This is Naked Capitalism fundraising week. 1221 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in financial realm. Please join us and participate via our Tip Jar, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our fifth goal, more original reporting.

Yves here. Note that Ilargi’s original title, Why The Global Economy Will Disintegrate Rapidly, was even more provocative. That’s because Ilargi doesn’t believe that pressures on oil supplies and costs won’t drive a crisis; he believe financial dynamics will do the job first. I’m not on the same page as Ilargi since he treats all debt as pretty much the same, when high levels of private debt, and in particular, household debt, weigh on growth and have the potential to cause crises. Moreover, other resources are also increasingly under pressure, most importantly, potable water. Nevertheless, this analysis below is cogent, and the if you have time, the video is a good way to digest the material.

Even though the dire tone no doubt sound a bit histrionic, collapse experts like Joseph Tainter and Jared Diamond have described how complex societies fail and the trajectory can be rapid. The Mayan civilization pretty much ended after seven years of severe droughts. Tainter’s thesis is that more complex societies have higher energy needs, while at the same time, they exploit cheap and easily accessible energy sources first, and then resort to more difficult to extract and more costly ones. Collapse then result from energy needs rising beyond what can readily be supplied even at higher cost levels.

Note that energy is only one of the resource constraints we are facing. Readers often point out that lower/no carbon sources of energy often require inputs that are environmentally costly, like rare earths, and (as this article mentions in passing) requires other infrastructure…which can be constructed only using current energy sources. Another way of saying that is the marginal EREOIs are not good guides in isolation; we need to think about fully loaded EREOIs too, particularly since the energy and other environmental costs of a transition will be front-loaded.

In addition, I am increasingly of the view that complex societal organization in and of itself may be the problem. This is a thesis Tainter rejects, in that he explicitly rejects culture as contributing to or causing collapse, even though he admits that the elites of some societies have been able to pull themselves out of an impending failure, while others have not.

The problem with complex societies is multi-level and conflicting obligations. Family versus employer. Citizen versus employer. Protecting/advancing your career versus your employer’s demands of and intentions for you (for instance, they put you in charge of a probably-career-limiting “hall of hollow mandates” initiative). If you are a boss or executive, legal duties versus moral obligations (yes, some people still have them) versus profit or competitive pressures. In the US, think of the frequent conflicts between local versus state versus Federal laws.

As Jamie Lannister pointed out in the Game of Thrones:

So many vows…they make you swear and swear. Defend the king. Obey the king. Keep his secrets. Do his bidding. Your life for his. But obey your father. Love your sister. Protect the innocent. Defend the weak. Respect the gods. Obey the laws. It’s too much. No matter what you do, you’re forsaking one vow or the other.

By Ilargi, editor of Automatic Earth. Originally published at Automatic Earth

We have written little on the topic of energy lately, other than related to oil prices going up and down, empty OPEC ‘promises’ to cut oil production, and the incredible debt load threatening to crush US -and Canadian- unconventional oil and gas. It’s a logical outcome of focusing more on finance than energy, because we feel the former has a shorter timeline than the latter. Something that harks back to our Oil Drum days.

But that doesn’t mean that the idea and/or principle of peak oil has disappeared, or that we have completely forgotten it. It has just been snowed under by the financial crisis (and by unconventinal oil and gas). And while we continue to find that the financial world will dump us into a bigger crisis sooner than energy will, it’s useful to look at oil et al from time to time.

Please note: we don’t wish to deny that oil depletion has its own dynamics, but in our view those dynamics will be hugely affected by the financial crisis that is looming big and will strike first. A crisis that, by the way, will affect not just oil and gas, but solar and wind just as much. You can get only as much ‘alternative’ energy as you can pay for, and that is before we even mention solar and wind’s EROEI (Energy Return On Energy Investment).

What the world needs to do, but we very much doubt it will voluntarily, is not to look for other forms of energy to replace oil and gas, but to look for ways to use much less energy (90% or so) while still maintaining societies that function as best they can. We doubt this because man is no more made to volunteer for downsizing than any other species.

The interview below with Louis Arnoux by the SRSrocco Report, combined with an article Louis wrote in July on the site of our old friend Ugo Bardi (is Florence really 6 years ago already?), is an excellent opportunity to catch up on energy issues.

The discussion of energy relative to finance will no doubt continue, and Louis doesn’t seem to have the exact same view as us, but that’s fine, or at least it shouldn’t deter us from listening. This graph from his work, for instance, contains a great depiction of what EROEI really means, and how it works out, and that is important to know.

And yes, we are aware of the contradiction between the provocative title of this post (borrowed from SRSrocco Report) and our own view that it’s not energy that will bring the economy down; the internal dynamics of finance don’t need any help on their way towards crashing the system. But it’s a great title nonetheless.

First, here’s the SRSrocco Report interview, below it you’ll find the article. Note: this is part 1, links to parts 2 and 3 are provided.

Louis Arnoux: Some reflections on the Twilight of the Oil Age – part I:

Alice looking down the end of the barrel

This three-part post was inspired by Ugo’s recent post concerning “Will Renewables Ever ReplaceFossils?” and recent discussions within Ugo’s discussion group on how is it that “Economists still don’t get it”? It integrates also numerous discussion and exchanges I have had with colleagues and business partners over the last three years.

INTRODUCTION

Since at least the end of 2014 there has been increasing confusions about oil prices, whether so-called “Peak Oil” has already happened, or will happen in the future and when, matters of EROI (or EROEI) values for current energy sources and for alternatives, climate change and the phantasmatic 2oC warming limit, and concerning the feasibility of shifting rapidly to renewables or sustainable sources of energy supply. Overall, it matters a great deal whether a reasonable time horizon to act is say 50 years, i.e. in the main the troubles that we are contemplating are taking place way past 2050, or if we are already in deep trouble and the timeframe to try and extricate ourselves is some 10 years. Answering this kind of question requires paying close attention to system boundary definitions and scrutinising all matters taken for granted.

It took over 50 years for climatologists to be heard and for politicians to reach the Paris Agreement re climate change (CC) at the close of the COP21, late last year. As you no doubt can gather from the title, I am of the view that we do not have 50 years to agonise about oil. In the three sections of this post I will first briefly take stock of where we are oil wise; I will then consider how this situation calls upon us to do our utter best to extricate ourselves from the current prevailing confusion and think straight about our predicament; and in the third part I will offer a few considerations concerning the near term, the next ten years – how to approach it, what cannot work and what may work, and the urgency to act, without delay.

Part 1 – Alice Looking Down the End of the Barrel

In his recent post, Ugo contrasted the views of the Doomstead Diner‘s readers with that of energy experts regarding the feasibility of replacing fossil fuels within a reasonable timeframe. In my view, the Doomstead’s guests had a much better sense of the situation than the“experts” in Ugo’s survey. To be blunt, along current prevailing lines we are not going to make it. I am not just referring here to “business-as-usual” (BAU) parties holding for dear life onto fossil fuels and nukes. I also include all current efforts at implementing alternatives and combating CC. Here is why.

The energy cost of system replacement

What a great number of energy technology specialists miss are the challenges of whole system replacement – moving from fossil-based to 100% sustainable over a given period of time. Of course, the prior question concerns the necessity or otherwise of whole system replacement. For those of us who have already concluded that this is an urgent necessity, if only due to CC, no need to discuss this matter here. For those who maybe are not yet clear on this point, hopefully, the matter will become a lot clearer a few paragraphs down.

