Yves here. This Nathan Tankus post is a bit technical at points, but demonstrates a basic issue for fiat currency issuers like the Federal government: their spending is always the result of creating new money, even when other transactions like Treasury bond issuance appear to be responsible.

By Nathan Tankus. Originally published at Notes on the Crises

On this substack I rely on Modern Monetary Theory (among other bodies of knowledge) to inform my analysis. Yet, I rarely explicitly write about MMT (for my own introduction to MMT and an overview of what it has to say about the current crisis, see my written remarks from a speech I gave to a Federal Credit Union). Today though, I’m going to tackle a recurring issue that comes up in discussions of MMT that I think will benefit my substack audience. One of the claims Modern Monetary Theory makes that critics have the most trouble with is the idea that the Federal Government already finances itself through money creation. Today, I’m going to restate this thesis step by step as simply as I can, while using T accounts. Incidentally, Professor Stephanie Kelton already substantiated this thesis in the United States 20 years ago in an article (aptly) entitled “Do Taxes and Bonds Finance Government Spending?”

Before we get into the details of financial transactions, it’s important to clarify some basic points about… well… the U.S. Constitution. There are three Branches of government: Congress (the legislative branch), the Presidency (the executive branch) and courts (the judicial branch). Administrative agencies, like the U.S. Treasury, are housed in the executive branch but how they function is often structured and directed by congress (while some are just creations of Executive power). Congress also often delegates some of its powers to administrative agencies. For all sorts of purposes (both within economics and outside of it) the three branches of government are consolidated. For the purpose of calculating the U.S. government deficit, most elements of the three branches of government are consolidated. Some people might find this basic overview of the constitution strange and far afield from the monetary question under discussion, but it is not. For monetary questions in the modern United States often revolve around the Federal Reserve and we must clarify the place of the Federal Reserve in the Federal Government in order to decide what entities are appropriate to consolidate together and what entities are not. The Sterility of many debates over MMT’s controversial proposition stem from not clarifying these fundamental legal questions from the beginning, leading people to talk past each other.

In the view of Modern Monetary Theory (and the legal scholars associated with it) it is erroneous to not consolidate The Federal Reserve System with the Federal Government when conducting monetary analysis if intragovernment relations are not the subject under examination or relevant to the dynamics being analyzed. If, for example, relations between the government and the domestic private sector (as well as sub-federal governments) are being analyzed, consolidating the Federal Reserve System with the rest of the Federal Government makes the most sense. The case for consolidating the Federal Reserve Board, which determines monetary policy, with the rest of the Federal Government is clear- it is an administrative agency that forms part of the executive branch. The reason the Federal Reserve System is sometimes not consolidated in this fashion is the confusion over Regional Federal Reserve Banks, which are not administrative agencies of the government. These entities are congressionally created corporations which conduct monetary policy at the direction of the Federal Reserve Board.

Conspiracy theorists often think that the Federal Reserve System is a private entity, and thus control of our monetary system is completely in private hands because of details surrounding the structure of Regional Federal Reserve Banks. In fairness to them, while this claim is wrong, it’s understandable why they think so. Chartered “private” banks are formally authorized by law to act in the interests of shareholders and deliver payouts which are dependent on their own profits. These Chartered banks, in turn, must purchase shares in their local Regional Federal Reserve Bank in order to become a Federal Reserve “member bank” and have access to the Federal Reserve. I can already hear the voices of the conspiracy theorists: “see!! The Bankers OWN SHARES IN THE FEDERAL RESERVE, ITS A PRIVATE ENTITY!!”

This, however, is less than it appears. For while these contracts are called “shares”, they don’t entitle Federal Reserve member banks to anything like what shareholders in big banks like Citibank (or any other company in the Fortune 500) are entitled to. Here, it’s worth quoting a Federal court case from last year called Wells Fargo v. United States:

Congress has transferred functional ownership and control of the FRBs [Federal Reserve Banks] to the Treasury and to the [Federal Reserve] Board […] Further, we are not moved, as the district court was, by the fact that private banks serve as the FRBs’ nominal shareholders […] Today, the United States, not the nominal shareholders, are the economic owners of the FRBs. Among other things, Congress has provided that the net earnings of the FRBs be “recorded as revenue by the Department of the Treasury,” FRB Amici at 17, and the FRBs are required to remit all their excess earnings to the United States Treasury […] Thus, the “capital” contributions made by member banks function as debt interests owned by the member banks, not equity interest […] money created for the Term Auction Facility or the Discount Window is as much a product of the “public fisc” as money that is distributed by the Treasury Department

To summarize, the “shares” chartered banks own of Regional Federal Reserve Banks are really debt contracts, net profits from the Federal Reserve System are delivered to the U.S. Treasury and the Federal Reserve Board jointly owns and controls the Regional Federal Reserve Banks along with the U.S. Treasury. As a result, the “money” (settlement balances in checking accounts created for the benefit of chartered banks and governments) the Federal Reserve System creates is a product of the Federal Government even though they are “unappropriated dollars”, similar to the Mint. Government owned corporations, such as the Post Office, are regularly consolidated with the rest of the Federal Government for analytical purposes. Similarly, its appropriate to consolidate the entirety of the Federal Reserve System with the rest of the Federal Government.

