property prices along with cheap credit drive up construction, which takes years from planning to completion, and suddenly all this capacity is coming on the market just as demand begins to sag…. That’s when the cycle turns south.

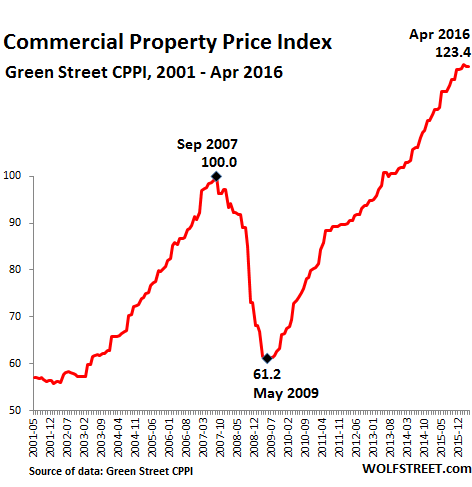

On a nationwide basis, the boom has been majestic. But now, after posting “nearly double-digit gains for each of the past few years,” according to Green Street’s just released Commercial Property Price Index (CPPI) report, “property appreciation has come to a halt.”

The index was essentially unchanged in April from March – actually microscopically down for the third month in a row, after having soared 23% past its prior crazy-bubble peak of 2007.

While there is “no evidence” that prices of Class A properties have fallen, prices of Class B properties “are probably lower than they were at the start of this year,” the report explained.

It’s typical in a downturn in a credit cycle for the weaker borrowers to take a hit first. So the weakness in B properties is consistent with an inflection point.

Keep in mind if that if the OCC’s fears are correct and banks eventually have lots of bad loans on their hands, the result would be a painful regional or national downturn and not a global financial train wreck, since derivatives are not amplifying the exposure to a large multiple of the real-economy lending. But with the US economy showing underwhelming growth and a lot of the rest of the world under deflationary pressures and facing the risk of Brexit-induced damage, even a mere moderately bad problem will have much more serious impact than if they economy was in adequate health.

.

How does a large CRE building program even get off the ground in a flagging economy? (And how did those prices end up 23% higher than in sep ’07? Where/why are they paying such high prices in a market where there should be quite a bit of excess CRE supply already due to bankruptcies? Bizarre.)

Mike Davis points out that real estate depends on a whole raft of laws and tax code give-aways, along with both direct and indirect government subsidize to function the way it does. In many localities real estate is the most powerful lobbying force and forms a “permanent government” along with the dominant political party,the cops, and the DA’s office. Normal economic laws don’t seem to effect them the same way they do other sectors of the economy without that political cover.

You mean like this: https://www.bostonglobe.com/business/2013/07/21/boston-real-estate-developers-line-seeking-for-large-projects-before-menino-departs/v3EueQAzFCqz4blmkaDsyJ/story.html

Deval Patrick after leaving the governorship went on to work at Bain Capital.

But there’s a story about I’m looking for about the biggest Boston real estate developer who got some cloudy days being too close to the last mayor.

The Fish Family own Beacon Hill, and not just Suffolk Construction, the “family” has their tentacles everywhere in Massachusetts. Their no-bid projects are legendary.

and not just Massachussetts. This is a “fictional story” of how they came to Cuyahoga County in Ohio. http://realneo.us/content/fictional-account-why-medcon-came-clevehoga-or-why-mayor-beryl-e-rothschild-got-snookered

The “vertical mall” with the $40 million collapsing parking garage recently sold for $165,000 to a scrap dealer of ill repute from Detroit. Cuyahoga County is as rife with ruin finance porn as it is with photo ruin porn. Thanks to our slimy electeds and their FIRE sector friends.

In a few days, the failing Medcon (our then name for what was hawked a the Medical Mart) will be overrun with the RNC. Despite the fact that an unvoted sales tax increase will continue for 20 years to pay for it, it was a sly underhanded way to get a convention center. So it’s a failing convention center that paid Chris Kennedy (Merchandise Mart/yes of political family) handsomely. Of course, he was just like a subprime lender – happy to give an adjustable rate second mortgage to an 80 year old black woman living in the ghetto off her SS checks – you know, “to spruce up her house.” Kinda like the drug dealers the banks recruited here on the streets in East Cleveland. Crack street sales dropped because the banks invited so many dealers to sell mortgages – “It’s legal they said. And it’s more lucrative.” They were right. The 80 year old grandma got snookered, the mayor of University Heights got snookered and the taxpayers of Cuyahoga County got snookered. Woot!

Lots of hot-shot money managers seeking big quarterly and annual bonuses for placing lots of cash in instruments with relatively high yields … at least until they move on to the next hustle? Of course those piles of cash are from our 401(k) and IRA accounts, not to mention PE and hedge funds (even QE funds invested on banks’ own accounts?), but who in this IBG-YBG crowd cares about ultimate repayment? How could we not be blowing bubbles under these circumstances? Only way I see is creating an economy that produces tangible value from productive investment instead of the still-trendy “financial engineering.”

The Wall St saying goes, “make it on Wall St., invest it on main street.” So the IBG-YBG crowd when it makes it magic retirement number takes those Wall St earnings and buys local just when the economy collapses and they can get choice real estate cheap.

This commentary prompts me to the first sentence of the article:

which I think does not address the real issue: in a deflationary world there is too much money chasing for yields that almost certainly must arise from… what? ZIRP & flat yields are a consequence of the deflationary environment and I think that it would be insane to rise rates in this situation. In other words, what is insane is the economic environment, not the rates.