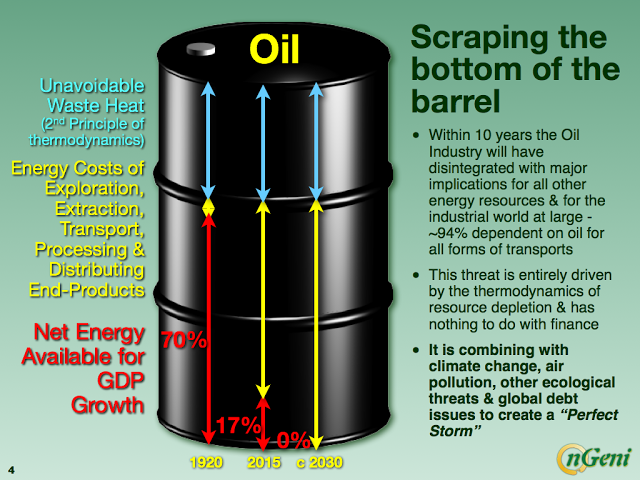

So coming back for now to whole system replacement, the first challenge most remain blind to is the huge energy cost of whole system replacement in terms of both the 1st principle of thermodynamics (i.e. how much net energy is required to develop and deploy a whole alternative system, while the old one has to be kept going and be progressively replaced) and also concerning the 2nd principle (i.e. the waste heat involved in the whole system substitution process). The implied issues are to figure out first how much total fossil primary energy is required by such a shift, in addition to what is required for ongoing BAU business and until such a time when any sustainable alternative has managed to become self-sustaining, and second to ascertain where this additional fossil energy may come from.

The end of the Oil Age is now

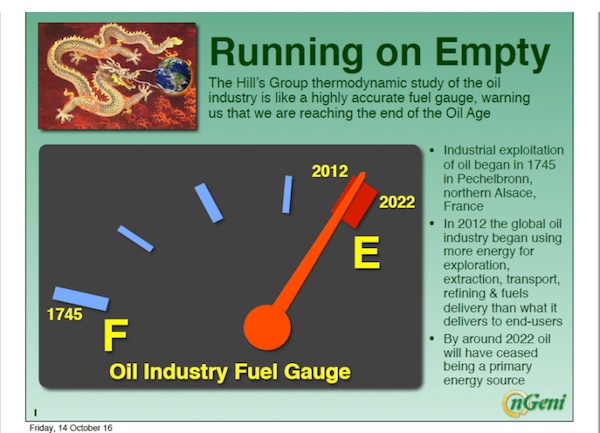

If we had a whole century ahead of us to transition, it would be comparatively easy. Unfortunately, we no longer have that leisure since the second key challenge is the remaining timeframe for whole system replacement. What most people miss is that the rapid end of the Oil Age began in 2012 and will be over within some 10 years. To the best of my knowledge, the most advanced material in this matter is the thermodynamic analysis of the oil industry taken as a whole system (OI) produced by The Hill’s Group (THG) over the last two years or so (http://www.thehillsgroup.org).

THG are seasoned US oil industry engineers led by B.W. Hill. I find its analysis elegant and rock hard. For example, one of its outputs concerns oil prices. Over a 56 year time period, its correlation factor with historical data is 0.995. In consequence, they began to warn in 2013 about the oil price crash that began late 2014 (see: http://www.thehillsgroup.org/depletion2_022.htm). In what follows I rely on THG’s report and my own work.

Three figures summarise the situation we are in rather well, in my view.

Figure 1 – End Game

For purely thermodynamic reasons net energy delivered to the globalised industrial world (GIW) per barrel by the oil industry (OI) is rapidly trending to zero. By net energy we mean here what the OI delivers to the GIW, essentially in the form of transport fuels, after the energy used by the OI for exploration, production, transport, refining and end products delivery have been deducted.

However, things break down well before reaching “ground zero”; i.e. within 10 years the OI as we know it will have disintegrated. Actually, a number of analysts from entities like Deloitte or Chatham House, reading financial tealeaves, are progressively reaching the same kind of conclusions.[1]

The Oil Age is finishing now, not in a slow, smooth, long slide down from “Peak Oil”, but in a rapid fizzling out of net energy. This is now combining with things like climate change and the global debt issues to generate what I call a “Perfect Storm” big enough to bring the GIW to its knees.

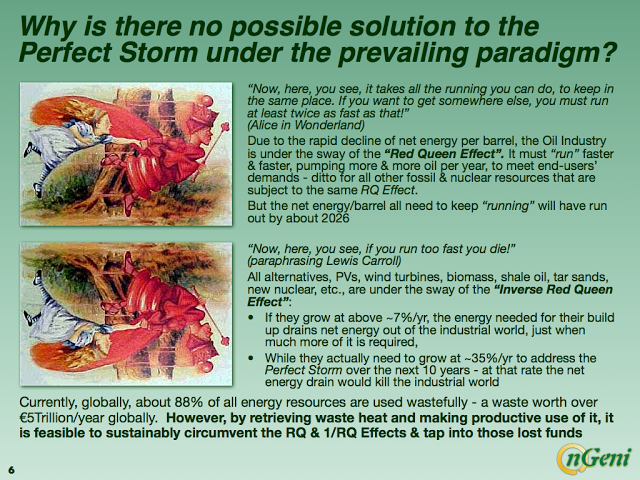

In an Alice world

At present, under the prevailing paradigm, there is no known way to exit from the Perfect Storm within the emerging time constraint (available time has shrunk by one order of magnitude, from 100 to 10 years). This is where I think that Doomstead Diner’s readers are guessing right. Many readers are no doubt familiar with the so-called “Red Queen” effect illustrated in Figure 2 – to have to run fast to stay put, and even faster to be able to move forward. The OI is fully caught in it.

Figure 2 – Stuck on a one track to nowhere

The top part of Figure 2 highlights that, due to declining net energy per barrel, the OI has to keep running faster and faster (i.e. pumping oil) to keep supplying the GIW with the net energy it requires. What most people miss is that due to that same rapid decline of net energy/barrel towards nil, the OI can’t keep “running” for much more than a few years – e.g. B.W. Hill considers that within 10 years the number of petrol stations in the US will have shrunk by 75%…

What people also neglect, depicted in the bottom part of Figure 2, is what I call the inverse Red Queen effect (1/RQ). Building an alternative whole system takes energy that to a large extent initially has to come from the present fossil-fuelled system. If the shift takes place too rapidly, the net energy drain literally kills the existing BAU system.[2] The shorter the transition time the harder is the 1/RQ.

I estimate the limit growth rate for the alternative whole system at 7% growth per year.

In other words, current growth rates for solar and wind, well above 20% and in some cases over 60%, are not viable globally. However, the kind of growth rates, in the order of 35%, that are required for a very short transition under the Perfect Storm time frame are even less viable – if “we” stick to the prevailing paradigm, that is. As the last part of Figure 2 suggests, there is a way out by focusing on current huge energy waste, but presently this is the road not taken.

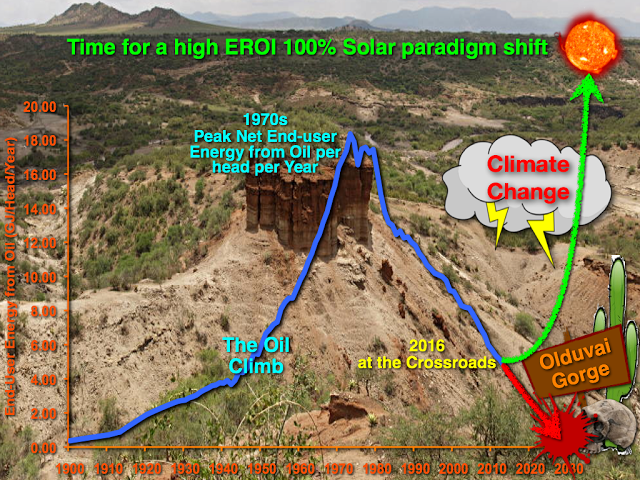

On the way to Olduvai

In my view, given that nearly everything within the GIW requires transport and that said transport is still about 94% dependent on oil-derived fuels, the rapid fizzling out of net energy from oil must be considered as the defining event of the 21st century – it governs the operation of all other energy sources, as well as that of the entire GIW. In this respect, the critical parameter to consider is not that absolute amount of oil mined (as even “peakoilers” do), such as Million barrels produced per year, but net energy from oil per head of global population, since when this gets too close to nil we must expect complete social breakdown, globally.

The overall picture, as depicted ion Figure 3, is that of the “Mother of all Senecas” (to use Ugo’s expression). It presents net energy from oil per head of global population.[3] The Olduvai Gorge as a backdrop is a wink to Dr. Richard Duncan’s scenario (he used barrels of oil equivalent which was a mistake) and to stress the dire consequences if we do reach the “bottom of the Gorge” – a kind of “postmodern hunter-gatherer” fate.