I know many readers’ heads must be dizzied from all this legal detail but I promise it is important because it is at the crux of the issues under debate. In a moment, we will return to MMT’s argument that the Federal Government always “money-finances” its spending. One final legal question must be clarified: the scope of our consolidation. Many discussions of these questions are based on the premise that Modern Monetary Theorists are simply consolidating the Federal Reserve System with the U.S. Treasury. However, this is not the case. What MMT scholars are doing is consolidating the entire federal Government, including Congress, together. When conducting that kind of analysis, how the system works at the aggregate level is what matters. Specific restrictions on specific agencies don’t matter if they don’t affect the aggregate results.

Thus, MMT arguments do not rely on, as is often claimed, the U.S. Treasury directly creating a monetary means of payment or receiving a direct overdraft from the Federal Reserve System. Instead, MMT’s argument that U.S. budget deficits are always money-financed relies on two claims about Federal Reserve-Treasury coordination which are reaffirmed constantly:

- The Federal Reserve continuously generates, indirectly or directly, liquidity in U.S. Treasury markets

- The Federal Reserve and the U.S. Treasury coordinates on a daily basis to ensure that payments are clearing between Federal Reserve bank accounts and Treasury auctions do not fail.

The recent Coronavirus crisis again showed that these two claims are true as the Federal Reserve launched a massive Treasury Security purchase program in response to signs that the U.S. Treasury market was beginning to malfunction. As long as the Treasury has authorization to issue treasury securities, this system will function smoothly.

Of course, that does leave the issue of the debt ceiling- a literal quantitative cap on how many Treasury Securities the Treasury can issue which has become a growing political football in the last few decades, even as it is currently suspended until 2021. If the Treasury is completely barred from creating a financial instrument of some kind, the public finance system might break down. Here it is especially important that MMT scholars are consolidating the entire Federal Government, and not simply the U.S. Treasury and the Federal Reserve. To return to constitutional basics, it is Congress which has the power of the purse and Congress directs administrative agencies to spend on its behalf. Congressional directives to spend or tax are much more fundamental than statutory quantity caps on the monetary face value of treasury securities which the U.S. Treasury can issue. Congress has given conflicting directives to administrative agencies, so they must decide which directive is the least important in order to follow Congress’s orders as best as it can. Non-MMT legal scholars agree with MMT legal scholars on this point. To quote the most famous recent analysis of the debt ceiling from Law professor Michael Dorf and economist Neil Buchanan:

This Article analyzes the choice the president nearly faced in summer 2011, and which he or a successor may yet face, as a “trilemma” offering three unconstitutional options: ignore the debt ceiling and unilaterally issue new bonds, thus usurping Congress’s borrowing power; unilaterally raise taxes, thus usurping Congress’s taxing power; or unilaterally cut spending, thus usurping Congress’s spending power. We argue that the president should choose the “least unconstitutional” course — here, ignoring the debt ceiling. We argue further, though more tentatively, that if the bond markets would render such debt inadequate to close the gap, the president should unilaterally increase taxes rather than cut spending

While agreeing with their framework to a large extent, my colleague Rohan Grey critiques their trilemma in his law review article “Administering Money: Coinage, Debt Crises, and the Future of Fiscal Policy” by arguing that they ignore that it is actually a “quadrilemma” where the Treasury could also create money directly. Most strikingly, when you reframe things this way it becomes clear that the least unconstitutional option is actually affirmatively constitutional, in that the U.S. Mint has the authorization to mint a large denomination platinum coin to finance its activities. What Grey’s perspective shares with Buchanan & Dorf is that none of them think that congressionally ordered spending or taxing should stop because of the debt ceiling and breaking the debt ceiling is a smaller violation of constitutional principles than the executive branch usurping Congress’s spending powers or taxing powers. It may be an extreme circumstance, but even in this extreme circumstance, the Treasury will fill up its account with the Federal Reserve (and/or begin creating money itself) and keep the wheels of government moving.

More generally, all of this intricate accounting is important but they are details that distract from the broader legal significance of what is going on. Congress has the power of the “public fisc” which is embedded in the constitution. Neither the Federal Reserve or the U.S. Treasury are creations of the constitution. They are creations of Congress which has delegated to them some of the Federal Government’s money power. As the Second Circuit recently noted in Wells Fargo v United States (quoted above), the funds that the Federal Reserve creates when it purchases new assets (Tsy bonds, corporate debt, etc) are public funds, that originate from the same “fisc” as the funds available to Treasury, or indeed the funds available to the Department of Education. In other words, the Treasury’s operating account is but one executive manifestation of Congress’s power of the purse, but readers should never confuse the powers of the Treasury with the powers of the Federal Government as a whole.

