The reliable Barry Ritholtz of The Big Picture provides his take (and note he expects a downward revision, as with the fourth quarter):

GDP came in way below consensus. Given recent revision history, its very likely this will not be the final number.

The economy slowed to its weakest pace of gains in 4 years, when GDP was 1.2% during Q1 2003.

Housing gets most of the blame (duh), but do not ignore the accelerating inflation factor as a key element. Most traders realize the Fed is watching that component closely; Hence, why you are not hearing the usual “Rate Cut” chants from the cheap seats. PCE rose 3.4% (it decreased 1.0% Q4) Even the nonsensival core PCE (ex food and energy) was plus 2.2% (following 1.8% Q4).

International trade, Business Capex spending, Inventory growth, and decreased government spending all weighed on the economy to produce that 1.3% number.

The one bright spot: Durable goods. Plus 7.3% in Q1 follows +4.4% in Q4. Pretty much everything else was punk.

Calculated Risk elaborates on housing’s impact, and confirms Ritholtz’s reservations:

MarketWatch has the headlines: GDP slows to 1.3% growth in first quarter, Inflation rages at fastest pace in 16 years, data show

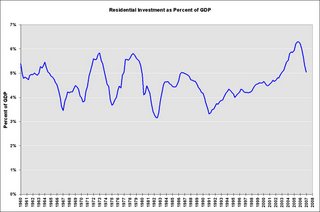

This graph shows Residential Investment as a percent of GDP since 1960. The median is 4.5% of GDP. Currently RI is still above 5% of GDP.RI peaked at 6.3% in the second half of 2005.

If this housing bust is similar to previous busts, RI as a percent of GDP will bottom in the 3.5% to 4.0% range.

So why did stocks close up for the day? Because the commentators are great at denial, um, teasing a positive story out of the figures. The Financial Times tells us:

The data show that unexpected weakness in net exports and government spending added to the anticipated severe drag on growth from housing construction during the first quarter.

Corporate spending was also subdued. But consumer spending remained very strong, with real personal consumption rising at an annualised rate of 3.8 per cent.

Most economists expect the surprise weakness in net exports and government spending – for which there is no obvious macro-economic explanation – will reverse in the months ahead.

I could just as easily make the reverse argument: GDP growth was poor despite an unexpectedly high and likely unsustainable level of personal consumption. But advertisers much prefer a preponderance of bullish talk on financial TV, so we shouldn’t be surprised that we hear more of those viewpoints.

I am not sure if the revision will be up or down — just that given the recent revision history, its very likely this will not be the final number.