Oil has been in use for thousands of year, in limited fashion at locations where it seeped naturally or where small well could be dug out by hand. Oil sands began to be mined industrially in 1745 at Merkwiller-Pechelbronn in north east France (the birthplace of Schlumberger). From such very modest beginnings to a peak in the early 1970s, the climb took over 220 years. The fall back to nil will have taken about 50 years.

The amazing economic growth in the three post WWII decades was actually fuelled by a 321% growth in net energy/head. The peak of 18GJ/head in around 1973, was actually in the order of some 40GJ/head for those who actually has access to oil at the time, i.e. the industrialised fraction of the global population.

Figure 3 – The “Mother of all Senecas”

In 2012 the OI began to use more energy per barrel in its own processes (from oil exploration to transport fuel deliveries at the petrol stations) than what it delivers net to the GIW. We are now down below 4GJ/head and dropping fast.

This is what is now actually driving the oil prices: since 2014, through millions of trade transactions (functioning as the “invisible hand” of the markets), the reality is progressively filtering that the GIW can only afford oil prices in proportion to the amount of GDP growth that can be generated by a rapidly shrinking net energy delivered per barrel, which is no longer much. Soon it will be nil. So oil prices are actually on a downtrend towards nil.

To cope, the OI has been cannibalising itself since 2012. This trend is accelerating but cannot continue for very long. Even mainstream analysts have begun to recognise that the OI is no longer replenishing its reserves. We have entered fire-sale times (as shown by the recent announcements by Saudi Arabia (whose main field, Ghawar, is probably over 90% depleted) to sell part of Aramco and make a rapid shift out of a near 100% dependence on oil and towards “solar”.

Given what Figure 1 to 3 depict, it should be obvious that resuming growth along BAU lines is no longer doable, that addressing CC as envisaged at the COP21 in Paris last year is not doable either, and that incurring ever more debt that can never be reimbursed is no longer a solution, not even short-term.

Time to “pull up” and this requires a paradigm change capable of avoiding both the RQ and 1/RQ constraints. After some 45 years of research, my colleagues and I think this is still doable. Short of this, no, we are not going to make it, in terms of replacing fossil resources with renewable ones within the remaining timeframe, or in terms of the GIW’s survival.

Next:

Part II: Enquiring into the appropriateness of the question

Part III: Standing slightly past the edge of the cliff

OK, I’ll bite. It’s probably a silly question, but shouldn’t the price per barrel of oil delivered to market be increasing? If it costs so much more now to produce that barrel (and increased use of energy implies higher production cost), then the oil producer should be charging more. A gallon of gas still gets me as far along the road as it used to, whether or not it took more oil to produce that gallon – it’s just that the producer needs to be paid more for it. But the price has been dropping.

I guess my problem boils down to not being able to understand this paragraph: “This is what is now actually driving the oil prices: since 2014, through millions of trade transactions (functioning as the “invisible hand” of the markets), the reality is progressively filtering that the GIW can only afford oil prices in proportion to the amount of GDP growth that can be generated by a rapidly shrinking net energy delivered per barrel, which is no longer much. Soon it will be nil. So oil prices are actually on a downtrend towards nil.“

Simpler: Oil’s “bang for the buck” in terms of GDP growth is shrinking, therefore the price is falling as well. In other words: producers are demand constrained for the amount they can charge. What he doesn’t say is that producers are also chained to existing debt obligations, so they have no choice but to sell at those prices to continue to generate revenues to remain in the game. Absent rising future prices, bankruptcies will be inevitable.

I’m still confused by that first sentence: A gallon of gas still gets me about as far as it did ten years ago, and producing that gasoline probably requires a (roughly) similar amount of high quality crude, so the bang for the buck is similar at that level. The key point being made seems to be (?) that a country like Saudi Arabia needs to “waste” more and more raw crude in order to get that final usable barrel of oil to market (to sell to the refinery). But I would have thought that if Saudi Arabia has a lot of raw crude at their disposal it wouldn’t necessarily matter how much they have to waste to produce that final barrel, as long as they can charge enough to pay for their production costs and make a profit. They will run out of that resource a lot faster, but running out of oil isn’t the focus here…the point apparently being made is that the need to waste more and more crude in order to bring it to market necessarily drives the cost down. Apologies I’m not an economist. I do see your second point about the debt issue, and I understand the points being made below about reduced global demand and a glut, but it’s the first part I don’t get – the connection between a “rapidly shrinking net energy delivered per barrel” (pre-refinery) and the current oil price.

” A gallon of gas still gets me about as far as it did ten years ago, and producing that gasoline probably requires a (roughly) similar amount of high quality crude, so the bang for the buck is similar at that level.”

Today’s oil costs a great deal more to get to your tank than 10 years ago’s oil. While it takes about the same amount of crude to refine gas and other refinery products, to get the crude to the refinery is significantly more expensive and the amount of oil necessary to support the delivery of that crude to the refinery is approaching the amount refined. When those trends intersect, when delivering oil to the refinery equals what the refinery can sell its products for, oil is no longer commercially viable.

Fracking relies on ZIRP finance and a “final fool” logic to stay in production: it cannot cover its own cost on economic merit, requiring instead free money along with other massive indirect subsidies. That is the key point: with out increasing the burden of unpayable debt oil is no loner economically viable, or at best on the cusp of unviability.

When financial losses are eventually allocated, and they must eventually be, oil will no longer be economical: it will cost more to make it than the value of the energy left to sell, this is what is driving the price down.

Thanks…all of that makes sense to me (why production costs are increasing, why the fracking model is in trouble, why the debt is a problem). But the remaining question for me is still why the article suggests that oil prices are expected to drop as a result of the production process getting more expensive and/or the process getting much more wasteful. That should create upward pressure on prices, but prices have been dropping.

Once it takes a gallon of fuel to make a gallon of fuel its’ uneconomic to make fuel that way and the market price drops to zero. This is what we are seeing.

This isn’t obvious because political interference is sustaining a non-economic demand because the shift away from this non-economic mode of fuel making is unthinkable within the NeoLiberal paradigm. Ilargi thinks it may not be possible at all while the powers that be are doing everything from wars to ZIRP to preserve a no longer viable status quo.

Between the TBTF bailouts and ZIRP we haven’t had anything resembling a market for anything capital intensive since 2008. The artifice can be sustained so long as political pressure can resist the intrusion of reality, but eventually reality will intrude.

“Once it takes a gallon of fuel to make a gallon of fuel its’ uneconomic to make fuel that way and the market price drops to zero. ”

– Please explain why the market price drops. I presume the gallon (or nearly gallon) being used is being used by the oil producer, so how does this affect what the market at large wants to pay for it?

Saudi Arabia is not the only supplier… to get total supply we need a lot of higher cost producers which got easy financing thanks to zirp and other factors.

I’m also trying to make sense of this statement with regards to oil prices. My understanding of falling oil prices is that demand is keeping up with output and the knockon effects of many bad loans going into fracking has driven up supply at the same time that demand was flattening or even declining due to global slow downs in markets like the US and China.

Businesses can’t afford the oil price (and other costs) to generate future growth. So they don’t invest in new projects, don’t pass go so don’t buy oil.

Larry,

This is the clearest and most perceptive comment in this whole set.

Start here:

Oil prices near or above $100 a barrel for three years allowed the application of fracking (not a new technology) in plays containing unconventional reservoirs where it had not been economical to do so before. By mid-2014 production from such plays had put so much light, tight oil (LTO, or shale oil) on the market that oil prices began dropping to levels that impeded further production, but production continued: borrowing and issuing shares were used to pay for it. The call went out to Saudi Aramco to restrict production in order to reduce the glut, but Saudi Aramco, having been through this before, replied that those producers who had caused the glut should be the ones to cut production.

Interest rates were very low after the 2008/2009 recession; search for yield eventually led to investors pouring money into “the shales” at about the time that the banks that had been supporting that effort were drawing back, and this is still going on. Meanwhile the global economy has not been putting in stellar performance so demand for crude oil has not been growing rapidly and this has helped keep oil prices low. One result in the US and elsewhere has been way more than fifty bankruptcies and a couple of hundred thousand jobs lost in the oil industry. The LTO producers, many billions of dollars in debt, have been producing what they can in order to create cash flow and keep the lights on; they await higher prices for oil so they can ramp up production and drive the price back down which, of course, they do not want. And OPEC producers eventually decided to join the fun and produce as much as they can, helping to keep prices low too.