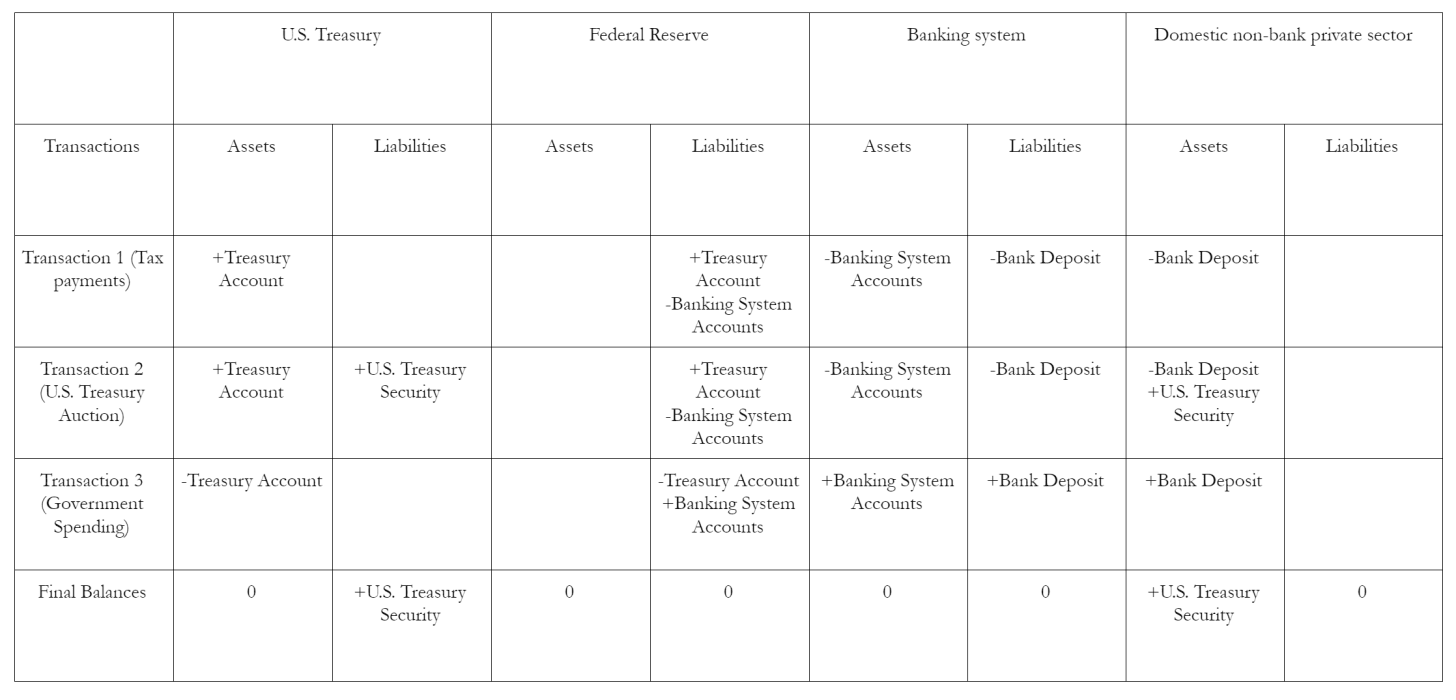

Finally, with all of that legal analysis out of the way, we can get to the monetary analysis. At first blush, it feels obvious that treasury securities and tax revenues “finance” government spending. As discussed above, the Treasury needs to fill up its account at the Federal Reserve in normal times. It does have the option of coin money creation- “seigniorage” and indeed approximately $325 million dollars last year came from coin seigniorage. However, most coins have their denominations specified such that it would be cumbersome for the Treasury to purely finance itself with small denomination coins. Putting aside the major counterexample of the Trillion Dollar Platinum Coin discussed above, which has not yet been used, current coin seigniorage is currently far too small to finance budget deficits. At first blush then, it must feel obvious that MMT scholars are wrong about how things currently work. I can again hear critics yelling at their computer screens saying “that coin option is CUTE AND ALL but that’s an extreme circumstance, that’s not how things work normally”. Let’s examine this issue with macroeconomic accounting.

