Big state budget shortfalls are an inevitable side effect of a weak economy. The Wall Street Journal reports that the decline is projected to leave states with an aggregate deficit three times the level last year, and suggest that the economy may be weaker than the GDP stats suggest.

FYI, I was just on a panel at the Inman Real Estate Conference in San Francisco with (among others) John Williams of ShadowStats, CR of Calculated Risk, and Noah Rosenblatt of UrbanDiggs. Williams claims that were government figures prepared on the same basis as they were in 1970, we’d already be in the worst recession since the Great Depression. I’m not sure I’d go that far, but I am willing to accept the notion that we are in a recession, as opposed to skirting on the brink of one.

From the Wall Street Journal:

The stumbling U.S. economy is forcing states to slash spending and cut jobs in order to close a projected $40 billion shortfall in the current fiscal year.

That gap — identified Wednesday in a survey by the National Conference of State Legislatures — is more than triple the size of the previous year’s. It is the result of broad economic weakness at the state and local levels that could cause pain throughout this year and into 2010. Sales-tax collections, for example, have been hurt by the housing slump and high gasoline prices, which are prompting cutbacks in consumer spending. Personal income-tax collections have been hit by rising unemployment, while corporate income-tax collections have been eroded by falling profits….

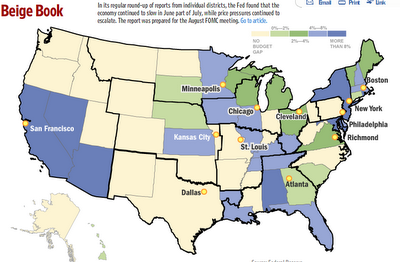

A separate survey of economic conditions by the Federal Reserve’s 12 regional banks — the “beige book” — said economic activity was sluggish across most of the U.S….

Unlike the federal government, most states are required to balance their budgets. Most have so far resisted tax increases, instead opting for raising prices on things like tolls and college tuition, and cutting back on services like education and health care. Some chose one-time measures such as tapping rainy-day funds that were built up in flusher times. That could lead to future cutbacks if the economy doesn’t bounce back in coming months.

The spreading economic weakness also is affecting localities, which are being ravaged by falling property-tax collections and a decline in state aid. In Minnesota, the city of Duluth plans to stop operating its Fun Wagon — a free trailer stuffed with games and cookout supplies for a neighborhood party. Other services, including a city pool and a fire hall, also are being eliminated….

The housing slump, now well into its second year, is the primary culprit. The decline in home sales has cut into real-estate transfer taxes. Construction spending and employment has declined. Fewer home sales have resulted in lower sales of home furnishings and washing machines, eating into sales taxes.

Of course, for many states, today’s budget woes stem at least partly from expanding their services during the good times and not planning enough for the inevitable downturn.

Meantime, states are dealing with shortfalls of many kinds. According to the report by the association of state legislatures, 22 states are reporting sales taxes that are below forecast. In nine of those states, the collections were below forecasts that had already been reduced downward. Seventeen states had a shortfall in corporate income tax, 11 states were behind on personal-income taxes, and 11 were also behind on miscellaneous taxes such as insurance-premium taxes.

I live in Alabama. The U of AL just raised tuition 14% for 08-09 based on cuts to higher education.

The state will be in PRORATION soon. Whenever local Govts. experience shortfalls, watch out for their only other means of raising moolah…… Traffic Tickets and fees.

I understand that Sheila Bair had some harsh words for bloggers concerning their comments about Indymac and the banking system. Probably not undeserved criticism for the blogs.

The entire group of bloggers is going to be marginalized unless people like Williams support fantastic claims such as the country being in the worst recession since the Depression is backed up by some solid evidence.

Let’s start being responsible rather than aiming for the sensational. By the way that means it’s probably necessary to moderate comments as well.

By the way that means it’s probably necessary to moderate comments as well.

Fuck you.

On principle.

Cheers,

prat

State shortfalls are old news. People have known about this for quite a while.

What people don’t understand is that this is just the beginning and that come October-November the crap is really going to hit the fan.

So far the stimulus package has assuaged public fears but as the year wears on and the miserable proposals from Congress prove to be the snakeoil everyone fears the wheels will come off.

A dramatic drop in oil prices may contain the damage but not for long as house prices keep falling, layoffs increase and prices especially for energy go right back up.

I was surprised at this latest little financial heart attack. I thought they could keep it together until the Fall. It is worse than I thought.

The entire group of bloggers is going to be marginalized unless people like Williams support fantastic claims such as the country being in the worst recession since the Depression is backed up by some solid evidence.

Well Tom if banks were forced to come clean on their level 3 accounting and the Fed wasn’t offering their alphabet soup and the Fed hadn’t bailed out Bear Stearns, where exactly do you think we would be now?

Reminds me of the time when a post here made comment on the upper echelon in world banking and a responding defensive post by one in the system was put forth how wonderful family men and great human beings are the world bankers.

Delusional at best but they can afford to be delusional since they control and have all the money.

All the corresponding posts were purge.

To praetorian:

So, as a “praetorian” you’ve gone from guarding Roman Emperors to issuing anonymous “fuck yous” in defense of bloggers?

Quite pathetic, really.

“Praetorian”…Puhleeeze….so, really, what’s the deal here: Are you just seriously ensconsed in some Dungeons and Dragons roll playing? Did the disturbing little fantasy bleed over into the blogoshere, where you are Praetorian the Protector, warding off the evil “Tom” in defense of your arch-lord, The Darth Blogo.

Go spend some more time with your action figures.

Cheers!

For a while the right has referred to unsatisfactory levels of optimism as 'economic sabotage,' the better to associate it with other existential threats such as terrorism, Marxism, liberalism &c &c &c. 'Confidence' has become another of those precious values that must be protected from subversion. That appears to have developed into an official policy of chilling unauthorized economic speech.

So it's clear that our patriotic duty is to spook all the old ladies into bank runs, since economic dislocation reduces the chance that the GOP falange can perpetuate itself. All you have to do is tack a horrific fabricated scare onto one of the viral emails that says Obama's a Marxist gangbanger Muslim militant Commie. It will spread like wildfire.

Quite pathetic, really.

_shrug_

Just a dude who prefers free, raucous speech. Call me what you like.

Cheers,

prat

They have a million ways to say shut up, don’t they? Nonetheless, events are slipping from their grasp.

When one is running a giant Ponzi Scheme such as our financial sector has become it is very unhelpful when someone points to the fact that it is, in fact, a giant Ponzi Scheme.