Note that EROEI is not mentioned anywhere in this.

EROEI is not mentioned because the oil industry pays no attention to it and in fact I doubt that one in a thousand workers in the industry have ever heard of it. Here’s the reason: Who buys crude oil? I don’t, and I’ll bet a dollar to a doughnut that you don’t either. Refineries buy crude oil. What price do they pay? They pay a price that allows them to sell the refined products they produce to customers at a price that allows them to cover costs and make a profit too. That’s it.

NB: The article mentions millions of oil trades. Those trades do not involve physical oil; they are bets on which way the oil price will change over a stated period of time, and for each bettor saying “up” there is another one saying “down.” The prices being bet on are the ones we see posted as the WTI or Brent prices. One wins, one pays, and the broker earns a fee. You can bet on the outcome of a football game without owning one of the teams, you know. The great cause for sadness is that those prices have come to be built into the pricing mechanism in the oil (and natural gas, I guess) industry.

Demand is being destroyed; colloquially, people are going broke. This is occurring as the cost of extraction (oil “production”) is increasing. Once oil is out of the ground it’s expensive to store, so it must be sold.; plus with so much debt producers need revenue. Remember the three classical economics propositions about responses to resource depletion: 1) incentivize further discovery of the resource (ignores that some resources are finite), 2) find substitute resources (no real economically viable substitute for oil is available), or 3) demand for the resource is destroyed -eventually along with the economy dependent upon it.

DanB,

A small point: The cost of extraction is at a low not seen, maybe, since the crisis in the 1980s. This is because the low oil price has curtailed drilling so the service companies, the ones who actually do the drilling, have cut crews and costs as much as they can, or gone bankrupt.

That’s the only part of your comment I’m referring to.

Once the net energy return on energy invested in oil production turns negative, oil production becomes uneconomic no matter how high oil is priced (at least in theory). Think of it this way: if production of a barrel of oil requires, say, 1.5boe* of energy inputs to find and extract from the ground, oil production is a money-losing proposition regardless of price.

*boe: barrel of oil equivalent

I also do not understand “So oil prices are actually on a downtrend towards nil”

Oil will have continuing utility, for plastics, heating, and transport.

Is this another way of stating that economic activity will trend toward nil in advance of oil price declines?

Even maintaining GDP (assuming the stated zero GDP growth) will require oil production.

One could even make the case that oil will be extracted even when the energy cost is quite high, if a less valuable energy source such as coal is burned to extract oil as oil has useful chemical byproducts and has good energy density for use in vehicles.

Admittedly, some oil will be too costly (“shrinking net energy delivered per barrel”) to pull out of the ground, but not all oil is in that category.

Gold is a product that has had diminishing ore quality for years and the energy cost of finding/producing gold per ounce has probably continued to increase.

Gold has not fallen toward zero because it is more difficult to find/extract than before.

Oil prices trending toward nil seems to imply “economic activity declining toward nil”

Oil production, unlike gold production, is constrained by not only the laws of economics but the laws of physics. Gold production is always economic as long as the gold price is high enough. Oil production becomes uneconomic, irrespective of the oil price, when the net energy return on energy invested in oil production turns negative.

I should add that once the net energy return on energy invested in oil production has turned negative, oil in the ground is worthless (it costs more to extract than it is worth in energy terms). Hence the “downtrend to nil.”

I think you are ignoring “value added” in oil products. Say the accountants priced gasoline high enough to cover the dollar cost of crude oil and the sludgy oil refinery waste product that oil tankers use as fuel. Then then you can be profitable even with a negative thermo balance. You just run out sooner.

Perhaps but said “valued added” factors into the costs of oil production/distribution also.

If it takes 1000 gallons of oil to produce 1 gallon of salable oil products, there may be a price at which oil products are still produced, but the reliance of oil production on the consumption of oil will negate that price demand unless it is being artificially sustained for non-economic financial or political reasons: ZIRP and consumption subsidies come to mind. This house of cards can have more life than we’d like to believe, but it cannot last.

But not all oil supplies will fall into the “net energy return lower than extraction energy invested” condition simultaneously.

Imagine that someone bought a lot of crude oil now and stored it in a tanker or in an easy to extract from natural cavern.

When the supply of new oil drops due to the more energy to extract than oil produces, I suspect the individuals with the stored oil will be able to command a good price for their stored oil.

The utility of the oil does not disappear for plastic use, heating, and transport and I argue this easily available oil would command a good price, not a low “nil” price.

I have some cars that don’t have much utility without oil/gasoline and I will probably be willing to pay a higher price, assuming I have something of value to exchange.

I would be happy to spend nil for this oil/gasoline, but I suspect if oil is nil priced, I’d also have nil exchangeable assets.

The existing low cost oil producers have a similar situation, as they will be able to get a good price when other suppliers are energy limited from tapping into “more energy in than you get out” reserves.

Nil priced oil implies a severely downsized WW economy to me.

True but eventually all remaining oil will.

…and eventually Climate Change will probably disrupt most of what we value now.

In the long run….

Since there is no true “net profit” but only an accounting fiction, the difference is made up with debt (which is now growing exponentially). At the end of the day, we have a gazillion $$ of debt that cannot be paid off. IOW we finally have to own up to the fact that we have been deluding ourselves for too many years with cooked books.

Steve Keen has been talking about a new economics that takes into consideration energy as the basis of an economy and just as in these posts, also the second law of thermodynamics, entropy. Solar energy isn’t a perpetual energy machine either… it seems that even our most conservative approach will one day be too expensive for our civilization and threaten to bring it down because the numbers don’t add up. Brings me to think that part of the problem is expense, i.e. money itself. And all this goes a long way toward explaining why money suddenly stopped having value. Is money the biggest oxymoron humans ever invented?

It does “cost” more in terms of resources required for extraction, on average. However, that is not reflected in cost to consumer at present due to the supply glut brought on by the Saudi price war vs. marginal producers (e.g. US unconventional).

I didn’t see anything in there about coal. It’s my understanding that coal is still very plentiful (compared to oil, at least.) The problem is how to use it without polluting. One idea I read about a long time ago was to build underground facilities to transform coal into hydrogen. Then hydrogen fuel cell cars can run with no pollution.

Even if that idea were feasible, it would still suffer from the same constraints listed above. And of course the environmental impacts simply from mining the coal alone would be monumental.

Ya this perhaps explains the very recent increases in CHinese coal imports and the commensurate rise in coal prices.

You would still need to convert the entire system… this means oil to maintain current system plus more oil to convert.

This is explained in the text!

I think the problem is that the systemic energy costs of carbon capture (which is basically what using coal without polluting means) with fossil fuels are trending toward being greater than the costs of extraction, transportation, processing, and utilization. There is also the problem that we lack the technology and infrastructure to substitute oil for any other form of carbon with regard to transportation, specifically. Basically, the argument is that if we try what you suggest in the current system, we won’t have any energy or resources left to do anything more than mine coal and turn it into hydrogen. We won’t even be able to grow enough food with the net energy left over, let alone build enough hydrogen engines to replace oil/gas combustion engines. That’s why we need a royal crapton more energy for the transition than we are producing.

I don’t see that at all. First, underground would appear likely to increase costs without effectively limiting emissions (which I suppose was the rationale for proposing it). Second, hydrogen is, by weight, a very small fraction of coal, and there have surely been better sources suggested. Third, separating the small quantity of hydrogen from the vast quantity of what was being considered waste would take a huge amount of energy, whatever the process might be, if only because of the need to do something with the waste. This sounds like an idea that came from someone with a lot invested in coal.

You’re right that H can be produced in other ways, maybe sewage or weeds, I don’t know. I do know that some car companies, e.g. Toyota, seem to think the H car will be part of the future, and is offering one for sale now for a mere 57,500 USD, with three years complimentary fuel included. Takes only five minutes to refuel, so it has that advantage over the electric battery car.

H is terrible choice as a energy medium. It’s the Jeb! Bush of the periodic table. Low energy, small, squirmy and leaks all over the place.