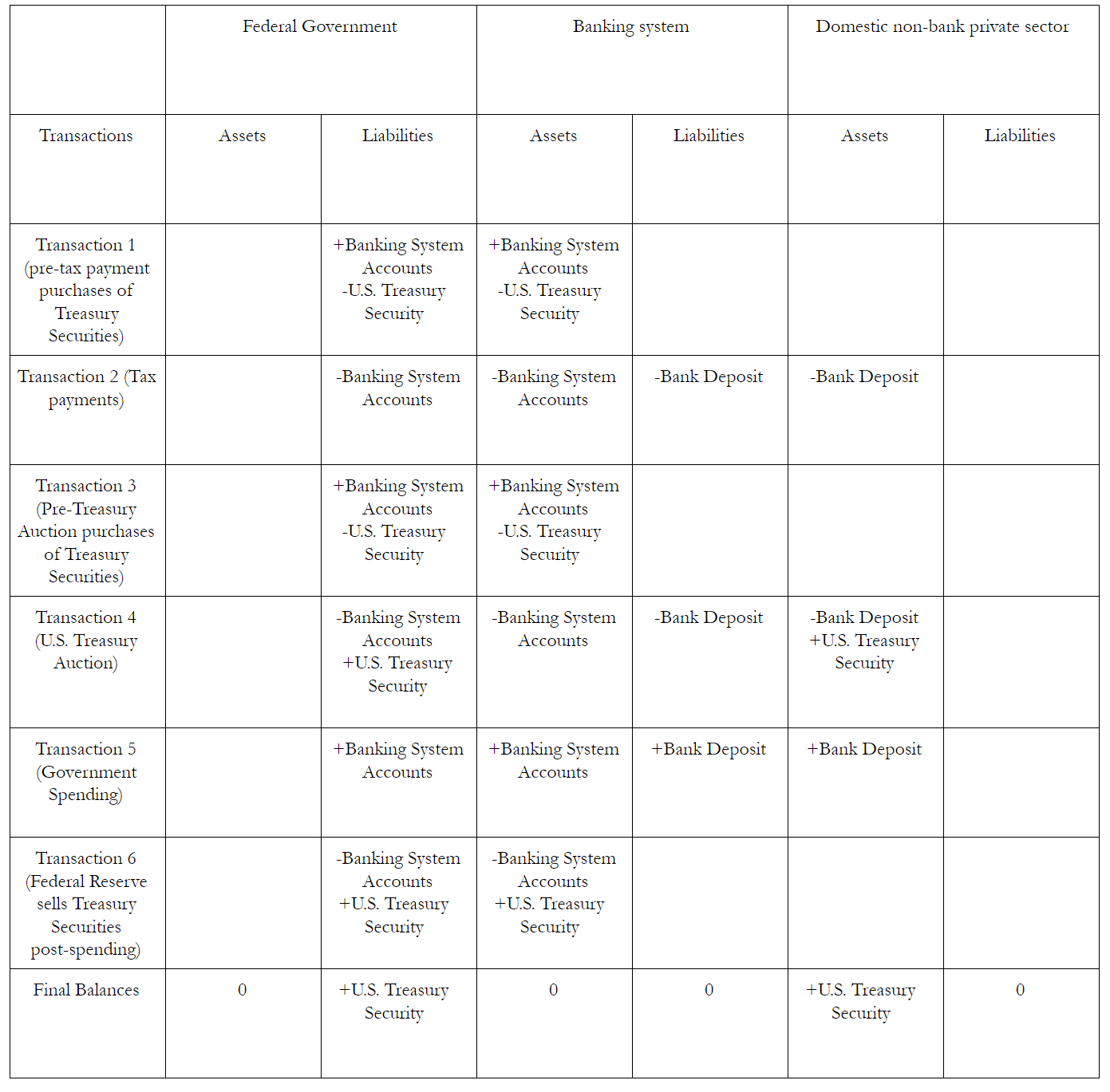

This seems pretty cut and dry no? Well, not so fast. One critical detail this set of accounts are missing is that there has to be sufficient settlement balances (money banks have in checking accounts with the Federal Reserve) circulating in the banking system for tax payments and treasury auctions to clear. For most of the history of Federal Reserve-Treasury coordination, the Federal Reserve and the Treasury had to coordinate every day in order to remove unwanted settlement balances and inject settlement balances which would be removed right out again by tax payments or treasury auctions. Because they only needed to temporarily inject settlement balances, the Federal Reserve typically entered into repurchase agreements. For simplicity, I’m going to focus on “outright” purchases here. Let’s look at how these transactions look when we consolidate the Federal Government all together

