Investors are so nervous that they are willing to take almost nothing in nominal terms, which is tantamount to a meaningful negative real return, to sit in the safety of three-month T-bills, which are now a mere 0.56%.

One explanation is the large number of fails in the repo market, which as Alea reports, is “massive”:

What “Fails” mean:

If primary dealer A does not deliver a security to primary dealer B as scheduled, then dealer A reports a fail to deliver and dealer B reports a fail to receive. In contrast, if primary dealer A does not deliver a security to customer C, then dealer A reports a fail to deliver and the fail to receive is not reported. A settlement fail goes unreported if neither the buyer nor the seller is a primary dealer.

This is recent data to march 5th on settlement fails between primary dealers. Settlement fails are reported on a cumulative basis for each week, including nontrading days.

U.S. Treasury Securities (In Millions of Dollars)

Fails to Receive: 891,825

Change from Previous Week: 696,427

Fails to Deliver: 903,242

Change from Previous Week: 724,368

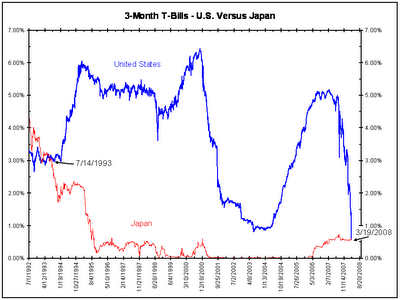

Not only is this the lowest level the rate has achieved since 1958, but as reader James Bianco of Bianco Research tells us, it puts US short rates below Japan’s for the first time since 1993 (click to enlarge):

An article in the Wall Street Journal today with the rather misleading title, “Fed Fix Works For Now,” says that the Fed is achieving some success in lowering mortgage bond yields. But the plunge in short rates and the rise in TED spreads says that much of the rest of the market is running for cover.

Bloomberg gave further commentary on the markets’ frazzled nerves:

Bonds gained on concern the investment firm run by ex-Long- Term Capital Management LP chief John Meriwether is facing losses and Thornburg Mortgage Inc. may go bankrupt. This week the Federal Reserve has cut interest rates, opened the so-called discount window to investment banks and arranged the sale of Bear Stearns Cos. to relieve market turmoil.

“There’s a whole flight-to-quality trade,” said Joe Tully, managing director of the money-market desk in Newark, New Jersey, at Prudential Investment Management, who’s betting $1 against a colleague that bill rates won’t fall below zero. “The markets are totally skittish. They just want to be in bills.”….

“It’s a capital preservation trade,” said Michael Cloherty, an interest-rate strategist at Banc of America Securities LLC in New York. “The rationale is, `I’ll buy a bill, I know that when the thing matures I’ll get 100 cents on the dollar.”’

The three-month London interbank offered rate, or Libor, for dollars rose for the first time in three weeks, indicating the Fed is struggling to instill confidence in money markets. The difference between what the government and companies pay for three-months loans, known as the TED spread, increased 32 basis points to 1.98 percentage points, the biggest gain since Jan. 22, when the Fed made an emergency cut in borrowing costs.

A high TED spread says banks are reluctant to lend to each other, which is not good. An earlier Fed measure, the Term Auction Facility, was designed to address high TED spreads. That appears no longer to be working.

Could the spike in fails be a temporary phenomenon related to the Bear Sterns crisis?

This appears to have started before the crisis at Bear (I dimly recall that European banks started refusing to trade with them nine days before the crisis hit, but I’m not clear whether they were counting back from the 13th, when Bear called JPM for help in the evening, or the 11th, when the run started draining their cash). But the troubles could have started earlier.

I haven’t seen any theories (save yours), which bugs me.

Treasuries market hasn’t made sense for a long time. With dollar dropping significantly last year, the T-yields for the same timeframe were tiny.

It is obviously the best time to buy equties. Let me guess that the market will grow by 7 to 10 per cent in the next couple weeks or so. There is no choice any more.

“It is obviously the best time to buy equties. Let me guess that the market will grow by 7 to 10 per cent in the next couple weeks or so. There is no choice any more.”

Can you explain this remark to me?