It’s been studied pretty extensively, and I’m just relating what the experts have concluded.

It is being used presently. I haven’t heard of any disasters.

And we’ve been using nuclear weapons for 71 years.

So far, so good.

The DOE concluded in the early aughts at least 30% would be lost in transport/distribution and storage.

Then the ways we have of making it now are very capital intensive, expensive and/or not scalable (electrolysis), not an attractive option(splitting water using a nuke reactor) and/or makes a huge amount of co2 .(coal gasification combined with splitting off the co2 gas from H gas)

If we must use land and water to grow energy, there are potentially better options with biofuels.

Well, maybe the D of E was wrong. Wouldn’t be the first time. I’m not a scientist, but Toyota, Mercedes, and Hyundai think the H car will be in the future. I agree with you procurement and storage techniques need to be improved. If that can be done, you have a car that makes no noise, no pollution, with only water as a byproduct.

The car companies were focused on solving their part of the problem – fuel cells. They got that working pretty well, but they didn’t have their eye on the big picture. Making and distributing H is a deal killer. GM was moaning to the USG a few years ago that the government needs to help somehow. The car companies all invested a bunch, and they don’t like seeing the investment be for naught, of course.

Now, there isn’t any single wonderful solution for the energy-climate problem. But we need a bunch of mini-solutions and H was one of the worser ones of what people have been considering so far.

At present some city bus fleets are using H all over the world. They have their own H supply back at the main garage, presumedly, so they don’t have to worry about distribution.

Yup. I recall some news like that. Back 5 years or more ago when I was paying closer attention (this stuff moves at a snails pace), GM was saying that they still needed to shrink down the size of fuel cells so they would be practical in reasonably functional cars. But they said things looked good for buses and long haul trucks.

That is of course the obvious entry point to commercialization because fueling stations are only needed in a limited number of locations, and the application may be less cost sensitive and/or more economically viable.

But that holds true for electric vehicles, natural gas vehicles, biofuel etc….so we are back to making choices.

If low co2 is a motivator – then you need to go back and figure in the whole supply chain footprint. H production is not low CO2 by any means. I don’t have data like that at my fingertips – and its difficult for anyone to generate from scratch. But current world production is 3% from electrolysis and the rest from hydrocarbons – most likely coal.

So if you think you did better with an H bus vs. a natural gas or propane gas or electric bus, I doubt it. Electrolysis takes a huge amount of electricity. Coal gasification first cracks hydrocarbon chains, then separates out the meager number of H molecules and throws away a lot of CO2 ones. Might as well just burn the hydrocarbon.

Oftentimes the decisions in any particular local are made based on availability of fuel. I guess maybe somewhere had a lot of excess coal power plant power and is using electrolysis to make H? Dunno.

The city bus fleets are getting compliments for not polluting the cities themselves, where the air pollution is the worse. If you’re talking about carbon for the whole planet Earth, then I guess you’re right—-there’s no hope whatsoever.

We have cheap clean propane buses here. Been around a long time :)

Most bus fuel cells are burning hydrocarbons, not hydrogen. All the commercial fuel cells require fairly pure

hydrogen fuel to run. However, large

amount of hydrogen gas is difficult to

transport and store. Therefore, a reformer

is normally equipped inside these fuel

cells to generate hydrogen gas from liquid

fuels such as gasoline or methanol or in some cases LPG/Propane. There are cells which directly convert methanol, but have their own issues. Lastly, most hydrogen is produced by steam methane reforming, and so most hydrogen production emits carbon dioxide.

Hydrogen is used to cool large turbo-generators for over 50 years, and there have been hundreds of explosions just in that industry, many of them fatal.

As craazyboy notes, it’s extremely leaky, about 5% of emissions from turbo generators are straight through the steel outer stator walls, and the fires are invisible, smokeless and hard to put out. Hydrogen is extremely reactive to many materials, causes steel embrittlement for example, which makes safe containment a headache til this day.

Coal is abundant, but the financial and energy costs of transforming solid carbon into liquid fuels are very high. Plus the amount of energy per Kg of coal is ~50% less than oil.

Plus coal gasification/liquefaction is a yuuuge source of CO2, with no practical solution for capture and storage. The Sasol plant in S. Africa is the largest point source of CO2 on the planet.

*Sigh*. You have to create totally new infrastructure. I looked at this back in the early 1990s. There was a multi-state mandate that a certain % of all cars sold be fully electric. The laws had to be scuppered because they couldn’t force consumers or even fleet owners to buy electric vehicles. Charging times and costs were a huge obstacle.

I mentioned fully loaded energy costs. The cost of conversion to a new fuel source would be huge and would take a lot of energy from conventional sources to do it.

With hydrogen you don’t have the changing time. Big advantage. Of course H could be sold as an option at some gas stations, just as diesel is now sold at thirty per cent of the gas stations. The tremendous resistance would be from the oil lobby.

Hydrogen is completely different from liquid fuels in terms of handling, transporting, and storing.

Yves’ comments on complex societal organization are very prescient. I think that explains our current gridlock about as well as anything else. Yes, the oligarchs are probably just being selfish, just as they always have been, but the managerial classes, who certainly have the capability to know and do better, are constrained by conflicting obligations such that they’re effectively neutered.

Has anyone else caught any peer reviewed studies referenced in this article?

If you listen to the video, as I suggested, the publication of the article is pending.

Frankly, given what I’ve seen out of academic energy publications, the peer review process is not what it is cracked up to be. That is true in spades for economics.

The key point is in part 2.

We know that GDP depends on energy… this means that each dollar of debt depends on energy.

The argument is that there is not enough oil out there to sustain the GDP required to cover all the promises/debt.

Thermodynamics and the overcomplex system guarantee that debt will default in some form or other.

And free money from QE has temporarily papered over this reality.

that debt will default in some form or other.

The liabilities are for inexpensive fiat so why need they default?

This is certainly disturbing. The one factor we’ve been believing in so far is if we price oil high enough, it will come, and peak oil is delayed. Next, we just need to get pharma products down to the price of aspirin, and we can then afford to drive our SUVs for the foreseeable future. Good enough.

But if we are already thermodynamically negative on producing and delivering oil products, or all fossil fuels(not sure about coal), then that blows the happy scenario right there. I guess if recoverable reserves at any price are extremely high you could go a long time before you hit zero, but they seem to be saying that’s not the case.

More bad news – we run out of plastic too. That right there will doom us. What will we replace that with? Wood, cardboard, paper and metal? You can’t be serious.

Oil is an input so it must be cheaper than the output. For price to sustainably go up, output prices would need to increase.

Also, oil is incredibly subsidized in multiple ways (i.e finance permitted the recent debt frenzy) which hides the true cost of oil as other sectors or demographics get squeezed to keep oil production high and the barrel cheap.

I think we will keep on seeing a growing number of nation, state, municipality, city, group failures to keep oil prices low. Gouging until there are no more lemons to squeeze

I think it’s a battle between which price gouging industry gets all our money.

Don’t think in money terms, think in terms of energy.

For example, in Quebec’s great north, a new diamond mine just started production… considering what we have just read how is this even feasible!

Wasting precious energy to dig more diamonds!!! More subtle but same thing with stadiums, golf courses or new burbs with 3000 square foot houses… Every time we develop these unsustainable projects we are squeezing a group to subsidize another one. If we kept tabs in energy consumption instead of dollar amounts, the gluttony would be more flagrant.

Forget basic income, Every human being should have a right to a basic amount of resources and energy.

i second that

What about other species?

Many are having a difficult time with climate change/habitat destruction.

A good question to ask oneself is if we were all forced to cut our energy consumption by 10%, how would our neighbourhood be affected?

What expenses would get cut first? The changes would be drastic because everything is based on consuming more not less.

Conservation is still the low hanging fruit in the whole mess. Most informed opinion agree we have quite a ways to go there that’s relatively painless.

But as long as we a flogged to “grow”, consume, etc…we are just headed for a cliff, faster.

Our debt overhang is baked in and we can’t stop. Our precious stock PE ratios are sooo dependent on growth expectations and discounting future profits. Clearly, we must die so our markets can live on.

The natives have shown that conservation can mean tipi.