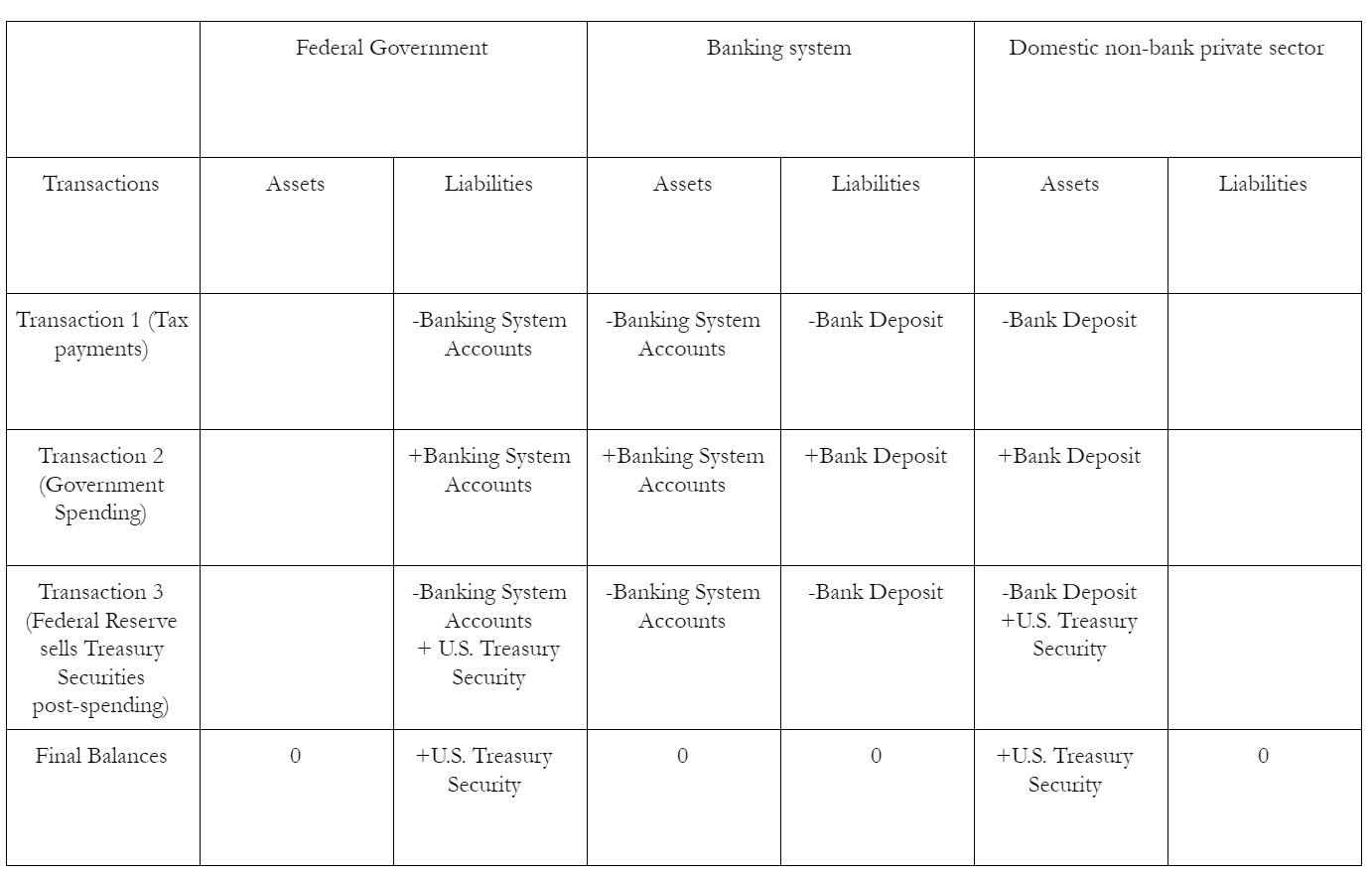

From this consolidated point of view, it begins to become clearer what Modern Monetary Theorists mean when they say “Government Spending is always Money-Financed”. Whenever the government sends a payment, its liabilities as a whole increase and the private sector gains financial assets. Meanwhile, treasury auctions don’t increase the quantity of government liabilities outstanding, they simply change the form of government obligation which the private sector holds. In fact, because the Federal Reserve has to take bonds out of circulation in order to ensure that the auction is able to clear, even less changes. What first appeared as the government “financing itself” now looks like intragovernmental accounting using a middleman but not changing much else of substance. In reality, that middle man is a “primary dealer” which is licensed by the Federal Reserve to ensure Treasury Auctions always succeed. It would make this process a little more efficient if the Treasury could sell treasury securities directly to the Federal Reserve which could, in turn, sell those securities after the spending occurred. However, this would not change much substantively. In fact, let’s examine what it would look like if that were the case.