Were not precisely the very same banks that now cry for higher rates, those that changed their business model from yield management to fee extraction?

“How does a large CRE building program even get off the ground in a flagging economy?”

same way that $100,000 cars are selling briskly when the average car is 10+ years old.

If you’re a very profitable corp. or professional services firm, high rents are not that high when you factor in prime location, views and amenities.

Then throw in rock bottom interest rates for developers.

And since the average rank-and-file worker gets less office sq feet than in the past, a firm can downsize on sq footage, upsize on amenties (and the executive wing), yet still make topline costs look reasonable.

I don’t know about working off the excess supply from the 2007 2008 peak.

I would say how does CRE build up in an asset price inflation which we have again, well, you need an asset to inflate. CAP rates were good for a while, now they’re coming down. The asset price inflation aspect works for San Francisco with the unicorn pens. There’s hiring and new offices and stock promotion, I’m looking at Tesla for example.

I am unsure how long the excess inventory takes to work off. I looked for a CRE reit index to follow the lows and highs but couldn’t find one. I think REITs, real estate investment trusts, mostly invest in commercial real estate of various kinds. There is a Vanguard product VGSIX, Vanguard REIT Index Fund Investor Shares, which hit a low on March 1, 2009, and didn’t take out the Greenspan bubble high until Jan. 1, 2015. It’s only up a buck since then.

It’s an aspect of asset price inflation which also helps make Trump great. Two aspects of asset price inflation occur in the Unicorn Pen of San Francisco. Loss making unicorns still take up grade A office space, Tesla, for example, but have levitating stock prices. This drives CRE. I don’t know why there’s demand in other real estate markets.

In the 10-year period before 2007 the VG REIT was paying out annual dividends/cap gains of 5.5 – 8.5% of its prior year ending asset value, which is a decent, consistent return for a retirement account.

Since 2000 the annual distributions have gradually declined from around 6-7% in early ’00s, to 5-6% over the previous 10 years, to a low of 3.9% last year, but with a cumulative 5-year gain of 44% in the underlying asset value from Dec ’10 to Dec ’15. The VG REIT is up over 12% this year, with perhaps room to go higher as mutual funds grapple with REITs becoming a separately tracked asset apart from “financial stocks,” where they’ve been included historically. Over the years many REITs have been a very good investment compared to some others, especially for investors who actively manage their asset allocation.

As others have mentioned, real estate is an odd asset since its value is largely based on cash-flow expectations (increasing/decreasing rents and vacancies), the amount of easy money floating around, and the generous tax subsidies given to landlords and speculators. With high leverage (debt), even a modest RE gain can lead to out-sized investment returns. For example, if a building with an 80% mortgage increases in value by only 10%, the investors would have a 50% increase on their cash investment, while also receiving very lucrative tax-deductions (based on the entire purchase price) to offset their other taxable income. Investors with a 90% mortgage would have an investment return of 100%.

I am trying to use the reit index as a proxy for the fall and raise in CRE values. The high on the vanguard index was Jan. 1, 2007.

https://finance.yahoo.com/echarts?s=VGSIX+Interactive#{“range”:”10y”,”allowChartStacking”:true}

I get that real estate markets are local, and that we are currently having a little local difficulty here in UK, but this kind of stuff must be significant in the sense that the drivers for blowing up a CRE bubble are exactly the same in UK as in US. Right now about £13bn of UK property funds are currently frozen for withdrawals and their value is being cut.

http://www.euronews.com/business-newswires/3217567-uk-regulator-urges-property-funds-to-treat-all-investors-fairly/

http://uk.reuters.com/article/uk-britain-eu-property-aberdeen-asset-idUKKCN0ZR16E

etc

Quick. Sell it all to the shrewd Chinese investors.

You mean like LKQ buying up all the junk yard chains?

A banker friend tells me that “it’s all relative. Yes standards are looser…than 2009-2012 when the bank markets were locked up completely and developers couldn’t get loans. Yes banks in general have fallen in love with apartment loans.

With that said, due to HVCRE (Google that one), as of the beginning of 2015, banks can no longer lend to development projects without 15% equity (based upon the “as complete value” not the cost…which is actually more stringent in the project up front before the bank advances dime one. Furthermore, developer’s can’t count OPM (Other Peoples Money) toward’s the 15%. So if you have a second mortgage or a government grant behind the first mortgage loan, those funds don’t count for purposes of the 15% equity. (Actually banks can still make those loans but they have a 150% capital charge as compared to a regular CRE loan….so what you find is that banks are reluctant (and in some cases aren’t lending at all)). While the mechanics of HVCRE are convoluted and need some revisions (for example they only permit the actual cost of land to be utilized…so if a developer purchases a plot of land in 1960 for $100,000 that is really worth $5,000,000 today, you’re only allowed to give them credit for $100,000) it’s overall had a positive effect on bank lending and the credit standards. Unlike a bank internal lending policy, it’s non-negotiable. As such, it’s now harder and harder to do deals.

Historical interest rates do provide a risk that projects aren’t going to cash flow going forward and yes big banks are much more stringent on that that others. Many of the big banks are underwriting an interest rate sensitivity of 5.75% or 6.0%. Clearly we aren’t going to have this interest rate environment forever. However, I was saying that SEVEN years ago! If rates go to historical norms overnight, our entire economy is going to be shot not just real estate. As such, I think as usual these claims are a bit far fetched. Small banks are taking more risks on deals that large banks but large banks are way too conservative.”