…also have shown that ‘growth” is one in four seasons, and seem to understand that what hasn’t been sown cannot be reaped. And this, without the benefits of advanced abstract ‘magi-matics’, and a seeming visceral rejection of any notion of usury. Would be interesting to know, what the “native” referents for cost, price and value are…

Thank you for making this obvious and neglected point. Having just returned from a cross country trip I can report that at least 75 percent of Americans seem to be driving large aggressive looking pickup trucks or some SUV variant. Also Arthur Berman–whose writings Yves has offered here–has given a different assessment that says oil will remain the dominant fuel well into the mid part of this century. It’s true that US fracking has now become uneconomic but there are plenty of conventional reserves still available in war torn countries like Libya and Iran and the reports of Saudi depletion are controversial. They may be selling part of Aramco because their current scheme of keeping prices low is not providing enough cash for their present militaristic regime.

The truth is that Americans can hugely reduce their energy consumption and only need a price signal to send them in that direction. We drive oversized vehicles, live in oversized houses, fly guzzling jet airliners on a regular basis. It may not be peak oil but rather peak airline and peak McMansion. The gloom and doomers are overstating their case.

Lessening waste, and using whatever energy we have more sensibly might get us through. We squander our resources so recklessly that we may deserve the outcome.

We blew it from Nixon when he pretty much murdered our space exploration program. If we had kept that apace, and even joined with Russia and China we would be well on to having orbiting solar power arrays that would be beaming plentiful, clean electricity down to the surface. We would have no issues with depleting rare earths because we would be getting them from the moon and asteroids, no longer stripping the earth. At this point, to do the same thing would require such a quick and all-in run that there wouldn’t be much energy left for society down below.

We would be able to stretch out the time frame a bit, as well as free up finance, if we would seriously cut our military spending and divert the monies into upgrading the electrical infrastructure and diving into renewables we might get to a point where we don’t face complete collapse (and just need to suck up a major retrenchment). But we CAN’T do this because TPTB will NEVER allow cuts to military spending, will NEVER allow for diversion into altering our entire energy system, and NEVER permit the rejiggering of society towards mass transit and off personal vehicles, NEVER allow for changing our cities into more livable, walkable, semi-self-sustaining entities (vertical farming in skyscraper green houses, for instance). The 1% want their sprawling mansions, their servants, their luxury personal cars and aircraft, and will not tolerate any exit from the ways they get their wealth (via unsustainable extraction of everything and everyone).

If you cut military spending the message sent would be that you lost your superpower position implying the loss of your reserve currency position… so all in all you would lose your money printing free lunch.

I disagree. We are NOT REQUIRED to spend so heavily on the military. We would do much better as a society if we spent MUCH less and used the money to actually productive ends. Our military primarily serves to force the neoliberal order on an unwilling world. Neoliberalism itself is harmful and not necessary, ergo, the military used to enforce/force it upon the world is unnecessary.

We do not lose our “free money printing lunch” by any means. Our govt creates its own money and entirely denominates its debt in that money. It cannot go bankrupt, cannot EVER “run out of money”. All the US govt debt is dispensible and ignorable (except that owed to foreign countries). ALL the debt held by the govt itself doesn’t even exist. You CANNOT owe money to yourself just as you cannot borrow money from yourself. Impossible. As for foreign debt holders, if they get screwed so what? We don’t hold any debt in THEIR currency so we owe nothing. We don’t even need to let foreign nations buy our debt. That itself if a fiction. The money system of the US is currently handled as if it is on the gold standard instead of the fiat system. THAT is the problem. Dispense with the fantasy that US currency and debt must be handled as if we are on ANY commodity-based standard and your dispense with a lot of the fake problem that too many get worked up about.

As so often stated here, the US government is ENTIRELY self-funding. It doesn’t require a single tax dollar OR FOREIGN INVESTOR to fund anything it does. Taxes are ONLY needed to encourage certain social and economic behaviors or to discourage others. That, and to enforce the use of the currency. You MUST pay taxes and you MUST do so in US dollars, thus they always have value. Only state governments REQUIRE taxes to fund their activities because they cannot print their own currency and cannot denominate all their debt in that same currency.

The US is getting more than its fair share of energy in part because of its military and reserve currency status.

You would need to start cutting your energy consumption fast before reducing your military might and losing you deserve currency status.

Catch-22.

Cutting your military is a nice idea but the way your economy has been structured around oil, it’s likely putting the cart ahead of the bull.

If you thought in terms if energy instead of dollars you would see a scenario with the laws of thermodynamics and another one where our money printers are denying these physical laws.

Then you would wonder how long they can keep on defying nature and who will be the winners and losers as they keep on doing this

You can print all you want, at the end the day, the resources will be the stranglehold.

Praedor – Im wondering why then the US govt hasnt printed all their citizens $1 million to solve their poverty?

as for the US govt is entirely self funding …. that is funny.

The US consumes a massively disproportionate share of the world energy and resources courtesy of reserve status (read military power).

Ross & Moneta ask some questions worth answering. Can printing money defy the laws of thermodynamics? Of course not. Yet apparently interest compounding can….;-)…

Shortages of goods are indeed the source of inflation. The Arab’s use of the “oil weapon” in 1973 after U.S. peak oil (1971) is a case in point. There’s no telling whether that situation will reoccur, but it’s a possiblity.

On the other hand, the (non-tree-hugger) Cato institute published a study of 56 hyperinflationary episodes throughout human history. How many stem from cental banks run amok, “over-printing” money? Zero.

So monkeys may fly out of my butt, but I wouldn’t recommend being preoccupied with it. Neither would I recommend being concerned about the government spending too many dollars, at least if history is any indication. Shortages of goods aren’t a current problem, either, yet inflation is on the lips of anyone answering MMT talking points.

Ever wonder why deflation isn’t *ever* brought up in these conversations?

Ross’s question about why government hasn’t printed money to solve poverty ignores the uses of poverty. Debt peonage is a perfect way to enlist people’s own thinking in producing obedience to the creditor class. Just as nature has vultures, human economies have those who profit from poverty, suffering and death. I give you Pete Peterson…boy psychopath.

If the government is funded by taxes, where do people get the dollars to pay those taxes if government doesn’t spend them out into the economy first?

Governments with sovereign, fiat currencies are (obviously) not provisioned by tax revenues. The fact that government spending has been recently dominated by the efforts to rescue the Ponzi capitalists is not structurally necessary, but is made possible by this fact. (According to the Fed’s audits, it produced $16 – $29 trillion to cure the frauds of the financial sector. BTW, where’s the inflation?)

The point of lots of NC’s editorializing is to point out that the possibility of doing the right thing exists, even if public policy pursues nothing like it.

Much of his argument is over my head, which is due to gaps in my education, but it is not helped by the excessive use of acronyms, which kept distracting me from the thread of the argument with the need to remember what that one stood for, or by the prolific and somewhat haphazard use of metaphor. I am sure that his usual audience can deal with all this, but if his object is to make more people understand it would be helpful if he gave more consideration to how he presents his ideas. If anyone can point me to a dry and orderly source that would help me master his basics so I’d have a better chance of following the argument, I’d appreciate it.

I think the excessive use of acronyms is getting out of hand almost everywhere now. The Department of Defense is bad but large corporations have managed to create even more complex sets of acronyms many of which have manifold ambiguities a set of ambiguities multiplied by any sort of cross-specialty discussions. Even the journals in many fields seem intent on turning information into alphabet soup. The jargon makes most specialties into a babel of tongues and the acronyms further help to smoother communications.

Try reading Our Finite World at Warning- the subject matter is complex and the conclusions didturbing.

My issue with this series of articles is not their assertion that the EROEI of fossil fuel energy delivered to the consumer is at or below 1:1.

We at PRI proved that nearly 5 years ago.

My issue is the implied assertion that PV/Wind EROEI is too small to matter.

We at PRI have shown the EROEI of equatorial mounted, roof mounted, fixed PV to be > 58 under real world conditions at Purdue University, and that of wind to be > 35 at white county Indiana. Neither location is the sunniest or windiest in the USA.

We at PRI have shown that nearly 60% or 50 Quads of energy is lost in the process of transformation from well head to actual work performed, that is, of the 90 Quads consumed by the US, only 40 Quads of energy actually reaches end users, and actually operates the economy.