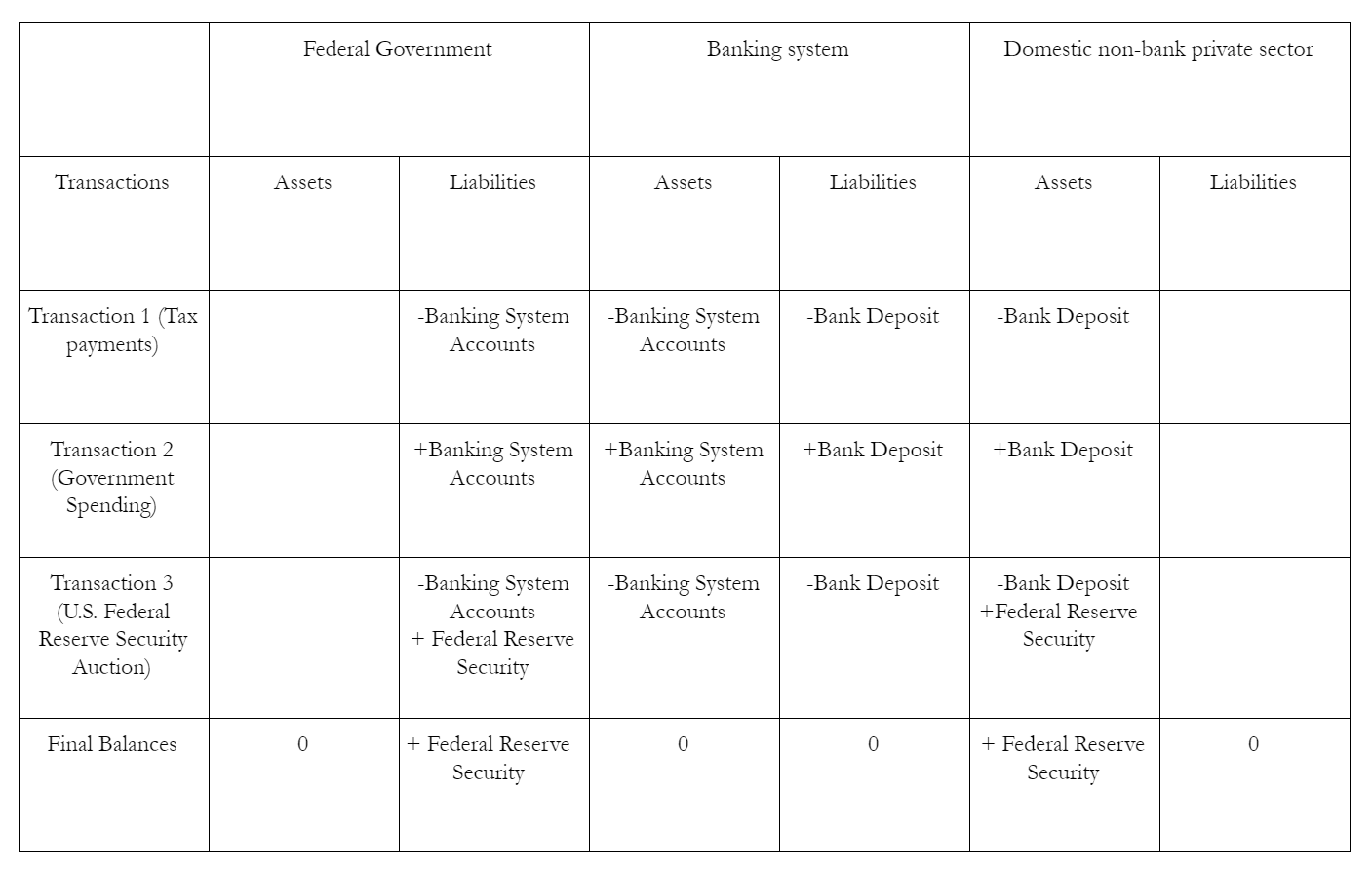

As we said, this simplified the process somewhat but the process, and the final results, were the same. At the end of the process, there is another treasury security outstanding which is held by the private sector. Another way of grasping that Modern Monetary Theorists argument applies to a range of arrangements between the Federal Reserve and the Treasury is to examine my proposal (along with Rohan Grey) for the Treasury to directly finance its spending with large denomination coin issuance and for congress to authorize the Federal Reserve to issue its own securities. Our proposal is not motivated by the idea that this structure is necessary to “implement MMT” but by the desire to simplify the government’s financial operations in order to clarify that we already rely on money-finance when the government spends. To grasp this, let’s go through the accounting we did above, but under these institutional arrangements.

What is remarkable is that this set of transactions, from the consolidated point of view, is almost identical to the set of consolidated transactions above. The consolidated government creates money which the private sector receives, and then it sells negotiable securities to drain money right back out. All that is different is that it is the Federal Reserve issuing securities now, not the U.S. Treasury. This would be legally important- it would put the debt ceiling fights in the past once and for all- but it wouldn’t make MMT’s claim that the Federal Government, as a whole, finances its spending with money creation any more true. Instead, what it would do is give the Federal Reserve more control over the maturity of the government securities which are outstanding and clarify to the public that, for the Federal Government as a whole, government securities are a monetary policy tool not a financing tool.

Conclusion

This post is long and very detailed, but I felt that writing out all the details was important because it is most often confusion about legal details which leads people to think that MMT’s argument is “semantics” or ill-conceived. It is not. Here, I’ll restate the argument:

- The Federal Reserve System, including Federal Reserve Banks, are a part of the federal government and it is appropriate to consolidate them with the rest of the federal government to analyze fiscal policy and monetary policy

- The Federal Reserve continuously generates, indirectly or directly, liquidity in U.S. Treasury markets

- The Federal Reserve and the U.S. Treasury coordinates on a daily basis to ensure that payments are clearing between Federal Reserve bank accounts and Treasury auctions do not fail.

- As a result, while the Treasury finances itself through U.S. Treasury Auctions, the Federal Government (including Congress and the Federal Reserve) finances government spending through money creation. For the Federal Government as a whole, the sale of securities to the private sector serves a monetary policy purpose, not a financing purpose.

- This argument does not at all rely on the Treasury’s ability to get an overdraft from the Federal Reserve or directly sell securities to the Federal Reserve. Indirect support from the Federal Reserve is sufficient.