We at PRI are quantitative. We do the math.

We have developed an energy model of the US economy using PV/wind/geothermal/hydro in which the US keeps it’s industrial base, but runs on 20 Quads.

The energy sources use phosphate mining waste, and petroleum production waste as raw materials.

The technologies involved are mature.

But,

No one wants to listen.

Should you want to know more visit http://www.publicresearchinstitute.org

INDY

I checked at the site you pointed to and found two BAD typos with some minimal poking around. The first was a bad path for one the pdfs posted on the site. The second “typo” is in an email address listed on the contacts page for the Delaware branch [enqiries@publicresearchinstitute.org] which I contacted to point out the first typo — at least the email bounced back to me.

Also — first look and quick impression — there isn’t much there there and I immediately missed seeing a fairly obvious piece of content I expected to see. Given the stated purpose of your organization it struck me as “odd” that no case studies were posted — at least I didn’t spot any. Maybe I’m just especially fussy today — but I’m disappointed.

I am currently reading “The Grid: The Fraying Wires Between Americans and Our Energy Future” by Gretchen Bakke. It explains the reasons our electricity grid is going to cause us increasingly problems in the future, and how the more we use wind and solar, the worse the problems get. The Energy Policy Act in 1992 separated electricity generation by law from electricity transmission & distribution.

Any solutions to electricity generation must address these issues that the grid is not ready to handle, nor likely to anytime soon. Talking pv/wind w/o addressing how they affect our deteriorating grid are talking out of school. I welcome anyone who can dispute this since I am not an expert in the field.

Some of the stuff at the PRI site looked like technology appropriate for supporting a small local grid. There are no small number of problems and costs involved with setting up a local grid though. It’s definitely the kind of project that needs a community effort — and those seem to be the kind of projects PRI specializes in. My complaint related to the funkiness of their website and the relative paucity of information to sift through. I did pull in about half a dozen pdfs to scan later. My impressions my change after looking at them — but the web content is very mixed quality at best. — And no I’m also no expert on this stuff.

Link whoring is against our site policy, as is commenting without bothering to read articles in full.

The author clearly states his issue is about transport fuels. Wind power is not used to help drive cars and trucks.

Just keep looking deeper into your reflection in the pond…You might even try kissing it…Aannnnd, you’re gone!

Where’s the data?… We may not like the environmental or geopolitical consequences, but I think there’s still plenty of remaining oil available in the world where the net energy expended in exploration, extraction, transport and refining of the oil are less than the net energy derived from that effort and that oil is available for sale to third parties. IOW, the marginal revs will exceed the marginal costs over the 10-year time horizon discussed in the article. I don’t think the primary constraints are geological nor monetary in nature. In my view resurrection of the “Peak Oil” meme in its various forms does a disservice to those who are attempting to get governments to pass and implement policies that meaningfully address global warming and ocean acidification issues.

Simplified: earth’s climate system is overheated, industrial civilization is a heat engine and therefore it is unsustainable.

This article is confusing and contradictory to distill any meaningful conclusion.

Talk of PEAK oli is going on for 3+ decades since mid 70s! New patches of new oil reserve are being discovered. Economics of extraction of oil depends upon the DEMAND which again depends upon the pricing power vs purchasing of power of the average consumer in western Nations and also developing Nations. In the west, it is well known that there is stagnant in wage growth since 90s! Global Economy is heading towards another recession within 6-12 months! Great recession of 2008 NEVER went away. ECho housing bubble bursting is NOT far away unless CBers go into deep NRP!

Mean while, oil went up to $120/barrel to 30 and now around 50! The price of capital made virtually zero( by CBers),lead to mal-investments with excess leverage like fraction etc in US. Many in Oil industry are going to Bkpt in the coming years. Advent of Electric cars and alternative energies like solar and wind do have some impact!

There are so many VARIABLES in this PEAK oil theory, no one is able to guess beyond 2-5 years let alone in 10 years! It is an exercise in futility!

What I find truly futile is working at meaningless jobs producing endless tons of pollution, both physical and mental.

On top of that, having to deal 24/7/365 with the endless loop of propaganda exhorting the wonders of a failed system of social organization.

Visionaries who attempted to draw attention to dire social problems in order to raise the consciousness of fellow citizens in order that they could rationally address these problems are ridiculed and accused of being wrong on specific details from a class of sociopaths that have been proven wrong on just about every claim they make.

Futility, or stupidity, can be found in abundance in the business as usual crowd. What is so hard to understand about the concept that you can’t build your entire society around a finite resource and expect to survive in the long term? It only makes sense when you consider the dominant society bases its existence on promoting the weakest human traits of greed, selfishness, and envy.

Being right about small scale aspects means nothing when you are wrong about large scale, systemic aspects. That is the trap we are attempting to extricate ourselves form now.

Jesus Yves, I’d given up on you and your rose colored glasses;

But for god sake, brutalizing your unicorn loving cuddle bunny readership with such potent bits of truth to win back your old misanthropic troglodyte readers such as WorldisMorphing is over the top …but –understand– futile.

WorldisMorphing is dead. Long Live UnhingedBecauseLucid !

Now, about you spilling the beans on the real situation, really, in front of these Carebears™; You’ll have to be more considerate in the future. It’s not because people tell you they would take the [now] proverbial red pill over the blue one that they actually CAN HANDLE the truth Yves !

…And posting an article with links to Cassandra’s Legacy in it !? …..and the Doomstead Diner !?!?!?!

You risk some of your audience connecting the dots on their own…

…and when they do… politics, regulation, corporate shenanigans will loose their relevance.

You’re torpedoing you’re own ship by doing so…unless — you reconfigure your ship to give this “new” matter the spotlight. But you’re a finance specialist in Manhattan, New York… what will your friends and connections say when you go all “Doomer” on them:

[“Poor Yves,…I think she joined a sect or something…”]

[“It’s probably a new-new-age phase she’s going through,…”]

————————–

You’ll have to make a choice Yves…choose wisely.

One difficulty dealing with reorienting industrial society is the cognitive dissonance prevalent in the citizenry. Edward Bernays and the business community have been all too successful in conditioning the population to view the world in an unrealistic way. This suits the business community fine, not so much for humanity.

What is most shocking to me is the utter lack of concern for others exhibited from the business community. Both here in the present and for future generations. It is all short term thinking and tunnel vision. It would be interesting if Wikileaks ever finds, and releases, confidential communications between various business leaders illustrating their utter lack of urgency concerning climate change and the winding down of industrial civilization. Similar to Michael Hudson’s remark that discussions between early capitalists strategizing on how to move peasants off the land, forcing them to give up their ability for self-sufficiency make good reading. I haven’t decided which is worse, leadership plotting for their own survival at the expense of those they rule, or utter cluelessness to the dire predicament modern civilization is racing towards.

In one way, the driverless car craze perfectly captures the insanity we are living through. If this article is remotely accurate in its predictions, you have to wonder who is behind the wheel steering this thing, and the realization hits that the answer is no one. The dominant narrative for the future features driverless cars and joyrides into low earth orbit for the low cost of $250,000 a trip. Isn’t the future grand? The society that embraces such fantasies will be totally unprepared for the hardships ahead. The level of human suffering will surely bring about a rage that cannot be contained.

It hasn’t dawned on people that the leadership we need right now will not be drawn from the business community as now constituted. The political revolution on the horizon will be characterized by factions attempting to hold on to a failed vision and existing power, and those seeing drastic action necessary to redirect our collective needs.

I find it oddly comforting that those at the zenith of power are most confident just before the fall. What they find unimaginable becomes imaginable. It is also oddly comforting to see this disaster coming. The magnitude is quite awe inspiring in its implications. Those predisposed to selfishness will choose the rout of hedonistic excess as a coping mechanism. The other rout is to see how fragile humanity’s hold on this world truly is, and embrace a life of humble sacrifice. To embrace living with less. To redefine what is truly important in this world.

I can’t take any comfort from watching things fall apart. As for the leadership we need and the leadership we have — I worry that the leadership we have derives from organizational entities — not people per se. I worry that Corporations — though they’re made of people and run by people — have somehow developed their own sense of purpose and their own agendas and morality [or lack thereof] quite apart from the people who appear to run them. Other organizations too seem to have a life of their own and just use people like tiny organelles.

It’s not easy to step off the treadmill.

Corporate execs think about shareholders and the next quarter (and their pay package); Mom and dad think about paying the mortgage and getting Jonny into that magnet school; Jonny eventually thinks about getting into the “best” college (with enormous student debt) without seeing that schools teach what has gone down in the past, not what the future holds.

In the end, we just hope that someone else is caught holding the bag.

@Jeremy Grimm

I didn’t mean to sound flippant with the comforting comment. Just trying to express the feeling of calm that sometimes occurs when trying to work through the dire situation we are facing. In a sense, it is overcoming fear. Once that state is reached, possibilities for action begin to open up.

The main nut to crack is the idea that dedicating oneself to business interests is the purpose of life. Corporations are evolving into the defining human organizing structures to the detriment of any form of spiritual life or other modes of existence. Corporations attempt to ameliorate their dehumanizing character by trying to incorporate truthful human relationship structures as subgroups. For example, treating the corporation as a “family” and using the language of solidarity and group effort as a motivational tool, while knowing full well that the benefits and overriding economic payoff will go only to a select few. It’s playing with the emotional weakness of their workers. In the end, the workers can always be thrown overboard if needed. This does not bode well for a stable society- and everyone knows it.

I find hope in the trend of Co-ops and a resurgence of smaller enterprises. Society must always have goods and services in order to survive, building less exploitive structures is what is needed. The corporate world is having to work harder at maintaining their position. This is a good thing and long overdue.

One way or another, the human scale will reassert itself in society. By design, which is a necessity, or by collapse of an unsustainable system.

I didn’t take your comment as flippant — sorry. What I meant in so many words is that though I share the feelings of Schadenfreude and calm I sense in your comment — I also fear the impacts of things falling apart for the Great as they make things fall apart for rest of us. Sorry — I need to be more clear.

I scanned through this post and wasn’t sure what to make of it. After listening to the first of the videos I am completely flummoxed — nGeni????? I got a little mystified by the idea that the only value in oil is the energy you can get out — like John Wright above — as he points out — plastics and heating(?) and transport — and I would add lubrication for machinery — assuming some other power for driving machines. The other problem I have is the circularity of the measures used in the charts — they seem to embed an assumption that GDP is equivalent to energy use. The ties between gold and oil price also bothered me. What does gold have to do with oil? They’re both commodities and It costs more energy to extract gold as gold becomes more scare — but that wasn’t the relation suggested.

I recall an article in Science [no I don’t have the link and I no longer subscribe] which indicated peak oil occurred some time around 2007 if memory serves. I have trouble believing the peculiar drop in the price of oil is directly related to the decrease in the net energy the oil delivers. It seems much more closely tied to the Saudis increasing their production at a time the demand for oil had dropped off on account of the Great Recession and its ongoing depression of consumer demand combined with the growth in consumer debt — and yes that is very U.S. centric but its the best I can do.

The nGeni magic GREEN box with all the magical properties on the left providing all the wonderful capabilities on the right — I just don’t have enough of my homemade mead left to digest that last slide in the video and I don’t plan to watch the other two videos at this point. If there were a magic box like the GREEN nGeni box I don’t think the guy pitching it would need to ask for money — people would be shoving it at him — 80% efficiency? He could build a few copies borrowing with his credit card and fund the rest with his profits. So is his Green box good-to-go? He made it sound like it was. Does it take the combined capital of General Motors, United Steel and Corning Glass to build it? He didn’t sell it that way so far as I could tell. — So why isn’t someone knocking out Green boxes at warp speeds? If energy == GDP we could grow the economy however much we wanted by building enough nGeni Green boxes.

It’s late — I’m fussy and cranky — and I don’t think I’ll watch another hour or two of nGeni Greeness to find out if cold fusion or something like it works and can be used to run my car. If someone else finds out more about the nGeni I hope they will share what they discover.

I agree. I listened very attentively until the nGeni thing, then I thought – great, another hoax. Pity, the video was so promising.

I do not have any more information about the gadget, but it sounds remarkably similar to the Waterboxx, in name and aspirations if not in the way it works – a trinket running on hype, wishful thinking and lack of scientific evidence.

I recently listened to a conversation among designers I happen to work with. The discussion was how they felt a sense of accomplishment, pride, at offering packaging solutions for a major food chain. The solutions in question would save a great amount of paper and other materials if implemented. I forget the exact figures they quoted, but generalities will suffice. The number was large, and that is a good thing. But as I listened, and behaved myself by not chiming in and throwing cold water over their excitement, I couldn’t help but thinking, the number of material saved could be 100% if the wasteful practice was stopped altogether. Their thinking was so small, and limited to a corporate framework, they couldn’t even imagine the most simplest “solution” of all- STOP the entire process.

This process is repeated countless number of times across the entire globe. Talented, well intended people, spending their life energies perpetuating a grossly wasteful system of social organization and production, mindlessly racing at depleting every resource on the planet.

Just as the monasteries became repositories of knowledge during the dark ages, the more I think about , and study our current situation, the only hope I see is forming self sustaining communities on a local level. Communities of like minded people, using the knowledge, technology, and a non exploitive ethos to support one another.

As the saying goes, “Build it and they will come”

The ‘thermodynamics’ claim is incorrect.

First: the claim that the energy cost of extraction subtracts from the available energy yield is not contested: It doesn’t matter what the price of oil is, or what the reserves are. If the extraction cost is greater than the yield there can be no more production (because oil production becomes a net consumer).

But the 2nd law ‘thermodynamic’ overhead / waste is incorrectly characterized as a constant of 1.8 GJ/bbl. Yes there is a 2nd law ‘Carnot Efficiency’ price, but it is not a fixed proportion of each barrel of oil extracted as claimed.

Consider a bbl of oil in hand with yield 6.2 GJ, extracted say at energy cost of 4.4 GJ in 2030. As long as 6.2 > 4.4 (which it is!) that oil was worth getting out of the ground (energetically). That bbl is now worth 6.2 GJ. It is not worth 6.2 – 4.4 = 1.8 GJ. The 4.4 price just reduces the effective reserves (over zero extraction price).

The ‘thermodynamic’ cost, say is still 1.8 GJ. This is the cost (waste) of burning 1 bbl of ‘oil in hand‘, ie net of extraction energy losses. It does not add to the extraction cost as claimed in this article.

The conclusion is incorrect therefore. Nothing special happens at 2030 or 2022. Production necessarily ceases only when it costs more energy to get the oil than is yielded by burning that oil irrespective of thermodynamic efficiency, I.e. even if the useful energetic yield (technically: ‘work’) after accounting for thermodynamic cost is just 1% of 6.2GJ /bbl.

I also think the post is flawed, at least in reference to the current situation. If current issues were thermodynamic then oil would be scarce: most of it would be used to produce energy for the production and transportation of oil and oil products.

However the thermodynamics of the energy transition is an interesting question.

Let’s say you’re off the electrical grid and your power goes off. You are in a remote area and a plane will be landing in a month with supplies. So for 1 month, you are on your own.

For the next 48 hours you can keep on going according to plan or you can spend your time and resources fixing your power supply or else your food will go bad. Obviously, if you keep on following your plans, you will probably be fine for a few days because you have access to short-term energy (your body and food) you can use.

In our economy, there is also a lot of short-term energy. It’s called our infrastructure, workers and the share of oil used by non-oil producing sectors. And there is a lot. So the oil companies can drastically increase production even if supplies are dwindling despite lower EROI. All they need is access to the non-oil producers’ share of oil consumption. This can be done with subsidies and financial engineering.

This can go on for a while… for example infra does not get maintained, roads don’t get repaved, new plants are not built, garbage collection is slowed down, snow accumulation needs to get higher before sending out the plows, etc. And rates can get cut so asset prices go up and make investors feel richer so they don’t notice the natural gradual depreciation going on everywhere around them….

Of course, once all the furniture has been burned to heat the house, we’re in trouble.

Slight Correction: The ‘thermodynamic’ cost is not a fixed proportion of the energy inherent in each barrel of oil – as is claimed.