- In the circumstance where the Treasury has to meet spending obligations assigned by Congress but is running up against a statutory cap on how much debt it can issue, it must either find a way to rely on money creation or break the statutory cap so that it doesn’t interfere with Congress’s “power of the purse”

- This emergent property of the Federal Government system would be better and more efficiently represented by assigning the responsibility for security auctions to the Federal Reserve and have the Treasury directly finance itself through money creation

Agree or disagree with this set of propositions, this is what Modern Monetary Theorists are arguing and, in my view, it is a coherent (even incisive) argument. Future controversy over the claim that “Taxes and Bonds do not finance federal government spending” should focus on the argument above and the way it analytically uses consolidation of Federal Government agencies, instrumentalities and Congress. Above all, MMT’s argument here is a mixture of legal analysis and macroeconomic accounting. To combat it requires pointing out some flaw in the legal reasoning or in the accounting. I’ve never heard any objections to the accounting from other academics. Instead, the most common ripostes come from economists conducting amateur legal reasoning with… predictable results. If you’re interested in digging deeper into the legal reasoning behind these arguments, I highly recommend my colleague Rohan Grey’s law review article cited above.

Hello, did I read this correctly? Did this author literally apply the word ‘mint’ in the Constitution and recommend some fantastic piece of metal coin be created? In a world of ‘fiat’ currency? Might as well have adopted wood as the best way to ‘mint’ money, which was used for four centuries in Britain, I believe. Anyway, diving into the weeds of a swamp that is unnecessarily convoluted, for political ideological purposes, seems problematic to me. Why not just insert the new money directly into the appropriate bank accounts as required by Congressional spending? After boiling out the alchemy swamp water, that’s what is done at day’s end, is it not? Managing reserve operations to maintain some ‘optimal’ interest rate and to ‘clear’ private bank transactions is an operational choice that has been made. The interest rate is set by the Federal Reserve. If the Feds want a 2% rate, they simply offer Treasuries with that rate of interest, and promise to buy at par what isn’t sold. Next. Private bond buyers are supplicants. Japan doesn’t pay interest on reserves. Zero. How do they manage that system?

Per Mosler, the natural overnight rate is zero — any rate above that requires the Fed to “defend” it via monetary operations.

As for the Bank of Japan, I believe they have policy guidance that sets the 10 year to zero as well?

You have apparently missed the point of the article, which is to show how the system currently operates. Hence the weeds.

@Christopher Herbert

July 1, 2020 at 7:48 am

——-

“Did this author literally apply the word ‘mint’ in the Constitution and recommend some fantastic piece of metal coin be created?”

Yes, you read that right. The authority to do so rests with the Secretary of the Treasury under Public Law 104-52 (codified at 31 U.S.C. § 5136).

Although legal experts disagree somewhat on the constitutionality of such a coin, the weight of opinion seems to be that it would be.

Rep. Rashida Tlaib has proposed minting a couple of trillion-dollar coins to finance monthly payments to everyone for the duration of the corona virus crisis.

I’m not linking to any stories about her proposal because all the ones I can quickly find are full of misinformation and misdirected criticism. However, I am sure that with a little digging you can find one that is balanced and accurate. IIRC, Nathan Tankus was involved in the earliest discussions of the concept, so he probably has written something on Rep, Tlaib’s proposal.

He has; the piece is linked about 2/3 through the above article (easy to miss if you’re reading quickly): https://nathantankus.substack.com/p/all-your-questions-about-the-trillion

And as far as “the treasuries”.. the selling of these investments… who gets the fee’s.?.. sounds like a good gig to me.. again.. let some private industry do their selling , with their own money.

Again, a protected industry, pretending to be good for the people…as a justification for another private industry getting to make money out of nothing.. and charging interest…

Boy luckily, there are some people paid to “teach” people they NEED the system to stay as it is…Personally, I say big deal. People don’t need treasuries to exist, wall street does.

Wow, I learned so much from this, but am still ignorant, being just a simple taxpayer without an economics degree.

Basic question: Why can not the Federal Reserve create money to send to Americans to pay rent, mortgages and unemployment? Directly, without the intermediation of interest and fee collecting banks?

As I understand it, the current set of monetary operations are a function of law rather than economics — which is to say that the US Federal government has chosen arrangements which constrain its own spending (both in terms of volume and procedures).

As to why it would choose this particular set of such constraints, I suggest you look to who governs on behalf of whom …

Tough going, but well worth it, it explains a lot. Also thanks for the ‘Fed is not owned by the banks’ explanation, I’d always struggled to understand its precise relationship to the banking sector vis a vis the government.

Proofreading note: The second graphic is squished so as to be unreadable (unless you right-click on it and select “view image”).

Thanks for the clarity and the details. The T accounts really help to visualize the flows and how they interact.

Thank you. The truth is in the details — the explanation of the legalities, and the multiple-entry accounting. Time for me to get to work on these ideas.

Thanks Nathan. This is surprisingly clear. I kept thinking that Stephanie Kelton minimized the flow-chart a little, but it really is this simple. To allow Treasury to spend directly would also let our terminally conflicted Congress off the hook for “balancing the budget” arguments. We wouldn’t have the mess we’ve got right now with all the money going out and nobody knowing who’s on the hook. That money could be spent and cleared without a hitch. The 60 Trillion Dollar Coin isn’t so funny after all. This would also help Congress out by freeing up its time to debate the best way to do fiscal spending; what are priorities – and not argue about their usual nonsense. The only question ever is, What is the best way to spend this money?

Here is one suggestion for the best way(s) to spend the money.

That is a very good list. The only thing missing is a jobs program, which I also favor because we’re all in this together and the environment needs lots of manual labor. Great place to employ the young.

> This would also help Congress out by freeing up its time to debate the best way to do fiscal spending; what are priorities – and not argue about their usual nonsense. The only question ever is, What is the best way to spend this money?

I feel highly confident that this is a set of conversations that most of our leaders would much prefer to avoid having.

The coalescence against Sanders in March is IMO the big tell that this is so.

Thanks fo this post. A very descriptive article. I have to read it many times to absorb the info. and understand it. It’s a lot more than what they teach in the “Monetary Policy” course for MBA’s.

All you need to know about Federla Government spending:

1. There is always enough new magically created fiat – matched by a corresponding amount of new debt-instrument issuance, naturally – for warmongering, bailing out the Wall Street fraud cartels and enriching the global Elite Looter class.

2. New fiat for da peeps? Why, that would be a highly irresponsible mis-use of government finance, sir! Let them eat private credit, with its usurious interest rates, to make ends meet. (Harrumph!)

‘Federal’ – hard to edit posts when they go directly into mod-landia.

This article is not really about what i.e THE FED RESERVE could or should do. It is another try to explain how the money creation works and how to educate the general people, but also economists etc, that critics of i.e MMT always try to hide the truth.

THE FED RESERVE (FED) has two mandates. Inflation-“control” and employment-“stability” which is about the real growth of the economy. The second mandate is about the stability of the financial system incl clearing of the interbank sector incl the needs of the government (and Treasury), aka the flow of money/finance (deficits!) For these mandates the FED seems to have very wide powers compared to other government agencies. So wide that we can speak of an independence from government policy and public transparency (not audited). Understanding the US twin deficits since the 70s and the sector-balance in the economy is a key in the development of the public/private relationsships.

The FED was created 1913 (after the great financial crises 1910) to secure elastic money when “free” markets fail or have to be postponed temporary (only corporate bonds). An independent agency having very close relationships with people (members of regional federal banks boarding the FED) from dependent private profit-maximizing money-creating all-markets participants entities should be subjected to detailed scrutiny due to conflicts of interests (Greenspan Put!). Instead revolving doors between government and treasury, oversight-agencies, the FED AND the private banks (members owning the regional fed banks) have been evolving and deepened more since the 70s. Today the FED also give “secretive” credit (on non-market terms) to large non financial or non primary dealer corporations on a covert basis. All in the name of financial stability and the public outcome! I think that in the name of the evolving debt-society since the 70s we are getting closer and closer to the naked thruth showing the debt-burden public that the emperor has no clothes about what money is and how it is created! The Corona-crises is another step towards the truth about the government (FED) always defending long term “inefficient” markets. And doing so the ruling class (the corporatist state). Here in the name of the economy of us all but how far is temporary? Going too far means resemblances with the regime of the Sovjet-Union. Market-prices are always built bottoms up. Not the other way around!

From the WW2 into the 70s we have seen the politics of the Treasury ruling using “bi-partisan” money-programes (using mostly taxes) for building a wellfare-society with the help of demand-theories by Keynes. In the renewed era of financialisation and private debt market-values rules and with them the whole economy fragily stands. Who is benefitting the most? Society or the few? Who loves riskfree money (government bonds) but hates government deficits?

You have the dual mandate wrong – in fact it is “price stability and maximal sustainable employment”. Note that first one, it reads stable *prices* (= 0 inflation, long term), not stable *inflation* as the economists and FedHeads keep talking about. So when the fed crew talk about “targeting a stable rate of inflation” which is > 0 they are already violating their mandate. We can discuss whether 0 inflation is really desirable, but in those terms the mandate is unambiguous, so if there is general agreement that this part needs to change, fine, change it, but not without the requisite debate in Congress and passage of a Bill.

Given how blithely the Fed folks have long disregarded even such core parts of their mandate, should it be any surprise that under Greenspan the Fed gave itself a 3rd mandate To Rule Them All, that of boosting stock prices, and has since then blown a series of huge and destructive (not for the rich, though, quite the opposite for them) financial bubbles, the latest one ongoing and dwarfing all its predecessors? This latest one features all manner of charter-violating market-propping asset-purchase programs via sluch-fund “Special Purpose Vehicles”, will likely culminate in the Fed buying stocks directly, and has resulted in capital misallocation so extreme, that a tiny niche automaker now has a share price so wildly inflated that by market cap it is the biggest automaker in the world. Nuts, just nuts.

Two reactions:

1. It seems that MMT is US-centric. Shouldn’t it be renamed to something like USMMT? Shouldn’t there be caveats that its descriptions and conclusions do not apply if alternative institutional arrangements are made?

2. As offshoot of 1. The need to intervene to ensure Treasury auctions clear does not seem necessary if the Fed isn’t aiming for an interest rate target. Just let the auctions decide how much T-bills are worth. If people value their money more and will only buy at a low price (i.e. high interest rate), so be it. The primacy of a central bank’s interest rate target is a pretty weak foundation for an entire theory of government financing to stand on. Again, what would the outcomes be under different institutional arrangements?